ALL STUDENTS: APPLYING FOR FEDERAL STUDENT AID 2014-2015 Award Year

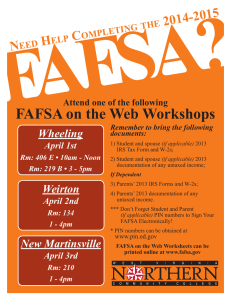

advertisement

ALL STUDENTS: APPLYING FOR FEDERAL STUDENT AID 2014-2015 Award Year Any student who will begin school on/after July 1, 2014, or any continuing student remaining in school on/after July 1, 2014, who would like to apply for financial aid, will need to complete a Free Application for Federal Student Aid (FAFSA). For 2014-2015. Please read this information carefully before beginning your financial aid application. Completing and submitting the FAFSA is free. The FAFSA will allow the Department of Education (ED) and the financial aid staff at MJI to determine the type of financial aid AND the amount of financial you and your family are eligible to receive. If you do not fill out the FAFSA, you could be missing out on financial aid opportunities! Be sure to list MJI’s school code (032843) on the application so that MJI will receive your information. Please also see “TIPS”. Step 1: Students completing the FAFSA application first need to obtain a PIN# to electronically sign the application. If you are a dependent student, your parent(s) will also need to obtain a PIN#. If you are unsure if you are considered a dependent or independent student, please see TIPS. Your PIN serves as your electronic signature and provides access your Federal Student Aid records online. Do not share it with anyone! Students completing a FAFSA for the first time can apply for a PIN in advance or at the time the FAFSA is completed. Continuing students who completed a FAFSA for a prior year may receive a FAFSA Renewal application notification. It will be sent to the email address provided on the previous application. You will also need to have your pin# accessible to electronically sign your updated application for the 2014-15 award year or to complete a FAFSA through the complete application process. Please access the PIN site to apply for a PIN or to reset it if you do not remember your PIN from prior years: www.pin.ed.gov Step 2: Complete the FAFSA or FAFSA renewal. To complete the FAFSA, please access the site at: FAFSA.ed.gov. Instructions can be found on the FAFSA itself in the "Help and Hints" box on the right of each page. For more detailed instructions, please access Instructions for Applying for Federal Financial Aid Online or Continuing Students: Instructions for Returning Students Applying for Federal Financial Aid Online. For more information about Federal Student Aid, please visit www.studentaid.ed.gov Step 3: Verification: Some students applying for financial aid will be selected by the Department of Education (ED) for a process called verification. If you were selected for verification you will be required to fill out a verification worksheet and provide to the financial aid office proof of income and supporting documentation such as, but not limited to: - US Tax return transcript (if you didn’t use the IRS Data Retrieval Tool when filing the FAFSA) Signed Foreign tax return Copies of your W-2, if requested (or foreign equivalent) Proof / supporting documents for untaxed income A copy of your high school transcript or diploma Documentation proving child support paid Food Stamp (or SNAP) certification ED uses various verification groups to identify what data elements are to be verified. The group designation determines the documents needed. If you are selected for verification, the verification group and required paperwork will be explained to you. See Verification Tracking Groups for more information. Please be in touch with your financial aid counselor 3 days after submitting your FAFSA to determine if you were selected for verification and to receive further instructions. Do not submit any additional supporting documentation unless you are requested to do so. The verification forms are to be completed through the student portal. Step 4: Award Notification: An award letter will be sent to your MJI email address. The awards are based on the information included on the FAFSA and the number of credits you will be taking. Twelve or more credits per term is considered full time. Awards are adjusted for course loads of less than 12 credits per term. Credits may be taken through online courses, onsite at an MJI campus or by taking approved courses at eligible Host Schools (for those attending through Study Abroad). Step 5: Additional Assistance: For information about the financial aid available at MJI, please refer to the ACADEMIC CATALOG & STUDENT HANDBOOK, pages 46-56. The MJI Catalog can be found: Academics | Michigan Jewish Institute. You may also access the Financial Aid page of the MJI website at: http://www.mji.edu/templates/mji/article_cdo/aid/569659/jewish/Financial-Aid-Office.htm For more information about Federal Student Aid please visit www.studentaid.ed.gov. You may also contact MJI's financial aid office at 02-547-8000 X 3 or 248-525-6833 x 300 (Israel office) / 248-414-6900 X 102 (U.S. office). v.140622 TIPS: Review before completing the FAFSA Am I Dependent or Independent? In order to apply for the Federal Financial Aid, it is important that each student determine their dependency status prior to completing the FAFSA. Please answer the following questions by placing a check mark on the appropriate line (refer to the FAFSA instructions if you believe you meet the definition of an unaccompanied youth, are homeless or at risk of being homeless): YES NO ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ Were you born before January 1, 1991? Are you married as of the date the FAFSA is being completed? (answer yes if separated but not divorced) At the beginning of 2014-15 school year, will you be working on master’s or doctorate program? Are you a veteran of the U.S. Armed Forces; OR, serving on active duty for purposes other than training? Do you have children who will receive more than 50% of your support? Do you have dependents (other than your children or spouse) who live with you for whom you provide more than 50% support? Will you be enrolled in a graduate or professional program (you already have an undergraduate degree)? Are you an orphan; OR, were you at any time since age 13, in foster care or a ward of the court? If you answered “YES” to ANY of the questions above, you will need to gather the following documents (do not send them to MJI unless requested to do so): - Social Security Card – the name on the FAFSA should match the Social Security card. For information on how to update or correct the name on the Social Security card, call SSA at 1-800-772-1213 or go to their website at www.ssa.gov. - US passport, or Resident Card (Green Card) if applicable - If your spouse is not a US citizen, a statement to certify foreign residency may be required - Proof of HS Graduation* or equivalent if applicable (Original Diploma, GED certificate, etc.) - A copy of 2013 US tax return (yours and/or your spouse’s if filed separately): - It is recommended that you use the IRS Data Retrieval Tool while completing the FAFSA; OR - A copy of your 2013 signed Federal Tax returns (1040, 1040A, 1040EZ) - A copy of your spouse’s 2013 signed Federal Tax returns (1040, 1040A, 1040EZ) - If you or your spouse were not required to file a US tax return, or your spouse was not included on the US return: - A copy of foreign return (Israeli 1301, 106, Tofas Shuma, דו"ח שומהetc.). - A copy of your spouse’s foreign return - If you and your spouse filed separate returns, contact MJI’s FA office for assistance - Other income information for you (and your spouse, if married): - Other untaxed income or financial support (financial support from family, bituachi leumi (National Insurance), etc.) - Current asset information for you (and your spouse, if married), such as bank accounts, investment, business value, etc. If you answered “NO” to ALL of the questions above, you will need to gather the following documents (do not send them to MJI unless requested to do so): - Social Security Card - US passport, or Resident Card (Green Card) if applicable - If either parent is not a US citizen, a statement to certify foreign residency may be required - Parent’s Resident (Green Card) if applicable - Proof of your H.S. Graduation* or equivalent if applicable (Original Diploma, GED certificate, etc.) - A copy of your 2013 US tax return: - It is recommended that you use the IRS Data Retrieval Tool while completing the FAFSA; OR - A copy of your 2013 signed Federal Tax returns (1040, 1040A, 1040EZ) - A copy of your parent’s 2013 signed Federal Tax returns (1040, 1040A, 1040EZ) - If you or your parent’s are not required to file a US tax return: - A copy of foreign return (Israeli 1301, 106, Tofas Shuma, דו"ח שומהetc.). - A copy of your parent’s foreign return (Israeli 1301, 106, Tofas Shuma, דו"ח שומהetc.). - Other income information for you and your parent’s: - Other untaxed income or financial support (bituachi leumi, etc.) - Current asset information for you and your parent’s, such as bank accounts, investment, business value, etc. High School Graduation: If you graduated from a High School outside of the US, it must be the equivalent of a US High School diploma. For example: a Bagrut Certificate or Mechina Certificate. Please contact MJI’s admissions department if you are unsure if you meet the High School Graduation requirements. v.140622 Tax Return Requirements: If you, or your spouse (if married), or your parent’s (if dependent) were required by U.S. law to file U.S. tax returns and did not do so, a return must be filed. If you have not filed at the time the FAFSA is completed, you may estimate the information requested and then update it when the return is filed. If you filed both a US return and a foreign return, use the information from the US return to complete the FAFSA. Not certain if you need to file a US return? Please refer to the following links to the IRS website: o Do You Need to File a Federal Income Tax Return? o U.S. Citizens and Resident Aliens Abroad - Filing Requirements o U.S.-Citizens-and-Resident-Aliens-Abroad Note: We are not U.S tax experts. If you have specific questions regarding your obligation to file tax returns, your filing status etc., please consult with a U.S. tax professional. If you do not file a return, you may be asked to provide proof that you did not and were not required to file a U.S. tax return. The table below is provided on the IRS website (Publication 17, page 5) as a general reference, as noted, it does not cover all tax filing requirements: IF your filing status is…. AND at the end of 2013 you were... THEN file a return if your gross income was at least... single under 65 $10,000 65 or older $11,500 under 65 (both spouses) $20,000 65 or older (one spouse) $21,200 65 or older (both spouses) $22,400 married filing separately any age $ 3,900 head of household under 65 $12,850 65 or older $14,350 under 65 $16,100 65 or older $17,300 married filing jointly qualifying widow(er) with dependent child * If you were born on January 1, 1949, you are considered to be age 65 at the end of 2013. ** Gross income means all income you received in the form of money, goods, property, and services that is not exempt from tax, including any income from sources outside the United States or from the sale of your main home (even if you can exclude part or all of it). Do not include any social security benefits unless (a) you are married filing a separate return and you lived with your spouse at any time during 2013 or (b) one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than $25,000 ($32,000 if married filing jointly). If (a) or (b) applies, see the Instructions for Form 1040 or 1040A or Publication 915 to figure the taxable part of social security benefits you must include in gross income. Gross income includes gains, but not losses, reported on Form 8949 or Schedule D. Gross income from a business means, for example, the amount on Schedule C, line 7, or Schedule F, line 9. But, in figuring gross income, do not reduce your income by any losses, including any loss on Schedule C, line 7, or Schedule F, line 9. *** If you did not live with your spouse at the end of 2013 (or on the date your spouse died) and your gross income was at least $3,900, you must file a return regardless of your age. U.S. Citizens or Resident Aliens Living Abroad To determine whether you must file a return, include in your gross income any income you earned or received abroad, including any income you can exclude under the foreign earned income exclusion. For more information on special tax rules that may apply to you, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad. v.140622