Document 13263645

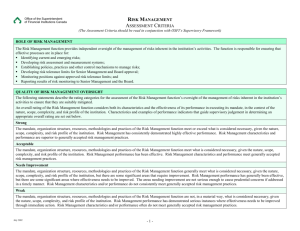

advertisement