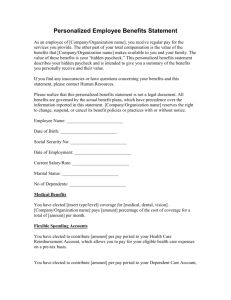

Introduction .......................................... 9.2 Health Benefits Plan .................................. 9.4 SECTION NINE

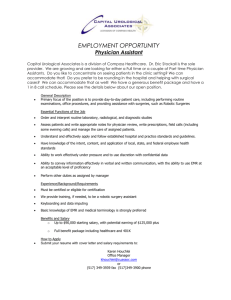

advertisement