Proceedings of 13th Asian Business Research Conference

advertisement

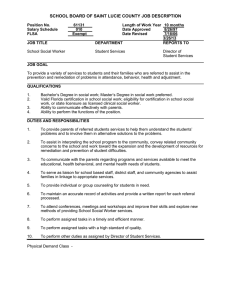

Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 Level Accounting And Convergence For Six SAARC Countries: What Does The Data Show? Monika Islam Khan* This papers aims to extrapolate the degree of contribution of total factor productivity and inputs used for production in total output per worker during 1980-2011 for six South Asian countries: India, Pakistan, Bangladesh, Maldives, Nepal and Sri Lanka. The agenda is to attribute variations in output per worker to characteristics explaining those differences. The proceedings begin with a CobbDouglas aggregate production function as used by the augmented Solow model. When output is defined in terms of output per worker, it is decomposed into capital intensity, labor-augmenting total factor productivity and human capital. The decomposed equation is then rearranged to calculate total factor productivity as the Solow Residual. The measured productivity and data on the decomposed elements are tabulated to observe the extent of their contribution to output per worker. This paper also aims to reveal whether there is any tendency of convergence in output and total factor productivity within these countries. Sigma and beta convergence models have been used to ascertain convergence in output and the Solow Residual. On an accounting basis, the analysis shows that physical capital and human capital in terms of educational attainment only partially accounts for the variation in output per worker amongst the six countries; a large portion of the difference can be expounded by variation in labor-augmenting total factor productivity in terms of the Solow Residual. Sigma and beta tests reveal no convergence in both output per worker and total factor productivity within the six SAARC nations. Field of Research: Economics, Economic Development JEL classification: E22, E23, O15 and O47 Keywords: capital output ratio, Cobb Douglas, convergence, technological change, productivity 1. Introduction In the year 2010, the PPP-adjusted output per worker of Maldives was approximately 9.6 times that of Bangladesh. So, in other words, in 2010 the average Maldivian worker had produced as much as the average Bangladeshi worker would have produced in almost ten years. Explaining such monumental differences in output per worker are important contributions to the region’s growth literature. What is facilitating the high output per worker in Maldives? This seemingly simple question has important implications for the individual economies as a whole. Could the level of output per worker for Bangladesh have been faster? ___________________________________________________________________ *Miss Monika Islam Khan, Masters’ student, Department of Economics, School of Business and Economics, North South University, Mail: 72/C-7, Naval Headquarters, Dhaka, BD, Email: monikaislamkhan@gmail.com, Tel: +88028871446, Cell: +8801715050295, Economics 1 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 Research and literature on growth and level accountings is ubiquitous. Considerable studies have been conducted on South Asian countries particularly those belonging to the South Asian Association for Regional Cooperation (SAARC). There is no doubt that all the SAARC countries have been growing economically over the past few decades with high growth rates of real GDP. However, this paper does not focus on whether their real GDP is growing; it discusses each country’s level of output per worker. How productive are the six countries in utilizing their available resources to produce their prevailing output per worker? This study is to ascertain the factors contributing to output per worker within the SAARC region apart from the more traditional capital and labor. Economic growth literature suggest that such differences in output per worker in a country over time can be attributed to over-time differences in number of employed persons, physical capital, human capital and total factor productivity 1. A standard Cobb-Douglas production function reveals capital and labor as primary variables determining the level of output that an economy can produce, but development in growth literature brought forth the distinction between physical and human capitals. Hypothetically speaking, the total factor productivity in a developing country should be increasing due to globalization, knowledge transfer and spillovers, but has it truly been the case for these six nations would be interesting to see. However, the most fascinating thing to observe would be the variation in total factor productivity between these countries and the extent to which variations determine differences in output per worker. The concept of convergence is often described as forces accelerating the growth of nations with a tendency of converging towards the same level of output per worker. Globalization, technology and knowledge transfer are considered forces driving this process between the poorer and richer countries by enlarging the size of their markets. Economic theory suggests that poor countries over time “catch up” to richer countries in terms per worker output. The SAARC was established to increase regional cooperation between the countries so as reap the benefits of economies of scale enjoyed by countries within regional blocs such as the European Union and ASEAN; there was much discussion on whether the countries within the SAARC are indeed experiencing convergence. Hence, an investigation into the current convergence scenario and its importance seems imperative. Section 2 discuss the degree to which literature supports our methodology of using level accounting rather than growth accounting, and the extent to which past studies have concluded on the convergence hypothesis regarding the SAARC nations. Our methodology of decomposing output per worker into capital intensity, human capital 1 Total factor productivity can be simply defined as the portion of surplus output that cannot be explained by the amount of inputs used in production. It is generally explained by level of technological progress or knowledge transfer and spillovers in an economy. 2 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 and total factor productivity, and techniques used in predicting convergence, divergence or neither have been discussed in Sections 3.1 and 3.2 respectively. Section 4 and its sub-sections present the empirical results based on the methodology and modeling espoused for this paper. Section 5 prepares to terminate the paper by offering some personal thoughts on the analysis of convergence and decomposition of output per worker that may aid researchers who would further dwell on this issue in the future. Finally, the paper finishes with remarks on the study itself, results obtained and conclusions drawn. 2. Literature Review This research has been greatly inspired by earlier contributions to this line of study; the two professors in their paper (Hall & Jones, 1999), aimed to check for degree of contribution of the traditional factors of production to output per worker for 127 countries. The empirical growth literature associated with the likes of (Hall & Jones, 1999) and (Barro, 1991) shares common features in terms of explaining the reasons for differences in total factor productivity. However, empirically, the two researches differ significantly. While (Barro, 1991) focuses on growth rates, the empirical framework of (Hall & Jones, 1999) differs fundamentally in its focus on levels rather than rates of growth. They elaborate on why a focus on levels is necessary to realize the true nature of variations in output per worker and differences in long-run economic performance that are most likely relevant to welfare. Several other contributions point toward a focus on levels as well instead of growth rates. Research provides evidence on the relatively low correlation of rates of growth across several decades, suggesting that differences in growth rates are rather transient (Easterly, et al., 1993). Hence, it was argued the empirical relevance of endogenous growth and in the paper presented a model in which differences in technological change and economic performance is associated with differences in levels, not rates of growth (Jones, 1995). A number of other papers with models of knowledge flows across countries like (Parente & Prescott, 1994), (Eaton & Kortum, 1995) and(Barro & Sala-i-Martin, 1992) also advocate for level accounting instead of growth accounting. They imply that technological transfer between countries precludes them from drifting apart from each indefinitely and in the long run all countries are likely to grow at a common rate. The role of technological progress has been emphasized to explain international output per worker output differences (Parente & Prescott, 2004), (Easterly, 2001) and (Hall & Jones, 1999). 3 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 Empirical analysis suggests that smaller samples of countries somewhat show a stronger tendency for convergence specially those at similar income levels. Papers focused on convergence like (Ben-David, 1998) and (Chatterji, 1992) find strong empirical evidence within the richer countries and within the poorer countries, although they failed to do so for the middle income countries. Some studies like (Quah, 1997) and (Galor, 1996) provide theoretical justifications for the convergence club hypothesis, according to which convergence will occur amongst smaller group of countries or subsets rather than broader samples of countries. Growth literature suggests two basic techniques of predicting convergence: sigmaconvergence and beta-convergence. Some studies found no convergence in per capita income across the seven SAARC countries during 1960-2000 following absolute and conditional beta convergence tests(Chowdhury, 2003). While (Solarin, et al., 2014) following a series of unit root and conditional beta convergence tests found no empirical evidence of convergence in real income across the SAARC countries covering the period (1970-2009). Finally, econometric analysis by (Jayanthakumaran & Lee, 2008) showed that pertaining to the oil crisis in the 1980s and the engagement of more bilateral Regional Trade Agreements (RTAs) outside of the SAARC, income divergence increased amongst the member countries. They concluded that India entered several bilateral RTAs that coincided with the income divergence, which is contradictory to the original objective of SAARC. 3. Methodology and modeling 3.1 Level Accounting and Output per Worker Economic success can be defined by higher output i.e. GDP, per capita income or output per worker. Output per worker is evidently better able to capture the economic performance of an economy as opposed to the other two; while output does not take into account the labor required to produce it, per capita income either overestimates or underestimates economic performance disregarding the fact that not every person in the population is productive. Hence, economic advancement can be explained by decomposing output per worker into inputs and total factor productivity which, subsequently, aids in describing the causes of higher output per worker in each of the six SAARC nations. 4 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 There are three important approaches to the decomposition of output per worker into inputs and productivity in literature. The first was developed by (Christensen, et al., 1981) and involves the comparison of each country to a reference point by the arithmetic average of the particular country’s factor share and the reference factor share and repeating the process for each country. Second is a method directly based on (Solow, 1957) that gives results similar to that of the first and second approaches with standard elasticities elaborated below. Assuming output Yit for country i at time t, this simple Cobb-Douglas function can be used to define the production framework: (1) Yit = Kitα [Ait Hit]1-α where Kit denotes the physical stock of capital, Ait the labor-augmenting measure of total factor productivity and Hit amount of human capital augmented labor required to produce Yit. α is the output elasticity of capital and thus, the model assumes constant returns to scale by imposing the output elasticity of labor as one minus the output elasticity of capital (1-α). The model assumes that labor is homogenous across each country and each unit of labor has been trained with equal years of schooling (educational attainment). Hence, the human capital-augmented labor is given by (2) Hit = hit Eit where hit is the human capital index per person and E it is the number of employed persons engaged in production. It would make more sense to rewrite the production function as output per worker as previously explained in this section. Dividing both sides of the output equation by labor Eit yields the output per worker (3) K yit = Ait it Yit 1 hit, where yit = Yit/Eit and hit = Hit/Eit 5 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 This equation allows us to decompose differences in output per worker into specific differences in total factor productivity, capital intensity, and human capital per person. This is a similar approach used by (David, 1977), (Mankiw, et al., 1992), (Klenow & Rodriguez-Clare, 1997) and (Hall & Jones, 1999) in which the decomposition results in a capital-output ratio rather than the capital-labor ratio for two reasons. First, the capital-output ratio is proportional to the investment rate; hence, this decomposition has a natural explanation. Second, (Hall & Jones, 1999) consider an economy that experiences an exogenous increase in productivity, holding investment rate constant. Over time the country’s capital-labor ratio will rise due to the increase in total factor productivity. Thus, in a capital-labor framework, some of the increase in output that is fundamentally due to productivity would be imputed to capital accumulation. Now taking log on both sides of the output per worker equation (3) and rearranging yields the log of total factor productivity, (4) ln yit = ln Ait + K ln it + ln hit 1 Yit ln Ait = ln yit - K ln it - ln hit 1 Yit Taking exponent on both sides gives us the level of total factor productivity in terms of the Solow Residual. 3.2 Convergence Hypothesis The concept of convergence can be defined in several ways. According to (Sala-iMartin, 2006) "there is β-convergence if poor economies tend to grow faster than rich ones, and a group of economies are converging in the sense of σ if dispersion of their real per capita GDP levels tends to decrease over time”. According to the Solow’s convergence hypothesis, poor countries tend to experience faster growth which facilitates the per capita income to converge. The Solow model also implies that returns to capital is lower in countries with higher capital per worker, hence, capital flows from rich to poorer countries will gradually lead to convergence. Differences in output per worker also arise if there are lags in diffusion of knowledge. Once the poorer countries gain access to the cutting edge technology, the differences in total factor productivity and hence output per worker will tend to disappear over time. 6 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 Sigma-convergence tests the dispersion of data over time and economies tend to converge when dispersion decreases over time. Absolute sigma convergence can be tested by estimating the following model: (5) σt = α + βt + νt Where σt is the standard deviation of our variable concerned in time period t. α and coefficient β are parameters and νt is the stochastic error term. For convergence to take place, our value of β must be negative and statistically significant. A more generic model for sigma-convergence has been shown in equation (5) which will be used to estimate regress dispersion over time for output per worker and total factor productivity. Beta-convergence tests the “catching up” process within countries and can be estimated using the following model: (6) (xit – xi,t-1) = λ + γxi,t-1 + εt Where at time t xit is the log value of the concerned variable for country i and xi,t-1 is the log value of the variable at time t-1. λ and coefficient γ are parameters, and εt is the stochastic error term. For convergence to take place, our γ must be negative and statistically significant. All the data used in this paper has been extracted from Penn World Tables (PWT) 8.1 (Feenstra, et al., 2015). For output, capital stock, total number of employed persons and human capital, data on output-side real GDP at current PPPs (in mil. 2005US$), capital stock at current PPPs (in mil. 2005US$), number of persons engaged (in millions) and index of human capital per person, based on years of schooling (Barro/Lee, 2012) and returns to education (Psacharopoulos, 1994) have been used respectively. Since labor shares in output is not available for all the six countries, we assume output elasticity of labor (1-α) to be 0.70 and equal across all countries. 4.1 Empirical Results: Level Accounting 7 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 A depiction of how the output per worker differs and behaves over time somewhat hints the overall trend of economic performance. Figure (1) shows that output per worker for Bangladesh, Pakistan and Nepal have been increasing very mildly over the years while Maldives, Sri Lanka and India have experienced rapid increase in per worker output. 7 8 9 10 11 Figure 1: Output per worker (1980-2011) 1980 1990 2000 2010 Year country = Bangladesh country = Maldives country = Pakistan country = India country = Nepal country = Sri Lanka All values of output per worker are in logs. Data on output, number of persons engaged, physical and human capitals is incorporated into equation (4) to calculate total factor productivity in logs. Table 1 depicts the decomposition of output per worker into the three multiplicative terms shown in equation (3): the contributions of capital intensity, human capital per person and total factor productivity. To make comparisons easier, values are expressed in ratios of Indian values. For example, according to this table the output per worker of Nepal is approximately 38% that of India. Using this simple analogy, Table 1 allows us to ascertain the reasons contributing to the high or low levels of output per worker (our primary measure of productivity and economic performance for this paper) in each country. 8 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 Table 1: Productivity Calculations (2010) - Ratios to Indian Values Country India Pakistan Bangladesh Maldives Nepal Sri Lanka Standard Deviation Y L 1 1.010204 0.551125 5.264308 0.380068 1.861339 1.830592 K 1 Y 1 1.055394 1.163908 1.043064 1.213704 1.045592 0.082682 h 1 1.033355 1.073708 1.086392 0.88738 1.63842 0.263837 A 1 0.989109 0.508414 5.48298 0.27788 2.916677 2.003519 4.1.1 India and Pakistan One would predict India to have a much higher output per worker between the two. However, data suggests otherwise. Table (1) reveals that, in terms of economic performance, the discrepancy is minimal. Output per worker and capital intensity are 1% and 5.5% higher in Pakistan than in India respectively. Despite a higher capital intensity and human capital (3.3% higher), output per worker is only slightly higher in Pakistan owing to the low level of labor-augmenting technical progress or knowledge pointing towards the importance of total factor productivity in production. 4.1.2 India and Bangladesh Engulfed in poverty and famine till the end of the last century, Bangladesh has only recently been able to achieve food security and relief from hardcore poverty. With a satisfactory GDP growth of approximately 6% per annum, the country has made serious efforts in achieving its millennium goals. However, productivity is a different affair altogether. With only 55% of the output per worker compared to India, Bangladesh still remains one of the less productive nations within the SAARC, despite its significantly higher levels of capital intensity and human capital at 116% and 107% respectively to that of India. The data depicts that this anomaly is primarily due to lower levels of technical progress or knowledge spillover that Bangladesh faces exhibited in the total factor productivity ratio, A, in Table (1) which is only almost 51% that of India. This suggests a general inability to use the available resources in the most productive manner. 9 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 4.1.3 India and Maldives Maldives, one of the world’s most geographically dispersed countries is economically driven by tourism and fishing with minuscule reliance on manufacturing and agriculture as compared to India. Despite the lack of dependency on the traditional drivers of an economy, Maldives has been able to grow at a rate of 7.5% per annum primarily due to tourism. As per Table 1, the Maldivian output per worker is more than five times or a tremendous 508% that of India despite having a little higher capital intensity and human capital (approximately 4.3% and 8.6% respectively more than India). The total factor productivity measure again becomes important in explaining the monumental discrepancy between the output per worker measures of the Maldives and the five other nations which is approximately 5.5 times that of India. 4.1.4 India and Nepal An economy inflicted by political uncertainty and poverty, Nepal has still been able to maintain a satisfactory growth rate. However, in terms of productivity they seem to be well lagging behind. With the highest capital intensity amongst the six countries and approximately 21% higher than that of India, Nepal has an output per worker only 38% of India as per Table 1. The low level of output per worker is attributable to human capital (88% that of India) and total factor productivity (only 27.8% of India) which is the lowest amongst all six countries. The importance of the contribution of total factor productivity is nowhere more prominent than for Nepal. The ratios shown in Table 1 clearly point out that the low levels of total factor productivity have acted as an impediment to increase in output per worker. 4.1.5 India and Sri Lanka Recovering from a civil war that continued to the early 2000s, Sri Lanka has been touted for attaining a commendable literacy rate of 98% of its population. As per Table 1, with a high level of human capital (approximately 63% higher than that of India), Sri Lanka seems to be the star performer amongst the lot. It has achieved an output per worker almost twice that of India even with capital intensity only analogous to and at times lower than that of the other five countries which is attributable to a high level of 10 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 knowledge spillover in terms of total factor productivity (almost 2.92 times that of India). Hence, for Sri Lanka, high human capital and total factor productivity appear to be significantly acting as drivers towards the high levels of output per worker. After careful analysis of Table 1, it can be extrapolated from the data that capital intensity in an economy and human capital per person may only partially be able to explain the differences in output per worker and total factor productivity to a large extent is able to discern the discrepancy in output per worker between the six SAARC nations. 4.2 Empirical results: Convergence Using the traditional models of estimating convergence shown in equations (5) and (6), we construct Tables 2 and 3. A careful look at Table 2 reveals that it shows no evidence of convergence. None of the coefficients have a negative value that depicts convergence; the statistically significant p-values (less than 0.05) for most statistics points towards income and total factor productivity divergence. The only statistically insignificant p-value of 0.982 signifies neither convergence nor divergence. Table 2: Sigma-convergence time period 1980-1996 1996-2011 1980-2011 Output per Worker coefficient p-value .0056587 0.028 .0143012 0.000 .0069231 0.000 Total Factor Productivity coefficient p-value .0000561 0.982 .012584 0.000 .0055804 0.000 Looking at Table 3, the weight of evidence is towards divergence or no convergence. Only one of the coefficients has a negative value but it is statistically insignificant. Rest of the values signifies neither convergence nor divergence. 11 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 Table 3: Beta-convergence Output per Worker Total Factor Productivity time period coefficient p-value coefficient p-value 1980-1996 .0013363 0.894 -.0077262 0.473 1996-2011 .0119841 0.181 .0080481 0.405 1980-2011 .0068921 0.296 .0000227 0.998 Divesting from the traditional models of testing convergence, we could look at level accounting to determine convergence between the six countries. Extending the last row of Table 1 for a decade-wise table would serve to compare the level of dispersion between the nations every ten years shown in Table 4. Table 4: Decade-wise Standard Deviation Year Y L 1990 2.405597 K 1 Y 0.132637 2000 1.807592 1.830592 0.105512 0.082682 2010 h A 0.312469 3.582323 0.319227 0.263837 2.136096 2.003519 According to Table 4, the standard deviations for capital intensity and human capital declined rather slowly; however, there was a steeper fall in standard deviation of total factor productivity over the decades coupled with a fall in dispersion of output per worker within the countries. This is indeed a necessary condition for convergence to occur, however, not the essential condition. Table 4 is not enough to comment anything definitively on the degree of convergence. Therefore, the no-convergence situation still exists within the six SAARC countries. 6. Recommendation and Conclusion Countries produce high levels of per worker output in the long run because they invest magnanimously on physical and human capital coupled with high levels of total factor productivity. Empirical analysis reveals that capital intensity and human capital may 12 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 only be partially attributable to high levels of output per worker between India, Pakistan, Bangladesh, Maldives, Nepal and Sri Lanka; a large portion of the differences in per worker output in these economies may be due to differences in productivity in terms of knowledge or technology. The basic definition of convergence constitutes a flow of capital, technology or knowledge from the richer countries to the poorer ones, thereby, causing a convergence of per capita output or per worker output. So if convergence is basically a transfer between the rich and the poor, then there will be very little to transfer if the countries have similar levels of capital, technology or knowledge. The countries in the SAARC are basically very similar to each other in terms of the four factors in the previous statement; so convergence between these nations seems highly unlikely as per the current situation. Furthermore, a couple of these countries may be engaging in RTAs with countries outside the SAARC leading to non-existent convergence in per worker output within the countries as depicted by the sigma and beta convergence tests. 7. References Barro, R. J., 1991. Economic Growth in a Cross Section of Countries. The Quarterly Journal of Economics, 106(2), pp. 407-443. Barro, R. J. & Sala-i-Martin, X., 1992. Convergence. The Journal of Political Economy, 100(2), pp. 223-251. Ben-David, D., 1998. Convergence Clubs and Subsistence Economies. Journal of Development Economics, Volume 55, pp. 153-169. Chatterji, M., 1992. Convergence Clubs and Endogenous Growth. Oxford Review of Economic Policy, 8(4), pp. 57-69. Chowdhury, K., 2003. Empirics for World Income Distribution: What Does the World Bank Data Reveal?. The Journal of Developing Areas, 36(2), pp. 59-83. Christensen, L. R., Cummings, D. & Jorgenson, D. W., 1981. Relative Productivity Levels, 1947-1973. European Economic Review, Volume XVI, pp. 61-94. David, P. A., 1977. Invention and Accumulation in America's Economic Growth: A Nineteenth-Century Parable. Journal of Monetary Economics, Volume VI, pp. 176-228. 13 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 Easterly, W., 2001. The Elusive Quest for Growth: Economists' Adventures and Misadventures in the Tropics. Cambridge, MA: MIT Press. Easterly, W., Kremer, M., Pritchett, L. & Summers, L., 1993. Good Policy or Good Luck?: Country Growth Performance and Temporary Shocks. Journal of Monetary Economics, 32(3), pp. 459-483. Eaton, J. & Kortum, S., 1995. Trade in Ideas; Patenting and Productivity in the OECD. Journal of International Economics, 40(3/4), pp. 251-278. Feenstra, R. C., Inklar, R. & Timmer, M. P., 2015. The Next Generation of the Penn World Table. American Economic Review, 105(10), pp. 3150-3182. Galor, O., 1996. Convergence? Inferences from Theoretical Models. Economic Journal, 106(437), pp. 1056-1069. Hall, R. E. & Jones, C. I., 1999. Why Do Some Countries Produce So Much More Output Than Others?. The Quarterly Journal of Economics, 114(1), pp. 83-116. Jayanthakumaran, K. & Lee, S.-W., 2008. The Complementarities of Multi-lateralism, and Regionalism and Income Convergence: ASEAN and SAARC. International Journal of Social, Behavioral, Educational, Economic, Business and Industrial Engineering, 2(12). Jones, C. I., 1995. R & D-Based Models of Economic Growth. The Journal of Political Economy, 103(4), pp. 759-784. Klenow, P. & Rodriguez-Clare, A., 1997. The Neoclassical Revival in Growth Economics: Has it gone too far?. In: B. B. S & R. J. J, eds. NBER Macroeconomics Annual 1997. Cambridge, MA: MIT Press. Mankiw, N. G., Romer, D. & Weil, D., 1992. A Contribution to the Empirics of Economic Growth. Quarterly Journal of Economics, Volume CVII, pp. 407-438. Parente, S. I. & Prescott, E. C., 1994. Barriers to Technology Adoption Development. The Journal of Political Economy, 102(2), pp. 298-321. Parente, S. L. & Prescott, E. C., 2004. A Unified Theory of the Evolution of International Income Levels, s.l.: Federal Reserve Bank of Minneapolis Staff Reports, 333. Quah, D. T., 1997. Empirics for Growth and Distribution: Stratification, Polarization,. Journal of Economic Growth, 2(1), pp. 27-59. Sala-i-Martin, X., 2006. The World Distribution of Income: Falling Poverty and Convergence, Period. The Quarterly Journal of Economics, CXXI(2), pp. 351397. Solarin, S. A., Ahmed, E. M. & Dahalan, J., 2014. Income Convergence Dynamics in ASEAN and SAARC Blocs. New Zealand Economic Papers, 48(3), pp. 285-300. Solow, R. M., 1957. Technical Change and the Aggregate Production Function. The Review of Economics and Statistics, 39(3), pp. 312-320. 14 Proceedings of 13th Asian Business Research Conference 26 - 27 December, 2015, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-93-1 15