990

advertisement

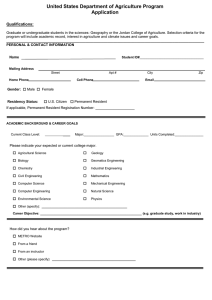

Form

990

OMS

Return of Organization Exempt From Income Tax

2771 EAST SHAW AVE

FRESNO, CA 93710

_ Name change

,....

lnotoal return

, 2012, and ending

Tax-exempt status

J

K

Website: ...

1

0

CHILDREN, INC

77-0443565

E Telephone number

559-278-0 800

...

>

0

ofj

tJ)

Ql

:;:;

·:;;

:;:::;

0

<(

) • (msert no.)

G Gross receopts $

1,543,666.

H(a) Is th1s a group return for atflloates?

~ Yes

~ No

No

H(b) Are all atfoloates oncluded 7

Yes

If 'No,' attach a lost. (see onstructoons)

I l4947(a)(1) or I 1527

H(c) Group exemption number ,...

l~ corporatoon l

JTrust JJ Assocoatoon

J. L Year of Formatoon:

I I Other .,.

j M State of legal dom1cole: CA

1996

l=Q~M~NUX _~EM~E~.S~- -------------------------------------------- -- - -

c

<0

c

(!)

I l501(c) (

2

3

4

5

6

7a

b

---------0----------------------------------------------------if the organization discontinued its operations or disposed of more than 25% of its net assets.

Check this box ...

Number of voting members of the governing body (Part VI, line 1a) . . . ' . . . . . . . . . . . . ' . ' . .. . . ......... . .

Number of independent votrng members of the govern1ng body (Part VI, line 1b) . . . . . . . ... . . . . . . . . .... .

Total number of individual s employed in calendar year 2012 (Part V , line 2a). . . . . . . . . .. . .... ... .. .....

Total number of volunteers (estimate 1f necessary) ............ . . . . . . . . . . . . . . . . . . . . . .. . ..... ··· · ··· ...

Total unrelated business revenue from Part VIII , col umn (C), line 12. . . . . . . . . . . . . .... . . . . . . . . . . . . . . . . . .

Net unrelated business taxable income from Form 990-T, line 34.

. . . ' . . ' ' . . . . . . . . . . . . . ........ ...

.

'

9

5

44

0

42,370.

19,772.

3

4

5

6

7a

7b

Prior Year

Q)

:::J

cQ)

>

Q)

a:

8

9

10

11

12

13

14

"'

"'c:

Q)

15

Contributions and grants (Part VI II, line 1h) . . . . . . .. . . ...... . . ... . . .. . . . ' . . . . . . . . . . ..

Program service revenue (Part VII I, line 2y)... . ................... . . . . . . . . . . ... .....

Investment income (Part VIII , column (A), lines 3, 4, and 7d). .. . . . . . . . . . . . . . . . . . . . . . .

Other revenue (Part VIII, col umn (A), lines 5, 6d, Be , 9c, 1Oc, and 11e) ........ . . . ....

Total revenue - add lines 8 through 11 (must eq ual Part VIII, column (A), line 12) ...

Grants and sim1lar amounts paid (Part IX, column (A), lines

1-3) . .. . . ... . . . . .

Q)

'

11a-1 1d,

"CD

~,

Zu.

1,235,967.

26 9,546.

1,448,168.

95,739.

243 ,62 3 .

1,47 9,590 .

64 , 076 .

1

11f-24e). . . . . . . . . . . . . . . .. . ... ..

17

Other expenses (Pa rt IX, column (A), lines

18

19

Total expenses. Add lines 13-17 (must equal Part IX, column (A), line 25) ... . . . . . . . .

20

21

Total assets (Part X, line 16) . . . . . . . . . . .. . . ... . .... . ..... .. . . . . . ... . . .. . . . ... . .

. . . . . . . . . . ..

Total liabilities (Part X, line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . ...

22

Net assets or fund balances. Subtract line 21

Revenue less expenses. Subtract line

18 from

line

12 .. . . . . . . . . . . . . . . . . . . . . . ·· ··· · ..

(5 o

~..,

1,178,622 .

. .. ..

Benefits paid to or for members (Part IX, column (A), line 4) .... . . ........... ... . .. ..

Salaries, other compensation, employee benefits (Part IX, column (A), lines 5 -10). ...

b Total fundraisi ng expenses (Part IX, co lumn (D) , line 25) ...

End of Year

Beginning of Current Year

!g

"~

822,981.

694,703.

1,594.

24,388 .

1,543,666.

'

0..

<>.!!

Current Year

896,251 .

624,812.

1,476.

21,368 .

1,543,907.

16a Professional fundrais1ng fees (Pa rt IX, column (A), line 11 e) ... . . . . . . . . ... . . . . . . . ' . '

><

w

I

' 2013

I Summary

Briefly describe the orga nization's mi ssion or most significant activities: ~QY~QVPES~I~~~~~-~E~Y~~~fi1' __ __

l=~L_I.fQIS.Nl~ _S]'~T_E_ Q.tii.YEIS.Sli~- E~.SNQ .fQIS.l=Q~L.&:~E- .SIU..P.&:NT_S.L _F_Al=Q.~T.¥ ,_ _S]'~F_f_ ~@_L_Q_Ct.-1 _

I

Ql

Ql

c Above

IX I501(c)(3)

N/ A

Form of organozat1on:

I Part

Same As

6/3 0

D Employer Identification Number

Termonated

rAmended return

f'-- Applocat1on pendong F Name and address of pnncopal otfocer:

I

Open to Public

Inspection

... The organ1zat10n may have to use a copy of th1s return to satisfy state reportmg requ1rements.

A For the 2012 calendar year, or tax year beginning

7 / 01

c

B Check of applicable:

_ Address change

FRESNO STATE PROGRAMS FOR

1545-0047

2012

Under section 501(c), 527, or 4947(aX1) of the Internal Revenue Code

(except black lung benefit trust or private foundation)

~~~~~~7'~~~~~~~\:'r~7z~ry

No.

'

'

'

719,422.

95,802 .

623 620 .

'

.. ....

from line 20 . . . . .. . . . . .. .. . . . . . . . . . . . . .

905,917 .

218,221.

687,696 .

I Part II I Siqnature Block

Under penalt1es of pequry, I declare that I have examoned thos return. 1ncludong accompanyong schedules and statements, and to the best of my knowledge and belief, ot os true. correct. and

complete. Declaration of preparer (other than otfocer) os based on all onformatoon of whoch preparer has any knowledge.

Sign

Here

~

~

Sognature of offrcer

Date

DEBBIE ADISHIAN-ASTONE

CFO /TREASURER

Type or prrnt name and totle.

Prrnt!Type preparer's name

Paid

Pre parer Form's name

Use Only Form's address ... 677 Scott Avenue

Check

osa, CPA, CFE

PTIN

P0 01969 12

Form's EIN ... 77-0 203007

~~~~~~~----------------------------------~--------~~~~---------

Clovis, CA 936 12

May the IRS discuss this return with the preparer shown above? (see instructions). . .

BAA For Paperwork Reduction Act Notice, see the separate instructions.

Phone no.

TEEAO113L

12118112

(559)

i"orm 990 (2012)

FRESNO STATE PROGRAMS FOR CHILDREN, INC

77-0443565

IPart Ill I Statement of Program Service Accomplishments

Page 2

0

Check if Schedule 0 contains a response to any question in this Part Ill. ..... . .. . . . . . . . ... .

Briefly describe the organ ization's m ission:

JQ~BQ~I~~~B~~- ~~~ -~EB~~c~~~J-~A1 ~~0B~~- ~~AJ~ ~B~~EB~DYLYB~~N9_~0B_~01~~G~ - -- ­

~IU~~~~~ -~A~Q~TJ L 3J~Fy_ ~N~- ~~c~~~9~~UB~~~~~M~~~~ - -------- --- - ------- - - - - 2

D1d the organization undertake any significant program serv1ces during the year wh1ch were not listed on the pnor

Form 990 or 990-EZ? ......... .. .. . . . . . ............... ......... .... . .... ... . ..... . . . . . . . . ..... . ... . . ....... .

If 'Yes,' describe these new services on Schedule 0 .

3 Did the organization cease conducting, or make significant changes in how it conducts, any program services?. . ...

0

0

Yes

[Ej

No

Yes

[Ej

No

If 'Yes,' describe these changes on Schedule 0.

4

Descri be the organization 's program service accomplishments for each of its three largest program services, as measured by expe nses.

Section 501(c)(3) and 501 (c)(4) organizations and sect1on 4947(a)(1 ) trusts are required to report the amount of grants and allocations to

others, the total expenses, and revenue , if any, for each program service reported .

4a (Code:

1,367,90 5.

)(Expenses $

includinggrantsof $

)(Revenue

$

457 , 063. )

fg~VJ QE~_ Q~~~~~-~EB~~~~J9 _~~-~TQQ~NJ _~~~~~~59 _~~~~~~~U~~~T~ -~H9_~R~ _~A~~T~ _

TO -----ATTAI N THEIR

EDUCATIONAL

GOALS----BY PROVI

DING APPROPRIATE

THE IR YOUNG

------------ ----------- - -- -- - -CARE

- - --FOR

-- -------------CHILDREN IN A CONVENIENT AND AFFORDABLE EDUCATIONAL SETTING.

4 b (Code:

4 c (Code:

- -- - - - -

-------

) (Expenses $

) (Expenses $

-------------

- -------------

including grants o f $

including grants of

4 d Other program services . (Describe in Schedule 0 .)

(Expenses

$

including grants of

4e Total program service expenses >

BAA

$

$

) (Revenue

$

------------- ) (Revenue

$

- -- - - -- - - - - - -

-------------

--------------

) (Revenue $

1, 367 , 905 .

TEEA0102L

08/0811 2

Form 990 (2012)

form 990 (2012)

77-04 43 565

FRESNO STATE PROGRAMS FOR CHILDREN, INC

Schedules

IPart IV IChecklist of Required

Page 3

Yes

No

Is the organization described in section 501 (c)(3) or 4947(a)(1) (other than a private foundation)? If 'Yes, ' complete

1

Schedule A. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Is the organ1zation required to complete Schedule B, Schedule of Contributors (see instructions)?. . . . . . . . . . . . . . . . . . . . . .

3

Did the organization engage in direct or mdirect polil1ca\ campa1gn activit1es on behalf of or in oppos1l10n to cand1dates

for public office? If 'Yes, ' complete Schedule C, Part I .......... . . . .. . . ... . . . . . . . . . . . .... . . ....... .

. .. .. .. .. .. .. .

4

Section 501 (cX3) organizations

D1d the organization engage 1n lobbymg activities, or have a sect1on 501 (h) election

in effect during the tax year? If 'Yes, · complete Schedule C. Part II. ................................................ . .

5

Is the organization a section 501 (c)(4), 501(c)(5), or 501(c)(6) organization that receives membership dues,

assessments, or simi lar amounts as defined in Revenue Procedure 98· 19? If 'Yes,' complete Schedule C, Part Ill. . .

6

D1d the organization maintain any donor adv1sed funds or any Similar funds or accounts for wh1ch donors have the nght

to prov1de adv1ce on the dlslnbul1on or mvestment of amounts 1n such funds or accounts? If 'Yes,' complete Schedule 0,

7

8

1

X

2

X

1--+--+---

f---+--+- 3

X

4

X

f---l---1--1---t---+-- 5

X

1---t--- + - - -

Part I. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

X

Did the organ1zation rece1ve or hold a conservat1on easement, 1nclud1ng easements to preserve open space, the

environment , historic land areas or historic structures? If 'Yes, ' complete Schedule 0, Part IL ... .. ... ........... . . .

7

X

complete Schedule 0 , Part Ill . .... . ...... ...... ....... ........ ....... ......... ... ....... ... . ..... ........... .... . .

8

X

Did the organization report an amount in Part X, line 21 , for escrow or custodial account liability; serve as a custod1an

for amounts not listed 1n Part X; or prov1de cred1l counseling, debt management cred1l repair, or debt negotiation

services? If 'Yes, · complete Schedule 0 , Part IV .. . .. .......... ..... . . ........ ...... . . .......... .... . ... ... . ... .

9

X

10

X

Did the organization ma intain collections of works of art, historica l treasures, or other similar assets? If 'Yes, '

9

10

Did the organization, directly or through a related organizallon, hold assets in temporarily restricted endowments ,

perman ent en dowments, or quasi -endowments? If 'Yes ,' complete Schedule 0, Part V . . ........ . .. . ..................

11

'

If the organization's answer to any of the follow1ng questions IS 'Yes', then complete Schedule D, Parts VI , VII, VIII , IX,

or X as applicable.

I

a D1d the orgamzat1on report an amount for land , buildings and equipment in Part X, line 1O? If 'Yes,' complete Schedule

0, Part Vl . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.. .. .

. . . . . . . . . . . . . . . . . . . . . . . . . 11 a

X

b Did the organization report an amount for Investments - other secunties 1n Part X, line 12 that is 5% or more of 1ls total

assets reported in Part X , line 16? If 'Yes,' complete Schedule 0, Part VII ......... . ................. . ............ . . . . l-1

_1_b

- +---+--Xc D1d the organization report an amount for Investments- program related in Part X, line 13 lhal1s 5% or more of 1ls total

assets reported in Part X, li ne 16? If 'Yes,' complete Schedule 0 , Part Vlll . . . . .. . . . ................... . .......... ... .

c

X

d Did the organization report an amount for other assets in Part X, \me 15 that is 5% or more of its total assets reported

in Part X, line 16? If 'Yes,' complete Schedule 0, Part IX..... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 d

X

11 e

X

e Did the .organization report an amount for other liabilities in Part X , line 25? If 'Yes,· complete Schedule 0 , Part X ..... .

f Did the organization's separate or consolidated f1nancia\ statements for the tax year 1nclude a footnote that addresses

the organization's liability for uncertain tax positions under FIN 48 (ASC 740)? If 'Yes,' complete Schedule 0, Part X... .

11

1--+--+---

f---+--+-11 f

X

. . . . . . . . . . . . . . . . . . 12a

X

12a Did the organization obta in separate, independent aud1led financial statements for the tax year? If 'Yes.' complete

Schedule 0 , Parts XI, and XII.. . . .... ........... .. ........

........... ......... .

b Was the organization 1ncluded 1n consolidated , Independent aud1led financ1al statements for the tax year? If 'Yes,' and

if the organization answered 'No ' to line 12a, then completing Schedule 0 , Parts XI and XII is optional ................

12b

Is the organization a school described in section 170(b)(1 )(A)(ii)? If 'Yes, ' complete Schedule E . . . . . . . . . . . . . . . . . . . . .

13

X

14a

X

business, mvestment, and program serv1ce acl1v111es outside the Un1ted States, or aggregate fore1gn Investments valued

at $100 ,000 or more? If 'Yes, ' complete Schedule F. Parts I and IV ...... ....... ...... .......... ........... ...... ....

14b

X

Did the organ ization report on Part IX, column (A) , l1ne 3 , more than $5 ,000 of grants or assistance to any orga nization

or entity located outside the United States? If 'Yes,' complete Schedule F, Parts II and I V ....... ..... . . .......... ... . .

15

X

Did the organization report on Part IX, column (A), line 3, more than $5 ,000 of aggregate grants or assistance to

individuals located outside the United States? If 'Yes ,' complete Schedule F, Parts Ill and IV .. . ...... ....... ..........

16

X

17

X

Did the organization report more than $15,000 total of fundrais1ng event gross income and contributions on Part VIII,

lines 1c and 8a? If 'Yes,' complete Schedule G, Part II .. . ... ............. ....... . . . . ... ....... . .... . .......... . . .. ..

18

X

Did the organ1zation report more than $15,000 of gross 1ncome from gam1ng act1v1t1es on Part VIII, line 9a? If 'Yes,'

complete Schedule G, Part Ill................. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

X

20 a Did the organization operate one or more hospital facilities? If 'Yes,' complete Schedule H ................ . ...........

20

X

13

14a Did the organization mainta in an office , employees, or agents outs1de o f the United States? .. . .

X

b Did the organ1zation have aggregate revenues or expenses of more than $10,000 from grantmakmg, fundra1s1ng ,

15

16

17

D1d the organ1zation report a total of more than $15 ,000 of expenses for profess1onal fundra1s1ng serv1ces on Part IX,

column (A), lines 6 and 11e? If 'Yes,' complete Schedule G, Part I (see instructions) .......................... . . ' ....

18

19

f---+--+--

b If 'Yes' to line 20a, did the organization attach a copy of its aud1ted financial statements to this return?. . . . . . . . . . . . . . . . . 2 0 b

BAA

TEEA0103L

12113112

Form 990 (20 12)

l'=orm 990 (2012)

FRESNO STATE PROGRAMS FOR CHILDREN, INC

Schedules (continued)

77-0443565

Page 4

I Part IV IChecklist of ReQuired

Yes

21

Did the organtzation report more than $5,000 of grants and other asstslance to governments and organtzations in the

United States on Part IX, column (A) , line 1? If 'Yes, ' complete Schedule I, Parts I and II............. . . . . . . . . . . . . . . . . .

22

Did the organtzation report more than $5 ,000 of grants and other asststance to tndtvtduals in the Untied Stales on Part

IX, col umn (A) , line 2? If 'Yes, ' complete Schedule I, Parts I and Ill.. ......... . . ... . . . . ...... ................... . . .. .

21

X

1--t---t--

X

22

Did the organization answer 'Yes' to Part VII, Seclton A, line 3, 4, or 5 about compensation of the organization's current

and former officers, directors, trustees , key employees, and highest compensated employees? If 'Yes ,' complete

Schedule J .

.. .. ... .... .. .. .......... .. .. .. .. .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

23

No

X

24a Did the organtzalton have a tax-exempt bond tssue wtth an outstandtng principal amount of more than $100,000 as of

~~~~F~t~aSc~~~~~~~arif ~~~. ~;tt;~~~sised

after Decem.b er 3.1.' 2002? If 'Yes:' ans.wer lines .2 4b throu~h .24<J .and. . . . . .

b Did the organization invest any proceeds of tax-exempt bonds beyond a temporary period exception'... ...... .........

c Dtd the organtzation mainta tn an escrow account other than a refunding escrow at any time during the year to defease

any tax-exempt bonds?.... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d Did the organization act as an 'on behalf of' issuer for bonds outstand ing at any time during the year?. . . . . . . . . . . . . . . . . .

25a Section 501(cX3) and 501(cX4) organizations. Did the organization engage in an excess benefit transaction with a

disqualified person during the year' If 'Yes,' complete Schedule L, Part I. ... .......

......... .... .. .

28

24c

1--+--+--24d

l--t--+--

X

25b

X

26

X

Dtd the organization provide a grant or other assistance to an offtcer, director, trustee, key employee , substantial

contributor or employee thereof, a grant selectton committee member , or to a 35% controlled enttty or family member

of any of these persons? If 'Yes,' complete Schedule L, Part Ill ... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

X

Was a loan to or by a current or former offtcer, dtrector, trustee, key employee, htghest compensated employee, or

disquali fied person outstand ing as o f the end of the organization's tax year? If 'Yes, ' complete Schedule L, Part II. . . .

27

X

25a

b Is the organtzation aware that it engaged tn an excess beneftt transaction with a dtsqualified person tn a prior year, and

that the transaction has not been reported on any of the organtzation's prtor Forms 990 or 990-EZ? If 'Yes,' complete

Schedule L, Part I. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

a

24

24b

1--:--:-t--+--

Was the organtzatton a party to a business transactton wtth one of the following parttes (see Schedule L, Part IV

instructions for app licable filing thresholds, conditions, and exceptions):

a A current or former officer , director, trustee, or key employee' If 'Yes,' complete Schedule L, Part IV .... . . .. .... . .. .

28a

X

b A family member of a current or former officer, dtrector, trustee, or key employee? If 'Yes,' complete

Schedule L, Part IV . .......... . . . ............ .... ........... ...... ...................... . .

28b

X

c An enttty of whtch a current or former officer, dtrector, trustee, or key employee (or a family member thereof) was an

officer, director, trustee, or direct or indirect owner? If 'Yes, ' complete Schedule L, Part IV. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28c

X

29

Did the organization receive more than $25 ,000 in non-cash contributions? If 'Yes, ' complete Schedule M . ... . .. . ......

29

X

30

Did the organization receive contnbutions of art, htstorical treasures, or other similar assets, or qua lified conservation

contributions? If 'Yes ,' complete Schedule M. ......... ....... . ... . ............... ... ........... ........ ... ......... .

30

31

Did the organization liquidate, terminate, or dissolve and cease operations? If 'Yes,' complete Schedule N, Part I . . . . . . .

X

X

32

Did the organizatton sell, exchange, dispose of, or transfer more than 25% of tis net assets? If 'Yes,' complete

Schedule N, Part II. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.. ... .....

. . . . . . . . . . . . . . . . . . 32

33 Did the organization own 100% of an entity disregarded as separate from the organization under Regulations sec! tons

301 .7701 ·2 and 301. 7701 -3? If 'Yes, ' complete Schedule R, Part I... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34 Was the organization related to any tax-exempt or taxable entity? If 'Yes,· complete Schedule R, Parts II, Ill, IV,

and V, line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b If 'Yes' to line 35a , did the organization receive any payment from or engage in any transaction with a controlled

enttty within the meaning of section 512(b)(13)? If 'Yes, ' complete ScheduleR, Part V, line 2..................... . ....

37

38

-

X

X

33

. . . . . . 34

35a Did the organization have a contro lled entity within the meaning o f section 512(b)(13)? ........ . ....... . . ......... . . .. .

36

31

1--t---t-

X

X

35a

1--t- - - t -35b

1--t---t--

Section 501 ~X3) organizations. Did the organization make any transfers to an exempt non -charitable related

organization. If 'Yes,' complete Schedule R, Part V, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

X

Did the organtzation conduct more than 5% of tis acltvities through an entity that ts not a related organization and that is

treated as a partnership for federal income tax purposes? If 'Yes,' complete Schedule R, Part VI. ......... ..... ... .. .

37

X

Did the organtzatton complete Schedule 0 and provtde explanaltons tn Schedule 0 for Part VI, ltnes 11 b and 19?

Note. All Form 990 filers are required to complete Schedule 0 ......... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38

BAA

X

Form 990 (2012)

TEEA0104L

08/08112

f'orm 99C (201 2)

77 - 044 3565

FRESNO STATE PROGRAMS FOR CHILDREN, INC

rPart v IStatements Regarding Other IRS Filings and Tax Compliance

Check if Schedule 0 contains a response to any question in this Part V .

Page 5

·············· ············· ... .................... n

1 a Enter the number reported in Box 3 of Form 1096. Enter -0· 1f not applicable.

·.... I

b Enter the number of Forms W-2G included in line 1a. Enter -0· if not app licable......... .

Yes

0

c Did the organization comply with backup w1lhhold1ng rules for reportable payments to vendors and reportable gaming

(gambli ng) winnings to prize winners?...................................... . ... . . . ................. . . . . . . . . . . . . . .

2 a Enter the number of emp loyees reported on Form W-3, Transmittal of Wage and Tax Stale·!

ments, filed for the calendar year ending with or within the year covered by this return . . . .

2a

I

I

No

2

1al

1b

1c

X

44

b If at least one is reported on line 2a , did the organization file al l requ1 red federal employment tax returns?. . . . . . . . . . . . . .

Note. If the sum of lines 1a and 2a is greater than 250, you may be required to e-file. (see instruct1ons)

3 a Did the organ ization have unrelated business gross income of $1,000 or more during the year? . . ........ . . . ......... .

b If 'Yes' has it fi led a Form 990-T for this year? If 'No,' provide an explanation in Schedule 0 . . . .. . ... .... .. ..... ... . .. .

2b

1---+--+ - -3a

3b

1---+-- + - -4a At any time dunng the calendar year, did the organ1zat1on have an mterest 1n, or a signature or other authority over, a

financial account in a foreign country (such as a bank account, securities account, or other financial account)?. . . ...... . 4a

1---t---1--b If 'Yes,' enter the name of the foreign country: ..

See instructions for filing requirements for Form TO F 90-22.1, Report of Foreign Bank and Financial Accounts.

5 a Was the organization a party to a prohibited tax shelter transaction at any time during the tax year?.. . . . . . . . . . . . . . . . . . Sa

b Did any taxable party notify the organization that it was or is a party to a proh ibited tax shelter transaction? ..... ....... 1-5

=-:bt---t-.......-1---t---1--c If 'Yes,' to line 5a or 5b, did the organization file Form 8886-T? .. . ........ . . . . . . .... . .. .... .. ...... .. ...... .... . .. ...

5c

f-----+--t---

6 a Does the organization have an nual gross receipts that are normally greater than $100,000, and did the organization

sol icit any contributions that were not tax deductible as charitable contributions? .. . . .... ............ . .......... . ..... .

b If 'Yes,' did the organ1zat1on mclude with every soi1C1tat1on an express statement that such contributions or g1fts were

not tax deductible? .................................... . ............................................... .. ......... .

7

Organizations that may receive deductible contributions under section 170(c).

a Did the organization receive a payment in excess of $75 made partly as a contribution and partly for goods and

services provided to the payor? ....... . . ..... . . . . . . ........ ... . .......... ............... .... . . .. . . .

b If 'Yes,' did the organization notify the donor of the value of the goods or se rvices provided? . .. ..... .

.. .. .

c Did the organization sell, exchange, or otherwise d1spose of tangible personal property for which it was reqUired to file

6a

f--+--t--6b

f--t--+- - :

7a

7b

f-----+--+-- -

~~~:s~~~n d~~~t~· ;~~ -~~~~~~ -~f· F~-r~~ '828~-fil·~~ -~~;i~~- ;~~ ·;~~; :::::: .......... :::::::::. j.·; ~( ....... ... .... ...... 1-- c+---t--2

d

7

e Did the organization receive any funds, directly or indirectly, to pay premiums on a personal benefit contract? ...... . ...

f Did the organization, duri ng the year, pay premiums, directly or indirectly, on a personal benefit contract? . . . . . . . . . . . . .

g If the organization rece1ved a contribution of quahf1ed mtellectual property, d1d the organ1zation fi le Form 8899

as required?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7e

f----t--t---.-.--

7f

1--- +-- +--7g

1----"t---1-- -

h If the organization received a contribution of cars, boats , airp lanes, or other vehicles, did the organization file a

Form 1098-C?.. .. . . ... . ... .

....... .. .. .. .

. .. .. .... .. .. .. .. .. .. .... .. .. .. ..

. . ... .. .. .

7h

8 Sponsoring o rganizations maintaining donor advi sed funds and section 509(aX3) s upporting organizations. Did the

supporting organization, or a donor advised fund maintained by a sponsoring organization , have excess business

holdings at any time during the year?................... . ........................................... . .. ... ......... .

9

Sponsoring organizations maintaining donor advi sed funds.

a Did the organization make any taxable distnbutions under section 4966?. . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . .

b Did the organization make a distribution to a donor, donor advisor , or related person? . .... ... ...... . . . . . ... . . . . . ..... .

10

Section 501(cX7) organizations. Enter:

a Initiation fees and capi tal contributions included on Part VIII , line 12 ............ .. . . .... .

b Gross receipts, included on Form 990, Part VI II, line 12, for public use of club facilities ....

11

Section 501(cX1 2) o rganizations. Enter:

a Gross income from members or shareholders .......... . . . . . .................... . ...... .

b Gross income from other sources (Do not net amounts due or paid to other sources

against amounts due or received from them.) ............ ... ............... . . . .. . . . . . . .

8

f--+--+---:

9a

l---t -- -l--9b

f - - t --+- -.

Ir---~-------~

10a l

10 b

~-~-------~

11 a

11 b

~~~~~-----~

12 a Section 4947(aX1) non . exempt charitable trusts. Is the organization filing Form 990 in lieu of Form 1041 ?. . . . . . . . . . . . . 12 a

b If 'Yes,' enter the amount of tax -exempt interest received or accrued during the year ..... . 12 b l

1---+--+---.

I

13 Section 501(cX29) qualified nonprofit health insurance issuers.

a Is the organization licensed to issue qualified hea lth plans in more than one state? .... . ................. . .... . .... . .. . 13a

Note. See the instructions for additiona l information the organization must report on Schedule 0 .

b Enter the amount of reserves the organization is required to maintain by the states in

which the organization is licensed to issue qualif1ed health plans . . . . . . . . . . . . . . . . . . . . . . . . .

I

1 3 bt1

~I

r---~--------~

c Enter the amount of reserves on hand. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 c

~-~--------+-~-~~--~

14a Did the organization rece ive any payments for indoor tanni ng services during the tax year?........ . . . . . . . . . . . . . . . . . . 14a

X

b If 'Yes,' has it fi led a Form 720 to report these payments? If 'No,' provide an explanation in Schedule 0. . . . . .. . .. . ....

BAA

TEEA0105L

08/0811 2

14b

Form 990 (2012)

F"orm 9912 (2012)

FRESNO STATE PROGRAMS FOR CHILDREN, INC

77 -04 43565

Page 6

IPart VI IGovernance, Management and Disclosure For each 'Yes' response to lines 2 through 7b below, and for

a 'No ' response to line Ba, Bb, or lOb below, describe the circumstances, processes, or changes in

Schedule 0 . See instructions.

Chec k if Schedu le 0 contains a response to any quest1on in this Part VI . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

[X]

Section A. Governing Body and Management

Yes

1 a Enter the number of voting members of the governing body at the end of the tax year .....

If there are material differences in voting rights among members

of the governing body, or if the governing body delegated broad

authority to an executive committee or similar committee, explain in Schedule 0.

1a

9

b Enter the number of votmg members included in line 1a, above, who are independent. ... .

1b

5

2

D1d any officer, d1rector, trustee, or key employee have a family relal1onsh1p or a busmess relat1onsh1p w1th any other

officer, director, trustee or key employee? ... .. ................... ........ . . . . . ... . .................... . . .

3

4

D1d the organization delegate control over management dut1es customarily performed by or under the d1rect supervision

of officers , directors or trustees, or key em ployees to a management company or o ther person? .See . .Sch . .0. ...

Did the orga nization make any significant changes to its governing documents

5

Did the organization become aware during the year of a significant diversion of the organization's assets? ..............

6

Did the organization have members or stockholders? ........................ .

. ' ' ' ...

'.'

..

since the prior Form 990 was filed?..................................... .. ..........................................

7 a D1d the organ1zation have members, stockholders, or other persons who had the power to elect or appomt one or more

members of the governing body?. . . . . . . . . . . . . . . .

... ......... .. ..

. . .......................... . .. .

b Are any governance decisions of the organ ization reserved to (or subject to approval by) members,

stockholders, or other persons other than the governing body? ....... ..... . . ........ . ... .. .................... ... . .. .

8

X

2

3

No

X

4

X

t--5---1t-----11---::X~

1---:6-+-+-::-::

x7a

X

t---t---1---7b

X

t---t---1----

D1d the organ1zallon contemporaneously document the meetings held or wntten act1ons undertaken dunng the year by

the following:

a The governin g body? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . • . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8a

X

b Each committee with authority to act on behalf of the governi ng body? ........ . .................................. . .. . t -8-b+---:X:-:-t- f---f---1---9 Is there any off1cer, d1rector or trustee, or key employee listed in Part VII, Section A, who cannot be reached at the

organization's m aili ng address? If 'Yes,' provide the names and addresses in Schedule 0... ............. ....... ......

9

X

Section B. Policies (This Section B requests information about policies not required bv the Internal Revenue Code.

Yes

10 a Did the organ1zat1on have local chapters , branches, or affiliates? ....... .. . ....................................... . . . .

b If 'Yes,' did the orgamzat10n have written policies and procedures governmg the act1vit1es of such chapters, affiliates, and branches to ensure the1r

operatiOns are consistent w1th the organization's exempt purposes?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 a Has the orgamzation prov1ded a complete copy of th1s Form 9:KJ to all members of its governmg body before filing the form? . . . . . . . . . . . . . . . . . . . . . .

b Describe in Schedule

0

the process, if any, used by the organization to review this Form 990.

f------t--+- 10 b

f-----+--+-:-:-11 a

X

See Schedule 0

12a Did the orga nization have a written conflict of in terest policy? If 'No, ' go to line 73...... .......

12a

X

b Were officers, d1rectors or trustees, and key employees required to disclose annually interests that could give rise

to conflicts?... ................ ......... . .. ......... ............. ....... ............... . . ..... . ... ...... ... . ... ....

12b

X

D1d the organization have a written whistleblower policy? .............. . .. .. . . ........ . ............. . ................

12c

13

X

X

14

X

13

14 Did the organization have a written document retention and destruction pol1cy?............. ............ ..... .........

15

No

X

10 a

D1d the process for determining compensat1on of the follow1ng persons mclude a review and approval by Independent

persons, comparability data , and contemporaneous substantiation o f the deliberation and decision?

a The organization's CEO, Executive Director, or top man agement official .....

b Other o fficers of key employees of the organization ...See .. Schedule

. .. .. .. .. .. .. .. ..... ....... .. .. .....

. 0 ........ . ....... . ....... . ..... . ...... . .. .

If 'Yes' to line 15a or 15b , describe the process in Schedule 0. (See Instructions.)

15a X

f---f--:-c-f--15 b X

f-----+--+--:

I

16a D1d the organization 1nvest in, contribute assets to, or participate in a joint venture or similar arrangement with a

taxable entity during the year?. . . . . . . . . . . . . . . . . . . . . . . . . .

.. .. .. .. .. .. .. .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 a

b If 'Yes,' did the organ1zat1on follow a wntten pol1cy or procedure requinng the organ1zation to evaluate 1ts

participation in joint venture arrangements under applicable federal tax law, and taken steps to safeguard the

I--:-:""

organization's exempt sta tus with respect to such arrangements?. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . • . . . . 16 b

X

J

Sect1on C. Disclosure

CA

--------------- -- - ------------

17

L1st the states with which a copy of this Form 990 is required to be filed ...

18

Section 6104 requires an organization to make its Forms 1023 (or 1024 if app licable), 990, and 990-T (501(c)(3)s only) available for public

Inspection. Indicate how you make these available. Check all that apply.

D Own website

19

D Another's website

IE]

Upon request

0

Other (explain in Schedule 0)

Describe 1n Schedule 0 whether (and 1f so, how) the organ1za11on makes 1ts governing documents, conf11ct of interest policy, and financial statements ava1lable to

the public during the tax year.

See Schedule 0

State the name, physical address, and telephone number of the person who possesses the books and records of the organization:

20

.. KATE TUCKNESS 277 1 EAST SHAW AVENUE

BAA

FRESNO CA 93710 559-278-0800

TEEAO1OGL 08/08112

Form 990 (2012)

Form 99C\ (2012)

77 -044 3565

FRESNO STATE PROGRAMS FOR CHILDREN, INC

Page 7

IPart VII I Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and

Independent Contractors

Check if Schedule 0 contains a response to any quest1on in th is Part VI I .... . .. . ... ..... . . . . . . .................... . ..... . . . . 0

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

1 a Complete this table for all persons required to be l1 sted. Report compensation for the calendar year end1ng w1th or withm the

organ1zat1on's tax year.

• List all of the org_anization's current officers, directors, trustees (whether individuals or organizations), regardless o f amount of

compensation . Enter ·D· in columns (D), (E), and (F) if no compen sation was paid.

• List all of the organization's current key employees, if any. See instructions for definition of 'key employee.'

• L1st the organization's five current highest compensated employees (other than an officer, director, trustee, or key employee)

who received reportable compensation (Box 5 of Form W-2 and/or Box 7 of Form 1099-MISC) of more than $100 ,000 from the

orgamzalion and any related organ1zat1ons.

• List all of the organization's former officers, key emp loyees , and highest compensated emp loyees who received more than $100,000

of reportable compensat1on from the organization and any related organizations.

• L1st all of the organization's former directors or trustees that received , 1n the capac1ty as a former d1rector or trustee of the

organization , more than $10,000 o f reportable compensation from the organization and any related organizations.

L1st persons 1n the follow1ng order: 1nd1v1dual trustees or d1rectors; institutional trustees; officers; key employees; h1ghest compensated

employees; and former such persons.

0

Check this box if ne1ther the orgamzat1on nor any related organization compensated any current off1cer, d1rector, or trustee.

(C)

(A)

(B)

Name and T1tle

Average

hours per

week (l1st

any hours

for related

organ•zalions

below

dotted

lone)

Pos•lion (do not check more than

one box, unless person •s both an

off1cer and a d~rector/trustee)

Q

:::>

::l

U>

~~ E=

lll~ =

0

Q~

2

0

:::;:

n·

Q

5

0

(2)

DR.

SANDRA

WITTE

5

----- - --- ----- -- - -- Chai r

40

5

_ @l~ ~N~~~9Q~~Q~~--- -- Director

0

5

- ~)_ QJi._ ~Q_LJ,~~N- IQ.R_f;~JiS9N -Vice Chair

40

(5) REV DON ROMSA

------ - ---- ----- -- -- - 5

0

Di rect or

(6) KATHIE REID

5

------- - ---- ---- - - - -Secretary

40

(7) ARTHUR MONTEJANO

------- --- ------ -- -- - - -5- 0

Director

(8) MOSES MENCHACA

5

------- ----- --- - -- -- 0

Director

(9) TAWANDA KITCHEN

---------------- --- - 5

40

Di r ector

(10) DEBBIE ADISHIAN - ASTONE

------- --- -------- --- 5

Treasurer

40

3

~

0

~

(l)

<1>I

,

~

<>

~

I>

a.

0

X

X

X

0

(F)

Est1mated

amount of other

compensat1on

from the

organ1zallon

and related

organ•zahons

<>~

X

X

.,.,

~~ 3

~vo

q

(E)

Reportable

compensation from

related o~aniZations

(W-2/1 9 -MISC)

:::>

U>

0

(1) MEHRZAD ZARRIN

----- - --- --- -- --- --Director

(1)

"0

::l

=

!C.

c

(1)

(')

;>::

(1)

'<

(D)

Reportable

compensation from

the orgamzalion

(W-211 099-MISC)

X

0.

0.

0.

106,128 .

49,715 .

0.

0.

0.

0.

107,280.

37,637.

0.

X

0

0

0

0

0.

0.

75,048.

28,37 4.

X

0.

0.

0.

X

0.

0

0.

X

0

X

X

0

0.

X

0

48,24 8.

32,836.

161,256.

62,105 .

(1 1)

--- --- - - -- -- --------- - - - (12)

------ - -- ------- -- -- -

----

(13)

---------------- - --- - ---(14)

--- --- - -------------- - - - -

BAA

TEEA0107L

12/17112

Form 990 (20 12)

Form 990 (2012)

77 - 0443565

FRESNO STATE PROGRAMS FOR CHILDREN , INC

I Part VII I Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated

(B)

(A)

Name and t1t1e

Page 8

Employees (can t)

(C)

POSi tiOn

(do not check more than one

box, unless person IS both an

off 1cer and a dlfector/trustee)

Average

hours

per

week

(llst any Q ~

hours a. :.

for

~ ~

related ~

orgamza Q ~ ~

Vl 0 £

= 3. -

c cg

-lions

~-

below

dotted

hne)

S

0

~

2

!!l-

a

(D)

(E)

(F)

Reportable

compen sa t10n from

the orgamzatlon

Reportable

co mpensahon from

E st1mated

amount of other

compensation

from the

(W-211099-MISC)

related organ1zat1ons

(W-2/1099-MISC)

orgamzat1 on

'003

and rela ted

orgamzat1ons

-

~

"

g

_Q~>-- --------- ------ - -----(16)

----- - --- -- ------- - -----(17)

----------------- - ----- --(18)

-------------------- -- -------(19)

------ ---- -- ---- - - -- -- ------- (20)

-------- - - --- - --- - ----------- (21)

---- - -- -- - -------- - - ---------J.23)- - - - - - - - - - - - - - - - - - - - - - - -

J.2~)- - - - - - - - - - - - - - - - - - - - - - - (24)

----- - - ---- ---- -- ---- ----J.2~)- - - - - - - - - - - - - - - - - - - - - - - 1 b Sub-total . ...... .

c Total from continuation sheets to Part VII, Section A . .. . . ..... ... ..... .. .. .

....

....

....

0.

0.

497,960.

210,667 .

0.

0.

d Total (add lines 1 band 1 c) .

. .. .. .. ...... .

497 ,960.

0.

210,667.

2 Total number of 1nd1v1duals (mcludmg but not lim1ted to those l1sted above) who rece1ved more than $100,000 of reportable compensat1on

from the organization .,.

0

Yes

3 Did the organ ization list any former officer, director or trustee, key employee, or highest compensated employee

on line 1a? If 'Yes,' complete Schedule J for such individual . . .. . . . . . . . . . . . . . . . . .. . ........... ... ' ......... . . . . . . . . .

4

For any individual listed on line 1a, IS the sum of reportable compensation and other compensation from

the organization and re lated organizations greater than $150,000? If 'Yes ' complete Schedule J for

such individual. .

. ' ...... . . . . ... . . . . . ' . ' .. ' .... '

' .. ' ' . ' ' ' . ' . ' . . . . . . . . . . . . . ' ' . ' . ' ..... . . .....

3

..... .. .

4

for services rendered to the organization? If 'Yes,' complete Schedule J for such person. . . . . .. . . . . . . . . . . . . . . . ... ......

5

'

No

X

J

X

5 Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual

X

Sect1on B. Independent contractors

Complete th1s table for your f1ve h1ghest compensated Independent contractors that rece1ved more than $ 100,000 of

compensation from the organization Report compensation for the calendar year ending with or w1th1n the organization's tax year

(B)

Description of services

(A)

Name and busmess address

2 Total number of Independent contractors (including but not limited to those listed above) who received more than

$100,000 in compensation from the organization .,.

BAA

(C)

Compensation

I

0

TEEAO 1OSL 01124/1 3

Form 990 (201 2)

F orm 990 (2012)

77 - 0443565

FRESNO STATE PROGRAMS FOR CHILDREN, INC

IPart VIll i Statement of Revenue

Page 9

Check if Schedule 0 contai ns a response to any question in thts Part V III. . . .......... ....... .......... . . . ............... . .

(A)

Total reven ue

~~ 1 a Federated campaigns.. .... ..

<(:::>

a:o b Membership dues .... . .. . .....

~ 2:

V><

t;:a:

as

.n:i!i

c Fundraising events ...... . . . . ..

d Related organ izattons.......

1d

1e

87 810 .

734 797 .

~b

f All other contributions, gtfts, grants, and

similar amounts not incl uded above. .

1f

37 4.

:Z:z:

g Noncash contributions mcluded m Ins la -11:

- a:

1- LIJ

::>::c

t-c

8<

$

h Total. Add lines 1a·lf ..... . . . . . . . . . . . . .. .. ........ . .

::>

~

0::

Lo.l

<J

:;::

Unrelated

business

revenue

0

(D)

Revenue

excluded from tax

under sections

51 2, 513 , or 51 4

-

~

822 981.

Business Code

:z:

Lo.l

(C)

1a

1b

1c

e Government grants (contnbuttons) . ..

~v;

(B)

Related or

exempt

function

revenue

2a J1~~E.B~!_P_~ Q.U.E;~ ~S~~~M- _

b .f~N'! _f;_E~ .: _C.!:HJ.Q.Ch-R_L __

c

0::

Lo.l

<n

d

::i!

0::

e

(.!)

900099

623990

414 693.

237 640.

42 370 .

-----------------

- --- ---- ---- - - ----------------- -All other program service revenue . . . .

0

f

0..

g Total. Add lines 2a-2f........... . . . . . . . . . . . . . . . . . . . .

0::

414 693.

280 010 .

~

694 703 .

~

1 594 .

3

Investment income (including dividends, interest and

other similar amounts) .... . . . . . . . . . . . . . . . . . . . ' .....

4

5

Income from investment of tax-exempt bond proceeds .. ~

Roya lties . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . ....

(i) Real

1 594 .

~

(11) Personal

6 a Gross rents . . . . . . . . '

b LP.ss: rental expenses

c Rental mcome or (loss) ....

~

d Net rental income or (loss). . . . . . . . . . . . . . . . . . . . . . . . . .

7 a Gross amount from sales of

assets other than mventory .

(1) Secunhes

(11) Other

b Less: cost or other basts

and sales expenses .. . . . .

c Gai n or (loss) . . . .. . .

d Net gain or (loss) ... . ' ... . . . . . . . . . . . . . . ......... . . ..

Lo.l

::>

:z:

~

Lo.l

~

8 a Gross income from fundraising events

(not including . $

of contributions reported on line 1c).

0::

0::

See Part IV, line 18 ......... .

Lo.l

X:

1-

b Less : direct exp enses ...

0

.... a

. . . .... b

c Net income or (loss) from fundra ising events. ... . . .

~

9 a Gross income from gaming activities.

See Part IV, line 19 ...... ... . . . . . . . a

b Less : direct expen ses .............. b

c Net income or (loss) from gam tng activittes ...... .. ..

~

10a Gross sa les of inventory, less returns

and allowances ... . . . . . . .... .. .. . . . a

b Less : cost of goods sold. ......

b

c Net income or (loss) from sa les of inventory . .. . . . . . .

Miscellaneous Revenue

11a

b

c

Ml~C~~~AB~QU~ - ------

~

Business Code

24 388.

24 388 .

24 388.

1 543 666.

676 721.

900099

- - - - - ------- ---- -

- ----- ------- ---d A ll other revenue ............ . . . .. . .

e Total. Add lines 11 a-l l d . . . . . . .

12

BAA

Total revenue. See instructions. .. . ..

... ' . . .. . ....

. ... .. . . . . . . . . .

'

~

~

TEEAO 109L

1211711 2

42 370 .

1 594 .

Form 990 (2012)

f"orm 990 (2012)

77-0443565

FRESNO STATE PROGRAMS FOR CHILDREN, INC

IPart IX I Statement of Functional Expenses

Page 10

Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A).

Check if Schedule 0 contai ns a response to any question in this Part IX .. . . . . . . . . . . . . . . . .. . ' ... . . . .. . . . . ..

(A)

(B)

(C)

(D)

Do not include amounts reported on lines 6b,

Total expenses

Program service

Management and

Fundraising

lb, Bb, 9b, and 1Ob of Part VIII.

expenses

qeneral expenses

expenses

1 Grants and other assistance to governments

~~~t ~~~~~~a~ifns in_the _united States_. _see_.

. .. ... l J

2

Grants and other assistance to individuals in

the United States. See Part IV, line 22 ......

3

Grants and other assistance to governments,

organizations , and individuals outside the

United States. See Part IV, lines 15 and 16 ..

Benefi ts paid to or for members. ......... ...

Compensation of current officers, directors,

trustees, and key employees..... ... ........

Compensation not included above, to

disqualified persons (as defined under

section 4958(f)(1 )) and persons described

in section 4958(c)(3)(B} ...

. . . . . . . ' ... . .

4

5

6

. . ..

7

Other salaries and wages ..... . . . . . . .

8

Pension plan accruals and contnbut1ons

(include section 401 (k) and section 403(b)

employer contributions)....... ........... . ..

9

Other employee benefits.... .. ...... . . ......

10

Payroll taxes..... . . . . . . . .. ... ....... . .. . ' . '

'

0.

0.

0.

0.

0.

956 , 141 .

0.

956,141.

0.

0.

279,826 .

279,826.

Fees for services (non-em ployees):

11

a Management. ..... . . . . .. . . . . . . . . . . . . .. . . . .

b Legal. ... .... .... . . . . . . . . . .. . . . . . . .... . . . .

c Accounting .... .. . ... ... .. . . . . . . . .. ........

111,685.

111,685 .

d Lobbying . ..... . ........ ' . ' . . . . . ..........

e Professional fundraising serv1ces. See Part IV, line 17 ..

f Investment management fees . . . . .. . . . . . . .

g Other. (If lme llg amt exceeds 10% of line 25, col·

umn (A) amt, list line 11 g expenses on Sch 0) ........

... . . . . . . .

12 Advertising and promotion ....

.

13 Office expenses. ....... . . .. ... . . .. . ... . ....

14 Information technology ........ . .... .... . ...

15 Royalties .... ........... ··········· ... ... ..

16 Occupancy.... . _.............. . ...... .....

17 Travel ....... . . . . . . . . . . . . ' .. . . . . . . . . . . .. . .

18 Payments of travel or enterta inment

expenses for any federal , state , or local

public officia ls .. . . . . . . . . . . . . . . . . . ... . ....

5 229.

5 229.

2 088.

2 088 .

19 Conferences, conventions, and meetings ....

20 Interest. ... .............................. ..

21 Payments to affiliates ..... . . . . . . . . . . . . . . . . .

..

22

Depreciation , depletion, and amortization. .

23

24

Insurance...... . . . . . . . . . . . . . . ' ... '. '.

Other expenses. Itemize expenses not

covered above (List miscellaneous expenses

in line 24e. If line 24e amount exceeds 10%

of line 25, co lumn (A) amount, list line 24e

expenses on Schedule 0.) ...... . . . . . . . . . . . .

a Food

------- - - - ---- - -- -- -b ~~li~~ -------------c gt~e~~~~~~l~~ ---- - ----

d QtUlt~~ --- ----- ------

69

26

25

3

556 .

014.

581.

470.

69

26

25

3

556.

014.

581.

470.

e All other expenses. . . . . . . . . . . . . . ...........

25

Total functional expenses. Add lmes 1 through 24e. ...

26

Joint costs. Complete th is line only if

the organization reported in column (B)

joint costs from a combined educational

campa ign and fundraising solicitation.

Check here ...

if fo llowing

SOP 98·2 (ASC 958·720) ..

. .. . . . ..

1 479 59 0 .

1 367 905.

111 685 .

0.

D

BAA

'

TEEA0110L 12118112

Form 990 (2012)

f"orm 990 (2012)

77 - 0443565

FRESNO STATE PROGRAMS FOR CHILDREN, I NC

IPart X IBalance Sheet

Page 11

Check if Schedule 0 contains a response to any question in this Part X .... . . . . .... . .............. . . . . . . ' . ' . ' . . . . . . . . . . . . . .

Cash- non-interest-bearing. ... ........ ........ ··· ··· .. . .. . .... . ........ . . .

Savings and temporary cash investments . . . . . . . . . . . . . . . . .. .... . . ... . .... . . .

1

2

3

Pledges and grants receivable , net . .......... .. . . . ........................ . .

Accounts receivable , net. .... . ................... . . . . . . . . . . . . . . . . . . . . . . . . . . . ..

4

Loans and other receivables from current and former officers, directors,

~~;tt1f~i ~?h:ctJf~o(_ees._ a_nd _highe_st co~pensated_ e_mployees_._co~p lete ..

5

s

s

E

T

s

7

Inventories for sale or use ...... .. . . .. . . . . .. . . .... . . . .. . . . .............. .

9

Prepaid expenses and deferred charges ..... . . . . . . . . .. . . . .. . ...... . . .... . ....

b Less: accumulated depreciation.

11

12

13

14

15

L

I

A

8

I

16

17

18

19

20

21

22

L

I

T

I

E

s

23

24

0

•

••

•

•

•••••••

••

••

••••

•

•

•

•

....

•

.

•

•

•

•

•

•

•

•

•

O •

•

•

•

0

•

•••

0

•

'

o

•

•

•

0

•

•

•

00•

•

o

•

•

•

O.

.

•

•

••

•

•••••• •

••

•

•

••

•

••

••••••••••••

o

•

•

•

•

O '.'.'

OO

o •••

•

'

.

•

•

oo

oo

••••

•

o•

•••••

o

o OO••

30

31

L

32

N

33

34

••

•

'

•

'o O o

O •

'

.

•

'

•••

' . '

•

O .

•

•

905 , 917 .

218,221.

20

21

I

22

23

24

95,802 .

25

26

218 , 221.

623 620 .

27

68 7,696 .

28

29

J

Cap ital stock or trust principal, or current funds ... . ' . ' . ' . . . ...... . .. ' ..........

Paid-in or capital surp lus, or land, building, or equipment fund ........... . . . . . ' .

Retained earnings, endowment, accumulated income, or other funds .

. ...

Total net assets or fund bala nces. .... . . . ' ' . ..

. .. .

Total liabilities and net assets/fund balances ..... . ..

16

17

18

19

D

•

3 210 .

l

•

o o

lOc

11

15

719 422 .

95 , 802 .

•

•

7, 7 49 .

13

14

oooo •

'

Organizations that do not follow SF AS 117 (ASC 958), check here ..

and complete lines 30 through 34.

F

•

•

8

9

12

Other assets. See Part IV, line 11 . . ............... . . . . . . ..... ' . .. .... . . .. . ...

Total assets. Add lines 1 through 15 (must eq ual line 34) . . . . . . .

..

Accounts payable and accrued expenses . . . . . . . . . .

...

. . . . . . . . . ...

Grants payable. . . . . . . . . . . . . . . . . . . . . . . . .......

.. . . . . . .. ' ..

.. . .

Deferred revenue . . ... . . .. .. . . . . . . . . . . .

.. .

Tax-exempt bond liabilities...... . . . . . . . . . . . . .

. .....

Escrow or custodial account liability. Complete Part IV of Schedule D ... . .. . . . . .

Loans and other payables to current and former officers, directors, trustees ,

key emp loyees, highest compensated employees, and disqualified persons.

Comp lete Part II of Schedule L. ... . .. . . ' ' ' ..... . ' ' . .... . . . . . . ' . . . . '. ' ' .

Secured mortgages and notes payable to unrelated thi rd parties. ..... ....

Unsecured notes and loans payable to unrelated third parties ..... .....

I

J

5, 298.

•

27

u

~

••

Organizations that follow SFAS 117 (ASC 958), check here ..

~ and complete

lines 27 through 29, and lines 33 and 34.

Unrestricted net assets . ' . . .. ..... . ' . . '

Temporarily restricted net assets ...... . .. . ... .... . .. .

Permanently restricted net assets . . . . . . . . . . . . . . . . . .

. .... . . . . . . . . . . . . ....

R

c

Intangible assets ... . . . ... . . .. . . .. . . . . . . . . . . . . . . .

4

598 , 725 .

25 , 659.

128,863.

141 ,711 .

7

Investments - publicly traded securities ..... . .. . . . . . . . . . . . .. ... . ... . .. '

Investments- other securities. See Part IV, line 11 ' ' . . .... . .. . .... . ........ ..

Investments - program- related. See Part IV, line 11. ..... . .... ... . ....... .. . . .

Total liabilities. Add lines 17 through 25 .. .. . . . ... . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0

A

44 656 .

41,446.

lOa

lOb

. .... . . .

26

~ 28

~ 29

8

A

..

Other liabilities (including federal income tax , payables to related thi rd part ies,

and other liabilities not included on lines 17·24). Complete Part X of Schedule D.

E

N

D

..

2

3

6

14,752 .

25

N

E

T

A

. .

1

5

8

10 a Land, bui ldings, and equipment: cost or other basis.

Complete Part VI of Schedule D........ . . . .........

End o year

J

. ...

Loa ns and other receivables from other di squalified persons (as defined under

section 4958(f)(1 )) , persons described in section 4958(c)(3)(B), and contributing

employers and sponsoring organrzations of sectron 501 (c)(9) voluntarS employees'

beneficiary organizations (see instructions). Comp lete Part II of chedule L ..

Notes and loans receiva ble, net . . . .......... . . . . . . . . . . . . . . . . . ........... . . . . .

6

A

513 , 606.

25,575 .

57,556 .

102,635.

l -l

(B(

(A)

Beginning of year

•O O•

.. . . ···· ·· ·

..... .... ........

30

31

32

623 620 . 33

719,422. 34

687,6 96.

905, 917 .

Form 990 (2012)

BAA

TEEA0111L 01103113

'Form

990 (2012)

FRESNO STATE PROGRAMS FOR CHILDREN , INC

77 - 0443565

IPart XI IReconciliation of Net Assets

.................. ... n

Check if Schedule 0 contains a response to any question in th1s Part XI. ... ... ..... . . . .. . ... ..... . .

1

Total revenue (must equal Part VIII , col umn (A) , line 12) .. . . . . ............ .. . . . . . . . . . .. .. .

2

Total expenses (m ust equa l Part IX , col umn (A), line 25) .. . .

Page 12

1

1 54 3 66 6 .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...... . .. f--:2,--t.--=1 L...:..

4 .!.-.

7~

9 L::!._

5~

9 ~0. :. . ·

Revenue less expenses. Subtract line 2 from line 1. . . . . .

. . . . . . . . . ....... . .. . ........ . ... . . . . . ... f--3- f - -_ _ __,6:. .4:...L0

"'-'7.,6c..:....

.

Net assets or fund balances at beginning of year (must equal Pa rt X, line 33, column (A)). . . . . . . . . . . . .

4

62 3 62 0 .

3

4

5

6

7

8

Net unrealized gams (losses) on mvestments ........................................................ . .

5

Donated services and use of facilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Investment expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

Prior period adjustments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ~~--------------8

9

Other changes in net assets or fund balances (explain in Schedule 0) ...... . .. . .. ... . .

Net assets or fund balances at end of year. Comb1ne l1nes 3 through 9 (must equal Part X, line 33 ,

co lumn (B)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ... ......... . .. . . .

10

f--1--------------9

0.

10

IPart XII I Financial Statements and Reporting

687 69 6 .

n

Check if Schedule 0 conta ins a response to any question in this Part XII . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

Accounting method used to prepare the Form 990:

DCash

Yes

~Accrual

No

Oother

If the organization changed its method of account1ng from a prior year or checked 'Other,' explain

in Schedule 0.

2 a Were the organization's fina ncial statements compiled or reviewed by an independent accountant?. . .

. ........ .

2a

X

f - - -f--- t - lf 'Yes,' check a box below to indicate whether the financial statements for the year were compi led or reviewed on a

separate basis, consolidated basis, or both:

j

J

0

Separate basis

0 Consolidated basis

0 Both consolidated and separate basis

b Were the organization's financial statements audited by an independent accountant? ..... ................. .

If 'Yes,' check a box below to indicate whether the financial statements for the year were audited on a separate

basis, consolidated basis, or both:

~ Separate basis

Consolidated basis

Both conso lidated and separate basis

D

2b

X

D

c If 'Yes' to line 2a or 2b, does the organization have a committee that assumes responsibility for oversight of the audit,

review, or compilation of its financial statements and selection of an independent accountant? ................ .. .... . .

If the organization changed either its oversight process or selection process during the tax year, explain

in Schedule 0.

3 a As a result of a federal award, was the organ1zat1on requ1red to undergo an aud1t or audits as set forth 1n the Single

Audit Act and OMB Circular A-133?... ............. ......... . . ................. . ................................... .

b If 'Yes,' did the organ1zation undergo the requ1red audit or audits? If the organ1zation did not undergo the required audit

or audits, ex plain why in Schedule 0 and describe any steps taken to undergo such audits . . ........ ........ ....... . .

BAA

2c

X

3a

X

f--t---+--3b

Form

TEEA0112L

08/0911 1

X

990

(20 12)

OMB No. 1545-0047

'SCHEDIJLE A

2012

Public Charity Status and Public Support

(P'orm 990 or 990-EZ)

Complete if the organ ization is a section 501(cX3) organization or a section

4947(aX1) nonexempt charitable trust.

Department of the Treasury

Internal Revenue Servrce

Open to Public

Inspection

,.. Attach to Form 990 or Form 990-EZ. ,.. See separate instructions.

IPart I I Reason for Public Charity Status (All organizations must complete this part.) See instructions.

The organ1zat1on is not a pnvate foundation because 1! 1s: (For lines 1 through 11, check on ly one box.)

~

1

2

3

4

A church, convention of churches or association of churches described 1n section 170(bX1XAXi).

A school described 1n section 170(bX1XAXii). (Attach Schedule E .)

A hosp1tal or a cooperative hospital service orga nization described in section 170(bX1XAXiii).

A medica l research organization operated in conjunction with a hospital described in section 170(bX1XAXiii). Enter the hospital's

name, city, and state:

lv1 An organization operatedfor the benet-;( Ot a coilegeorun1versity owned or operatedbya-goven1mentalunitdescr;tied in sectiOn - - - - - - .

~ 170(bX1XAXiv). (Complete Part II.)

5

8

6

7

8

0

A federal, state, or local government or governmental unit described in section 170(bX1XAXv).

An organ1zat1on that normally rece1ves a substantial part of 1ts support from a governmental un1t or from the general public descnbed

in section 170(bX1XAXvi). (Complete Part II.)

A community trust described in section 170(bX1XAXvi). (Complete Part II.)

0

unrelated business taxable 1ncome (less section 511 tax) from bus1nesses acquired by the organization after June 30, 1975. See section 509(aX2).

(Complete Part Il l.)

An organization organized and operated exclusively to test for public safety. See section 509(aX4).

DAnrelated

organtzation that normally receives: (1) more than 33·1/3% of its support from contributions, membership fees, and gross rece1pts from activ1t1es

to 1ts exempt funct1ons - subject to certain except1ons, and (2) no more than 33-1/3% of 1ts support from gross investment 1ncome and

9

10

Osupported

An organization organized and operated exclusively for the benefit of, to perform the functions of, or carry out the purposes of one or more publicly

organizations described in section 509(a)(1) or section 509(a)(2). See section 509(aX3). Check the box that describes the type of

11

supporting organization and complete lines 11 e through 11 h.

a 0Type I

e

b 0Type II

c 0

Type Ill - Functionally integrated

d 0

Type Ill -Non -functionally integrated

Dother

By checki ng this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified persons

than foundat1on managers and other than one or more publicly supported organizations descnbed in sect1on 509(a)(l) or

section 509(a)(2) .

~ht~~ko[~fsni~g~on rece~v~d _a w_ntt~~ d_eter~ination_ :r_o~ _the_I_Rs _that.'s.a _Type

g

1 ••

Type II_ or Typ_

e Ill _

supportin·g· ~rganizatton,_ .... . . ...... __ 0

Since August 17, 2006, has the organ1zation accepted any gift or contribution from any of the following persons?

Yes

h

(i)

A person who directly or indirectly controls, either alone or together with persons described in (ii) and (iii)

below, the governing body of the supported organization? .

. ....... .

11 g (i)

(ii)

A fa mily member of a person described in (i) above?.

11 g (ii)

(iii) A 35% controlled entity of a person described in (i) or (ii) above? ...

Provide the following information about the supported organization(s).

(i) Name of supported

orgamzat1on

(ii)EIN

(iii) Type of organrzatron

(descnbed on lines 1·9

above or IRC section

(see instruc tions))

11 g (iii)

(iv) Is the

(v) Drd you notrfy

organ1zahon 1n

the organrzatron in

column (i) listed rn column (i) of your

your governrng

support?

document?

Yes

No

No

Yes

No

(vi) Is the

organ1zahon 1n

column (i)

organrzed rn the

U.S.?

Yes

(vii) Amount of monetary

support

No

(A)

(B)

(C)

(D)

(E)

Total

BAA For Paperwork ReductiOn Act Not1ce, see the In structions for Form 990 or 990-EZ.

TEEA0401L 08109112

Schedule A (Form 990 or 990-EZ) 2012

FRESNO STATE PROGRAMS FOR CHILDREN, INC

77 - 0 44 3565

IPart II ISupport Schedule for Organizations Descri bed in Sections 170(b)(1 )(A)(iv) and 170(b)(1 )(A)(vi)

Page 2

Schedule A (Form 990 or 990-EZ) 2012

(Complete only 1f you checked the box on line 5, 7, or 8 of Part I or 1f the organ1zat1on failed to qualify under Part Ill. If the

organization fails to qualify under the tests listed below, please complete Part Il l.)

s ecton

r A

P u brIC s uppo rt

Calendar year (or fiscal year

(a) 2008

(b) 2009

(c) 2010

(d) 201 1

(e) 2012

beginning in) ...

1 G1fts, grants, contributiOns, and

membership fees received. (Do not

mclude any 'unusual grants. ) ..... . . . 1,388 ,4 37 . 1, 293,972. 1,300 , 619. 1,235 ,40 6. 1, 237 , 674 .

2 Tax revenues levied for the

or~an i za t ion's benefit and

eit er paid to or expended

on its behalf. . . . . . . . . . ' .... '

3 The value of services or

faci lities furnished by a

governmental unit to the

organization without charge ...

4 Total. Add lines 1 through 3 ... 1,388,437 . 1 , 293,972 . 1,300,619. 1,235,406. 1,237,674.

5 The portion of total

contributions by each person

(other than a governmental

unit or publicly supported

organization) included on line 1

that exceeds 2% of the amount

shown on line 11 , column (f) ..

Public s upport. Subtract line 5

from line 4. . . . . . . . . . . . '.'. ' . ' .

6

(f) Total

6, 45 6, 10 8.

0.

0.

6,456 ,108.

0.

6,456,108.

S ect'ton BTtiS

oa UDDO rt

Calendar year (or fiscal year

b eg inni ng in) ...

7

Amounts from line 4........

8

Gross income from interest,

dividends, payments received

on securities loans, rents,

royalties and income from

similar sources...... . . . . . . . . . .

(a) 2008

(b) 2009

(c) 2010

(d) 2011

(e) 2012

1,388,437. 1 , 293,972. 1,300,619. 1 ,235,406. 1,237,674.

5,66 4.

3,2 4 5 .

1,209.

1,47 6.

1 ,594.

(f) Total

6,456 ,108.

13,188 .

9 Net income from unrelated

business activities, whether or

not the business is regularly

carried on .... ' ...............

10 Other income. Do not include

gain or loss from the sa le of

capita l as~ts CfpQ iai£ i'J:v

Part IV.) . . ee ... i=i.r ..........

0.

24,236.

19,337.

16,286.

21,368 .

24,388 .

11 Total s upport. Add lines 7

through 10. ...................

105,615.

6,574,911 .

12 Gross receipts from related activities, etc (see instructions) .................. .. .. .. .. .. .. .. .. .. .. .. .. .. .. . .. 1 12

0.

13 First five years. If the Form 990 is for the organization's first, second, th1rd, fourth, or fifth tax year as a sect1on 501 (c)(3)

organization, check this box and stop here ................ ... ................ .

Section C. Computation of Public Support Percentage

14 Public support percentage for 2012 (line 6, column (f) divided by line 11, column (f)) .

98 . 19%

15 Public support percentage from 2011 Schedule A, Part II, line 14.. . . ..... .

98 . 09%