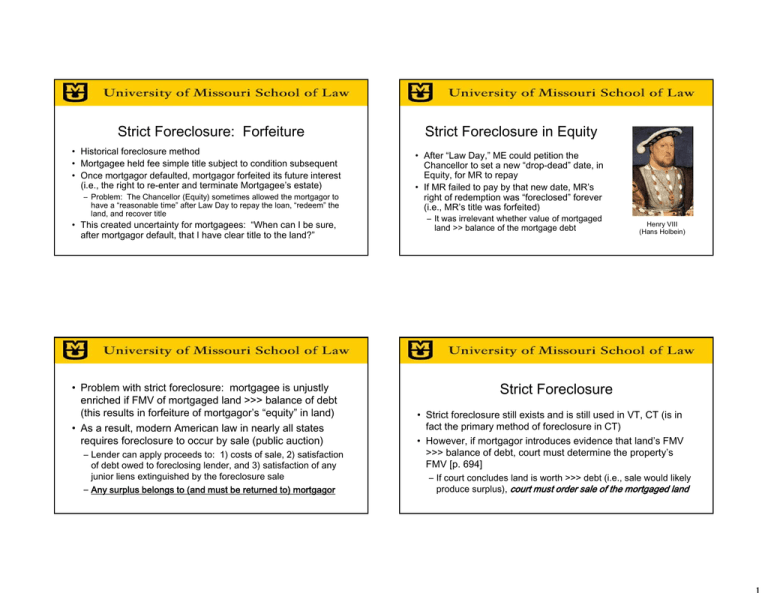

Strict Foreclosure: Forfeiture Strict Foreclosure in Equity

advertisement

Strict Foreclosure: Forfeiture • Historical foreclosure method • Mortgagee held fee simple title subject to condition subsequent • Once mortgagor defaulted, mortgagor forfeited its future interest (i.e., the right to re-enter and terminate Mortgagee’s estate) – Problem: The Chancellor (Equity) sometimes allowed the mortgagor to have a “reasonable time” after Law Day to repay the loan, “redeem” the land, and recover title • This created uncertainty for mortgagees: “When can I be sure, after mortgagor default, that I have clear title to the land?” • Problem with strict foreclosure: mortgagee is unjustly enriched if FMV of mortgaged land >>> balance of debt (this results in forfeiture of mortgagor’s “equity” in land) • As a result, modern American law in nearly all states requires foreclosure to occur by sale (public auction) – Lender can apply proceeds to: 1) costs of sale, 2) satisfaction of debt owed to foreclosing lender, and 3) satisfaction of any junior liens extinguished by the foreclosure sale – Any surplus belongs to (and must be returned to) mortgagor Strict Foreclosure in Equity • After “Law Day,” ME could petition the Chancellor to set a new “drop-dead” date, in Equity, for MR to repay • If MR failed to pay by that new date, MR’s right of redemption was “foreclosed” forever (i.e., MR’s title was forfeited) – It was irrelevant whether value of mortgaged land >> balance of the mortgage debt Henry VIII (Hans Holbein) Strict Foreclosure • Strict foreclosure still exists and is still used in VT, CT (is in fact the primary method of foreclosure in CT) • However, if mortgagor introduces evidence that land’s FMV >>> balance of debt, court must determine the property’s FMV [p. 694] – If court concludes land is worth >>> debt (i.e., sale would likely produce surplus), court must order sale of the mortgaged land Judicial Foreclosure Modern Foreclosure Choices • Judicial foreclosure (permitted in all states) – Required (only method) in: AR, CT, DE, FL, IL, IN, IA, KS, KY, LA, NY, NJ, ND, OH, PA, SC, VT (homes), WI • “Power of sale” foreclosure (permitted in 30 states) – Only if state statute allows, and only if mortgage/deed of trust contains a “power of sale” – Mortgage: sale conducted by mortgagee – Deed of trust: sale conducted by named trustee, on behalf of lender/beneficiary • Judicial foreclosure sale is typically a sheriff’s sale – Public auction, minimal advertising (typically legal notice published in local newspaper classified ads) – Typical terms: Cash sale, “as is” (though the foreclosing creditor may “credit bid” against the judgment amount) – Land goes to high bidder, after the court “confirms” the sale • Until sale occurs, MR can redeem its title by paying off the full balance of debt – If applicable, MR can prevent the sale by curing default and reinstating the mortgage (if state law or loan documents permit) • After default, mortgagee brings a judicial action to foreclose mortgage debt. Issues: – Is the debt valid? – Is Mortgagor in default? – What is the unpaid balance due? – Does mortgagee have the right to foreclose (e.g., is the mortgagee the person entitled to enforce the debt, and has the debt been properly accelerated)? • After court enters judgment (often a default), court orders execution sale (sheriff’s sale) Effect of a Foreclosure Sale • At a foreclosure sale, the buyer gets title as it existed on the day that the foreclosing creditor acquired its lien. The sale: – Extinguishes the lien of the foreclosing creditor – Extinguishes any subordinate (junior) liens or interests – Transfers the mortgagor’s interest to the high bidder, free of the extinguished liens – The extinguished liens against the land are transferred to the proceeds of the sale (in the same order of priority) • Mortgagor owns land subject to – First priority mortgage held by Bank One (debt = $100,000) – Second priority mortgage held by Bank Two (debt = $50,000) – Third priority judgment lien held by Creditor (judgment amount = $50,000) • Mortgagor defaults to Bank One, which forecloses (at sale, land is sold to Buyer for $175,000) – Buyer gets title free and clear of all three liens, which attach to sale proceeds in same order of priority • BankTwo can foreclose its junior mortgage lien, but its foreclosure sale will NOT affect the lien of the senior lienholder (BankOne) – Buyer at sale will get title free and clear of BankTwo’s lien, but subject to BankOne’s senior lien • Thus, while BankTwo can join BankOne as a party to its judicial foreclosure action, it does not have to do so – BankOne is a proper party but not a necessary one – Even if BankTwo does join BankOne as a party, BankTwo can’t force BankOne to foreclose its senior lien Judicial Foreclosure: Problem 2 • Wells owns Blueacre, subject to: – A first mortgage held by BankOne (debt = $150,000) – Second mortgage held by BankTwo (debt = $100,000) – A lease in favor of Crouch • Wells defaults to BankTwo • Q: Can BankTwo foreclose as a junior lienor? • Q: If BankTwo brings a judicial foreclosure, does it have to join BankOne as a party to that action? Does it have to join Crouch? • Does Bank Two have to join Crouch (the tenant) as a party to the foreclosure? – Key Questions: Is Crouch’s lease junior to the Bank Two mortgage or senior to it? Does Crouch have a “nondisturbance” agreement with Bank Two? • If Bank Two’s mortgage is senior and it wants to terminate Crouch’s lease, he must be joined as a party “Necessary” Parties: Problem 2 • In a judicial foreclosure, BankTwo MUST join as a party (1) the mortgagor and (2) any other person that holds an interest that can and should be extinguished by the sale. This includes: – Wells (mortgagor) – Any persons holding liens junior to BankTwo – Any persons holding subordinate interests in the land (e.g., tenants like Crouch) that can and should be extinguished by the sale • Thus, BankTwo must conduct a title search prior to foreclosure, to identify all such “necessary” parties • Wells owns Blueacre – First mortgage: BankOne ($150K) – Second mortgage: BankTwo ($100K) • BankTwo brings a judicial foreclosure after default by Wells • At the sale, Trump buys the land for a high bid of $200K • How should the sale proceeds be distributed? Problem 2(b) “Proper” Parties • In Problem #2, Bank One is not a “necessary” party – Bank One has priority over Bank Two; Bank Two’s foreclosure sale will have no effect on Bank One’s lien (buyer at sale will take subject to Bank One’s senior mortgage lien) • Bank One is a “proper” party, however – Bank Two can join Bank One as a party for the purpose of establishing the amount due on Bank One’s mortgage (bidder at sale needs to know this information) • B/c Trump takes title subject to BankOne’s senior mortgage lien, that lien is still valid against the land • Thus, Bank One’s lien does not attach to the sale proceeds • Distribution of proceeds: – First: costs of sale – Second: BankTwo gets the next $100K of sale proceeds (in satisfaction of its debt) – Third: Any subordinate lienholder(s), in order of their priority – Fourth: Wells (mortgagor) • Suppose Trump didn’t know of BankOne’s mortgage, and “overpaid” b/c he thought he’d receive clear title • Would he have a claim against BankTwo for nondisclosure of the senior mortgage? – No; buyer at judicial foreclosure sale takes “as is,” w/out warranty or representation as to quality of title being conveyed – BankOne’s mortgage was recorded, so Trump had constructive notice of it – BankTwo has no duty to disclose any senior lien (bidders are expected to investigate title, like any other potential buyer) • Bank2 makes three arguments: – 1) Our lien was not extinguished by Bank1’s foreclosure sale – 2) Because we weren’t joined as a party, the sale to Trump was entirely invalid/void – 3) We can now pay off the $150K that Wells owed to Bank1, at which point we will have fee simple title to the land • Which arguments (if any) are correct? The Omitted Party: Problem 3 • Wells owns land, subject to: – First mortgage held by Bank1 ($150K) – 2nd mortgage held by Bank2 ($100K) • Wells defaults to Bank1, which forecloses judicially – Wells is named as a party, but Bank2 is not (Bank1 missed Bank2’s lien in its title search) – After judgment, Trump buys the land at the sheriff’s sale for high bid = $150,000 • Bank2’s first argument is correct! – B/c Bank2 was not joined as a party to the judicial foreclosure action, Bank2 isn’t bound by the result (no due process of law) – Thus, the foreclosure sale did not extinguish Bank2’s lien (which remains valid against the property) • Argument 2 is incorrect! – Wells (the mortgagor) was properly joined, so the foreclosure sale is valid against her (res judicata, Wells can’t relitigate) – Wells’s title thus passed to Trump (buyer) – Unfortunately for Trump, he took that title subject to Bank2’s not-yetextinguished mortgage lien! • Trump got Wells’s title (manifested by the “buyer’s hat”), but he took it subject to Bank2’s mortgage (which was not extinguished by the sale, as Bank2 wasn’t a party) • Trump also got Bank1’s rights as senior mortgage lender, by way of subrogation (manifested by the “lender’s hat”) – The sale extinguished Bank1’s mortgage vs. Wells (who was joined), but not vs. Bank2 (which was not joined as a party) – As against Bank2, the Bank1 mortgage lien still exists and still has priority vs. Bank2 (whose mortgage lien was junior) – The defective sale is treated as an assignment by Bank1 of its senior lien position to the buyer, Trump, by way of subrogation The Omitted Party Problem: Trump (Buyer) Now Wears “Two Hats” Problem 3: Trump’s Options Now? • Trump can redeem his title from Bank2’s lien by paying it off in full ($100K) – Trump would then have clear title • Trump could instead choose to “reforeclose” the senior mortgage (this time, joining Bank2 as a party) • Which option should Trump take? Why? Problem 3: Options for BankTwo? • Trump’s decision depends on the FMV of the land • If FMV is => $250,000, Trump will likely just “redeem” (wearing his “buyer” hat) by paying $100,000 to Bank2 to satisfy its lien – This will extinguish Bank2’s lien and clear Trump’s title • If FMV is < $250,000, Trump will re-foreclose the first mortgage (wearing his “lender” hat) – This will put the burden on Bank2 to bid at the sale if Bank2 wants to protect its lien • Note: Trump and Bank2 both have rights of “redemption,” but their respective rights of redemption aren’t the same • Trump has right to redeem the fee title to the land, b/c he purchased it at the first (defective) foreclosure sale • By contrast, Bank2 only has the right to redeem its lien (its interest as the junior lienholder) • If Trump redeems his interest (by paying off Bank2’s lien), then Bank2’s lien is extinguished! • BankTwo can foreclose its junior lien – Buyer at sale would get Trump’s title, but subject to Trump’s rights as first mortgagee (Trump’s “lender hat”) – Buyer would then have to pay off Trump’s senior mortgage lien ($150K) to gain clear title • Bank2 could “redeem” its junior lien by paying Trump the balance due on first mortgage ($150K) – Trump would then hold fee title, but subject to both the $150K senior lien and the $100K junior lien (both of which would then held by Bank2) – To redeem his title, Trump would have to pay off both liens • Therefore, in Problem 3, Bank2’s third argument is incorrect – Bank2’s lien was not extinguished by the sale, so Bank2 can still act to redeem its lien – But, Bank2 would be redeeming its subordinate lien, not the mortgagor’s title – The mortgagor’s title (Wells’s title) actually passed to Trump (buyer) at the foreclosure sale, so only Trump can redeem full title Strict Foreclosure/Omitted Juniors • Some states allow “strict foreclosure” to clean up the mess caused by omission of the junior lienor (e.g., Pessin, p. 709) – Court would order Bank2’s junior lien to be extinguished, unless Bank2 paid off the senior mortgage within the time period set by the court – If Bank2 redeemed its lien within that period, Bank2 wouldn’t get fee title; Bank2 would only get Trump’s right as first mortgagee (by subrogation) – Thus, Trump could still redeem fee title by paying off both liens Judicial Foreclosure: Confirmation • After the sale takes place, the court then must “confirm” the sale – Confirmation of the sale reflects a judicial conclusion that the sale was properly conducted (was procedurally correct) – Following confirmation, sheriff would deliver deed to the property to the buyer