Preliminary draft James D. Shilling and Tien Foo Sing

advertisement

Preliminary draft

Paper to be presented at the 2006 Annual ASSA-AREUEA Conference, Boston

Why is the real estate market an oligopoly?

James D. Shilling*1 and Tien Foo Sing*2

Date: 30 March 2006

Abstract

This paper demonstrates that there is a positive incentive for firms to concentrate in local

real estate markets but not for the reasons cited by Eaton and Schmitt (1994). Eaton and

Schmitt argue that high concentration rates for manufacturing firms are the result of

economies of scope and scale in the use of flexible manufacturing techniques. In real

estate, however, these economies do not exist. We show that the incentives for real estate

firms to concentrate generally increase with capacity constraints and decrease with

product variety. We further find that real estate firms have a preference for investing in

their local trade area or submarket. These findings provide a plausible resolution of the

different concentration ratios found in local and national real estate markets.

Key words (JEL Classification): Market Structure (L13), Economics of Information

(L15), Reputation.

*1

*2

School of Business, University of Wisconsin – Madison (jshilling@bus.wisc.edu)

Department of Real Estate, National University of Singapore (rststf@nus.edu.sg)

1

Why is the real estate market an oligopoly?

1.

Introduction

What we attempt to do in this paper is to offer a theory that explains why real estate

markets at a local level tend to be dominated by a small number of firms who are able to

exert some (but not complete monopoly) control over supply and market prices, and why

real estate markets at a national level have a market concentration ratio that is very close

to zero. 1 Research in industrial organization has long been concerned with explaining

why some markets have a high concentration ratio and why other markets have a low

concentration ratio. Perhaps the most basic finding in this long stream of literature is that

markets may be concentrated for a variety of reasons, for example, because of scale

economies (Baumol, 1982; Baumol, Panzar and Willig, 1983; Eaton and Lemche, 1991;

Eaton and Schmitt, 1994; and Mazzeo, 2002) or natural barriers to entry (Kreps and

Wilson, 1982; Shapiro, 1982 and 1983; Allen, 1984; Fudenberg and Kreps, 1987; Tadelis,

1999; and Hörner, 2002). 2

The analysis in this paper is patterned somewhat after that of Eaton and Schmitt (1994).

Eaton and Schmitt develop a model in which firms locate strategically and integrate

vertically in order to manage the production of a mix of differentiated goods more

efficiently. The resulting cost savings are passed onto consumers in the form of lower

prices. Because vertical integration is involved (through preemption and merger, or

equivalently through cartels), this leads to a high level of (both local and national) market

concentration (though not necessarily a monopolization) in which no more than a few

firms (at most) are needed to supply the market most efficiently.

An important problem with the Eaton-Schmitt theory (at least when it comes to

explaining why local real estate markets are highly concentrated) is that it is based on the

premise that firms can produce an array of differentiated products by using flexible

techniques that exhibit economies of scope. In real estate, however, these economies do

not exist. As a result, a highly concentrated local real estate market (in the context of

Eaton and Schmitt’s model) would not be welfare optimal.

The theory that we develop in the present paper explicitly recognizes this limit. We

assume that real estate firms produce a homogenous good with no degree of

differentiation (except for location) with an inflexible production function. We further

assume that the marketplace defines the parameters of the firm’s supply function by

imposing a maximum density constraint. We then build a model with two city centroids

located at the extreme ends of the linear city. We find that real estate firms have a

preference for investing in their local trade area or submarket, as many observers suggest.

This is because different developers can minimize their costs of production by investing

1

2

High concentration ratios in local real estate markets have been documented by Forgey, Mullendore,

and Rutherford (1997). Low concentration ratios in national real estate markets have documented by

Burt, Guilarte, Rader, and Yasuda (2002).

Still other reasons include predatory price practices (Spence, 1979; Rosenthal, 1981; and Milgrom and

Roberts, 1982a and 1982b).

2

entirely within their respective trade areas. We also find that capacity constraints can

cause market concentration (though not necessarily monopolization) to be welfareoptimal when properties in different locations are highly substitutable. 3

These findings provide a plausible resolution of the different concentration ratios found

in local and national real estate markets. Another mystery that may be resolved is why

expected returns on real estate development are high (because of the existence of some

market power).

The paper is organized into seven sections. Section 1 gives the motivation of the paper

with brief review of literature in industrial organization. Section 2 defines the basic

model assumptions. In a static duopoly framework, Section 3 shows that capacity

constraints and developer’s quality are two factors that support Betrand’s equilibrium in

real estate market. In Section 4, we extend the duopoly model to incorporate Hotelling

spatial structure that reflects the case of a bi-nodal urban market. The rigidity of land

market is reflected in the model. Section 5 discusses possible extensions to the multinodal model. Section 6 concludes with recommendations for future extension.

2.

Basic Model Assumptions

The basic model is developed on the Bertrand framework with two players each of the

player will compete in a real estate submarket that is fixed in their respective location, xi.

In Betrand model, the products sold by the two developers are undifferentiated and they

are perfect substitutes in buyer’s demand function, which can be represented as follow:

Di(pi, pj) = a – bpi + dpj

(1)

where pi and pj represent respective prices set by the two developers such that they would

maximize their profit at given cost functions. The coefficients b and d denote the

elasticity of demand with respects to changes in prices of properties i and j, where [i ≠ j] 4 ,

assuming that both are located in the same city, xi. The two properties are of the same

type, m, and the degree of substitution between the two properties is represented by a

cross-elasticity of substitution variable, d, such that [0 < d < b].

In a market where buyers are assumed to have perfect information of product prices, they

would maximize their utility functions by purchasing properties from the developer that

offers the lowest price. The duopoly developers will compete only on pricing strategies,

and they would always supply the quantity to meet whatever demand in the market. If the

cost functions of both developer are also identical, c, the demand functions for developer

i denoted by Di(.), will be given as follow:

3

4

These results extend the findings of Sommerville (1999), and Ong, Sing, and Lee (2004).

The denotation i and j are used synonymously and interchangeably to represent the two properties

modeled in the study or the two rivalry developers that develop the properties respectively. If [i = j],

the two properties are developed by the same developer, and the market is a monopoly.

3

⎧ D( Pi ) if pi < p j

⎪

⎪

⎪⎪

Di ( pi , p j ) = ⎨ D( Pi ) / 2 if pi = p j

⎪

⎪

⎪

⎪⎩ 0

if pi > p j

(2)

The above demand function implies that developer i could charge a price that is

marginally below the price of developer j, and corner the market. If the market is Paretoefficient, developer j will react to the pricing strategy of his rival developer i by reducing

their price correspondingly to a level that is lower than that of developer i and take over

the entire market from developer i. The pricing reactions of the two developers will be

repeated infinitely until the Nash equilibrium is attained, which is represented by, [pi = pj

= c]. At the equilibrium, the market demand is equally distributed between the two

developers, and the two developers earn zero profit at this point.

In Bertrand’s equilibrium, competition between the duopoly developers will drive down

the property price to the cost level, at which the two developers both make zero profit.

This strategy as proposed in Bertrand’s world is sustainable, if no predatory pricing

strategy is anticipated and the game is static in nature. Is the outcome of Bertrand’s

model realistic? If not, why do we still observe an oligopoly market structure for real

estate market? If Bertrand’s output is not welfare optimal, why haven’t we expected more

active mergers and competitive preemptions by incumbent developers that will lead to

more a concentrated / monopoly real estate market?

The following sections explore unique factors inherent in real estate market help explain

the Bertrand Paradox when applied to a real estate market. We would start off with a

complete information market where products are undifferentiated. The assumptions are

subsequently relaxed when the distance to city centroid is captured in the model using the

Hotelling’s kernel of linear city to further decipher why the paradox that is not supported

in real estate markets.

3.

A mono-centric city model

Based on the demand structure defined in equation 1, the distance effect is controlled

since [xi = xj], i.e. the two developers competing in a mono-centric, where properties built

by the two developers are fixed in one location, i.e. the price and quantity relationships of

the outputs are distance independent. The Bertrand paradox is solved by purely

examining the pricing reactions at the sub-game Nash equilibrium point. The Bertrand

model is then extended into a two-period game when the price strategies information of

the follower is not revealed. In the next section, we further relax the assumption by

allowing expanding the mono-centric city to multi-nodal or multi-nuclei models, where

the spatial feature is captured using Hotelling’s linear city kernel.

4

3.1

Supply-Side Capacity Constraint

The supply of land is inelastic, and building that can be built on the land is also controlled

by zoning restriction. There is a maximum density of new units / space that can be

developed on a land parcel in a city at xi, that is [ qi + q j ≤ q ]. The capacity constraint,

which restricts the supply of real estate by each of the developers, is represented by

dividing the total quantity of output by a fraction, δ where [0 ≤ δ ≤ 1], below:

D1 ( p1 , p 2 ) = q1 = δ × q

(3a)

D 2( p1 , p2 ) = q2 = (1 − δ ) × q

(3b)

In a market with inelastic price function, pi, and fixed marginal cost, c, the profit

functions for the two developers, πi, are represented below:

(4a)

π 1 = ( p1 − c)δ q

(4b)

π 2 = ( p 2 − c )(1 − δ )q

Given that the market is Pareto-efficient, the two developers will earn an equal profit, i.e.

[π1 = π2] by setting the Nash equilibrium prices at:

⎛1− δ

p1* = ⎜

⎝ δ

⎛ δ

p 2* = ⎜

⎝1− δ

⎛ 2δ − 1 ⎞

⎞

⎟c

⎟ p2 + ⎜

⎝ δ ⎠

⎠

⎛ 2δ − 1 ⎞

⎞

⎟c

⎟ p1 − ⎜

⎝ 1−δ ⎠

⎠

(5a)

(5b)

Based on the demand structure given by equation (1), the equilibrium demands for the

real estate outputs by the two developers are derived as follows:

⎡ (b − (b + d )δ ) p1 − (2δ − 1)d .c ⎤

q1* = a − ⎢

⎥

1−δ

⎣

⎦

⎡ (δ (b + d ) − d ) p 2 − (2δ − 1)c ⎤

q 2* = a − ⎢

⎥

δ

⎣

⎦

(6a)

(6b)

By fixing selected parameters in equations 6(a and b), we numerically analyze the effects

of changes in b and d on δm, a fraction of maximum market demand that will eliminate

developer 2 from the market by setting the profit function of developer 2 equal to zero as

follows:

π 2 = ( p 2 − c)q 2* (b, d , δ m ) = 0

(7)

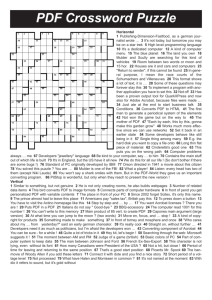

Figure 1 shows δm, which is known as a monopoly market constraint, is inversely related

to the elasticity of demand, but positively related to the cross-elasticity of substitutions.

When the degree of substitution between the two outputs increases, developer 1 is

5

required to acquire a higher fraction of market demand in order to eliminate the rival

developer 2 from the market. On the other hand, the fraction of monopoly demand

decreases when the elasticity of demand, b, increases. Developer 1 acquires the entire

market share if the market is elasticity that is when [b ≤ 0.3]. When a market is highly

elastic, and when the two properties by developers 1 and 2 are highly substitutable, we

are more likely to expect a highly concentrated market.

Proposition 1:

Capacity constraint,δ, in a duopoly market is a function of the demand elasticity, b, and

cross elasticity of substitution, d. In a market with highly substitutable products, and

where buyers are less insensitive to price changes, i.e. inelastic demand, a developer

requires a higher capacity constraint of δm in order to preempt entrants and earn

monopoly return.

The above results imply that in a mass market, where properties are highly substitutable,

it requires developer to have capacity to increase its market share to a substantial level,

δm, before it can preempt potential entrants and earn a monopoly return. Therefore, in a

perfectly substitutable market, we would expect to see only few large developers that

monopolize the market. In this market, such as in the low cost housing segment, it is

more difficult to eliminate entrants unless the incumbent has a strong capacity that will

enable him to possess a high market share. The low cost housing markets in many

countries are a typical example of a monopoly market. In mid- and upper priced private

condominium markets, where buyers are more price sensitive and the demand elasticity is

high, the market is not likely to be monopolized by a single developer. There exist

several developers neither of them controls a majority market share. Developers will have

to raise the stake in the market to δm to eliminate entrants, and it is more costly to obtain a

monopoly control in the market.

6

1.00

0.95

0.90

0.85

0.80

0.75

0.70

0.60

0.55

0.50

Elasti

city o

f Dem

and, (

b)

4.

1.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

0.65

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

Fraction of maximum market demand, (δ)

Figure 1: Capacity Constraint and demand structure

oss

Cr

i

s tic

ela

ty

of

n,

tio

u

t

i

t

bs

su

(d )

Differentiated products in a multi-nodal urban land market

The duopoly model is further extended by incorporating spatial features of properties

using Hotelling’s linear city kernel. In the model, property space are differentiated by a

distance and a quantity vector as

(x, q) = [(x1, q1), (x2, q2), …. ,(xN, qN)]

(8)

where xi denotes the distance of properties measured from a fixed node, X m , where [m =

(1, 2)] indicates a bi-nodal urban market, and qi denotes the quantity of property

developed at each location at a distance xi. The distance vector is a continuous function

that increases in an equally space distance, n = ( X 2 − X 1 ) N , over the entire linear space

of N, where [x1 < x2 < x3 <….. xN].

4.1.

Differentiated markets in a bi-nodal city

Unlike in Eaton and Schmitt (1994) model in which equation (8) is used to describe a

flexible production technology, where X m represents a basic product and xi represents a

product variant that is manufactured at a unit incremental cost of r. The production cost

7

increases as the product variant, xi, contains feature that is further away from the attribute

space of the basic product, r (| xi − X m |) .

In our duopoly model involving two rival developers who develop properties of

homogeneous type spaced out over a linear city with two centroids at X 1 and X 2 . The

two developers are assumed to have established market recognition and competitive edge

in their respective home markets at X i , such that they possess cost advantage in location

closer to the home-base. They would incur higher costs when they move further away

from their home-market. The marginal development costs for developers in a bi-nodal

market with two centroids located at the two extreme end of the city are an increasing

function as represented by Figure 2.

The marginal costs incurred by the developers when producing a unit of property at

location, xi, consist of c and r. c is the variable cost that is location independent, and is

related to the type of property. Since the market produces only one homogeneous type of

property, the unit variable cost is assumed to be constant for both developers. The second

marginal cost is associated with the distance from the centroids, r (| xi − X m |) . It is

incurred as a result of the need of the developers to move resources from the home-base

to the product location because of the fixity in the location of the outputs. For every

parcel of land at xi with a fixed and equal density qi, the fixed cost incurred in acquiring

the site is assumed to be the same at K across the entire linear city of a distance of not

more than (| X 2 − X 1 |) . Given that the entire city is divided into a maximum of N

parcels of equally spaced land, the unit land size is represented by a linear scale of

[n = ( X 2 − X 1 ) N ] . Based on the above assumptions, the total cost function for the two

developers could then be represented as follows:

[

]

(9a)

[

]

(9b)

C1 ( xi ) = (c + r )( xi − X 1 ) D1 ( p1 , p 2 ) − n( xi − X 1 ) K

C 2 ( xi ) = (c + r )( X 2 − xi ) D2 ( p1 , p 2 ) − n( X 2 − xi ) K

where qi = Di ( p1 , p 2 ) is the aggregate market demand, on which the capacity constraint

of each developer can be further imposed as a fraction of the maximum density, q , for

each land parcel at xi, that is (qi = δ .q) .

8

Figure 2: Cost structure of two developers with respective home-market at X m

C2 ( xi ) = c + r ( X 2 − xi )

C1 ( xi ) = c + r ( xi − X 1 )

X 2 = xN

X 1 = x1

For a land development at xi, the profit function of the developers could be represented as

follow:

{

}

π m = p m − [c + r (| xi − X m |)] qi − n(| xi − X m |) K

(10)

Assuming that the land development is a continuous function increasing along the linear

city, and the accumulative profit for developers in a market boundary of up to x* is then

represented as follow:

x*

∫ π 1 = p1 − c − [rq1 + nK ) ∫ ( xi − X 1 )]dxi

X1

∫π

X2

2

= p 2 − c − [ rq 2 + nK ) ∫ * ( X 2 − xi )]dx i

x

(11a)

(11b)

Let assume that the market demand for the property type is inelastic, and buyer’s surplus,

S, is close to that in monopoly market, such that the utility of the buyer is maximized at

[U(pi) = S – pi]. For tractability, the distance invariant marginal cost is also set to zero, (c

= 0). Following Bertrand competition in an oligopoly framework, developers will drive

price down to marginal cost, [p*1 = p*2 = MC*i(x1)]. The Nash equilibrium is obtained at

the marginal cost function of the second most efficient developer, {MC*i(x1) = max

[MC1(xi), MC2(xi)]}.

Let x* be the market boundary at which the two developers would be welfare-optimal.

The market boundary for the two developers under the welfare-efficient condition could

9

be derived by equating the two cost function at x*, that is [MC1(x*) = MC2(x*)], which is

given as follow:

⎡

⎢

1

*

x = ( X 2 − X 1 )⎢

⎢

2rq 2 + nK

⎢1 +

2rq1 + nK

⎢⎣

⎤

⎥

⎥

⎥

⎥

⎥⎦

(12)

Figure 3 shows the relationship between the market boundary at x* that is welfare

optimal and the size of linear city, (| X 2 − X 1 |) , and capacity constraint as given by

fraction of the maximum market density, δ.

Figure 3: Market share of developers in a duopoly market

Optimal market boundary, (x*)

0.7

0.6

0.5

0.4

0.3

0.2

0.1

1.0

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0.0

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0.0

Size

of lin

e

ar cit

y

, (X

2

–X )

1

rket

Ma

re

Sha

of d

e

pe

velo

r 1,

(δ)

Lemma 1:

The division of the share of the market demand between the duopoly developers as

measured by the distance, x*, is a positive function of the size of the linear city,

(| X 2 − X 1 |) , and a negative function of the capacity constraint of developer 1, δ.

10

The results suggest that when a city is expanded, both developers would be better off by

stretching their market boundary outwards and obtain incremental profits. However,

when capacity is constrained, developers would prefer to focus on their home market to

minimize the costs incurred in exploring new market further away from the centroid.

Marginal costs increase when they move into new market outside the traditional

catchments. Higher returns are expected when developers invests in new market where

they do not possess competitive advantages.

After demarcating the welfare-optimal market boundary, x*, the aggregate profit

functions for the two developers can be derived as below:

x*

∫ π 1 = ∫ [MC2 ( xi ) − MC1 ( xi )]dxi

X1

⎛ X 12 x *2

⎞

⎛ x *2 X 12

⎞

*

⎜

⎟

= rq 2

−

+ x X 2 − X 2 X 1 − rq1 ⎜

+

− x* X 1 ⎟

⎜ 2

⎟

⎜ 2

⎟

2

2

⎝

⎠

⎝

⎠

∫π

(13a)

X2

2

= ∫ * [ MC1 ( xi ) − MC 2 ( xi )]dxi

x

(13b)

⎛ X 22 x *2

⎞

⎛ x *2 X 22

⎞

*

*

= rq1 ⎜

−

+ x X 1 − X 1 X 2 ⎟ − rq 2 ⎜

+

− x X2 ⎟

⎜ 2

⎟

⎜ 2

⎟

2

2

⎝

⎠

⎝

⎠

where q1 and q2 could be subject to capacity constraint, that is [δq1 + (1 − δ ) q 2 = q ] and q

is the maximum density of the aggregate output in the duopoly market.

Proposition 2:

Given the optimal market boundary that gives welfare-optimal return to each of the

developers, ∫ π 1 = ∫ π 2 , aggregate profits of the developers increase with an increase in

the linear size of a bi-modal city. However, the aggregate profits of developers will be

lower, if they face an increasing capacity constraint.

Figure 4 supports the Proposition 2 above, and the results shows that in a welfare optimal

duopoly market, where neither of the two developers could establish competitive

advantages across the city, the aggregate profits would likely be divided equally between

the two developers. This is a sufficient condition to suggest that monopoly is not a

favorable outcome in real estate market, unless the two developers based in two centroids

agree to merge to form a monopoly.

11

Figure 4: Aggregate profit of developer 1

0.18

0.16

0.14

0.12

0.10

0.08

0.06

0.04

nea

X

2

–X

1)

4.2.

8

0.

9

0.

ty (

6

0.

7

0.

r ci

0.00

e t Sh

Mark

1

0.

2

0.

3

0.

4

0.

5

0.

Siz

eo

f li

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

0.02

Aggregate Profit for developer 1, (∫ π1)

0.20

f

are o

r 1, (

lope

d ev e

δ)

Merger and Predatory Pricing Strategies

The aggregate profit functions for the two developers in a duopoly market as represented

by equations 13(a) and 13(b) can be represented diagrammatically in Figure 5, which can

be summarized as follow:

Profit of developer 1, ∫π1 = shaded area (a) and cross-hatched area (b)

Profit of developer 2, ∫π2 = dotted area (c) and cross-hatched area (d)

By setting the oligopoly price at the marginal cost of the second most efficient developers,

the Nash equilibrium that is represented by the thick line in Figure 5 is welfare optimal.

Both developers would earn positive profits, which will be smaller, but close to

monopoly profit. The duopoly profit will be eroded when new entrants are attracted to the

markets. New entrants will fill up different market space until a point, at which any

additional entrant will crowd out incumbents in order to keep a zero profit in the market.

This Bertrand’s paradox where price is set equal to marginal cost will only occur in an

oligopoly market, if the market place along the Hotelling’s linear city in our model is

undifferentiated. However, as long as the new entrants can establish competitive edge

with respect to particular location, X m , there will be incentive for these new entrants to

earn positive profits as represented by hatched area (e) in Figure 5.

12

Proposition 3:

There are positive profits for new entrants to establish strong foothold in space along the

linear city, (| X 2 − X 1 |) , and the profits of incumbents will be eroded with the new

entrants. The loss in profits for incumbents as indicated by shaded area (a) and dotted

area (c) is dependent on the location at which the new entrants possess competitive edge

in their production technology. The loss for incumbent developer m increase when

(| X e − X m |) is smaller.

Given the fixity of product and differentiated nature of the property markets along the

linear city, and also high costs involved in building up competitive strength in multiple

nodes in the market, it would be ineffective for developers to preempt new entrants using

predatory or limit pricing strategies of Milgrom and Robert (1982a). It would also be

costly and economically infeasible for incumbent developers to engage in multi-market

reputation building strategies that will predate entry (Burns, 1986; Kreps and Wilson,

1982; Milgrom and Robert, 1982a). However, incumbent developers could stretch their

market boundary as wider as possible, such that new entrants, if enter, will be located

closer to their rival developers. They can then limit their losses brought about by the new

entrants.

Figure 5: Distribution of aggregate profits between the duopoly developers

∫π

∫π

i

i

(c)

(a)

(d)

(e)

(b)

X1

Xe

X*

X

f

X2

Differentiated products reduce the effectiveness of predatory limit pricing strategy, and it

would also costly for incumbent to engage in multi-market reputation building exercises.

13

In this differentiated market, a merger offer by incumbent developers to an entrant in the

next market, X e , could create a welfare-optimal outcome as shown in Figure 6. The

Nash equilibrium line as indicated by the darken line is shifted upward for the market

along ( X 1 − x * ) , and incremental profits accrued to the two developers involved in the

merger exercise. The merger is deemed to be a more superior in enhancing profits of

merged developers, compared with exit deterrence via predatory pricing strategy (Saloner,

1987).

Proposition 4:

Merger of two developers with established home market reputation in adjacent markets

are welfare optimal. However, there are no externality effects on the developer outside

the merger. The profit level of the developer not involved in the merger remains

unchanged.

In the linear city with differentiated market, mergers would only occur between two

developers in adjacent markets. Developers, X e , located in between the two merged

markets, ( X 1 , X f ) , if reject the merger offer, could distort the welfare optimal results of

the merger.

Figure 6: Effects of Merger of Developers

∫π

∫π

i

i

(c)

(a)

(d)

(e)

(b)

X1

Xe

X*

X

f

X2

14

4.3.

Elastic Demand

By allowing the demand function to follow equation (1) that is [qi = Di(pi, pj)], the profit

function could be generalized to allow the effects of demand elasticity and crosselasticity of substitution to be taken into consideration when determining the oligopoly

profit function:

⎛ X i2 x *2

⎞

⎛ x *2 X i2

⎞

*

*

⎜

⎟

∫ π i ( pi , p j ) = rq j ⎜ 2 − 2 + x X j − X i X j ⎟ − rqi ⎜⎜ 2 + 2 − x X i ⎟⎟

⎝

⎠

⎝

⎠

where [qi = Di(pi,pj)] and [qj = Dj(pi, pj)] as given in equation (1), and [i ≠ j].

(14)

Proposition 5:

In an elastic market where demand is responsive to price changes, the profits of

developers will be an increasing function in the cross-elasticity of substitution, d, and an

decreasing function in the demand elasticity, b.

4.4

Variable Price Structure

In a bi-nodal urban land structure, price could vary by the distance from the centroids,

and buyer’s utility function can be represented as follow:

[ U m ( p m , x i ) = S − p m − tυ (| x i − X

m

|) ]

(15)

where S is the buyer’s surplus, tυ is marginal disutility when the property located further

away from the centroid, and υ denotes different property sub-type. The profit function of

the developer m taking into consideration the distance effects is written as follow:

{

}

π m = p m + tυ (| xi − X m |) − [c + r (| xi − X m |)] qi

(16)

The optimal profit of developer varies when the marginal disutility and incremental cost

of the development change according to the following equation:

max(π m ) = [| tυ − r |]q m,i

xi

(17)

Proposition 6:

When the marginal rate of increase in unit cost is lower than the marginal disutility rate,

developers will be able to maximize the profit by stretching their market boundary

outward from their home-base. When [tυ < r], there is no incentive for developers to

expand their market boundary, and it would be better off for the developer to focus only

on its home-market where he has competitive advantages.

15

The above proposition implies that for properties that have a very high marginal disutility

rate, they are concentrated in the city centre to optimize the agglomeration effects. For

example, prime grade office buildings are mainly found in the Central Business District,

and the increasing disutility in transportation costs reduces the demand for prime office

space in the fringe of city. Similarly, for industrial properties with lower disutility in

traveling are found further away from city centre.

5.

Possible extensions to the multi-nodal urban land market model

The multi-nodal urban land market models discussed in the earlier section are not without

limitations, the assumptions made in the above models could be further relaxed to make

the results more realistic. Some possible extensions to the earlier version of the multinodal urban market model are discussed.

5.1

Reputation of developer

Differences in reputation between two developers could be extended in the demand

structure of the duopoly developers using an exogenous variable, φ, that shifts the

demand curve for a more reputable developer 1 upward, and the demand functions of the

two developers are represented below:

D1(p1, p2) = a – (b-φ)p1 + dp2

D2(p1, p2) = a – bp1 + dp2

(17a)

(17b)

The demand functions in equation (17a) suggests a more superior product of developer 1,

who is able to sell more unit of property given the same price, or alternatively, he will be

able to charge a premium on a given quantity of the same product. Various sub-game

optimal strategies could be derived to provide explanations on the duopoly real estate

market structure.

5.2.

Incomplete information on cost structure

In the earlier models, developers are assumed to have complete information about the

cost and demand functions of the competitors. The assumption could be further relaxed

by allowed information asymmetry in the two-period game, where the second developer

will have to react to the pricing strategy of the first developer after observing its move. In

a simple two-period model by Tirole (1998), the marginal cost of one of the developer is

not a common knowledge, and the cost function could take two values depending on the

reputation of the developer. The probability that the developer has a low cost structure,

c1L is ϕ, whereas there is also a (1- ϕ) probability that the cost structure is c1H, where [c1L

< c1H]. In Bertrand framework, the Nash equilibrium price can be determined, which

contains the following expected marginal cost function:

c1e = ϕ c1L + (1 − ϕ ) c1H

(18)

16

The incomplete information could be further extended in a dynamic game environment

where the developer could revise the information in a repeated game process, and the

standard perfect Bayesian equilibrium could be solved (Kreps and Wilson, 1982;

Milgrom and Roberts, 1982a).

5.3.

Location dependent capacity constraint

Capacity constraint is fixed at a fraction, δ, of the maximum density of land in the earlier

model. This fraction variable is also to be constant in the subsequent multi-nodal model,

which implies that developers’ capacity constraint is unchanged whether they are located

in their home-market or when they move away from the home market. This assumption

may appear rigid, and could be further relaxed by allowing the capacity constraint to vary

at different space across the linear city, xi, that is [ q m = ∑ δ ( xi )q i ].

5.3.

Different sub-market and switching costs

The earlier multi-nodal city with only one property type could be further extended to

allow different sub-market or sub-property type along the linear city, [υ = (a, b,… k)].

Figure 7 shows that the demand curve is determined by the highest and best use types

along the linear city, and the highest priced uses will set the market price at each space, xi.

Figure7: Urban Land Pricing Structure

p1,a

p1,b

X1

Xs

At point xs, there will be indifferent as to develop type “a” or type “b” property on the

land, as both could be sold at the equilibrium market price. To the right of xs, developer

could switch the use from type “b” to type “a” by incurring a switching cost, S. The profit

17

function of developer based at X 1 , who could develop two different property use types

along the linear city, can be derived as follow:

∫π

xs

m

= p m ,a − [c m ,a + r ∫ ( xi − X 1 )dxi ] + nK ( x s − X 1 )

X1

(19)

xi

+ p m ,b − [c m,b + r ∫ ( xi − X 1 )dxi ] + n( K + S )( xi − x s )

xs

6.

Conclusion

The existence of flexibility in production techniques, as suggested by Eaton and Schmitt

(1994), explains why oligopoly is a prevalent form of market structure for manufacturing

firms. This occurs for two reasons. First, most manufacturing firms are able to generate

economies of scope by investing in a few basic products, and then by developing a wide

range of product variants from these basic products. Second, these same firms can then

gain economies of scale by producing on a large scale (which is why in Eaton and

Schmitt’s model firms will explore “merger” or “cartel” strategies). This, in turn, propels

certain industries to a high concentration.

For real estate firms, the story is different. Real estate firms generally do not possess

these same economies. Real estate assets tend to be homogenous products with little

degree of differentiation (except for location), and production techniques are quite

inflexible. These conditions would cause (in Eaton-Schmitt’s analysis) low levels of

market concentration. But such concentration is counterfactual. Most local real estate

markets tend to be dominated by a few large developers.

Our own analysis emphasizes the existence of capacity constraints and factors specific to

individual properties (i.e., locational advantages) as the keys to understanding why high

concentration rates are found in local real estate markets, and why low concentration rates

are found in national real estate markets.

In the context of a Bertrand duopoly model with spatial features of a Hotelling’s linear

city with two city centroids located at the extreme ends of the linear city, we show that

increased capacity constraints will generally lead to a high concentration rate (though not

necessarily monopolization) when properties in different locations are highly

substitutable. We also show that real estate firms have a preference for investing for

investing in their local trade area or submarket.

The model further suggests that the quickest way for a developer to expand market share

(and achieve economies of scale) is through a merger. Not all mergers, however, may be

beneficial, for example, when the market place along the Hotelling’s linear city is

undifferentiated. In this case the only mergers likely to occur are those between two

developers in adjacent markets.

18

These are interesting findings (and completely testable). A natural next step is to extend

the model to include some noisy demand signals and the possibility of sequential

decision-makings, and apply it to data on concentration rates.

19

Reference:

Allen, F. (1984). Reputation and product quality, The RAND Journal of Economics, 15,

311-327.

Baumol, W. J. (1982). Contestable markets: an uprising in the theory of industry structure,

The American Economic Review, 72, 1-15.

Baumol, W. J., Panzar, J. C. and Willig, R. D. (1983). Contestable markets: an uprising in

the theory of industry structure: reply, The American Economic Review, 73, 491-496.

Burns, M. (1986). Predatory pricing and the acquisition costs of competitors, Journal of

Political Economy, 94, 266-296.

Burt, R. S., Guilarte, M., Raider, H. J. and Yasuda, Y. (2002). Competition, contingency,

and the external structure of markets, Advances in Strategic Management, Ingram, P.

and Silverman, B., eds., Elsevier, New York.

Eaton, B. C. and Lemche, S. Q. (1991). The geometry of supply, demand, and

competitive market structure with economies of scope, The American Economic

Review, 81, 901-911.

Eaton, B. C. and Schmitt, N. (1994). Flexible manufacturing and market structure, The

American Economic Review, 84, 875-888.

Fudenberg, D. and Kreps, D. M. (1987). Reputation in the simultaneous play of multiple

opponents, The Review of Economic Studies, 54, 541-568.

Forgey, F. A., Mullendore, W. E., and Rutherford, R. C. (1997), Market structure in the

residential real estate brokerage market, Journal of Real Estate Research, 14, 107-115.

Hörner, J. (2002). Reputation and competition, The American Economic Review, 92, 644663.

Hotelling, H. (1929). Stability in competition, The Economic Journal, 39, 41-57.

Kreps, D. M. and Wilson, R. (1982). Reputation and imperfect information, Journal of

Economic Theory, 27, 253-279.

Mazzeo, M. J. (2002). Product choice and oligopoly market structure, The RAND Journal

of Economics, 33, 221-242.

Milgrom, P. and Roberts, J. (1982a). Limit pricing and entry under incomplete

information: an equilibrium analysis, Econometrica, 50, 443-459.

Milgrom, P.and Roberts, J. (1982b).Predation, reputation and entry deterrence, Journal of

Economic Theory, 27, 280-312

Ong, S.E., Sing, T.F. and Malone-Lee, L.C. (2004). Strategic considerations in land use

planning: the case of white sites in Singapore, Journal of Property Research, 21(3),

235-253.

Rosenthal, R. W. (1981). Games of perfect information, predatory pricing and the chainstore paradox, Journal of Economic Theory, 25, 92-100.

Saloner, G. (1987). Predation, merer and incomplete information, Rand Journal of

Economics, 18, 165-186.

Shapiro, C. (1982). Consumer information, product quality, and seller reputation, Bell

Journal of Economics, 13, 20-35.

Shapiro, C. (1983). Premiums for high quality products as returns to reputations,

Quarterly Journal of Economics, 98, 659-679.

Somerville, C. T. (1999). The industrial organization of housing supply: market activity,

land supply and the size of homebuilder firms, Real Estate Economics, 27, 669-694

20

Spence, A. M. (1979). Entry, capacity, investment and oligopolistic pricing, Bell Journal

of Economics, 8, 534-544.

Tadelis, S. (1999). What’s in a name? Reputation as a tradeable asset, The American

Economic Review, 89, 548-563.

Tirole, J. (1998). The Theory of Industrial Organization, The MIT Press, Cambridge,

Massachusetts.

21