Proceedings of World Business Research Conference

advertisement

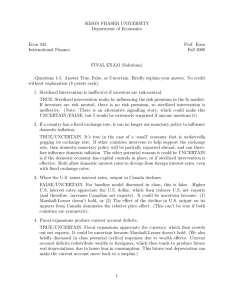

Proceedings of World Business Research Conference 21 - 23 April 2014, Novotel World Trade Centre, Dubai, UAE, ISBN: 978-1-922069-48-1 Monetary and Fiscal Policy Interaction in the Greece: A Cointegration Approach Hounaida Daly* and Mounir Smida** Recently, monetary authorities have increasingly focused on implementing policies to ensure price stability and strengthen central bank independence. Simultaneously, in the fiscal area, market development has allowed public debt managers to focus more on cost minimization. This « divorce » of monetary and debt management functions in no way lessens the need for effective coordination of monetary and fiscal policy if overall economic performance is to be optimized and maintained in the long term. This paper analyzes these issues based on a review of the relevant literature and of country experiences from an institutional and operational perspective. The main sphere of interaction between monetary and fiscal policies relates to the financing of the budget deficit and monetary management. The particular stance of monetary policy affects the capacity of the government to finance the budget deficit by changing the cost of debt service and limiting or expanding the available sources of financing. The evidence does not let hear strong political interactions in Greece, and supports the idea that the monetary policy is more stabilizing in its influence on the economic activity than the budget policy. JEL Codes: E52, E58, E62 and E61 _____________________________ * PhD student in Economic Sciences at Faculty of Economics Sciences and Management of Sousse. Research Unit: MO2FID (E.49/C.06). E mail: Hounaida.Daly@gmail.com. ** Professor in Economics Sciences at Faculty of Economic Sciences and Management of Sousse. Director of Research Unit: (MO2FID) (E.49/C.06).