Proceedings of 7th Annual American Business Research Conference

Proceedings of 7th Annual American Business Research Conference

23 - 24 July 2015, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-79-5

Uses and Misuses of EBITDA in Firm Valuation

A. J. Stagliano

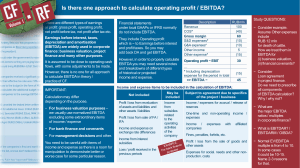

This research deals with valuation techniques and the application of EBITDA in mergers/acquisition (M&A) transactions. In particular, it establishes an interrelationship among historical earnings numbers, median M&A transaction multiples, company/industry specific, and adjustments to final deal price for small to mid-size companies. The analysis here makes use of both the reciprocal of capitalization rate and cash flow assessments. Even in the very short term, not all businesses with the same earnings will sell at the same price. Company and industry specific factors can affect a firm’s earnings in a positive or negative manner. Thus, EBITDA should be used carefully when valuations are made.

Businesses are purchased with a clear expectation of future earnings. Risk factors can negatively impact future profits. On one hand, value declines with increased risk and greater uncertainty of potential earnings. On the other, factors that reduce earnings risk can enhance value. Establishing the initial offering price for sale of a business is a judicious mix of art and science. The science — using financial data mechanically —should not be allowed to wholly overshadow the art that has to be involved. Although EBIDTA is a generally accepted method for faithfully reflecting economic value, blindly applying an earnings multiple can lead to serious investment errors.

The research reported here contributes to the area of financial analysis in a very practical way. The results show that the underlying drivers of business value are not always easily or simply captured by a single valuation indicator. At times, modifications must be made to allow for estimated, non-specific, and qualitative factors. Valuation in M&A practice is not only complex, but also somewhat subjective in nature.

Track: Finance, financial analysis

Key words EBITDA, financial analysis, valuation of the firm

JEL classification: G34

_____________________________________________________

A. J. Stagliano, Ph.D., Professor of Accounting, Erivan K. Haub School of Business, Saint

Joseph’s University, 5600 City Avenue, Philadelphia, PA 19131-1395, Voice: 1-610-660-1652

(secretary: 1-610-660-1650), Facsimile: 1-610-660-1126, E-mail: astaglia@sju.edu