Document 13301894

advertisement

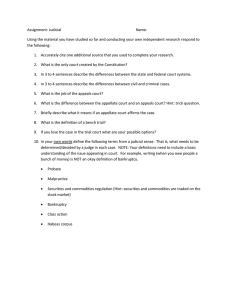

File: Fr ey er m u t h ( Fin a l) . d o c C r ea t ed o n : 1 2 / 2 2 / 2 0 0 6 1 0 :2 9 :0 0 P M L a s t P r in t ed : 1 2 / 2 3 / 2 0 0 6 1 :0 9 :0 0 P M Crystals, Mud, BAPCPA, and the Structure o f Bank rup tcy D eci si o nm ak i ng R. Wilson Freyermuth * A critical feature of any legal system is its formal dispute resolution mechanism. F rom the perspectiv e of a transactions lawyer, the dispute resolution process should be structured to accomplish ( or at least contribute positiv ely toward) doctrinal clarity. In the language made familiar by the work of P rofessor C arol R ose, this reflects a preference for “crystal” rules rather than “mud” rules: P roperty law . . . has always been heav ily laden with hardedged doctrines that tell ev eryone exactly where they stand. Default on paying your loan installments? T oo bad, you lose the thing you bought and your past payments as well. F orget to record your deed? S orry, the next buyer can purchase free of your claim, and you are out on the street. . . . In a sense, hard-edged rules like these — rules I call “crystals” — are what property is all about. If, as J eremy B entham said long ago, property is “nothing but a basis of expectation,” then crystal rules are the v ery stuff of property: their great adv antage, or so it is commonly thought, is that they signal to all of us, in a clear and distinct language, precisely what our obligations are and how we may take care of our interests. . . . E conomic thinkers hav e been telling us for at least two centuries that the more important a giv en kind of thing becomes for us, the more likely we are to hav e these hard-edged rules to manage it. W e draw these ev er-sharper lines around our entitlements so that we know who has what, and so that we can trade instead of getting * Joh n D. Lawson Professor of Law, U niversity of Missouri-Columb ia. I am grateful to my colleague Mich elle Cecil for h er invitation to participate in th e sy mposium and to Judge Wedoff and professors Culh ane and Wh ite for th eir th ough tful deb ate on th e meaning of th e “ means test.” Special th anks to my colleagues Mich elle Cecil and Ray Ph illips for conversations th at h elped to sh ape my th ough ts — and to my own Bankruptcy professor, th e late Mel Sh imm, wh ose wisdom I grow to appreciate increasingly . Th anks also to Ted Janger, wh ose previous work h as more b roadly ( and th ough tfully ) explored th e role of cry stals and mud in th e b ankruptcy reform process. See Ted Janger, C r y stals and Mud in B ankr uptcy L aw : J ud icial C ompetence and Statutor y D esig n, 43 ARIZ. L. REV. 559 ( 20 0 1) . File: Fr ey er m u t h ( Fin a l) . d o c 1 0 7 0 C r ea t ed o n : 1 2 / 2 2 / 2 0 0 6 1 0 :2 9 :0 0 P M M I S S O U RI L A W RE V I E W L a s t P r in t ed : 1 2 / 2 3 / 2 0 0 6 1 :0 9 :0 0 P M [V o l. 7 1 into the confusions and disputes that would only escalate as the goods in q uestion become scarcer and more highly v alued.1 T his need for doctrinal clarity is perhaps ev en more important in the bankruptcy context. A lack of doctrinal clarity produces a greater v olume of disputes for the system to resolv e, as parties already stuck in a largely z erosum collection game posture to maximiz e their respectiv e positions. As the v olume of disputes increases, the system’s dispute resolution process consumes an increasing proportion of debtor assets− assets that are almost inev itably insufficient to satisfy creditors in any indiv idual case. As a real estate professor, I tend to focus on bankruptcy only as it intersects with mortgage law and Article 9 of the U niform C ommercial C ode. T hus, I feel somewhat out of my element as a commenter in this symposium, and my observ ations may be suspect coming from a bankruptcy “outsider.” B ut as an outside observ er, it seems troublesome that bankruptcy’s dispute resolution system — and particularly its multiple layers of appellate rev iew — has always been so poorly designed to produce doctrinal clarity. And ev en if B AP C P A does resolv e a number of specific legal issues that hav e bedev iled the system, it does not sufficiently address this broader structural problem. J udge W edoff’s fine article on the “means test” prov ides a frame for my comments. M any ( if not most) would agree that if the system permits the discharge of otherwise enforceable debt, the system ought not be av ailable to a debtor who is abusing it. In some respects, the B ankruptcy C ode ( the “C ode”) has serv ed this gatekeeping function through “crystal” rules. F or example, § 7 2 7 ( a)( 8 ) prohibits a court from awarding a discharge to a C hapter 7 debtor who has receiv ed a discharge in a prior C hapter 7 case commenced within the prev ious eight years.2 N o discretion here; a j udge need do nothing more than check the calendar and the prior court records. H owev er, the C ode has also serv ed this gatekeeping function through fuz z ier and more ambiguous standards. P rior to B AP C P A, § 7 0 7 ( b) req uired the court to dismiss a C hapter 7 case if the granting of relief would be a “substantial abuse” of C hapter 7 .3 B ecause it is not obv ious what conduct constitutes “abuse” and when that abuse becomes “substantial,” C ongress entrusted bankruptcy j udges in § 7 0 7 ( b) with the discretion to make a fact-specific “substantial abuse” determination in each case. 1. Carol M. Rose, C r y stals and Mud in P r oper ty L aw , 40 STAN . L. REV. 577, 577-78 ( 1988) . 2. 11 U .S.C. § 727( a) ( 8) ( Supp. V 20 0 5) ( “ Th e court sh all grant th e deb tor a disch arge, unless . . . th e deb tor h as b een granted a disch arge under th is section . . . in a case commenced with in 8 y ears b efore th e date of th e filing of th e petition. . . .” ) . 3. Section 70 7( b ) formerly provided: “ After notice and a h earing, th e court . . . may dismiss a case filed b y an individual deb tor under th is ch apter wh ose deb ts are primarily consumer deb ts if it finds th at th e granting of relief would b e a sub stantial ab use of th e provisions of th is ch apter.” 11 U .S.C. § 70 7( b ) ( 20 0 0 ) , amend ed b y 11 U .S.C. § 70 7( b ) ( Supp. V 20 0 5) . File: Fr ey er m u t h ( Fin a l) . d o c 2 0 0 6 ] C r ea t ed o n : 1 2 / 2 2 / 2 0 0 6 1 0 :2 9 :0 0 P M D E C IS IO N M A K IN G IN B A P C P A L a s t P r in t ed : 1 2 / 2 3 / 2 0 0 6 1 :0 9 :0 0 P M 1 0 7 1 In R ose’s terminology, C ongress’s adoption of the “substantial abuse” standard was a choice for “mud.”4 As R ose explained, one may defend the v irtue of mud rules by arguing that they permit the legal system to do j ustice in indiv idual cases where a crystal rule might work a substantial inj ustice.5 In this way, the “substantial abuse” standard put the bankruptcy j udge in the position to make a fact-specific j udgment that a particular debtor was undeserv ing of the system’s benefits ev en though the debtor triggered none of the C ode’s crystal screening mechanisms.6 As R ose explained, howev er, mud rules create doctrinal unpredictability. E xactly what did C ongress mean by “substantial abuse”? O ne might expect that different j udges would possess different philosophical, political, or moral v iews of the parameters of the term “abuse” and when abuse was “substantial.” Did such differences compromise the C ode’s intended screening mechanism? And if so, to what extent? P erhaps j udges entrusted with the discretion to dismiss petitions for “substantial abuse” did so too rarely by allowing too many abusiv e petitions. P erhaps they did so too freq uently by dismissing petitions from truly deserv ing debtors. R egardless, it was relativ ely difficult for potential debtors ( ev en counseled ones) to understand precisely the parameters of “substantial abuse,” thereby complicating decisions regarding whether to pursue bankruptcy relief. L ikewise, this lack of clarity increased the risk that, once inside the bankruptcy system, otherwise similarly situated debtors might receiv e disparate treatment. As R ose suggests, when legal rules tend toward mud, actors within the system will tend to produce “countermov es” that push the system toward crystal through priv ate ( contract) or public ( legislation) bargaining.7 As P rofessor T ed J anger has prev iously explained, the ten-year debate that led to B AP C P A reflects the latter type of countermov e.8 T he debate ov er the desirability and content of a “means test” for consumer debtors reflected a perception — whether accurate or not — that too many undeserv ing consumer debtors were obtaining C hapter 7 relief. In 2 0 0 5 , C ongress resolv ed the debate — 4. See Rose, supr a note 1, at 578 ( “ Th e troub le with th is ‘ scarcity story ’ is th at th ings don’ t seem to work th is way [ th e adoption of ‘ cry stal’ rules] , or at least not all th e time. Sometimes we seem to sub stitute fuz z y , amb iguous rules of decision for wh at seem to b e perfectly clear, open and sh ut, demarcations of entitlements. I call th is occurrence th e sub stitution of ‘ mud’ rules for ‘ cry stal’ ones.” ) . 5. I d . at 585 ( “ Yet th e courts seem at times unwilling to follow th is story or to permit th ese cry stalline definitions, most particularly wh en th e rules h urt one party very b adly .” ) . 6. Ted Janger, C r y stals and Mud in B ankr uptcy L aw : J ud icial C ompetence and Statutor y D esig n, 43 ARIZ. L. REV. 559, 584 ( 20 0 1) ( “ [ T] h e role of muddy rules is to deter [ ab usive] b eh avior.” ) . 7. Rose, supr a note 1, at 582 ( noting th is pattern in th e transition from caveat emptor toward b uy er-protective rules in th e purch ase and sale of real estate) . 8. Janger, supr a note 6, at 559-62. File: Fr ey er m u t h ( Fin a l) . d o c 1 0 7 2 C r ea t ed o n : 1 2 / 2 2 / 2 0 0 6 1 0 :2 9 :0 0 P M M I S S O U RI L A W RE V I E W L a s t P r in t ed : 1 2 / 2 3 / 2 0 0 6 1 :0 9 :0 0 P M [V o l. 7 1 or at least tried to — with the enactment of B AP C P A, which gav e us modified § 7 0 7 ( b) and its means test. I will not focus upon the technical details of the means test as set forth in § 7 0 7 ( b)( 2 ). I could add nothing of use to J udge W edoff’s article,9 or that of professors M arianne C ulhane and M ichaela W hite ( to which J udge W edoff’s article responds),10 or to P rofessor J ohn P ottow’s thoughtful paper.11 Instead, my focus is the dispute resolution process by which the bankruptcy system will ultimately resolv e q uestions about the parameters of the means test. E v en if the means test is a mov ement toward crystal, the language of the test leav es a bit of mud lying around,12 and the nature of bankruptcy’s dispute resolution system seems structured to encourage parties to wallow in it.13 T he algorithmic q uality of § 7 0 7 ( b)( 2 ) — or, if one sees the glass as half-empty, its mind-numbing detail — looks at first blush like a choice for crystal. N ev ertheless, the threshold standard in § 7 0 7 ( b)( 1 ) remains “abuse.”14 In J udge W edoff’s v iew, the retention of this sort of mud prov es that the means test merely works a presumption.15 H e suggests that a bankruptcy j udge can conclude that a debtor passes the means test and still dismiss the 9. E ugene R. Wedoff, J ud icial D iscr etion to F ind A b use U nd er Section 7 0 7 ( b ) ( 3 ) , 71 MO. L. REV. 10 35 ( 20 0 6) . 10 . Marianne B. Culh ane & Mich aela M. Wh ite, C atch ing C an-P ay D eb tor s: I s th e Means T est th e O nly W ay ? , 13 AM. BAN K R. IN S T. L. REV. 665 ( 20 0 5) . Th is article took issue with Judge Wedoff’ s understanding of th e means test as expressed in E ugene R. Wedoff, Means T esting in th e N ew § 7 0 7 ( b ) , 79 AM. BAN K R. L.J. 231 ( 20 0 5) . 11. Joh n A. E . Pottow, T h e T otality of th e C ir cumstances of th e D eb tor ’s F inancial Situation in a P ost-Means T est W or ld : T r y ing to B r id g e th e W ed of f / C ulh ane & W h ite D iv id e, 71 MO. L. REV. 10 53 ( 20 0 6) . 12. Rose’ s article uses th e example of th e evolution of mortgage law ( from forfeiture th rough th e development of foreclosure) to demonstrate th e cy clical nature of th e legal process: [ W] e see a b ack-and-forth pattern: crisp definition of entitlements, made fuz z y b y accretions of j udicial decisions, crisped up again b y th e parties’ contractual arrangements, and once again made fuz z y b y th e courts. H ere we see private parties apparently following th e “ scarcity story ” in th eir private law arrangements: wh en th ings matter, th e parties define th eir respective entitlements with ever sh arper precision. Yet th e courts seem at times unwilling to follow th is story or to permit th ese cry stalline definitions, most particularly wh en th e rules h urt one party very b adly . Th e cy cle th us alternates b etween cry stal and mud. Rose, supr a note 1, at 585. 13. In h is work, Ted Janger describ ed th e proposed means test as a “ perilous cry stal,” Janger, supr a note 6, at 614, and suggested th at it “ h as all of th e disadvantages of mud and none of its advantages, as well as all of th e disadvantages of a cry stal and none of its advantages.” I d . at 620 . 14. 11 U .S.C. § 70 7( b ) ( 1) ( Supp. V 20 0 5) . 15. Wedoff, supr a note 9, at 4; Wedoff, supr a note 10 , at 278-79. File: Fr ey er m u t h ( Fin a l) . d o c 2 0 0 6 ] C r ea t ed o n : 1 2 / 2 2 / 2 0 0 6 1 0 :2 9 :0 0 P M L a s t P r in t ed : 1 2 / 2 3 / 2 0 0 6 1 :0 9 :0 0 P M D E C IS IO N M A K IN G IN B A P C P A 1 0 7 3 debtor’s case based upon a finding of “abuse.” L ikewise, he suggests that a debtor can fail the means test, yet still remain eligible for C hapter 7 relief based on upon the totality of the circumstances.16 Is J udge W edoff correct? P erhaps, or perhaps not.17 R egardless, bankruptcy’s dispute resolution procedure ensures that we will spend v ast ( and almost certainly excessiv e) resources answering the q uestion. As R ose pointed out, the dark side of mud rules is that they are costly to clarify — either through increased transaction costs, litigation costs, or both.18 T he bankruptcy system accentuates this cost problem in two ways. F irst, the litigation costs of the clarification process consume estate resources that would otherwise be av ailable for payment to unsecured creditors. S econd, and eq ually important, when bankruptcy standards are ambiguous, clarification of those standards occurs through a dispute resolution system that features not only adv ersarial j udicial proceedings,19 but also multiple layers of appellate rev iew. C onsider a C hapter 7 debtor who fails the means test, but nev ertheless argues that he should be eligible for C hapter 7 relief because the specific facts of his case demonstrate a lack of abuse. T he threshold q uestion of the debtor’s eligibility will be decided by the bankruptcy court, but the bankruptcy court may not hav e the final say regarding the parameters of § 7 0 7 ( b): • T he losing party may appeal the bankruptcy court’s decision of right to the district court — or, in some districts, the bankruptcy appellate panel ( B AP ) — which can make a de n ov o determination and need not accord deference to the bankruptcy court’s interpretation. • T he decision of the district court ( or the B AP ) may be appealed of right to the court of appeals, which can make a de 16. Wedoff, supr a note 9. 17. My gut instinct is with Judge Wedoff. O ne could h y poth esiz e a b ankruptcy sy stem th at functioned in purely cry stalline fash ion with no room for j udicial discretion — e.g ., punch in th e numb ers and out spits a ticket say ing “ disch arged” or “ dismissed.” In such a sy stem, of course, we could not care too much ab out wh eth er th e sy stem accomplish ed j ustice at th e micro level — i.e., wh eth er th e sy stem “ fairly ” or “ eq uitab ly ” resolved individual deb tor-creditor relationsh ips. As Rose explains, h owever, if we do care ab out fairness and eq uity , we prob ab ly h ave to accept some level of mud ( and expect th e legal sy stem to produce it) . And th e Code h as alway s given at least lip service to th e idea of “ fairness” and “ eq uity ” in resolving deb tor-creditor relationsh ips. So I’ m not surprised th at Congress ch ose to retain th e “ ab use” standard, even if th e means test goes to great ( excessive? ) length s to try to q uantify th e b asic determinants of eligib ility decision. 18. Rose, supr a note 1, at 584. 19. Janger, supr a note 6, at 584-88 ( exploring th e j udicial role in th e b ankruptcy process and wh eth er it is preferab le for b ankruptcy j udges to operate in an adj udicative role as compared to a mediative role) . File: Fr ey er m u t h ( Fin a l) . d o c 1 0 7 4 C r ea t ed o n : 1 2 / 2 2 / 2 0 0 6 1 0 :2 9 :0 0 P M M I S S O U RI L A W RE V I E W L a s t P r in t ed : 1 2 / 2 3 / 2 0 0 6 1 :0 9 :0 0 P M [V o l. 7 1 n ov o determination and need not accord deference to the respectiv e interpretations of the bankruptcy court or the district court. • F rom the court of appeals, the losing party may then petition the S upreme C ourt for a writ of certiorari. If granted, the S upreme C ourt then makes a de n ov o determination without the need for deference to any of the lower court interpretations. S imultaneously, this same process will proceed in ninety-four different districts, with each bankruptcy court decision hav ing no binding impact outside its own district. T he current system can achiev e doctrinal clarity only after an issue works its way through the v arious courts of appeals, and perhaps not ev en then.20 T his system seems almost calculated to giv e trustees, debtors, and creditors ( especially ov ersecured creditors)21 the incentiv e to expend resources of the bankruptcy estate litigating the meaning of the C ode, and to appeal, and to appeal again, and perhaps ev en again. B ut to what purpose? In theory, multiple layers of rev iew prov ide for the percolation of issues of statutory interpretation and thus could contribute constructiv ely to the ov erall q uality of bankruptcy decision making.22 In the bankruptcy context, howev er, it seems doubtful that the benefits of percolation j ustify multiple 20 . See Judith A. McK enna & E liz ab eth C. Wiggins, A lter nativ e Str uctur es f or B ankr uptcy A ppeals, 76 AM. BAN K R. L.J. 625, 627 ( 20 0 2) ( “ Th e b ankruptcy appellate sy stem is not well structured to produce b inding precedent. Th e numb er of first-level reviewers greatly exceeds th e numb er of b ankruptcy j udges producing th e j udgments reviewed, and appellate caseloads are spread th inly among district j udges, giving few j udges much opportunity to develop b ankruptcy expertise. Moreover, th e inab ility of most appellate reviewers to create b inding precedent diminish es th e value of appellate review and is asserted to h inder lawy ers’ and oth ers’ ab ility to structure transactions and predict litigation outcomes.” ) . 21. O versecured creditors — th ose h olding security interests in collateral th e value of wh ich exceeds th e amount of th e deb t owed to th e creditor — are entitled to collect th eir attorney fees out of th is “ eq uity cush ion,” th ereb y reducing th e resources oth erwise availab le to fund th e deb tor’ s reorganiz ation or to make pay ments to unsecured creditors. See 11 U .S.C. § 50 6( b ) ( Supp. V 20 0 5) . 22. See, e.g ., Mary land v. Balt. Radio Sh ow, Inc., 338 U .S. 912, 918 ( 1950 ) ( “ It may b e desirab le to h ave different aspects of an issue furth er illumined b y th e lower courts. Wise adj udication h as its own time for ripening.” ) ; Ch arles L. Black, Jr., T h e N ational C our t of A ppeals: A n U nw ise P r oposal, 83 YAL E L.J. 883, 898 ( 1974) ( explaining th at conflicts “ can b e endured and sometimes perh aps ough t to b e endured wh ile j udges and sch olars ob serve th e respective workings out in practice of th e conflicting rules” ) ; Samuel E streich er & Joh n E . Sexton, A Manag er ial T h eor y of th e Supr eme C our t’s R esponsib ilities: A n Empir ical Stud y , 59 N.Y.U . L. REV. 681, 699 ( 1984) ( noting potential b enefits of furth er percolation of issues likely to b e addressed b y Supreme Court) . File: Fr ey er m u t h ( Fin a l) . d o c 2 0 0 6 ] C r ea t ed o n : 1 2 / 2 2 / 2 0 0 6 1 0 :2 9 :0 0 P M D E C IS IO N M A K IN G IN B A P C P A L a s t P r in t ed : 1 2 / 2 3 / 2 0 0 6 1 :0 9 :0 0 P M 1 0 7 5 automatic layers of rev iew. O ne of the ostensible benefits of percolation is the idea that the av ailability of published district and appellate court opinions should help later appellate courts produce more thoughtful ( and more accurate) decisions. Y et the relativ e freq uency with which bankruptcy court decisions are published means that by the time an issue reaches the second and third lev els of rev iew, there are likely to be numerous published opinions discussing the issue.23 F urther, rev ersal rates in bankruptcy appeals are relativ ely low,24 which at least raises some q uestion of whether an additional lev el of j udicial rev iew improv es actual decision making q uality to an extent that j ustifies its cost. In 1 9 9 7 , the report of the N ational B ankruptcy R ev iew C ommission, which was established under the B ankruptcy R eform Act of 1 9 9 4 , recogniz ed this problem and recommended that C ongress truncate the appellate process by eliminating the first layer of rev iew ( rev iew by a district court or B AP ).25 At first blush, the suggestion to eliminate the f i rs t layer of rev iew seems odd; intuition suggests that the district courts or B AP s would resolv e appeals more q uickly.26 S peed of resolution is especially important in the bankruptcy context, where the automatic stay giv es particular significance to the familiar adage, expressed by a kite-flying founder in another context, that time is money. F urther, one might argue normativ ely that the ov erall q uality of appellate bankruptcy decision making would be better if appeals were decided by a more specializ ed tribunal ( like the B AP s) rather than the courts of appeal.27 S till, without substantial empirical ev idence to j ustify the cost of the 23. C f . Bry an T. Camp, B ound b y th e B A P : T h e Star e D ecisis Ef f ects of B A P D ecisions, 34 SAN DIEG O L. REV. 1643, 1669 ( 1997) ( “ [ A] trial court may b e ab le to overcome some of th e disadvantages of lack of time, lack of proper b riefing, and lack of colleagues if th ere are a variety of easily discovered decisions on point.” ) . 24. McK enna & Wiggins, supr a note 20 , at 630 ( discussing appeal rates and outcomes from j udgments of district courts and BAPs) , 663-68 ( discussing appeal rates and outcomes from j udgments of b ankruptcy courts) . 25. NATION AL BAN K RU P TC Y REVIEW COMMIS S ION REC OMMEN D ATION S TO CON G RES S § 3.1.3 ( 1997) ( “ Th e current sy stem wh ich provides two appeals, th e first eith er to a district court or a b ankruptcy appellate panel and th e second to th e U .S. Court of Appeals, as of righ t from final orders in b ankruptcy cases sh ould b e ch anged to eliminate th e first lay er of review.” ) . 26. Th e availab le empirical evidence is consistent with th is intuition. See, e.g ., McK enna & Wiggins, supr a note 20 , at 659-63. 27. Th e general literature on th e virtues and vices of specializ ed courts is extensive and reflects significant disagreement. See, e.g ., RIC H ARD A. POS N ER, TH E FED ERAL COU RTS : CH AL L EN G E AN D REF ORM 171( 1996) ( specializ ed courts are more likely to b ecome ideologically ch arged) ; LeRoy L. K ondo, U ntang ling th e T ang led W eb : F ed er al C our t R ef or m T h r oug h Specializ ation f or I nter net L aw and O th er H ig h T ech nolog y C ases, 20 0 2 U CLA J. L. & TEC H . 1 ( increased need for specialist j udges and oth er forms of specializ ation in resolving h igh -tech nology -related disputed) ; Jeffrey W. Stempel, T w o C h eer s f or Specializ ation, 61 BROOK . L. REV. 67, 111-26 ( 1995) ( supporting specializ ed trib unals accompanied b y generalist appellate review) . File: Fr ey er m u t h ( Fin a l) . d o c 1 0 7 6 C r ea t ed o n : 1 2 / 2 2 / 2 0 0 6 1 0 :2 9 :0 0 P M M I S S O U RI L A W RE V I E W L a s t P r in t ed : 1 2 / 2 3 / 2 0 0 6 1 :0 9 :0 0 P M [V o l. 7 1 additional layer of appellate rev iew, the C ommission’s recommendation was at least a step in the right direction. R ather than adopt the C ommission’s recommendation, B AP C P A instead created a procedure that permits, but does not necessarily req uire, the circumv ention of the first layer of appellate rev iew. B AP C P A prov ides that the district court or B AP can certify certain appeals directly to the court of appeals.28 See g ener ally Arti K . Rai, Eng ag ing F acts and P olicy : A Multi-I nstitutional A ppr oach to P atent Sy stem R ef or m, 10 3 COL U M. L. REV. 10 35 ( 20 0 3) ; Rich ard L. Revesz , Specializ ed C our ts and th e A d ministr ativ e L aw making Sy stem, 138 U . PA. L. REV. 1111 ( 1990 ) . O ne migh t defend placing a sole lay er of appellate review with th e court of appeals rath er th an th e district court on th e “ th ree h eads are b etter th an one” th eory — th at “ communication b etween th e j udges will lead to a b etter result since each j udge can test th e soundness of h is or h er reasoning against th e oth ers.” Camp, supr a note 23, at 1668-69. See also Mich ael Ab ramowicz , En B anc R ev isited , 10 0 COL U M. L. REV. 160 0 , 1630 -36 ( 20 0 0 ) ( presenting th e normative argument for maj oritarian review) . H owever, as noted supr a text accompany ing note 23, th e relative freq uency and availab ility of pub lish ed b ankruptcy court decisions as a reference point for district court j udges may somewh at weaken th e force of th is argument. Furth er, b ecause th e BAPs operate in th ree-j udge panels, th is argument provides no b asis for preferring th e courts of appeals over th e BAPs. Wh eth er BAPs produce “ b etter” decisionmaking th an courts of appeals remains open to argument. Certainly , as noted supr a text accompany ing note 26, BAPs appear to make decisions more q uickly . Wh eth er th ose decisions are “ b etter” or more “ accurate” is a q uestion th at is so value-laden as to defy empirical evaluation ( or consensus even if th ere was good empirical data) . O ne migh t posit th at b ankruptcy cases are most likely to produce statutory interpretation q uestions of a ty pe th at would b e relatively uninteresting to generalist j udges. See, e.g ., Frederick Sch auer, Statutor y C onstr uction and th e C oor d inating F unction of P lain Meaning , 1990 SU P . CT. REV. 231, 246-48 ( noting th at th e Court’ s 1990 statutory interpretation cases h ad one common factor: “ None of th em was interesting. Not one. Compared to flag b urning or affirmative action or separation of powers or political patronage, th ese cases struck me as real dogs.” ) . If th is th esis is correct, one migh t expect th at BAP j udges — wh o are more freq uent participants with in th e b ankruptcy sy stem — migh t produce more engaged decisionmaking th an generalist appellate j udges. For furth er discussion of th e potential b enefits and/ or costs of specializ ed b ankruptcy appellate trib unals, see g ener ally Daniel J. Bussell, B ankr uptcy A ppellate R ef or m: I ssues and O pinions, in NORTON AN N U AL SU RVEY OF BAN K RU P TC Y LAW 257 ( 1995-96) ; Nath an B. Feinstein, T h e B ankr uptcy Sy stem: P r oposal to R estr uctur e th e B ankr uptcy C our t and B ankr uptcy A ppellate P r ocesses, in NORTON AN N U AL SU RVEY OF BAN K RU P TC Y LAW 517 ( 1995-96) ; Paul M. Baisier & David G. E pstein, R esolv ing Still U nr esolv ed I ssues of B ankr uptcy L aw : A F ence or an A mb ulance, 69 AM. BAN K R. L.J. 525 ( 1995) ; McK enna & Wiggins, supr a note 20 . 28. 28 U .S.C.. § 158( d) ( 2) ( A) ( Supp. V 20 0 5) provides: Th e appropriate court of appeals sh all h ave j urisdiction of appeals [ from appealab le orders of th e b ankruptcy court] if th e b ankruptcy court, th e district court, or th e b ankruptcy appellate panel involved, acting on its own File: Fr ey er m u t h ( Fin a l) . d o c 2 0 0 6 ] C r ea t ed o n : 1 2 / 2 2 / 2 0 0 6 1 0 :2 9 :0 0 P M D E C IS IO N M A K IN G IN B A P C P A L a s t P r in t ed : 1 2 / 2 3 / 2 0 0 6 1 :0 9 :0 0 P M 1 0 7 7 H owev er, the court of appeals retains the discretion not to authoriz e the direct appeal.29 W hether this procedure will in fact truncate the appeals process is an empirical q uestion, but it seems open to doubt that courts of appeals — already facing crowded appellate dockets and v acancies exacerbated by the politiciz ation of the S enate confirmation process — would routinely grant all certification req uests. O ne might hav e designed an entirely different system of bankruptcy dispute resolution. In its landmark study ev aluating the pre-1 9 7 8 bankruptcy system, the B rookings Institution report argued for a predominantly administrativ e bankruptcy model. Its study found that consumer bankruptcy cases, both liq uidation and reorganiz ation, were better suited for administrativ e resolution than j udicial adj udication. T he report thus proposed the establishment of a bankruptcy agency.30 W hile the B rookings R eport env isioned a bankruptcy agency that would hav e been primarily operational and not regulatory in nature,31 an administrativ e model could hav e created a system in which disputes ov er interpretational q uestions were resolv ed in a much more streamlined manner. F or example, C ongress might hav e created broad statutory standards regarding certain policy issues — e . g . , the “substantial abuse” screen for C hapter 7 relief, as in the old § 7 0 7 ( b) — and an administrativ e mechanism for implementing those standards through rulemaking. T his model might hav e prov ided for more consistent application of the C ode’s standards to similarly-situated debtors throughout the system, particularly by comparison to an adv ersarial model that produces clarity — when it produces clarity — only through percolation. F urther, such a system would hav e permitted more freq uent and effectiv e refinement of the applicable regulations ov er time, as warranted by empirical ev aluation of the system’s operation and its external effects on the behav ior of commercial actors. L ast, but not least, j udicial rev iew in such a model would presumably come with appropriate motion or on th e req uest of a party to th e j udgment, order, or decree . . . or all th e appellants and appellees ( if any ) acting j ointly , certify th at— ( i) th e j udgment, order, or decree involves a q uestion of law as to wh ich th ere is no controlling decision of th e court of appeals for th e circuit or of th e Supreme Court of th e U nited States, or involves a matter of pub lic importance; ( ii) th e j udgment, order, or decree involves a q uestion of law req uiring resolution of conflicting decisions; or ( iii) an immediate appeal from th e j udgment, order, or decree may materially advance th e progress of th e case or proceeding in wh ich th e appeal is taken; and if th e court of appeals auth oriz es th e direct appeal of th e j udgment, order, or decree. 29. I d . 30 . DAVID T. STAN L EY & MARJ ORIE GIRTH , BAN K RU P TC Y : PROB L EM, PROC ES S , REF ORM ( 1971) ( sh ortcomings of th e existing b ankruptcy sy stem, including inter-state and inter-court ineq uities) . 31. I d . at 20 1. File: Fr ey er m u t h ( Fin a l) . d o c 1 0 7 8 C r ea t ed o n : 1 2 / 2 2 / 2 0 0 6 1 0 :2 9 :0 0 P M M I S S O U RI L A W RE V I E W L a s t P r in t ed : 1 2 / 2 3 / 2 0 0 6 1 :0 9 :0 0 P M [V o l. 7 1 deference for the administrator’s interpretation of the statute,32 a concept that implicitly discourages disappointed litigants from aggressiv ely seeking j udicial rev iew of merely debatable q uestions of statutory interpretation. Instead, we hav e the system we hav e. As P rofessor M elissa J acoby warned in anticipation of B AP C P A, we can expect B AP C P A to be filtered and its actual impact shaped by the influences of day-to-day actors in the bankruptcy system.33 W hen folks as thoughtful as J udge W edoff and P rofessors C ulhane, W hite and P ottow disagree about what § 7 0 7 ( b) means, we can expect that debtors and creditors will aggressiv ely litigate the issue of what constraints the means test places on j udicial discretion. T hey will litigate it through the bankruptcy courts; they will litigate it through the district courts ( unless they all agree to go straight to the court of appeals and the court of appeals will hav e them); they will litigate through the courts of appeal; and ( heav en help us) they might ev en litigate it to the S upreme C ourt of the U nited S tates. T hroughout that process, I picture an unsecured creditor sitting in the gallery shaking her head and wondering why she underwrites a collection system that serv es her so poorly. F inally, our current j udicial model of bankruptcy administration makes it less likely that bankruptcy decision making can meaningfully address many of the issues raised by the other papers in this symposium. As these papers suggest, there are substantial and important connections to be explored regarding the intersection of the bankruptcy system and issues of health care,34 labor,35 taxation,36 race,37 and how self-awareness influences use of credit.38 As long as clarification of the C ode’s standards occurs in the j udicial setting, the institutional limits of the j udicial process make it unlikely that the bankruptcy system can explore or address these connections in a thoughtful way. 32. Ch evron, U .S.A., Inc. v. National Res. Def. Council, Inc., 467 U .S. 837, 844 ( 1984) ( reviewing court “ may not sub stitute its own construction for a reasonab le interpretation” b y th e agency ) ; AL F RED C. AMAN , JR. & WIL L IAM T. MAY TON , AD MIN IS TRATIVE LAW § 13.8, at 491-50 4 ( 2d ed. 20 0 1) ( discussing parameters of j udicial deference to agency interpretations of law) . 33. Melissa B. Jacob y , R ipple or R ev olution? T h e I nd eter minacy of Statutor y B ankr uptcy R ef or m, 79 AM. BAN K R. L.J. 169, 189 ( 20 0 5) . 34. Melissa B. Jacob y , B ankr uptcy R ef or m and th e C osts of Sickness: Explor ing th e I nter sections, 71 MO. L. REV. 90 3 ( 20 0 6) . 35. Daniel K eating, W h y B A P C P A L ef t L ab or L eg acy C osts A lone, 71 MO. L. REV. 985 ( 20 0 6) . 36. Mich elle Arnopol Cecil, B ankr uptcy R ef or m: W h at’s T ax G ot to D o w ith I t? , 71 MO. L. REV.879 ( 20 0 6) . 37. Mech ele Dickerson, R ace Matter s in B ankr uptcy R ef or m, 71 MO. L. REV. 919 ( 20 0 6) . 38. Rich ard L. Weiner, Enh anced D isclosur e, Emotion, and B A P C P A , 71 MO. L. REV. 10 0 3 ( 20 0 6) .