Charlotte/Douglas International Airport, North Carolina; Airport Summary: October 12, 2011

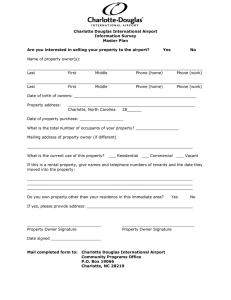

advertisement

October 12, 2011 Summary: Charlotte/Douglas International Airport, North Carolina; Airport Primary Credit Analyst: Todd R Spence, Dallas (1) 214-871-1424; todd_spence@standardandpoors.com Secondary Contact: Anita Pancholy, Dallas (214) 871-1402; anita_pancholy@standardandpoors.com Table Of Contents Rationale Outlook Related Criteria And Research www.standardandpoors.com/ratingsdirect 1 899134 | 301730366 Summary: Charlotte/Douglas International Airport, North Carolina; Airport Credit Profile US$80.675 mil arpt rev bnds (Charlotte/Douglas Intl Arpt) (Non-amt) ser 2011A due 07/01/2040 Long Term Rating A+/Stable New US$33.995 mil arpt rev bnds (Charlotte/Douglas Intl Arpt) (Amt) ser 2011B due 07/01/2040 Long Term Rating A+/Stable New A+(SPUR)/Stable Affirmed Charlotte, North Carolina Charlotte/Douglas Intl Arpt, North Carolina Charlotte (Charlotte/Douglas Intl Arpt) various series Unenhanced Rating Rationale Standard & Poor's Ratings Services assigned its 'A+' long-term rating to Charlotte, North Carolina's $80.7 million series 2011A airport revenue bonds and $40 million series 2011B airport revenue bonds issued on behalf of Charlotte/Douglas International Airport (CLT). At the same time, Standard & Poor's affirmed its 'A+' long-term and underlying rating (SPUR) on the city's outstanding revenue bonds, issued for CLT. The outlook on all ratings is stable. The rating reflects our assessment of CLT's: • • • • Consistently strong liquidity position and very low airline cost structure; US Airways Inc.'s (B-/Stable) continued commitment to the airport; Generally favorable demand characteristics; and Strong financial margins. The rating further reflects what we view as CLT's: • Generally positive passenger trends; • Strong financial metrics; and • Very strong unrestricted cash position. Offsetting credit weaknesses, in our opinion, include the airport's: • Very high air carrier concentration (US Airways accounts for 88.5% of passengers boarding flights); and • High exposure to connecting passengers (74%). Net revenues for the airport's included cost centers secure the bonds. Included cost centers refer to the terminal complex and public aircraft facilities, while excluded cost centers include the cargo areas, aircraft maintenance center, catering areas, and the fixed-base operator area. A debt service reserve (DSR) fund funded to the IRS Standard & Poors | RatingsDirect on the Global Credit Portal | October 12, 2011 2 899134 | 301730366 Summary: Charlotte/Douglas International Airport, North Carolina; Airport maximum also secures the bonds. CLT has met some of its DSR requirements with surety bonds provided by MBIA Insurance Corp. (B/Negative) and Ambac Assurance Corp. (not rated). Although Charlotte is not planning to replace any of these surety bonds, we don't consider this a credit concern. The combined coverage of the MBIA and Ambac surety bonds is approximately $13 million and $11 million, respectively, while the airport's unrestricted cash balance as of June 30, 2011, totaled $395 million. CLT is an important connecting hub within US Airways' system and serves what we view as a strong, diverse, and expanding service-area economy, including 13 counties anchored by the City of Charlotte (AAA/Stable). In our opinion, these have contributed to the airport's favorable traffic trends. The Charlotte metropolitan area's population averaged a 2.17% average annual growth rate from 2007-2011. The feasibility consultant projects population growth to continue at an average annual growth rate of 1.78% from 2011-2017. The city owns and operates CLT, which is located seven miles west of Charlotte's central business district. From fiscals 2007-2011, the airport's total enplanements increased at a average annual growth rate (AAGR) of 5.8%. During fiscal 2011 (ending June 30), it enplaned 19.7 million passengers, up 11.2% from fiscal 2010. The increase can be split into connecting and origin and destination (O&D) with a 12.9% increase in connecting passengers and a 6.4% increase in O&D passengers. This was the result of US Airways increasing its hubbing operations; while local demand was remained relatively strong after an 8.4% decrease in 2009 followed by a 4.0% increase in 2010 and 6.4% increase in 2011. From fiscals 2007-2011, the AAGR for O&D passengers was 1.1%, and connecting traffic was 7.7% AAGR. During this period, O&D passengers' share of total passengers ranged from 25%-30% of total enplanements. For fiscal 2011, CLT enplaned almost 5.0 million O&D passenger (25.4% of total enplanements). Management has historically maintained what we consider strong financial metrics, which includes strong debt service coverage (DSC), a low airline-cost structure, good revenue diversity, and a low debt burden with very strong liquidity. More specifically, DSC, as calculated by Standard & Poor's, has exceeded 2.0x from fiscals 2006-2010. Standard & Poor's DSC calculation includes committed passenger facility charges (PFCs) in the numerator and excludes transfers from the previous year. Coverage in 2011, as calculated by Standard & Poor's, is 2.32x -- based on unaudited data. Coverage during the forecast period from 2012-2017 as calculated by Standard & Poor's ranges from 1.75x to 2.32x. Indenture coverage during the forecast ranges from 2.96 to 4.24x. At fiscal year-end 2011 (June 30), CLT's cost per enplanement is what we view as a low $1.57, down from an already low $2.09 in fiscal 2005. Including airline credits, this drops to 67 cents for fiscal 2011 and $1.48 for fiscal 2005. Cost per enplanement is a total measure of how much it costs airlines operating out of an airport per enplaned passenger. Cost per enplanement to is forecast to remain low from 2012-2017, remaining under $1.00 each year including airline credits. Management has done a good job, in our opinion, of limiting CLT's reliance on air carriers. As a result, its revenue diversity is what we consider good, with passenger airline revenues representing about 25% of total pledged operating revenue in fiscal 2011. This is down from 32.4% in fiscal 2005. We believe the airport's debt load is very manageable at $35 per enplaned passenger. Based solely on O&D, debt per enplanement increases to $139. Management has maintained what we consider a very strong unrestricted cash position historically, providing CLT with an added financial cushion should activity levels unexpectedly drop. For fiscal year-end 2011, the airport's unrestricted cash balance totaled almost $395 million or 2,348 days worth of cash on hand to cover operating expenses based on budgeted 2012 expenses. From fiscals 2005-2010, CLT's fiscal year-end unrestricted cash balances provided about 1,800-2,600 days' cash on hand. Standard & Poor's also considers the airport's exposure www.standardandpoors.com/ratingsdirect 3 899134 | 301730366 Summary: Charlotte/Douglas International Airport, North Carolina; Airport to variable-rate debt manageable given the airport's strong liquidity position. As of June 30, 2011, its audited unrestricted cash balance totaled approximately $395 million, compared with its unhedged variable-rate debt of $124.9 million or 18% of the approximately $693 million of general airport revenue bonds (GARBs) outstanding (pro forma including 2011A, B and C). CLT has no swaps outstanding. CLT has what we consider a very high air carrier concentration, with US Airways and its regional affiliates in fiscal 2011 accounting for 89.8% of total enplanements and 59.7% of O&D enplaned passengers. Enplanements represent the number of passengers who board an aircraft at CLT. O&D enplaned passengers represent the number of passengers who ultimately start or end their trips at the airport. Connecting enplanements represent the number of passengers who board an aircraft passing through CLT on their way to their ultimate destination. In fiscal 2010, US Airways, and its affiliates, accounted for almost 25% of the airport's operating revenues. CLT also has a high exposure to connecting traffic due its role as an important connecting hub within US Airways' system. For fiscal 2011, approximately 75% of the airport's total enplanements were connecting passengers, while only 25% were O&D passengers. We expect CLT's debt burden and airline cost structure to potentially increase as a result of its $475 million capital improvement program (CIP), which includes projects intended to preserve, enhance, or expand safety, security, and capacity. All the projects are discretionary and will be undertaken when financially feasible and demand is in place. Many of the projects in the CIP will be financed with additional bonds. Outlook The stable outlook reflects our view that CLT's financial margins and liquidity position will remain strong, despite potential additional borrowing plans. We do not expect to lower the rating during our two-year outlook horizon unless US Airways decides to eliminate most of its connecting service at the airport. Activity levels above the forecast that lead to higher-than-forecast coverage as calculated by S&P and continued high unrestricted cash position could prompt us to raise the rating. Related Criteria And Research USPF Criteria: Airport Revenue Bonds, June 13, 2007 Ratings Detail (As Of October 12, 2011) Charlotte, North Carolina Charlotte/Douglas Intl Arpt, North Carolina Charlotte (Charlotte/Douglas International Airport) Long Term Rating A+/Stable Affirmed Charlotte (Charlotte/Douglas International Airport) (ASSURED GTY) (MBIA) Unenhanced Rating A+(SPUR)/Stable Affirmed A+(SPUR)/Stable Affirmed Charlotte (Charlotte/Douglas Intl Arpt) arpt Unenhanced Rating Many issues are enhanced by bond insurance. Standard & Poors | RatingsDirect on the Global Credit Portal | October 12, 2011 4 899134 | 301730366 Summary: Charlotte/Douglas International Airport, North Carolina; Airport Complete ratings information is available to subscribers of RatingsDirect on the Global Credit Portal at www.globalcreditportal.com. All ratings affected by this rating action can be found on Standard & Poor's public Web site at www.standardandpoors.com. Use the Ratings search box located in the left column. www.standardandpoors.com/ratingsdirect 5 899134 | 301730366 Copyright © 2011 by Standard & Poors Financial Services LLC (S&P), a subsidiary of The McGraw-Hill Companies, Inc. All rights reserved. No content (including ratings, credit-related analyses and data, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of S&P. The Content shall not be used for any unlawful or unauthorized purposes. S&P, its affiliates, and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions, regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P's opinions and analyses do not address the suitability of any security. S&P does not act as a fiduciary or an investment advisor. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process. S&P may receive compensation for its ratings and certain credit-related analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees. Standard & Poors | RatingsDirect on the Global Credit Portal | October 12, 2011 6 899134 | 301730366