H- Incidence of Public School Tax- ation in Oregon with Special

advertisement

JUNE 1932

STATiON BULLETIN 306

H-

Incidence of Public School Taxation in Oregon with Special

Reference to Elementary

and County School

Fund Laws

Agricultural Experiment Station

Oregon State Agricultural College

CORVALLiS

TABLE OF CONTENTS

Page

Summary

3

Introduction

Public School ILvenue System

Purpose of this Study

Sources of Information Utilized

Method of Procedure

Validity of Data Used

Operation of County School and Elementary School Fund Laws

Statistically Presented

Basic Tables

Maps

Analysis and Summarizations

Shifting of Revenues as Effected by the County School and

Elementary School Fund Laws Summarized

5

S

10

11

11

12

13

13

14

103

103

Effects of Elementary and County School Fund Laws

Compared, Three-Year Averages

104

Operation of the County School Fund and Elementary

School Fund Laws in City School Districts Having

Assessed Valuations in Excess of One Million Dollars

105

An Analysis of the levies and Apportionments of Funds

Under the County School and Elementary School Fund

Laws with a View to Measuring the Equalizing Effects

of the Laws

Conclusions

107

110

SUMMARY

Public school finance presents two major problems, the constantly mounting expenses for public education and the equaiization of the school tax burden.

The public school system of the State of Oregon is primarily

supported by levies on the assessable general property. During

the decade 1920-1930 the taxes levied on general property for

public school purposes have increased from a little more than 14

millions to almost 20 millions, an increase of 40 percent. The

aggregate levies for public school purposes in the various counties are with few exceptions larger than the levies for any other

purpose, state or local.

For the year 1928-29 weighted public school levies ranged

from 8.51 mills (Gilliam county) to 25.63 mills (Lincoln county)

on equalized rural values. For the same year average aggregate

levies for public school purposes ranged from 14.45 mills (Crook

county) to 38.49 mills (Grant county) on urban equalized values.

Total taxes for public school purposes for the same year constituted from 27.74 percent (Clatsop county) to 63.92 percent (Deschutes county) of all rural taxes, and from 14.43 percent (Crook

county) to 48.05 percent (Benton county) of all urban taxes.

The problem of the equalization of the tax burden increases

in importance with the increase of the levy. In Oregon, as in

other states, the problem is twofold: inequality in burden be-

tween counties and inequality between districts within the same

county.

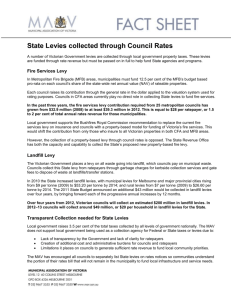

Equalized valuations per school-census child on the 1929

assessment rolls varied from $2,287 in Josephine county to $11,290 in Sherman county. Interdistrict variations in many counties

exceed intercounty variations in the state.

There are two public school revenue laws in this state, the

County School Fund law and the Two-Mill Elementary law, passed

with a view to equalizing the interdistrict school tax burden. No

attempt is made to effect equalization between the counties.

Under the County School Fund law a levy must be made on

assessable general property in each county adequate to produce

not less than $10 per capita for all children within the county between the ages of 4 and 20 years.

Under the Two-Mill Elementary law a uniform levy of two

mills is placed upon the equalized value of all assessable property

in the state.

The County School Fund is apportioned as follows: $100 to

each district and subdistrict in the county and the balance of the

fund among the school districts in proportion to the number of

school-census children.

The Elementary School Fund is apportioned within each county on the basis of number of teachers employed in the first eight

+.-..-.--.-.-.----.-"-"-..-..-.-.--.--..-.-..----.-. I

I

SUMMARY (Continued)

grades in the several districts in the county; provided, that the

number of teachers employed shall not exceed one teacher for

every 30 pupils or fraction thereof enrolled in the first eight

grades.

The purpose of this study is primarily to analyze the effect

of these two laws in the shifting and allocation of the EchOOl

tax burden.

Analysis of data indicates that the greater portion of the

funds produced under the above-named laws flows back into the

same school districts in which they are raised. In the case of the

Elementary Fund more than 85 percent of the funds went back

into the district in which raised and in the case of the County

School Fund more than 83 percent of the funds went back into the

district in which raised. In other terms, out of an average annual

amount of $4,902,167 produced under the laws for the years 1927

1930, only $745,774 or 15.21 percent went annually into districts

other than those in whkh collected.

For the years 1927-1930, 24 city school districts with assessed

valuations of $1,000,000 or above contributed in the aggregate to

the County and Elementary School Funds $152,715.79 annually in

excess of the apportionments received under the laws. Of the

$152,715 so contributed, $125,851 came from city school districts

located in the Willamette Valley.

For the years 1927-1930, 45 city school districts with assessed

valuations of $1,000,000 or over received apportionments of $243,358.37 annually in excess of contributions made under the laws.

The effects of the County and Elementary School Fund laws

in the shifting of the tax burden are to a high degree supplement.

ary. The districts in which the effects of the laws tend to counter-

act one another are for the most part border-line casesthat is,

districts in which the levies made under the laws very nearly equal

the apportionment received under the same laws. The Elementary

law supplemented the County School Fund law in excess apportionments by an average annual amount of $302,389.00 for the years

1927-1930, and counteracted the law by an average annual amount

of $18,735.22.

-

The average annual excess apportionments for all counties

under consideration in this study for the years 1927-1930 aggregated $745,774.33. These excess apportionments were made to

1,214 school districts in the state. Of these 1,214 districts, 725 districts had general school levies, includin.g Special District levies,

Union High School levies, and High School Tuition Fund levies,

below the average for their respective counties; 376 districts had

assessed valuations above the average per school-census child;

300 districts had both general levies below their county averages

and assessed valuations per census child above the average, and

806 districts had either or both lower-than-average general levies

and/or higher-than-average per-census-child valuations.

Incidence of Public School Taxation in

Oregon with Special Reference to

the Elementary and County

School Fund Laws

By

W. H. DREESEN

I. INTRODUCTION

school finance presents two major problems: the constantly

PUBLIC

mounting expenses and the problem of the equalization of the tax bur-

den for the maintenance of the public school system.

During the past ten years the total taxes levied on general property

in Oregon for public school purposes have increased from approximately

14 millions of dollars in 1920 to almost 20 millions- f dollars in 1930, or an

increase of more than 40 percent.

GENERAL PROPERTY TAXES FOR PUBLIC SCHOOLS

Tax

Special school tax

Elementary school fund

County school fund

High school tuition

Total

19211930

$ 9,000,813.24"

$1 2,8.80,802.460

$14,145,712.94

$19,756,! 71.015

2,081,678. lOt

2,4 16,934.78

646,286.82

2,249,977.381

3,220,731.435

1,404,659.729

"Seventh Biennial Report, State Tax Commission, p. 44.

fSixth Biennial Report, State Tax Commission, p. 36.

IEleventh Biennial Report, State Tax Commission, Table 10.

§State Levy of Taxes for 1930, p. 18.

iThe county school fund was obtained by deducting the high school tuition fund for

the year from the general school fund, as appearing in the Seventh Biennial Report of the

State Tax Co,nmission, p.44.

IThe foregoing data do not include niiliage levies for the institutions of higher learning.

The average aggregate levies for public school purposes tn the variOus counties are with few exceptions larger than the levies for any other

purpose.** For the school year 1928-29 these levies ranged from 8.51 mills

in Gillim county to 25.63 mills in Lincoln county on equalized rural values.

For the same year these levies ranged from 14.45 mills in Crook county

to 38.49 mills in Grant county on urban values.

Table I indicates the percentage that the school taxes constitute of the

total taxes levied.

""The aggregate levies include the Two-Mill Elementary levy and Cotinty School Fund

levy as well as the Special District, Union High School, and County Tuition Fund levy.

6

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

TABLE I. WEIGHTED AVERAGE LEVIES FOR PUBLIC SCHOOL PURPOSES

ON EQUALIZED VALUES BY COUNTIES AND PERCENTAGES THAT

SCHOOL LEVIES CONSTITUTE OF TOTAL GENERAL PROPERTY LEVIES.

SCHOOL YEAR 1928-29.

Rural area

County

Baker

Benton

Clackarnas -Clatsop

Columbia

Coos

Crook

-

Curry Deschutes

Douglas

Gilliam

Grant

Harney

Hood River

Jackson

Jefferson

Josephine -Klamath Lake

Lane

Lincoln

Linn -

Total school

levy

MilLc

12.81

13.30

17.44

16.84

23.59

22.05

14.84

20.24

23.74

12.77

8.51

14.86

13.74

23.50

18.27

13.23

18.49

15.57

11.39

14.28

2563

Yamhill

10.83

17.22

13.32

14.79

17.51

15.02

11.84

17.85

14.40

13.91

14.26

14.01

13.01

16.02

13.99

Totals for State

15.80

Malheur

Marion

Morrow -Multnomah

Polk

Sherman

Tillamook

Umatilla

Union

Wallowa

Wasco

Washington

Wheeler --

Percentage of

total general

property levy

Cities

Percentage of

total general

property levy

Total school

levy

Mills

47.11

50.67

44.48

27.'4

51.38

43.82

35.85

39.81

63.92

40.37

34.34

41.56

42.36

54.05

52.63

45.78

43.84

48.04

38.02

39.22

30.36

34.63

49.55

39.60

39.68

57.85

53.48

36.05

36.60

48.89

24.16

21.96

45.17

39.21

26.31

43.92

33.30

20.17

16.99

38.49

23.30

27.55

29.69

20.85

31.89

27.78

2586

38.50

44.46

30.37

38.25

37.52

35.56

35.97

23.64

34.14

37.24

35.56

39.36

36.19

42.09

22.69

26.66

40.39

40.22

36.86

39.59

41.42

44.60

39.11

2303

41.56

35.14

40.17

44.62

46.14

20.47

24.14

18.12

33.03

18.80

26.67

16.55

20.95

16.48

20.74

22.33

30.35

29.34

26.62

18.60

21.10

20.69

43.24

18.31

40.61

41.35

48.05

34.47

23.30

47.41

36.67

14.43

14.94

27.17

32.42

29.51

14.45

j

36.22

The problem of the equalization of the tax burden intensifies with an

increase in the burden itself. Light levies are paid without much regard

to the equality of the burden, and the whole subject is of academic interest

only. But as these levies become heavier theoretical differences take on

practical significance. The problem in Oregon, as in most other states, is

twofold: equalization between the different counties within the state and

equalization between the districts within each county. As the public school

system in Oregon derives its support primarily from levies on the general

property tax, the average valuation per census child in the different counties throws some light on the existing inequalities in the public school tax

burden as between the different counties. Table II gives the equalized

valuation per census child and the average levies, including County School

Fund levies, Special School District, Union High School District, Elementary, and County Tuition Fund levies for the year 1929-30.

7

INCIDENCE OF PUBLIC SCHOOL TAXATION

THE AMOUNT OF EQUALIZED VALUATION

Csus CHILD

P

929 AS5SSMENT T2OLL3

COUNTIE5

o

o

a

o

0

o

o

0

0

o

0

a

a

0

a

a

0

o

o

0

0

0

0

0

0

0

0

0

0

0

o

A1<ER

5E NT ON

CLACKAMAS

CLAT5OP

_.__._

EQUALIZED VALUATION

COLUMSIAI

Coos

CROo<

CuRRY

DESCHUTE5

I

DOUGLAS

GILL I AM

GRANT

hARtlEY

H000 RIvER

JACI<50N

JEFFEQ5OH

JO5EPI-IINE

----1

I

KL AM AT H

LAIE

LANE

LINCOLN

I

LINN

MALHEUQ

I

MARION

MORROW

MULTNOMAN

PoL<

5HERMAN

TILLAMO 01<

---

I

U MAT ILL A

UNION

WALLOWA

WASCO

WASHINGTON

WNEELER

YAMI-IILL

I

0

a

-

8

0

8

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

TABLE II. EQUALIZED VALUATION PER CENSUS CHILD BY COUNTIES.

1929 ASSESSMENT ROLLS. AVERAGE LEVIES BY COUNTIES, INCLUDING

COUNTY SCHOOL FUND LEVIES, SPECIAL SCHOOL DISTRICT, UNION

HIGH SCI-IOOL DISTRICT, COUNTY TUITION FUND, AND ELEMENTARY

SCHOOL FUND LEVIES.

County

Equalized valuation

per census child,

1929 rolls

ii

Average levies for public school

purposes, including levies mdicated above, on equalized valuation rolls of 1929

Mills

Baker

Benton

Clackamas -Clatsop

Columbia

Coos

Crook

Curry

Deschutes

Douglas

Gilliam

Grant

Harney

Hood River

Jackson

Jefferson

Josephine

Klainath

Lake

Lane

Lincoln

Linn

Malheur

Marion

Morrow

Multnomah

Polk

Sherman

Tillamook

Umatilla

Union

Wallowa

Wasco

Washington

Wheeler

Yamhill

Average

$4,445

3,242

3,816

3,875

2,749

3,029

5,814

5,260

2,993

4,780

9,744

4,924

6,095

3,369

3,214

9,100

2,287

4,436

7,727

3,S22

2,956

4,457

3,497

3,120

7,921

5,070

3,395

11,290

6,042

6,781

3,806

3,871

5,148

3,822

6,193

3,187

4,321

15.31

16.86

18.96

20.89

28.03

27.47

16.07

21.06

25.54

17.06

9.84

16.53

15.44

23.80

22.96

12.25

23.57

20.11

12.88

15.71

29.06

12.87

19.73

15.94

16.39

16.62

17.31

12.12

17.28

16.29

18.72

18.74

16.65

15.59

14.32

17.10

17.56

Public school revenue system. With the exception of small amounts

received from the Irreducible School Fund" public education in Oregon

is primarily supported by levies on the assessable general property. The

principal levies are made under the County School Fund law, Elementary

School Fund law, County High School Tuition Fund law, and under district levies; the latter may be for either or both grade schools and secondary schools.

The irreducible school fund is derived from the following sources*:

1. The proceeds of the sales of the sixteenth and thirty-sixth sections

of every township of this state, or of any lands selected in lieu

thereof.

Twenty-nirith Biennial Report of the Superintendent of Public Instruction of the

State of Oregon, page 57.

INCIDENCE OF PUBLIC SCHOOL TAXATION

9

The proceeds of all gifts, devises, and bequests, made by any person

to the State for common school fund purposes.

The proceeds of all property granted to the State when the purpose of such grant shall not be stated.

All proceeds of the sales of tide and overflow land.

All the moneys and clear proceeds of all property which may accrue to the State by escheat or forfeiture.

Unclaimed bank deposits escheated to the State.

All moneys received from the rental, sale, disposition, or use of

lands belonging to the State.

All moneys received by the State under contracts made in pursuance

of the provisions of Chapter IV, title XXXII, Oregon Laws, pertaining to confirmation of State Land Titles.

Royalties from leases of sand and gravel beds of navigable portions

of navigable streams within the State.

The proceeds of sales of timber on State lands.

The irreducible school fund must be maintained intact; the income

therefrom only may be used. The distribution of income to the counties

and in turn to the school districts is made on the basis of the number of

children residi'ng therein between the ages of 4 and 20 years.*

The apportionments made under this fund have thus far constituted a

negligible amount, ranging from $432,276.88 in 1920 to $411,60.38 in 1930t

or approximately 2 percent of the total amount expended annually for

public education, grade and secondary, during recent years.

Under the County School Fund law a levy must be made on all taxable

property in the county adequate to produce not less than $10 per capita

for each child residing in the county between the ages of 4 and 20 years.1:

The County School Fund collected in accordance with this law is apportioned as follows: $100 to each district and subdistrict in the county and

the balance to the districts in the county in proportion to the number of

children resident therein between the ages of 4 and 20 years.

Under the Two-Mill Elementary Fund law a uniform levy of two mills

is placed on the equalized value of all assessable property in the state. The

'Oregon Laws, Section 4987.

tTwenty-ntnth Biennial Report, Superintendent of Public Instruction, p. 73.

IThe County School Fund law: 'For the purpose of creating a county school fund the

county courts of the several counties of this state are hereby required to levy, at the same

time other taxes are levied, a tax for school purposes upon all the taxable property of the

county which aggregates an amount which shall produce at least $10 per capita for each and

all of the children svithin the county between the ages of 4 and 20 years, as shosvn by preceding school census, which said taxes shall be collected at the same time, in the same

manner, and by the same olliceis as other taxes are collected; provided, that the per capita

amount so levied in any county shall not be less tItan the per capita amount of the school

tax levied in the county for the year 1919."

"The county school superintendent shall ntakc an apportionmetit of the entire school

fund then in the county treasury on the second Monday in November of each year, and at

such other times during the year as he may deem advisable. The county school fund,

collected in pursuance of the school tax levied by the county court, shall be apportioned in

the follosving manner: In November he shall apportion $100 to each district and subdistrict

in his county that has reported to him as required by law. The balance of the county school

funds thereafter remaining in the treasury, and any amount of such funds to be apportioned

at any other time, shall be apportioned among the several d,stricts in h,s county that have

-esnried o him as required by law, in proportion to the total 'number of chtldrett resident

in each district betsveen the ages of 4 and 20 years,' as shown by the clerk's last annual

Oregon Laws Section 4168.

10

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

Elementary Fund raised under the law is apportioned to the districts within

the county in which it is raised on the basis of the number of teachers employed in the first eight grades; provided that the number of teachers employed shall not exceed one teacher for every 30 pupils or fraction thereof

enrolled in the grades.5

The County High School Tuition Fund law passed by the legislature in

1915, provided for the raising of a high school tuition fund by a levy upon

all the property in the county not included in standard high school districts.

This fund is used in paying the tuition of pupils from non-high school districts attending standard high schools in the state.

The amounts raised under this law have increased from $646,286.82

in 1921 to $1,404,659.72 in 1930.t All but four counties in the state function

under this law; Crook, Klamath, and Lincoln counties with county unit

organization, and Lane county tinder the County High School Fund"

law are the exceptions.

The special district levies for either or both grade and high schools

are usually the heavier levies in the districts. The law requires that the

revenue raised under this levy in each school district shall not be less than

the difference between $620 and the amount received by the district from

the county school fund4

Purpose of this study. The evident intent of the two public school revenue laws of the state, the County School Fund law and the Elementary

School Fund law, is the equalization of the school tax burden among the

districts within the several counties. No attempt is made in these laws tc.

cross county boundaries and equalize the tax load between the counties.

It is the primary purpose of this study to discover the operation of

these two laws in the collection of revenue and the apportionment of ii

among the school districts.

No claim is made for absolute accuracy. Basic data used for two out

of the three years under consideration were copied from the annual reports of more than 2,100 school-district clerks from all parts of the state.

In most counties, however, these records had been audited and corrections entered. Data on joint school districts are least satisfactory owing

vThe Two-Mill Elementary law: "Section 1. In addition to ihe provisions for the

support of ihe public schools of Oregon now provided by law there is hereby levied, consniencing with ihe year 1920, and annually thereafter, a tax of two mills on the dollar upon

all taxable property within the state of Oregon for ihe support and maintenance of the

public elementary schools of the state of Oregon and the fund arising therefrom shall be

known as the state elementary school fund.

"Section 2. The county shall receive credit upon the amount of siate taxes required to

be paid by such county each year to the aniount of said state tax hereby levied, and the

county treasury shall on the first day of May and Noveniber of each year credit from the

general fund to ihe state elementary school fund of his county one-half of the amount of the

tax required by this act to be levied aitd collected in his county for that year.

'Section 3. Ott the first Monday in May, and at such other times during the year as

he may deem advisable, the county school superintendent shall make an apportionment of

the entire siate elementary school fund created by this act ihen in the county treasury. He

shall apportion this fund to the several districts in his county in proportion to the number

of teachers employed in the first eight grades of the public schools in the several districts;

provided, ;hat in deterttiining the total number of teachers eniployed in the first eight grades

in a school district, the number shall not exceed one teacher for every thirty pupils or

fraction thereof enrolled in tlse first eight grades of the schools of satd district for the

current year."

This law was enacted by a vote of the people in 1920. General Laws of Oregon, Special

Session, 1920, Chapter 38.

tTwenty-niiith Biennial Report, Superintendent of Public Instruction, page 71.

tHigh schools in the state may be organized as district, union, or county high schools.

INCIDENCE OF PUBLIc SCHOOL TAXATION

11

to a frequent lack of completeness of data on both levies imposed in these

districts and apportionments made to them under the laws. In a number

of countiesnotably Grant, Hood River, and Wheelerdata for four

years were collected and analyzed with a view to obtaining more nearly

representative results.

Sources of information utilized. Data on the apportionment of the

funds collected under the Two-Mill Elementary and County School Fund

laws among the various school districts of the state for the years 1927-1929,

as indicated above, were obtained from the annual reports of the schooldistrict clerks. Similar data for the year 1929-30 were obtained from the

annual reports of the county school superintendents as submitted to the

State Superintendent of Public Instruction.* Information on Special District levies, High School Tuition levies and Union High School levies, was

obtained from county assessors and from assessment and tax records in the

office of the State Tax Commission.

The maps are copies of school district maps as found in the offices of

the county school superintendents and county assessors in 1930. No claim

is made for the absolute accuracy of the boundaries of the individual

school districts. In a number of counties changes in school-district bound-

aries and consolidations of districts have taken place since that year,

but as the data in this study cover the three yetrs preceding 1930,

these maps are more appropriate than those containing the more recent

changes.

The author wishes to acknowledge his indebtedness to the various

offices and individuals who kindly and freely furnished the necessary information for this study. Special acknowledgment is due Mr. James M.

Burgess of the State Department of Education; the County School Superintendents; Mr. C. C. Chapman, Editor of the Oregon Voter; and the members of the State Tax Commission. The author wishes to give due credit

to Miss Rachael Williams for her careful work in making the almost unlimited computations in this study.

Method of procedure. In order to discover the operation of the TwoMill Elementary and County School Fund laws, the primary purpose of

this study, it was necessary to ascertain the amount levied on each school

district in the state under these laws and also the apportionment received

by each district under the same laws.

The County School Fund levies were computed ott the assessed valuations of each school district, for the three years 1927-1930, for each of

the thirty-three counties in the state having the district system of school

financing and administration.

The Two-Mill Elementary levy was likewise computed on the equal-

ized valuation of each of the school districts for the same years, the

assessed valuations having been previously changed into equalized values

consistent with their respective county ratios fixed by the State Tax Corn*Detailed information on individual school districts was collected by the State Office

of Public Instruction for the school year 1921.30.

12

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

mission. The three-year average levies under the County School Fund law,t

the three-year average levies under the Two-Mill Elementary law,t and

the combined three-year average levies under the two laws were thus obtained for each of the 2,126 school districts of the state.

The apportionments made to the individual districts under the County

School Fund and Two-Mill Elementary laws were also obtained for the

three years 1927-1930. The combined levies, three-year average, were next

compared with the combined apportionment, three-year average, for each

of the 2,126 school districts in the state.

Validity of data used. An explanation at this point of the relation of

the tax year to the public school fiscal year in the state may not be out of

place as it may lead to a better understanding of the data used and the

validity of the conclusions drawn. It is a well-recognized fact in statistics

that data numerically presented may be accurate whereas the conclusions

deducted therefrom may be wide of the mark.

The school fiscal year overlaps the tax year. In other words, during

any one school year, funds are received from tax levies on two different

tax rolls, or on tax rolls for two different years. The following facts chronologically set forth give a picture of the conditions.

Third Monday in June, 1931. Close of district school fiscal year 193031. Beginning of school year 1931-32.

November 1, 1931. County treasurer shall credit from the General

Fund to the state Elementary School Fund of his county one-half

of the amount of the tax required by law to be levied and collected

in his county for that year. (Apparently the tax levied upon the

1930 rolls.)

Second Monday in Noveniber, 1931. The county school superintendent

shall make an apportionment of the entire school fund then in the

county treasury on the second Monday in November of each year,

and at such other times during the year as he may deem advisable.

(Apparently funds from levies upon the 1930 rolls.)

November 5, 1931. Date of payment of second half of taxes levied on

1930 assessment rolls. This payment includes the second one-half

of the special school district levy on the 1930 rolls.

March 1, 1932. Assessment rolls on which taxes are levied to be collected, first half on May 5 and second half on November 5, 1933.

May 1, 1932. County treasurer shall credit from the General Fund to

the state Elementary School Fund of his county one-half of the

amount of the tax required by law to be levied and collected in

his county for that year. (Apparently the tax levied upon the 1931

assessment rolls.)

First Monday in May, 1932. On this date and at such other times during the year as lie may deem advisable, the County School Superintendent shall make an apportionment of the entire state Elementary School Fund created by the elementary school law and

then in the county treasury.

The three-year average data are used except where otherwise indicated. In the case

of a few count,es four-year average data are used. In a few individual districts data for one

or two years only are given.

INCIDENCE OF PUBLIC SCHOOL TAXATION

13

May 5, 1932. Date of payment of first one-half of taxes levied upon the

1931 rolls. This payment includes one-half of the special school

district levy on the 1931 rolls.

It is apparent from these conditions that the school year and the tax

year overlap. The apportionment of school funds made, for example, on the

second Monday in November, 1931, and the Special District School tax col-

lected on November 5, 1931, are funds obtained mainly from levies upon

the assessment rolls of 1930, whereas the apportionments made on the first

Monday in May 1932 and the Special School District tax collected May 5,

1932, are funds obtained mainly from levies upon the 1931 assessment rolls.

The situation is further complicated by the fact that the county school

fund is affected by delinquent taxes. It shares with other tax funds losses

due to delinquent taxes and likewise receives its share of back taxes paid.*

Comparisons of levies upon the assessment rolls of any one tax year

with the apportionments made during the nearest corresponding school

year are therefore not strictly valid.

In order to reduce the discrepancies to a minimum and to make the

data as nearly representative as possible all calculations are based on at

least three-year averages and in the case of a few counties on four-year

averages. The remaining discrepancies can largely be accounted for by delinquent taxes and do not invalidate the conclusions, if it may be assumed

that the percentage of delinquent taxes in the various school districts in

any one county are approximately the same. The following case will illustrate the situation:

The total amount levied under the County School Fund and Two-Mill

Elementary laws in Benton county on the assessment rolls of 1927, 1928,

and 1929, was $284,220.66. The total amount apportioned during the three

school years 1927-1930 was $277,026.27, an average annual excess of levies

over apportionments of $2,398.13 or 2.5 percent of total levies. Applying

this to the data of Benton county, Table IV, indicating operation of the

County School Fund and Two-Mill Elementary laws, the amounts under

the first column 'Amounts by which Levies Exceed Apportionments'

would in the aggregate be decreased by one-half of the $2,398.13 discrepancy and the amounts under the second column "Amounts by which Apportionments Exceed Levies" would in the aggregate be increased by onehalf of the $2,398.13 discrepancy. In other terms, the amounts in the first

column would be decreased by approximately 5 percent and the amounts

in the second column would be increased by approximately 5 percent.t

IL OPERATION OF COUNTY SCHOOL AND ELEMENTARY SCHOOL FUND LAW STATISTICALLY

PRESENTED

Basic tables. In the following tables accompanying the county schooJ

district maps the operation of the County School Fund law and the TwoMill Elementary law bver a three-year period is statistically presented. In

The Two-Mill Elementary levy is a preferred fund and is not subject to reduction

because of delinquent taxes. There have been few vtolations of this law.

tOrte-half of $2,398.13 represents approximately 5 percent of the aggregate "excess

levies over apportionments" and 'excess apportionments over levies" for Benton county.

14

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

the first part of the first column of each table are listed the school districts,

numerically arranged, that had tax levies under the above-named two laws

in excess of the apportionments made to them under the same laws. These

districts are followed by the districts, also numerically arranged, that havc

received apportionments tinder the two laws in excess of the levies made

upon them under the same laws.

In the second column, opposite the respective districts, are given the

amounts by which the levies under the laws exceed the apportionments,

and in the third column opposite their respective districts are given the

amounts by which the apportionments exceed the levies.

The author again wishes to emphasize the fact that the actual taxes

paid by the district under the County School Fund law during any one year

may be either below or in excess of the levy made upon it, owing respectively to delinquency in the payment of the tax and the payment of back

or delinquent taxes.

In the next two columns to the right in the tables are given the threeyear averages of the total combined levies of the Special School District

levies, Union High School levies, and the County Tuition Fund levies by

districts. School district levies below the weighted average levies for the

county are placed in the first of these two columns and school district

levies above the average for the county are placed in the second of these

two columns.

This method is followed with a view to indicating a correlation, or lack

thereof, between the operation of the County School Furid.and Two-Mill

Elementary School Fund laws on the one hand, and the combined Special

School District, Union High School District, and County Tuition Fund

levies on the other hand.

As the evident intent of the County School Fund and Elementary School

Fund laws is to equalize the public school tax burden among the school dis-

tricts within each county, it appears that the intent of these laws is most

nearly realized if those districts with low general school levies contribute

toward these funds in excess of the apportionments received under them,

and if those districts with high general school levies receive apportionments

in excess of the levies imposed under these laws. The arrangement of the

data will enable the reader to make the comparisons for the districts in

which he may be interested.

In the next two columns to the right are found the average assessed

valuations per school-census child for each of the school districts within

the county.5 in the first of these two columns are found the valuations of

those districts which have assessments above the weighted verage for the

county and in the second of these columns are found those valuations

which are below the county average. This arrangement presents the relation between the operation of the County School Fund and Elementary

School Fund laws on the one hand, and the tax paying ability of the school

district as measured by the assessed valuation per census child on the other.

Maps. The maps accompanying the basic tables have been added with

a view to presenting a little more vividly the areas contributing to the

The census valuations are based on the 1929 assessment rolls. Three-year averages

would have given results not appreciably different.

INCIDENCE OF PUELIC SCHOOL TAXATION

County School and Elementary School funds in excess of apportionments

received under the laws and the areas receiving apportionments in excess

of contributions made. It is evident that to the extent that errors existed

in the source material used in the calculations, the maps are in error. This

applies particularly to joint districts.

The legends on the individual maps are self.explanatory Those districts in which the levies sustained and apportionments received balance

within fifty dollars are stippled. Those districts in which the levies ex-

ceeded the apportionments by an amount exceeding fifty dollars are

shaded with diagonal lines. Those districts in which the apportionments

exceeded the levies by fifty dollars or more are left blank except for the

number of the district.

In the case of a number of maps it was found extremely difficult to

locate the district boundaries. In the case of these maps special markings

are used which are explained in the accompanying legends. The district

numbers in these maps are placed as nearly as possible over the geographical center of the district. The maps are based on three-year average data.

C)

C)

H

t,1

I1

z

H

(1)

H

H

0

z

BAKER COUNTY

H

z

EXCESS LEVIES

BALANCE

EXCESS APPROPRIATIONS

17

INCIDENCE OF PuBLIc SCHOOL TAXATION

BAKER COUNTY

TABLE III. DATA INDICATING OPERATION OF THE TWO-MILL ELEMENTARY AND COUNTY SCHOOL FUND LAWS. SPECIAL DISTRICT LEVIES

AND ASSESSED VALUATION BY SCHOOL DISTRICTS.

Total Special Dis-

trict, Union High i

Operation of the Elemen- School, and Court. Average assessed valtary and County School ty Tuition Fund uation per school-cenFund laws; three-year av- levies; three-yeai sus child by districts,

average 1927-1930 1929 assessment rolls

erage 1927-1930

Amounts iy

Amounts by

which levies which apportionments

exceed apexceed levies

portionunder the

ments under

laws

the laws

indicated

indicated

I....

$

2.

6

8..

10.

1l. I

12...

1

l4

15....

16...

19....

51993

82199

18...

1.3

3.7

20...

22.

30...

32....

33....

36..-.

40....

43...

421.52"

449.41

59...

394.92"

42

48.

17.3

10.3

10.5

5.2

2.8

5.8

3.7

1.3

8.5

2.1

1.4

3.7

10.2

7.6

1.7

71..,

9-.--

...

11.4

4.4

467.23

S2.

I

2.7

116.83

174.06

69

1

25

166.65

53.49

161.29

37

38....

39...

4t

44...

45

'

17.0

15.7

$13,917.97

186.19

249.91

47415

35.

6

18

18

20

20

18

242

97

4,603

10,183

7,663

26,36.8

9,131

7,816

18,663

6,083

23,107

15,604

13,975

19,054

13,465

9,213

20,830

9,705

12,447

61

12

53

28

14

139

17

11

45

13

32

18

46

16

32

24,512

17,571

6,553

13,376

11'

15

41

13

26,747

29,870

8,779

9,121

23,097

9

9

.

26

25

12

.7

21

31...

19,682

2.6

62----366.29"

68----410.92

37

35

21

101

26,858

3.1

153.86

52.57

8

46

18,935

13,913

18,305

9.4

75712

School

census

13,481

6.1

80.75

380.67

146.19

352.42

55.04

1,249.65

277.50

740.21

35.79

2,166.68

13.02

23

24....

25....

26_..

27----i

28....

Assessed

valuation

below the

average

for the

county

6,099

49,796

6.2

2.6

4.6

3.0

8.9

1.8

2.4

8.9

7.8

3.6

311.52

Assessed

valuation

above the

average

for the

county

$15,907

6,132

12,532

24,809

2.2

223.00

1,43567

Mills

3.1

27964

639.37

1,34273

64498

17....

Mills

2.4

15.57

93.65

768.31

575.03

669.91

7

for the

county

below

809.60

2,229.85

355.40

4

the average

Levies

above

the average

for the

county

Levies

298.67

136.37

254.59

221.40

1,393.68

823.94

'Data for two years only.

5.9

5.0

16.1

11.6

10.4

3.7

6.6

6.5

10.0

3.1

.

'

22.8

24.6

2,495

7,223

8,888

5,502

9,230

7,822

5,287

7,009

6,031

2,976

2,651

18

8

70

28

30

12

12

21

4,126

2,504

2,848

22

26

176

64

AGRICULTURAL LXPERIMENT STATION BULLETIN 306

18

BAKER COUNTY-TATII,E III (Continued).

Total Special flit

rict, Union High

Operation of the Elemen- School, and Coun Average assessed vattary and County School ty Tuition Fund uation per school-cenFund laws; three-year av- levies; three-year sus child by districts,

z

average 1927-1930] 1929 asseSsment runs

erage 1927-t930

Amounts by Amounts by

which levies which apportionments

exceed apportionexceed levies

nients under

under the

the laws

laws mdiindicated

cated

-C

0

0

-o

46..

47...

49

50...

51....

52.

53....

56....

57.

61..

63..

65....

66..

67....

74.

75..

77..

78W.

79

80

81....

$

245.24

6.00k

329.40

254.12

294.14?

299.39

416.49

782.50

226.31

1,9l7.29

6S2.05

420.51

297.37

231.61

298.78

67.84

257.63

193.80

278.3l

361.30

205.29

466.49

84....

Levies

above

the average

for the

county

Mills

Mills

35464

286.17?

83.

Levies

below

the average

for the

county

Assessed

valuation

above the

average

for the

county

10.2

14.7

$ 2,655

I

94

$ 5454

15.1

6,371

10.6

I

Assesse

valuation

below the

average

for the

county

4,826

2,688

School

census

56

39

35

49

14

7.5

16.7

11.0

I

12.9

16.5

23.2

14.9

5,479

9.7

12.5

6.4

10.3

.7

I

5.8

.7

7.4

4.1

County average

"Data for two years only.

tData for one year only or incomplete data.

9.15

1,638

3,206

3,993

188

27

4,990

15

9

11

19

11,652

8,211

11,151

I

20,045

23

18

17

7

7

7,921

...

10.2

38

3,624

3.7

....

3,131

8,346

5,319

2.7

4,896

4

13

2,589

20

4

5,276

19

INCIDENCE OF PUBLIC SCHOOL TAXATION

BENTON COUNTY

LEGEND

EXCESS LEVIES

BALANCE

EXCESS

APPROPRIATIONS

20

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

BENTON COUNTY

TABLE IV. DATA INDICATING OPERATION OF THE TWO-MILL ELEMENTARY AND COUNTY SCHOOL FUND LAWS. SPECIAL DISTRICT LEVIES

AND ASSESSED VALUATION BY SCHOOL DISTRICTS.

0

z

U

0

0

.0

C)

Total Special Dis

trict, Union High

Operation of the Elemen- School, and Coun- Average assessed valtary and County School ty ,Tuition Fund uation per school-ceoFund laws; three-year aver- levies; three-year sus child by districts,

age 1927-1930

Amounts by Amounts by

which levies which apporexceed aptionments

portionexceed levies

ments under under the

the laws

laws mdiindicated

cated

$

9C

937.19

267.88

971.53

570.17

2,480.85

1,106.79

48.95

1,096.32

7.42

18..

19....

23...

24....

26...

6.1

4.6

6.0

4-9

12.9

13.3

5.5

3-4

9.2

3.8

9.0

826.07

406.96

356.74

402.04

72.92

346.20

90.24

97.68

290.49

38..

40J.

4lJ.

5 9____

62.,.

8 1J.

83.

85....

6,139

3,504

15,175

3,072

9,418

7,871

3,426

6,206

8,246

3,849

4,582

4,787

6,449

3,528

3,458

7,432

8,524

4,813

4,753

3,702

7,078

3,067

7,167

County average

Data for one year only.

9.4

6.9

6.0

6.4

$ 2,551

3,417

31

20

37

16

15

I

16.3

15.7

15.3

17.2

4.728

3,845

3,056

7.1

5.7

6.9

11.4

7-4

25.5

9-9

14.0

11.9

8.3

3.4

4,159

3,103

3-4

11.98

67

24

1,248

97

45

57

12

301

2,219

27

129

2,859

4,091

21.8

3.4

4.8

53

28

17

28

2,622

1,342

2,576

18.6

2,175

57

24

27

147

17

21

35

20

49

17

39

39

19

21

19

3,964

15.7

10.9

School

cen"us

56

51

43

136

3,658

6,118

3,898

7.0

5.5

160.03

382.31

459.21

164.94

89.80

133.81

230.47

2,458.51

22.53

35.52

379.59

128.04

690.80

218.75

Assessed

valuation

below the

average

for the

county

$ 6,028

9-4

1,104.21

548.35

3 4___

36..,

Mills

12.9

33----93.64

29J.

Mill.5

5-4

3-9

4.1

8.0

6.2

$

17....

conty

4-5

8.36

527.47

127.89

129.56

133.72

217.85

526.68

88.74

212.09

20.74

703.70

62.19

127.82

14W.

county

8.2

4.6

7.0

5.5

300.5 1

12...

for the

18.0

155.16

505.73

8.. Ii

11....

I

Assessed

valuation

above the

average

for the

county

Levies

above

the average

for the

5.1

635.09

536.98

2..

Levies

below

the average

4.8

84077

25J.

1929 assessment rolls

average 1927-1930

15

55

2,073

1,092

2,865

1,001

2,139

1,869

648

1,582

1,279

2,876

2,087

2,110

2,900

110

22

33

152

117

135

45

15

38

38

4

34

14

INCIDENCE OF PUBLIC SCHOOL TAXATION

21

22

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

CLACKAMAS COUNTY

1'ABLE V. DATA INDICATING OPERATION OF THE TWO-MILL ELEMENTARY AND COUNTY SCHOOL FUND LAWS. SPECIAL DISTRICT LEVIES

AND ASSESSED VALUATION BY SCHOOL DISTRICTS.

Total Special Dis.

trict, Union High

Operation of the Elemen- School, and Coun- Average assessed vattary arid County School ty Tuition Fund uation per school-cenFund laws; three-year av- levies; three-year sus child by districts,

erage 1927-1930

average 1927-1930 t929 assessment rolls

Amounts by Amounts by

which levies which apporexceed aptiotinients

portionexceed levies

ments under

under the

the laws

laws mdiindicated

cated

H

I

4..'

$

10

13

14

15.

23..

25..

26..

34..

36..

37..

38.

4L.

47..

49..

53..

60.

62

64..

73..

75..

87..

88

97..

104.

115..

lOs..

123..

30lJ

306j

309J

i

263.78

320.31

61.00

1,371.80

681.93

187.67

466.23

68.44

1,781.16

57.44

9..

IL.

12_

16.,

2L.

22.

24.

27..

28

29

38..

Levies

above

the aveiage

for the

county

Mills

jt'iills

11.5

8.5

12.4

17912.79

32.81

240.55

252.66

2,795.64

977.94

lEt

12.2

18.5

20.2

21.3

10.0

10.7

17.2

11.4

10.4

21.3

21.1

18.7

100. 74

509.25

63.30

47.84

632.39

283.67

292.53

129.53

32258

7.27

1,093.81

209.48

563.61

Data for two years only.

11.6

2,572

26

2,377

3,481

4,047

5,624

5,157

4,305

2,751

13.5

10.0

13.3

11.0

2,857

28

1,437

1,518

73

34

35

56

66

1,753

105

2,555

1,556

2,612

53

105

61

17

43

64

2,648

2,555

5,131

25.8

25.4

51

.148

10

21

2,951

23.8

19.8

38

29

52

24

50

17

2,184

2,296

1,494

23.0

10.9

11.6

9-9

17.1

184

2,092

2,457

10.6

139

64

1,815

277

3,313

18.1

56

502

124

2,737

2,270

27.7

42

97

32

68

348

46

38

3,766

17.1

11.6

$ 2,585

4,401

4,990

105,383

5,093

10.3

10.4

8.3

2.02

345,45

292.05

725.34

41

4,225

5,849

10,647

13.9

275.25

39.91

1,05 1.96

948.29

156.07

310.65

4,167.38

4,646.37

10,859.81

350.15

19.22

13.39

92

3,586

4,558

3,636

7,242

3,656

School

census

28

63

39

54

3,481

6,991

3,483

10,865

3,291

9,729

19.4

4,425.20

522.10

3,867.53

37.22

average

for the

county

Assessed

valuation

below the

average

for the

county

4,086

21.6

22.3

700.43

Assessed

valuation

above the

$ 5,110

20.9

27.6

10.5

9.0

12.6

16.7

13.7

15.7

16.8

10.5

$ 8,352.13

260.82

6.

Levies

below

the average

for the

county

80

21

1,779

2,354

1,522

261

86

97

23

INCIDENCE OF PuBLIc SCHOOL TAXATION

CLACKAMAS COUNTY-TABLE V (Continued).

Total Special Dis-

trict Union High

Average assessed vatty Tuition Fund uation per school-cenlevies;

three-year

avthree-year sus child by districts,

Fund laws;

average 1927-1930 1929 assessment rolls

erage 1927-1930

of

the Elemen- School, and Coun

Operation

tary and County

School

Amounts by Amounts by

which levies which apportionrnents

exceed apexceed levies

portionunder the

ments under

laws mdithe laws

cated

indicated

$

33__

35-39--

40.

41

42

43.44..

46..

48..

50

5

54-55-.

59--

6L.

63

65

67

68

69

70

7L.

74..

76..

7 7__

7

79--

89..

83.

453.45

676.91

25.02

276.11

321.17

171.89

190.30

7743v

153.18

813.74

3,078.06

1,776.40

165.30

314.31

1,950.24

Levies

below

the average

for the

county

Levies

above

the average

for the

county

1Iil;s

Mills

22.8

14.5

12.0

9.7

12.6

13.0

10.7

12.3

92

96..

98

99--

lOU..

10 1..

15.9

12.0

106.1

107..

ItO..

21.0

3,175

3,195

19.9

9.3

14.4

13.1

10.6

15.6

10.5

10.3

18.7

14.8

11.8

22.1

9.8

10.3

11.6

25.4

22.3

12 1.37

17.6

11.1

13.5

1,521

92

80

2,382

2,307

2,339

2,254

235

38

55

106

1,617

1,268

1,598

184

256

235

33

10

1,566

1,075

2,076

23.6

19.6

16.0

19.0

9.3

18.2

11.7

38.0

33.8

24.8

17.8

3,653

3,672

18

53

161

985

1,785

26

30

61

58

1,231

51

51

2,672

2,571

2,006

1,886

2,005

2,542

1,951

2,283

2,646

1,409

1,682

1,908

917

961

3,780

11.6

School

census

$ 1,890

4,422

22.3

26.1

304.92

299.60

138.98

665.64

55,58

Assessed

valuation

below the

average

for the

county

2,356

2,921

15.2

9.0

8.3

10.0

Data for two years oniy.

4,073

10.1

287.35

413.69

553.65

70.39

361.73

316.84

3,276.94

1,326.84

563.65

392.22

$ 3,264

36.5

57.91

9l

I

32.1

188.84

238.64

587.36

1,098.90

125.78

2,193.73

average

for the

county

4,944

15.8

12.4

9.7

3 5 9.9 7

I 73.28

695.64

420.02

320.20

456.30

187.15

120.87

302.86

145.26

463.06

120.12

177.62

520.54

55.43

459.66

253.78

322.62

47.27

23.6

22.5

Assessed

valuation

above the

1,599

25

31

37

49

94

41

64

59

33

38

64

43

20

58

100

27

334

45

8

1,452

1,904

2,648

1,741

1,286

2,486

1,044

2,282

2,186

2,463

1,970

1,376

2,327

1,643

1,426

73

77

35

32

35

36

45

62

61

10

32

360

283

95

55

24

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

CLACKAMAS COUNTYTABLE V (Continued).

0

z

'0

0

0

-o

Co

rotal Special DisJtrict, Union High

Operation of the Elemen- School, and Coun- Average assessed valtary and County School i ty Tuition Fund uation per school-cenFund laws; three-year av- levies; three-year sus child by districts,

erage 1927-1930

average 1927-1930

Amounts by Amounts by

which levies which appor-Levies

exceed aptionments

below

portionexceed levies

the avments under

under the

erage

the laws

laws indi-for the

indicated

111..

112..

1 14

1l5._

116.

117..

118..

1 19_

120..

121..

122..

1 26

305

307

312J

County average

cated

$

258.11

409.69

1,552.31

3,238.31

384.34

133.74

649,76

4,226.52

581.69

267.91

127.07

240.05

58.64

155.83

524.28

Levies

above

the as'erage

County

for the

county

hulls

Mills

1929 assessment rolls

Assessed

valuation

above the

average

for the

county

9-3

17.7

15.3

Assessed

valuati

$ 1,721

1,693

1,469

1,502

1,561

27.3

20.8

$ 6,800

10.0

13.5

37.1

15.4

10.0

19.0

14.9

10.2

10.0

rt

below the

average

for the

county

School

census

51

38

244

390

29

10

59

985

1,048

392

1956

56

3,122

3,579

15

18.8

2,655

2,579

2,152

1,632

17.71

2,757

26

15

30

15

46

INCIDENCE OF PUnLIC SCHOOL TAXATION

CLATSOP COUNTY

EXCESS LEVIES

BALANCE

EXCESS APPROPRIATIONS

25

26

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

CLATSOP COUNTY

TABLE VI. DATA INDICATING OPERATION OF THE TWO-MILL ELEMENTARY AND COUNTY SCHOOL FUND LAWS. SPECIAL DISTRICT LEVIES

AND ASSESSED VALUATION BY SCHOOL DISTRICTS.

Total Special Dis-

trict, Union Higi.

Operation of the Elemen- School, and Coun- Average assessed valtary and County School Ity Tuition Fund uation per school-cenFund laws; three-year av- levies; three-year sus child by districts,

0

z

eiage 1927-1930

U

I

-u

&)

i

Amounts by Amounts by

which levies which apporexceed aptionmetits

port ionexceed levies

ments under

under the

the laws

laws mdi.

indicated

cated

Levies

below

the av-

erage

for the

county

Mills

13...

252.31

3,966.80

614.49

880.00

75.72

6,211.69

1,119.78

6,049.38

2,468.73

287.28

614.26

331.63

352.02

3,353.79

5,619.55

1,248.88

6....

7J

9-.-.

10....

16...

18...

IL...

20...

21

22...

23....

26....

29....

30....

31.

32...

42J

lylills

16.4

$ 6,767

for the

Data for two years only.

county

17.5

85

45

14

24

72

49

34

56

10

21

40

19

25

54

14

$ 2,985

11.6

4,394

2,399

2,660

1,037

4,355

23.3

14.4

20.1

16.0

13.5

3,89t

24.2

23.9

18.6

3,654

5,295

24.0

22.4

7.8

5.3

7.0

1,814

2,152

3,029

58

40

166

60

4,057

48

4,166

1,778

217

89

2,907

23

129

41

5,197

10-s

5,040

20.6

13.5

13.31

4,172

::

38

3,649

5,057

29.5

23.5

3,293

68

100

209

100

149

557

62

94

5,116

11.0

School

census

46

52,949

14,810

24,848

16,740

7,906

14,310

44,798

27,932

33,542

4.8

11.8

County average

for the

11,421

9-3

5.5

average

28,997

8,724

23,657

13.4

10.9

Assessed

valuation

below the

16,376

7,972

14.1

264.65

1,094.07

299.03

1,039.01

512.19

1,036.87v

3 9....

County

Assessed

valuation

above the

average

for the

county

2.9

5.1

5-I

9.3

5.3

240.11

45.92

38...

Levies

above

the average

8.1

5.0

5.8

5-9

4.9

$14,687.82

246.34

744.17

1,554.18

1,139.00

1,828.08

536.23

1,748.66

320.00

480.75

114.84

596.96

511.73

1,029.15

323.99

2:...

1929 assessment rolls

average 1927-1930

4,800

43

19

INCIDENCE or PUBLIC ScHooL TAXATION

COLUMBIA COUNTY

_____ EXCESS ESIES

BALANCE

EXCESS APPROPRIATIONS

27

28

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

CORUMBIA COUNTY

TABLE VII. DATA INDICATING OPERATION OF THE TWO-MILL ELEMENTARY AND COUNTY SCHOOL FUND LAWS. SPECIAL DISTRICT LEVIES

AND ASSESSED VALUATION BY SCHOOL DISTRICTS.

Total Special Djs.

I

rict, Union High

Operation of the Eteinen. School, and Coun. Average assessed valtary and County School y Tuition Fund uation per school-cenFund laws; three.year av- evies; three-year sus child by districts,

erage 1927-1930

S

c

1J.-

Amounts by Amounts by

which levies which apporexceed aptionments

portionexceed levies

ments under

under the

the laws

laws mdiindicated

cated

$ 2,144.15

42J..

4 3...

47....

49J..

Mills

Mills

8.8

14.5

7.5

$ 3,840.66

339.21

2,162.80

3,180.9l

12.7

220.77

792.45

2,188.40

162.76

550.58

182.22

133.70

1,026.33

1,293.59

264.08

1,447.72

21....

23....

25....

29....

30....

32...

33....'

224.04

34....

35....

36....

3 7...

57.31

271.93

356.43

348.19

459.73

596.67

543.78

88.01

84.87

422.16

749.40

388.91

39.--.

44...

45....

48....

5 0....

54.

57....

58....

County average.

Data for two years only.

School

census

317

7,046

7,359

4,877

3,816

24.2

20:2

-

I

11,336

4,239

61,318

5,185

26,713

4,885

7,799

16,550

3,003

6,045

3,190

74

14

109

63

138

29

58

17

48

$ 2,395

10

27

25

35

95

73

886

5826

30

5,479

13,741

85

23

2,059

23.6

20.6

26.9

1,787

1,645

3,066

17.1

H

2,255

1,263

59

526

138

87

19.2

1,111

31.7

19.9

75

2,037

2,322

534

36

1,724

4

1,346

1,579

2,490

1,147

768

2,541

2,309

2,199

1,803

1,661

1,200

669

612

112

190

62

164

145

24

36

19.3

30.3

18.5

29.3

20.4

8,123

3,083

11.8

33.7

43.0

1, 106.3

Assessed

valuation

below the

average

for the

county

$ 3,718

29.5

22 0. 5 5

12....

13....

15....

16....

19....

cotenty

7.6

13.5

15.2

501.34

1,841.33

4,063.06

442.97

1,159.57

1,380.66

7J..

Assessed

valuation

above the

average

for the

county

erage

for the

20.1

2,80021

9...

ll...JI

Levies

above

8.0

12.5

8.5

7.4

758.83

1,126.10

144.63

438.73

2...

tl1e av-

10.1

5,71 1.65

38....

40....

Levies

below

the average

for the

county

7.4

12.8

13.7

14.4

17.7

17.4

1, 549.2 1

134.69

711.42

285.95

83.69

1,209.70

56.87

28J..

verage 1927-1930 1929 assessment rolls

13.3

18.0

28.6

27.2

28.8

13.0

37.6

56.8

22.6

6.1

12.7

3,076

8,106

52

16

52

44

49

51

31

62

30.3

22.3

2,256

1,294

1,438

18.22

2,931

i

6

49

66

93

INCIDENCE OF PUBLIC SCHOOL TAXATION

COOS COUNTY

EGEN

EXCESS LEVIES

BALANCE

EXCESS APPROPRIATIONS

29

30

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

COOS COUNTY

TABLE VIII. DATA INDICATING OPERATION OF THE TWO-MILL ELEMENTARY AND COUNTY SCHOOL FUND LAWS. SPECIAL DISTRICT LEVIES

AND ASSESSED VALUATION BY SCHOOL DISTRICTS.

'Total Special District, Union High i

0

z

5)

0

0

.0

((I

Operation of the Eleinen- School, and Coun- Average assessed valtary and County School ty Tuition Fund uation per school-cenFund laws; three-year ay. evjes; three-year sus child by districts,

erage 1927-1930

A.nostnts by Amounts by

which levies which apporexceed aptioninents

portion.

exceed levies

ments under

under the

the laws

laws mdiindicated

rated

$

202.16

1,708.95

140.64

647.86

1,500.71

526.86

18.2

1.6

5.8

17.3

3.3

16.5

21.6

15.5

4.1

4.2

4.2

8.4

3.8

17.8

9.8

4-3

7.6

5.8

5.7

4.8

15.4

9.9

7.2

12.46

2,378.20

2,561.79

39.-

3.3

10.0

11.4

4.3

100.24

10,868.55

578.37

9,480.53

1,053.92

416.91

18.2

18.0

5.1

13.6

439.79

79.58

152.55

317.16

383.08

7,174.24

14.6

21.8

19.1

22.4

137

142

46

86

1,689

33

23

42

12

HI

is

43

45

27

12

139

15

55

43

32

76

17

32

11

13

12

59

11

35

16

8

16

19

10

15

3,626

2,651

3.0

5.9

15.3

School

census

37

29

3,115

1,824

3,254

1,893

2,022

3,120

3,251

22.2

20.7

21.1

221.72

274.47

$ 3,111

2,795

7.2

3.9

$

5,100

4,987

4,472

9,224

5,566

46,567

4,877

5,903

7,706

5,434

10,700

20,647

11,548

7,887

5,038

4,753

22,847

8,673

9,154

6,964

6,550

8,825

12,971

5,851

12,096

71,672

5,572

12,656

12,496

8,468

6,183

6,659

5.1

16.19

218.96

1,014.66

606.78

29.46

213.46

31..

i

5-9

ccsuntv

5,266

3,400

3,754

19.9

2. 1

Assessed

valuat ion

below the

aversge

for the

$ 4,076

I

5.3

5 74.93

386.51

29

Mills

10.8

375.80

13..

18..

Mills

Assessed

valuation

above the

average

for the

county

16.5

43-33

26..

28..

County

Levies

above

the sverage

for the

couttty

11129 assessment rolls

20.0

711.10

780.65

3,753.31

643.30

23.46

1,476.76

756.06

1,366.52

1,505.41

7,534.10

235.77

589.44

257.10

4,381.26

3,818.65

557.86

884.28

IL.

Levies

below

the average

for the

19.5

172.95

129.8 7

2

average 1927-1930

3,831

3,406

3,680

90

881

55

1,303

204

23

41

38

64

336

31

22

1,442

1,661

15

656

31

INCIDENCE OF PUBLIC SCHOOL TAXATION

COOS COUNTY-TABLE VIII (Continued).

z0

0

0

0

.0

Total Special District, Union High

Operation of the Elemen- School, and Coun- Average assessed vattary and County School ty Tuition Fund uatlon per school-cenFund laws; three-year av- levies; three-yea sus child by districts,

erage 1927.1930

average 1927.1930 1929 assessment rolls

Amounts by Amounts by

which levies which apporexceed aptionments

exceed levies

portionunder the

ntents under

laws mdithe laws

indicated

cated

68...

273.52

473-47

265.43

2,648.79

90.57

5,338.49

856.65

107.810

208.30

72.

555 .45

.13

46

4 7__

48

49.-

Si5 4____

60...

66....

69..

220.58

1,350.49

237.91

189.95

2,446.96

201.23

975.83

269.95

7 4___.

7 7...

Ii....

63...

90

91....

2J.

County average

5Data not complete.

Levies

below

the av-

Levies

above

the average

erage

for the

county

for the

county

Mills

Mills

12.2

Assessed

valuation

above the

average

for the

county

21.3

16.9

19.1

$ 4,936

4,226

13.1

20.9

7-4

20.2

4,368

4.0

20.6

7.0

6.0

4,043

25.3

3.3

8.3

4,570

21.7

12.3

17.6

6.0

15.76

Assessed H

valuation

below the

average

for the

county

School

census

$ 2,307

3,121

43

67

1,601

213

14

34

2,148

2,343

I

3,018

2,482

3,180

2,585

2,320

--

2,073

2,942

1,109

4,330

I

507

45

63

23

24

35

18

166

26

12

341

18

68

13

3,282

32

AGRICULTURAL EXPERIMENT STATION BULLETIN 306

CROOK COUNTY

Crook county has the County Unit plan of organization. The assessed

valuation of all taxable property in the county on the 1929 rolls was $5,722,610, and the equalized valuation $5,453,995.85. The school census was 938,

representing an average equalized value per school-census child of $5,814.

The state average for the year was $4,321.

INCIDENCE OF PuBLIc SCHOOL TAXATION

CURRY COUNTY

_____

CXCESS LEVIES

8LANC

EXCESS )PROPRATIONS

33

34

AGRICULTU1AL EXPERIMENT STATION BULLETIN 306

CURRY COUNTY

TABLE IX. DATA INDICATING OPERATION OF THE TWO-MILL ELEMENTARY AND COUNTY SCHOOL FUND LAWS. SPECIAL DISTRICT LEVIES

AND ASSESSED VALUATION BY SCHOOL DISTRICTS.

Total Special Dis-

a

U

I

1average 1927.1930 1929 assessment rolls

erage 1927-1931

Amounts ' Amounts by

which levies which apporexceed aptionments

portionexceed levies

ments under

under the

the laws

laws mdi.

indicated

cated

I

0

ci

i'D

$

421.57

1,480.60

608.21

155.87

County average

Mills

12.4

$33,049

8,666

9,638

8,368

15.1

8.3

4.32

15.9

14.3

14.6

24.7

13.8

366.19

12.1

119.71

12.3

377-39

27.70

49.05

911.07

8

27

$ 6,067

-

6,334

15,911

145.35

50.61

44 t .09

355.21

4,901

10,515

5,019

1,515

3,226

2,065

17,056

13.6

12.00