International Trade Issues in Mergers & Acquisitions

advertisement

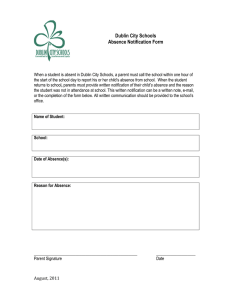

International Trade Issues in Mergers & Acquisitions (Everything Corporate Lawyers Wanted to Know About International Trade, But Were Afraid to Ask) Presentation to the New Jersey Corporate Counsel Association Daniel J. Gerkin, Of Counsel, K&L Gates LLP, Washington, DC Darlene Lapola, In-House Counsel, Avis Budget Group, Inc. Marina Solo, Of Counsel, K&L Gates LLP, Newark, NJ Jerome J. Zaucha, Partner, K&L Gates LLP, Washington, DC December 13, 2012 Copyright © 2012 by K&L Gates LLP. All rights reserved. Introduction Companies contemplating mergers and acquisitions with international implications must be mindful of the potential international trade issues associated with the proposed transaction This presentation will highlight some of the key international trade issues to consider in connection with a potential merger or acquisition, including the following topics: Notification, Amendment, and Approval Requirements Due Diligence Approaches for Dealing with Results of Due Diligence Evaluation of Potential Impact of Trade Regulations on PostAcquisition Operation of Business 1 Notification, Amendment, and Approval Requirements 2 Notification, Amendment, and Approval Requirements If target operates in a regulated industry, consider whether U.S. Government agency imposes any requirements/ restrictions, such as: The U.S. Department of Agriculture Agricultural land The U.S. Department of Transportation Air carriers Merchant shipping vessels The Federal Communications Commission (FCC) Radio licenses The Federal Reserve Board/The Office of the Comptroller of the Currency Banks 3 Notification, Amendment, and Approval Requirements (cont’d) Acquisitions implicating national security considerations The Committee on Foreign Investment in the United States (“CFIUS”) U.S. Department of Defense, Defense Security Service (“DSS”) U.S. Department of State, Directorate of Defense Trade Controls (“DDTC”) Entities holding licenses/authorizations from U.S. Government International Traffic in Arms Regulations (“ITAR”) Export Administration Regulations (“EAR”) Bonds held in connection with acting as importer of record 4 4 Notification, Amendment, and Approval Requirements (cont’d) Acquisitions implicating national security considerations (cont’d) The CFIUS The CFIUS, an interagency committee chaired by the U.S. Department of the Treasury, conducts reviews of proposed mergers, acquisitions or takeovers, of U.S. persons by foreign interests under Section 721 of the Defense Production Act. Definition of “covered transaction” Treatment in transaction documents The CFIUS review is a voluntary process and affords an opportunity to foreign persons and U.S. persons entering into a transaction to submit the proposed transaction for review by CFIUS to assess the impact of the transaction on U.S. national security. Overview of review, investigation, and Presidential review periods 5 Notification, Amendment, and Approval Requirements (cont’d) Acquisitions implicating national security considerations (cont’d) The CFIUS (cont’d) Although filing a notice of a transaction with CFIUS is voluntary, CFIUS can initiate a review unilaterally and can compel the production of necessary information regarding the terms of any covered transaction If CFIUS is not satisfied that national security concerns can be mitigated, it can recommend that the President suspend or prohibit such a transaction, and the President may order divestment if the transaction has been completed, regardless of whether a notice was filed 6 Notification, Amendment, and Approval Requirements (cont’d) Acquisitions implicating national security considerations (cont’d) The CFIUS (cont’d) Recent examples: Dubai Ports World – acquisition of company that operated various U.S. port facilities by Dubai company Firstgold Corp. – failed acquisition of Nevada-based mining concern Ralls Corporation – President invoked national-security concerns to prevent a firm owned by two Chinese nationals from acquiring four wind-farm projects in Oregon 7 Code 1: NAAP8 8 Notification, Amendment, and Approval Requirements (cont’d) Acquisitions implicating national security considerations (cont’d) DSS A Company is considered to be operating under Foreign Ownership, Control, or Influence (“FOCI”) whenever a foreign interest has the power, direct or indirect, whether or not exercised, and whether or not exercisable, to direct or decide matters affecting the management or operations of that company in a manner which may result in unauthorized access to classified information or may adversely affect the performance of classified contracts. 5 percent ownership threshold (SF-328) 9 Notification, Amendment, and Approval Requirements (cont’d) Acquisitions implicating national security considerations (cont’d) DSS (cont’d) The following factors relating to a company, the foreign interest, and the government of the foreign interest are reviewed in the aggregate in determining whether a company is under FOCI: Record of economic and government espionage against U.S. targets; Record of enforcement and/or engagement in unauthorized technology transfer; The type and sensitivity of the information that shall be accessed; The source, nature and extent of FOCI; Record of compliance with pertinent U.S. laws, regulations and contracts; The nature of any bilateral and multilateral security and information exchange agreements that may pertain; and Ownership or control, in whole or in part, by a foreign government 10 Notification, Amendment, and Approval Requirements (cont’d) Acquisitions implicating national security considerations (cont’d) DSS (cont’d) When a company with a facility security clearance enters into negotiations for the proposed merger, acquisition, or takeover by a foreign interest, the contractor must submit notification to DSS of the commencement of such negotiations. The notification shall include the type of transaction under negotiation (stock purchase, asset purchase, etc.), the identity of the potential foreign investor, and a plan to mitigate/negate the FOCI consistent with paragraph 2-303, National Industrial Security Program Operating Manual (NISPOM). FOCI Mitigation 11 Notification, Amendment, and Approval Requirements (cont’d) Acquisitions implicating national security considerations (cont’d) DDTC A company registered with DDTC (as a manufacturer/exporter or broker of defense articles, defense services, or related technical data) under the International Traffic in Arms Regulations (22 C.F.R. Part 120, et seq.; “ITAR”) must notify DDTC at least 60 days in advance of any intended sale or transfer of ownership or control to a foreign person Section 122.4(b) of the ITAR CFIUS overlay; ordinarily not treated as a consent 12 Notification, Amendment, and Approval Requirements (cont’d) Acquisitions implicating national security considerations (cont’d) DDTC (cont’d) A company registered with DDTC under the ITAR must, within five days of the event, notify DDTC if there is a material change in the information contained in the company’s Statement of Registration, including, for example, the establishment, acquisition, or divestment of a subsidiary or foreign affiliate Section 122.4(a)(2) of the ITAR 13 Notification, Amendment, and Approval Requirements (cont’d) In connection with offshore transactions by U.S. companies Exemplary jurisdictions Australia/New Zealand Brazil India 14 Code 2: DDTC15 15 Due Diligence 16 Due Diligence (cont’d) Importance/purpose of international trade due diligence relates to: Successor liability – minimizing potential liability for prior activities of the target (Sigma Aldrich ALJ decision); Severe penalties Ensuring proper valuation and minimize disruption; Potential for cost savings Identifying existing and avoiding future compliance issues; Assessing timeline and cost of post-acquisition compliance; and Assisting in integration of the target’s business into the business of the acquiring company Substantial lead time required 17 Due Diligence (cont’d) There are an array of issues that should be covered in any international trade due diligence Such issues go beyond penalties for prior violations by the company being acquired Although any due diligence inquires should be tailored to a particular transaction, the following general areas should be analyzed: The nature and type of target’s international commercial activities; The target’s affiliates, customers, agents, distributors, and export destinations; The target’s suppliers and the nature and type and origin of raw materials or finished goods sourced by the target Prior enforcement actions, prior disclosures, and legal advice; and Existing compliance and recordkeeping programs 18 Due Diligence The United States traditionally substantially regulated both import and export trade, although it is becoming apparent that more and more countries are following this pattern and increasing regulations on import and export activities Accordingly, also now focus on compliance with the trade laws of other countries The following are examples of U.S. international trade-related issues that should be considered in connection with due diligence Export Controls Antiboycott Embargo Restrictions and Sanctions Customs Compliance Foreign Corrupt Practices Act/Anti-Money Laundering 19 Due Diligence (cont’d) International Trade Topics to Cover (cont’d) Export Controls Applicable laws Export Administration Regulations (15 C.F.R. Part 730, et seq.; EAR), which are administered by BIS International Traffic in Arms Regulations (22 C.F.R. Part 120, et seq.; ITAR), which are administered by DDTC Brief overview of topics to cover Classification of target’s commodities, software, and/or technology Foreign national employees – I-129 work visa Export activities/licenses and other authorizations Automated Export System (AES) compliance Prior investigations, enforcement actions, and disclosures Antiboycott issues – focus on transactions in certain regions Existence of export compliance policies/procedures Prior contact with U.S. Government Results of any prior export control-related audits by the target 20 Due Diligence (cont’d) International Trade Topics to Cover (cont’d) Embargo Restrictions and Sanctions Applicable laws The various statutes, Executive Orders, and regulations (including 31 C.F.R. Part 500, et seq.), which are administered by OFAC Statutes and Executive Orders authorizing the imposition of sanctions on non-U.S. persons for engaging in certain activities relating to Iran Brief overview of topics to cover Nature of U.S. involvement in non-U.S. business activities of the target Identification of prior and ongoing dealings with countries and persons that currently are or have, within the last five (5) years, been subject to embargo-type restrictions Nature of non-U.S. operations involving and structure of the entities engaged in dealings with embargoed countries/persons Existing compliance policies/procedures Prior investigations, enforcement actions, and disclosures Prior contact with U.S. Government Results of any prior embargo-related audits undertaken by the target 21 Due Diligence (cont’d) International Trade Topics to Cover (cont’d) Customs Compliance Brief overview of topics to cover Prior applications/requests to CBP Prior investigations, enforcement actions, and disclosures Existing compliance policies/procedures Identification of imports into the United States Importer of record Classification (e.g., Pharmaceutical Appendix) Valuation Country of origin (e.g., API) Preferential trade programs Customs brokers and bonds Prior contact with U.S. Government Results of any prior customs-related audits undertaken by the target 22 Due Diligence (cont’d) International Trade Topics to Cover (cont’d) Foreign Corrupt Practices Act Brief overview of topics to cover Identification of target’s practices with respect to foreign agents, consultants, and distributors Existing manuals and compliance procedures Possible violations Prior investigation and enforcement matters Prior contact with U.S. Government Results of any prior audits undertaken by the target Nature of non-U.S. operations 23 Due Diligence (cont’d) International Trade Topics to Cover (cont’d) Other Government Contracts Facility Security Clearances Issues relating to classified information 24 Code 3: DD25 25 Notification, Amendment, and Approval Considerations 26 Notification, Amendment, and Approval Considerations U.S. Regulatory Issues Offshore Regulatory Issues Regional/Local Counsel 27 Approaches for Dealing with Results of Due Diligence 28 Approaches for Dealing with Results of Due Diligence There are a number of approaches for dealing with violations discovered in connection with due diligence Valuation reduction Escrow – sum of money withheld from sales price to offset costs associated with potential penalties for violations Require target to file voluntary disclosure with relevant U.S. Government agency prior to closing Buyer can make closing terms contingent upon outcome of action on voluntary disclosure Indemnification (possibly in conjunction with a post-closing voluntary prior disclosure) Require post-closing cooperation in connection with future audits etc. Earn-out where the parameters are defined by losses resulting from penalties and audits Stripping “offending” assets out of the transaction or isolating them in a separate acquisition vehicle or cancellation of transaction altogether 29 Evaluation of Potential Impact of Trade Regulations on PostAcquisition Operation of Business 30 Evaluation of Potential Impact of Trade Regulations on Post-Acquisition Operation of Business International trade issues may impact the feasibility/objective of a potential merger or acquisition Because of substantial restrictions that can apply, evaluation of any such restrictions must be undertaken For example: Involvement of Restricted/Denied Parties Exports of technology to country in which acquiring company is organized and/or located May not be feasible to combine target’s technology with acquiring company’s technology If acquisition is intended to allow acquired company to act as distributor of goods and an antidumping or countervailing duty order applies to such goods, may not be feasible 31 Code 4: EVAL32 32 Questions? 33 Contact Information Daniel J. Gerkin daniel.gerkin@klgates.com (202) 778-9168 Darlene Lapola Marina Solo marina.solo@klgates.com (973) 848-4129 Jerome J. Zaucha, Partner, Washington, DC jerome.zaucha@klgates.com (202) 778-9013 34