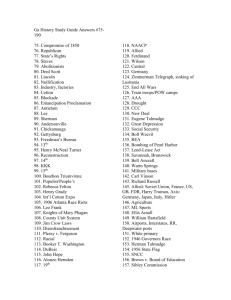

ASSEMBLY BUDGET COMMITTEE PRELIMINARY REVIEW OF THE GOVERNOR’S PROPOSED 2015-2016 STATE BUDGET ACT

advertisement