ADVANCE MARKET COMMITMENT FOR PNEUMOCOCCAL VACCINES IMPLEMENTATION WORKING

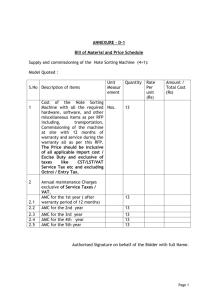

advertisement