Proceedings of 10th Annual London Business Research Conference

advertisement

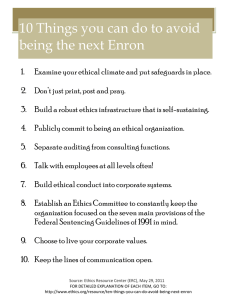

Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 Ethics Practices of Malaysian Public Listed Companies – Empirical Evidence Ahmad Saiful Azlin Puteh Salin* and Zubaidah Ismail** The Malaysian Code of Corporate Governance (MCCG) was revised for the third time in 2012. One of the new requirements under this revision is the need for public listed companies to formalize ethical standards in a code and ensure its compliance. Based on this, the study attempted to examine the level of ethics practices disclosure among the companies in their Annual Report 2013. A disclosure index based on MCCG requirements was developed to analyse the disclosure. This study found that a majority of the companies did not have or formalized the code of ethics in their company. However, those who have a formal code of ethics, appeared to have a lack of commitment and did not have any systematic way to promote, support, and ensure compliance with the code. JEL Codes: M41 and G34 1. Introduction Malaysia, Hong Kong, and Singapore are among the South East Asian countries that were seriously shaken by the East Asian financial crisis in 1997. Since that time, these countries have taken continuous and substantial efforts to enhance their corporate governance mechanism and practices (Sawicki, 2009; Hamid et al., 2011; Manan et al., 2013). This is because poor corporate governance was identified to worsen the crisis (Mitton, 2002). However, although many studies were conducted in the field and discipline of corporate governance, there are very few studies conducted on developing markets such as the Malaysian market. This study examines the Malaysian corporate governance mechanism and its effects on ethics practices. Besides, recently Malaysia has been plagued with many corporate scandals. Although much effort has been made by the government to prevent these scandals from occurring, they still continue. For example, the KPMG Malaysia Fraud Survey Report 2009 revealed that a total of 61% of the respondents believe fraud in the private sector will continue to increase in the future. In addition, more than three-quarter of the respondents agree that financial statement frauds will continue. The survey also reported that the major factors that contributed to the frauds include poor internal control, collusion with external parties and unethical practices (KPMG, 2009). Many studies have been conducted on ethics practices previously. Some ethics studies have been conducted on the code of business ethics. Gaumnitz and Lere (2004) and Schwartz (2002) are examples of studies conducted to assess and evaluate the content, the construction, and the evolution of code of ethics over the years. However, this kind of research is not so valuable because the effectiveness of the application of the code in *Ahmad Saiful Azlin Puteh Salin, Faculty of Business and Law, Edith Cowan University, Western Australia, Australia. Email: saifulazlin@yahoo.com Faculty of Accountancy, Universiti Teknologi MARA (Perak), Malaysia. Email:ahmad577@perak.uitm.edu.my ** Faculty of Business and Law, Edith Cowan University, Western Australia, Australia. Email: z.ismail@ecu.edu.au Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 organizations such as the operations of the code, how the code communicates across the organization, and how it blends with an organization‟s environment remain questionable (Helin & Sandstrom (2007). Specific attention is also given to the implication of the code of ethics at different levels of employment and various professions such as manager (Marquardt & Hoeger, 2009), employees (Kaptein, 2004), and auditor (Dedoulis, 2006). Many examples of corporate malpractices and mismanagement have indicated that immoral attitude and behaviour among the employees will contribute to the occurrence of fraud, financial crime, and financial loss to the company. At worst, the company will collapse and go into insolvency due to the unprecedented loss and damage of reputation that cannot be repaired and recovered. The failure of many prominent international companies such as Enron, Parmalat, Tyco, Polly Peck, HIH Insurance, WorldCom, Adelphia Communications, Arthur Andersen, Satyam, and many others shows that poor ethical conduct of its employees, particularly the top management will lead to the destruction of the company (Sims & Brinkman, 2003). Malaysia also has its own scandals like Transmile, Megan Media Holdings, MEMS Technology, Fountain View Development, and FTEC Resources (Salin et al., 2011). Basically, the employees are collectively responsible for continuous profitability and sustainability of the company. This can be accomplished if all of the workforce both at the top and lower levels together responsibly manage and operate the company, have a sense of accountability in their entire tasks and activities, and uphold moral conduct to the highest value. However, poor ethics practices will lead to the decline of business activities and ultimately business performance (Ali & Falcone, 1995). Based on this premise, the study attempts to examine the level of ethics practices among the companies listed in the Malaysian stock exchange. This study is important and significant because it is time for the business players in the business world to adopt good moral practices in their daily business. This study will contribute in several ways. Firstly, this study develops an instrument that reflects the ethical practices of a company. A checklist and measurement will be developed from MCCG 2012 to determine or capture what are the responsibilities of the employees towards ethical conduct and ethical practices of a company. The instrument will be beneficial for the companies and researchers of business ethics to assess the compliance of the company in relation to the ethical practices of the company in Malaysia. Secondly, this study will highlight to the relevant regulatory bodies in Malaysia where more effort is warranted and emphasize more in protecting and preventing the collapse companies in Malaysia. Briefly, the results from this research will give a sign to these agencies that they should focus on promoting the right ethical culture and ethical framework in companies to complement their corporate governance structure. Thirdly, this study will add to the body of the literature regarding the importance of ethics and the current ethical practices of a company particularly in the developing countries. Many prior studies to date have focused on the companies listed in the capital markets in developed countries. Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 2. Literature Review Ethics can be simply described as a concern with right or wrong behaviour. It deals with what is good and what is bad, moral duty, obligation, moral principles, and values (Duska, 2007). Hosmer (1994) and Luo and Bhattacharya (2006), found that good ethical practices promote trust between companies and their customers, hence enhances the reputation of these companies (Roberts & Dowling, 2002). Long and Driscoll (2008) argued that a firm‟s code of ethics leads to its legitimacy in the eyes of the public and help the company to survive in the business world. When companies incorporate good ethical practices, companies can satisfy their stakeholders which in turn affect their performance (Chun, Shin, Choi & Kim, 2013). Internally, all the efforts taken to implement ethics within an organization will affect the internal stakeholders such as employees and managers. Baker, Hunt, and Andrews (2006) suggested that by implementing a code of ethics, job satisfaction among the employees and their commitment to organizations will increase. Eventually, the employees will have higher productivity, less absenteeism and low turnover which will increase individual job performance. When ethical practices are positively associated with internal processes and involve employees, it will increase corporate performance (Chun et al., 2013). As suggested by Becker, Huselid, Pickus, and Spratt (1997), good human resource practices are expected to shape employees‟ attitudes and behaviours properly. Indirectly, this will influence the operational and financial performance of the organization. The company also needs to inform all the external stakeholders of the company that the company is committed to implement good ethical practices by disclosing sufficient information about those practices in the annual report. These practices are much easier nowadays due to internet technology that enables businesses to disclose their corporate information efficiently (Hashim et al., 2014). Healy and Palepu (2001) argued that the information about a company, irrespective whether it is required to be disclosed under laws and regulations or not, will reduce information asymmetry and lessen the divergence between owner (principal) and manager (agent). Empirical findings showed that the disclosure of positive information is associated with superior accounting quality (Francis, Nanda & Olsson, 2008), decreases stakeholder concerns and uncertainty (Hirst, Koonce & Venkataraman, 2007), has stronger market response (Hutton, Miller & Skinner, 2003), results in cheaper capital cost (Easley & O‟Hara, 2004), and lowers the premium of nonequity financing (Mazumdar & Sengupta, 2005). In contrast, poor information disclosure indicates low of quality of accounting (Francis et al., 2008). According to Leuz and Wysocki (2006), a company with low minimum disclosure of information to the outsiders may indicate an intention to hide and cover up the company‟s bad condition and manipulate the information for its own advantage only. Theoretical Framework – Signalling Theory Signalling theory is based on the work by Spence (1973). The problem with agent-principal relationship is the information gap, well known as information asymmetry. The agent knows more information about the company‟s operation and management than the principal because they are involved in day to day business affairs. Hence, to reduce this problem, agent or managers of a company will provide more and higher quality information to the external parties. This will portray a good image of the company. Hence, investors will be interested to invest in the company while the existing owners or shareholders will increase Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 their current holdings. A lender will provide money to be lent at a discount rate which will reduce the capital cost of the company. Suppliers and consumers have more confidence to continue their relationships with the company, thus increasing the sales and revenue of the company. The government also will not place this company under their radar for close monitoring which lead to the disappearance of unnecessary regulatory costs. In the context of this study, some companies may wish to signal their quality by adapting and implementing good ethics practices in their operation and management. These practices are then disclosed in the annual report as their commitment to engage in morally responsible conduct in their daily business transactions. For example, the company will formalize the code of ethics that bind the work of the employees and top management of the company. The code, either in full or summary is then disclosed in the annual report. These disclosures will also highlight to the stakeholders the company‟s intolerance for any misconducts and malpractices such as fraud and corruptions. 3. Research Methodology Data Collection Content analysis was used to collect the data to examine all the hypotheses of the study. This type of data collection is common for corporate governance research because data can be collected in a large quantity from many companies and for several years. Furthermore, much information about ethics including its changes can be easily examined through the annual report of the companies. This primary data collection related to ethics was extracted from the annual reports of companies, which are posted on the Bursa Malaysia‟s website (http://www.bursamalaysia.com) and are readily downloadable. Assessment Instrument To evaluate the disclosure of ethics practices, an index was developed from the MCCG 2012. The information disclosed for the index were measured using a 3-point Likert scale. “2-point” score represents beyond level of disclosure (more information), “1-point” score represents a minimum disclosure (as required by MCCG code), while “0-point” score represents no disclosure (no information). Based on this, a formatted checklist was developed comprising of numerous items. The accumulated score for each item was used to measure sub-indices and ultimately the index. To avoid subjectivity and bias, all items were considered as equal in importance, hence they were equal in weight (Barros, Boubaker & Hamrouni, 2013). Sample This study included the biggest 500 companies by market capitalization that were listed under Bursa Malaysia (formerly known as Kuala Lumpur Stock Exchange) in the year 2013. However, 33 companies from financial and banking institutions industries were eliminated because this sector is subjected to different laws and regulations and have different accounting and business treatments. Five (5) companies that were just listed in the stock exchange were also excluded because the annual reports were not available. Finally, eight (8) companies that were currently restructured were also eliminated because they have financial statements that were based on periods of either more or less than 12 months. The final sample used in this study comprised of 454 companies, as in Table 1 below. Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 Table 1: Sample selections Base sample (by highest market capitalization at 31 Dec) Elimination: 1. Finance 2. Newly listed company (annual report not available) 3. Company with FYE more/less than 12 months Final sample No of Firms 500 (33) (5) (8) 454 The MCCG 2012 was issued by the Securities Commission of Malaysia on March 2012 and applied to all companies with the financial year ending on 31 December 2012 onwards. The current study considers 2012 as the transition year for the company to adopt the new MCCG 2012. Thus, collecting data for this period will be subjected to bias and uncontrollable factors. Due to this reason, the study will not collect the data for the financial year ending in 2012. 4. Findings and Discussion Table 2 shows the descriptive statistics on the industry of the firms that were selected for this study. A majority of the firms are operating in trade and services industry (144 companies or 27.3%) followed by industrial product industry (111 companies or 24.4%) and plantation industry (106 companies or 23.3%). Only a few firms are operating in the technology industry and mining industry. Table 2: Firms and Industry of the Sample Industry Trade and services Industrial product Plantation Consumer product Construction Technology Mining Total Number of Firms 124 111 106 65 32 15 1 454 Table 3 shows the main results of this study. There are eight (8) items requiring disclosure by the company about their ethical practices. These items were developed and modified from the Recommendation 1.3 under Principle 1 – Establish Clear roles and Responsibilities of MCCG 2012. Almost half of the sample (217 companies or 47.8%) did not disclose whether the company has a formal code of ethics or not. The remaining companies (237 companies or 52.2%) clearly stated that they have formal code of ethics or have formalized the code of ethics, with 152 companies or 33.5% providing further information on the code. This is considered as unsatisfactory because it indicates that nearly half of the companies operate without any Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 formal guideline of ethical practices. It is unclear what is the reference used by the company when it faces ethical issues. These include making a decision that possibly has the impact on the and behaviour to other people internally and externally, process and procedures of investigation if the employees are accused of alleged misconducts, and type of punishment meted out for an employee‟s misbehaviour. From the 237 companies that have formalized the code of ethics, only 206 companies made a clear commitment to the code with merely 49 companies stating how or in what ways the companies have committed to the code, such as, understanding the content and formally sign the formal undertakings to comply with the code. The results indicate that the company may not be serious enough to implement the ethics practices in the company and just establish a document without specific power and authority. Items number 3, 4, and 5 support the results of item 2. Only 22 companies (4.8%) have indicated that they have implemented a system to support the code and a slightly higher percentage of companies have a system to promote the code and ensure the compliance to the code (32 companies or 7.0% each for item 4 and item 5). These findings indicate that the companies do not have any plan or intention to make ethics practices meaningful and a part of the business environment in the companies. Having code of ethics without proper support mechanism will impair the effectiveness of the code. This support can include dedicated employees who monitor the implementation of the code, goods, services, money, and other resources that are specifically provided to implement the code. Likewise, without communication of the code within the company, employees will forget about the existence of the code and without a mechanism to ensure the code compliance, employees will have poor perceptions on ethics; for example, may regard violating the code of ethics as acceptable and tolerable since no action will be taken. In terms of whistleblowing provision, more than half of the companies (253 companies or 55.7%) do not indicate whether a whistleblowing channel exist or not in their company. This is quite surprising as whistleblowing is not a new issue. The Malaysian government had enacted Act 711 of Whistleblower Protection Act in 2010. After four years of implementation, many companies still do not have a proper and formal mechanism for the reporting of sensitive information. After the code is established, it needs to be reviewed so that it will keep pace with the changes in the business environment. Only 64 companies or 14% of the companies indicated they re-assess the code. Without a systematic review and evaluation, the code provision can be outdated and difficult to enforce. The final item in this checklist is the availability of a summary of the code on the company‟s website. Only 116 companies indicated that their code of conduct is available on their website with 71 companies giving a specific link or address for the code in their website. Making the code available to the public is important because it will show the transparency of the company and show their commitment to have a noble conduct in the workplace. As described by Signalling Theory, this positive information will benefit the company greatly in the long term. Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 Table 3: Company’s Score on Ethics Practices Items No. 1. 2. 3. 4. 5. 6. 7. 8. Disclosure items Formalize the code (for the company/general) Commit to code Implement system to support code Implement system to promote code Implement system to ensure code compliance Establish whistleblowing channel/provision Periodically review the code Summary of code available on the website No disclosure Frq. % 217 47.8 Meet disclosure Frq. % 85 18.7 Beyond disclosure Frq. % 152 33.5 248 432 422 422 54.6 95.2 93.0 93.0 157 11 18 12 34.6 2.4 4.0 2.6 49 11 14 20 10.8 2.4 3.0 4.4 253 55.7 141 31.1 60 13.2 390 338 86.0 74.4 32 45 7.0 10.0 32 71 7.0 15.6 Table 4 shows the score of the items among the companies in relation to ethics practices. Based on the table, it is clear that only eight companies managed to score more than 10 out of 16 which are very disappointing results. This indicates that majority of the company do not foresee the importance of ethical practices and disclosing these items in the annual report. This is supported by the findings that showed 83 companies do not have any ethical practices at all which accounted for 18% of the total sample. Table 4: Total Scores for disclosure Score >10 10 9 8 7 6 5 4 3 2 1 0 Total Number of companies 8 4 4 11 13 23 42 52 63 76 75 83 454 Table 5 shows that only 12 companies (2.6%) managed to score minimum ten (10) marks in this study. It was led by a business conglomerate Sime Darby which is involved in various business sectors such as plantation, industrial, motors, property, energy, and utilities. It is one of the largest companies in Malaysia with a market capitalization more than USD15 billion and has been operating in more than 20 countries. This is the possible reason why the company has emphasized good ethical practices. As a multinational business player, this Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 company needs to keep up with the international trend that places sustainability and ethics as a part of the business operation. This is indicated on their website (Figure 1), where all ethics and governance related documents such as Business Principles, Code of Business Conducts, Corporate Child Protection Policy, Conflict of Interest, and Whistleblowing are easily accessible with links provided on the main page. Table 5 also shows that all companies with a higher score are basically large multinational and diversified companies that have been operating in multiple countries. This indicates that exposure of business in many countries can influence the companies to adopt good ethical practices, especially companies which have been operating in more developed countries. Two companies, Shell Refining and British American Tobacco are originally from developed countries, so it is not surprising for these companies to have a higher score. Table 5: Companies with score 10 and higher Rank 1. 2. 2. 3. 3. 3. 3. 3. 4. 4. 4. 4. Company Sime Darby Bhd Kulim (M) Berhad Shell Refining Company British American Tobacco ECS ICT Felda Global Ventures Holdings Telekom Malaysia / TM Top Glove Corp CCM Duopharma Chemical of Malaysia Co Malaysian Airline Maxis Score 13 12 12 11 11 11 11 11 10 10 10 10 Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 Figure 1: Main Page of Sime Darby Website (extract) 5. Summary and Conclusions The purpose of this study was to examine the level of ethics practices among Malaysian companies in their Annual Report 2013. It was found that the majority of the company do not have code of ethics in their company. However, those who have a formal code of ethics showed a lack of commitment and did not have any systematic way to promote, support, and ensure the compliance with the code. These poor results showed that business players in Malaysia mainly do not have the interest to introduce and maintain good ethics practices in their transactions and day to day business activities. This may be the reason why the respondents of the KPMG fraud survey indicated that fraud, bribery, and corruptions is a major business problem in Malaysia and a majority of them believe that business can‟t be done in Malaysia without paying bribes (KPMG, 2013). This research has a few limitations that can be used as an extension in future research. Firstly, it concentrated mainly on Malaysian public listed companies. Thus, the results from this study may not be generalized to non-listed companies and other countries which have different political, cultural, and economic factors. Future studies should extend the samples by including many countries i.e. ASEAN countries so that comparisons can be conducted. Secondly, data were collected for only one (1) year; i.e. 2013. A longer period of study such as five (5) years of data analysis may give more accurate results. Thirdly, the disclosure items selected for ethics practices were solely based on MCCG 2012. Therefore, other factors or variables may be excluded from this study. Future research should incorporate international best practices such as Organisation for Economic Co-operation and Development (OECD), International Corporate Governance Network (ICGN), Global Reporting Initiative (GRI) report, and many others. Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 References Ali, AJ and Falcone, T 1995, Work ethic in the USA and Canada, Journal of Management Development, Vol. 14 No. 6, pp. 26-34. Baker, TL, Hunt, TG and Andrews, MC 2006, Promoting ethical behaviour and organizational citizenship behaviours: The influence of corporate ethical values, Journal of Business Research, Vol 59 No. 7, pp. 849-857. Barros, CP, Boubaker, S and Hamrouni, A 2013, Corporate governance and voluntary disclosure in France, Journal of Applied Business Research, Vol. 29 No, 2, pp. 561577. Becker, BE, Huselid, MA, Pickus, PS and Spratt, MF 1997, HR as a source of shareholder value: Research and recommendations, Human Resource Management, Vol 36, No. 1, pp. 39-47. Chun, JS, Shin, Y, Choi, JN and Kim, MS 2013, How does corporate ethics contribute to firm financial performance? The mediating role of collective organizational commitment and organizational citizenship behaviour, Journal of Management, Vol. 39 No. 4, pp. 853877 Dedoulis, E 2006, The code of ethics and the development of the auditing profession in Greece, the period 1992–2002, Accounting Forum, Vol. 30 No. 2, pp. 155-178. Duska, RF 2007, Contemporary Reflections on Business Ethics, Springer Science & Business Media, Dordrecht, The Netherlands. Easley, D and O'hara, M 2004, Information and the cost of capital, The Journal of Finance, Vol. 59 No. 4, pp. 1553-1583. Francis, J, Nanda, D and Olsson, P 2008, Voluntary disclosure, earnings quality, and cost of capital, Journal of Accounting Research, Vol. 46 No. 1, pp. 53-99. Gaumnitz, BR and Lere, JC 2002, Contents of codes of ethics of professional business organizations in the United States, Journal of Business Ethics, Vol. 35 No. 1, pp. 3549. Hamid, AA, Haniff, MN, Othman, MR and Salin, ASAP 2011, The comparison of the characteristics of the anglo-saxon governance model and the governance of IFIs, Malaysian Accounting Review, Vol. 10 No. 2, pp. 1-12. Hashim, MH, Nawawi, A and Salin, ASAP 2014, Determinants of strategic information disclosure – Malaysian evidence, International Journal of Business and Society, Vol. 15, No. 3, pp. 547-572. Healy, PM and Palepu, KG 2001, Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature, Journal of Accounting and Economics, Vol. 31 No. 1, pp. 405-440. Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 Helin, S and Sandström, J 2007, An inquiry into the study of corporate codes of ethics, Journal of Business Ethics, Vol. 75 No. 3, pp. 253-271. Hirst, D, Koonce, L and Venkataraman, S 2007, How disaggregation enhances the credibility of management earnings forecasts, Journal of Accounting Research, Vol. 45 No. 4, pp. 811-837. Hosmer, LT 1994, Strategic planning as if ethics mattered, Strategic Management Journal, Vol. 15 No. S2, pp. 17-34. Hutton, AP, Miller, GS and Skinner, DJ 2003, The role of supplementary statements with management earnings forecasts, Journal of Accounting Research, Vol. 41 No. 5, pp. 867-890. Kaptein, M 2004, Business codes of multinational firms: What do they say? Journal of Business Ethics, Vol. 50 No. 1, pp. 13-31. KPMG 2009, KPMG Malaysia Fraud Survey Report. KPMG 2013, KPMG Malaysia Fraud, Bribery and Corruption Survey 2013. Leuz, C and Wysocki, P 2006, Capital-market effects of corporate disclosures and disclosure regulation, Research Study Commissioned by the Task Force to Modernize Securities Legislation in Canada, pp. 183-236. Long, BS and Driscoll, C 2008, Codes of ethics and the pursuit of organizational legitimacy: Theoretical and empirical contributions, Journal of Business Ethics, Vol. 77 No. 2, pp. 173-189 Luo, X and Bhattacharya, CB 2006, Corporate social responsibility, customer satisfaction, and market value, Journal of Marketing, Vol. 70, No. 4, pp. 1-18. Manan, SK, Kamaluddin, N and Salin, ASAP 2013, Islamic work ethics and organizational commitment: Evidence from employees of banking institutions in Malaysia, Pertanika Journal of Social Science and Humanities, Vol. 21 No. 4, pp. 1471-1489. Marquardt, N and Hoeger, R 2009, The effect of implicit moral attitudes on managerial decision-making: An implicit social cognition approach, Journal of Business Ethics, Vol. 85 No. 2, pp. 157-171. Mazumdar, SC and Sengupta, P 2005, Disclosure and the loan spread on private debt, Financial Analysts Journal, Vol. 61, No. 3, pp. 83-95. Mitton, T 2002, A cross-firm analysis of the impact of corporate governance on the East Asian financial crisis, Journal of Financial Economics, Vol. 64 No. 2, pp. 215-241. Roberts, PW and Dowling, GR 2002, Corporate reputation and sustained superior financial performance, Strategic Management Journal, Vol. 23 No. 12, pp. 1077-1093. Proceedings of 10th Annual London Business Research Conference 10 - 11 August 2015, Imperial College, London, UK, ISBN: 978-1-922069-81-8 Salin, ASAP, Kamaluddin, N and Manan, SKA 2011, „Unstoppable fraud, scandals and manipulation: An urgent call for an Islamic-based code of ethics‟, In: Proceedings of International Conference on Sociality and Economics Development, 2011, pp. 474-478. Sawicki, J 2009, Corporate governance and dividend policy in Southeast Asia pre- and postcrisis, The European Journal of Finance, Vol. 15 No. 2, pp. 211-230. Schwartz, MS 2002, A code of ethics for corporate code of ethics, Journal of Business Ethics, Vol. 41 No. 1-2, pp. 27-43. Sims, RR and Brinkmann, J 2003, Enron ethics (Or: Culture matters more than codes), Journal of Business Ethics, Vol. 45 No. 3, pp. 243 - 256. Spence, M 1973, Job market signalling, The Quarterly Journal of Economics, Vol. 87 No. 3, pp. 355-374.