Proceedings of 6th Annual American Business Research Conference

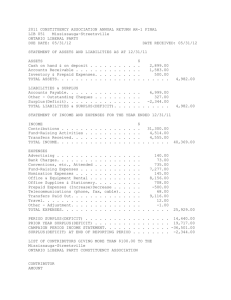

advertisement

Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 Major Public Sector Accounting Standards and the Public Accounts of the Province Of Ontario, Canada Joe Abekah and Kofi Baah This study reviews the Public Accounts of Ontario from 1995 to 2013 with the view to determining the impact of two major reporting changes on reported financial statements of Ontario. These are (1) the capitalization of tangible capital asset expenditures from the 2002/2003 fiscal year, and (2) the consolidation into the provincial accounts of Broader Public Sector Organizations since the 2005/2006 fiscal year. Results show that while there was an immediate increase (decrease) in reported surplus (deficit) following the start of capitalization, surplus (deficit) levels have returned to the pre-capitalization levels. On the other hand, the consolidation of Broader Public Sector Organizations has consistently led to smaller reported deficits. The relevance of the effect of these changes to the stakeholders of provincial reporting is a matter for further enquiry. 1. Introduction Financial reporting has long been a means by which a government communicates with voters and other stakeholders about the financial management of the areas and entities under a government’s jurisdiction. Reporting practices have evolved over the years, from a time when government financial reporting was largely a record of receipts and payments (cash basis accounting), to the current situation where government reporting is governed by the prescribed standards of the Public Sector Accounting Board (PSAB) of the Canadian Institute of Chartered Accountants, now Chartered Professional Accountants (CPA), Canada. Thanks to the PSAB standards, public accounts today, in large measure, follow accrual accounting principles. Ontario actually started using the accrual basis of accounting for its financial statements from fiscal year 1993/94 (Province of Ontario, 2003). Even so, some elements of cash basis reporting remained for some time. Two major changes to reporting by government entities since the adoption of accrual accounting and PSAB standards are the requirement to capitalize tangible capital assets (PSAB 3150) and the requirement for consolidation of all government reporting entities (PSAB 1300). In Ontario, these changes were implemented from the 2002/2003 fiscal year and the 2005/2006 fiscal year respectively. ______________________________________________________________________________ Joe Abekah, University of New Brunswick, Fredericton Kofi Baah, Ministry of Health, Ontario Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 The purpose of this study is to examine how these two changes have affected reported government surpluses (deficits) with the view to determining whether reported surplus (deficits) are better than, worse than, or the same as, what they would have been without the changes. The rest of the paper is organized as follows: Section 2 provides a brief rationale for the paper, followed by Section 3 on data collection and methodology. The results are presented in Section 4 with concluding remarks in Section 5. 2. Rationale Users of government financial statements are many and varied, including the general public, legislators, councilors, investors, analysts and other governments (PSAB 2005), all with different expectations. With so many interested parties, the importance of government financial reporting cannot be overemphasized. The importance of periodic reporting is outlined by the PSAB as: “A government financial report should present information that is useful in evaluating the government's financial condition at the end of the accounting period and its financial performance during the accounting period” (PSAB 2005, PS 1000 par. 07). As the PSAB Handbook further puts it: “users look to financial statements to provide information about: (a) the sources and types of government revenues; (b) the allocation and use of economic resources; (c) the cost of goods and services provided in the accounting period; (d) the extent to which the costs of the period were met by the revenues of the period; (e) the government's financial position; (f) the stock, allocation and use of non-financial resources; (g) the extent to which revenues were sufficient to meet expenditures; (h) how the government financed its activities and how it met its cash requirements; (i) actual results of activities of the period in comparison with those originally planned and those of past periods; and (j) whether public economic resources were managed in accordance with legislative authorities.” (PSAB 2005, PS 1000 par. 19) The importance of government financial reporting is further highlighted by the significant roles the various levels of government play in the economy, currently about thirty-five percent of Canada’s GDP (Edwards, 2012). The reports also play a significant role in providing advantages or disadvantages to the reporting government and other political entities. Therefore, governments have interests in the reporting process as the reporting methods may or may not be in a government’s overall interest. Both standards in this study have significant impact (in nominal dollar terms) on reported surpluses (deficits) in relation to the pre-standard adoption situation. Although governments had no option but to adopt the standards, a government could still be pleased or displeased with a standard depending on how they affect overall reporting. Knowing their impact also helps other informed users to make better judgements about government activities and to ascertain whether the new standards provide better information to the varied users of government accounting information. Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 3. Data Collection and Methodology Annual Reports, including Consolidated Financial Statements, of the Province of Ontario are published and are available on line under http://www.fin.gov.on.ca/en/budget/paccts/2013/. Currently, annual reports and statements dating back to the 1994/95 fiscal year can be individually accessed. The consolidated financial statements include Consolidated Statement of Operations, Consolidated Statement of Financial Position, Consolidated Statement of Change in Net Debt, Consolidated Statement of Change in Accumulated Deficit, Consolidated Statement of Cash Flow, notes and schedules. Information in the statements of operations, financial position, and cash flows formed the major focus of our data collection. Information from these statements for individual years was compiled into nineteen-year data sets from 1994/95 to 2012/13. To aid the comparisons, components of the statement of operations were recast as percentages of total revenues for the respective year and the annual surplus (deficit) was similarly expressed as a percentage of the year’s revenues. Fiscal year 2002/2003, the year of adoption by Ontario of the tangible capital asset capitalization standard, PS3150, served as a new event date from where a review of the impact of the standard began. With the aid of information from the statement of cash flow, the reported surplus (deficit) was recast to show what the surplus (deficit) would have been under the pre-capitalization regime. A means test of the surpluses (deficits) ratios over the pre- and post-capitalization periods enabled us to make summary observations about the impact of capitalization on reporting. Before the adoption in 2005/2006 of PS 1300, the accounts of Broader Public Sector Organizations, namely, public hospitals, school boards, and community colleges were not consolidated into the public accounts of Ontario. Fiscal year 2005/2006 was when consolidation into provincial accounts of these broader public sector organizations began in Ontario in compliance with PS 1300. It served as the new event date from where assessment of the impact of consolidation began. With the aid of information in Schedule 10 of the consolidated financial statements, the annual impact of consolidation was determined for the years 2005/2006 to 2012/2013. A means test of the surpluses (deficits) ratios as reported and what they would have been without consolidation enabled us to make summary observations about the impact of consolidation, as per PS 1300, on Ontario government reporting. 4. Results of Analysis and Tests Panels A and B of Table 1 present summary components of revenues and expenses for the Province of Ontario in nominal dollars with the attendant surplus (deficit) for 1995-2002 and for 2003-2013 respectively. The same information is presented in ratio (percentage of total revenue) form in Panels A and B of Table 2. They show that various forms of taxation have constituted seventy percent (70%) or more of provincial revenues every year. Since 2003, however, federal government transfers to the province have averaged 17% of provincial revenues (reaching a high of 22% in 2011), from an average of 11.6% during the 1995-2002 period. Healthcare, Education and Training, and Interest on Provincial Debt have averaged over seventy percent of provincial expenditures during the nineteen-year period with health care alone averaging over forty percent of provincial expenditures during the last five years. There were three surplus years (2000 to 2002) during the 1995-2002 eight study years while there were four surplus years during the 2003-2013 eleven study years. All surplus years were before 2009. Reported surpluses have always been significantly less than reported deficits. The best reported surplus during 1995-2002 Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 (in 2001) represented five percent (5%) of revenues of that year. In contrast, the worst reported deficit during 1995-2002 (in 1995) represented twenty-two percent (22%) of the revenues of that year. For the post capitalization period of 20032013, the best surplus year was 2007 and the reported surplus represented three percent (3%) of revenues that year. The worst reported deficit (in 2010) was twenty percent (20%) of the year’s revenues. In general, deficits averaged seven percent (7%) of annual revenues during 1995-2002 and six percent (6%) of revenues during 2003 to 2013 as reported in Panel A of Table 4. Figure 1 shows the behavior of surplus (deficit) during 1995-2002 (1to 8) and 2003-2013 (9-19). Figure 1 Reported Surplus (Deficit) Percentages 1995(1) to 2013 (19) as 0.1 0.05 0 1 2 3 4 5 6 7 8 9 10111213141516171819 -0.05 Surplus (Deficit) 95/02 -0.1 Surplus Deficit) 03/13 -0.15 -0.2 -0.25 4.1 The Effects of TCA Capitalization Capitalization led to the expensing of tangible capital assets (TCA) expenditures over their respective useful lives following the adoption PSAB 3150 from the 2002/2003 fiscal year. Prior to that, the full expenditure was expensed in the year the asset was purchased. We expect that initially depreciation per year would be less than the one-time expensing that was the prior case. If the same annual level of capital expenditures were undertaken, reported surpluses would be higher (reported deficits would be lower) post capitalization. Visually, Figure 1 does not support this proposition. An independent-samples T-Test was conducted to compare the average reported surplus (deficit) during the pre-capitalization period to the surplus (deficit) reported during the post capitalization period. Results are presented in Panels A and B of Table 5. There was no significant difference between the average reported surplus (deficit) during the 1995-2002 period (M = -.07, SD = 0.10) and the average reported surplus (deficit) during the TCA capitalization period of 2003-2013 (M = -.06, SD = 0.07); t(17) = -0.32, p = 0.75. These results suggest that the capitalization of tangible capital assets has not affected the level of reported surplus (deficit) as a percentage of reported provincial revenues. The next phase was to look at the reported surpluses (deficits) during the capitalization period to see whether they would have been significantly different had the province actually continued to report under the expensing regime preceding Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 the 2003 adoption of PSAB 3150. Table 3, Panel A, reports what the reported surplus (deficit) would have been during the 2003-20013 capitalization period if expensing of TCA expenditures had continued. The adjusted surpluses (deficits) are also recast as percentages of reported revenues. This is also represented by Figure 2 below. Figure 2 Reported and Adjusted Surplus (Deficit) Percentages 2003 to 2013 0.05 0 1 2 3 4 5 6 7 8 9 10 11 -0.05 -0.1 Reported (%) -0.15 Adjusted (%) -0.2 -0.25 -0.3 A paired sample T-Test was conducted to compare the average surplus (deficit) as reported versus what they would have been had there been no capitalization of TCA expenditures (adjusted). Results are presented in Panels A and B of Table 5. There was a significant difference between the average reported surplus (deficit) (M = -.06, SD = 0.07) and the adjusted surplus (deficit) had there been no capitalization (M = -.09, SD = 0.09); t(10) = 4.25, p = 0.00. These results suggest that the capitalization of tangible capital assets increased reported surpluses in surplus years and reduced reported deficits in deficit years. 4.2 The Effects of Broader Public Sector Consolidation The coming into force of PSAB PS 1300, Government Reporting Entity, in April 2005 required governments to consolidate entities that they control. The standard provides “indicators of control” to determine whether control exists and the Province of Ontario implemented the standard from fiscal 2005/2006. Before then Ontario did not consolidate the financial results of some of its broader public sector (BPS) organizations. To comply with PS 1300, the provincial government assessed the existing legislation and regulations governing about 150 public hospitals, 24 community colleges, and 103 school boards which were deemed to be controlled by the government. Since the 2005-06 fiscal year-end, the financial results of those entities have been consolidated and reported as part of the Public Accounts of Ontario. Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 At the time of consolidation certain adjustments are made to the BPS financial information to eliminate interorganizational gains or losses and to avoid double counting. One such key adjustment relates to capital grants (transfer payments) from the province to the BPS organizations. Under PSAB the province normally records all transfer payments including capital grants as expense. However, BPS entities defer and amortize capital grants over time on the acquisition of tangible capital assets. At consolidation, there could be a mismatch in the amounts of the province’s transfer payment expense recorded as grant revenues by BPS Organizations. Without consolidation adjustment, the net impact will be an inter-entity gain or loss created on the province’s consolidated financial statements. We illustrate the impact of the capital adjustment as follows: Assume that the province provides $2 billion as capital transfer to hospitals for the construction of buildings. That amount will be reported as transfer payment expense on the statement of operations in the year the grant is made. Hospitals on the other hand would capitalize the $2 billion on their balance sheets as deferred contribution (liability) subject to straight line amortization of the building (capital asset). Further assume that the building will be amortized over 40 years. Ignoring the half year rule, the amortization expense is $50 million per year on a straight line basis. Prior to BPS consolidation, the $2 billion would have been reported as part of the expenses on the statement of operations in the year the grant was made. With BPS consolidation however, the $2 billion would be adjusted to the BPS revenue to offset the province’s transfer payment expense as an elimination entry. The impact on the province’s expenses will be the yearly $50 million amortization expense instead of $2billion. Starting with the reported surplus (deficit) on the consolidated statement of operations for each of the eight fiscal years from 2005/06, we isolated the impact of BPS consolidation with the aid of information from Schedule 10 of the consolidated financial statements. Surpluses (deficits) if there were no consolidation were determined. The surpluses (deficits) were recast as percentages of reported revenues. The results are presented in Panel B of Table 3. Panel C of Table 3 breaks down the dollar impact of consolidation by identifying the contribution from broader public sector hospitals, school boards, and community colleges respectively. Figure 3 further shows reported consolidated surpluses (deficits) and what surpluses (deficits) would have been without consolidation. Panels B and C of Table 3 and Figure 3 show that surpluses would have been smaller than reported and deficits would have been larger than reported without consolidation. In fact, in 2005-06 and 2007-08 deficits rather than surpluses would have been reported without consolidation. From Panel C of Table 3, it is clear that since the adoption of PS 1300, BPS consolidation has cumulatively contributed $19.9 billion reduction in the accumulated deficits of the Province of Ontario. Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 Figure 3: Reported Surpluses (Deficits) with/without BPS Consolidation 0.05 0 1 2 3 4 5 6 7 8 -0.05 -0.1 Consolidated Unconsolidated -0.15 -0.2 -0.25 4.3 Test of Consolidation impact After determining what reported surpluses (deficits) would have been if there were no consolidation, a paired sample T-Test was conducted to compare the average surplus (deficit) as reported versus what they would have been the case had there been no consolidation of BPS accounts. Results are presented in Panels A and B of Table 5. There was a significant difference between the average reported surplus (deficit) (M = -.07, SD = 0.08) and the surplus (deficit) had there been no consolidation (M = -.09, SD = 0.10); t(7) = 2.09, p = 0.04. These results suggest that the consolidation of BPS accounts increased reported surpluses in surplus years and reduced reported deficits in deficit years. 5. General Observations and Conclusion The provision of more useful information for decision making by users of public sector accounting information is the driving force behind the PSAB’s push for the use of full accrual accounting by provincial governments. Our study reviewed the effects of two significant changes in public reporting by Ontario as a result of this push, namely, TCA capitalization and BPS consolidation. If overall provincial spending post-capitalization had been at the same levels as precapitalization, we would have expected reported surpluses to be higher and reported deficits to be lower, all other things being equal. Our tests indicate that the levels of surpluses (deficits) relative to provincial revenues have not been significantly different after capitalization came into effect in 2002/2003. One explanation could be that governments, aware of the reporting effects of capitalization, factor that into their expenditure considerations and concentrate on overall surplus (deficit) levels rather than on the benefits or otherwise of a particular standard. The other major consequence of the PSAB’s full accrual reporting quest is the consolidation of the accounts of broader public entities into the provincial accounts. The major impact of this consolidation is a positive impact on reported Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 provincial surpluses and deficits; that is, reported surpluses (on the few occasions that there have been) have been higher than would otherwise be without consolidation, and the reported deficits since consolidation began have been lower than they would otherwise have been. Given that surplus (deficit) levels have generally remained the same as they were in the pre-capitalization and consolidation era, it is reasonable to suggest that “gains” brought about by a PSAB reporting change are quickly factored into provincial activities so that a tolerable level of surpluses (deficits) are maintained in provincial financial affairs. This study is limited in the fact that it is unable to make observations about how stakeholders in the Public Accounts of Ontario perceive the reporting changes that have emanated from PSAB 3150 and 1300. From our study and results, however, we can say that governments of Ontario over the years have been happy with the changes. This is because on the whole the capitalization and consolidation have contributed favorably to the provincial results reported in compliance with these new standards. See Appendix 1 for Tables REFERENCES CPA Canada (2003). Twenty questions about government financial reporting: federal, provincial and territorial governments. PSAB. Toronto, Canada. CPA Canada, 2013. Public Sector Accounting Handbook. CPA Canada, 2013: Public Sector Accounting Board, PS 1300. Government Reporting Entity. Toronto, Canada. CPA Canada, 2013: Public Sector Accounting Board, PS 3150. Government Reporting Tangible Capital Assets. Edwards, C. (2012). Can We Cut Government: Canada Did, Cato Institute. May/June Edwards, C. (2013). Canada’s Fiscal Reforms. Cato Journal, Vol. 33, No. 2 (Spring/Summer). Ferris, J. S. and Winer, S. L. (2007). Just How Much Bigger is Government in Canada? A Comparative Analysis of the Size and Structure of the Public Sectors in Canada and the United States, 1929–2004. Canadian Public Policy – Analyse de Politiques, Vol. XXXIII, No. 2. pp 1-34 Ministry of Finance, Province of Ontario (2013). Public Accounts of Ontario (Various years). Available at: http://www.fin.gov.on.ca/en/budget/paccts/2013/ Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 APENDIX 1: TABLES Table 1 Panel A: Consolidated Statement of Operations, Province of Ontario (1995 – 2002) 1995 1996 1997 1998 1999 2000 2001 2002 Other Taxes Total Taxation Government of Canada Other 14758 9090 4557 2640 1939 1475 34459 7607 3973 15633 9424 5174 2695 1944 1446 36316 7645 4398 16357 9964 5852 2772 2491 1030 38466 5778 5206 16293 10843 7456 2851 2591 1167 41201 5098 6189 17190 11651 7447 2882 2660 1247 43077 4515 8194 17617 12879 8095 3118 2819 1353 45881 5885 11165 18624 13735 9200 3424 2820 1479 49282 6129 9271 19097 13803 6646 3502 2851 1739 47638 7754 8494 Toal Revenue 46039 48359 49450 52488 55786 62931 64682 63886 Expenses Health Care Education and Training Interest on Debt Social Services General Government Other 17848 9421 7832 10607 2255 8205 Total Expenditure 56168 57085 56355 56454 57788 61909 61601 63442 Surplus (Deficit) 10129 Year to March 31 ($ Millions) Revenues Personal Income Tax Retail Sales Tax Corporations Tax Employer Health Tax Gasoline and Fuel Taxes 17775 9761 8255 10439 1558 9297 -8726 17921 8957 8607 9273 1467 10130 -6905 18416 9524 8729 9272 1355 9158 -3966 Source: Adapted from Public Accounts of Ontario, Various Years 19694 9117 9016 11297 1957 6707 -2002 22006 11971 8977 9483 1085 8387 1022 22993 10609 8896 9602 1304 8197 3081 24108 11710 8509 7773 1960 9382 444 Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 Table 1 Panel B: Consolidated Statement of Operations, Province of Ontario (2003 – 2013) Year to 3/31 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Personal Inc. Tax 18195 18301 19320 21041 23655 24538 24727 23393 23624 24548 25,574 Retail Sales Tax 14183 14258 14855 15554 16228 16976 17267 17059 18813 20159 20,957 Corporations Tax 7459 6658 9883 9984 10845 12990 6748 5615 8383 9944 12,093 Employer Health 3589 3753 3886 4197 4371 4605 4617 4545 4733 5092 5,137 Gasoline & Fuel 2988 2945 3004 3010 3033 3093 3021 2994 3060 3090 3,100 Revenues Other Taxes 3137 3233 5027 6131 6178 6230 6015 11325 12534 12765 12557 Total Taxation 49551 49148 55975 59917 64310 68432 62395 64931 71147 75598 79,418 Govt. of Canada 8894 9893 11882 13251 14036 16597 16591 18620 23041 21305 21,661 10164 9359 9984 11057 12051 12093 11486 12242 12470 12870 12290 Other 68609 68400 77841 84225 90397 97122 90472 95793 106658 109773 113,369 Health Care 26127 29218 31510 32834 35698 38168 40747 43164 44773 46476 46,476 Edu. & Training 12788 13918 15475 11599 12058 12618 13215 20592 22372 23448 23,454 Interest on Debt 9694 9604 9368 9019 8831 10298 8566 12274 9480 10082 10,082 Social Services 7959 8645 9224 8502 7697 6482 7165 8719 0 0 0 Gen. Govt 3656 3716 4381 4134 4795 8914 5254 6430 8545 7424 7,413 Other 8268 8782 9438 17839 19049 20042 21934 23876 35499 35312 35164 68492 73883 79396 83927 88128 96522 96881 115055 120669 122742 122,589 117 -5483 -1555 298 2269 600 -6409 -19262 -14011 -12969 -9,220 Total Revenue Expenses Total Expenses Surplus (Deficit) Source: Adapted from Public Accounts of Ontario, Various Years Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 Table 2 Panel A: Component Ratios, Statement of Operations 1995-2002 Year to March 31 Revenues 1995 1996 1997 1998 1999 2000 2001 2002 Personal Income Tax Retail Sales Tax Corporations Tax Employer Health Tax Gasoline and Fuel Taxes Other Taxes Total Taxation Government of Canada Other 0.32 0.20 0.10 0.06 0.04 0.03 0.75 0.17 0.09 0.32 0.19 0.11 0.06 0.04 0.03 0.75 0.16 0.09 0.33 0.20 0.12 0.06 0.05 0.02 0.78 0.12 0.11 0.31 0.21 0.14 0.05 0.05 0.02 0.78 0.10 0.12 0.31 0.21 0.13 0.05 0.05 0.02 0.77 0.08 0.15 0.28 0.20 0.13 0.05 0.04 0.02 0.73 0.09 0.18 0.29 0.21 0.14 0.05 0.04 0.02 0.76 0.09 0.14 0.30 0.22 0.10 0.05 0.04 0.03 0.75 0.12 0.13 Total Revenue 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Health Care Education and Training Interest on Debt Social Services General Government Other 0.39 0.20 0.17 0.23 0.05 0.18 0.37 0.20 0.17 0.22 0.03 0.19 0.36 0.18 0.17 0.19 0.03 0.20 0.35 0.18 0.17 0.18 0.03 0.17 0.35 0.16 0.16 0.20 0.04 0.12 0.35 0.19 0.14 0.15 0.02 0.13 0.36 0.16 0.14 0.15 0.02 0.13 0.38 0.18 0.13 0.12 0.03 0.15 Total as % of Revenue 1.22 1.18 1.14 1.08 1.04 0.98 0.95 0.99 Surplus (Deficit) -0.22 -0.18 -0.14 -0.08 -0.04 0.02 0.05 0.01 Expenses Source: Adapted from Public Accounts of Ontario, Various Years. Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 Table 2 Panel B: Component Ratios, Statement of Operations 2003-2013 Year to March 31 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Personal Income Tax 0.27 0.27 0.25 0.25 0.26 0.25 0.27 0.24 0.22 0.22 0.23 Retail Sales Tax 0.21 0.21 0.19 0.18 0.18 0.17 0.19 0.18 0.18 0.18 0.18 Corporations Tax 0.11 0.10 0.13 0.12 0.12 0.13 0.07 0.06 0.08 0.09 0.11 Employer Health Tax 0.05 0.05 0.05 0.05 0.05 0.05 0.05 0.05 0.04 0.05 0.05 Gasoline and Fuel Taxes 0.04 0.04 0.04 0.04 0.03 0.03 0.03 0.03 0.03 0.03 0.03 Other Taxes 0.05 0.05 0.06 0.07 0.07 0.06 0.07 0.12 0.12 0.12 0.11 Total Taxation 0.72 0.72 0.72 0.71 0.71 0.70 0.69 0.68 0.67 0.69 0.70 Government of Canada 0.13 0.14 0.15 0.16 0.16 0.17 0.18 0.19 0.22 0.19 0.19 Other 0.15 0.14 0.13 0.13 0.13 0.12 0.13 0.13 0.12 0.12 0.11 Total Revenue 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Health Care 0.38 0.43 0.40 0.39 0.39 0.39 0.45 0.45 0.42 0.42 0.41 Education and Training 0.19 0.20 0.20 0.14 0.13 0.13 0.15 0.21 0.21 0.21 0.21 Interest on Debt 0.14 0.14 0.12 0.11 0.10 0.11 0.09 0.13 0.09 0.09 0.09 Social Services 0.12 0.13 0.12 0.10 0.09 0.07 0.08 0.09 0.00 0.00 0.00 General Government 0.05 0.05 0.06 0.05 0.05 0.09 0.06 0.07 0.08 0.07 0.03 Other 0.12 0.13 0.12 0.21 0.21 0.21 0.24 0.25 0.33 0.32 0.34 Total as % of Revenue 1.00 1.08 1.02 1.00 0.97 0.99 1.07 1.20 1.13 1.12 1.08 -0.08 -0.02 -0.07 -0.20 -0.13 -0.12 -0.08 Revenues Expenses Surplus (Deficit) 0.00 0.00 0.03 Source: Adapted from Public Accounts of Ontario, Various Years. 0.01 Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 Table 3: Panel A: Reported and Adjusted Surplus (Deficit) If No TCA capitalization $M; % of Revenues Reported Amortizatio n If No Amtztn TCA Acquisition Adjusted 2003 117 715 832 -1323 -491 2004 -5483 785 -4698 -1350 -6048 2005 -1555 801 -754 -1388 -2142 2006 298 815 1113 -1675 -562 2007 2269 838 3107 -2120 987 2008 600 880 1480 -2748 -1268 2009 -6409 988 -5421 -3553 -8974 2010 -19262 3212 -16050 -9066 -25116 2011 -14011 3412 -10599 -10838 -21437 2012 -12969 3647 -9322 -11033 -20355 2013 -9,220 3930 -5290 -11787 -17077 Reported (% ) Adjusted (% ) 0 -0.01 -0.08 -0.09 -0.02 -0.03 0 -0.01 0.03 0.01 0.01 -0.01 -0.07 -0.1 -0.2 -0.26 -0.13 -0.2 -0.12 -0.19 -0.08 -0.15 Source: Adapted from Public Accounts of Ontario, Various Years. Panel B: Reported and Adjusted Surplus (Deficit) if No BPS Consolidation [$Millions] Reported Surplus (Deficit) Less BPS Impact Surplus (Deficit), No BPS 05/06 06/07 07/08 08/09 09/10 10/11 11/12 12/13 298 449 -151 2,269 340 1,929 600 610 -10 -6,409 727 -7,136 -19,262 1,579 -20,841 -14,011 10,405 -24,416 -12,969 2,021 -14,990 -9,220 3,813 -13,033 0 0 0.03 0.02 0.01 0 -0.07 -0.08 -0.2 -0.21 -0.13 -0.23 -0.12 -0.14 -0.08 -0.11 Reported as Revenues % Surplus (Deficit), No BPS % Source: Adapted from Public Accounts of Ontario (Statement of Operations and Schedule 10) Panel C: Decrease (Increase) to Provincial Expense Due to BPS Consolidation [$ millions] 05/06 Hospitals School Boards Colleges Total 459 -88 78 449 06/07 308 -67 99 340 07/08 330 11 269 610 08/09 521 15 191 727 09/10 976 231 372 1,579 10/11 1,488 8,574 343 10,405 11/12 1,241 720 60 2,021 12/13 1,132 2,659 22 3,813 Cum. Total 6,455 12,055 1,426 19,936 Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 Source: Adapted from Public Accounts of Ontario (Statement of Operations and Schedule 10) Table 4: Descriptive Statistics Panel A: Reported Surplus (Deficit) - Normal Reporting Mean Minimum Maximum Standard Deviation Nominal $ Million 1995 - 2002 2003 - 2013 -865 -5,966 -8,726 -19,262 10,129 2,269 5,987 7,129 % of Reported Revenues 1995 - 2002 2003 - 2013 -0.07 -0.06 -0.22 -0.20 0.05 0.03 0.10 0.07 Panel B: Reported and Adjusted Surplus (Deficit): 2003-2013 TCA Capitalization Mean Minimum Maximum Standard Deviation Nominal $ Million Reported Adjusted -5,966 -9,317 -19,262 -25,116 2,269 987 7,129 9,830 % of Reported Revenues Reported Adjusted -0.06 -0.09 -0.20 -0.26 0.03 0.01 0.07 0.09 Panel C: Reported and Adjusted Surplus (Deficit) 2006-2013: BPS Consolidation Mean Minimum Maximum Standard Deviation Nominal $ Million % of Reported Revenues Consolidated Unconsolidated Consolidated Unconsolidated -7,338 -9,831 -0.07 -0.09 -19,262 -24,416 -0.2 -0.23 2,269 1,929 0.03 0.02 7,896 10,047 0.08 0.10 Proceedings of 6th Annual American Business Research Conference 9 - 10 June 2014, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-52-8 Table 5: Test Results Panel A: Test Sample Statistics: 1995-2002 Reported (%) 2003-2013 Reported (%) 2003-2013 Adjusted (%) 2006-2013 Consolidated ($m) 2006-2013 Unconsolidated ($m) 2006-2013 Consolidated (%) 2006-2013 Unconsolidated (%) Mean -0.07 -0.06 -0.09 -7338 -9831 -0.07 -0.09 N 8 11 11 8 8 8 8 Standard Deviation 0.10 0.07 0.09 7,896 10,047 0.08 0.10 Standard Error .04 .02 .03 2,792 3,552 0.028 0.034 Panel B: Comparative Surplus (Deficit) Test Statistics: 95-02 Vs 03-13 Reported % 03-13 Reported Vs. 03- 13 adjusted (%) 06-13 Consolidated Vs. 06-13 Unconsolidated (%) ** = two-tail * = one-tail t -0.32 4.25 2.09 df 17 10 7 t-critical 2.11 1.81 1.89 PT(<=t) 0.75** 0.00* 0.04*