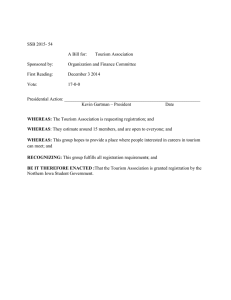

Document 13131221

advertisement