CALIFORNIA STATE UNIVERSITY, FRESNO ADVANCEMENT SERVICES POLICIES AND PROCEDURES MANUAL PREFACE

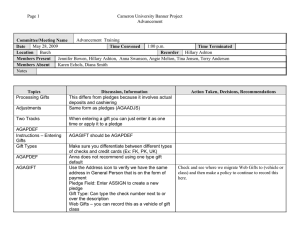

advertisement