®

The

PIOGA press

The monthly newsletter of the Pennsylvania Independent Oil & Gas Association

March 2015 • Issue 59

Governor Wolf’s proposed budget

More for DEP, more for DCNR and a severance tax too

G

overnor Tom Wolf unveiled his proposed state budget on

March 3, a $33.8-billion spending plan that represents an

8.7-percent increase over the current budget that expires

June 30. The ambitious proposal features a $1-billion increase in

education spending, reduction of the corporate net income tax

from 9.99 percent to 5.99 percent, increase in the personal

income tax from 3.07 to 3.7 percent, increase in the state sales

tax from 6 to 6.6 percent and an expansion to cover more goods

and services, reduction in property taxes by about 50 percent,

and more taxes on tobacco products.

As described in the accompanying article, the new

Democratic governor also wants a severance tax on natural gas

of 5 percent plus 4.7 cents per mcf.

All in all, Wolf is proposing approximately $5 billion in new

taxes, or a combined increase in taxes of 16 percent.

“It’s time to do something different and work together to get

the state back on track,” Wolf said in his budget address. “Our

budget should be as bold and ambitious as Pennsylvania has

been for over 300 years.”

The reaction from leaders of the Republican-controlled

(Continues on page 2)

Details of of Wolf’s severance tax

A

ttempting to fulfill one of his campaign pledges,

Governor Tom Wolf is proposing a natural gas severance

tax of 5 percent plus 4.7 cents per mcf as part of his

budget package. The governor claims the tax would generate

approximately $1 billion annually, with most of that going

toward public education.

“Natural gas production is growing faster in Pennsylvania

than anywhere else in the country,” Wolf said in his March 3

budget address. “Yet, we are the only major producer of natural

gas that does not ask drillers to pay their fair share or provide a

return on our resources.”

Wolf rolled out his “Pennsylvania Education Reinvestment

Act” in mid-February with a statewide tour of schools, and at

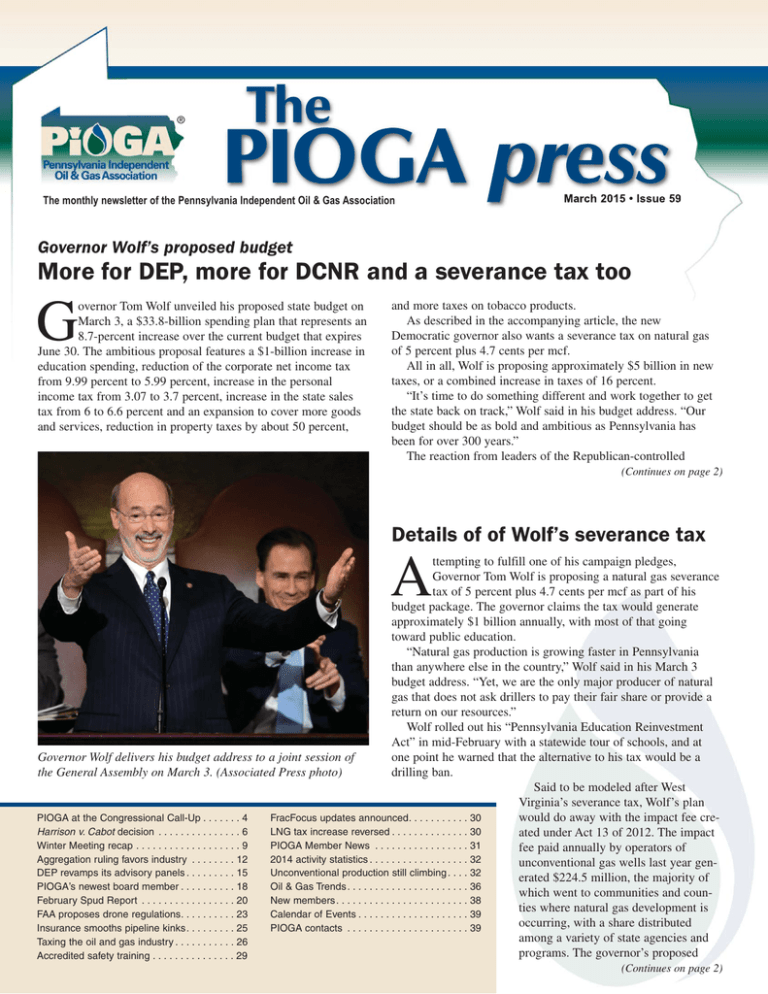

Governor Wolf delivers his budget address to a joint session of

one point he warned that the alternative to his tax would be a

the General Assembly on March 3. (Associated Press photo)

drilling ban.

Said to be modeled after West

Virginia’s severance tax, Wolf’s plan

PIOGA at the Congressional Call-Up . . . . . . . 4

FracFocus updates announced. . . . . . . . . . . 30

would do away with the impact fee creHarrison v. Cabot decision . . . . . . . . . . . . . . . 6

LNG tax increase reversed . . . . . . . . . . . . . . 30

ated under Act 13 of 2012. The impact

Winter Meeting recap . . . . . . . . . . . . . . . . . . . 9

PIOGA Member News . . . . . . . . . . . . . . . . . 31

fee paid annually by operators of

Aggregation ruling favors industry . . . . . . . . 12

2014 activity statistics . . . . . . . . . . . . . . . . . . 32

unconventional gas wells last year genDEP revamps its advisory panels . . . . . . . . . 15

Unconventional production still climbing . . . . 32

erated $224.5 million, the majority of

PIOGA’s newest board member . . . . . . . . . . 18

Oil & Gas Trends . . . . . . . . . . . . . . . . . . . . . . 36

which went to communities and counFebruary Spud Report . . . . . . . . . . . . . . . . . 20

New members . . . . . . . . . . . . . . . . . . . . . . . . 38

ties where natural gas development is

FAA proposes drone regulations. . . . . . . . . . 23

Calendar of Events . . . . . . . . . . . . . . . . . . . . 39

occurring, with a share distributed

Insurance smooths pipeline kinks. . . . . . . . . 25

PIOGA contacts . . . . . . . . . . . . . . . . . . . . . . 39

among a variety of state agencies and

Taxing the oil and gas industry . . . . . . . . . . . 26

programs. The governor’s proposed

Accredited safety training . . . . . . . . . . . . . . . 29

(Continues on page 2)

Page 2

Budget: Continued from page 1

General Assembly could be summed up by comments from

Senate President Pro Tempore Joe Scarnati, who called it “a very

bad plan,” and from Speaker of the House Mike Turzai, who

described the proposal as “disrespectful of people’s hard-earned

tax dollars. He wants to take so much out of their pockets.”

The conservative Commonwealth Foundation said the impact

of Wolf’s budget would cost the average Pennsylvania family

$1,450 a year in what would be the largest tax hike in state history.

As far as agencies and programs related to the oil and gas

industry, the proposed budget for the Department of

Environmental Protection would increase by 3 percent to $147

million. An estimated $10 million would be earmarked from severance tax revenue for additional inspection and oversight of the

industry. Acting Secretary John Quigley said 50 additional

inspectors would be hired, spread across all DEP program areas.

The Department of Conservation and Natural Resources

would see a bump of 2.4 percent in funding to manage the 120

state parks and 2.2 million acres of state forest land. The total

DCNR budget would be $342.6 million, including $34 million

from the general fund.

DCNR initiatives under the proposed budget would include:

• A monitoring program to track, detect and report on the

impacts of shale gas development on state forest lands to continue to improve management practices.

• A major upgrade of the environmental review tool that identifies threatened and endangered species for protection.

• Improvements in seismic monitoring to enhance the sophis-

The PIOGA Press

tication of the department’s geological information.

• An auditing program to ensure the Commonwealth is adequately compensated for shale gas activities on DCNR lands.

The budget for the Department of Health includes $10,000 for

the creation of a registry to monitor the health of residents in

areas where shale-gas development is occurring.

Wolf is also proposing to issue $675 million in new bonds to

fund energy investments. Among other programs, the bond plan

includes $50 million to re-launch the Pennsylvania Sunshine

solar program, $50 million for energy efficiency grants, and $25

million to extend natural gas distribution lines to manufactures

and business parks. He projects the debt service on the bonds

will be $55 million a year, to be paid from the gas severance tax.

Many are predicting that partisan wrangling over the final

form of the budget will go well beyond the annual June 30 deadline for putting a new spending plan in place. House Republicans

prefer to raise new revenue by dismantling and selling the state

liquor store system before they consider tax hikes. Senate

Republicans want Wolf to reduce future pension payments for

government employees, and to make other retirement system

changes to save money before they look at new taxes, too. Wolf’s

budget does neither. ■

Severance tax: Continued from page 1

budget (see related article) includes $225 from the severance tax

to go to local communities to manage the impact of unconventional gas development.

Other provisions include exemptions for gas given away free,

gas from low-producing wells and wells brought back into production after not producing marketable volumes of gas.

Producers would be barred from deducting the tax from royalty

payments.

Based on statements made during the initial announcement of

the tax proposal, it would include conventional gas production.

Backing off from initial claims that the severance tax would

generate $1 billion annually, the governor’s budget shows the tax

taking effect January 1, 2016, and bringing in $165.7 million for

the remainder of the 2015-16 fiscal year. For the first full fiscal

year (2016-17), $765.3 million in severance tax revenue is projected, growing to $948.1 million by FY 2019-20.

“This is not a partisan idea. It’s a recognition that

Pennsylvanians are right now getting a bad deal. We deserve to

be fairly compensated for the use of our resources,” Wolf said,

obviously not understanding that natural gas is privately owned,

except under public lands where the state holds subsurface

rights.

“Threat of extortion”

Most disturbing was a remark made by Wolf in response to a

reporter’s question early into the governor’s “Education

Reinvestment” tour. Asked about working with the industry to

accept a severance tax, the governor responded that “the alternative is not really no tax, the alternative is no drilling, a ban as in

the case of New York.”

PIOGA’s Lou D’Amico said in response to the governor’s

remark: “This statement is tantamount to threat of extortion

against an industry that is responsible for creating and supporting

March

February

2015

2014

Page 3

RLA Premier Conference Center

28 Meeting Rooms

Full Service – One Price

Expectations Exceeded

x Customized Meeting

Packages

x Retreat-like Setting

x Ergonomic Furniture Design

x State-of-the-art Technology

x Executive Style Food

Service

For inquires or a personal tour, call

724-741-1024

info@theRLA.org

Regional Learning Alliance at Cranberry Woods 850 Cranberry Woods Drive

www.theRLA.org

Cranberry Township, PA 16066

Page 4

hundreds of thousands of jobs in the Commonwealth, that is now

producing 20 percent of our nation’s natural gas and that is significantly contributing to our nation’s growing energy independence. Suggesting a potential ban of the very activity being touted

as the source of promised tax revenues does not belong in a tax

proposal announcement–unless, of course, the reference to a

drilling ban was intended as a warning to our industry.

”We have been through this before, when our industry fought

a severance tax proposed several years ago by former Governor

Ed Rendell and received undue attention and excessive delays

from certain state agencies” D’Amico continued. “Given the

return of several former Rendell-era leaders to this administration, we are prepared to face similar tactics in the months ahead,

but it will not deter us from opposing a tax that will put 250,000

jobs at risk or from fighting a moratorium on natural gas drilling

in Pennsylvania.”

Aside from Wolf’s proposal, early into the 2015-2016 session

legislators had either introduced or announced plans for about a

dozen different severance tax bills that would tax production at

rates ranging from 3.2 percent to 8 percent and direct the result-

The PIOGA Press

ing revenue at budget problems such as education and state pension obligations.

Get involved

PIOGA is working with oil and gas industry groups, the

Pennsylvania Chamber of Business and Industry and other supporters to deliver the message to elected officials that a severance

tax would be devastating to our industry and harmful to

Pennsylvania’s economy. We encourage you to reach out to your

state representative, senator and Governor Wolf to let them know

what this tax would mean to you and your business. We also ask

that you urge employees, industry colleagues, royalty owners,

family and local businesses to do the same.

If you don’t know how to contact your elected officials, visit

www.bipac.net/lookup.asp?g=PIOGA for an easy-to-use lookup

tool.

You can also check www.pioga.org for sample letters that you

and others can use. These letters should be available by the time

you read this.

Please take the time to become involved! ■

PIOGA and IPAA partner for another successful Congressional Call-Up

M

embers of PIOGA and the Independent Petroleum

Association of America joined together in Washington,

D.C., for the annual Congressional Call-Up on March

2-4 to talk about the challenges and opportunities for the oil and

gas industry in America. Fourteen PIOGA members joined over

100 oil and gas representatives from across the country in the

nation’s capital for our meetings with over 125 congressional

members.

The PIOGA group met with 19 congressmen and senators

from Pennsylvania, Maryland, Ohio and New York. Many of the

Pennsylvania legislators and their staff continue to be knowledgeable about the importance of oil and gas development to the

nation, but some still need to be educated about the complexities

of our industry as it relates to tax and capital reinvestments, the

benefits of allowing more exports, and the continued struggle for

our industry with overregulation from multiple state and federal

agencies. Another key area of discussion was the differences

between legacy conventional producers and shale producers, and

the important distinctions between their operations and impacts.

On the federal level, IPAA’s top legislative concerns for the

114th Congress are taxes, oversight of administrative actions and

job creation. Our members were able voice their concerns

regarding the negative effects that bad tax policy would have on

our industry. We explained that access to capital is critical in

constructing a business plan for independents. Higher oil and

natural gas taxes mean less money for capital budgets, which

means less drilling and production will take place and fewer jobs

will be created. We urged the legislators that we met with to keep

the current provisions in place.

We also discussed the need for more transparency with

Endangered Species Act listing decisions, limiting the amount of

taxpayer money spent on litigation, expanding the role for states,

and ensuring the ecosystems and the species that occupy them

are protected for future generations. We also discussed the

importance of crude oil exports and the market opportunities that

From left: Jim Kriebel of the Kriebel Companies, PIOGA’s Lou

D’Amico and Tom Bartos of ABARTA Energy in D.C.

exist to help even out the global market. Lastly, we were able to

convey the importance of independent producers to the workforce, supporting more than 2 million jobs in the United States.

Our industry continues to face significant challenges and misperceptions and it was critical for our independent producers to

get this face time with members of Congress to discuss the

potential impacts to their businesses and their ability to create

jobs, economic prosperity and affordable domestic energy for

America. We encourage all PIOGA members to get involved in

this political process and contact your local, state or federal representatives to keep our issues at the forefront.

PIOGA would like to extend a thank-you to our members

who attended our annual trip to D.C. to help us talk about the

issues: Jim and Shane Kriebel from Kriebel Companies;

Gary Slagel and Holly Christie, Steptoe & Johnson; Daria

Fish, Chief Oil & Gas; Patrick Marty, Anadarko; Burt

Waite, Moody & Associates; Kevin Gormly, Vorys, Sater,

Seymour and Pease; Tom Bartos, ABARTA Energy; and Carl

Carlson, Range Resources. ■

March

February

2015

2014

Page 5

We’re so dedicated to your

industry, we see it everywhere.

And you’ll see that dedication in action when you work with Travelers Oil & Gas. We’ve been

protecting your industry for more than 30 years.

Our Risk Control specialists focus on oil and gas customers exclusively and bring with them insight

into the latest methods to manage risk. Plus, your employees may be eligible to participate in well

control certification training we sponsor through Wild Well Control, Inc. In the event of a loss,

our Claim professionals have the experience to protect your interests even in the most complex

scenarios.

For more information, contact your agent or visit travelers.com/oilgas.

travelers.com

© 2013 The Travelers Indemnity Company. All rights reserved. Travelers and the Travelers Umbrella logo are registered trademarks of The

Travelers Indemnity Company in the U.S. and other countries. CP-7853-WS New 9-13

Page 6

Pennsylvania Supreme Court

decision makes operators

bear risk of challenged

lease’s expiration

S

hould an operator in a lawsuit challenging the validity of

its oil and gas lease have to risk having its lease expire

during that suit by not commencing operations? Nearly all

states whose courts have addressed this issue say, “No.” Those

states’ courts allow operators to extend or “equitably toll” their

challenged leases if they prevail in the suit. But not in

Pennsylvania, where the Supreme Court has rejected equitable

tolling in most situations and forced the operator to bear the risk

that its lease will expire during the suit challenging that lease.

On February 17, the Pennsylvania Supreme Court issued a

significant opinion in Harrison v. Cabot Oil & Gas Corp. in

which the court refused to apply equitable tolling principles.

Wayne and Mary Harrison filed suit in the United States District

Court for the Middle District of Pennsylvania by asserting a

declaratory judgment claim that they had been fraudulently

induced by Cabot to enter into an oil and gas lease. Cabot counterclaimed seeking its own declaratory judgment that in the event

the Harrisons’ claims failed, Cabot was entitled to an extension

of the lease’s primary term under equitable tolling principles for

so long as the suit was pending. In fashioning its claim for relief,

Cabot suggested that the lease term be extended for the period

commencing at the end of the litigation for so long as the case

Venango Machinery Equipment & Appraisals, LLC

Robert Hileman CSA, EAANA

453 Moody Run Road Oil City, PA 16301

Ph: (814) 758-0062

FX: (814) 677-4119

bhileman@venangoequipment.com

www.venangoequipment.com

Specialize in Machinery & Equipment Appraisals with over 25 years of

experience. Our Specialty is Oil & Gas Field Equipment which includes

all types of Drilling Rigs, Service Rigs, Land Rigs, and their related

Support Equipment &Tooling, Construction Equipment, Transportation

Equipment & Manufacturing Machinery & Equipment.

The PIOGA Press

was pending. For instance, if the case took

Author:

18 months from start to finish, Cabot advocated that the lease should extend for an

additional 18 months once the case ended.

Cabot justified its request to extend the

lease term by arguing that the Harrisons’

suit put a cloud on its lease and prevented it

from prudently taking steps to commence

operations—which would have tolled the

lease’s primary term.

Steven B.

The District Court ultimately granted

Silverman, Esq.

Cabot’s motion for summary

judgment, thereby disposing of

all of the Harrisons’ claims. The

trial court, however, denied

Cabot’s counterclaim, holding that Pennsylvania law did not support equitable tolling of a gas lease under these circumstances.

The trial court relied on the 1982 case of Derrickheim Company

v. Brown, 451 A.2d 477. In that case, the Superior Court held

that an operator who suspended operations until a title defect was

resolved was not entitled to equitable tolling. The Superior Court

held that the operator was not justified in ignoring the lease’s

express language regarding the lease expiring during a cessation

of operations. The trial court believed that the facts of the two

cases were significantly similar and that the reasoning of

Derrickheim controlled.

As a result of the District Court’s decision, Cabot appealed to

the United States Court of Appeals for the Third Circuit, which

then certified the case to the Pennsylvania Supreme Court on the

grounds that there was an issue “of first impression and of signif-

Geotechnical

Environmental

Ecology

Water

Construction Management

• Certied AST Inspection

• Spill Planning

• Upstream and Midstream

Environmental Permitting

• Construction Management

• Water Resourcing

• Air Permitting and Monitoring

• Geotechnical Engineering

GZA GeoEnvironmental, Inc.

www.gza.com | 27 Oƥces Nationwide

Laurel Oil & Gas Corp.

David Palmerton Principal

Wexford, PA o: 724-935-0018 | c: 315-243-2702

• Conventional and Unconventional

Drilling and Completion Programs

Laurel Oil & Gas Corp.

A Division of GZA GeoEnvironmental, Inc.

www.laureloilandgascorp.com

Warren Schoenfelt

We provide Certified Appraisals in accordance with USPAP (Uniform

Standards of Professional Appraisal Practice) and The Appraisal Ethics

Commission for financing, lines of credit, Acquisitions & mergers, estate

planning, insurance, and tax purposes. Member of EAANA Equipment

Appraisers Association of North America) & ASA (American Society of

Appraisers).

GZA GeoEnvironmental, Inc.

Bridgeport, WV 724-766-5150

• Operations and Production

Services

• Workovers and Recompletions

• Well Plugging Management

• Storage Field Operations

• Re-Entry/Sidetracks

www.gza.com

www.laureloilandgascorp.com

March

February

2015

2014

Page 7

icant public importance, given that its resolution may affect a

large number of oil and gas leases in Pennsylvania.” Thus, in

somewhat unusual circumstances, the case went from a federal

appeals court straight to the Pennsylvania Supreme Court for its

determination.

In a unanimous decision, the Supreme Court upheld the trial

court’s decision not to toll the oil and gas lease. In so ruling, the

court noted that a party acts at its own peril if it refuses to perform its contractual duties. In this instance, the court held in

essence that Cabot should not have risked expiration of the lease

by failing to commence operations. The court also noted that

finding for Cabot would require the adoption of a “special

approach to repudiation pertaining to oil and gas leases,” which

it declined to do. The court acknowledged, but ultimately chose

to ignore that nearly every other state addressing this issue

adopted the equitable tolling rule Cabot advocated. Those other

states which have adopted the rule Cabot argued for include

Louisiana, Arkansas, Illinois, Texas and Montana.

The Supreme Court explained that the Harrisons’ attempt to

invalidate the lease did not justify “altering material provisions”

of the lease—i.e. the primary term. The court noted as an alternative approach operators are free to negotiate tolling agreements

in their leases, particularly since lease challenges are so prevalent. The court also noted that the result of the case may have

been different “where there is an affirmative repudiation of the

lease.” In other words, had the lessors prevented the operator

from entering the leasehold property to conduct operations, the

court may have been willing to toll the primary term of the lease.

The Harrison case is significant in several respects and its lessons should not be ignored. First, the case opens the door for

Insurance Brokers & Consultants

Side by Side

With You

Into the Future

Digging Out Potential Savings

Adrianne Vigueras

Vice President Energy Division

avigueras@ecbm.com

888-313-3226 ext. 1335

WWW.ECBM.COM

lessors to try to “run out the clock” on leases by filing frivolous

lease litigation. Although operators might have claims against

lessors for bringing frivolous suits, it may tip the scales for

lessors in deciding whether to pursue litigation that may “be a

close call” where a lease is at risk for expiring during the suit.

Secondly, the case clearly imposes on operators both the obligation and the risk to continue operations even in the face of suits

challenging the validity of their leases. That risk is obviously

great where the operator faces the potential ruling that its lease is

invalid. Third, if a lessor files suit to challenge a lease’s validity

and simultaneously denies the operator the right to conduct operations, the operator must now consider filing for equitable relief

through an injunction before seeking to toll the lease term. In

other words, believe it or not, an operator whose lease is being

challenged may be in a better position to extend the term of its

lease if it is being prevented from operating by the lessor. Lastly,

and most importantly, the Harrison case makes clear that all

future leases entered into in Pennsylvania contain tolling provisions to extend the primary terms of those leases in the event of a

validity challenge by the lessor.

If you would like additional information about this important

development, contact the author at 412-253-8818 or ssilverman@babstcalland.com. ■

Page 8

The PIOGA Press

Energy and

Natural Resources

(PSOR\PHQW

DQG/DERU

/LWLJDWLRQ

(QYLURQPHQWDO

%XVLQHVV

6HUYLFHV

&RQVWUXFWLRQ

3XEOLF6HFWRU

6HUYLFHV

&UHGLWRUV­5LJKWV

DQG,QVROYHQF\

&KRRVHD´UPZKHUHLQGXVWU\LQWHOOLJHQFH

SURGXFHVKLJK\LHOGLQJUHVXOWV

<RXFDQWUXVW%DEVW&DOODQGWREULQJJUHDWHUYDOXHWR\RXUERWWRPOLQH

7ROHDUQPRUHFRQWDFWRXUDWWRUQH\VE\YLVLWLQJEDEVWFDOODQGFRP

March

February

2015

2014

Page 9

Winter Meeting

in review

T

here’s no doubt about it: Our members and our industry

are facing difficult times due to low product prices.

Nevertheless, we were very pleased with the turnout for

our February 24-25 Winter Meeting at Seven Springs.

Things started off with sporting clays on Monday the 23rd,

and about three-dozen hardy souls showed up to shoot on a day

with single-digit temperatures but brilliant sunshine and cloudless blue skies. On Tuesday and Wednesday, well over 200 members and guests participated in the conference sessions, dinner

and the ever-popular Monte Carlo Night.

Conference report

The theme of the conference was “Clouds on the Horizon,”

and many of the conference presentations dealt not only with

approaching challenges but also issues confronting the industry

right now. Opening the conference, PIOGA President &

Executive Director Lou D’Amico thanked the members who take

the initiative to participate in the association’s activities, whether

through involvement in committees or supporting events such as

the Winter Meeting.

Kevin Moody, PIOGA vice president & general counsel, provided an overview of important legal activity and then led a

panel discussion on local ordinances with Kevin Garber and

Blaine Lucas of Babst Calland and Lisa McManus of

Pennsylvania General Energy. They discussed a pending federal

lawsuit against a “community bill of rights” ordinance in Grant

Township, Indiana County, that is preventing PGE from operating a legally permitted injection well and forcing the company to

bear the expense of trucking wastewater out of state. The consensus was that industry will prevail in this and other challenges to

similar ordinances. Looking at trends in local regulation, Lucas

said the tendency is toward placing geographic rather than environmental constraints on industry—limiting compressor stations

to industrial zones, conditional-use requirements that hold up

projects and increased setbacks that greatly limit where development may occur.

Next up was D’Amico, delivering an impassioned sermon on

the evils of a severance tax and

the need for

those in the

industry and

those who support the industry

to start telling

their story to the

General

Assembly and

the public (see

page 1).

“I hope you

Top: Lou D’Amico urges members of the

don’t just stand

industry to actively oppose a severance tax.

on the sidelines,”

Above: Enjoying Monte Carlo Night.

he cautioned.

“This issue is just too important to all of us.”

Ron Cusano of Schnader Harrison Segal & Lewis, along with

Roy Rakiewicz and Meghan Barber of ALL4, Inc., ran through

several federal and state emissions issues. Among them were

final amendments to the U.S. Environmental Protection Agency’s

Subpart OOOO New Source Performance Standards affecting

emissions from well completions, production, storage vessels

and other sources; the Obama administration’s recently

announced strategy for reducing methane emissions, an effort

PIOGA is attempting to become involved in as a representative

of small businesses; aggregation of emissions sources for New

Source Review permitting (see the related article in this issue);

and modifications by the state Department of Environmental

Protection to its General Plan Approval/General Operating

Permit, known as GP-5.

PIOGA Environmental Committee co-chairs Paul Hart of

Fluid Recovery Services and Ken Fleeman of ABARTA Energy

teamed up with the association’s regulatory consultant Scott

Roberts to provide a rundown of the many topics under the committee’s radar. For example, Roberts explained that as a result of

Page 10

sue-and-settle legal tactics by environmental activists, the U.S.

Fish & Wildlife Service is expanding its efforts regarding threatened and endangered species to include restrictions on “critical

habitat”—areas where a species doesn’t necessarily exist, but

could. Currently, PIOGA is working to counter a listing by the

agency of the northern long-eared

bat which could affect the industry’s operations.

Dan Weaver, PIOGA director of

public outreach, and Dave Mashek

of Meinert/Mashek

Communications offered perspective on how opponents of natural

gas development have changed tactics over the past several years. In a

session that generated a good

Ken Fleeman discussing

amount of dialogue among conferenvironmental issues.

ence participants, Mashek emphasized: “We need voices out there across the Commonwealth, supporting our industry.” He advised those in the industry to utilize

their employees and their families to help counter the negative

message of the “professional protesters” and tell how the industry is benefitting local communities. Weaver provided an update

on PIOGA’s energy education project, which is using a teachthe-teachers approach to create a generation of energy-aware citizens.

Dick Gmerek of Gmerek Government Relations kicked off the

Wednesday sessions with an insider’s view of what’s happening

in Harrisburg as a new Democratic administration begins butting

up against the staunchly conservative leadership setting the agenda for the GOP-controlled legislature. A natural gas severance

tax, he predicted, may become the litmus test for whether the

Republican leadership is able to achieve its goal of finding ways

of dealing with a massive budget deficit that don’t involve raising taxes. Anticipating a protracted budget process, rancorous

confirmation hearings in the Senate for Governor Wolf’s choice

to head DEP and a deluge of industry-related legislation, Gmerek

opined: “It’s going to be a long year.”

Legislative and regulatory activities in Washington were

addressed by Samantha McDonald of the Independent Petroleum

Association of America (IPAA). She touched on many of the

same federal issues of concern to PIOGA—such as the Obama

administration’s new methane-reduction strategy and endangered

species designations—and also explained that a major emphasis

of the IPAA involves clearing the way for crude oil exports and

increasing exports of liquefied natural gas.

Some of the event’s most positive news came during a session

on the benefits of the natural gas impact fee. Due to unforeseen

circumstances, the scheduled county commissioner panelists

were unable to attend; however, one sent a written statement that

was read aloud at the meeting and the other participated via conference call.

In his written statement, Doug McLinko, chairman of the

Bradford County Board of Commissioners, recounted the prosperity natural gas development brought to his county and said he

originally did not support the Act 13 impact fee because “we did

not want to make a decision that would hurt the industry that had

already done so much for us.” However, after much consideration, the county decided to opt in to the impact fee program, and

The PIOGA Press

the result has been very beneficial. The Act 13 money has

allowed the county to implement several new programs, including the Bradford County Infrastructure Bank that provides lowinterest loan financing to support infrastructure projects countywide.

McLinko stated that he strongly opposes efforts to impose a

severance tax, which he would be “incredibly irresponsible” and

would harm not only the industry but also the communities of

Bradford County.

Speaking by phone, Washington County Commissioner Diana

Irey Vaughan agreed that the impact fee has been very good for

local governments within her county, allowing officials to rehabilitate bridges, update emergency response capabilities and to

soon construct a new public safety facility. “It’s impossible to

overstate the importance of the funds,” she said. The commissioner also described drilling that has occurred on county-owned

property, noting that it has been a tremendous success with little

nuisance.

Joe Baran of Bertison-George provided detailed statistics on

how the impact fee revenue has been distributed, emphasizing

that the entire state—even areas where no unconventional gas

development has occurred—is benefitting. The message of the

widespread effect of the impact fee isn’t getting out, he said.

Baran analyzed taxes and activity surrounding states, arguing

that drilling has been suppressed

by a severance tax in West

Virginia—the state which Governor

Wolf says is the model for his proposed tax. Baran also took issue

with Wolf’s contention that a severance tax in Pennsylvania would

generate $1 billion annually.

RJR Safety’s Wayne Vanderhoof

wrapped up the conference programming with a presentation on

safety issues surrounding condenJoe Baran talks about the

sate, the highly flammable natural

impact fee.

gas liquids found in the “wet” gas

typical of southwest Pennsylvania.

He advised producers and service providers to identify where

condensate-related hazards exist in their operations, engineer out

as much of the risk as possible, establish safety procedures for

workers and provide employees with appropriate personal protective equipment.

Something new

A new feature to PIOGA’s major events was unveiled at Seven

Springs—the Product and Services Showcase. It’s an opportunity

for our service and supplier members to make presentations

highlighting their products to attendees. Offering Showcase presentations were AM Health and Safety, Community Bank, Fortis

Energy Services, Guttman Energy, MHF Services, PIC

Appalachia, Profire Energy and Tensar International. We will

continue to tweak this concept, but from reports we’ve received

the Showcase sessions were well-received.

Thanks to our attendees, speakers and sponsors for making

PIOGA’s 2015 Winter Meeting a success. We greatly appreciate

your support.

Next up on our schedule is the June 1 Summer Picnic and

Golf Outing at Wanango Golf Club in Reno. ■

March

February

2015

2014

Page 11

IN THE

OIL GAS

AND

BUSINESS, A LOT OF LAW FIRMS

A R E P L A Y I N G C AT C H - U P.

NOT US.

At Vorys, we have a history of setting standards in the oil and gas business. We have been

instrumental in developing the statutory and regulatory initiatives that benefit the industry.

We do unitizations for more producers than anyone else in the state of Ohio. And while other

law firms are trying to keep up with changes in the industry, we are helping to create them.

For more information, visit vorys.com/shale.

Vorys, Sater, Seymour and Pease LLP 500 Grant Street Suite 4900 Pittsburgh, PA 15219

Columbus

Washington

Cleveland

Cincinnati

Akron

Houston

Pittsburgh

Page 12

The PIOGA Press

Federal judge rules in favor of common sense in PA aggregation case

T

he U.S. District Court for the Middle District of

Pennsylvania relied on the plain meaning of the word

“adjacent” in a case challenging whether a producer’s

compressor stations should be grouped together for the purpose

of more stringent emissions permitting. Taking on the issue of

aggregation in Citizens for Pennsylvania’s Future v. Ultra

Resources, Inc., U.S. District Judge Robert D. Mariani ruled that

Ultra Resources’ eight compressor stations in Potter and Tioga

counties did not constitute a major emitting source of nitrogen

oxide (NOx) under the federal Clean Air Act or Pennsylvania’s

New Source Review (NSR) rules and that the Department of

Environmental Protection had properly permitted the facilities.

Any facility that emits—or has the potential to emit—100

tons per year (TPY) of a pollutant must be classified as a major

emitting source and is subject to a tougher permitting process

than facilities that fall below the 100 TPY threshold. While the

compressor stations at issue individually emit far below the 100

TPY threshold for NOx, in the aggregate they have the potential

to exceed the threshold.

Citizens for Pennsylvania’s Future, the environmental advocacy group more commonly known as PennFuture, filed suit in

2011, arguing that Ultra violated NSR requirements by constructing a major NOx source without the proper permit. Ultra

obtained separate DEP authorizations to use the General Plan

Approval/General Operating Permit known as GP-5 for each of

the compressor facilities. PennFuture contended that the stations

are functionally interrelated—even though the compressors are

not connected by a common pipeline, they all feed into the same

metering station—and should be considered a single facility with

the potential to emit in excess of the 100 TPY threshold.

Aggregation requires meeting a three-pronged test: Whether

the pollution sources are within the same industry, whether the

facilities are located on one or more adjacent or contiguous properties and whether they are under control of the same entity. The

federal Environmental Protection Agency has interpreted adjacent or contiguous property to include an analysis of “interdependence.”

The definitions of “adjacent” and “interdependent” are

open to interpretation, however,

and Pennsylvania

has not always

agreed with the

federal agency on

what they mean.

The EPA prefers

a functional interrelationship test

in making singlesource determinations, but in 2012

the U.S. Court of

Appeals for the

Sixth Circuit

One perspective on PennFuture’s case:

“It’s as if a Wal-Mart store were to be required to secure a

building permit for constructing 1.82 million square feet of floor

area because it happened to be building 10 supercenters of

182,000 square feet each in 10 nearby communities. Common

sense quickly tells us how absurd that would be. Nonetheless,

that’s exactly what PennFuture was asserting in this case; that,

because the facilities were part of the same distribution system, they should be considered a unit for permitting purposes,

even though they are miles apart (this case involved a roughly

30 square mile area of Potter and Tioga counties on which

were proposed eight compressor stations or about one per

four square miles).”

—Tom Shepstone, writing in the Natural Gas NOW blog

ruled in Summit Petroleum Corp. v. U.S. EPA ruled against the

EPA’s approach.

In the case involving Ultra Resources, Judge Mariani agreed

with the Sixth Circuit that “the plain meaning of ‘contiguous’

and ‘adjacent’ should control a determination of whether two or

more facilities should be aggregated.”

“Because a number of separate and unconnected parcels of

land on which the compressors are located would have to be

aggregated in order for the [NOx] emissions to reach the level of

a ‘major’ source, and some of these properties are separated by

several miles, the properties at issue cannot reasonably be considered…to be ‘adjacent,’ ” Mariani wrote in his decision. The

compressor stations are located several miles from one another,

and DEP generally considers facilities adjacent when within a

quarter-mile of each other.

The District Court judge found that the compressor stations

also are not interdependent, even though all deliver gas to the

same receipt point. Mariani wrote that DEP should consider

interdependency on a case-by-case basis.

“Despite this court’s finding that the plain meaning of ‘contiguous’ and ‘adjacent’ should control a determination of whether

two or more facilities should be aggregated, we decline to hold

that functional interrelatedness can never lead to, or contribute

to, a finding of contiguousness or adjacency,” he stated, adding

that the court “recognizes the risk that a strict application of the

plain meaning of the terms ‘adjacent’ and ‘contiguous’ may

allow oil and gas exploration and production companies to

manipulate or structure their wells and compressors in such a

technical way as to avoid being deemed a “major” source,

including by avoiding the aggregation of their wells and compressors.”

In addition to being a significant loss for PennFuture, the ruling could have implications beyond Pennsylvania. Since the

2012 Summit Petroleum ruling, the EPA has taken the position

that the more commonsense application of aggregation applies

only to emitters within the area covered by the Sixth Circuit—

essentially Kentucky, Michigan, Ohio and Tennessee. This latest

ruling may help to change that.

PIOGA member Babst Calland defended Ultra Petroleum in

the case. ■

March

February

2015

2014

Page 13

Page 14

The PIOGA Press

Extraordinary depth in

mineral title

THE PROOF

IS IN THE

NUMBERS

7,000 mineral title opinions in multiple plays in 2013

200 energy attorneys cross-trained to understand

title in 22 states

One of the largest due diligence teams nationwide

More than 100 years of experience in energy law

20 attorney Division Order Title Opinion Team

Leader in unitization permits filed in the Utica Shale

Top-ranked in energy law by Chambers USA, The Best

Lawyers in America®, and AV rated by Martindale-Hubbell

Sharon O. Flanery

ENERGY AND NATURAL RESOURCES

DEPARTMENT CHAIR

Dedicated to shaping energy law for the future

www.steptoe-johnson.com

HIS IS AN ADVERTISEMENT

March

February

2015

2014

Page 15

DEP reformulates TAB,

announces new conventional

producers’ advisory group

A

s the Department of Environmental Protection is poised

to release a second formal draft of its Chapter 78 rulemaking, the Wolf administration decided to appoint a

new slate members to DEP’s Oil and Gas Technical Advisory

Board (TAB) and announced the creation of a separate committee to offer input on rules affecting the conventional industry.

TAB was created under the Oil & Gas Act of 1984 (and reauthorized under Act 13 of 2012) to consult with DEP in the development of oil and gas regulations of a technical nature. The

board reviews and comments on draft regulations before they are

formally presented to the Environmental Quality Board to start

the rulemaking process. TAB’s five members are appointed by

the governor and must include three individuals who are a petroleum engineer, a petroleum geologist or an experienced drilling

representative of the oil and gas industry; one experienced mining engineer from the coal industry; and one geologist or petroleum engineer chosen from among three names submitted by the

Citizens Advisory Council.

The Wolf administration wanted to make its own mark on

TAB, calling for new members on the panel. The five members

had served between seven and 26 years, and had included three

PIOGA directors—Gary Slagel, Burt Waite and Sam Fragale.

At least one of those individuals wasn’t contacted to tell him

his service was no longer needed. Waite told the Pittsburgh PostGazette: “The official word is that they are reinvigorating [the

technical advisory board] with all new membership. If the

department was dissatisfied with the volunteer work that I was

doing, or the other members were doing, I don’t know.”

At the Citizens Advisory Council’s February 17 meeting, DEP

indicated TAB was being refocused to advise the agency on

unconventional oil and gas regulations and policy. On the same

day, DEP formally announced it was creating the Conventional

Oil and Gas Advisory Committee (COGAC). The new committee

will advise DEP about matters related to conventional oil and gas

extraction practices and regulations and will be structured similarly to TAB. A DEP news release said COGAC will “increase

transparency and communication about regulating the conventional oil and gas drilling industry.”

“Creating this advisory committee will increase dialogue

between DEP and the regulated community as well as broaden

the interests we hear from,” Acting DEP Secretary John Quigley

said. “Improving communication between all stake holders and

our department will foster stronger environmental safeguards in

the future.”

The Citizens Advisory Council provided three names to be

considered for TAB, per the requirements of the Oil & Gas Act,

and also offered three recommendations for COGAC. Both

groups will have to be populated by the time TAB meets on

March 20 and COGAC holds its first meeting on the 26th.

DEP intends present revised drafts of the Chapter 78,

Subchapter C regulations governing surface operations at the

March meetings. Apparently, TAB will be reviewing the portions

that apply to unconventional operations and COGAC will consider the version dealing with conventional oil and gas operations.

A Safe Biocide

(Except for Bugs)

New from Universal

Bacteria Specialist:

An environmentally friendly

biocide with 1,450 ppm FACs.

ENVIROLYTE biocide offers you a safe, biodegradable

alternative to toxic biocides for controlling

bacteria in crude oil production and processing.

sPPMFREEAVAILABLECHLORINE

ANDNEUTRALP(

s#ANTREATPRODUCEDWATERBEFOREREUSE

s#LEARSWELLOFDOWNHOLEMICROORGANISMS

s0ROTECTSPRODUCTIONEQUIPMENT

s%LIMINATESMICROBIALINDUCEDCORROSION

SAFE FOR PEOPLE. GOOD FOR PRODUCTION.

Find out more at

www.universalbacteria.com

or call 281.342.9555

E.P.A. Reg. No. 87636-2

© 2014 Universal Bacteria Specialist (UCS1405/0614)

Page 16

The PIOGA Press

As part of the state budget package for the current fiscal year,

lawmakers directed DEP to split its oil and gas regulations into

conventional and unconventional sections.

The timing of the change in the makeup of TAB is “terrible,”

in that “we’re right in the middle of this regulatory process,”

Waite told the Post-Gazette. DEP began working on changes to

the Chapter 78 regulations in 2012, and the regulatory process is

mandated to be completed by 2016—a timetable that will require

the rulemaking to continue on a fast track.

Another conventional producers’ council?

As DEP was rejiggering its oil and gas advisors, the General

Assembly was advancing legislation to create the Pennsylvania

Grade Crude Development Advisory Council. Senate Bill 279

unanimously passed the Senate on February 18.

Sponsored by Senator Scott Hutchinson (R-Venango County),

SB 279 establishes a 17-member panel to:

• Examine and make recommendations on existing regulations

that impact the conventional oil and gas industry.

• Explore the development of a regulatory scheme that provides for environmental oversight and enforcement specifically

applicable to the conventional industry.

• Promote the long-term viability of the conventional industry.

• Assist with and comment on new DEP policies impacting

conventional producers.

• Review and comment on all proposed DEP technical regulations under the Oil & Gas Act.

• Facilitate cooperation and communication in support of the

conventional industry among government agencies and the academic and research community.

• Make recommendations on the promotion and development

ONE

CALL

HANDLES

IT ALL.

of the conventional industry in Pennsylvania.

• Develop a plan to increase the production of Pennsylvania

Grade crude oil in an environmentally responsible way to more

adequately supply the refineries that depend on Penn Grade

crude.

• Develop a working group with DEP to explore and develop

an environmentally responsible and economically viable method

of managing produced water.

Two of the council’s members would be named by PIOGA,

and the association strongly supports the legislation.

A companion bill has been introduced in the House of

Representatives as HB 600, sponsored by Representative Kathy

Rapp (R-Warren County). Legislation creating the council had

received wide support among lawmakers last session, but time

ran out before the proposal could find its way to the governor’s

desk.

“The council created under this bill would work to promote

the conventional gas and oil industry and protect it from regulations intended solely for the Marcellus Shale gas extraction

industry,” said Hutchinson. “The panel would work with the DEP

to ensure that the differences between the operations are taken

into account as these regulations and laws are developed and

implemented.”

DEP’s announcement of its own conventional oil and gas

advisory panel came the same day that SB 279 received the

unanimous approval of the Senate Environmental Resource and

Energy Committee, and Hutchinson said he was pleased that the

department recognizes the need for the conventional industry’s

input.

“I am pleased to see the DEP is now moving in a similar

direction as I propose in Senate Bill 279, but I still believe it is

important that we codify this initiative in law,” Senator

Hutchinson said. “One significant difference is the Penn Grade

Crude Development Advisory Council is intended to promote the

conventional oil and gas industry in the Commonwealth…. This

industry is an important part of the regional economy. It should

be supported by the state, not stymied by excessive and unnecessary regulatory burdens.” ■

TENORM Issues?

Problem

Purchasers of Penn Grade & Utica Crude Oil

Dan Palmer

Crude Relationship Mgr PA / NY

814-368-1263

dpalmer@amref.com

20 Years

•

•

•

•

Technical Field Support

Industrial Packaging

Truck, Rail, Barge Logistics

Compliant Disposal Options

of experience

handling

environmentally

sensitive materials

Supplying Quality Lubricants Refined Using

Penn Grade Crude Oil

77 N. Kendall Ave.

Bradford, PA 16701

814-368-1200

www.amref.com

ISO 9001:2008 Certified

mhfservices.com y Rick Zink, Director, Energy Services y 724.312.1756 y tf 877.452.9300

March

February

2015

2014

Serving the Oil & Gas

Industry with a

full line of tools and

equipment, backed

by 24/7 support.

sunbeltrentals.com

1-877-687-1146

3 Phase Test Separators

4800w Light Towers

25KW–2000KW Generators

Telehandlers/Forklifts 10,000 lbs

Trash Trailers

Trash Pumps

3000 PSI Steamers

Water Stations

Pipe Racks

Shower Trailers

Heater Treater Ignition Burner

Management Systems

Sunbelt Rentals, Inc. ©2014

Page 17

Sunbelt Rentals provides rental equipment

solutions for even the most demanding or

challenging oil and gas project. Devoted

specifically to addressing the growing

needs of this industry, our Oil and Gas

division offers specialized knowledge and

equipment to meet your needs, all backed

by 24/7 support and our commitment

to safety. For the most comprehensive

product and service offering, contact the

professionals at Sunbelt Rentals.

Page 18

Meet your newest PIOGA board member

Rich Adams, Chief Oil & Gas

R

ich Adams had a distinguished 35-year career at the

Northcentral Regional office of the Pennsylvania

Department of Environmental Protection in Williamsport.

Throughout his career, he specialized in water quality and watershed protection, providing program management for environmental permitting and projects including industrial and mine

drainage treatment plants, and stream and wetland restoration.

He was also instrumental in developing DEP’s policies and modeling protocols for the special protection programs on high quality / exceptional value watersheds. In his last two years with DEP,

he was tasked with managing the water resource elements of

Marcellus Shale development.

After retiring from state government in 2008, he consulted

with the Susquehanna River Basin Commission on projects relating to water usage and Marcellus development. In 2009, Adams

was hired by Chief Oil & Gas as a senior regulatory advisor for

water resources. Over the past five years, he has held positions of

increasing responsibility and is currently Director of EHS

Programs. His team of nine Chief employees includes environmental specialists, engineers, and health and safety coordinators.

He has been a member of the Northcentral Pennsylvania

Conservancy and is an active member of PIOGA, serving on the

Environmental Committee and now on the Board of Directors.

Professional achievements include the DEP Secretary’s Award

for Excellence and the Governor’s Award for Excellence, as well

as being a certified professional engineer.

As a PIOGA board member Adams hopes to help facilitate

communication and provide additional coordination with DEP.

The PIOGA Press

He would also like to

highlight industry standards for environmental

diligence and showcase

the successes that have

resulted in industry innovations and best management practices.

“I like to think of

myself as a practical environmentalist,” he says. “I

look for solutions to serve

the industry, and at DEP I

enjoyed providing compliance assistance and training to communities and

companies. We all need clean air, clean water, sustainable land

practices and we all need energy. We must protect the environment while we are producing energy needed for our country—to

heat our homes, to produce and transport the variety of manufactured goods we use every day, and to strive towards energy independence. ”

Adams, originally from Aliquippa, holds a bachelor of science

degree in chemical engineering from Bucknell University and a

master’s in chemical engineering with a minor in environmental

studies from Clarkson University. He enjoys the outdoors, especially fishing and golfing. He resides in Williamsport and has

been married to his wife, Sandy, for 35 years. Together they have

two children, Cynthia Adams, MD, a pediatrician at Boston’s

Children’s Hospital and Richard Adams, EIT, a civil and environmental engineer in New York. ■

March

February

2015

2014

Page 19

Searching for true

midstream experience?

In the race to build out the midstream infrastructure in the Marcellus and Utica Shale plays,

finding a law firm with comprehensive capabilities is imperative. With no room for delays or cost over-runs,

midstream clients depend on Spilman for knowledgeable, responsive attorneys and predictable, reasonable costs.

M

A

E

R

T

S

D

I

S

P

I

L

M

A

N

M

BCF, CNG, Compression, Condemnation, Decompression, Distribution, Easement, Fractionation, Gathering Agreement, Infrastructure, LNG,

Middlemen, Midstream, Off Loading, Open Season, Pricing Volatility, Regulations, Right of Way, Shale, Spilman, Storage, Supply, Transmission

Pennsylvania | West Virginia | Virginia | North Carolina

Responsible Attorney, Ronald W. Schuler | 1.800.967.8226 | www.spilmanlaw.com | This is an attorney advertisement.

Page 20

The PIOGA Press

available at www.portal.state.pa.us/portal/server.pt/community/

oil_and_gas_reports/20297.

The table is sorted by operator and lists the total wells reported as drilled last month. Spud is the date drilling began at a well

site. The API number is the drilling permit number issued to the

well operator. An asterisk (*) after the API number indicates an

unconventional well.

Spud Report:

February

The data show below comes from the Department of

Environmental Protection. A variety of interactive reports are

OPERATOR

WELLS SPUD

A&S Prod Inc

Bearcat Oil Co LLC

Whilton Brooks A

Cabot Oil & Gas Corp

Catalyst Energy Inc

2 2/3/15

2/19/15

1 2/24/15

3 2/4/15

2/22/15

2/26/15

4 2/16/15

2/16/15

2/16/15

2/16/15

9 2/2/15

2/4/15

2/9/15

2/12/15

2/17/15

API #

COUNTY

MUNICIPALITY

053-30638

053-30639

123-47582

123-47548

123-47547

123-47546

115-21915*

115-21916*

115-21919*

115-21920*

121-45722

121-45721

121-45793

121-45792

121-45794

Forest

Forest

Warren

Warren

Warren

Warren

Susquehanna

Susquehanna

Susquehanna

Susquehanna

Venango

Venango

Venango

Venango

Venango

Hickory Twp

Hickory Twp

Mead Twp

Mead Twp

Mead Twp

Mead Twp

Bridgewater Twp

Bridgewater Twp

Bridgewater Twp

Bridgewater Twp

Cranberry Twp

Cranberry Twp

Cranberry Twp

Cranberry Twp

Cranberry Twp

OPERATOR

WELLS SPUD

Chief Oil & Gas LLC

EQT Production Co

Gas & Oil Mgmt Assoc Inc

Hilcorp Energy Co

1

1

1

2

Howard Drilling Inc

Northeast Natural Energy LLC

PA Gen Energy Co LLC

PVE Oil Corp Inc

1

1

1

4

2/9/15

2/12/15

2/17/15

2/25/15

2/3/15

2/26/15

2/11/15

2/12/15

2/12/15

2/10/15

2/24/15

2/18/15

2/11/15

2/20/15

2/26/15

API #

COUNTY

MUNICIPALITY

123-47675

123-47676

123-47677

123-47673

015-23172*

059-26741*

123-47660

085-24724*

085-24734*

083-56589

031-25657*

105-21845*

083-56701

083-56703

083-56704

Warren

Warren

Warren

Warren

Bradford

Greene

Warren

Mercer

Mercer

McKean

Clarion

Potter

McKean

McKean

McKean

Brokenstraw Twp

Brokenstraw Twp

Brokenstraw Twp

Brokenstraw Twp

Overton Twp

Morris Twp

Pleasant Twp

Shenango Twp

Shenango Twp

Wetmore Twp

Toby Twp

Keating Twp

Sergeant Twp

Sergeant Twp

Sergeant Twp

R.L. Laughlin & Co., Inc.

“Providing Gas Measurement Services Since 1970”

t Site Automation

t Meter Sales

t Gas Analysis

t Electronic Chart Integration

t Meter Installations

t Calibrations & Repairs

SERVING YOU IN 2 LOCATIONS:

125 State Rt. 43

Hartville, OH 44632

330-587-1230

5012 Washington St., W.

Charleston, WV 25313

304-776-7740

High Pressure Data Logger

Electronic pressure logger to simplify

recording of testing data.

•

Designed to digitally record pressure during tests,

•

An easy, accurate way to record pressure tests.

•

Pressure Logger complete with pressure transducer,

2 pre-formatted jump drives and step by step instructions

on how to create customized test reports.

www.MaxProTech.com

814-474-9191

March

February

2015

2014

OPERATOR

Page 21

WELLS SPUD

Range Resources Appalachia

7

Rice Drilling B LLC

8

Southwestern Energy Prod Co 10

SWEPI LP

3

Sylvan Energy LLC

2

Talisman Energy USA Inc

3

Trimont Energy LLC

4

Victory Prod Co LLC

Xite Energy Inc

1

3

2/4/15

2/23/15

2/23/15

2/23/15

2/23/15

2/19/15

2/19/15

2/19/15

2/9/15

2/9/15

2/9/15

2/9/15

2/21/15

2/21/15

2/21/15

2/21/15

2/1/15

2/1/15

2/1/15

2/4/15

2/4/15

2/4/15

2/12/15

2/12/15

2/11/15

2/11/15

2/11/15

2/13/15

2/14/15

2/12/15

2/19/15

2/5/15

2/5/15

2/5/15

2/6/15

2/23/15

2/24/15

2/25/15

2/17/15

2/4/15

2/22/15

2/26/15

API #

COUNTY

MUNICIPALITY

083-56672

125-27583*

125-27584*

125-27585*

125-27586*

125-27581*

125-27400*

125-27582*

125-27561*

125-27562*

125-27563*

125-27564*

125-27568*

125-27569*

125-27570*

125-27571*

115-21445*

115-21927*

115-21928*

115-21929*

115-21931*

115-21930*

115-21423*

115-21424*

125-27385*

125-27379*

117-21760*

117-21764*

117-21765*

121-45588

121-45583

015-21468*

015-21470*

015-23179*

121-45781

121-45859

121-45783

121-45860

083-56654

121-45650

121-45654

019-22386*

McKean

Washington

Washington

Washington

Washington

Washington

Washington

Washington

Washington

Washington

Washington

Washington

Washington

Washington

Washington

Washington

Susquehanna

Susquehanna

Susquehanna

Susquehanna

Susquehanna

Susquehanna

Susquehanna

Susquehanna

Washington

Washington

Tioga

Tioga

Tioga

Venango

Venango

Bradford

Bradford

Bradford

Venango

Venango

Venango

Venango

McKean

Venango

Venango

Butler

Wetmore Twp

Cross Creek Twp

Cross Creek Twp

Cross Creek Twp

Cross Creek Twp

Robinson Twp

Robinson Twp

Robinson Twp

N Bethlehem Twp

N Bethlehem Twp

N Bethlehem Twp

N Bethlehem Twp

S Strabane Twp

S Strabane Twp

S Strabane Twp

S Strabane Twp

Jackson Twp

Jackson Twp

Jackson Twp

New Milford Twp

New Milford Twp

New Milford Twp

New Milford Twp

New Milford Twp

Donegal Twp

Donegal Twp

Rutland Twp

Sullivan Twp

Sullivan Twp

Allegheny Twp

Allegheny Twp

Pike Twp

Pike Twp

Pike Twp

Allegheny Twp

Allegheny Twp

Allegheny Twp

Allegheny Twp

Bradford Twp

Cornplanter Twp

Cornplanter Twp

Summit Twp

WINNER

Northeast

2013

:HOO3DG6LWH'HVLJQ3LSHOLQH5RXWH'HVLJQ

&RPSUHVVRU0HWHULQJ6WDWLRQ6LWHV

:DWHU:LWKGUDZDO,PSRXQGPHQW3HUPLWWLQJ

/DQG6XUYH\LQJ5RDGZD\%ULGJH(QJLQHHULQJ

(QYLURQPHQWDO6HUYLFHV

&RQVWUXFWLRQ0DQDJHPHQW,QVSHFWLRQ

1500 Sycamore Rd., Suite 320

Montoursville, PA 17754

570-368-3040

www.mctish.com

Additional Offices

Allentown, PA

Pittsburgh, PA

Page 22

The PIOGA Press

Groundwater & Environmental Professionals Since 1891

Oil

Oil and

and Natural

Natural Gas

Gas

Development

Development Services

Services

Pre-Drilling Water Supply

Inventory and Sampling

Post-Drilling Complaint

Resolution and Investigations

Gas Well Permitting for

Conventional and

Unconventional Plays

Development of High Capacity

Groundwater Supply Wells

Disposal Well Permitting

Erosion & Sedimentation

Control Planning

Fresh Water Determination

Studies

Soil and Groundwater

Remediation

Stray Gas Migration

Investigations

Soil & Groundwater

Contamination Investigations

Hydrogeologic Studies

Assistance with Water Sourcing

Expert Witness Testimony

Water Management Plan

Preparation

Wetland Delineation and

Aquatic Surveys

SPCC/Control & Disposal Plans

Meadville PA&RWWRQ5RDG0HDGYLOOH3$3K

Houston PA-RKQVRQ5RDG%OGJ6XLWH+RXVWRQ3$3K

Waverly NY%URDG6WUHHW([W6XLWH:DYHUO\1<3K

Visit us online at: www.moody-s.com

March 2015

Page 23

FAA proposes regulations that

would allow use of drones in oil

and gas operations, but do they

go far enough?

T

hrough recent advances in technology, unmanned aircraft

systems (UAS) are easier to operate and capable of performing many functions in various commercial sectors. In

light of these capabilities, a variety of commercial entities,

including those in the oil and gas sector, have recently sought

approval from the Federal Aviation Administration (FAA) to use

these devices as part of their commercial operations.

The FAA’s current policy is that no one may use UAS in

activities related to a commercial purpose, unless specifically

authorized by the agency. However, the FAA issued a notice of

proposed rulemaking on February 23 setting forth its long-awaited proposal for how to begin allowing the use of unmanned aircraft by businesses without case-by-case approvals from the

agency. (See 80 Fed. Reg. 9544, Feb. 23, 2015.) Although the

regulations are a step in the right direction, some limitations may

prove insufficient for certain stakeholders in the oil and gas

patches in Pennsylvania and across the country that seek to maximize the use of these devices as part of day-to-day operations.

Background

UAS, as they are referred to by the FAA, are also known as

remotely piloted aircraft (RPA) or unmanned aerial vehicles

(UAV). In the mainstream news and popular

culture, these devices are often referred to

as “drones.” They are aircraft—usually

small planes or helicopters—that do not

have an on-board pilot, but are instead operated remotely. These devices can range from

very small (less than 5 pounds) to very large

(e.g., UAS used in military operations), and

operate at different speeds and altitudes.

They can be equipped with cameras, video

transmission devices and a variety of sensor

packages that can perform, for instance, air,

biological, chemical or radioactive sampling, or geophysical surveying.

Authors:

Thomas R.

DeCesar

The use of drones in oil and gas

operations

The demand by oil and gas companies

for using unmanned aircraft continues to

rise. Potential industry uses include pipeline

and right-of-way monitoring/investigation,

George A.

project siting and surveying, environmental

Bibikos

monitoring through video feed or

chemical sensors, and drill-site inspection. If necessary, unmanned aircraft

can also help provide situational awareness for first responders.

In fact, the first two commercial unmanned aircraft operations

approved by the FAA were used for surveying and pipeline monitoring related to oil drilling operations in Alaska. In addition,

Quality

PEOPLE • PRODUCTS • SERVICE

Since 1954

Largest

HDPE Pipe

Stocking Distributor

in the Eastern

United States

Your

HDPE Specialists: Fabrication Fusion Pipe I

•

1-800-353-3747 • www.leesupply.com

•

Soil

Stabilization

Page 24

the FAA has granted authority to two other companies in the oil

and gas industry to perform flare stack monitoring and aerial

monitoring of operations for safety purposes. Several other

requests for specific authorization within the oil and gas industry

are pending.

Proposed regulations

As noted above, the use of drones is prohibited unless the

FAA grants an exception under Section 333 of the Modernization

and Reform Act of 2012 to authorize the use of UAS for commercial purposes. Specific authority to use unmanned aircraft for

commercial purposes under Section 333 has, to date, been granted to fewer than 40 companies across the country.

In response to the increasing demand for the ability to use

UAS in commercial operations, the FAA has proposed regulations that would authorize the widespread use of UAS weighing

55 pounds or less without requiring specific approval from the

FAA. There are some notable, safety-based limitations on the use

of unmanned aircraft under the FAA’s proposal: operations

would be restricted to daylight, within the operator’s visual line

of sight and to a maximum altitude of 500 feet. While flights

near structures are permitted, flights over people generally are

not. The FAA will also require unmanned aircraft operators to

pass an aeronautical knowledge test and obtain a UAS license.

Owners of unmanned aircraft must register their device with the

FAA.

The upside and a potential downside

Overall, the proposed rules are generally beneficial to oil and

gas companies, which would be able to use unmanned aircraft in

The PIOGA Press

day-to-day operations without specific permission from the FAA.

As currently proposed, the rules would allow for efficient aerial

surveying and mapping of project sites, providing companies

with useful planning and safety information that may not otherwise be available. Given the rapid pace of innovation in the UAS

field, the future should provide even more advances for companies to utilize.

One limitation imposed by the FAA that will likely have a

significant effect on some potential oil and gas-related operations

is the requirement that flights must take place within the operator’s visual line of sight. For some operations, particularly

pipeline or right-of-way monitoring, this limitation may be crucial. These operations would typically entail programming an

unmanned aircraft to fly a pre-set route, or using a streaming

video feed so the operator could guide the aircraft from a remote

location. The utility of these operations diminishes, if not completely disappears, when an operator must remain within sight of

the aircraft. The agency’s proposal in this regard may fall short

by not providing flexibility where a company can show that its

operations outside the line of sight would be just as safe as operations with the operator present.

Conclusion

In sum, the overall reaction to the FAA’s proposed rules is

tempered optimism. The agency’s proposal would certainly be

helpful to many oil and gas companies interested in using this

technology.

Unfortunately, the restrictions suggested by the FAA may

limit the extent of UAS usage within the industry unless changes

are made and the FAA takes a more flexible approach in deter-

Responsible

Reclamation

An opportunity to restore diversity

• Conservation seed mixes

• Native seeds

• Bioengineering

materials

ernstseed.com

sales@ernstseed.com

800-873-3321

March

February

2015

2014

mining which unmanned aircraft operations are safe.

In addition, oil and gas companies should understand that the

rulemaking process may take a long time to complete. Until the

FAA’s rules are finalized—a process some expect to take two or

more years—receiving specific authority from the FAA continues to be the only way for companies to use unmanned aircraft

under current FAA guidelines. Stakeholders wishing to utilize

UAS in their operations may wish to consider engaging counsel

to apply for specific approvals from the FAA in the interim.

Finally, the agency is requesting comments on the issues

involved with the proposed rule, and companies interested in

using these devices should strongly consider letting the FAA

know how the proposed rules could be improved.

Smoothing pipeline kinks

By Adrianne Vigueras, Vice President

ECBM Brokerage

ipelines are the arteries of the natural gas industry. The

necessity to move product efficiently is paramount to a

profitable industry. Having said that, pipeline debates have

begun among residents as well as environmentalists across

Pennsylvania as to the pros and cons of a pipeline in “my backyard.”

All of these debates are in the court of public opinion, and

pipeline companies need tools to address the concerns of the residents whose land is being utilized. Insurance has sometimes

been used to quell the fear of residents that in the event of a leak

the pipeline company will not be able to make reparation.

P

Page 25

Given the expected time frame of more than two years until

implementation, oil and gas companies with an immediate interest in deploying UAS applications within the proposed rule’s

limitations might also consider comments to the agency urging

the quick adoption of the rules, even provisionally—especially

since the proposed rules are not terribly complex or controversial. Industry stakeholders would be well served to consider

engaging the FAA in the regulatory process and offering comments on the proposed regulations. ■

Martin L. Stern, Edward J. Fishman and James B. Insco II also

contributed to this article as part of K&L Gates’ unmanned aircraft team.

policy can also include environmental risks as well as business

interruption for clients if limited to one or two. In this way, the

pipeline company can more easily project financial risk.

Residents along the pipeline will be more comfortable with the

fact that if there is a breach the company will be able to pay for

the quick repair. They do not have to worry about a pipeline

company not having the assets to respond quickly.

By smoothing out these kinks, pipelines will have a bit easier

time convincing residents to allow them to go through their property. It will also allow them to better project financial risk.

For more information on this subject contact the author at

610-664-8299 ext. 1335. ■

Reliable Resources...

SM

fro m e xp l o r a ti o n to m a rke t

CEC is a reliable resource in

the expanding energy industry,

delivering integrated engineering,

ecological and environmental

ƐŽůƵƟŽŶƐƚŽƚŚĞhƉƐƚƌĞĂŵĂŶĚ

Midstream markets.