REAL ESTATE TRANSACTIONS & FINANCE Fall 2015 Deed Warranties

advertisement

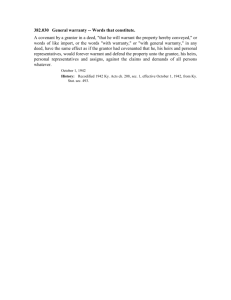

REAL ESTATE TRANSACTIONS & FINANCE Fall 2015 Deed Warranties Reading Assignment: NWBF pp. 208-222 1. What does the Brown v. Lober case (page 215) suggest about how useful deed warranties are as a means of title assurance? How would you have advised the plaintiffs to act differently in asserting their claim? 2. In 2010, you inherited a parcel of farmland from your father, who had purchased it in 1995 from the prior owner, Jones, for a price of $100,000. Your father received title by a general warranty deed that did not make any exceptions to the general warranty. Over the past decade, population growth in the nearby town has resulted in increasing development in the vicinity of the farm. You have been thinking about selling the farm to a local developer (who would be subdividing it for residential use), and the developer is prepared to pay $500,000. Unfortunately, negotiations got waylaid when you got sued by the owner of the adjoining farm, Smith. It turns out that 60 years ago, Smith’s predecessor and Jones’s predecessor entered into an agreement (properly recorded) in which they mutually restricted their respective parcels to agricultural use only, by a covenant that purported to bind the parties “and their heirs, successors, and assigns.” You have suffered an economic loss of $300,000, because the land’s value as farmland is only $200,000 (based on current farmland values). Unfortunately, if you bring an action against Jones for breach of the covenant against encumbrances, the maximum amount you could recover from Jones will be $100,000 — the amount of the purchase price Jones received when he delivered the deed to your father. See, e.g., Forrer v. Sather, 595 P.2d 1306 (Utah 1979). Why does the law limit Jones’s liability on his title warranties in this fashion? What justification exists for placing the loss due to future appreciation upon you rather than Jones? 3. Assume that you bring the action against Jones described in Problem 2 (an action for breach of the covenant against encumbrances, based upon the “agricultural use only” covenant). Can Jones argue that the covenant has not been breached, because your father implictly agreed to take title subject to the agricultural use only covenant? Why or why not? Compare Jones v. Grow Inv. & Mortgage Co., 11 Utah 2d 326, 358 P.2d 909 (1961) with Merchandising Corp. v. Marine Nat’l Exch. Bank, 12 Wis. 2d 79, 106 N.W.2d 317 (1960). 4. Note 7, page 220 explains that the plaintiff in a breach of deed warranty case is allowed to recover interest, costs, and in some cases attorney fees if the warranty is breached. [The interest, cots, and fees are not capped by the rule discussed in question 2.] It also explains that if the defendant gets sued for a title defect and wins, then the defendant can’t turn around and recover those costs of defense from her grantor — even if her grantor also had delivered a general warranty deed — since her grantor’s title wasn’t defective! How can you protect yourself against this “Catch22”?