SECURED TRANSACTIONS PROBLEM SET 18 Fall 2015

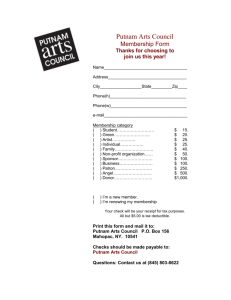

advertisement

SECURED TRANSACTIONS Fall 2015 PROBLEM SET 18 Introduction to Bankruptcy, Valuation and Payment of Claims, and the Automatic Stay Bankruptcy, After-Acquired Property, and Proceeds Read carefully §§ 16.01, 16.02, 16.03, and 16.06 of UNDERSTANDING SECURED TRANSACTIONS and Bankruptcy Code §§ 361, 362, 501, 502, 506, 541, 542, 549, 550, and 552. 1. Your day starts with a call from Sara Jones at First Bank: Last night, I was out at dinner at Irregardless. One of our borrowers, Stan Hall, was seated at the next table. He has a line of credit for his plumbing services business, which is running over a $50,000 balance. We haven’t gotten any minimum payment from him for the last two months, so I said hello to him and asked if he could come by the Bank to make a payment and discuss the status of his account, or else I would have to put a freeze on his line of credit. He got really belligerent and said that he had filed for bankruptcy earlier in the day and not to bother him about the balance of the debt any further. This morning, when I got in to work, I had a phone message from his attorney, threatening to file a motion for sanctions against the Bank for violating the automatic stay because I spoke to Stan about making payment and threatened to freeze his credit line. Does the Bank have a problem here? What’s your response? What additional information, if any, do you need? 2. Shortly after hanging up with Sara Jones, you get a call from Todd Grant, a law school classmate who avoided commercial law courses in law school. He tells you: About a month ago, while at the courthouse waiting for a hearing, I saw a notice on the bulletin board that Commerce Bank would be conducting a foreclosure sale of a Porsche 911 on October 15 at 10:00 a.m. on the steps of the County Courthouse. I’ve always wanted to drive a Porsche, so I went to the sale, and I ended up as the high bidder for $10,000. I paid cash and took possession of the car. Yesterday, I got a letter from Fred Lacey, who said he was the bankruptcy trustee for someone named Bob Harris, who turns out to have been the former owner of the car. The letter said that Harris had filed for bankruptcy at 9:45 a.m. on October 15, so that the foreclosure sale was invalid, and he demanded that I turn over the Porsche to him immediately. I didn’t know anything about this. Do I have to turn over the car? If so, can I get my money back? What’s your response? 3. As you returned from your mid-morning coffee break, you discover this message from Bubba Charles at Putnam County Bank: It’s Bubba. Two of my borrowers filed for bankruptcy on Friday (I just got the notices today). One of them, Donald Tramp, owes us $20,000 as of Friday, and his line of credit accrues interest at 10%. We have a perfected security interest in some of Tramp’s equipment, but altogether it’s only worth about $10,000. The other, Sara Smith, owes us $10,000 as of Friday, and the promissory note she signed bears interest at 10%. The collateral for her loan is a diamond (which we’re holding in our vault), which is worth $20,000. Kelly Smith usually handles all our bankruptcy stuff, but she’s on vacation for two weeks, so I’ve got to cover for her. I understand I’m supposed to file a proof of claim for the Bank. What’s the amount of the claim I should file in each case? What’s your response? What additional information, if any, do you need? 4. At lunch, you run into Dan Arthur at Atlantic Commercial Finance (ACF). He tells you: One of our borrowers, Crouch Concrete Co. (CCC), has filed for Chapter 11 bankruptcy. We have a security interest in all six of CCC’s concrete trucks, perfected by a notation on the certificate of title for each truck. CCC owes us a total of $200,000. The six trucks, altogether, are worth about $180,000. I want to foreclose on the trucks now, before they depreciate any further. Can I get relief from the automatic stay, or are we stuck waiting for CCC to see if it can reorganize? What’s your response? What additional information, if any, do you need? 5. How would your analysis of Problem 4 be different if the six concrete trucks had a collective value of $300,000? 6. Just before 5:00 pm, you get another call from Bubba at Putnam County Bank: Another bankruptcy problem and Kelly’s still not here. At lunchtime today, Putnam Sight and Sound, a local electronics retailer, filed a Chapter 11 bankruptcy case. They have a line of credit with us, secured by all their inventory, accounts, and chattel paper, and that interest is properly perfected by a UCC-1. They primarily sell TVs, computers, cameras, and sound systems; about 400 items each week. Each Monday, they get a new shipment of inventory, and pay for it by drawing on our line of credit. Today’s Thursday, so they’d get a new shipment this coming Monday. I’m assuming that if they get a new shipment of inventory on Monday, as usual, it will still be covered by our security agreement. Is there anything I need to do about this situation, or can it wait until Kelly’s back in the office in 2 weeks? What’s your response to Bubba? What steps should Putnam County Bank take to protect its security interest in its collateral? What additional information, if any, do you need? In considering your answer, suppose that over the weekend, Putnam Sight and Sound makes 200 sales of TVs, computers, or other electronic devices, either in cash sales or sales in which customers sign installment contracts. What is the effect of those sales on Putnam County Bank’s security interest? What happens to the cash from those sales?