VOL. CXCII - NO.12 - INDEX 974

JUNE 23, 2008

ESTABLISHED 1878

Avoid Construction Risk Transfer Pitfalls:

Build Peace of Mind with Due Diligence

Parties must know and

comply with the law

governing indemnification

By Frederic J. Giordano and Robert F. Pawlowski

M

ost construction agreements contain provisions allocating the

risk for claims arising from the

contracted work. Owners, general contractors and developers (“Contractors”)

typically require their subcontractors both

to indemnify the contractors for claims

arising from the work and to provide the

contractors with insurance coverage for

related liabilities. Subcontractors often

require similar protections from their

subcontractors. Contractors frequently

include broad indemnification provisions

in their contracts. They also almost always

incorporate provisions requiring that they

Giordano is a partner and Pawlowski

is an associate in the Insurance Coverage

Practice Group in the Newark office of

Kirkpatrick & Lockhart Preston Gates

Ellis. The views expressed in this article

are not necessarily those of K&L Gates or

any of its clients.

be named as additional insureds on their

subcontractors’ general liability insurance

policies. While on the surface contractors in this situation appear fully covered

against any potential liability, they might

not be protected.

New Jersey, like many other states,

has an “anti-indemnification” statute limiting the extent to which subcontractors

may indemnify contractors in connection

with construction contracts. And, even

though contractors may require their subcontractors to provide them with comprehensive liability insurance coverage, additional insured status alone will not provide

adequate protection if the subcontractors’

insurance policies are deficient in the first

place.

Pursuant to New Jersey’s “anti-indemnification statute,” one party cannot

indemnify another party to a construction

contract for the indemnitee’s sole negligence, and any agreement purporting to do

so is void against public policy. The antiindemnification statute, however, permits

a party to a construction contract to indemnify another party for the indemnitee’s concurrent or partial negligence. See Secallus

v. Muscarelle, 245 N.J. Super. 535, 537

(App. Div. 1991).

A contractual provision intended to

extend coverage to an indemnitee for the

indemnitee’s partial negligence must state

explicitly that it extends to the indemnitee’s negligence. See Mantilla v. NC Mall

Assoc., 167 N.J. 262, 264 (2001). Thus,

when the parties to a construction contract

agree that one will indemnify the other for

losses arising from the contracted work,

including to the extent permissible for the

indemnitee’s own negligence, they should

specify explicitly in the contract that the

indemnification extends to the indemnitee’s own concurrent or partial negligence

to the fullest extent permitted by law. By

drafting a suitable and clear contractual

indemnification provision, the parties can

better effectuate their intentions. Although

New Jersey courts will sever the offending portion of a contract if that portion

does not defeat the central purpose of the

contract, see Jacob v. Norris, McLaughlin

& Marcus, 128 N.J. 10 (1992), the better

practice is to address indemnification at

the contracting stage rather than leave it

to a court to enforce partially an overbroad

indemnification provision at the claim

stage.

Contractors and subcontractors that

operate outside New Jersey should further

recognize that the limitations on indemnification in construction contracts vary

from state to state, and they may need to

modify their contracts for projects in other

This article is reprinted with permission from the JUNE 23, 2008 issue of the New Jersey Law Journal. ©2008 ALM Properties, Inc. Further duplication without permission is prohibited. All rights reserved.

2

NEW JERSEY LAW JOURNAL, JUNE 23, 2008

states.

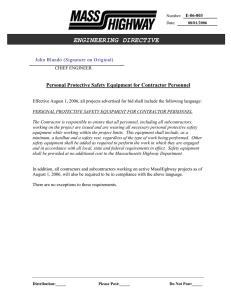

Indemnification is only one part of risk

transfer. Insurance is the other part. The

anti-indemnification statute’s prohibition

against indemnifying an indemnitee for its

“sole negligence” does not impact insurance policies to which the indemnitee is

added as an additional insured. The statute

specifically carves out an exception, stating

that it “shall not affect the validity of any

insurance contract, workmen’s compensation or agreement issued by an authorized

insurer.” See N.J.S.A. §2A:40A-1; see

N.J.S.A. §2A:40A-2 (containing no “insurance exception” for design professionals).

Thus, while an indemnitor may not

indemnify the other party to a construction contract for the indemnitee’s sole

negligence, the indemnitor can purchase

insurance that extends additional insured

coverage to the indemnitee for its sole negligence. Whether to provide such coverage

is a business decision that the parties can

make — and factor into the contract — at

the time of contracting. To the extent that

one party agrees to provide broad additional insured coverage to the other, both

should ensure the contract specifies that

the former’s policy will add the latter as

an additional insured on an endorsement

that includes coverage for the additional

insured’s sole negligence, such as the insurance industry standard endorsement CG

20 10 11 85 (drafted and made available

for use by the Insurance Services Office,

an insurance industry-funded organization

that drafts standard form insurance policy

language), or otherwise specifies that additional insured coverage will extend to the

additional insured’s sole negligence. To

further effectuate the parties’ intentions,

the contract should indicate that such additional insured coverage will be primary and

noncontributory to the additional insured’s

own insurance.

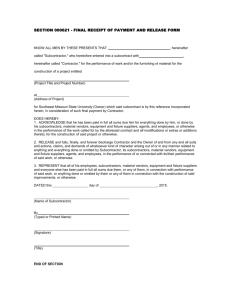

When a subcontractor agrees to provide a contractor with additional insured

coverage – whether or not such coverage

extends to the contractor’s sole negligence

– both parties should confirm that the subcontractor not only names the contractor

as an additional insured on the subcontractor’s liability insurance policies, but also

that the policies provide all the coverage

that the subcontractor promised in the construction agreement. If the subcontractor

does not provide the agreed coverage, the

contractor may not receive the intended

protection from third party claims, exposing the subcontractor to a breach of contract claim for failure to procure insurance

and the contractor to potentially uninsured

liabilities.

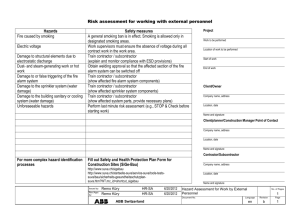

A contractor should consider specifying the type of insurance coverage it wants

perhaps right down to specific policy

forms – in its contract with its subcontractor. By way of example, it is generally better for a contractor to be named

individually as an additional insured on a

specific endorsement, instead of named as

an additional insured pursuant to a blanket

endorsement. Many blanket endorsements

provide coverage only as required by contract and unnecessarily inject contractual

issues into the insurance equation or add

policy exclusions that could eliminate the

intended coverage.

Next, a contractor should confirm

that its subcontractor has fulfilled the

contract’s insurance requirement. A subcontractor typically provides a contractor with a “Certificate of Insurance” as

evidence that the subcontractor has added

the contractor as an additional insured

on the subcontractor’s liability insurance

policy. But, insurance companies have

taken the position that a Certificate of

Insurance — usually issued by a broker

itself — provides no coverage for a contractor if the policy contains no additional

insured endorsement. This position has

found support in some courts. Likewise, a

Certificate of Insurance does not describe

the full extent of the subcontractor’s insurance coverage. So, without more than

a Certificate of Insurance, a contractor

cannot be certain that it qualifies as an

192 N.J.L.J. 974

additional insured under its subcontractor’s policy, or that such policy provides

the coverage specified in the construction

agreement.

The best practice for a contractor is

to review any policy to which it has been

added as an additional insured, including

all endorsements thereto, to confirm its

status and the coverage terms. To facilitate

such a review, a contractor should require

in the construction contract that the subcontractor provide the contractor with

a copy of any liability insurance policy

by a certain date, or upon the contractor’s demand. Recognizing that it may

be impractical for a large contractor to

review every insurance policy from every

subcontractor it retains, however, a contractor should consider reviewing at least

the policies for those trades most likely to

give rise to claims like roofing and framing and for high value projects. Also, a

subcontractor, or its insurance broker,

should compare any policy against the

construction contract to ensure that the

subcontractor complies with its contractual obligations. To the extent that the

construction contract spans more than

one policy term, both parties further

should ensure continued compliance at

subsequent insurance renewals.

Construction projects always have

the potential to go wrong, and the parties to construction contracts usually

agree at the outset how they will allocate

any resulting liabilities. Insurance and

indemnification together can provide

this risk transfer. To effectuate their

intentions properly, however, the parties must know and comply with the

law governing indemnification. They

also must identify and obtain appropriate insurance protection. Contractors

and subcontractors who are aware of

the potential pitfalls associated with

indemnification agreements and promises to insure can take care to protect their

interests to the fullest extent possible,

thereby building peace of mind. ■