Document 13145487

advertisement

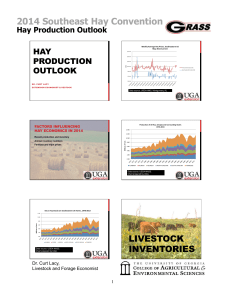

2011 Southeast Hay Convention Hay Production Economics and Outlook Dr. Curt Lacy Extension Economist-­‐Livestock Dr. Curt Lacy Extension Economist-­‐Livestock Good Quality Bermuda Hay Prices ($/ton), 4x5 Roll Southeastern Weekly Prices, 2005-2011 Current situation Inputs Outlook for 2011 $120.00 $100.00 $/ton $80.00 $60.00 $40.00 $20.00 20 11 20 10 20 09 20 08 20 07 20 06 20 05 $- Good Quality Bermuda Hay Prices Net Returns Over Fertilizer, Fuel and Machinery 2001-­‐2009 $150.00 $100.00 $50.00 $-­‐ 0 20 0 20 0 20 0 20 9 8 7 6 4 05 20 0 20 1 03 20 Dr. Curt Lacy, Extension EconomistLivestock, clacy@uga.edu 229-386-3512 1 Data Source: USDA-NASS 02 20 $(150.00) Livestock Marketing Information Center 0 20 $(50.00) $(100.00) 2011 Southeast Hay Convention Hay Production Economics and Outlook $600.00 100% 90% Percentage of Expenses $/Acre Cost $500.00 $400.00 Machinery $300.00 Fuel Fertilizer $200.00 $100.00 80% 70% 60% Fuel Fertilizer 30% 20% 10% $-­‐ 0% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2001 2002 2003 2004 2005 2006 2007 2008 2009 Input situation and outlook INPUTS PRICES RECEIVED Demand for fertilizers Fuel costs Equipment costs $5.00 $4.00 • • • • Tightening Supplies Increasing demand Political unrest Steady to higher prices for 2011 and 2012 Number of hay consuming units. Economy Acres of hay $1,000 $900 $800 $700 $/ton Spot Diesel Price ($/gal), US Gulf Coast June 2006-­‐March 2011 $3.00 $600 $500 $400 $2.00 $300 $1.00 $200 $0.00 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 Fe 00 9 b 2 0 M ar 10 2 0 1 1 06 /17 /1 4 06 /17 /13 06 /17 /1 2 $100 06 /17 /1 1 06 /17 /1 0 Machinery 50% 40% Spot Diesel Price, US Gulf Coast Nitrogen (AN) Dr. Curt Lacy, Extension EconomistLivestock, clacy@uga.edu 229-386-3512 2 Phosphorous (DAP) Potash (Muriate) 2011 Southeast Hay Convention Hay Production Economics and Outlook Projected Supply and Demand More corn acres Increasing South American demand Strength of US dollar Price of natural gas = Steady to higher fertilizer prices in 2011-­‐2012 U S HAY STOCKS AND PRODUCTION Crop Year Mil. Tons 120 110 100 90 80 70 60 50 40 December 1 Hay Stocks Alfalfa Hay Production Other Hay Production 2006 2008 2010 Livestock Marketing Information Center Data Source: USDA-NASS, Compiled & Analysis by LMIC Livestock Marketing Information Center Data Source: USDA-NASS, Compiled & Analysis by LMIC Southeastern US Acres of Other Hay and All Hay 1974-­‐2010 14,000 Acres (thous.) 12,000 10,000 8,000 Other Hay 6,000 All Hay 4,000 2,000 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 0 Dr. Curt Lacy, Extension EconomistLivestock, clacy@uga.edu 229-386-3512 3 2011 Southeast Hay Convention Hay Production Economics and Outlook JANUARY 1 “BEEF COW FACTORY’ U.S., Annual Inventories of Non-­‐Bovine Forage Consuming Livestock in Georgia 2002 vs. 2007 Mil. Head 50 Number of Head 45 Replacement Heifers 40 Beef Cows 35 83796 100,000 74008 80,000 60,000 40,000 20,000 8952 6735 0 Ewes 30 All Goats Horses & Ponies Mule, Burros & Donkeys 25 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 Number of Operations Beef Cows and Horses 2002 vs. 2007 Rabbits Llamas Alpacas Mule, Burros & Donkeys All Goats Ewes 4500 4000 3500 3000 2500 2000 1500 1000 500 0 Dairy Farms Number of Operations Dairy Cows and Other Types of Hay Consuming Livestock 2002 vs. 2007 25,000 20,000 15,000 10,000 5,000 0 Beef Cattle High beef cattle prices are good for at least two reasons: Suggests herd expansion is coming soon Makes it more economical to feed cows hay Dairy herd continues to consolidate Larger farms tend to be more specialized and willing to contract with local or regional growers. Increasing emphasis on forage-­‐based systems increases demand for hay or baleage. Rapidly expanding goat and sheep market provides another often overlooked target market. Livestock Marketing Information Center Data Source: USDA-FAS, Compiled & Analysis by LMIC Dr. Curt Lacy, Extension EconomistLivestock, clacy@uga.edu 229-386-3512 4 Horses & Ponies 2011 Southeast Hay Convention Hay Production Economics and Outlook Livestock Marketing Information Center Livestock Marketing Information Center Data Source: USDA-FAS, Compiled & Analysis by LMIC Data Source: USDA-FAS, Compiled & Analysis by LMIC Stocks May 1 Total Production Total Supply Disappearance Ending Stocks Season Average Price U.S. All Hay 20.60 143.80 164.40 146.50 17.90 $131 per ton $175.00 Southeastern All Hay $155.00 mgmt $135.00 3.52 25.34 28.86 24.88-­‐25.8 3.06-­‐3.98 $125-­‐$135 per ton Good quality Bermuda Hay mach $115.00 $/ton Item estab $95.00 op int $75.00 labor $55.00 rprs $35.00 fuel $15.00 $(5.00) chemicals Expected Optimistic Price Scenario 2011 could be a very interesting one for hay producers. Dr. Curt Lacy Extension Economist-­‐Livestock clacy@uga.edu Tight supplies and an improving economy will likely increase demand. However, higher input prices could reduce costs enough to lower profits. Producers need to start thinking in terms of risk management and not just income minus expenses. Dr. Curt Lacy, Extension EconomistLivestock, clacy@uga.edu 229-386-3512 5 Pessimistic fert