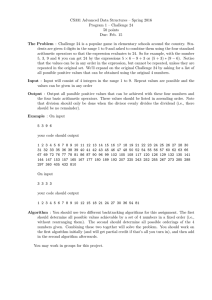

gsr 2007 discussion paper Fixed-Mobile Convergence

advertisement