Proceedings of 8th Asian Business Research Conference

advertisement

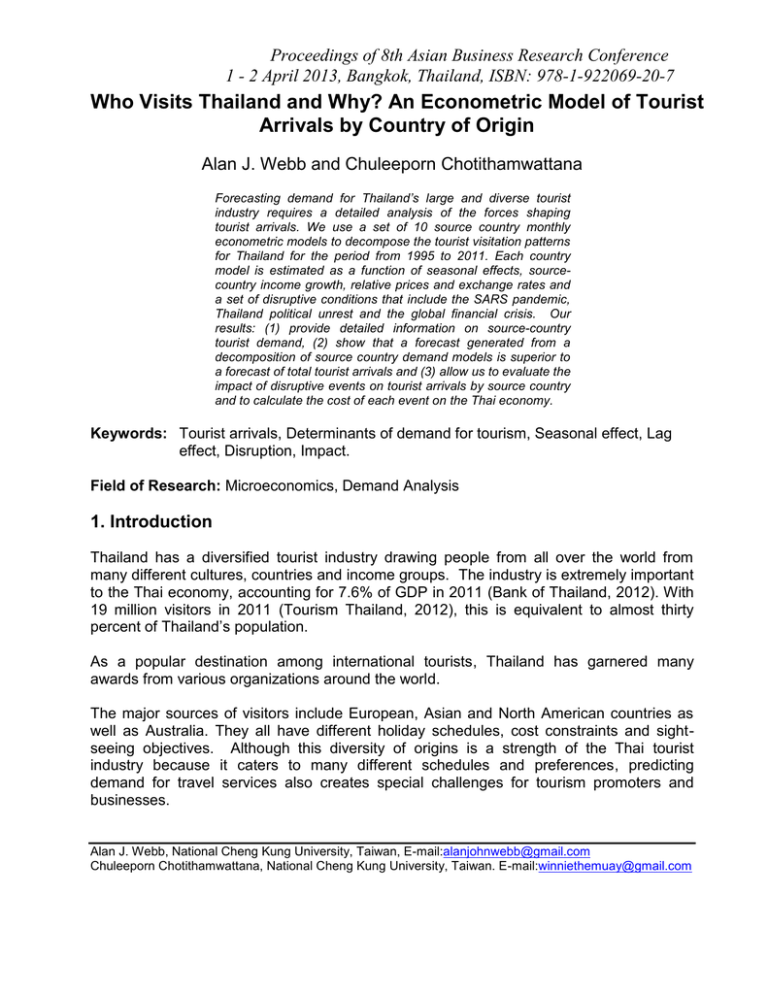

Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 Who Visits Thailand and Why? An Econometric Model of Tourist Arrivals by Country of Origin Alan J. Webb and Chuleeporn Chotithamwattana Forecasting demand for Thailand’s large and diverse tourist industry requires a detailed analysis of the forces shaping tourist arrivals. We use a set of 10 source country monthly econometric models to decompose the tourist visitation patterns for Thailand for the period from 1995 to 2011. Each country model is estimated as a function of seasonal effects, sourcecountry income growth, relative prices and exchange rates and a set of disruptive conditions that include the SARS pandemic, Thailand political unrest and the global financial crisis. Our results: (1) provide detailed information on source-country tourist demand, (2) show that a forecast generated from a decomposition of source country demand models is superior to a forecast of total tourist arrivals and (3) allow us to evaluate the impact of disruptive events on tourist arrivals by source country and to calculate the cost of each event on the Thai economy. Keywords: Tourist arrivals, Determinants of demand for tourism, Seasonal effect, Lag effect, Disruption, Impact. Field of Research: Microeconomics, Demand Analysis 1. Introduction Thailand has a diversified tourist industry drawing people from all over the world from many different cultures, countries and income groups. The industry is extremely important to the Thai economy, accounting for 7.6% of GDP in 2011 (Bank of Thailand, 2012). With 19 million visitors in 2011 (Tourism Thailand, 2012), this is equivalent to almost thirty percent of Thailand’s population. As a popular destination among international tourists, Thailand has garnered many awards from various organizations around the world. The major sources of visitors include European, Asian and North American countries as well as Australia. They all have different holiday schedules, cost constraints and sightseeing objectives. Although this diversity of origins is a strength of the Thai tourist industry because it caters to many different schedules and preferences, predicting demand for travel services also creates special challenges for tourism promoters and businesses. Alan J. Webb, National Cheng Kung University, Taiwan, E-mail:alanjohnwebb@gmail.com Chuleeporn Chotithamwattana, National Cheng Kung University, Taiwan. E-mail:winniethemuay@gmail.com Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 Figure 1 shows the pattern of monthly tourist arrivals in Thailand for the period from 1995 to 2011. We observe a gradual upward trend in tourist arrivals over the period and as well as a distinct seasonal pattern that has become less regular with greater variation since 2007. During any given year, the highest number of international tourist arrivals is typically at year end with the lowest arrivals in May and June. The data show, however, that this general seasonal pattern has been disrupted a number of times over the period including the Sudden Acute Respiratory Syndrom (SARS) panidemic (2003), the global financial crisis (2008-11), sporadic political demonstrations (various months from 2008 to 2010) and weather (floods in 2011). The growing variability of monthly tourist arrivals coupled with the apparent increasing frequency of disruptions, means that an aggregate forecast of annual arrivals will miss important details and not be very accurate. 2. Literature on Tourist Demand Forecasting A number of studies have estimated demand for tourism services using a variety of approaches. Song and Li (2008) have an extensive review of international tourist demand modeling and forecasting since 2000 covering 121 studies. They divide the recent quantitative studies into two groups—non-causal time series models and causal econometric models. The non-causal time series models simply use past patterns of tourist arrivals to forecast future arrivals. These non-causal approaches include various versions of autoregressive moving average models (ARIMA). Causal econometric models, on the other hand, seek to explain underlying relationships that affect tourist visitations such as income growth in the source country, transport costs, exchange rates, etc. Song and Li classified 72 studies as using non-causal time series techniques, 71 used (causal) econometric models and more than 30 of the studies used both time series and econometric methods to compare forecasting performance. Among the more recent non-causal time series models, is a study by Kulendran and Shan (2002) which focused on forecasting China’s monthly inbound tourist arrivals for the 19881 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 2000 period using a seasonal ARIMA model. The overall forecast indicated that China foreign visitor arrivals would grow annually on average 14% and total visitor arrivals would grow annually on average 25% up to year 2005. Applications of time series models to Thailand tourist demand include a study of border tourism (Jintranum et.al. 2012) and two studies forecasting monthly tourist arrivals (Balogh, et.al, 2007 and Chokethaworn et.al, 2010). Although time series studies usually generate accurate short term forecasts, they fail to explain underlying structural changes that drive demand in the longer term. Econometric approaches are better-suited to generating the type of information that businesses and governments need for promotions and planning infrastructure developments because they explain the forces that determine demand for tourism services. Econometric models can also be used to look at alternative forecast scenarios using estimated parameters. Econometric studies fall into two groups based on the time interval of the data—annual versus monthly data. Studies using annual data have fewer time observations so they frequently use a combination of annual and panel data. Garin-Muñoz and Amaral (2000) estimated the number of per capita overnight stays in Spanish hotels by country of origin using annual data for the period from 1985 to 1995. GDP per capita, exchange rates and a ratio of destination-to-origin consumer prices were key determinants of tourist visits. Naude and Saayman (2005) used cross-section annual panel data for the 1996-2000 period to identify the determinants of tourist arrivals in 43 African countries. In addition to income, ratio of consumer prices, they also found political stability, tourism infrastructure and marketing information to be key determinants of tourists’ destination choices. Maloney and Rojas (2005) conducted a similar study using dynamic panel data of annual tourist arrivals for the period 1990-2002 for 8 origin countries to 29 Caribbean travel destinations. Two other studies of note using annual time series panel data include one of tourist visits to the Canary Islands (Garin-Muñoz, 2006) and one of tourist arrivals for the Balearic Islands (Garin-Muñoz and Montero-Martin, 2007). A characteristic of these annual time series panel studies is that they rely on key factors— income, relative prices, transportation costs as well as political climate and tourist infrastructure in the destination country—to explain why tourists in source countries visit one or more destinations. However, these factors are not sufficient for understanding tourist visit patterns. Tourism is a highly seasonal industry and seasonal factors are a key part of any vacation destination decision and for that monthly data is required. Studies using monthly data rely on many of the same explanatory variables—income, relative prices, exchange rates—as those using annual data but the shorter time interval allows researchers to add seasonal effects as well as short term factors such as special events or disruptions that may affect tourist travel decisions for short periods. Hultkrantz & Olsson, (1997), for example, found that special events were important determinants for tourism demand models in the Scandinavian tourist studies. Other factors that also influence the demand for tourism include climate, cultural values, natural attractions and government travel regulations (Williams & Shaw, 1991). Lag and lead effects also depend 2 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 on time increments. The effects of changes in explanatory variables in one period are likely to spill over into the next, and this is especially true for monthly data. Notable econometric studies relying on monthly data to forecast tourism demand include Hiemstra and Wong (2002) who estimated a set of seven demand models based on monthly data from 1990 to 1998 that identify the major factors associated with changes in the key source countries for tourism to Hong Kong. The significant parameters included the Asian financial crisis (1997-1998), gross domestic product, relative consumer prices, exchange rates, and interest rates as well as seasonal factors and the change in Hong Kong sovereignty. Salman et al. (2007) estimated a domestic demand model for tourism in the objective 6 region of Sweden using monthly data for the period 1980-1998. Key macroeconomic factors such as real income, nominal and real exchange rate, and the price level were significant as well as seasonal and weather effects. They also tested for effects from the Chernobyl nuclear disaster but results were not significant. These empirical findings are broadly consistent across time periods and across countries. All include source country income, relative prices and/or exchange rates, seasonal factors and, often, a special occurrence that is peculiar to the destination and time under consideration. Dritsakis and Athanasiadis (2000) argue that the main variable that positively influences virtually all tourist movements is growth in per capita GDP because it is linked to increases disposable income, and the willingness and ability to purchase various income-sensitive goods and services including travel. Income growth alone, however, may not always be the key motivator to travel. According to Cho (2006), household consumption is affected not only by income but also by increases in wealth associated with appreciation of assets, especially real estate and stock prices. Case, Quigley, and Shiller (2005) explored the household behavior that underlies the link between wealth and consumption and found that direct wealth effects begin to show up relatively quickly and continue to boost consumption growth for a number of quarters. International tourism is generally considered a luxury good (Kim, et.al. 2012) and consequently is very sensitive to changes in both income and wealth. There are only a few econometric studies of Thailand tourism demand. Most of the work on Thailand tourism has been non-causal time series models. Two unpublished research studies using econometric approaches (Chokethaworn, 2010 and Virojanarom, 2008) found that GDP per capita in country of origin, the ratio of Thailand-source country CPI, nominal exchange rates, and transportation costs were significant determinants of tourist arrivals. 3. Methodology For our study, we disaggregate Thailand tourist arrivals into the top 10 source countries for the 1995-2011 period and estimate the arrival pattern of each over the period. The top ten sources are shown in Table 1 along with the total and average tourist arrivals for each source. The fifth column shows arrivals for 2011 and the last column shows the percentage increase in arrivals from 1995. Thailand’s southern neighbor, Malaysia, has 3 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 been the major source of tourists accounting for 1.4 million tourists annually. The major Asian economies--Japan, China, Korea, Taiwan and Singapore—are all among the top 10 sources of tourists. Outside the region, the UK and Germany in Europe and the United States in North America along with Australia account for the more distant tourist sources. Together, these ten countries accounted for 121 million tourist arrivals for the 17-year period or 63% of Thailand’s 193 million tourist arrivals. However, as the last two columns show, there has been a change in the sources of tourists. All of the top 10 sources show an increase in arrivals for 2011 over their average for the period except Taiwan. The largest increase is China—a 452 percent increase over 1995—followed by Australia with a 413 percent increase. Tourist arrivals from outside the top 10 also increased 4-fold over 1995. By 2011, Thailand reported 19.2 million tourist arrivals per year—almost a 3-fold increase over 1995. Table 1. Top Ten Sources of Thailand Tourist Arrivals, 1995-2011 Annual Tourist Arrivals, 1995-2011 17-Year 17-Year Increase Rank Country Total Average 2011 from 1995 ---------millions---------percent 1 Malaysia 24.1 1.4 2.5 227 2 Japan 18.7 1.1 1.1 134 3 China 13.5 0.8 1.7 452 4 Korea 11.5 0.7 1.0 223 5 UK 11.4 0.7 0.8 235 6 US 9.3 0.5 0.7 208 7 Singapore 9.2 0.5 0.7 197 8 Taiwan 8.3 0.5 0.4 94 9 Germany 7.7 0.5 0.6 174 10 Australia 7.4 0.4 0.8 413 Subtotal 121.1 7.1 10.5 216 All others 72.3 4.3 8.8 415 TOTAL 193.4 11.4 19.2 277 Source: Adapted from the website of Tourism Authority of Thailand We will estimate the arrival patterns for each these ten countries plus an aggregation of the remainder—shown as “All others” in Table 1—and sum the results to forecast total tourist arrivals by month for Thailand. This approach provides greater seasonal detail and a more accurate forecast than studies based on annual or aggregate data. At the same time, the estimation results will show the key drivers of tourist arrivals from each country source and, from this, we observe sensitivity of tourists from each country source to economic, political and natural/weather disruptions. 4 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 3.1 Model Specifications Based on the experience of previous studies for other countries, we hypothesize that Thailand tourist arrivals for each of 10 country sources can be specified as: ) ) where TA is tourist arrivals from the ith source (i=1, 2, …10) in the tth period. independent variables are: (1) The is the number of tourist arrivals of the ith source in the t-1 period, with positive expected sign; GDPit is a measurement of country income for the ith source in the tth period, with a positive expected sign; Stockit is the stock market index of the ith source in the tth period and should also have a positive sign. We use the stock market index as a proxy for changes in wealth for particular countries. The greater the sense of wealth, the more willing people will be to take a vacation. ExchRit is the ith source exchange rate relative to the Thai baht in period t. We expect a positive sign because an increase in ExchR implies that the currency of the source country will have greater purchasing power in Thailand. PriceRatioit is the ratio of consumer prices in the ith source to Thai consumer prices in period t. We expect a positive relationship following the same logic as for ExchR. TCit is a proxy for transportation costs between the ith source and Thailand in period t. The expected sign is negative. (We use the cost of jet fuel as a proxy to represent the approximate differences in travel costs between Thailand and the source country.), Seaskt is a set of k-1 monthly seasonal dummy variables where k is an indicator of the month (k=1~12) to determine the seasonal pattern of tourist arrivals from the i th source in period t. For this study, we exclude the month of December. Consequently, the statistical estimates will incorporate the December seasonal effects into the intercept term. All other monthly (seasonal) effects will reflect the difference from the December effect. ) is a set of J events which have disrupted tourist arrivals over the 1995-2011 period. Each of the J disruptions will be equal to 1 if the jth disruption in period t is present and 0 otherwise. A number of events disrupted the flow of tourists to Thailand over the 17 years of this study. They include Severe Acute Respiratory Syndrome (SARS) in April and May 2003, Thailand political rallies and demonstrations in November 2008, April~June 2009 and April ~July 2010; global 5 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 financial crisis from September 2008 to December 2011 and Bangkok floods from August 2011 to October 2011. All disruption effects are expected to be negative. Using this general specification, we estimate 11 tourist demand models—10 for the specified country sources and a scaled-down version (explained below) for “All Other” countries. A summation of the 11 individual models will generate an estimate of Thailand’s total tourist arrivals: ∑ The data sources for the independent variables are listed in Appendix Table A at the end of the paper. 4. Results of Source Country Model Estimations The results for all 11 source country equations are shown in Table 2 below. Only those variables with a significant p-value of 0.1 or better are included in the final equations reported. Transportation costs (TCit) and Bangkok floods were the only hypothesized independent variables that were not significant in any of the estimated equations and consequently, they are not reported. All other hypothesized independent variables were significant for at least two of the estimated equations. The table is divided into four parts. The top part shows constant term, lag effects, and macroeconomic variables affecting number of tourist arrivals. The second part shows monthly seasonal effects of tourists from each source country. Because December is used as the base month, the estimated coefficient for each month indicates how many more (for a plus sign) or how many less (for a negative sign) tourists visited Thailand in that month, on average, compared to December. The January coefficient for Malaysia, for example, is -43,497 meaning that, on average, 43 thousand fewer Malaysian tourists visited Thailand in January than in December for the study period. The “Disruptions” part of the table shows effects of extraordinary events that have disrupted tourist visits. These include the SARS outbreak in April 2003, the sporadic political demonstrations and protests from 2008 to 2010 and the global financial crisis September 2008 to the end of 2011. As noted above, we also tested for effects of the August to October 2011 Bangkok area floods but found no significant impact on tourist arrivals. The bottom part of Table 2 shows statistical results for each of the estimated equations. 6 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 Table 2. Estimated models for top ten Thailand monthly tourist arrivals (TAt) (tourists per month), 1995-2011. Equation Malaysia Japan China Korea UK US Singapore Taiwan Germany Australia All Others Constant -20,829* 37,438* 15,106* -28,816* 12,922* -14,040* 35,952* -18,548‡ 12,307* 3,350* 38,613* TAt-1 0.66* 0.60* 0.7* 0.6* 0.61* 0.34* 0.68* 0.97* GDP p.c. 70.6* 22.3* 15.5* 1.8* 1.6* 2.10* 1.43* Stock Ind 2.3‡ 1.14* Exch Rate 7,492* 1,057,964* 192* - 17,484* Price Ratio 258,778* - 12,362‡ Seasonal Effects Jan -43,497* 10,770** 19,838* -12,913* - -43,123* Feb -27,088* 13,478** - -9,493* -5,869* -23,776* - -11,024* Mar -38,769* - -6,935* -4,637* -18,895* - -2,811* -4,1273* Apr -34,799* -22,217* -8,311‡ -13,615* -7,708* -30,264* - -15,974* -2,247* -93,659* May -38,504* -19,695* -7,378‡ -23,515* -13,748* -20,234* - -22,153* -8,871‡ -66,562* Jun -44,415* -8,861* -13,080* -11,488* -13,080* -8,269* 8,059* -22,881* Jul -45,393* - -4,459‡ -7,179* -34,019* 11,637* -16,472* 44,188* Aug -39,442* 14,515** - -10,066* -16,044* -30,264* 10,613* -14,911* -6,724* -34,638‡ Sep -51,470* -19,435* -20,127* -21,258* -23,861* - -15,471* - -97,629* Oct -41,211* -22,348* -8,845‡ -5,152* -5,668* -24,359* - -8,279* Nov -34,550* - -4,745* -9,540* - -8,537* Disruptions SARSa -47,766* -20,801* -30,193** -37,696* - -14,606† -17,218* -21,454* b ‡ GFinC - -3,329* -13,672 - -4,492* Pol Disrc -17,854** -9,561‡ - -6,047* - -7,281‡ R-Squared 0.79 0.80 0.69 0.83 0.90 0.90 0.78 0.72 0.93 0.94 0.94 Adj R 0.77 0.79 0.68 0.83 0.89 0.89 0.77 0.71 0.93 0.94 0.94 F-Statistic 49.85 96.98 72.14 76.81 125.16 115.01 48.79 64.02 269.70 408.96 451.55 D-W Stat 1.11 1.80 2.11 1.04 2.08 1.44 1.88 1.70 1.45 2.28 1.60 .a Severe Acute Respiratory Syndrome, April-May 2003; b 2008 Global Financial Crisis Sept 2008-Dec. 2011; c Thai political unrest: Nov 2008, April-June 2009, April-July 2010. Note: *p-value < 0.001, ‡p-value < 0.05, †p-value < 0.1; 7 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 All of the estimated equations except Malaysia, Korea and the United States have a significant lagged endogenous term (TAt-1) indicating a partial adjustment structure. The positive coefficient means that tourist arrivals in current month depend, in part, on the arrivals in the previous month. GDP per capita in the origin country, as expected, turns out to be one of the primary determinants of tourist visits to Thailand. Only Japan, Singapore and Taiwan do not have significant income effects. However, the stock market index—a proxy for a wealth effect—turns out to be significant for Singapore as well as Germany. Relative exchange rates are significant determinants for only 4 countries—Malaysia, Korea, the United States and Taiwan--and relative consumer prices are important only for Korea and Taiwan. Seasonal factors largely reflect the holiday pattern for each source country. For most countries, December is the peak travel season for tourists and, as a result, the monthly coefficients are mostly negative. The exceptions are peak holiday times for certain countries—Japan in August, China and Korea during the Chinese New Year break and Taiwan during summer school holidays. In the Disruptions section, we can see that the SARS outbreak caused a sharp decline of tourists from all six Asian countries plus the United States which works out to a total monthly decline of 190 thousand tourists. Effects of the global financial crisis are significant for Japan, Korea and the United States but appear to have no significant effect on tourist arrivals from other countries. Thailand’s political unrest appears to have had a significant effect on only four countries—China, Korea, the United States and Taiwan. The estimation of “All Other” merits some additional explanation. Because this is an aggregate of many different tourist sources, we did not have appropriate aggregate information on GDP per capita, stock indices, exchange rates and price ratios. Consequently, only dummy variables for monthly seasonal effects and a lagged adjustment term were used to estimate this model. The results show that July is the peak month of inbound tourists and September is the lowest month of tourist arrivals. Like the UK, Germany, and Australia, the regression results show that none of the disruptions had a significant effect on Thailand inbound tourists for this group. And like tourists from the top ten sources, lag effect is significant and positive. The r-squared statistical results indicate that estimated equations explained 69 to 94 percent of the monthly variation in tourist arrivals 5. Evaluation of results We examine two topics in this section. First, we use the model estimates in Table 2 to evaluate the forecasting capability of the models by first testing the fit against actual data and then comparing the forecast accuracy using out-of-sample data. Second, we use the coefficients from the “disruption” results to calculate the lost revenue for Thailand’s tourist economy. 8 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 5.1 Comparing Forecast Accuracy We expect that the summation of separately-estimated country models incorporating source country information should generate a more accurate measure of total tourist arrivals than a single model estimation for total tourist arrivals. We can test this by various means. First, a plot of a summation of the 11 estimated models against actual total tourist arrivals for Thailand shows visually a close fit of the data (Figure 2). Second, we use Root Mean Square Error (RMSE) test of the residuals of the aggregated 11-model series and a single model estimation of tourist arrivals. We estimated a single model of total tourist arrivals (TTAt) as a function of trend and seasonal factors. Among the models tested, this had the best performance. The result in thousands of tourist arrivals is: TTA = 666 + 4.6 Trend -74Jan -96Feb –136Mar –265Apr -361May -324Jun -196Jul (32.83) (-1.80) (-2.33) (-3.30) (-6.45) (-8.77) (-7.89) (-4.77) -74Aug -319Sep -252Oct -149Nov (-4.25) (--7.76) (-6.12) (-3.63) (2) R2 = 86.6 Adj R2 = 85.8. (t-statistics in parentheses) Table 3 shows that the RMSE of the 11-country summation of separately estimated tourist arrivals by country has a lower RMSE than the single equation estimation of total tourist arrivals. The aggregated 11-country RMSE (77 thousand) is smaller than the 9 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 aggregate estimate from equation (2) (98 thousand). This is statistical evidence of a tighter fit of the actual data for the 11-country estimate. Table 3. RMSE comparison of 11-model estimate with single total model estimate Methodology A Summation of Separately An Estimation of Total Estimated Tourist Arrivals by Tourist Arrivals Country Observations 204 204 RMSE 77,735 98,263 Finally, the true test of a forecasting model it its ability to perform an out-of-sample forecast. We incorporate projected macroeconomic variable values into each of the 11 models to forecast Thailand tourist arrivals for the first 9 months of 2012 and compare them with a forecast using equation (2). The results shown in Table 4 compare the two approaches with the actual monthly arrivals for 2012. The 11-model aggregate forecast clearly out-performs the forecast for total arrivals as shown by the monthly error terms of the two forecasts. The single equation forecast consistently under-estimates the number of monthly tourist arrivals by about 20 percent for most of the 9-month period. The error of the 11-model aggregate, however, is 11% or less for all months. Table 4. Comparison of monthly forecasts of Thailand tourist arrivals, Jan-Sep 2012 11-Model Aggregate Forecast Total Arrivals Forecast (Eqn 2) Total Total Total 2012 Actual Forecasted Residual Error Forecasted Residual Error ----------arrivals/mo--------% ----arrivals/mo---% Jan 1,992,158 1,774,717 -217,441 -10.9 1,549,971 -442,187 -22.2 Feb 1,853,736 1,896,657 42,921 2.3 1,532,846 -320,890 -17.3 Mar 1,895,560 1,770,735 -124,825 -6.6 1,497,798 -397,762 -21.0 Apr 1,686,268 1,658,208 -28,060 -1.7 1,372,925 -313,343 -18.6 May 1,546,888 1,533,675 -13,213 -0.9 1,282,158 -264,730 -17.1 Jun 1,644,733 1,538,012 -106,721 -6.5 1,323,422 -321,311 -19.5 Jul 1,815,714 1,660,120 -155,594 -8.6 1,456,306 -359,408 -19.8 Aug 1,925,806 1,711,038 -214,768 -11.2 1,482,394 -443,412 -23.0 Sep 1,603,270 1,616,623 13,353 0.8 1,342,662 -260,608 -16.3 5.2 Using Disruption Parameters to Evaluate Impact on Tourist Revenue Finally, we can use the results of the 10 country models to estimate the effects of the three sets of travel disruptions—SARS, the global financial crisis and Thailand’s indigenous political disruptions. The estimated “disruption” coefficients show the decline in tourist arrivals from what would have been the pattern had the disruption not occurred. All the effects are negative although not all countries show significant effects. 10 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 Using Tourism Authority (2012) data on average length of stay and average expenditure per day per tourist by source country, we can estimate the immediate economic impact of each of these three sets of disruptions as shown in Table 6. The highest daily expenditure is by Singaporean tourists and the lowest daily expenditure is by Malaysians. Tourists from the US spent the most time in Thailand (an average of 2 weeks) and Malaysians spent the least amount of time (5 days). Multiplying the average daily expenditure by the average length of stay by the decline in tourists (estimated coefficient) for the number of months of the disruption gives us an estimate of the impact of each of the three disruptions. Of the 3 disruptions, SARS had the smallest direct total impact on the tourism industry with an estimated effect of $388 million. This is largely due to the limited time frame— only two months—for the disruption. However, seven of the 10 countries had significant SARS effects and the monthly decline in tourist visits (as shown by the SARS coefficient values), is greater than the effect for the two other disruptions. The SARS effect, while short in duration, was very intense. Table 6. Estimation of disruption impacts on tourist spending in Thailand (A) (B) (C) (B)*(C) = (D) (A)*(D)*2 Countries Coefficient Per Capita Average Per Capita Total 2Spending/day stay Spending/trip mo Loss tourist US$/day Days Mil US$ US$ arrivals/mo SARS-Affected Countries Malaysia -47,776 137.10 4.78 655.34 -62.62 Japan -20,801 146.69 7.45 1,092.84 -45.46 China -30,193 146.63 7.61 1,115.85 -67.38 Korea -37,696 153.17 7.30 1,118.14 -84.30 USA -14,606 146.18 14.01 2,047.98 -59.83 Singapore -17,218 160.96 5.39 867.57 -29.88 Taiwan -21,454 136.76 6.62 905.35 -38.85 Total -189,744 - 388.32 Global financial crisis affected countries Japan -3,329 146.69 7.45 1,092.84 -141.87 Korea -13,672 153.17 7.30 1,118.14 -596.19 USA -4,492 146.18 14.01 2,047.98 -538.75 Total -21,492 1,276.81 Political disruption affected countries China -17,854 146.63 7.61 1,115.85 -239.07 Korea -9,561 153.17 7.30 1,118.14 -128.28 USA -6,047 146.18 14.01 2,047.98 -148.60 Taiwan -7,281 136.76 6.62 905.35 -79.10 Total -40,742 -595.05 Source: Tourism Authority of Thailand 11 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 The global financial crisis, with an estimated cost of $1,277 million, has had the greatest impact on Thai tourism but the effect is concentrated in 3 source countries—Japan, Korea and the United States—and it is the longest running disruption. The sporadic political demonstrations have cost the Thai tourist industry an estimated $595 million with the effects concentrated in tourist arrivals from China, Korea, the United States and Taiwan. The estimated impacts of the three disruptions have likely underestimated the full economic effects on Thailand for three reasons. First, although we did not find a significant effect for the “All Other” group for any of the disruptions, certainly some of the countries within the group likely had a significant decline for one or more of the disruptions. Second, countries which showed no statistically significant impact may, nevertheless, have had some tourists who postponed or cancelled travel to Thailand. Finally, from our knowledge of the workings of the macro-economy, we know that an initial impact (which is the one we have measured) will have downstream effects as those who would have earned money from visiting tourists cut back their own spending thereby reducing the earnings of others in the Thai economy. We have made no attempt to measure this multiplier effect. 6. Conclusions We have shown that estimation of econometric forecasting models from the decomposition of tourist arrivals by source country not only results in a more accurate overall forecast of tourist demand for Thailand, it also generates a set of parameters that give us information on fundamental factors driving visits to Thailand by source country. An added benefit is the estimation of “disruptions” which gives us a starting point for evaluating the impact of each of these on the tourist industry. Decomposition of tourist arrivals by source country, although useful, is only part of the story. Even tourists from the same country have many different needs and vacation objectives. It may be just as important to know whether a tourist is a backpacker, on a family vacation or a retired traveler. This type of information—if it could be collected and analyzed—would likely tell us more than country-of-origin data about why these different groups of tourists visit Thailand and the facilities and services that they seek. References Balogh, P., Kovacs, S., Chaiboonsri, C, and Chaitip, P., 2007, Forecasting with X-12ARIMA: International tourist arrivals to India and Thailand, Applied Studies in Agribusiness and Commerce, Agroinform Publishing House, Budapest. Chokethaworn, K., Sriwichailamphan, T., Sriboonchitta, S., Chaiboonsri, C., Sriboonjit, J., and Chaitip, P., 2010, International tourist arrivals in Thailand: Forecasting with ARFIMA-FIGARCH approach, Annals of the University of Petrosani, Economics, 10(2), 75-84. 12 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 Case, K. E., Quigley, J. M., & Shiller, R. J. 2005, Comparing wealth effects: The stock market versus the housing market. Advances in Macroeconomics, 5(1), 1-32. Cho, S. 2006, Evidence of a stock market wealth effect using household level data. Economics Letters, 90(3), 402-406. Chokethaworn, K. 2010, Modeling international demand to Thailand: Spatial and temporal aggregation. Unpublished Doctoral, Chiang Mai University, Chiang Mai, Thailand. Dritsakis, N., & Athanasiadis, S. 2000, An econometric model of tourist demand. Journal of Hospitality & Leisure Marketing, 7(2), 39-49. Garin-Munoz, T., & Amaral, T. P. 2000, An econometric model for international tourism flows to Spain. Applied Economics Letters, 7(8), 525-529. Garín-Muñoz, T., & Montero-Martín, L. F. 2007, Tourism in the Balearic Islands: A dynamic model for international demand using panel data. Tourism Management, 28(5), 1224-1235. Garín-Munoz, T. 2006, Inbound international tourism to Canary Islands: A dynamic panel data model. Tourism Management, 27(2), 281-291. Hiemstra, S., & Wong, K. K. F. 2002, Factors affecting demand for tourism in Hong Kong. Journal of Travel & Tourism Marketing, 13(1-2), 41-60. Hultkrantz, L., & Olsson, C. 1997, Chernobyl effects on domestic and inbound tourism in Sweden-A time series analysis. Environmental and Resource Economics, 9(2), 239-258. Jintranum, J., Sriboonchitta, S., Calkins, P. and Chaiboonsri, C., 2012, Border tourism demand from GMS countries to Thailand: X12ARIMA and TRAMO/SEAT Model, British Journal of Economics, Management & Trade, 2(2): 125-166. Kim, H., Park, J. H., Lee, S. K., & Jang, S. C. S. 2012, Do expectations of future wealth increase outbound tourism? Evidence from Korea. Tourism Management, 33(5), 1141-1147. Kulendran, N., & Shan, J. 2002, Forecasting China's monthly inbound travel demand. Journal of Travel & Tourism Marketing, 13(1-2), 5-19. Maloney, W. F., & Rojas, G. V. M. 2005, How elastic are sea, sand and sun? Dynamic panel estimates of the demand for tourism. Applied Economics Letters, 12(5), 277280. Naude, W. A., & Saayman, A. 2005, Determinants of tourist arrivals in Africa: A panel data regression analysis. Tourism Economics, 11(3), 365-391 13 Proceedings of 8th Asian Business Research Conference 1 - 2 April 2013, Bangkok, Thailand, ISBN: 978-1-922069-20-7 Salman, A. K., Shukur, G., & Bergmann-Winberg, M. L. 2007, Comparison of econometric modelling of demand for domestic and international tourism: Swedish Data. Current Issues in Tourism, 10(4), 323-342. Song, H.Y. and Li, G., 2008, Tourism Demand Modeling and Forecasting: A Review of Recent Research, Tourism Management, 29, 203-220. Tourism Thailand 2012, http://thai.tourismthailand.org/about-tat/statistic Virojanarom, V. 2008, Estimation of foreign tourism demand in Thailand using nonstationary panel data analysis. Unpublished Master, Chiang Mai University, Chiang Mai, Thailand. Williams, A. M., & Shaw, G. 1991, Tourism & economic development: Western European experiences. London: Belhaven Press. Appendix Table A. Data sources for forecasting model of Thailand tourist arrivals Source Country Data Australia http://www.abs.gov.au/websitedbs/D3310114.nsf/home/Home?opendocument China http://www.stats.gov.cn/english/ Germany http://www.statistik-portal.de/Statistik-Portal/en/ Japan http://www.stat.go.jp/english/index.htm Korea http://kostat.go.kr/portal/english/index.action Malaysia http://www.statistics.gov.my/portal/ Singapore http://www.singstat.gov.sg/stats/themes/people/hist/popn.html Taiwan http://eng.stat.gov.tw/mp.asp?mp=5 UK http://www.ons.gov.uk/ons/index.html http://www.census.gov/population/www/popclockus.html: USA http://www.census.gov/econ/estats/ Global Macro Data Oil, GDP http://www.forecast-chart.com/chart-crude-oil.html Financial http://stats.oecd.org/# indicators; http://www.nationmaster.com/graph/eco_gdp_per_cap_in_190-economy-gdp-per-capita-1900 GDP http://data.worldbank.org/indicator/NY.GDP.PCAP.CD?page=2 growth http://knoema.com/pjeqzh#Singapore http://knoema.com/satfjze CPI http://knoema.com/rjirstd#Germany Exchange oanda.com/currency/historical-rates rates Thailand Data National Statistical Office of Thailand: http://service.nso.go.th/nso/nsopublish/themes/economic.html http://service.nso.go.th/nso/nsopublish/download/files/socioSoc53.pdf Office of the National Economic and Social Development Board: http://www.nesdb.go.th/Default.aspx?tabid=95 Bank of Thailand: http://www.bot.or.th/English/Statistics/EconomicAndFinancial/EconomicIndices/Pages/menu.aspx http://www.bot.or.th/Thai/EconomicConditions/Thai/report/DocLib_/annual_Y54_T.pdf http://www2.bot.or.th/statistics/ReportPage.aspx?reportID=409&language=eng http://www.indexpr.moc.go.th/price_present/cpi/stat/others/indexg_report2.asp?list_year=2550 14