Bachelor of Science in Business Administration Accounting Major: CPA Track

advertisement

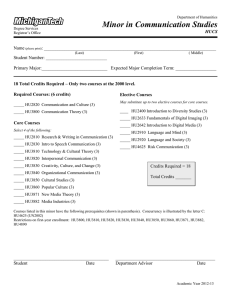

Bachelor of Science in Business Administration Accounting Major: CPA Track (suggested 4 year plan) Year 1, First Term Courses ENGL101 (if not exempt) or elective MATH 220 (or as placed) ECON200 CORE BMGT110 Year 1, Second Term Credits 3 3 4 3 3 16 Year 2, First Term Courses BMGT220 BMGT230 (if still needed) or elective Lower level elective Lower level elective CORE (Lab Science) Credits 3 3 3 3 4 16 Credits 4 3 3 3 3 16 Courses BMGT221 CORE Remaining electives CORE Credits 3 3 6 3 15 Year 3, Second Term Credits 3 3 3 3 3 1 16 Year 4, First Term Courses BMGT326 (Major Requirement 5 of 8) BMGT422 (Major Requirement 6 of 8) College Core Professional Writing BMGT499 (College Core) Courses ECON201 MATH220 (if still needed) or BMGT230 COMM107 CORE Lower Level elective Year 2, Second Term Year 3, First Term Courses BMGT310 (Major Requirement 1 of 8) BMGT321 (MajorRequirement 2 of 8) College Core College Core Upper level ECON (from list) BMGT367 (College Core) effective Fall 2011 Courses BMGT311 (310 prereq) Major Req. 3 or 8 BMGT323 (Major Requirement 4 of 8) College Core BMGT364 (College Core) Advanced Studies Core BMGT391 (College Core) Credits 3 3 3 3 3 1 16 Year 4, Second Term Credits 3 3 3 3 1 13 Courses BMGT495 (College Core) (340/350/364 prereqs) BMGT411 (Major Requirement 7 of 8) Upper level elective (1 of 1) Major Requirement (8 of 8) from options Credits 3 3 3 3 12 Please note that this is a potential plan for completing your degree within four years. The order of the classes does not necessarily need to be followed exactly as written. Be sure to check course pre-requisites. Consult http://www.rhsmith.umd.edu/undergrad/account.html for more details on courses and additional credits that are required for the MD CPA and for links to other states. 50 credits are to sit for the CPA exam in Maryland and most states. Remember that you must complete ECON200 or ECON201, BMGT220, BMGT 230 or BMGT231, and MATH220 or MATH140 by the end of the semester in which you reach 45 credits (Advanced Placement credits excluded).