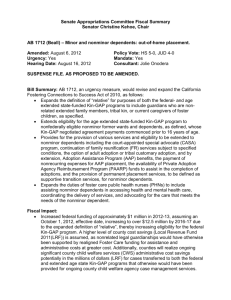

January 31, 2011 ALL COUNTY LETTER NO. 11-15

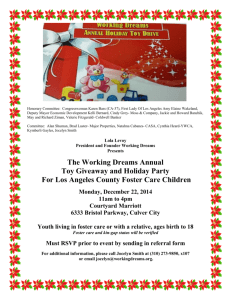

advertisement