Vendee’s Lien [Note 5, p. 61] Remedies for Nonbreaching Party • Rescission

advertisement

![Vendee’s Lien [Note 5, p. 61] Remedies for Nonbreaching Party • Rescission](http://s2.studylib.net/store/data/013307335_1-70447afcfcc5c1ca6ca3974baf910e2e-768x994.png)

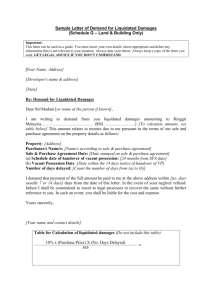

Remedies for Nonbreaching Party • Rescission • Damages (actual damages, or, if contract so provides, liquidated damages) • Specific performance • Vendor’s lien (breach by purchaser) • Vendee’s lien (breach by seller) Vendor’s Lien [Note 6, p. 61] • If Seller delivers title to land but Buyer fails to pay, Seller has a common law vendor’s lien to secure payment of unpaid purchase price – Example: Buyer pays with a check that “bounces” – Land may be sold in judicial sale to satisfy lien • If Buyer resells land to a BFP, BFP would take free of vendor’s lien (again, Seller should seek lis pendens) Vendee’s Lien [Note 5, p. 61] • If the Seller breaches a contract for the purchase of land but does not return earnest money deposited by the Buyer, the Buyer has a common law vendee’s lien on the land to secure repayment of the earnest money – Land can be sold in a judicial sale to satisfy the lien • If Seller resells land to a BFP, BFP would take free of vendee’s lien (Buyer should assert lis pendens to avoid this result) Expectation Damages • Nonbreaching party may recover expectation damages to compensate for party’s “lost bargain” – Measure of damages for the nonbreaching Seller = Contract Price MINUS Fair Market Value of land at time of breach – Measure of damages for the nonbreaching Buyer = Fair Market Value of land at time of breach MINUS Contract Price • Suppose Seller and Buyer have contract (price = $200K) and Buyer breaches. How does Seller establish the amount of its expectation damages? Expectation Damages • To recover expectation damages, nonbreaching Seller must prove that FMV of land was lower than the contract price • FMV is typically determined by appraisal, based on one or more of three measures of value – (1) Replacement cost (i.e., cost of rebuilding) – (2) Income approach (i.e., based on present value of projected future net cash flow) – (3) Comparable sale price approach (i.e., value extrapolated by reference to recent sales of “comparable” properties) Illinois Land Trust • The form of ownership in Schwinder is a special statutory form of ownership in Illinois — the land trust • In a land trust, legal title is held by a trustee – But, the trust beneficiary has full control over the management of the property, and also has the right to possession of the property – The trustee has no real duties (no active management), but just appears as the “record” owner Consequential Damages • Nonbreaching party may also recover consequential or “out of pocket” damages to reimburse that party for foreseeable expenses incurred in relation to the contract – E.g., Buyer breaches but Seller incurs cost of broker’s commission – E.g., Seller breaches but Buyer incurs cost of title investigation Land Trust: Advantages? • Anonymity/privacy – Beneficiary’s name doesn’t appear on public records • Ease of transfer – Beneficiary can transfer ownership w/out delivery of a deed (transfer by assignment of the beneficial interest in the trust) – Traditionally used by seller to avoid real estate transfer tax (but IL statutes have been “fixed” this problem) to preserve transfer tax revenues Centex Homes v. Boag • In 1974, the New Jersey Supreme Court held that a condo developer could not obtain specific performance against a buyer that breached a contract to purchase a condo unit – Court: unit was one of more than 100 identical units in the development; seller could readily establish damages based on contemporaneous sales of other units – Thus, seller’s legal remedy (damages) was adequate Schwinder v. Austin Bank of Chicago [p. 55] • Schwinder contracted to buy condo unit from Baginski – When Baginski refused to close, Schwinder sought specific performance of the contract • Based on the rationale expressed in Centex Homes v. Boag, why not let Baginski breach the contract and pay damages to Schwinder? • Schwinder court holds: condo was sufficiently “unique” to justify an award of specific performance, and Schwinder’s legal remedy (damages) was not adequate [p. 58] • Concern: Schwinder may have difficulty proving expectation damages • Suppose that instead, Schwinder had contracted to buy the condo unit “as is” (no upgrades), and he had not yet taken possession of the unit. Would he still get specific performance? • Concern: Schwinder may have suffered consequential damages that might have been unforeseeable (and thus not recoverable) – Condo unit had been upgraded to Schwinder’s specifications – Schwinder had spent 2 years living in the residence – These factors demonstrated “uniqueness” of unit to Schwinder as the Buyer – If FMV of condo unit has not changed relative to contract price, Schwinder may not have incurred expectation damages at all – Schwinder may value the unit, subjectively, at a price not reflected in the FMV, but this “intrinsic lost bargain” is not recoverable under contract law Specific Performance: Buyer • Nearly all courts hold that when the Seller breaches, the nonbreaching Buyer can obtain specific performance (as long as that is possible and not inequitable) • From buyer’s perspective, any parcel of land is unique (no perfect substitute) – This may even be true for a condo unit (a 7th floor condo may not be a perfect substitute for a 10th floor condo unit, even if they were of identical size/layout) Specific Performance: Seller • Problem 4: Buyer breaches contract because Buyer can’t get a loan • In this circumstance, does it make sense for the Seller to seek specific performance? Why or why not? Specific Performance: Seller • Notwithstanding Centex Homes v. Boag, most courts award specific performance to sellers, too • Rationale: Damages are based on FMV on date of breach, but Seller can’t immediately “cover” (resale takes time) – Seller must establish value by appraisal, which can be highly subjective (e.g., what properties are “comparable”) – Risk of judicial error in appraisal of value is mooted if Seller can get specific enforcement • If Buyer has no other readily accessible assets from which to pay full purchase price, it makes no sense for Seller to seek specific performance – Seller would get judgment vs. Buyer, but would have to tender deed, and then would have to enforce judgment by forcing an execution sale of the land! • By contrast, if Buyer has other readily accessible assets from which it could pay purchase price, Seller might choose specific performance (to avoid uncertainty associated with having the re-sell the land) Donovan v. Bachstadt • Bachstadt breached contract to sell land to Donovan because Bachstadt’s title turned out to be defective • Donovan sued Bachstadt for: – Expectation damages (FMV was >>> $58,900 contract price) – Consequential damages (b/c when Donovan bought another house, Donovan had to borrow at 13.25%, rather than the 10.5% rate Bachstadt had offered as seller financing) • Is Donovan entitled to these damages? • English rule (page 47: Seller should not be liable for expectation damages if Seller, without his own fault, can’t show a good title) seems to be based on the notion that Seller can’t be expected know whether Seller has good title at the time of contracting • But – Seller could obtain title report before Seller accepts an offer, condition its title obligation on any items disclosed in that report, and contractually limit Buyer to rescission Expectation Damages and Title Defects • Under the traditional common law rule (the “English Rule”), if Seller’s breach was due to a title defect, Buyer was limited to rescission and return of deposit • Under the “American Rule,” nature of Seller’s breach doesn’t matter, and Buyer is entitled to expectation damages • Do you think the Donovan case is correct to adopt the American Rule? What are the implications of the American Rule for someone like Bachstadt, looking to sell a home? The American Rule and Title Insurance • Note: If Bachstadt’s title was defective through no fault of his own, and he had purchased an owner’s policy of title insurance when he bought the land, the title insurer would have to indemnify Bachstadt against his liability to Donovan – Title insurance policy typically insures “marketability” of owner’s title, and any loss suffered because owner’s title is determined to be “unmarketable” Donovan v. Bachstadt • Bachstadt breached contract to sell land to Donovan because Bachstadt’s title turned out to be defective • Donovan sued Bachstadt for: – Expectation damages (FMV was >>> $58,900 contract price) – Consequential damages (b/c when Donovan bought another house, Donovan had to borrow at 13.25%, rather than the 10.5% rate Bachstadt had offered as seller financing) • Is Donovan entitled to these damages? Donovan: Holding • Buyers can’t recover – “[A]n interest differential occasioned by seller’s default might be a proper factor ... where the buyer shortly thereafter purchased another property financed at a higher interest rate.” [p. 51] – “This is not such a situation. The defendant’s motive was to sell a house and not to lend money.” [p. 51] • Does this result make good sense? Why isn’t the possibility of Buyer having to borrow at a higher rate foreseeable? • If Bachstadt had performed, Donovan’s monthly mortgage payment ($44,000 loan, 30-year amortization, 10.5% interest rate) would have been $402.49 per month • The monthly payment on Donovan’s 13.25% bank loan for a loan of the same amount was $495.34 per month • Thus, Donovan pays an additional $1,114.20 per year in interest, each year for 30 years • The present value of this amount (discounted at 13.25%) = $8,207.87 • Why shouldn’t the Seller be liable for this harm? • The key to understanding Donovan is that the interest rate differential was not due to post-contract market rate fluctuations, but due to the requirements of New Jersey’s usury statute – State law imposed a 10.5% usury limit on purchase money mortgage note (held by Seller) [p. 46] – This limit did not apply to institutional (bank) financing • Result would likely have been different if Bachstadt’s breach had caused Donovan to lose the benefit of a 10.5% bank loan and Donovan then had to borrow at higher rate Donovan v. Bachstadt • If the court had awarded Donovan both expectation damages (K price minus FMV) and also consequential damages (based on interest rate differential), Donovan probably would have gotten a double recovery (double counting) • Can you explain why? • Drafting implications for consequential damages – If one party expects to incur out-of-pocket costs that would go beyond the “typical” out-of-pocket cost, it should negotiate for recitals in the contract that recite/acknowledge the party has incurred or will incur those costs • E.g., “Seller acknowledges that Buyer has incurred $3,500 in travel expenses in negotiating and finalizing this Contract.” – The recital may prove useful to the nonbreaching party to help establish that the expense in question was foreseeable to the breaching party (and thus recoverable) • Likely, the $58,900 contract price already reflected the interest rate differential that resulted from Seller’s agreement to provide financing – B/c 10.5% seller financing enabled Buyer to acquire land for lower monthly payments than Buyer would have paid if Buyer had gotten institutional loan, Buyer likely agreed to pay a higher price – Giving Buyer consequential damages for the interest rate differential would be “double counting” to the extent that the differential was already reflected in the contract price Liquidated Damages: Orr v. Goodwin • Contract for sale: price = $1,020,000; deposit = $25,000 – Contract provided: “LIQUIDATED DAMAGES: If the Buyer shall default in the performance of their obligation under this agreement, the amount of the deposit may, at the option of the Seller, become the property of the Seller as reasonable.” [p. 63] • After Buyer breached, Seller kept the deposit, but later filed suit for consequential damages that exceeded the $25,000 deposit amount (incl. carrying costs of land, such as taxes) Liquidated Damages and Orr v. Goodwin • Court holds that by retaining the deposit, Seller had opted for liquidated damages in lieu of actual damages • Liquidated damages clause was valid, so deposit was Seller’s only remedy • Is this result appropriate? Court’s Reasoning: Orr v. Goodwin • No “punishment” or “penalty” involved in enforcing clause • $25,000 was a reasonable pre-estimate of possible damages • Sellers had re-listed property for $1 million ($20,000 less than agreed price), suggesting that $25,000 damages are not “grossly disproportionate” to liquidated amount • If Sellers wanted to preserve their right to pursue actual damages, they had to return deposit Liquidated Damages • Restatement (2d) of Contracts § 356: clause liquidating damages is valid if: – (1) parties intended to agree in advance to liquidate damages in case of breach; – (2) at time of contract, liquidated amount is a reasonable preestimate of possible damages – (3) actual damages would be uncertain in amount and difficult to prove Liquidated Damages and Orr v. Goodwin • Court appears to suggest that if the Seller had returned the Buyer’s $25,000 deposit, the Seller could have then sued to recover its actual damages (if greater than $25,000) • Is that appropriate? Can Liquidated Damages Be Optional? United Nations HQ Trump World Tower • Restatement: parties must’ve intended to liquidate damages • If the Seller can waive the deposit and sue for actual damages instead, arguably the Seller didn’t intend to liquidate damages! • Lefemine v. Baron (Fla. 1991): such an optional clause is not valid, but an unenforceable penalty (b/c the only time Seller would enforce it is when it exceeds Seller’s actual loss and would thus exact a penalty for breach) • Contra: Reiter v. Bailey (Wash. 1934); Hoelscher v. Schenewerk (Mo. 1991): option to seek actual damages does not defeat validity of liquidated damages provision Trump World Tower: 86th Floor Penthouse Unit Uzan v. 845 UN Ltd. Pship. Trump World Tower: 86th Floor Penthouse Unit • Uzans signed K to buy 4 condo units, price = $32MM, cash deposit = $8MM • After 9/11, Uzans refused to close • K: on default, Seller “shall have the right to retain, as and for liquidated damages, the Down payment” • Uzans: Seller suffered no actual harm, so retention of deposit = penalty [Stabenau and Alteka, note 3, p. 69] Uzan — Liquidated Damages • Question: At time the parties entered into the contract, was $8MM a reasonable “pre-estimate” of Seller’s potential damages if Buyers breached? • Realistically, could Seller’s damages have been that high? If so, how? Liquidated Damages • Most courts enforce 10% deposit clause as reasonable, even if the Seller did not suffer any actual loss • Potential damages could include: – – – – Short-term market price reductions Re-sale costs (liability for broker commission) Other out-of-pocket costs, incl. attorney fees Carrying costs (e.g., taxes) pending re-sale • What about a 25% deposit? Liquidated Damages • Some states have adopted statutory limits, applicable mostly to residential contracts – E.g., in California, the Seller can keep a 3% deposit as liquidated damages (up to 3% is presumed valid, conclusively) [Cal. Civ. Code § 1675]; however, a deposit greater than 3% is presumptively unreasonable, unless Seller can prove otherwise – E.g., in Washington, 5% deposit is presumed reasonable estimate of liquidate damages, conclusively [Wash. Rev. Code Ann. § 64.04] • Argument: deposit amount can be viewed as Buyer purchasing an “option” to terminate the K – Option contracts are customarily enforced in accordance with their terms (no “reasonableness” analysis of option price) • But, in Uzan, the contract did not characterize the deposit as an “option”; instead, it characterized retention of the deposit as “liquidated damages” • Drafting: if seller wants to negate having contract analyzed using liquidated damages analysis, it should draft deposit as explicit “option agreement” instead and characterize amount as the “option price” • Note, however, that ultimately the Uzan court did not evaluate this deposit clause using liquidated damages analysis – Court: for a real estate contract deposit, Seller does not have to show “the stipulated damages bear a reasonable proportion to the probable loss caused by the breach” [p. 4] – Liquidated damages analysis not necessary for real estate contract deposit • Was this an appropriate decision? Why or why not?