Procedural due process challenges to punitive damages Haslip

advertisement

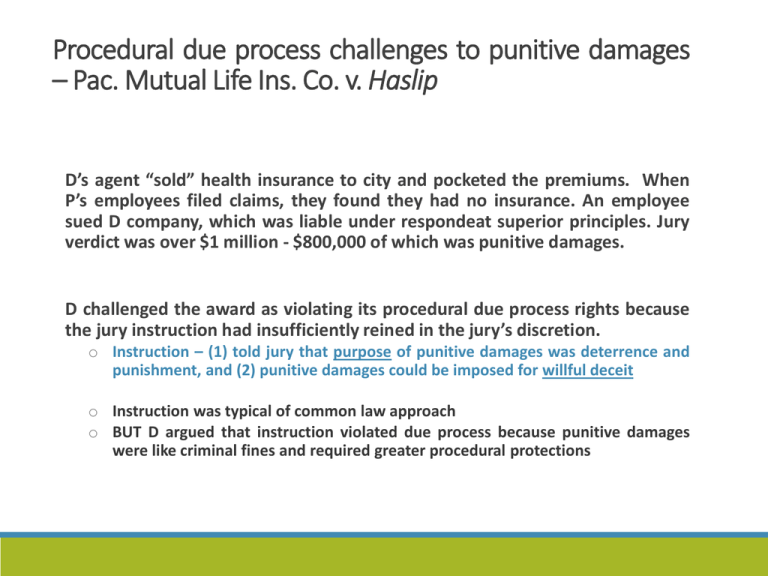

Procedural due process challenges to punitive damages – Pac. Mutual Life Ins. Co. v. Haslip D’s agent “sold” health insurance to city and pocketed the premiums. When P’s employees filed claims, they found they had no insurance. An employee sued D company, which was liable under respondeat superior principles. Jury verdict was over $1 million - $800,000 of which was punitive damages. D challenged the award as violating its procedural due process rights because the jury instruction had insufficiently reined in the jury’s discretion. o Instruction – (1) told jury that purpose of punitive damages was deterrence and punishment, and (2) punitive damages could be imposed for willful deceit o Instruction was typical of common law approach o BUT D argued that instruction violated due process because punitive damages were like criminal fines and required greater procedural protections Procedural due process & Haslip oHaslip Court held punitive damages award did not violate procedural due process o Jury instruction regarding “purpose” of punitive damages adequately guided jury (also had an intent standard in the instruction) o Post-trial appellate review of jury verdict based on 7-factor test provided sufficient procedural protection o App. Ct. looked at: reprehensibility of D’s conduct, D’s wealth, relationship of PD to P’s harm, litigation costs, profitability of D’s action, and criminal penalties/civil awards for same conduct oWhat if a state has stringent pre-trial guidance in jury instructions (i.e., factors such as the above) but no post-trial review of an award? o Honda Motor Co v. Oberg (1994) – Some form of post-trial review is a necessary aspect of procedural due process o It’s not clear, however, that post-trial review must take the form of a multifactor test in Haslip. The review in Haslip was good enough but it may not be required. Substantive due process – the early years oTXO (1993) recognized that even when adequate procedural safeguards exist, an award can be grossly excessive so that it violates substantive due process. o TXO upheld punitive damages award claiming there was no bright line rule to determine excessiveness. D’s knowing/false assertion that P was not the true title holder of oil/gas rights could potentially cause enormous harm so 500:1 ratio of punitives to compensatories was not unreasonable. oBMW v. Gore (1996) – 3 guideposts in determining whether punitive damages pass substantive due process scrutiny o Reprehensibility of D’s conduct o The ratio between punitive damages and the likely/actual harm from from D’s conduct o Other civil/criminal penalties that could be imposed for D’s conduct o SCT struck down award of $2 million in punitives – they were grossly excessive in light of amount of (not-all-that-reprehensible) in-state conduct. State Farm v. Campbell (2003) – refining BMW Campbell caused two serious accidents. State Farm investigators found he was the cause but, when defending lawsuit, refused offers to settle for the policy limits. Lawsuit against Campbell resulted in $186K verdict (above the policy limits), which SF refused to pay. Campbell sued SF for bad faith refusal to settle, fraud & IIED. Evidence showed SF had national policies re meeting financial goals that involved refusing to pay claims and squeezing unsophisticated insureds, etc. Campbell was awarded $2.6 million compensatories (remitted to $1 million) and $145 million punitives (remitted to $25 million). SCT of Utah reinstated $145 million punitive damages award after relying on the Gore guideposts o SFs actions were very reprehensible, SF had massive wealth and secret actions would only rarely be discovered and punished, SF could be punished $10K in fines for each fraud, and its officers could be imprisoned so the acts were treated as significant violations in other areas of law State Farm – refining Gore’s guideposts State Farm majority held that the 1st Gore guidepost (D’s reprehensibility) was the most important indicium of whether punitive damages are reasonable. o What are indicia of reprehensibility? o How does the Court believe State Farm fared under these indicia? Do you agree? o What role does the out-of-state conduct or dissimilar conduct play in the Court’s decision that punitive damages are excessive? State Farm & Gore guideposts 2 & 3 oRegarding Gore’s 2nd guidepost – what presumption regarding the ratio between punitive and compensatory damages does the Court establish? o When is this Court likely to see deviation from single digit multipliers as acceptable? o Is D’s wealth a legitimate consideration? oWhat is the relevance of the 3rd guidepost – other fines/penalties? Philip Morris & Co. v. Williams (2007) P’s husband died of lung cancer after smoking. P sued D for fraud claiming D had known for 40 years that cigarettes caused cancer but concealed information from the public and/or lied about it (decedent relied on those lies to continue smoking). Jury awarded $525,000 in compensatories (after remittance) and $79.5 million in punitives. Oregon SCT upheld award after applying Gore’s guideposts. D challenged the lower court’s jury instructions. P’s attorney told jury to “think about how many other Jesse Williams in the last 40 years in the State of Oregon there have been….” o Jury instruction: “Punitive damages are awarded against a D to punish misconduct and to deter misconduct” and “are not intended to compensate P or anyone else for damages caused by the D’s conduct.” o State court rejected D’s request for a different instruction telling jury they could consider harm suffered by others in determining relationship of D’s conduct to P’s harm BUT that it could not punish D for the impact of its alleged misconduct on other persons who may bring lawsuits of their own Philip Morris Co v. Williams – Supreme Court oWhy does the SCT reverse the award – i.e., what does the jury instruction allow the jury to do? oIs this a procedural due process (lack of adequate safeguards) problem or a substantive due process (direct review of excessiveness) problem? oAfter Williams, can juries still take into account the harm D has caused to other people D in determining the reprehensibility of D’s conduct (Gore guidepost #1)? oWhat must lower courts do to ensure that juries seek “simply to determine reprehensibility” but not “punish for harm caused strangers?” http://www.courts.mo.gov/file.jsp?id=7659 Punitive Damages For Breach of Contract General Rule: No punitive damages for breach of contract unless there is an independent tort in the contract setting that can be the basis of the punitive damages award. WHY is there this general hostility to punitive damages in breach of contract? ◦ Tradition – the forms of action (contract/tort) are separate ◦ Hostility to punitive damages generally – courts don’t want to extend beyond torts and “open the floodgates” of litigation ◦ Deterrent effect on parties entering contracts could be too significant (similar to reasons courts allow limitations on consequential damages) Independent Torts (Possibly) Supporting Punitive Damages In Breach of Contract Situations Fraud ◦ Examples – Formosa, Haslip, State Farm, Gore Conversion (theft) ◦ Haslip (alternative theory) Bad-Faith Breach (insurance contracts only?) ◦ State Farm – excellent example Tortious Interference with contract/business relations ◦ Courts usually require that D’s breach of contract have the purpose of interfering w/ P’s other relationships – NOT enough that D knew could hurt other relationships Gross Negligence (?) ◦ Usually not a basis for punitives in breach of contract UNLESS there is physical harm to person or property in addition to economic harm ordinarily occurring from breach of the contract ◦ Ordinary negligence is not the basis for punitives (contract or not) Formosa Plastics v. Presidio Engineers Formosa invited Presidio to bid on a construction project for concrete foundations. Sent a bid package w/ representations re parties’ obligations on (1) ordering & delivery of material, (2) work schedule, (3) beginning/end dates. ◦ Presidio relied on these representations to enter a bid, which was accepted. ◦ Job was substantially delayed, ended up costing far more than estimated. ◦ Presidio discovered that Formosa intentionally lied about the bid package & ran a scheme to induce contractors to make low bids & then stay in the game even after Formosa breached its obligations ◦ Jury found fraud/awarded punitive damages. Texas SCT upheld despite Formosa’s argument that this was merely breach of K. Fraud was an independent tort. Don’t most of Presidio’s damages come from breach of contract? What is it about fraudulent inducement that makes us so willing to award punitives? What if D intentionally began scheduling deliveries or multiple workmen after the project began? Is that fraud or just intentional breach – most likely the latter? Timing seems to matter a lot re these sorts of claims for punitive damages – Why?