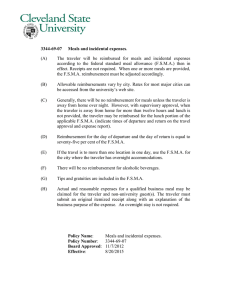

FINANCIAL POLICIES TABLE OF CONTENTS Contents

advertisement