OTC derivatives market: Demand heterogeneity, financial innovation, and economic welfare

advertisement

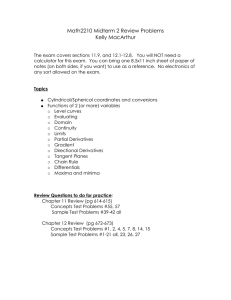

OTC derivatives market: Demand heterogeneity, financial innovation, and economic welfare Hong V. Nguyen Economics and Finance Department University of Scranton Scranton, PA 18510 USA hong.nguyen@scranton.edu Empirical financial economics and econometrics cannot tell us definitely if derivatives have been a net benefit to society in the nearly 4,000 years they have been around. Nevertheless, the reasons to believe that derivatives have done more good for society than harm are compelling. Christopher L. Culp, 2010b, The social functions of financial derivatives, in Robert W. Kolb and James A. Overdahl, eds.: Financial Derivatives – Pricing and Risk Management (Wiley: Hoboken, NJ), p. 66. Abstract The rapid growth in the derivatives market in the 1970s and 1980s led to some concern in the mid-1990s about whether these securities were becoming another means for users to speculate and the potential negative impact of such activities on financial markets and the economy (Darby, 1994). About a decade later, the financial crisis and the Great Recession of 2007-2009 took place, which has brought to the fore legislative actions here in the U.S. and abroad dealing with various aspects of the derivatives market (Dodd-Frank Act, 2010; Allen, 2012). The purpose of this paper is to provide a framework to review the literature on the role of derivatives as financial innovation. It considers demand heterogeneity as an independent determinant of innovation and explains the role of derivatives as financial innovation that adds to economic welfare. I find that the literature supports the use of this framework and the argument that derivatives contribute to economic welfare. Not considered in this paper is the systemic aspects of derivatives use and the policy questions dealing with this risk. 1 Introduction The financial turmoil of the second half of the 2000s has brought to the forefront the role of derivatives in contributing to the financial crisis and its impact on real economic activity. While acknowledging that derivatives may improve economic efficiency, various aspects of this market, such as the trading mechanism and its transparency, have been subject to close scrutiny, resulting in regulatory actions here and abroad (Dodd-Frank Act, 2010; Allen, 2012). This paper reviews and discusses the literature on the economic role of derivatives based on a framework which links innovation to demand heterogeneity. The main research question in this review is: “What is the economic role of derivatives?” I employ a demand framework that views heterogeneity as an important determinant of innovations (Valente, 2003; Kirman, 2006), which provides a basis for their economic value (Malerba, Nelson, Orsenigo, and Winter, 2007). This framework is attributed to Lancaster (1966a and 1966b), who analyzed demand based on characteristics of goods rather than the goods themselves. Within this framework one can also analyze innovations as new products or new variants of existing products that result in an increase in economic welfare. These innovations may include financial products (Bernado and Cornell, 1997), such as derivatives (Merton, 1992). While derivatives improve economic efficiency (see, for example, Allen and Gale, 1991; Merton, 1992; Duffie, 2010), there are external effects from their use that need to be considered (see, for example, Acharya and Bisin, 2014). I extend the demand heterogeneity framework by placing derivatives use within the financial system, which is viewed as an interconnected network of intermediaries (Gofman, 2011). In Figure 1 below, I show the overall framework relation between the economy and derivatives as financial innovation. Figure 1 Derivatives as financial innovation Economy Real Sector Financial Sector Derivatives as financial innovation Improving economic welfare by meeting demand heterogeneity The organization of the paper is as follows. In Section 2, I use the Lancaster model of demand to explain the nature of demand heterogeneity and its link to innovation and economic welfare. I then proceed to discuss, in Section 3, the literature on financial innovation, heterogeneity, and derivatives use. Section 4 concludes. 2 Demand heterogeneity, innovation, and economic welfare Heterogeneity on the supply side has also been studied in economics, for example, in the evolutionary economics literature (see, for example, Nelson and Winter 1982). However, it is demand heterogeneity that this paper is concerned with. In this section, I review the literature on heterogeneity and innovation. I take as given the various motivations, such as increasing market share (Tufano, 1989), of firms in providing the financial products. 2.1 Demand heterogeneity and innovation Webster’s Third New International Dictionary (unabridged edition, 1993) defines innovate as “to introduce as or as if new,” and innovation as “something that deviates from established doctrine or practice” or as “something that differs from existing forms.” The idea of innovation as an important dimension of capitalism has first been articulated by Schumpeter (1939), who defines innovation as “doing things differently in the realm of economic life.” (p. 84). Innovators play an important part in what Schumpeter called the process of “creative destruction.” While it causes disruption to markets by making existing capital obsolete, the process makes it possible for economic growth and welfare to improve over time (on Schumpeter, see, for example, McGraw, 2007). Von Hippel (1988) discussed the process of industrial innovation in several industries such as thermoplastics. That technological innovation contributes to economic growth and welfare is a well-established idea (Solow, 1957; Romer, 1990). In what follows, I review the literature on the impact of demand heterogeneity on innovation. While assuming homogeneity in certain cases may simplify the analysis without sacrificing realism, Valente (2003, p. 1) has suggested that “assuming homogeneous products requires a centralized pricing mechanism … it is also a severely limiting factor in the possibility of analyzing product-embodied innovations.” Bresnahan and Greenstein (1999) view demand heterogeneity as having played an important role in determining the structure of the computer industry. Langlois (2001) emphasizes that standardization has its limits due to the demand for variety. According to Adner and Levinthal (2001 p. 611), “[r]elatively underexplored … is the effect of the demand environment on the development and evolution of technology …” Kirman (2006, pp. 89-90) considers it “odd that heterogeneity does not play a greater role in economic models. In so many other disciplines it is fundamental. In the theory of evolution, variation, that is, heterogeneity even of a limited sort is crucial.” Windrum, Ciarli, and Birchenhall (2009) have formulated a model in which demand heterogeneity determines the evolution of environmental technologies. 2.2 Demand heterogeneity, innovation, and economic welfare: The Lancaster model I now discuss the Lancaster model to formalize the role of demand heterogeneity as an important and independent determinant of innovations. Lancaster (1966b) viewed the consumers as engaging in consumption activities by using goods, which generate the characteristics that they desire. In Lancaster’s scheme, the utility function (U) depends not on the goods themselves, but on the characteristics of these goods, that is, U = U(z) (1) where z is a vector of characteristics transformed from a vector of goods, x, through the matrix B: z = Bx (2) There is a relation between goods and consumption activity, denoted as vector y, through the matrix A: x = Ay (3) For example, the consumption activity is driving (say, to go from point C to point D), two characteristics may be the speed and comfort, and two of the goods are a car and gasoline. The same good may be used in more than activity, such as gasoline used in lawn maintenance activity in the case of a lawn mower. For simplicity, one may assume that there is a one-to-one correspondence between consumption activity and good, that is, one good for each activity and each activity using one good, then the consumption technology is the B matrix, transforming goods into desired characteristics that maximize the utility function, U(z), subject to the usual budget constraint facing the buyer. Individual buyers are faced with the same efficiency frontier defined as the minimum cost of buying the goods that allow then to reach the highest possible values of the desired characteristics. But they may each pick a different point on this frontier depending on what characteristics are valued more. The following figure shows two characteristics on the axes, with the frontier being drawn as a smooth curve for ease of discussion. Figure 2 The efficiency frontier Characteristic 2 A B X C I Characteristic 1 Points A, B, and C show three of many possible points on the frontier that can be obtained from using goods to transform into levels of characteristics 1 and 2. The buyer who picks point A value characteristic 2 more relative to the buyer who picks point B. The buyer may combine two or more goods, such as goods B and C to reach the preferred levels of characteristics at point X on the frontier. This approach views preferences as being not so much over the goods themselves as they are over the desired characteristics obtainable from these goods. What characteristics are desirable would depend on each individual buyer’s preferences. This is a major source of heterogeneity among buyers. As prices of goods change, the shape of the frontier would vary and the selected points would also change. For simplicity, I assume constant prices, and focus on innovation, discussed in the next section. By focusing on characteristics rather than the goods themselves, Lancaster (1966b) made it possible to discuss demand heterogeneity as an independent determinant of innovations. Innovation is expressed in a shift outward in the efficiency frontier, allowing buyers to reach higher levels of characteristics at the same or lower cost. According to Lancaster (1966a, pp. 2023), “innovation in the true sense occurs in the consumption technology, and this takes place primarily through the introduction of new goods or new variants and product differentiation … This change [innovation] does lead to increased welfare, but the direction from which change comes, the incentives for change, and the analysis and measurement of change differ considerably between production and consumption.” The contribution of innovations to economic welfare in connection with heterogeneity has been examined in the literature. Bresnahan and Greenstein (2001) emphasize “the distinction between inventions that solve general problems and the complementary inventions that solve particular ones. Both must occur for economic welfare to increase … Invention of general purpose enabling technologies, such as computer hardware and software, telephone transmission technologies, or data networks, permits but does not compel invention of valuable uses.” (p. 96). Some specific areas of study are medical and pharmaceutical product innovations. Trajtenberg (1989) conducted an economic analysis of computed tomography scanners in which demand was a motivator. Concerning pharmaceuticals, Malerba, Nelson, Orsenigo, and Winter (2007) have suggested that “many industries face a diverse set of customers and no single design ever emerges that satisfies all needs … If one aggregates across different kinds of drugs, the pharmaceutical industry remains relatively unconcentrated because a variety of different types of drugs are needed to meet the diverse requirements of different humans with different ailments.” p. 372. 3 The financial system, innovation, and economic welfare In this section, I explain the financial system as a network of intermediaries and how innovations to the system lead to an increase in welfare. 3.1 The financial system: Intermediation, diversification, and risk management Almost 6 decades ago, Gurley and Shaw (1955) emphasized the role of financial intermediation in the process of economic development: “[D]evelopment is associated with debt issue at some points in the economic system and corresponding accretions of financial assets elsewhere.” (p. 515). Bencivenga and Smith (1991) explain that the financial system promotes growth by enabling more savings to go toward capital investment through financial intermediation. This view is supported by Rajan and Zingales (1998), who found that industries that relied more heavily on external finance grew faster than other industries in a financial system with better intermediation services. The reason for this is that financial intermediation provides valuable opportunities for external financing of investment projects with positive net present values that may go unfunded otherwise. Bhatt (1989) considered credit market developments as contributory to economic growth in both developing and developed countries. Levine (2004) suggests that a financial system contributes to growth and welfare by providing opportunities for the diversification and management of risk. Financial intermediation provides a number of characteristics desired by firms and individuals. They include safety in holding assets that bridge the gap between the present and the future; allowing diversification to minimize risk through and maximize returns through participation in a large number of intermediated assets. The access to one’s assets at a short notice has also been part of what the financial system does, with important consequences for the real economy. Financial record keeping also facilitates such intermediary activities. 3.2 Financial innovation I use the concept of financial technology, viewed in an analogous way to the consumption technology, to explain how financial innovation contributes to economic welfare. Frame and White (2004, p. 118) state that financial innovation “represents something new that reduces costs, reduces risks, or provides an improved product/service/instrument that better satisfies participants' demands.” Tufano (2003, p. 3) defines it as “the act of creating and then popularizing new financial instruments as well as new financial technologies, institutions and markets.” According to Allen and Gale (1994, p. 6): “The theory of financial innovation deals with the provision of opportunities for risk sharing or intertemporal smoothing …” Lancaster (1966a) viewed his analysis as also being applicable to situations of risk where desired characteristics that may be valued differently by potential buyers, such as maximum gain versus maximum loss. He considered it as extending the expected utility maximization analysis of Von Neumann and Morgenstern (1944). Financial innovation has a long history, going back to the times of Babylonia and Assyria, thousands of years BCE (Allen and Gale, 1994). Financial innovation can take many different forms. Double-entry bookkeeping that is traced back to the Middle Ages may be considered a financial innovation of a process nature, considered important for the development of capitalist organization with respect to financing (Basu, Kirk, and Waymire, 2009). The ATM (automatic teller machine) is a computer-related innovation (in the 1960s and 1970s) that has improved the financial infrastructure with respect to liquidity demand. New forms of financial intermediation, such as mutual funds, may be considered financial innovation (Ackermann, 2013). The greater efficiency in the allocation and use of resources made possible by financial innovation adds to economic growth and welfare (see, for example, Allen and Gale, 1994; Tufano, 2003; and Levine, 2004). Financial innovation improves financial intermediation and the efficiency of capital allocation, and generates faster economic growth. According to Michalopoulos, Laeven, and Levine (2009, p. 27): “Institutions, laws, regulations, and policies that impede financial innovation slow technological change and economic growth.” As Shiller (2012) has put it, financial innovation contributes to the “good society.” As an idea that can be used over again and again, the benefits of financial innovation to society may be greater than just the sum of the benefits of the individual market participants (see, for example, Haliassos, 2013). Ideas are important for sustained economic growth, as Romer (1990) has shown. A channel for financial innovation to affect economic growth has been offered by Froot, Scharfstein, and Stein (1993). Hedging with derivatives allows a company to maintain a steady cash flow, which is important in cases where external finance is costly. Adam (2002) obtained evidence that shows that hedging with derivatives increases the likelihood of a company having adequate internally generated funds for financing its capital investment. Goderis, Marsh, Castello, and Wagner (2006) found evidence indicating that banks used credit derivative products to diversify their risk exposures that would then make it possible for them to increase lending. Hirtle (2007) studied the use of credit derivatives by banks and found that it increased bank credit supply and lowered the spreads for borrowers. Research on financial innovation is of a more recent origin, going back to the 1970s and early 1980s (see, for example, Silber, 1975 and 1983). The empirical work that is systematic in terms of hypotheses and statistical testing is limited, especially as related to the economic value of derivatives as financial innovation. In addition, the empirical evidence comes mostly from economy-wide studies and is limited to financial innovation in a broad sense, and not specific to financial derivatives. As Frame and White (2004) have put it: “A striking feature of this literature [on financial innovation] … is the relative dearth of empirical studies …” (p. 116). However, from this limited evidence, they conclude that “the welfare consequences of financial innovation … are largely positive, especially with product and process innovations.” (p. 134). Below, I review some of this limited evidence, both macroeconomic and microeconomic, on the contribution of financial innovation and derivatives. As Tufano (2003) has pointed out, financial innovations are often introduced by large commercial and investment banks. A study by Lerner (2006) shows that a significant percentage of financial innovations from 1990 and 2002 was carried out by large financial institutions, such as Goldman Sachs and JP Morgan. Atkeson, Eisfeld, and Weill (2013) examine the question of why larger institutions provide intermediation services in the OTC derivatives market, and point out that the larger institutions make it possible for smaller market participants to share risks. Tufano (2003) has surveyed the literature on financial innovation from several perspectives. He acknowledged that measuring the social welfare impact of financial innovation, including derivatives, was problematic. He suggested that the area of industrial organization may be relevant and fruitful to the task of estimating the social welfare impact, an area of research that is relatively new at the present time. Together with Lerner in a more recent paper (Lerner and Tufano 2011), Tufano suggested that a counterfactual approach to the measurement of the social value of financial innovation may be fruitful, even though it may be hard to do. With this approach, one assumes away the existence of financial innovations like derivatives and then tries to ascertain how much welfare would be reduced. To look at it in a different way, one can ask how much society is willing to pay over and above what it pays for the current financial technology to have the new innovation rather than to go without it. This is the sort of counterfactual approach that Fogel (1964) used to estimate the impact of the railroads on American economic growth in the 19th century. One of the earliest empirical studies of financial innovation is that of Garbade and Silber (1978). They reviewed the impact of the advent of the telegraph and the trans-Atlantic cable in the 19th century and explained that such technological changes improved the functioning of financial markets and economic welfare. Dynan, Elmendorf, and Sichel (2006) show that financial innovation helps smooth consumption over the business cycle and has a stabilization effect on the economy. Michalopoulos, Laeven, and Levine (2009) examined a sample of U.S. industries over the period 1967 to 2000. They used labor productivity growth in the financial sector and in the industrial sector to measure financial innovation and technological innovation, and found that these two measures are positively correlated. The inference here is that to encourage technological innovation, you need financial innovation; and to encourage financial innovation, you need to have technological innovation. Labor productivity growth is important in contributing to the rise in the standard of living in the U.S. and elsewhere (see, for example, Jones, 2014). 3.3 Derivatives as financial innovation Culp (2010) suggests that derivatives as a risk management tool have been around for about 4,000 years. Van Horn (1985) looked at financial innovation as reducing inefficiencies and expanding markets, and listed futures and options among the products of financial innovation. Writing in the mid-1980s, Miller (1986, p. 463) singled out financial futures to be the “most significant financial innovation” over the preceding twenty-year period. Derivatives as financial innovation provide various ways of dealing with the problem of managing risk and uncertainty (Stulz, 2003). The spanning role of these financial instruments in completing markets is an important economic function in providing risk sharing opportunities (see, for example, by Allen and Gale, 1991; Cuny, 1993; Duffie and Rahi, 1995). Acharya, Viral, Brenner, Engle, Lynch, and Richardson (2009) viewed derivatives as “the ultimate financial innovation.” Carvajal, Rostek, and Weretka (2012, p. 1895) study a model in which competitors innovate with assetbacked securities to satisfy “heterogeneous risk-sharing needs” of investors with respect to current versus future consumption. Merton (1992, p. 17) best summarizes the economic role of financial innovation: In general, innovations in financial products and services can improve economic performance in three basic ways: by meeting investor or issuer demands to “complete the markets” with new securities or products that offer expanded opportunities for risksharing, risk-pooling, hedging, and inter-temporal or spatial transfers of resources; by lowering transactions costs or increasing liquidity; and by reducing “agency costs” that arise from either “information asymmetries” between trading parties or principals’ incomplete monitoring of their agents’ performance. All three of these driving forces behind financial innovation are consistent with its working to improve economic efficiency [bolded emphasis added]. Two of the functions listed in the above quote (risk sharing and hedging, and lower transaction costs) have been examined by Pesendorfer (1995). He models the process of innovation by financial intermediaries as one in which existing standard financial instruments are to create new securities, what he refers to as “customer-tailored instruments,” consistent with the Lancaster notion of “new variants” of existing goods to expand the efficiency frontier with respect to desired characteristics. In support of his view, Pesendorfer (1995) provides two examples of financial innovation: zero coupon bonds created by Merrill Lynch and Salomon Brothers in 1982, and collateralized mortgage obligations (CMOs) introduced by First Boston and Salomon Brothers in 1983. These innovations are consistent with an increase in consumption/investment and an improvement in economic welfare (Shiller, 2012; Cass and Citanna, 1998). 3.4 3.4.1 Empirical evidence Financial innovation and economic welfare Research on financial innovation is of a more recent origin, going back to the 1970s and early 1980s (see, for example, Silber, 1975 and 1983). The empirical work that is systematic in terms of hypotheses and statistical testing is even more limited, especially as related to the economic value of derivatives as financial innovation. However, from this limited evidence, Frame and White (2004, p. 134) conclude that “the welfare consequences of financial innovation … are largely positive, especially with product and process innovations.” Michalopoulos, Laeven, and Levine (2009) examined a sample of U.S. industries over the period 1967 to 2000. They used labor productivity growth in the financial sector and in the industrial sector to measure financial innovation and technological innovation, and found that these two measures are positively correlated. The inference here is that to encourage technological innovation, you need financial innovation; and to encourage financial innovation, you need to have technological innovation. Labor productivity growth has been considered important in contributing to the rise in the standard of living in the U.S. and elsewhere (Jones, 2014). Garbade and Silber (1978) reviewed the impact of the advent of the telegraph and the trans-Atlantic cable in the 19th century and explained that such technological changes improved the functioning of financial markets and economic welfare. Dynan, Elmendorf, and Sichel (2006) show that financial innovation helps smooth consumption over the business cycle and has a stabilization effect on the economy. Tufano (2003) has surveyed the literature on financial innovation from several perspectives. He acknowledged that measuring the social welfare impact of financial innovation was problematic. He suggested that the area of industrial organization may be relevant and fruitful to the task of estimating the social welfare impact, an area of research that is relatively new at the present time. Together with Lerner in a more recent paper (Lerner and Tufano, 2011), Tufano suggested that a counterfactual approach to the measurement of the social value of financial innovation may be fruitful, even though it may be hard to do. With this approach, one assumes away the existence of financial innovations like derivatives and then tries to ascertain how much welfare would be reduced. To look at it in a different way, one can ask how much society is willing to pay over and above what it pays for the current financial technology to have the new innovation rather than to go without it. This is the sort of counterfactual approach that Fogel (1964) used to estimate the impact of the railroads on American economic growth in the 19th century. In summary, the empirical literature seems to speak to a welfare-improving role for the financial system and the innovations to the system (financial innovation). 3.4.2 Derivatives and economic welfare OTC markets, including the OTC derivatives market, are large, judging by the value of the securities traded through these markets. According to Nystedt (2004, p. 42), “[t]he United States has some of the largest and most innovative OTC issuers, while also being home to some of the world's largest ODE (organized derivative exchange) markets.” Schinasi, Craig, Drees, and Kramer (2000) provide a good discussion of the various aspects of the OTC derivatives market. Figure 3 below shows that the OTC derivatives market is very large, with total notional amounts of more than $600 trillion. Figure 3 OTC derivatives market, 2007 and 2013 Note: Data used in constructing the charts come from Bank for International Settlements (BIS), Statistical release: OTC derivatives statistics at end-June 2013, November 2013, Table A, p. 5. The nature of heterogeneity suggests that trading mechanisms may differ between homogeneous derivative products and heterogeneous ones. According to Carvalho (1997, p. 481), “exchange-traded derivatives are created to cover risks of a more generic or homogeneous nature. In contrast, hedging against more specific bets that have to be tailored to specific customers may be obtained in "over-the-counter" (OTC) deals.” Similarly, Nystedt (2004, p. 5) has stated that “[c]ontrary to the highly standardized and usually cleared contracts offered by traditional organized derivative exchange (ODE) markets, OTC derivatives can be individually customized to an end-user's risk preference and tolerance.” Switzer and Fan (2008) document a substitution relationship between trades in OTC markets and trades in a central futures exchange with respect to the Canadian dollar, that is, as trades of futures in the central exchange increase, trades of forwards and swaps in the OTC market would decline. Their evidence also shows a complementary relationship between the two markets in terms of the risks hedged: OTC trades hedge against idiosyncratic risk while central exchange trades hedge against systematic risk. Thompson (2010) has argued that decentralized clearing may still be efficient as the moral hazard problem of protection sellers may be counteracted by the adverse selection problem of protection buyers so that full information may be revealed in bilateral arrangements. Similarly, Golosov, Lorenzoni, and Tsyvinski (2013) studied decentralized (bilateral) trading which they consider to be common with many OTC derivatives, and found that it is possible for bilateral trading to attain efficiency with low-cost learning. McConnell and Schwartz (1992) studied a successful financial instrument introduced by Merrill Lynch in 1985, known as LYON (Liquid Yield Option Note), which gave investors a way of enhancing their returns for a given risk profile and a way for corporate issuers (including American Airlines, Motorola, and Marriott) to raise funds from these retail customers. Kanemasu, Litzenberger, and Rolfo (1986) studied stripped Treasury securities as “a prominent example of security innovation in response to an existing set of government securities that was not sufficiently tailored to meet investors’ preferences.” (p. 3). Brewer, Jackson, and Moser (1996) estimated the value of interest rate derivatives and found it to be positive in that their use lowered the cost of borrowing to consumers. Writing five years later and using bank holding companies as their sample (Brewer, Jackson, and Moser, 2001, p. 64), they concluded that “derivative usage appears to foster relatively more loan making, or financial intermediation.” However, they did not ascertain the value of this intermediation to society in terms of greater capital investment and consumption. Black, Garbade, and Silber (1981) found that the innovation of GNMA’s pass-through securities reduced mortgage interest rates. 4 Conclusions This paper has attempted to show that financial innovation is based on demand heterogeneity and contributes to economic welfare. Derivatives, as financial innovation, allow market participants to share risks and to facilitate financial intermediation. In so doing, they facilitate the timing of consumption and investment, and improve the living standard of a country. References Acharya, Viral, Menachem Brenner, Robert Engle, Anthony Lynch, and Matthew Richardson, 2009, Derivatives - The ultimate financial innovation, in Viral Acharya and Matthew Richardson, eds.: Restoring Financial Stability: How to Repair a Failed System (Wiley, Hoboken, NY). Acharya, Viral V., Lasse Heje Pedersen, Thomas Philippon, and Matthew P. Richardson, 2010, A tax on systemic risk, Unpublished paper, New York University. Acharya, Viral V., Lasse Heje Pedersen, Thomas Philippon, and Matthew P. Richardson, 2012, Measuring systemic risk, CEPR Discussion Paper No. DP8824. Acharya, Viral and Alberto Bisin, 2014, Counterparty risk externality: Centralized versus overthe-counter markets, Journal of Economic Theory 149, 153-182. Ackermann, Josef, 2013, Financial innovation: Balancing private and public interests, in Michael Haliossos, ed.: Financial Innovation: Too Much or Too Little? (The MIT Press, Cambridge, MA). Adam, Tim R., 2002, Do firms use derivatives to reduce their dependence on external capital markets?, European Finance Review 6, 163-187. Adner, Ron and Daniel Levinthal, 2001, Demand heterogeneity and technology evolution: Implications for product and process innovation, Management Science 47, 611-628. Adrian, Tobias, and Hyun Song Shin, 2009, Money, liquidity, and monetary policy, American Economic Review: Papers & Proceedings 99, 600-605. Adrian, Tobias and Markus K. Brunnermeier, 2011, COVAR, National Bureau of Economic Research Paper Series WP 17454. Akerlof, George A., 1970, The market for 'Lemons': Quality uncertainty and the market mechanism, Quarterly Journal of Economics 84, 488-500. Allen, Franklin and Douglas Gale, 1991, Arbitrage, short sales, and financial innovation, Econometrica 59, 1041-1068. Allen, Franklin and Douglas Gale, 1994, Financial Innovation and Risk Sharing (The MIT Press, Cambridge, MA). Allen, Franklin and Douglas Gale, 2000, Financial contagion, Journal of Political Economy 108, 1-33. Allen, Frank, 2012, Trends in financial innovation and their welfare impact: An overview, European Financial Management 18, 493-514. Allen, Julia Lees, 2012, Derivatives clearinghouses and systemic risk: A bankruptcy and DoddFrank analysis, Stanford Law Review 64, 1-28. Amihud, Yakov and Haim Mendelson, 1987, Trading mechanisms and stock returns: An empirical investigation, Journal of Finance 42, 533-553. Arnsdorf, Matthias, 2011, Quantification of central counterparty risk, Journal of Risk Management in Financial Institutions 5, 273-287. Arora, Navneet, Priyank Gandhi, and Francis A. Longstaff, 2012, Counterparty credit risk and the credit default swap market, Journal of Financial Economics 103, 280-293. Atkeson, Andrew G., Andrea L. Eisfeldt, and Pierre-Olivier Weill, 2013, The market for OTC derivatives, National Bureau of Economic Research Working Paper Series WP 18912. Avellaneda, Marco and Rama Cont, 2010, Transparency in over-the-counter interest rate derivatives markets, Finance Concepts, ICAP Information Services. Babus, Ana, 2009, Endogenous intermediation in over-the-counter markets, Unpublished manuscript, Imperial College London. Bank for International Settlements (BIS), 2011, The macrofinancial implications of alternative configurations for access to central counterparties in OTC derivatives markets, CGFS Papers No 46 (Bank for International Settlements). Bank for International Settlements (BIS), 2013a, Margin requirements for non-centrally cleared derivatives, Second Consultative Document (Bank for International Settlements and International Organization of Securities Commission, February). Bank for International Settlements (BIS), 2013b, Macroeconomic impact assessment of OTC derivatives regulatory reforms (Bank for International Settlements and International Organization of Securities Commission, August). Barton, Jan and Gregory Waymire, 2004, Investor protection under unregulated financial reporting, Journal of Accounting and Economics 38, 65-116. Basu, Sudipta, Marcus Kirk, and Greg Waymire, 2009, Memory, transaction records, and ‘The Wealth of Nations’, Accounting, Organizations and Society 34, 895-917. Beck, Thorsten, Ross Levine, and Norman Loayza, 2000, Finance and the sources of growth, Journal of Financial Economics 58, 261-300. Bencivenga, Valerie R. and Bruce D. Smith, Financial intermediation and endogenous growth, Review of Economic Studies 58, 195-209. Benoit, Sylvain, Gilbert Colletaz, Christophe Hurlin, and Christophe Pérignon, 2013, A theoretical and empirical comparison of systemic risk measures, Unpublished paper, Université d’Orléans and HEC Paris. Benston, George J., 1973, Required disclosure and the stock market: An evaluation of the Securities Exchange Act of 1934, American Economic Review 63, 132-155. Benston, George J., 1999, Regulating financial markets: A critique and some proposals (The AEI Press, Washington, D.C.). Bernado, Antonio E. and Bradford Cornell, 1997, The valuation of complex derivatives by major investment firms: Empirical evidence, Journal of Finance 52, 785-798. Bernanke, Ben, 2010, Implications of the financial crisis for economics, Bank for International Settlements Review 123, 1-10. Bernheim, B. Douglas and Michael D. Whinston, 2008, Microeconomics (Mc-Graw Hill Irwin, New York, NY). Bessembinder, Hendrik and William Maxwell, 2008, Markets: Transparency and the corporate bond market, Journal of Economic Perspectives 22, 217-234. Bhatt, V. V., 1989, On financial innovations and credit market evolution, World Development 16, 281-292. Bhattacharyya, Sugato and Vikram Nanda, 2000, Client discretion, switching costs, and financial innovation, Review of Financial Studies 13, 1101-1127. Biais, Bruno, 1993, Price formation and equilibrium liquidity in fragmented and centralized markets, Journal of Finance 48, 157-185. Biais, Bruno and Richard C. Green, 2007, The microstructure of the bond market in the 20th century, Unpublished manuscript, Toulouse University and Carnegie Mellon University. Biais, Bruno, Florian Heider, and Marie Hoerova, 2012, Clearing, counterparty risk, and aggregate risk, International Monetary Fund Economic Review 60, 193-222. Bianchi, Javier, 2009), Overborrowing and systemic externalities in the business cycle, Federal Reserve Bank of Atlanta, Working Paper No. 2009-24. Bisias, Dimitrios, Mark Flood, Andrew W. Lo, and Stavros Valavanis, 2012, A survey of systemic risk analytics, U.S. Department of the Treasury, Office of Financial Research, Working Paper 0001. Black, Deborah G., Kenneth D. Garbade, and William L. Silber, 1981, The impact of the GNMA pass-through program on FHA mortgage costs, Journal of Finance Papers and Proceedings 36, 457-469. Blair, Margaret M., and Erik F. Gerding, 2009, Sometimes too great a notional: measuring the ‘systemic significance’ of OTC credit derivatives, Vanderbilt University Law School – Law and Economics Working Paper No. 09-22. Bliss, Robert R., and Robert S. Steigerwald, 2006, Derivatives clearing and settlement: A comparison of central counterparties and alternative structure, Federal Reserve Bank of Chicago Economic Perspectives 4Q, 22-29. Bloomfield, Robert and Maureen O’Hara, 1999, Who wins and who loses, Review of Financial Studies 12, 5-35. Blume, Lawrence and David Easley, 1992, Evolution and market behavior, Journal of Economic Theory, 58, 9-40. Blume, Lawrence and David Easley, 2009, The market organism: Long-run survival in markets with heterogeneous traders. Journal of Economic Dynamics & Control 33, 1023-1035. Board Committee on Banking Supervision and Board of the International Organization of Securities Commissions (BCBS/IOSCO), 2013, Second Consultative Document: Margin requirements for non-centrally cleared derivatives. Boz, Emine and Enrique G. Mendoza, 2014, Financial innovation, the discovery of risk, and the U.S. credit crisis, Journal of Monetary Economics 62, 1-22. Bresnahan, Timothy F. and Shane Greenstein, 1999, Technological competition and the structure of the computer industry, Journal of Industrial Economics 47, 1-40. Bresnahan, Timothy F. and Shane Greenstein, 2001, The economic contribution of information technology: Towards comparative and user studies, Journal of Evolutionary Economics 11, 95-118. Brewer, Elijah III, William E. Jackson, and James T. Moser, 1996, Alligators in the swamp: The impact of derivatives on the financial performance of depository institutions, Journal of Money, Credit, and Banking 28, 482-497. Brewer, Elijah III, William E. Jackson, and James T. Moser, 2001, The value of using interest rate derivatives to manage risk at U.S. banking organizations, Federal Reserve Bank of Chicago Economic Perspectives Q3, 49-64. Brunnermeier, Markus, Gary Gorton, and Arvind Krishnamurthy, 2011, Risk topography, NBER Macroeconomics Annual 26, 149-176. Brunnermeier, Markus and Martin Oehmke, 2013, Bubbles, financial crises, and systemic risk, in George M. Constantinides, Milton Harris, and Rene M. Stulz, eds.: Handbook of the Economics of Finance, Vol. 2, 1221-1288 (Elsevier, Amsterdam, Holland). Brunnermeier, Markus and Yuliy Sannikov, 2014, A macroeconomic model with a financial sector, American Economic Review 104, 379-421. Bystrom, Hans, 2010, Margin setting in credit derivatives clearing houses, Journal of Fixed Income, Spring, 37-43. Caballero, Ricardo J., and Alp Simsek, 2009, Complexity and financial panics, National Bureau of Economic Research Working Paper Series No. 14997. Cantillon, Estelle, and Pai-Ling Yin, 2011, Competition between exchanges: Lessons from the battle of the Bund, Unpublished manuscript, Université Libre de Bruxelles and MIT. Carow, Kenneth A., 1999, Evidence of early-mover advantages in underwriting spreads, Journal of Financial Services 15, 37-55. Carvajal, Andres, Marzena Rostek, and Marek Weretka, 2012, Competition in financial innovation, Econometrica 80, 1895-1936. Carvalho, Fernando J. Cardim De, 1997, Financial innovation and the post Keynesian approach to the “process of capital formation”, Journal of Post Keynesian Economics 19, 461-487. Cass, David and Alessandro Citanna, 1998, Pareto improving financial innovation in incomplete markets, Economic Theory 11, 467-494. Coffee, John C., 2012, The political economy of Dodd-Frank: Why financial reform tends to be frustrated and systemic risk perpetuated, Columbia Law Review 97, 1019-1081. Cont, Rama and Thomas Kokholm, 2013, Central clearing of OTC derivatives: Bilateral vs. multilateral netting, Conference paper, the Midwest Finance Association. Culp, Christopher L., 2010a, OTC-cleared derivatives: Benefits, costs, and implications of the ‘Dodd-Frank Wall Street Reform and Consumer Protection Act’, Journal of Applied Finance 2, 103-129. Culp, Christopher L., 2010b, The social functions of financial derivatives, in Robert W. Kolb and James A. Overdahl, eds.: Financial Derivatives – Pricing and Risk Management (Wiley: Hoboken, NJ), p. 66. Cuny, Charles J., 1993, The role of liquidity in futures market innovations, Review of Financial Studies 6, 57-78. Darby, Michael R., 1994, Over-the-counter derivatives and systemic risk to the global financial system, National Bureau of Economic Research Working Paper Series No. 4801. de Frutos, M. Ángeles, and Carolina Manzano, 2002, Risk aversion, transparency, and market performance, Journal of Finance 57, 959-984. Duffie, Darrell and Rohit Rahi, 1995, Financial market innovation and security design: An introduction, Journal of Economic Theory 65, 1-42. Duffie, Darrell, Nicolae Gârleanu, and Lasse Heje Pedersen, 2005, Over-the-counter markets, Econometrica 73, 1815-1847. Duffie, Darrell, Nicolae Gârleanu, and Lasse Heje Pedersen, 2007, Valuation in over-the-counter markets, Review of Financial Studies 20, 1865-1900. Duffie, Darrell, Ada Li, and Theo Lubke, 2010, Policy perspectives on OTC derivatives market infrastructure, Federal Reserve Bank of New York Staff Report No. 424. Duffie, Darrell, 2010, The failure mechanics of dealer banks, Journal of Economic Perspectives 24, 51-72. Duffie, Darrell and Haoxiang Zhu, 2011, Does a central clearing counterparty reduce counterparty risk?, Review of Asset Pricing Studies 1, 74-95. Duffie, Darrell, 2012, Dark Markets (Princeton University Press, Princeton, NJ). Dynan, Karen E., Douglas W. Elmendorf, and Daniel E. Sichel, 2006, Can financial innovation help to explain the reduced volatility of economic activity?” Journal of Monetary Economics 53, 123-50. Easley, David and Maureen O’Hara, 2009, Ambiguity and nonparticipation: The role of regulation, Review of Financial Studies 22, 1817-1843. Edwards, Amy K., Lawrence E. Harris, and Michael S. Piwowar, 2007, Corporate bond market transaction costs and transparency, Journal of Finance 62, 1421-1451. Financial Stability Board, 2013, OTC Derivatives Market Reforms, Fifth Progress Report on Implementation. Flannery, Mark J., 1998, Using market information in prudential bank supervision: A review of the U.S. empirical evidence, Journal of Money, Credit, and Banking 30, 273-305. Flannery, Mark J., Simon H. Kwan, and Mahendrarajah Nimalendra, 2013, The 2007-2009 financial crisis and bank opaqueness, Journal of Financial Intermediation 22, 55-84. Fleischer, Victor, 2010, Regulatory arbitrage, Legal Studies Research Paper Series Working Paper No. 10-11, University of Colorado Law School. Fogel, Robert W., 1964, Railroads and American Economic Growth: Essays in Econometric History (The Johns Hopkins Press, Baltimore, Maryland). Frame, W. Scott and Lawrence J. White, 2004, Empirical studies of financial innovation: Lots of talk, little action?, Journal of Economic Literature 42, 116-144. Friend, Irwin and Randolph Westerfield. 1975, Required disclosure and the stock market: Comment. American Economic Review 65.3: 467-472. Froot, Kenneth A., David S. Scharfstein, and Jerome Stein, 1993, Risk management: Coordinating corporate investment and financing policies, Journal of Finance 48, 16291658. Gai, Prasanna, Sujit Kapadia, Stephen Millard, and Ander Perez, 2008, Financial innovation, macroeconomic stability and systemic crises, Economic Journal 111, 401-426. Galati, Gabriele and Richhild Moessner, 2011, Macroprudential policy - A literature review, Bank for International Settlements Working Papers No. 337. Gao, Yu, Scott Liao, and Xue Wang, 2011, The economic impact of the Dodd-Frank Act of 2010: Evidence from market reactions to events surrounding the passage of the Act, Unpublished paper, University of Minnesota. Garbade, Kenneth D. and William L. Silber, 1978, Technology, communication and the performance of financial markets: 1840-1975, Journal of Finance Papers and Proceedings 33, 819-832. Gennaioli, Nicola, Andrei Shleifer, and Robert Vishny, 2012, Neglected risks, financial innovation, and financial fragility, Journal of Financial Economics 104, 452-468. Gerding, Erik F., 2011, Credit derivatives, leverage, and financial regulation’s missing macroeconomic dimension, Berkeley Business Law Journal Symposium Edition, 102-145. Giglio, Stefano, Bryan Kelly, Seth Pruitt, and Xiao Qiao, 2013, Systemic risk and the macroeconomy: An empirical evaluation, Unpublished paper, University of Chicago and the Federal Reserve Board. Glosten, Lawrence R. and Paul R. Milgrom, 1985, Bid, ask and transaction prices in a specialist market with heterogeneously informed traders, Journal of Finance 14, 71-100. Goderis, Benedikt, Ian W. Marsh, Judit Vall Castello, and Wolf Wagner, 2006, Bank behavior with access to credit risk transfer markets, Cass Business School Research Paper. Available at SSRN: http://ssrn.com/abstract=937287. Gofman, Michael, 2011, A network-based analysis of over-the-counter markets, Unpublished manuscript, University of Chicago. Golosov, Michael, Guido Lorenzoni, and Aleh Tsyvinski, 2013, Decentralized trading with private information, National Bureau of Economic Research Working Paper No. 15513. Green, Richard C., Burton Hollifield, and Norman Schürhoff, 2007, Financial intermediation and the costs of trading in an opaque market, Review of Financial Studies 20, 275-314. Green, Richard C., Dan Li, and Norman Schürhoff, 2010, Price discovery in illiquid markets: Do financial asset prices rise faster than they fall?, Journal of Finance 65, 1669-1702. Greenstone, Michael, Paul Oyer, and Annette Vissing-Jorgensen, 2006, Mandated disclosure, stock returns, and the 1964 Securities Act Amendments, Quarterly Journal of Economics 121, 399-460. Gurley, John G. and Edward S. Shaw, 1955, Financial aspects of economic development, American Economic Review 45, 515-538. Haliassos, Michael, ed., 2013, Financial Innovation: Too Much or Too Little? (The MIT Press, Cambridge, MA). Hansen, Lars Peter, 2013, Challenges in identifying and measuring risk, University of Chicago and NBER. Hanson, Samuel G., Anil K. Kashyap, and Jeremy C. Stein, 2011, A macroprudential approach to financial regulation, Journal of Economic Perspectives 25, 3-28. Hauch, Charles L., 2013, Dodd-Frank’s swap clearing requirements and systemic risk, Yale Journal on Regulation 30, 277-289. He, Zhiguo and Arvind Krishnamurthy, 2012, A macroeconomic framework for quantifying systemic risk, Unpublished manuscript, University of Chicago and Northwestern University. Heller, Daniel and Nicholas Vause, 2011, Expansion of central clearing, Bank for International Settlements Quarterly Review, 67-81. Heller, Daniel and Nicholas Vause, 2012, Collateral requirements for mandatory central clearing of OTC derivatives, Bank for International Settlements Working Paper No. 373. Hendershott, Terrence and Charles M. Jones, 2005, Island goes dark: Transparency, fragmentation, and regulation, Review of Financial Studies 18, 743-793. Henderson, Brian J. and Neil D. Pearson, 2011, The dark side of financial innovation, Journal of Financial Economics 100, 227-247. Hens, Thorsten and Marc Oliver Rieger, 2008, The dark side of the moon: Structured products from the customers’ perspective, National Center of Competence in Research, Financial Valuation, and Risk Management, Working paper 459. Hicks, John, 1967, Critical Essays in Monetary Theory (Oxford University Press, Oxford, England). Hirshleifer, Jack, 1971, The private and social value of information and the reward to inventive activity, American Economic Review 61, 561-574. Hirtle, Beverly, 2007, Credit derivatives and bank credit supply, Federal Reserve Bank of New York Staff Reports No. 276. Hotchkiss, Edith S. and Tavy Ronen, 2002, The informational efficiency of the corporate bond market: An intraday analysis," Review of Financial Studies 15, 1325-1354. International Monetary Fund (IMF), 2010, Making Over-the-Counter Derivatives Safer: The Role of Central Counterparties (IMF, Washington, D.C.). International Swaps and Derivatives Association (ISDA), 2011a, Counterparty Credit Risk Management in the US Over-the-Counter (OTC) Derivatives Markets (ISDA, New York, NY). International Swaps and Derivatives Association (ISDA), 2011b, Swap Execution Facilities: Can They Improve the Structure of OTC Derivatives Markets? (ISDA, New York, NY). International Swaps and Derivatives Association (ISDA), 2011c, OTC Derivatives Market Analysis (ISDA, New York, NY). International Swaps and Derivatives Association (ISDA), 2012a, OTC Derivatives Market Analysis Mid-Year 2012 (ISDA, New York, NY). International Swaps and Derivatives Association (ISDA), 2012b, Initial margin for non-centrally cleared swaps: Understanding the systemic implications, (ISDA, New York, NY). International Swaps and Derivatives Association (ISDA), 2012c, Margin Survey 2012 (ISDA, New York, NY). International Swaps and Derivatives Association (ISDA), 2012d, OTC Derivatives Market Analysis Mid-Year 2012 (ISDA, New York, NY). International Swaps and Derivatives Association (ISDA), 2013a, OTC Derivatives Market Analysis Year-End 2012 (ISDA, New York, NY). International Swaps and Derivatives Association (ISDA), 2013b, Non-Cleared OTC Derivatives: Their Importance to the Global Economy (ISDA, New York, NY). Jones, Charles I., 2014, Macroeconomics, 3rd edition (W. W. Norton, New York and London). Kanemasu, Hiromasu, Robert H. Litzenberger, and Jacques Rolfo, 1986, Financial innovation in an incomplete market: An empirical study of stripped government securities, Rodney L. White Center for Financial Research #26-86, University of Pennsylvania. Keynes, John Maynard, 1930, A Treatise on Money Vol. 1 (Macmillan and Company, London, England). Kirman, Alan, 2006, Heterogeneity in economics, Journal of Economic Interaction and Coordination 1, 89-117. Koeppl, Thorsten V., 2013, The limits of central counterparty clearing: collusive moral hazard and market liquidity, Unpublished manuscript, Queen’s University. Korinek, Anton, 2012, Systemic risk-taking: Amplification effects, externalities, and regulatory responses, Unpublished paper, University of Maryland. Kroszner, Randall S., 1999, Can the financial markets privately regulate risk?, Journal of Money, Credit, and Banking 31, 596-618. Kroszner, Randall S., and William Melick, 2009, The response of the Federal Reserve to the recent banking and financial crisis, Unpublished manuscript, University of Chicago and Kenyon College. Krugman, Paul, and Robin Wells, 2013, Microeconomics, 3rd ed. (Worth, New York, NY). Lacker, Jeffrey, 1998, On systemic risk, Comments presented at the Second Joint Central Bank Research Conference on Risk Measurement and Systemic Risk, Tokyo. Lacker, Jeffrey, 2010, The regulatory response to the financial crisis: An early assessment, Talk presented at the Institute for International Economic Policy and the International Monetary Fund Institute, Washington, D.C. Lagos, Ricardo, Guillaume Rocheteau, and Pierre-Olivier Weill, 2011, Crises and liquidity in over-the-counter markets, Journal of Economic Theory 146, 2169-2205. Lancaster, Kelvin J., 1966a, Change and innovation in the technology of consumption, American Economic Review, Papers and Proceedings, 56, 14-23. Lancaster, Kelvin J., 1966b, A new approach to consumer theory, Journal of Political Economy 74, 132-157. Langlois, Richard N., 2001, Knowledge, consumption, and endogenous growth, Journal of Evolutionary Economics 11, 77-93. Lauermann, Stephan and Asher Wolinsky, 2011, Search with adverse selection, Unpublished paper, University of Michigan and Northwestern University. Layard, P. R. G. and A. A. Walters, Microeconomic Theory (McGraw-Hill Book Company, New York, NY). Le Vine, Barry, 2011, The derivatives market’s black sleep: Regulation of non-cleared securitybased swaps under Dodd-Frank, Northwestern Journal of International Law & Business 31, 699-737. Leitner, Yaron, 2012, Inducing agents to report hidden trades: A theory of an intermediary, Review of Finance 16, 1013-1042. Lerner, Josh, 2006. The new new financial thing: Origins of financial innovations, Journal of Financial Economics 79, 223-255. Lerner, Josh and Peter Tufano, 2011, The consequences of financial innovation: A counterfactual research agenda, Annual Review of Financial Economics 3, 41-85. Levine, Ross, Norman Loayza, and Thorsten Beck, 2000, Financial intermediation and growth: Causality and causes, Journal of Monetary Economics 46, 31-77. Levine, Ross, 2004, Finance and growth: Theory and evidence, National Bureau of Economic Research Working Paper 10766. Levitin, Adam J., 2013, Response: The tenuous case for derivatives clearinghouses, The Georgetown Law Journal 101, 445-466. Li, Dan and Norman Schürhoff, 2012, Dealer networks: Market quality in over-the-counter markets, Unpublished paper, Board of Governors of the Federal Reserve and Université de Lausanne. Lin, Li and Jay Surti, 2013, Capital requirements for over-the-counter derivatives central counterparties, International Monetary Fund Working Paper No. 13/3. Macey, Jonathan R. and Maureen O’Hara, 1999, Regulating exchanges and alternative trading systems: A law and economics perspective, Journal of Legal Studies 28, 17-54. Madhavan, Ananth, 1996, Security prices and market transparency, Journal of Financial Intermediation 5, 255–283. Mailath, George J. and Alvaro Sandroni, 2003, Market selection and asymmetric information, Review of Economic Studies 70, 343-368. Malamud, Semyon and Marzena Rostek, 2014, Decentralized exchange, Unpublished paper, Swiss Finance Institute. Malerba, Franco, Richard Nelson, Luigi Orsenigo, and Sidney Winter, 2007, Demand, innovation, and the dynamics of market structure: The role of experimental users and diverse preferences, Journal of Evolutionary Economics 17, 371-399. Manasfi, J. A. D., 2013, Systemic risk and Dodd-Frank’s Volcker Rule, William & Mary Business Law Review 4, 180-212. Markose, Sheri, Simone Giansante, and Ali Rais Shaghaghi, 2012, ‘Too interconnected to fail’ financial network of US CDS market: Topological fragility and systemic risk, Journal of Economic Behavior & Organization 83, 627-646. Mas-Colell, Andreu, Michael D. Whinston, and Jerry R. Green, 1995, Microeconomic Theory (Oxford University Press, New York, NY). McBride, Paul M., 2010, The Dodd-Frank Act and OTC derivatives: The impact of mandatory central clearing on the global OTC derivatives market, The International Lawyer 44, 10771122. McConnell, John J. and Eduardo S. Schwartz, 1992, The origin of LYONS: A case study in financial innovation, Journal of Applied Corporate Finance 4, 40-47. McGraw, Thomas K., 2007, Profit of Innovation: Joseph Schumpeter and Creative Destruction (The Belknap Press of Harvard University Press, Cambridge, MA). Merriam-Webster, 1993, Webster’s Third New International Dictionary (Merriam-Webster, Inc. Publishers, Springfield, MA). Merton, Robert C., 1992, Financial innovation and economic performance, Journal of Applied Corporate Finance 4, 12-22. Michalopoulos, Stelios, Luc Laeven, and Ross Levine, 2009, Financial innovation and endogenous growth, National Bureau of Economic Research Working Paper Series No. 15356. Miller, Merton H., 1986, Financial innovation: The last twenty years and the next, Journal of Financial and Quantitative Analysis 21, 459-471. Milne, Alistair, 2012, OTC central counterparty clearing: Myths and reality, Journal of Risk Management in Financial Institutions 5, 335-346. Moreno, Diego and John Wooders, 2010, Decentralized trade mitigates the lemons problem, International Economic Review 51, 383-399. Murawski, Carsten, 2002, The impact of clearing on the credit risk of a derivatives portfolio, Unpublished paper, University of Zurich. Murphy, David, 2012, The systemic risks of OTC derivatives central clearing, Journal of Risk Management in Financial Institutions 5, 319-334. Nahai-Williamson, Paul, Tomohiro Ota, Mathieu Vital, and Anne Wetherilt, 2013, Central counterparties and their financial resources - a numerical approach, Bank of England Financial Stability Paper No. 19. Nelson, Richard R. and Sidney Winter, 1982, An Evolutionary Theory of Economic Change (The Belknap Press of Harvard University Press, Cambridge, MA). Nosal, Ed, 2011, Clearing over-the-counter derivatives, Federal Reserve Bank of Chicago Economic Perspectives 4Q, 137-146. Nystedt, Jens, 2004, Derivative market competition: OTC markets versus organized derivative exchanges, IMF Working Paper WP/04/61. Pesendorfer, Wolfgang, 1995, Financial innovation in a general equilibrium model, Journal of Economic Theory 65, 79-116. Pigou, Arthur C., 1946, The Economics of Welfare, 8th ed. (Macmillan, London, England). Pirrong, Craig, 2009, The economics of clearing in derivatives markets: Netting, asymmetric information, and the sharing of default risks through a central counterparty, Unpublished paper, University of Houston. Pirrong, Craig, 2011, The Economics of Central Clearing: Theory and Practice, International Swaps and Derivatives Association Discussion Paper 1. Pirrong, Craig, 2012, Clearing and collateral mandates: A new liquidity trap?, Journal of Applied Corporate Finance 24, 67-73. Png, Ivan, 2012, Managerial Economics, 4th ed. (Routledge, New York, NY). Rajan, Raghuram G. and Louis Zingales, 1995, What do we know about capital structure? Some evidence from international data, Journal of Finance 50, 1421-1460. Rajan, Raghuram G. and Louis Zingales, 1998, Financial dependence and growth, American Economic Review 88, 559-586. Reinhart, Carmen M. and Kenneth S. Rogoff, 2009, This Time Is Different – Eight Centuries of Financial Folly (Princeton University Press, Princeton and Oxford). Rodriguez-Moreno, Maria and Juan Ignacio Peña, 2012, Systemic risk measures: The simpler the better? Available at SSRN: http://dx.doi.org/10.2139/ssrn.1681087. Romer, Paul M., 1990, Endogenous technological change, Journal of Political Economy 98, S71102. Schinasi, Garry J., R. Sean Craig, Burkhard Drees, and Charles Kramer, 2000, Modern Banking and OTC Derivatives Markets (IMF, Washington, D.C.). Schroth, Enrique, 2003, Innovation, differentiation, and the choice of an underwriter: Evidence from equity-linked securities, Review of Financial Studies 19, 1041-1080. Schultz, Paul, 2012a, The market for new issues of municipal bonds: The roles of transparency and limited access to retail investors, Journal of Financial Economics 106, 492-512. Schultz, Paul, 2012b, Municipal Bonds: One Market or Fifty?, Unpublished paper, University of Notre Dame. Schumpeter, Joseph A., 1939, Business Cycles: A Theoretical, Historical and Statistical Analysis of the Capitalist Process, Vol. I (McGraw-Hill Book Company, New York, NY). Seligman, Joel, 1983, The historical need for a mandatory corporate disclosure system, Journal of Corporation Law 9, 1-61. Shiller, Robert J., 2012, Finance and the Good Society (Princeton University Press, Princeton, NJ). Shin, Hyun Song, 2010, Financial intermediation and the post-crisis financial system, Bank for International Settlements Working Papers No. 304. Silber, William L., 1975, Towards a theory of financial innovation in William L. Silber: Financial Innovation (D. C. Heath & Co., Lexington, MA). Silber, William L., 1983, The process of financial innovation, The American Economic Review, 73, 89-95. Sill, Keith, 1997, The economic benefits and risks of derivatives securities, Federal Reserve Bank of Philadelphia Business Review, 15-26. Singh, Manmohan, 2010, Collateral, netting and systemic risk in the OTC derivatives market, International Monetary Fund Working Papers No. 10/99. Singh, Manmohan, 2011, Making OTC derivatives safe: A fresh look, International Monetary Fund Working Papers No. 11/66. Singh, Manhoman, 2013, OTC derivatives market – regulatory developments and collateral dynamics, Banque de France Financial Stability Review 17, 207-213. Slive, Joshua, Jonathan Witmer, and Elizabeth Woodman, 2012, Liquidity and central clearing: Evidence from the CDS market, Bank of Canada Working Paper 2012-38. Solow, Robert M., 1957, Technical change and the aggregate production function, Review of Economics and Statistics 39, 312-320. Stephens, Eric and James Thompson, 2011, CDS as insurance: Leaky lifeboats in stormy seas, Unpublished paper, University of Alberta and University of Waterloo. Stulz, Rene M., 2003, Risk Management and Derivatives (Thomson, Mason, Ohio). Stulz, Rene M., 2004, Should we fear derivatives?, Journal of Economic Perspectives 18, 173192. Switzer, Lorne N. and Haibo Fan, 2008, Interactions between exchange-traded derivatives and OTC derivatives: Evidence for the Canadian dollar futures vs. OTC markets, International Journal of Business 13, 25-42. Thompson, James, 2010, Counterparty risk in financial contracts: Should the insured worry about the insurer?, Quarterly Journal of Economics 125, 1195-1252. Tirole, Jean, 2010, Illiquidity and all its friends, Bank for International Settlements Working Papers No. 303. Trajtenberg, Manuel, 1989, The welfare analysis of product innovations, with an application to computed tomography scanners, Journal of Political Economy 97, 444-479. Tuckman, Bruce, 2011, Update: The clearing mandate in Dodd-Frank, systemic risk, and competition. Center for Financial Stability, New York, NY. Tufano, Peter, 1989. Financial innovation and first-mover advantage, Journal of Financial Economics 25, 213-240. Tufano, Peter, 2003, Financial innovation, in G. M. Constantinides, M. Harris, and R. M. Stulz, eds.: The Handbook of the Economics of Finance, Vol. 3, Part A (North-Holland, Amsterdam, the Netherlands). U.S. Government Printing Office, 1999, Gramm-Leach-Bliley Financial Services Modernization Act, PL 102-106 (Washington, D.C.). Available at http://www.gpo.gov/fdsys/pkg/PLAW106publ102/pdf/PLAW-106publ102.pdf. U.S. Government Printing Office, 2002, Sarbanes-Oxley Public Company Accounting Reform and Investor Protection Act, PL 107-204 (Washington, D.C.). Available at http://www.gpo.gov/fdsys/pkg/PLAW-107publ204/pdf/PLAW-107publ204.pdf U.S. Office of the Comptroller of the Currency, Quarterly report on bank trading and derivatives activities, first quarter 2011 (Washington, D.C.). Available at http://www.occ.gov/topics/capital-markets/financial-markets/trading/derivatives/dq111.pdf. U.S. Securities and Exchange Commission, Securities Exchange Act of 1934. Available at http://www.sec.gov/about/laws/sea34.pdf. U.S. Securities and Exchange Commission, Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Public Law 111-203, H.R. 4173. Available at http://www.sec.gov/about/laws/wallstreetreform-cpa.pdf Valente, Marco, 2003, Consumer preferences and technological innovation in the evolution of markets, Unpublished paper, Universita dell’Aquila. Van Horn, James C., 1985, Of financial innovations and excesses, Journal of Finance 40, 621631. Varian, Hal R., 2010, Intermediate Microeconomics, 8th ed. (Norton, New York, NY). Von Hippel, Eric, 1988, The Sources of Innovation (Oxford University Press, New York, NY). Von Neumann, J. and O. Morgenstern (1944), Theory of Games and Economic Behavior. Princeton, N.J.: Princeton University Press. Windrum, Paul, Tommaso Ciarli, and Chris Birchenhall, 2009, Consumer heterogeneity and the development of environmentally friendly technologies, Technological Forecasting & Social Change 76, 533-551. Yan, Hongjun, 2008, Natural selection in financial markets: Does it work?, Management Science 54, 1935-1950. Yin, Xiangkang, 2005, A comparison of centralized and fragmented markets with costly search, Journal of Finance 60, 1567–1590. Zhang, Ivy Xiying, 2007, Economic consequences of the Sarbanes-Oxley Act of 2002, Journal of Accounting and Economics 44, 74-115. Zhu, Haoxiang, 2012, Finding a good price in opaque over-the-counter markets, Review of Financial Studies 25, 1255-1285.