Choice of Law Assignment 17 Maintaining Perfection and Priority

advertisement

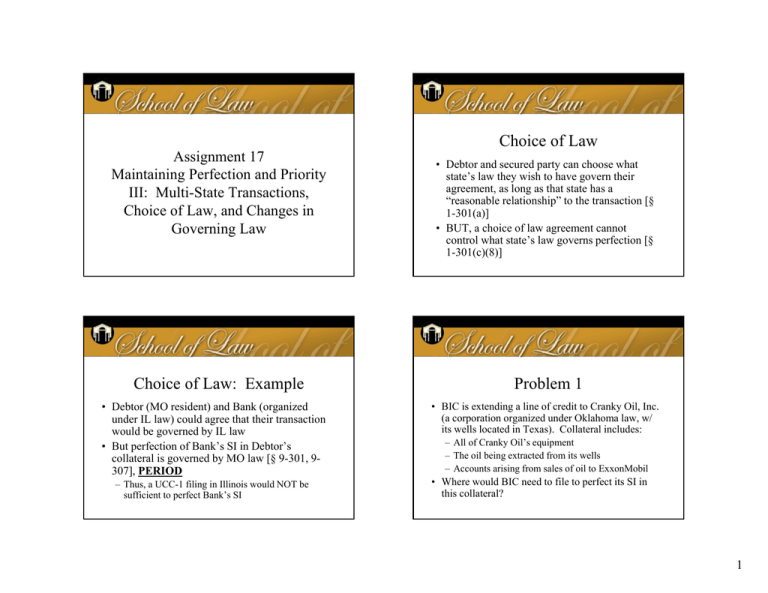

Choice of Law Assignment 17 Maintaining Perfection and Priority III: Multi-State Transactions, Choice of Law, and Changes in Governing Law Choice of Law: Example • Debtor (MO resident) and Bank (organized under IL law) could agree that their transaction would be governed by IL law • But perfection of Bank’s SI in Debtor’s collateral is governed by MO law [§ 9-301, 9307], PERIOD – Thus, a UCC-1 filing in Illinois would NOT be sufficient to perfect Bank’s SI • Debtor and secured party can choose what state’s law they wish to have govern their agreement, as long as that state has a “reasonable relationship” to the transaction [§ 1-301(a)] • BUT, a choice of law agreement cannot control what state’s law governs perfection [§ 1-301(c)(8)] Problem 1 • BIC is extending a line of credit to Cranky Oil, Inc. (a corporation organized under Oklahoma law, w/ its wells located in Texas). Collateral includes: – All of Cranky Oil’s equipment – The oil being extracted from its wells – Accounts arising from sales of oil to ExxonMobil • Where would BIC need to file to perfect its SI in this collateral? 1 • General rule: perfection is governed by law of state where debtor is located [§ 9-301(1)] – Cranky Oil, Inc. located in OK, state of incorporation [§ 9-307(e)], so BIC would file as to equipment and accounts in OK central filing office [§ 9-501(a)(2)] • Exception: perfection as to “as-extracted collateral” (oil) is governed by the law of state where wellhead is located [§ 9-301(4)] – Thus, BIC would file as to oil by filing UCC-1 in TX, in the local county recorder of deeds office [§ 9501(a)(1)] (real estate-related collateral) • General rule: perfection is governed by law of state where debtor is located [§ 9-301(1)] • Exception: perfection as to goods that are “timber to be cut” is governed by law of state where the timber is located [§ 9-301(3)(B)] – Thus, BIC would file as to timber by filing a UCC1 in Oregon and Idaho, in the office of each county recorder of deeds where timber is growing [§ 9501(a)(1)] (real estate-related collateral) Problem 1 • BIC making loan to Cranky Lumber, a partnership of Stan and Bob Cranky, with its main office in Columbia, MO. Collateral includes: – Timber cut and to be cut from Oregon and Idaho timberland on which it holds timber rights, and – Accounts arising from timber sales • Where would BIC need to file to perfect its SI in this collateral? • As to Debtor’s accounts, BIC must file in state where Debtor is located – Debtor here is a general partnership (not a registered organization) – A nonregistered organization is located: • At its place of business, if it has only one • At its chief executive office, if it has more than one [§ 9-307(b)(2), (3)] • Most likely result: Cranky Lumber is located in Missouri 2 Review: Law Controlling Perfection • Titled goods: perfection is governed by law of state under whose certificate of title the goods are presently covered [§ 9-303(c)] • Regular goods: perfection is governed by law of state where debtor is located [§ 9-301(1)] – Debtor location rules in § 9-307 • Ag liens: perfection is governed by law of state where crop is growing [§ 9-302] • Real-estate related collateral (fixtures, standing timber, as-extracted collateral): perfection is governed by law of state where land is located [§ 9301(3)(a), (b), 9-301(4)] Ostensible Ownership and the “Multiple State” Problem • Bank has SI in Debtor’s stamp collection, perfected by a UCC-1 filing in MO (where Debtor lives) • Debtor moves from MO to GA • 3d parties dealing with Debtor in GA are not likely to discover UCC-1 filing in MO • How to solve this problem, w/out having one national filing system? § 9-316. Continued Perfection of Security Interest Following Change in Governing Law (a) [General rule: effect on perfection of change in governing law.] A security interest perfected pursuant to the law of the jurisdiction designated in Section 9-301(1) ... remains perfected until the earlier of: (1) the time perfection would have ceased under the law of that jurisdiction; (2) the expiration of four months after a change of the debtor’s location to another jurisdiction; or (3) the expiration of one year after a transfer of collateral to a person that thereby becomes a debtor and is located in another jurisdiction. § 9-316(b) [Security interest perfected or unperfected under law of new jurisdiction.] If a security interest described in subsection (a) becomes perfected under the law of the other jurisdiction before the earliest time or event described in that subsection, it remains perfected thereafter. If the security interest does not become perfected under the law of the other jurisdiction before the earliest time or event, it becomes unperfected and is deemed never to have been perfected as against a purchaser of the collateral for value. 3 • Perfection of SI is governed by law of state of debtor’s location [§ 9-301(1)] (originally, MO) – Bank was perfected by UCC-1 filed in MO • As soon as Debtor relocated to GA, GA law began to govern perfection of Bank’s SI, immediately • But, Bank’s perfection doesn’t lapse immediately – Bank has 4-month grace period of temporary perfection [§ 9-316(a)(2)] under GA law (b/c it was perfected under MO law) – This gives Bank 4 months to file in GA to maintain continuous perfection of its SI [§ 9-316(b)] § 9-301(1). Except as otherwise provided in this section, while a debtor is located in a jurisdiction, the local law of that jurisdiction governs perfection, the effect of perfection or nonperfection, and the priority of a security interest in collateral. § 9-307(b)(1). A debtor who is an individual is located at the individual’s principal residence. § 9-307(b)(2). A debtor that is an organization and has only one place of business is located at its place of business. § 9-307(b)(3). A debtor that is an organization and has more than one place of business is located at its chief executive office. § 9-307(e). A registered organization that is organized under the law of a State is located in that State. • Dana Green moves her consulting practice, Green Consulting LLC, from St. Louis, MO to Chicago, IL Problem 2 – Bank has a perfected SI in all of the equipment and accounts of Green Consulting LLC (filed in MO) • Does Bank have to file a new UCC-1 in IL to maintain perfection of its SI? • Green Consulting LLC may have relocated its actual business operations, but Green Consulting LLC is a registered organization (LLC) and thus has not actually “relocated” – If Green Consulting LLC remains an LLC organized under MO law, it remains located in MO (and MO law still applies, so no new filing needed!) – If Green had formed a new LLC in IL, that new LLC would be an entirely different legal entity! 4 § 9-316. Continued Perfection of Security Interest Following Change in Governing Law • Bank loaned $200K to Gray; secured by collateral: Problem 3 – Bike (perfected by UCC-1 filing in MO) – Bentley (perfected by notation on COT issued by MO) • July: Gray moved to NY • It’s November; does Bank still have a perfected SI in the bike and the car? • When Gray moved her primary residence to NY in July, NY law immediately began to govern whether Bank’s SI was perfected [§ 9-301(1)] • Bank’s SI was temporarily perfected for 4 months, because Bank’s SI was properly perfected under MO law by UCC-1 filing in MO [§ 9-316(a)(2)] • If Bank filed a new UCC-1 in NY during that 4 month period, Bank’s SI remains continuously perfected thereafter [§ 9-316(b)] • If not, Bank’s perfection lapses [§ 9-316(b)], and Bank’s security interest would no longer be perfected (a) [General rule: effect on perfection of change in governing law.] A security interest perfected pursuant to the law of the jurisdiction designated in Section 9-301(1) ... remains perfected until the earlier of: (1) the time perfection would have ceased under the law of that jurisdiction; (2) the expiration of four months after a change of the debtor’s location to another jurisdiction; or (3) the expiration of one year after a transfer of collateral to a person that thereby becomes a debtor and is located in another jurisdiction. Problem 3: Bank’s SI in Bicycle • If Gray moved on July 1, 4 month period grace period of temporary perfection [§ 9-316(b)] expired on November 1 • If Bank didn’t file in NY by that date, Bank’s perfected status lapsed – By contrast, if Gray moved to NY after July 4, 4 month period has not lapsed yet; Bank remains temporarily perfected (and can obtain continuous perfection by filing in NY) 5 • Suppose you are advising a New York bank • Gray has approached the bank seeking a loan, and offering the bicycle as collateral for the loan • You conduct a search for filings in NY, and it comes up clean (no UCC-1 filings in NY covering bike against the debtor “Gray”) • What do you have to do to account for the effect of § 9-316(a)? – Confirm Gray has lived in NY for >> 4 mos. – If not, you must identify Gray’s previous location, and search for filings in that state § 9-316(b) [Security interest perfected or unperfected under law of new jurisdiction.] If a security interest described in subsection (a) becomes perfected under the law of the other jurisdiction before the earliest time or event described in that subsection, it remains perfected thereafter. If the security interest does not become perfected under the law of the other jurisdiction before the earliest time or event, it becomes unperfected and is deemed never to have been perfected as against a purchaser of the collateral for value. Bank takes SI in Gray’s bike, files UCC-1 in MO Gray moves to NY 6/1 2012 Problem 4: Facts Citi loans Gray $25K, takes SI in bike, files UCC-1 covering bike in NY Creditor levies on bike 7/1 8/1 9/1 2015 2015 2015 As of Nov. 3, what are the respective priorities of PCB, CitiBank, and Creditor in Gray’s bike? 11/1/2015: End of Grace Period § 9-316(b) [Security interest perfected or unperfected under law of new jurisdiction.] If a security interest perfected in the debtor’s old state becomes perfected in the debtor’s new state before the applicable grace period in subsection (a) expires, it remains perfected thereafter. If the security interest does not become perfected in the debtor’s new state before the grace period expires, it becomes unperfected and is deemed never to have been perfected as against a purchaser of the collateral for value. 6 • Citi would have priority over Bank – 11/1/2015: 4 month temporary perfection lapsed, Bank never filed UCC-1 in NY – Bank’s SI deemed never to have been perfected vs. Citi (a purchaser for value) [§ 9-316(b)] • Bank still has priority over Creditor [§ 9317(a)(2)] – When Creditor became lien creditor (9/1/15), Bank’s SI was perfected [§§ 9-316(a)(2)]; no “retroactive loss of perfection” vs. lien creditor [§ 9-316(b)] Problem 4 • If Creditor had not levied on the bike until Nov. 2, Creditor would have had priority over Bank – Nov. 1, 2015: Bank’s perfection lapses when fourmonth period expires, Bank’s SI in bike is prospectively unperfected [§ 9-316(b)] – Creditor would thus obtain his judgment lien before Bank had re-perfected its SI under NY law, and would get priority under § 9-317(a)(2)(A) Problem 3: The Car Problem 3: The Bentley • Bank loaned $200K to Gray, secured by Gray’s Bentley • Perfection of SI in titled vehicle is governed by the state whose certificate of title covers the vehicle; in this case, that’s MO [§ 9-303(b), (c)] • Even if Gray moves to NY, MO law continues to govern perfection, until the Bentley becomes “covered” by a title certificate issued by another state – SI perfected by notation on COT (issued by MO) • July 1: Gray moved to NY • It’s November 3; is Bank’s SI in Bentley still perfected? – If Bentley has not become “covered” by another state’s certificate of title, MO law still governs, and Bank’s SI thus remains perfected! 7 Titled Vehicles • If proper application is made in New York for a title certificate covering the Bentley, then: – MO law immediately ceases to govern perfection of Bank’s SI in the Bentley [§ 9-303(b)] – NY title certificate immediately covers the Bentley [§ 9-303(b)] – NY law immediately begins to govern whether Bank’s SI in the Bentley is perfected [§ 9-303(c)] • First Bank took PMSI in Trucker’s truck – Perfected by notation on COT, issued by MO • Trucker moved to Alaska, got a “clean” COT from Alaska • Trucker then got a loan from Bank of Fairbanks, which took a SI in the truck and noted it on the Alaska title certificate • Priority: First Bank vs. Bank of Fairbanks? Problem 5 Titled Vehicles • Absent fraud, Gray should not be able to get NY to issue a new certificate of title, unless Gray surrenders the existing MO title certificate – Most state titling agencies require surrender of old title certificate before issuing a new one – B/c Bank has old certificate, Gray couldn’t get new NY title w/out Bank’s cooperation (unless by fraud) – Bank could apply for new NY title for the Bentley (to be issued with Bank’s lien noted on it), and thereby maintain continuous perfection under NY law Problem 5 • Once the truck becomes covered by the Alaska certificate of title, then: – MO certificate of title ceases to cover the truck [§ 9303(b)] – AK law begins to control perfection of First Bank’s SI in the truck [§ 9-303(c)] – First Bank’s SI is not noted on the AK certificate of title, but, First Bank’s SI in the truck remains temporarily perfected anyway [§ 9-316(d)] 8 § 9-316. Continued Perfection of Security Interest Following Change in Governing Law § 9-316. Continued Perfection of Security Interest Following Change in Governing Law (d) [Goods covered by certificate of title from this state.] Except as otherwise provided in subsection (e), a security interest in goods covered by a certificate of title which is perfected by any method under the law of another jurisdiction when the goods become covered by a certificate of title from this State remains perfected until the security interest would have become unperfected under the law of the other jurisdiction had the goods not become so covered. (d) [Goods covered by certificate of title from this state.] Except as otherwise provided in subsection (e), a security interest in goods covered by a certificate of title which was perfected on the old State’s title certificate at the time the new State issued its title certificate remains perfected until perfection would have lapsed under the law of the old State if the new State had not issued a title certificate. Rationale: First Bank should not lose its perfected status just b/c Trucker wrongly obtained a new certificate of title from another state (Alaska). Rationale: First Bank should not lose its perfected status just b/c Trucker wrongly obtained a new certificate of title from another state (Alaska). § 9-316. Continued Perfection of Security Interest Following Change in Governing Law (e) [When subsection (d) security interest becomes unperfected against purchasers.] A security interest described in subsection (d) becomes unperfected as against a purchaser of the goods for value and is deemed never to have been perfected as against a purchaser of the goods for value unless [the secured party re-perfects in this state] before the earlier of: (1) the time the security interest would have become unperfected under the law of the other jurisdiction had the goods not become covered by a certificate of title from this State; or (2) the expiration of four months after the goods had become so covered. First Bank takes SI in Trucker’s truck, notes lien on MO title certificate Bank of Fairbanks loans Trucker $5K, takes SI in truck, has it noted on AK title certificate Trucker moves to AK Trucker gets clean AK title 1/1 6/1 7/1 2011 2015 2015 7/2 2015 Problem 5 Trucker in 4 months AK 4 months since new AK title issued 10/1 2015 11/1 2015 9 • Until Nov. 1, First Bank had priority over Bank of Fairbanks (prior SI remained temporarily perfected) – To remain continuously perfected, First Bank had to perfect under AK law before Nov. 1 – When it didn’t, First Bank’s perfection lapsed on Nov. 1 and First Bank’s SI is deemed never to have been perfected vs. Bank of Fairbanks (which would then take priority) [§ 9-316(e)] • How could First Bank have perfected under AK law prior to November 1? • How can First Bank protect against this risk? • How can First Bank monitor? State title systems index vehicles by VIN (vehicle ID number), which is unique to each vehicle – First Bank could search each state’s certificate of title system, periodically, to see if a certificate has been issued vs. the vehicle’s VIN – First Bank could check NMVTIS (federal database) – (more likely) First Bank could retain a VIN monitoring service to alert it if another state issues a new certificate covering vehicle with same VIN Perfection as to Vehicle in New State • First Bank can maintain continuous perfection of its SI in the truck in one of two ways – It can somehow have its lien noted on the AK title certificate for the truck (but not possible if First Bank doesn’t have the title certificate!) – It can take possession of the truck [§ 9-313(b)] • This is the ONLY situation where a secured party can perfect a SI in a titled vehicle by possession Titled Vehicles and Change in Governing Law • If State B issues a title certificate for a vehicle previously covered by State A, perfection of any SI in that vehicle becomes governed by State B law [§ 9-303(b), (c)] – Usually, issuance of new certificate in State B would require surrender of State A certificate 10 • If State B issues “clean” certificate as a result of fraud, what effect does that have on a SI that had been perfected by a notation of the SI on prior certificate issued by State A? – At first blush, Article 9 creates a similar rule as for change of governing law for regular goods – Secured party that had perfected on State A certificate remains temporarily perfected after State B issues certificate [§ 9-316(d)] – Temporary perfection lapses if secured party does not reperfect in State B w/in 4 mos. [§ 9-316(e)] § 9-337. [Priority of Security Interests in Goods Covered by Certificate of Title.] If, while a security interest in goods is perfected by any method under the law of another jurisdiction, this State issues a certificate of title that does not show that the goods are subject to the security interest or contain a statement that they may be subject to security interests not shown on the certificate: (1) a buyer of the goods, other than a person in the business of selling goods of that kind, takes free of the security interest if the buyer gives value and receives delivery of the goods after issuance of the certificate and without knowledge of the security interest; and (2) the security interest is subordinate to a conflicting security interest in the goods that attaches, and is perfected under § 9311(b), after issuance of the certificate and without the conflicting secured party’s knowledge of the security interest. • In Problem 5, § 9-316(d), (e) would appear to give First Bank 4 mos. to reperfect, but they may not even have that! • Suppose after Trucker gets clean AK ertificate, he sells the truck one week later § 9-337 – Hypo 1: He sells it to his neighbor Stan for $75,000 – Hypo 2: He sells it to Ted’s Used Trucks for $75,000 • Would Stan take free of First Bank’s SI? Would Ted’s? § 9-337 • First Bank’s SI remains temporarily perfected under § 9-316(d) • But, Stan gave value and took delivery after AK issued “clean” title certificate, and w/out knowledge of First Bank’s SI • Thus, Stan takes free of that SI [§ 9-337(1)] • Note: Ted’s Used Trucks (a dealer in cars), would not be entitled to protection of § 9-337(1) • Would Ted’s Used Trucks ever be protected? 11 • At first, Ted’s Used Trucks would take the car subject to First Bank’s SI [§ 9-337(1)] • But, if First Bank does not take steps to “reperfect” its SI in the vehicle w/in 4-month grace period after AK issues the new certificate, First Bank’s perfection will lapse [§ 9-316(e)] • Upon lapse, First Bank would be deemed never to have been perfected vs. Ted’s Used Trucks [§ 9316(e)] – At that point, Ted’s would then hold the vehicle free of First Bank’s SI Problem 6 • BIC previously extended a $5 million line of credit to ABC, Inc. (a Texas corporation) – BIC holds a perfected SI in all of the present and after-acquired equipment of ABC, Inc. • XYZ, Inc. (Delaware corporation) plans to buy all of the assets of ABC, Inc. in a merger • If this transaction occurs, what impact does it have on BIC’s SI in ABC’s equipment? § 9-316. Continued Perfection of Security Interest Following Change in Governing Law • If there was no change in governing law, BIC wouldn’t have to do anything to maintain its perfected status in its collateral – Initial UCC-1 remains effective to perfect SI after transfer of the collateral to XYZ [§ 9-507(1)] • But, in this case, XYZ is organized in Delaware (after the acquisition, 3d parties will be looking to Delaware’s UCC system for information about liens against XYZ’s property) (a) [General rule: effect on perfection of change in governing law.] A security interest perfected pursuant to the law of the jurisdiction designated in Section 9-301(1) ... remains perfected until the earlier of: (1) the time perfection would have ceased under the law of that jurisdiction; (2) the expiration of four months after a change of the debtor’s location to another jurisdiction; or (3) the expiration of one year after a transfer of collateral to a person that thereby becomes a debtor and is located in another jurisdiction. 12 Transfer of Collateral to Debtor Located in Another State • Article 9 gives secured party 1-year grace period of temporary perfection, rather than just 4 months – Rationale: it may take longer for the secured party to discover sale has occurred and to track down the collateral [§ 9-316 cmt. 2] • Problem 6: to remain continuously perfected, BIC would have to file in Delaware (location of XYZ) w/in 1 year after XYZ acquires the assets of ABC § 9-316(a)(1) • Note: If BIC’s initial UCC-1 filing in TX would have lapsed during the ensuing year, BIC would not get a full 1-year grace period – Example: If transfer occurs on Nov. 1, but BIC’s UCC-1 in TX would lapse on Dec. 1, then BIC becomes unperfected in DE after Dec. 1 (unless it files in DE before that date) 13