Pennsylvania Tax

DECEMBER 2004

Be Ready To Get What You Wanted:

Massive Pennsylvania Business Tax Changes On the Horizon*

When you ask for something, you better be prepared to

get it. For years business leaders have bemoaned

Pennsylvania’s high corporate tax rates. In response to

the perceived unfriendly, outdated and anticompetitive business tax environment in

Pennsylvania, Governor Rendell established the

Pennsylvania Business Tax Reform Commission

earlier this year. The Commission’s mandate was to

recommend ways to fix the perceived business tax

problems without sacrificing overall revenue for the

Commonwealth. The Commission released its final

report on November 30 in which it made seven

recommendations, the cornerstone of which is to cut

the corporate net income tax rate by almost one-third

(an estimated $634 million tax cut for 2005). These

proposals are expected to be on the legislative agenda

in early 2005, backed by the Rendell administration.

Sound like good news? It will be for some, but for the

unprepared it could be a new disease that is worse than

the last one. Five of the Commission’s seven

recommendations will be a welcome tonic for what ails

scores of Pennsylvania businesses. These helpful

recommendations basically would loosen restrictions

on corporations’ ability to utilize net operating losses,

modify the manner in which multi-state businesses

apportion their income to Pennsylvania, and simplify

the business tax appeals process. Because the

Commission’s proposals had to be revenue neutral,

however, the Commission recommended two sweeping

reforms that, notwithstanding the large corporate tax

cut, would cause many businesses to see an increase in

their overall Pennsylvania tax burden.

First, businesses formed as pass-through entities

(limited partnerships, LLCs, LLPs, business trusts and

S corporations) and their owners would suffer a greater

than 30% tax hike. This proposal is estimated to raise

$175 million in 2005 alone and arguably would hit

small businesses disproportionately (which tend to be

organized as pass-throughs), but also would be an

unwelcome blow to service-based businesses (such as

law firms, accounting firms, management consulting

firms, information technology consultants, investment

management firms, etc.), which are a growing segment

of the Pittsburgh-area economy. The proposal would

not exclude from this tax increase any pass-through

businesses (either by industry or size) other than

general partnerships. Accordingly, pass-through

businesses should evaluate how this proposal will

affect them and explore opportunities with their tax

advisors for legitimate tax planning that are invited by

this proposal.

Second, in what would be a “sea change,” the

Commission proposed for Pennsylvania to join a

growing minority of states that require so-called

“combined” tax reporting for “unitary” businesses.

Under this proposal, companies doing business in

Pennsylvania would be required to include the

financial results of affiliated companies that are part of

the same “unitary” group when they calculate their

income subject to Pennsylvania tax. Currently,

Pennsylvania’s tax regime requires each corporation

subject to tax in Pennsylvania to calculate its income

on a “separate-company” basis.

* This article also appeared in the Pittsburgh Business Times, December 17, 2004.

Kirkpatrick & Lockhart LLP

The Commission noted that Pennsylvania’s separatecompany reporting regime invites overly aggressive tax

planning. Admittedly, there have been widely reported

abuses across the country spawned by separatecompany reporting regimes (including WorldCom’s

now-infamous royalty charge of more than $20

billion for “executive foresight”). While it is true

that a combined reporting regime minimizes the

opportunities for untenable tax hijinks, the result of

moving to a combined reporting system may

overwhelm the benefits resulting from the lower tax

rate even for companies that have not taken

aggressive positions. Although no absolute

generalizations can be made, corporations engaged

in manufacturing and trading are most likely to

experience the worst results.

of their unitary group. Moreover, moving from a

separate company reporting regime to combined

reporting presents a window of opportunity for wellprepared taxpayers to adapt their structures before

legislation is enacted and achieve efficiencies that will

not be available later.

Businesses that know how these significant changes

will affect them and who have identified changes

that they can make in order to plan for the new

regime will be more likely to embrace change. Those

businesses that do not may wonder why they ever

asked for tax reform.

Because this proposal is expected to be considered

carefully by the legislature early next year,

corporations need to determine now how they would

be affected by combined reporting. Among the most

critical aspects of that determination will be which

affiliates are “in” and “out” of the unitary group. The

ultimate legal standards for this determination will be

among the most hotly debated topics as the proposal

progresses. Additionally, businesses that pay careful

attention to operating details can influence the scope

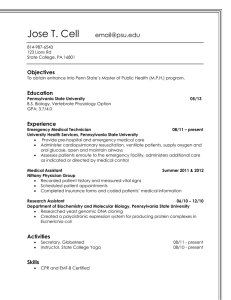

J. STEPHEN BARGE

sbarge@kl.com

412.355.8330

FOR FURTHER INFORMATION, please contact one of the

following K&L lawyers:

J. Stephen Barge

Peter A. Gleason

Raymond P. Pepe

Andrew B. Pullman

W. Henry Snyder

sbarge@kl.com

pgleason@kl.com

rpepe@kl.com

apullman@kl.com

hsnyder@kl.com

412.355.8330

717.231.2892

717.231.5988

412.355.8369

412.355.6720

The attorneys resident in all offices, unless otherwise indicated,

are not certified by the Texas Board of Legal Specialization.

®

Kirkpatrick & Lockhart LLP

Challenge us. ®

www.kl.com

BOSTON

■

DALLAS

■

HARRISBURG

■

LOS ANGELES

■

MIAMI

■

NEWARK

■

NEW YORK

■

PITTSBURGH

■

SAN FRANCISCO

■

WASHINGTON

.........................................................................................................................................................

This bulletin is for informational purposes and does not contain or convey legal advice. The information herein

should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer.

© 2004 KIRKPATRICK & LOCKHART LLP.

ALL RIGHTS RESERVED.