MECKLENBURG COUNTY, NORTH CAROLINA GENERATION, RECYCLING, AND

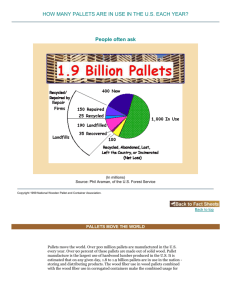

advertisement