Fresno State Programs for Children, Inc. Report 2013-14 Annual

advertisement

Fresno State Programs for Children, Inc.

2013-14

Annual Report

Approved by the Board of Directors

September 17, 2014

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

CAMP US CHILDREN'S CENTER/EARLY EDUCATION CENTER

TABLE OF CONTENTS

June 30, 2013 and 2014

PAGE

General Information

Corporate Information

Independent Auditor's Report

2

3-4

Financial Statements:

Statements ofFinancial Positíon

5

Statements of Activities

6

Statements of Cash Flows

7

Notes to the Financial Statements

8-12

Additional Infonnation:

Combining Statement ofFinancial Position

!3

Combining Statement of Activities

!4

Schedule ofExpenditures ofFederal and State Awards

15

lndependent Auditor's Report on Internal Control Over Financial Reporting

and on Compliance and Other Matters Based on an Audit of Financial Statements

Performed in Accordance with Government Auditing Stamlards

!6-17

Schedule ofFindings and Questioned Costs

!8

Sumrnary Schedule of Prior Audit Findings

19

Combining Schedule of Administrative Costs

20

Combining Schedule ofExpenditures by State Categories

2!

Schedule ofRenovation and Repair Expenditures

22

Schedule ofReimbursable Equipment Expenditures

23

Audited Final Attendance and Fiscal Report forms:

Audited Attendance and Fiscal Report far Califomia State Preschool

Programs (CSPP)

24-25

Audited Attendance and Fiscal Report far Child Development

Programs (CCTR)

26-28

Audited Fiscal Report for Child Development Programs (CRPM)

Additiona! Information for California State University, Fresno

29

30

Schedulc of Net Position

3!

Schedule ofRevenues, Expenses and Changes in Net Position

32

Other Information

33-34

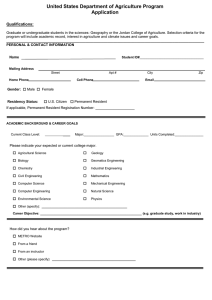

GENERAL INFORMATION

Fresno State Programs For Children, Inc.

Federa1 Grant Project No. 1O-Q621-00-5136-2

Federa1 Grant Project No. 10-Q621-00-3609-2

Chi1d Deve1opment Contract Project No. 10-Q621-00-3254-2

Chi1d Development Contract Project No. 10-Q621-00-3038-2

Federa1 Grant ProjectNo. 10-Q621-00-5136-2

Federa1 Grant Project No. 10-Q621-00-3609-2

Chi1d Deve1opment Contract Project No. 1O-Q621-00-3254-2

Child Development Contract Project No. 1O-Q621-00-24861-1

Nonprofit Corporation

Address:

California State University, Fresno Auxiliary Corporations

2771 E. Shaw Avenue

Fresno, California 93710-8205

(559) 278-0800

For the period July 1, 2013 tlu·ough June 30, 2014

Days of Operation: 234

Schedule of Operation Each Day:

Opening Time- 7:30a.m.- Sites II, III, IV

Closing Time- 5:30p.m.- Sites II, III, IV

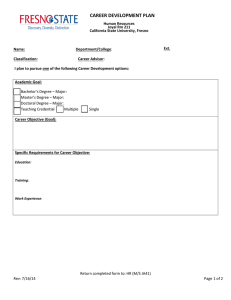

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

CORPORATE INFORMATION

For the Fiscal Year Ended Jnne 30,2014

BOARD OF DIRECTORS

Deborah S. Adishian-Astone

Virginia Crisco

Lindsay Fidler

Tawanda Kitchen

Kathie Reid

Linda Rodriguez

Colleen Torgerson

Sandra Witte

Mehrzad Zarrin

Fresno, Califomia

Fresno, California

Fresno, California

Fresno, Califomia

Fresno, California

Fresno, California

Fresno, California

Fresno, California

Fresno, California

CORPORATE OFFICERS

Chair

Vice Chair

Treasurer

Secretary

Sandra Witte

Colleen Torgerson

Deborah S. Adishian-Astone

Kathie Reid

CORPORATE DATA

Executive Offices

2771 East Shaw Avenue

Fresno, California 93710-8205

Telephone (559) 278-0800

Auditors

Price Paige and Company

677 Scott Avenue

Clovis, Califomia 93612

Telephone (559) 299-9540

2

PRICE PAIGE & COMPANY

Accountancy Corporation

The Place to Be

INDEPENDENT AUDITOR'S REPORT

To the Board of Directors of

Fresno State Programs lor Children, lnc.

Fresno, California

We have audited the accompanying financial statements of Fresno State Programs lor Children, /ne. (Programs lor

Children), a nonprofit organization, which comprise the statements of financial position as of June 30, 2013 and

2014, and the related statements of activities and cash flows lor the years then ended, and the related notes to the

financial statements.

Management's Responsibility for the Fin ancia/ Statements

Management is responsible lor the preparation and fair presentation of these financial statements in accordance

with accounting principles generally accepted in the United States of America; this includes the design,

implementation, and maintenance of internal contra/ relevant ta the preparation and fair presentation of financial

statements that are free from material misstatement, whether due ta fraud or error.

Auditor's Responsibility

Our responsibi/ity is ta express an opinion on these financial statements based an aur audits. We conducted aur

audits in accordance with auditing standards generally accepted in the United States of America and the standards

applicable ta financial audits contained in Government Auditing Standards, issued by the Comptroller General of the

United States. Those standards require that we plan and perform the audit ta obtain reasonable assurance about

whether the fin ancia/ statements are free from material misstatement.

An audit involves performing procedures ta obtain audit evidence about the amounts and disclosures in the financial

statements. The procedures selected depend an the auditor's judgment, including the assessment of the risks of

material misstatement of the financial statements, whether due ta fraud or error. ln making those risk assessments,

the auditor considers internal contra/ relevant to Programs far Children's preparation and fair presentation of the

financial statements in order ta design audit procedures that are appropriate in the circumstances, but nat far the

purpose of expressing an opinion on the effectiveness of Program lor Children's internal control. Accordingly, we

express na such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the

reasonab/eness of significant accounting estimates made by management, as well as evaluating the averal/

presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate ta provide a basis lor our audit

opinion.

Opinion

ln aur opinion, the financial statements referred ta above present fairly, in all material respects, the financial position

of Fresno State Programs far Children, /ne. as of June 30, 2013 and 2014, and the changes in its net assets and its

cash flows lor the years then ended in accordance with accounting principles generally accepted in the United

States of America.

677 Scott Avenue

Clavís, CA 93612

te/ 559.299.9540

(ax 559.299.2344

3

www.ppcpas.com

I

I

Other Matters

Additionallnformation

Our audit was conducted lor the purpose of forming an opinion on the financial statements as a whole. The

accompanying schedule of federal and state awards an page 15 and the information reflected an pages 13-14 and

20-29 are presented as required by the Audit Guide lor Audits of Child Development and Nutritional Programs

issued by the California Department of Education. The information reflected an pages 31-34 is presented, as

required by the Chancellor of the Ca!ifornia State Univers'ty, lor purposes of additional analysis and is nat a required

part of the financial statements. Such information has been subjected ta the auditing procedures applied in the audit

of the basic financial statements and, in our opinion, is fairly stated, ·ln al! material respects, in relation to the basic

financial statements taken as a whole.

Other Reporting Required by Government Auditing Standards

ln accordance with Government Auditing Standards, we have also issued our report dated September 11, 2014, on

aur consideration of Programs lor Children's internal contra! aver flnancial reporting and on aur tests of its

compliance with certain provisions of laws, regulations, contracts, and gran! agreements and other matters. The

purpose of that report is to describe the scope of aur testing of internal contra! aver financial reporting and

compliance and the results of that testing, and nat to provide an opinion on internal contra! aver financial reporting or

on compliance. That repar! is an integral part of an audi! performed in accordance with Government Auditing

Standards in considering Programs lor Children's internal contra! aver financial reporting and compliance.

Clavís, California

September 11, 2014

4

FRESNO STATE PROGRAMS FOR CIDLDREN, INC.

STATEMENTS OF FINANCIAL POSITION

JUNE 30, 2013 AND 2014

ASSETS

2013

Current Assets:

Cash and Cash Equivalents (Note 3)

Accounts Receivable - Contracts

Accounts Receivable - Other

Prepaid Expenses- Deposits

$

Total Current Assets

Fixed Assets:

Equipment

Less Accumulated Depreciation

Total Fixed Assets

TOTAL ASSETS

624,384

128,863

141,711

7,749

2014

$

692,791

4,180

72,566

17,520

902,707

787,057

44,656

(41,446)

44,656

(42,516)

3,210

2,140

$

905,917

$

789,197

$

218,221

$

86,693

LIABILITIES AND NET ASSETS

Current Liabilities:

Accounts Payable and Accrued Expenses (Note 5)

Net Assets:

U nrestricted:

U ndesignated

Designated

Total Unrestricted Net Assets

637,696

50,000

687,696

TOTAL LIABILITIES AND NET ASSETS

$

905,917

Thc accompanying noles are an integra! part ofthe financial statemcnts

5

652,504

50,000

702,504

$

789,197

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

STATEMENTS OF ACTIVITIES

FOR THE YEARS ENDED JUNE 30, 2013 AND 2014

2013

2014

CHANGES IN UNRESTRICTED NET ASSETS:

Revenues:

State Apportionment

Federal Funds

O ne-Time Grants

University Contributions (Note 7)

Day Care Fees- Parent Fees

Student Body Fees (Note 7)

Interest Income

Donations

Miscellaneous

391,730

343,067

87,810

280,010

414,693

1,594

374

24,388

383,453

331,894

1,788

56,250

293,107

361,586

1,333

160

33,292

1,543,666

1,462,863

Expenses:

Program Expenses - Child Care

Management and General

1,367,905

111,685

1,337,660

110,395

Total Expenses (Note 8)

1,479,590

1,448,055

Increase (Decrease) in Net Assets

64,076

14,808

Net Assets at Beginning ofYear

623,620

687,696

$

$

o

Total Revenues

$

NetAssets at End ofYear

687,696

The accompanying notes are an integral part ofthe 'financial statements

6

$

702,504

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED JUNE 30, 2013 AND 2014

2013

CASH FLOWS FROM OPERATING ACTIVITIES

Increase/(Decrease) in Net Assets

Adjustments to Reconcile Increase in Net Assets

to Net Cash Provided/(Used) by Operating Activities:

Depreciation

Changes In:

Accounts Receivable

Prepaid Expenses - Deposits

Accounts Payable and Accrued Expenses

$

64,076

$

2,088

Net Cash Provided/(Used) by Operating Activities

Net Increase/(Decrease) in Cash

Cash and Cash Equivalents at Beginning of Y ear

Cash and Cash Equivalents at End of Year

$

CASH FLOW INFORMATION

lncome Taxes Paid

$

14,808

1,070

(11 0,3 83)

7,003

122,419

193,829

(9,772)

(131,528)

85,203

68,407

85,203

68,407

539,181

624,384

624,384

The accompanying notes are an integral part ofthe financial statements

7

2014

$

692,791

$

6,972

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

NOTES TO THE FINANCIAL STATEMENTS

JUNE 30, 2013 AND 2014

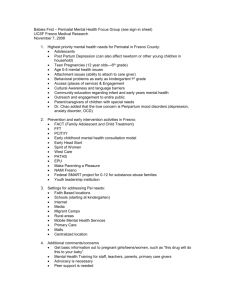

Note 1 -General Information

Fresno State Programs far Children, !ne. ("Programs far Children") was incorporated on December 3,

1996, and began operations on July l, 1999, as a separate non·profit corporation. The Corporation provides

child care services primarily far college stndents, faculty, staff and loca! community members in three sites

at Califomia State University, Fresno.

Note 2- Summary of Significant Accounting Policies

The fmancial statements of the Programs far Children have been prepared on the accrual basis of

accounting. This method accounts far revenues and expenses in the period in which they are considered to

have been eamed and incurred, respectively. The significant accounting policies of the Programs far

Children are described below to enhance the usefulness of the financial statements.

Estima tes

The preparation of fmancial statements in conformity with generally accepted accounting

principles requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date ofthe

financial statements and the reported ammmts of revenues and expenses during the reporting

period. Actnal results could differ from those estimates.

Fund Accountinp-

Programs far Children receives revenues from state and federal grants far program operations. Ta

ensure observance of limitations placed on the use of resources available ta Programs far

Children, the accounts are maintalned in accordance with the principles of fund accounting. Fund

accounting is the procedure by which resources far various purposes are classified far accounting

and reporting purposes into funds established in accordance ta their nature and purpose. Federal

and state child development contracts are reported as a single contract because Programs far

Children bas been allowed ta commingle expenditures. The Combining Statement of Financial

Position and Combining Statement of Activities reflect the respective assets, liabilities, revenues,

expenses and net assets of the General Child Development Program Fund and Child Care Food

Program Fund.

Cash and Cash Eguivalents

Far purposes of the Statements of Cash Flows, cash includes short-tenn highly liquid investments

with an initial maturity of three months or less.

Accounts Receivable-Other

Accounts receivable-other are statecl at the amount management expects to collect from

outstanding balances. Management provides far probable uncollectible amounts through a

provision far bad debt expense andan adjustment to a valuation allowance based on its assessment

of the current status of indiviclual accounts. Balances that are still outstanding after management

has used reasonable co!lection efforts are written offthrough a cbarge to the valuation allowance

and a credit to accounts receivable. Inclucled in accounts receivable at June 30, 2014 are amounts

relating to uncollectible daycare fees - parents. Allowances far doubtful accounts in the amounts

of $5,500 and $2,500 have been established as of June 30, 2013 anc! 2014, respectively.

8

Note 2

Summary of Significant Accounting Policies, continued

Fixed Assets

Fixed Assets are reflected on the financial statements at cost less accumulated depreciation.

Depreciation is computed using straight-line rates based on the estimated useful !ives, ranging

from three to ten years. The organization capitalizes all expenditures in excess of$5,000.

401(k) Plan

The organization has a 40 I (k) plan which covers eligible employees meeting age and length of

service requirements. Eligible employees contribute to the plan with salary deferrals. The

organization matches the first 5% of employee deferrals. Contributions to the plan for the years

ended June 30,2013 and 2014, totaled $2,536 and $1,997 and are included in employee benefits.

Tax Status

The organization is organized and operated exclusively for educational purposes and is thus

allowed tax exempt status under provisions ofsection 50l(c)(3) ofthe Internal Revenue Code and

section 2370l(d) of the California Revenue and Taxation Code. However, income for certain

activities not directly related to the organization's tax-exempt purpose is subject to taxation as

unrelated business income.

Expense Allocation

The costs of providing various programs and other activities have been summarized on a

functional basis in Note 8 - Expenses by Natural Classification. Accordingly, certain costs have

been allocated among programs and supporting services.

Note 3

Cash and Cash Eguivalents

Cash at June 30 consisted ofthe following:

Deposits:

Cash On-Hand and in Banks

Pooled Funds:

Cash in State of California Lo cal Agency

Investrnent Funds

Total

$598,725

$667,068

25 659

25 723

$_924 384

$692 791

At June 30, 2014, the FDIC insures cash balances held in interest and noninterest-bearing accounts

combined up to $250,000. At June 30,2013 and 2014, Programs for Children's uninsured cash balances at

Citibank total e el $356,178 and $417,569 respectively.

Programs for Children maintains som e of its cash in the State of California Loca! Agency Inves!ment Fund.

The state pools these funds with those of other organizations and invests the eash. Tbese pooled funds are

carried at cast, which approximates market value. Interest earned is remitted quarterly to Programs for

Children. Any investment losses are proportionately shared by all funcls in the pool.

9

Note 4- Fair Value Measurernents

Generally accepted accounting principles define fair value as the price that would be received to sell an

asset or paid to transfer a liability in an orderly transaction between rnarket participants at the measurement

date. ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to

measure fair value. The hierarchy gives the highest propriety to unadjusted quoted prices in active markets

for identical assets or liabilities (Level I measurements) and the lowest priority to measurements involving

significant observable input (Level 3 measurements). The three levels of the fai.r value hierarchy are as

follows:

Level 1 - Inputs are quoted market prices (unadjusted) in active markets for identical assets or

liabilities. Valuations for assets and liabilities traded in active exchange markets. Valuations are

obtained from readily available pricing sources far market transactions involving identical assets

or liabilities.

Level 2 - Inputs other than quoted prices within Level I that are observable, either directly or

indirectly. Valuations for assets and liabilities traded in less active dealer or broker markets.

Valuations are obtained from thu·d party pricing services far identical or similar assets or

liabilities.

Level3- Inputs are unobservable. Valuations for assets and liabilities that are derived from other

valuation methodologies, including option pricing models, discounts cash flow models and similar

techniques, and not based on market exchange, dealer, or broker t.raded transactions. Level 3

valuations incorporate certain assumptions and projections in determining the fair value assigned

to such assets or liabilities.

The table below presents the balance of assets measured at fair value on a recurring ba~is ul June 30:

2013

Fair

Value

Cash and Cash Equivalents

Totals

$624,384

$624 384

Level I

2014

Fair

Value

Cash and Cash Equivalents

Totals

$692,79 I

$_622.791

$624,384

$624 384

Levet!

$692,791

$6.22,7.21

Note 5- Accounts Payable and Accrued Expenses

Included lll accounts payable are the unspent California Department of Education (CDE) funds for the

years ended June 30:

Contract

CCTR

CSPP

2013

$113,243

o

2014

$24,278

20 677

$113 243

H.4..2.5..5.

The amounts will be repaid to the CDE only after the CDE has closed the years' contracts and has notified

the Programs for Children to repay the funds.

10

Note 6- Contingencies

Programs for Chi1dren has received Ca1ifornia Department ofEducation funds for specific purposes that are

subject to review and audit by the grantor agencies. A1though such audits cou1d generate expenditure

disallowance under terms ofthe grants, it is believed that any required reimbursements will not be material.

The organization receives approximate1y 49% of its revenues from State and Federa1 contracts. A

reduction in the amounts obtained from contracts cou1d impact the operations ofthe organization.

Note 7- Related Parties

Programs for Chi1dren had transactions with Califomia State University, Fresno during the year ended June

30 as follows:

An allocation was received from the University' s Division of Student Affairs to supp1ement Programs

for Children operations of $31,560 and $0 for each of the years ended June 30, 2013 and June 30,

2014, respective1y.

The Jordan College of Agricu1ture Science and Technology contributed $27,440 for each ofthe years

ended June 30,2013 and June 30,2014. The Kremen Schoo1 ofEducation and Human Deve1opment

contributed $28,810 for each ofthe years ended June 30, 2013 and June 30, 2014.

Student Body Fee income allocated to Programs for Children amounted to $414,693 for the year ended

June 30, 2013 and $361,586 for the year ended June 30, 2014. At June 30, 2013, the Programs for

Chi1dren had a receivab1e from the University of $0 and a payab1e to the University of $61,784 for

sa1ary/wages rehnbursement. At June 30, 2014, Programs for Children had a receivab1e from the

University of $0 for Student Body Fee income and a payable to the University of $0 for salary/wages

and other expense reimbursement.

Faci1ity Lease for use of University premises effective Jn1y I, 2011 through June 30, 2016.

Reimbursement of University resources has been set forth by the Memorandum of Understanding

(MOU). Based on the terms set forth by the MOU, Programs for Children paid to the University $0 for

both years for administration fees; and $0 for facilities/maintenance fees for the year ended June 30,

2013 and June 30, 2014.

In addition to the University, Programs for Chi1dren is related to California State University, Fresno

Association ("Association") due lo common management of the two entities. Programs for Children had

the following transactions with the Association during the years ended June 30, 2013 and 2014:

Pursuant to a management services agreement, Programs for Children pays administrative fees to the

Association for management services. The administrative fees for the years ended June 30, 2013 and

2014 were $70,600 and $68,500, respective1y, based on services rendered.

Programs for Children has transactions with the Association. The amounts due the Association from

Programs for Children were $0 and $200 at Jtme 30, 2013 and 2014, respectively.

Programs for Children has transactions with the Agricultural Foundation of California State

University, Fresno. The amounts due the Agricultural Foundation from the Programs for Children

were $0 and $121 at June 30, 2013 and 2014, respectively.

11

Note 8- Expenses by Natural Classification

The following is a detailed list of expenses by natural classification for the year ended June 30:

2014

General &

2013

General &

Program

Administrati ve

Total

Program

Administrative

Total

Certificated Salaries:

Teachers

Supervisors

Classified Salaries:

Instructional Aides

Clerical

Other

$363,105

143,666

$363,105

143,666

$352,090

149,857

$352,090

149,857

297,507

43,109

64,495

297,507

43,109

64,495

111,685

279,826

279,473

43,109

61,967

277,947

279,473

43,109

61,967

110,395

277,947

68,319

44,259

1,238

14,593

11,421

5,229

3,470

2,088

25 581

65,546

44,310

2,113

14,624

11,044

2,735

3,474

1,070

28 301

$1337660

65,546

44,310

2,113

14,624

11,044

2,735

3,474

1,070

28 301

$!,;148 ill

$111,685

Administration Fees

Employee Benefits

279,826

$110,395

Food Services:

Food

Personnel

Other Food Expenses

Instructional Supplies

Other Supp1ies

Travel/Training

Telephone

Depreciation

Other Operating Expenses

68,319

44,259

1,238

14,593

11,421

5,229

3,470

2,088

25 581

U,3.67 905

$!11 685

$1,'1.7.!1,~

$110395

Note 9- Subseguent Events

Subsequent events have been evaluated through September 11, 2014, which is the date the financial

statements were available to be issued, noting no matters requiring disc1osure in the financial statements for

the year ended June 30, 2014.

Note I O- Uncertain Tax Positions

Pragrams far Children has qualified as a non-prafit organizatian and bas been granted tax-exempt status

pursuant to the Internal Revenue Cade Sectian 50l(c)(3) and Califarnia Revenue and Taxatian Cade

Section 23701(d) and is exempt from Federal and State of California incame taxes.

Generally accepted accounting principles provides accaunting and disclasures guidance about pasitions

taken by an entity in its tax returns that might be uncertain. Management bas considered its tax positions

anc! believes that all of the positions taken in its federal and state exempt organization tax returns are more

likely than nat to be sustained upon examination. Programs far Children's returns are subject to

examination by federal and state taxing authorities, generally for three years and four years, respectively,

after they are filed.

12

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

CAMPUS CHILDREN'S CENTER/ EARLY EDUCATION CENTER

COMBINING STATEMENT OF FINANCIAL POSITION

JUNE 30, 2014

General Child

Development

Program

ASSETS

Current Assets:

Cash and Cash Equivalents

Accounts Receivable - Contracts

Accounts Receivable - Other

Prepaid Expenses - Deposits

Due from Child Care Food Program

$

Total Current Assets

692,791

678

72,566

17,520

6,149

Child Care

Food

Program

$

$

789,704

Fixed Assets:

Equipment

Less Accumulated Depreciation

Total Fixed Assets

TOT AL ASSETS

Total

3,502

692,791

4,180

72,566

17,520

(6,149)

o

(2,647)

787,057

44,656

(42,516)

44,656

(42,516)

2,140

2,140

$

791,844

$

(2,647)

$

789,197

$

89,340

$

(2,647)

$

86,693

LIABILITIES AND NET ASSETS

Cun·ent Liabilities:

Accounts Payable and Accrued Expenses

Unrestricted Net Assets

702,504

TOTAL LIABILITIES AND NET ASSETS

$

791,844

702,504

$

(2,647)

The accompanying notes are an integral part ofthe financial statements

13

$

789,197

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

CAMPUS CHILDREN'S CENTER! EARLY EDUCATION CENTER

COMBINING STATEMENT OF ACTIVITIES

JUNE 30, 2014

General Child

Development

Program

Changes in Unrestricted Net Assets:

Revenues:

State Apportionment

Federal Funds

One-Time Grants

University Contributions

Day Care Fees - Parent Fees

Student Body Fees

Interest Income

Donations

Miscellaneous

$

383,453

266,935

1,788

56,250

293,107

361,586

1,333

160

33,292

Child Care

Food

Program

Total

$

$

64,959

383,453

331,894

1,788

56,250

293,107

361,586

1,333

160

33,292

Total Revenues

1,397,904

64,959

1,462,863

Expenses:

Program Expenses- Child Care

Management and General

1,272,701

110,395

64,959

1,337,660

110,395

Total Expenses

1,383,096

64,959

1,448,055

Increase in Net Assets

Net Assets at Beginning of Year

Net Assets at End ofYear

$

14,808

14,808

687,696

687,696

702,504

$

The accompanying notes are an integral part ofthe financial statements

14

$

702,504

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

Carn pus Children's Center/Early Education Center

Child Care Food Program- Centers

Schedule ofExpenditures ofFederal and State Awards

Year Ended June 30, 2014

Program Name

Federal:

U.S. Department ofHealth and Human Services

Pass~through Califomia Department ofEducation

Child Care Food Program

04549-CACFP-10-NP-CS

Child Care and Development (CCDF) Cluster

Child Development Programs

3609-1

Federal

CFDA

Number

Program

or Award

Amount

$

10.558

64,959

Reven uc

Recognized

$

64,959

Expenditures

$

64,959

93.596

134,284

132,416

132,416

Child Development Prograrns

5136-1

93.575

64,053

63,163

63,163

Child Development Programs

3609-1

93.596

49,218

48,311

48,311

Child Development Programs

5136-1

93.575

23,477

23,045

23,045

335,991

331,894

331,894

Total U.S. Department ofHealth and Human Scrvices

Total Federal Assistance

$

335,991

$

331,894

$

331,894

Child Development Prograrns

3254-1

$

219,492

$

192,163

$

192,163

State:

Child Development Programs

3254-1

80,449

71,265

71,265

Child Development Programs

3038-1

135,493

120,025

120,025

Child Development Programs

24861-1

1,788

1,788

1,788

437,222

385,241

385,241

Total Califomia Department ofEducation

Total State Assistance

$

437,222

$

385,241

BASIS OF PRESENTATION

Thc accompanyíng Scheclule ofExpenditures ofFederal and State Awards (the Scheclule) presents the

activity of all federal and state awarcl programs ofthe Fresno State Programs far Children, Inc. The

Schedule includes federal awards passed through other agen eies and nonfederal awards.

The accompanying Scheclule is presented on the accmal basis ofaccounting. The information in this

Schedule is prescnted in accordance with the requirements ofOMB Circular Awl33, Audits o[States,

Loca! Govemments, and Non-Proflt Organizations.

15

$

385,241

PRICE PAIGE

& COMPANY

Accountancy Corporation

The Place to Be

INDEPENDENT AUDITOR'S REPORT ON INTERNAL CONTROL OVER

FINANCIAL REPORTING AND ON COMPLIANCE AND OTHER MATTERS

BASED ON AN AUDIT OF FINANCIAL STATEMENTS PERFORMED IN

ACCORDANCE WITH GOVERNMENT AUOITING STANDAROS

To the Board of Directors of

Fresno State Programs lor Children, Ine.

Fresno, California

We have audited, in accordance with the auditing standards generally accepted in the United States of America and

the standards applicable to financial audits contained in Govemment Auditing Standards issued by the Comptroller

General of the United States, the financial statements of Fresno State Programs lor Children, lnc. (Programs lor

Children), a nonprofit organization, which comprise the statement of financial position as of June 30, 2014, and the

related statements of activities and cash flows lor the year then ended, and the related notes to the financial

statements, and have issued aur report thereon dated September 11, 2014.

lnternal Control Over Financial Reporting

ln planning and performing aur audit of the financial statements, we considered Programs lor Children's internal

control aver financial reporting (internal control) ta determine the audit procedures that are appropriate in the

circumstances lor the purpose of expressing aur opinion on the financial statements, but nat far the purpose of

expressing an opinion on the effectiveness of Programs lor Children's internal control. Accordingly, we do nat

express an opinion on the effectiveness of Programs lor Children's internal control.

A deficiency in internal contra/ exists when the design or operation of a control does nat allow management or

employees, in the normal course of performing their assigned functions, to prevent, or detect and correct,

misstatements on a timely basis. A material weakness is a deficiency, or a combination of deficiencies, in internal

contra I, such that there is a reasonable possibility that a material misstatement of the Programs lor Children's financial

statements will nat be prevented, or detected and corrected on a timely basis. A significant deficiency is a deficiency,

or a combination of deficiencies, in internal control that is less severe than a material weakness, yet important enough

ta merit attention by those charged with governance.

Our consideration of internal control was far the limited purpose described in the first paragraph of this section and

was nat designed to identify all deficiencies in internal control that might be material weaknesses or significant

deficiencies. Given these limitations, during aur audit we did not identify any deficiencies in internal control that we

consider ta be material weaknesses. However, material weaknesses may exist that have nat been identified.

Compliance and Other Matters

As part of obtaining reasonable assurance about whether Programs far Children's financial statements are free !rom

material misstatement, we performed tests of its compliance with certain provisions of laws, regulations, contracts,

and grant agreements, noncompliance with which could have a direct and material effect on the determination of

financial statement amounts. However, providing an opinion an compliance with those provisions was nat an

objective of aur audi!, and accordingly, we do nat express such an opinion. The results of aur tests disclosed no

instances of noncompliance or other matters that are required to be reported under Government Auditing Standarc/s.

677 Scott Avenue

Clovis, CA 93612

te/ 559.299.9540

(ax 559.299.2344

16

www.ppcpas.com

Purpose of this Report

The purpose of this report is solely to describe the scope of aur testing of internal control and compliance and the

results of that testing, and nat to provide an opinion on the effectiveness of Programs lor Children's internal control or

on compliance. This report is an integral part of an audi! performed in accordance with Government Auditing

Standards in considering Programs lor Children's intern al control and compliance. Accordingly, this comrnunication is

nat suitable lor any other purpose.

Clovis, California

September 11, 2014

17

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

SCHEDULE OF FINDINGS AND QUESTIONED COSTS

FOR THE YEAR ENDED JUNE 30, 2014

I.

Summary of Auditor's Results

Financial Statements:

Type of auditor's repar! issued:

Unmodified

lnternal contra! aver financial reporting:

Material weakness(es) identified?

___ Yes

X

Na

Significant deficiencies identified

that are nat considered ta be

material weakness(es)?

___ Yes

X

Na

___ Yes

X

Na

Noncompliance material ta financial statements

noted?

11.

Findings- Financial Statement Audit

None reported

111.

Findings and Questioned Costs- Federal and State Awards

None reported

18

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

SUMMARY SCHEDULE OF PRIOR AUDIT FINDINGS

FOR THE YEAR ENDED JUNE 30, 2014

I.

Findings- Financial Statement Audit

None reported

11.

Findings and Questioned Costs- Federal and State Awards

None reported

19

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

Combining Schedule of Administrative Costs

Year Ended June 30, 2014

Reimbursable

Administrative Costs

lnsurance

Office Supplies

Accounting Fees

Audi! Fees

Other Operating Expenses

Total Administrative Costs

CCTR-3034

CSPP-3066

$

7,274

5,477

47,239

14,389

787

$

3,274 $

2,465

21,261

6,476

354

$

$

75,166

$

33,830

$ 108,996

20

CRPM-3008

$

Total CDE

10,548

7,942

68,500

20,865

I, 141

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

Camp us Children's Center/Early Education Center

Combining Schedule of Expenditures by State Categories

Far the Year Ended June 30, 2014

Center

Federal

State

PreMeal

Meal

One-Time

School

Program Program

Grants

Progrnms

o

o

o 109,284

1000 Certificated Personnel Salaries

1100 Salaries-Teachers

1300 Salaries-Supervisors

3400

3500

3600

3900

Clnssified Personnel Salaries

Salaries-Instruct Ai des

S.A.-Instructional Aides

Workstudy-Instruct.Aides

Salaries-Clerical

Salaries-Food Services

O

O

o

o

o

o

o

30,556

Sub-Total

30,556

Sub-Total

12,838

1,114

5,113

2,514

26,578

Health/Life Benefits

SUI

Workers Camp. Ins.

Other Benefits

o

Total

Unreimbursed

Expenses

o

Total

Reported

Expenses

352,090

501,947

o

48,547

o

o

o

54,632

2,800

13,380

107,861

121,380

6,220

29,729

156,408

176,012

o

o

o

o

13,754

133,113

265,190

156,408

176,012

9,020

43,109

44,310

428,859

o

o

o

o

o

o

o

o

o

41,635

3,616

16,599

79,666

6,920

31,766

134,139

11,650

8,208

86,271

15,721

165,098

26,443

277,947

o

o

o

1,587

o

o

o

5,113

2,007

1,084

1,901

237

541

3,741

7,543

313

7,942

138

3,050

65,546

2,113

101,269

o

623

337

590

73

168

o

o

o

5,113

2,007

1,084

1,901

237

541

3,'141

7,543

313

7,942

138

3,050

65,546

2,113

101,269

296

2,735

1,020

10,548

3,474

O

O

O

O

O

296

2,735

1,020

10,548

3,474

O

O

738

1,070

O

O

O

O

O

O

O

o

o

o

o

o

o

O

O

O

O

O

O

O

O

O

O

92

849

316

3,274

1,078

204

1,886

704

7,274

2,396

O

O

O

O

O

O

O

O

O

O

O

O

O

O

O

O

O

O

O

O

O

o

o

o

305

6,555

211

7,825

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

9,020

43,109

44,310

428,859

o

o

o

o

o

O

O

O

O

O

754

Sub-Total

O

656

31,433

o

4 790 Food Supplies

501,947

o

o

o

4710 Food

346,149

o

o

o

o

Classroom Furnishings

Inside Toys

Outside Toys

Bedding Supplies

Infant Supplies

Cleaning/Maint Supplies

Laundry Supplies

Office Supplies

Miscellaneous Supplies

Paper Goods

155,798

3,526

1,384

747

1,31 I

164

373

2,580

4,448

216

5,477

95

1,798

38,646

1,246

62,011

o

4300 Instructional Books/Media

5000

5110

5200

5300

5440

5500

5500

5600

5600

5600

5800

5800

5800

O

o

4000 Books nnd Supplics

4300 Arts & Crafts

4300

4300

4300

4500

1500

4500

4500

4500

4500

4500

Total

Reimbursed

Expenses

352,090

----~o~----~o______~o~~4~6~,5~1~4________~1o~3~,3s4*3____~14~9~,,~5~7________~o~~1~49~,~s5~7~

Sub-Total

2000

2100

2100

2100

2300

2500

Center and

Block Grant

Child Dcvelopment

Programs

242,806

1,161

2,341

97

2,465

43

947

20,345

53,478

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

134,139

11,650

53,478

26,443

277,947

Services and Other Opcmting Expenses

lnstructional Consultants

Travel/Conferences

Dues/Nl:emberships

lnsurance-Pupils

Telephone

Utilitíes

DepreciationofEquip.

Rent

Repairs/Maintenance

AccountingFees

Audit Fee

OtherOperatingExpense

O

332

O

O

O

2,046

21,261

6,476

6,564

4,545

47,239

14,389

14,581

6,591

68,500

20,865

21,145

O

1,070

O

6,591

68,500

20,865

21,145

_____,o'---_____o;;----è1'ó,7-:i8c0;8---;c;;-;;:;;o;;-----------;v;-;,-;70----~~1c;,7;';8é;8----------C,:O:--occ1;;',7~8iò8'-

6000 Equipment Purchased

Sub-Tolal

O

O

1,788

42,288

93,956

138,032

Federal and State Child Developmcnt contracts are recorded as a single contract becausc the center has becn allowed to commingle expcnditures.

Thc auditors have examined the claims for reimbursement and the original supporting records covering thc transactions under ihcse contracts

to an extcnt considered necessary to assure themselves that the amounls claimed by the agency were proper.

21

O

138,032

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

Schedule ofRenovation and Repair Expenditures

Year Ended June 30, 2014

CCTR-3066

Unit Cost Under $10,000 Per ltem

Miscellaneous Repairs

Subtotal

$

4,545

CSPP-3034

$

4,545

2,046

2,046

CRPM-3008

$

Total Costs

$

6,591

6,591

Unit Cost Over $10,000 Per Itcm

With Prior Written Approval

None

$

$

$

$

$

$

$

$

$

$

Subtotal

Unit Cost Ovcr $10,000 Per Item

Without Prior Writtcn Approval

None

Subtotal

Total Rcnovation and Rcpair Expenditures

$

4,545

$

Note: Fresno State Programs far Children, Inc.'s capitalization threshold is $5,000 or more.

22

2,046

6,591

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

Schedule of Reimbursable Equipment Expenditures

Year Ended June 30, 2014

Unit Cost Under $7,500 Per Itcm

Room Divider for Infants

Wall and Gateway for Infants

Subtotal

CCTR-3066

$

CSPP-3034

$

Total Costs

CRPM-3008

$

1,110

$

1,11

o

678

678

1,788

1,788

Unit Cost Over $7,500 Per Item

With Prior Written Approval

None

$

$

$

$

Without Prior Wrítten Approval

None

Subtotal

$

$

$

$

Total Renovation and Repair Ex:penditures

$

$

$

Subtotal

Unit Cost Over $7,500 Per ltem

Note: Fresno State Programs for Children, Inc.'s capitalization threshold is $5,000 or more.

23

1,788

$

1,788

Please Read lnstructions Before

1

g Report

AUDITED ATTENDANCE AND FISCAL REPORT

for California State Preschool Programs

IAgency Name:

Fresno state Programs lor Children, !ne

Fiscal Year Ended:

June 30, 2014

lndependent Auditor's Name:

Vendor No. 0621

Contract No.

CSPP oMa

Prke, Paige and Company

COLUMN A

SECTION I - CERTIFIED CHILDREN

DAYS OF ENROLLMENT

CUMULATIVE

FISCAL YEAR PER

FORM CDFS 8501

IB

AUDIT

ADJUSTMENTS

ID

COLUMNC.

CUMULATIVE

FISCAL YEAR PER

AUDIT

ADJUSTMENT

FACTOR

IE

AOJUSTED DAYS

OF ENROLLMENT

PER AUDIT

Thr;:, and Four Year 0/ds

r 11

I

rull-11me

Tl

""

203

5,684

3,024

200

203

5,684

3,024

200

1.1800

1.0000

0.7500

0.6172

-

-

1.4160

1.2000

0.9000

0.6172

-

-

-

-

-

1.2980

1.1000

0.8250

0.6172

-

1.2980

1.1000

0.8250

0.6172

-_

-

-

1.7700

1.5000

1.1250

-

?~Q

1;.<10

R RR.d Of

2,268.000

123.440

I Needs

i

Full-time

"'

i

I

Limited and Mnn-Fnnli.<h

"'

wuc•o•u

i

i

-

Tr

-

-

I i

At Risk of Abuse or

-

'O

-

I

I

Full-time

-

Thce

-

n

;u

"'I

-

"J

-

Full-time

i

One-h"lf-Hme

ITOTAL DAYS OF ENROI MI'NT

,TION

IDAYS OF

INCE

IDAYS OF Al

D

-

9,111

_234

9,111

-

.llliili

9,~~1

~

9,111

NO NONCERTIFIED CHILDREN - Check this box, amit page 2, and continue ta Section III if na noncertlfied children were enrolled in the program.

mts- 11

lry, attach

sheets ta explain adju

AUD 8501, Page 1 of 4 (FY 2013-14)

California Department of Educalion

24

Please Read lnstructions Before Completing Report

AUDITED ATTENDANCE AND FISCAL REPORT

for California State Preschool Programs

Name:

.....!:11::"'-'Y

Fiscal Year End:

Vendor No. 0621

Fresno State Programs far Children, lnc

June 30, 2014

rN 111 -

Contract No.

COLUMN A

COLUMN 8

COLUMN C

~~~~~L YEAR

AUDIT

ADJUSTMENT

INCREASE OR

(DECREASE)

CUMULATIVE FISCAL

YEAR PER AUDIT

~~~:~:.~

""

$0

Coun\y

Other (Specify):

Other'

i

$0

$0

o

, of Effort (EC § 8279)

o

o

Subtotal

·from

'amily ees for Cer itiec

'amily ees or Cer itiec

i

nteresr oarned on

I

I

$0

17,286

3,027

Part-Day

1UNK~o

r ~·V, cu INCOME

Family Fees for Noncertified Children

Head Start

, (EC §

Other

Other

o

o

o

o

TOTAL t<C'IENUE

o~<; I JUN

1000

2000

3000

IV- REIMBURSABLE EXPENSES

ii

i

i

$0

~loo,798

$0

133,112

86,227

31,433

42,288

I

.ooo Books and

:ooo

. and Other •

l Other

<on,"'

44

$20,313

~-

00,18"

133,112

86,271

31 ,433

42,288

o

I Capital Outlay

400 New

I)

(1~:~~~~~:~~:~:";';••:":~·::·;··~·,•~·:~::::;:~:: on Agency's compllanca with Contract Fundlng Tarms and Conditlons and Program

IF

''i"l

~lj,;hiJih

i

0

O

of the Callfornia Dapartrnent of Education, Early Educatlon and Suppmt Divislon:

11

vl a\tendance records are being

as required (check YES or NO):

COMMENTS- I

attach additional sheets to explain

YES

NO- Explaln any dlscrepancles.

.

~~~~:~::~:~iexpenses

claimed above are eligible far

i

reasonable, necessary, and adequately

l0

D

[2]

(check YES or NO):

YES

NO- Explaln any dlscrepancies.

NO SUPPLEMENTAL REVENUES OR EXPENSES- Check this box and omit page 4 if there are na supplemental revenues or expenses to report.

California Department of Educatlon

AUD 8501, Page 3 of 4 (FY 2013-14)

25

Please Read lnstructions Before Completing Report

AUDITED ATTENDANCE AND FISCAL REPORT

far Child Development Programs

1~..,.

Name:

Fresno State Programs far Children, lnc

Fiscal Year Ended:

Vendor No. Q621

June 30, 2014

lndependent Auditor's Name:

Contract No.

_'-''-' I K·OU04

Price, Paige and

IA

SECTION I· CERTIFIED CHILDREN

DAYS OF ENROLLMENT

FIS°C-;;~~Cé"~";EF

FORM •

COLUMN B

AUDIT

IC

"""

AOJUSTMENTS

T[" :Fl~C!'L

-~EAR PE~"'~UDIT

D

ADJUSTMENT

FACTOR

COLUMN E

ADJUSTED DAYS

OF ENROLLMENT

PERAUDIT

lnfants(up ~o 18,

Full-time

I

FCCH /nfants (up lo 18 monthsl

Full-time plus

Full-time

Tl

i

i

Toddlers (18 up lo 36

V'

11 I

''"

Full-tlme

i

T

I

.

-

2.006

1,282

793

281

1,282

793

281

1.700

1.275

0.935

.

.

.

-

-

.

1.652

1.400

1.050

0.770

-

.

.

2,179.400

1,011.075

.

.

-

.

.

.

.

1.652

3,905

844

216

3,905

844

216

1.400

1.050

0.770

5,467.000

25

1,377

265

72

25

1,377

265

72

1.180

29.500

1,377.000

198.750

39.600

.

-

1.416

-

-

1.200

0.900

0.660

-

166.320

Thr:~, ~ears and 0/der

Full-time

I

1.000

0.750

0.550

I Needs

I

Full-time

-

Tl

-

.

-

-

I

-

-

i

-

-

-

I

-

Full-time

-

I

Limited and

"V<

-~u"U.OU

< 'VHOIC'

Full-time

i

Th1

At ~;~~i~f Abuse

1.298

1.100

0.825

0.605

-

-

1.298

-

-

-

1.100

0.625

0.605

-

1.770

-

1.500

1.125

-

~

-

-

-

·o·

v•

Full-time

i

ve""' o<y

I

TOTAL DAYS OF ENI

DAYS OF OPERATION

DAYS OF"'"

o

-

1ENT

9,060

234

9,060

-

-

9,~~~~

9,060

NO NONCERTIFIED CHILDREN " Check thls box, omit page 2, and contlnue to Sectlon III lf no noncertlfled chlldren were

I"

lf 0°'' 0 '

'", attach additional sheets to explain orlil'

AUD 9500, Page 1 of 4 (FY 2013-14)

Californla Department of Education

26

Please Read lnstructions Before Completing Report

INC:E AND FISCAL REPORT

AUDITED A"• 1

for Child Development Programs

Agenc 1 Name:

Fresno State Programs lor Children, Ine

Fiscal Year Ended:

June 30, 2014

1ooo, lu" 11 • NONCERTIFIED CHILDREN

IReport all chlldren who were not certified, but who

lwere served at the same sites as certifled children.

DAYSOFENROLLMENT

Contract No.

COLUMN A

CUMULATIVE

FISCAL YEAR PER

FORM CDFS 9500

lnfa2;,siup lo 18

Full-time

i

u•

FC?u~-{;~:a~~~

(up lo 18 "'v""'"'

Full-!ime

I

u

Ò

/ VVV<O<

Vendor No. g§_21

(

JB

AUDIT

ADJUSTMENTS

IC

CUMULATIVE

FISCAL YEAR PER

AUDIT

CCTR-3034

ID

(

ADJUSTMENT

FACTOR

COLUMN E

ADJUSTED DAYS

OF ENROLLMENT

PER AUDIT

.

.

2.006

387

11

397

11

1.700

.

.

0.935

.

-

-

1.652

-

674.900

14.025

1.275

-

1.050

-

-

0.77D_

-

1.400

(18 Up lo 36

I

Full-time

n

(

i

-

-

1.652

1,259

336

1,259

336

1.400

-

-

0.770

138

2,925

1,145

192

138

2,925

1'145

192

1.180

-

-

1.416

1.200

-

-

0.900

-

-

0.660

-

1.050

1

352.800

-

Three Years and 0/der

I

i

Full-time

Tl

i

i

1.000

0.75D_

0.550

162.840

2,925.000

858.750

105.600

I Needs

~A'

r:;, 11

i

Full-time

i

I

Umiled and "v'

,.L.,~,;,,

-

-

1.298

-

Full-time

-

-

1.100

-

Tl

-

-

0.825

-

-

-

0.605

-

-

-

1.298_

-

-

1.100

-

0.625

-

-

-

0.605

-

-

-

1.770

-

-

1.500

-

-

-

1.1~

I

e

I I

At R:.~k of Abuse or''~~·~"''

I

I

Full-time

-

i

vo e~,;,:;:'~

Full-1ime

i

i

JU IA~

DAYS OF

attach additional sheets to explain

;-IJ

AUD 9500,

~T

Page 2 of

-

6,403

-~

6,403

-

15

<

4 (FY 2013-14)

California Department of Education

27

Please Read lnstructions Before Completing Report

AUDITED ATTENDANCE AND

REPORT

for Child Development Programs

IAéiBn•:y Name:

Fres na State Programs far Children, !ne

Vendor Na .

.9§31_

~J'-"u'-'ne"-"3"0,c.:2,_,0'-'12

4 _ _ _ _ _---,-_ _ _ _ _ _ _ Contract No.-'

r-'~•r-T~o"e''"~''----------1

Fiscal Year End:

lnsert Any Commingled Contract Na.

IA

FISCAL YEAR

PER FORM

CDFS 9500

SECTION 111- REVENUE

Kc~~~~" 1cu INCOME

tR&,O'Q

1

B

AUDIT

ADJUSTMENT

INCREASE OR

(DECREASE}

$0

IC

CUMULATIVE FISCAL

YEAR PER AUDIT

$64,959

'of Effort (EC § 8279)

I Checks to

Jther (Soecitv):

:ounty

o

o

$64,959

o

1,67

o

o

o

i

Children

261,124

261,124

3§:2,60C

$790,353

$0

45:'.600

$790,353

.u

~u

~u

9i

346,149

295,746

1,676

l,S:

l,95

o

lEC~·

::Jther

i

TOTAL REVENUE

SECTION IV- REIMBURSABLE EXPENSES

C.

' IO

!FC ~H

'IYI

I Salaries

1 I Salaries

I

· Benefits

I Books and

i

5000 .

; and Other

1

O Other

I Capital Outlay

6400 New Equipment

I)

6500

1 orUse.

Start-Up

, (service level

Budget I

t#

'Credlt

93,956

o

o

o

o

o

o

t#

lndirect Costs.

Rate:

TOTAL

'~

0.00%

IR•<ol

I·

o

1 1

CLAIMED FOR '"'IMRI

$997,267

$97

ll::;;,:.~~~~~t~Audltor's Assurances on Agency's comp!lance wlth Contracl Fundlng Terms and Condltions and Program

IR

of the Callfornla Department of Educatlon, Early Educatlon and Support Dlvlslon:

IEii~l~lli:y, enrollment, and attendance records are being

lmellnlal1;ed ·" requlred (cl18ck YES or NO):

1

0

YES

O

NO- Explaln any discrepancJes.

, ellech addHlonal •hool• lo "plaln 1

:~;~~~~::~~1;~:expenses

clalmed above are eliglble for

, reasonable, necessary, and adequately

'~-'~-''

(check YES or NO):

0

YES

O

NO - Explain any

[2]

NO SUPPLEMENTAL REVENUES OR EXPENSES- Check this box and omit page 4 lf there are no supplemental revenues or expenses to report.

AUD 9500, Page 3 of 4 (FY 2013-14)

Californla Department of Education

28

Please Read lnstructions Before Completing Report

AUDITED FISCAL REPORT

for Child Development CRPM Support Contracts

Agency Name:

Fresno State Programs for Children, Ine

Fiscal Year End:

.::J.::u:.:;ne::...::.30"''-'2"0"1..:.4_ _ _ _ _ _ __

Contract Term

From:

lndependent Auditor's Na me:

Vendor No. .::0006"'2'-'1----1

Contract No.

..::Cc.R::.P..c:M:.::3.::0o::08'-----------l

July 1, 2013

To:

June 30, 2016

COLUMNA2

COLUMN B

Price Paiqe and Companv

COLUMN A1

PRIOR YEAR'S

SECTION I • REVENUE

RESTRICTED INCOME

Prorated Portion far Nonsubsidized Enrollment

Other (Speci v\:

Other (Speci ):

Other (Speci ):

AUD 9529-CRPM

GURRENT

ENDING

FISCAL YEAR

BALANCE FOR

THIS CONTRACT

(Multi-Year

Contract Onty)

PER FORM

COFS 9529-

$0

CRPM

$0

AUDIT

ADJUSTMENT

INCREASE OR

(DECREASEI

COLUMN C

CUMULATIVE

THROUGH

CURRENT

FISCAL YEAR

PERAUDIT

$0

$0

o

o

o

Subtotal

$0

$0

$0

$0

o

INTEREST EARNED ON APPORTIONMENTS

UNRESTRICTED INCOME

Other (Specify):

Other (Specify):

o

o

TOTAL REVENUE

SECTION 11 • REIMBURSABLE EXPENSES

1000 Certificated Salaries

2000 Classified Salaries

3000 Emplovee Benefits

4000 Books and Supplies

5000 Services and Other Operatinq Expenses

6100/6200 Other Approved Capital Outlay

6400 New Eou'1pment (program-related)

6500 Replacement Equipment (program-related)

Depreciation or Use Allowance

NONREIMBURSABLE EXPENSES

6100-6500 Nonreimbursable Capital Outlay

Other (Specify):

·

$0

$0

$0

$0

$0

$0

$0

$0

o

o

o

o

o

o

1,813

J25

1,788

o

o

o

o

o

Other (Specifv):

TOTAL EXPENSES CLAIMED FOR REIMBURSEMENT

(Subsidized and Nonsubsidized)

$0

$1,813

($25)

$1,788

COMMENTS. if necessary, attach additional sheets to explain adjustments:

I2J

NO SUPPLEMENTAL REVENUES OR EXPENSES- Check this box and amit page 2 lf there are no supplemental revenues or expenses to

AUD 9529-CRPM, Page 1 of 1 (FY 2013-14)

Californla Department of Education

29

ADDITIONAL INFORMATION

FOR CALIFORNIA STATE UNIVERSITY, FRESNO

30

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

SCHEDULE OF NET POSITION

JUNE 30, 2014

(far inclusion in the California State University)

Assets:

Current Assets:

Cash and Cash Equlvalents

Short-term Investments

Accoonts Recelvable, Net

Prepald Expenses and Other Assets

Total Corrent Assets

$

Noncurrent Assets:

Capital Assets, Net

Total Noncorrent Assets

667,069

25,722

76,746

17,520

787,057

2,140

2,140

789,197

Total Assets

Liabllities:

Corrent Liabilities:

Accoonts Payab1e

Accroed Salari es and Benefits Payable

Accrued Compensatecl Absences, Current Pmtion

Total Corrent Liabllities

67,218

2,500

69,718

Noncorrent Liabilities:

Accroed Compensated Absences, Net of Corrent Portion

Total Noncorrent Liabilities

16,975

16,975

86,693

Total Liabilities

Net Position:

Net fnvestment in Capital Assets

Unrestrictecl

2,140

700,364

$

Total Net Position

See Accompanying lnclependent Auditors' Report

31

702,504

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

SCHEDULE OF REVENUES, EXPENSES AND CHANGES IN NET POSITION

YEAR ENDED JUNE 30, 2014

(for inclusion in the California State University)

Revenues:

Operating Revenues:

Student Tuition and Fees

Grants and Contracts, Noncapital:

Federal

State

Sales and Services of Auxiliary Enterprises (net of scholarship allowances of$0)

$

361,586

331,894

385,241

293,107

Total Operating Revenues

1,371,828

Operating Expenses:

Auxiliary Enterprise Expenses

Depreciation and Amortization

Total Operating Expenses

1,446,985

1,070

1,448,055

Expenses:

Operating Loss

(76,227)

Nonoperating Revenues:

Gifts, noncapital

Investment lncome, net

Other Nonoperating Revenues

Net Nonoperating Revenues

56,410

1,333

33,292

91,035

Increase in Net Position

14,808

Net Position:

Net Position at Beginning ofYear, as Previously Reported

Net Position at End of Y ear

687,696

$

Sec Accompanying lndcpendent Auditors 1 Reporl

32

702,504

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

OTHER INFOR.\1ATION

JUNE 30, 2014

(far inclusion in the California Statc University)

I.

Restricted Cash and Cash Equivalents at June 30, 2014:

Not Applicable

2.1

Composition of lnvestments at June 30, 2014:

Current

Unrestricted

State ofCalifomia Loca! Agency

lnvestment Fund (LAIF)

Restricted Current Investrnents at June 30, 2014 related to:

Not Applicable

2.4

Restricted Noncurrent Investrnents at June30, 2014 related to:

Not Applicable

3.1

Composition of Capital Asscts at June 30, 2014:

Depreciable Capital Assets

o

25,722

2.3

Balance

_ ~June30, 2013

Total

Corrent

Current

Restricted

Prior Period

Adjustrnents

Noncurrent

Noncurrent

Unrestricted

Restricted

o

25,722

Balance

June 30, 2013

(restated)

Reclassifications

Total

Noncurrent

o

Total

o

25,722

Transfers

of Completed

Additions

Reductious

CWIP

Balance

June 30, 2014

w

w

Personal Property:

Equipment

Total Depreciable Capital Assets

44,656

o

o

44,656

o

44,656

44.656

o

o

44,656

o

44,656

(41,446)

o

o

i41,446)

(1,070)

(42,516)

(41,446)

o

o

(41,446)

(1,070)

(42,516)

3,210

o

o

3,210

(1,070)

2,140

Less Accumulated Depreciation

Personal Property:

Equipment

Total Accumulated Depreciation

Total Capital Assets, Net

3.2

Detail ofDepreciation and Arnortization Expense at June 30, 2014:

Depreciation and Amortization Expense Related to Capital Assets

Amortization Related to Other Assets

1,070

Total Depreciation and Amortization

1.070

o

See Accompanying lndependent Auditor's Report.

FRESNO STATE PROGRAMS FOR CHILDREN, INC.

OTHER INFORMATION

JUNE 30, 2014

(for indusion in the California State University)

4.

Long-Term Liabilities Activity Scbedule:

Balance

June 30, 2013

Accrued Compensated Absences

5.

22,011

Prior Period

Adjustments

Reclassifications

o

Balance

June 30, 2013

(restated)

o

Reductions

Additions

22,011

15,484

Future Minímum Leasc Payments:

Not Applicable

6.

Long Term Debt Obligation Schedule:

Not Applicable

7.

Calculation of Net Position:

7.1

Calculation of Net Position- Net Investment in Capital Assets:

Auxiliary Organizations

GASB

FASB

Capital Assets, Net of Accumulated Depreciation

Net Position- Net Investment in Capital Asset

$

$

$

$

2,140

2,140

Total

Auxiliaries

2,140

2,140

$

$

_,_

·~

7.2 Calculation of Net Position- Restricted for Nonexpendable Endowments:

Not Applicable

8.

Transactions witb Related Entities

Payments to University for salaries or University personnel working on contracts, grants and other programs

Payments to University for other than salaries ofUniversity personnel

Payments received from University for services, space, and programs

Amount

432,220

7,672

56,250

o

Amounts receivable from University

Amounts (payable to) University (enter as negative number)

9.

Other Postemployment Benefits Obligation (OPEB):

Not Applicable

10.

Pollution Remediation Liabilíties under GASB Statement No. 49:

Not Applicable

1I. The Nature and Amount ofthe Prior Period Adjustment(s) Recorded to Beginning Net Position:

Not Applicable

See Accompanying lndependent Auditor's Report.

(18,020)

Balance

June 30, 2014

19,475

Corrent

Portion

2,500

Long-Term

Portion

16.975