SECTION II PRE-AWARD

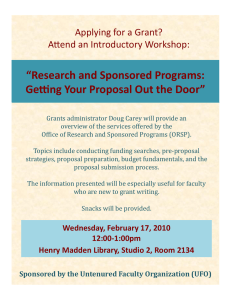

advertisement