Accounting Business Documents [INTERMEDIATE 1;

advertisement

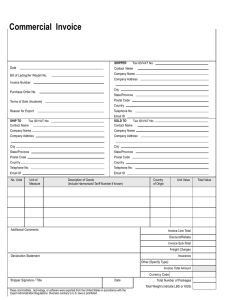

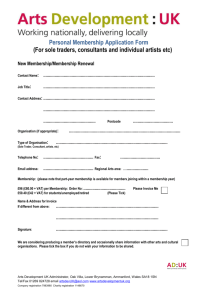

Accounting Business Documents [INTERMEDIATE 1; INTERMEDIATE 2; HIGHER] Dorothy Brown Accounting Intermediate 1; Intermediate 2 Business Documents Higher ------------------------------------------------------------------------------------------------------------ The Scottish Qualifications Authority regularly reviews the arrangements for National Qualifications. Users of all NQ support materials, whether published by LT Scotland or others, are reminded that it is their responsibility to check that the support materials correspond to the requirements of the current arrangements. Acknowledgement Learning and Teaching Scotland gratefully acknowledge this contribution to the National Qualifications support programme for Accounting. ISBN 1 84399 025 3 First published 2004 This publication may be reproduced in whole or in part for educational purposes by educational establishments in Scotland provided that no profit accrues at any stage. © Learning and Teaching Scotland 2 Accounting Intermediate 1; Intermediate 2 Business Documents Higher ------------------------------------------------------------------------------------------------------------ CONTENTS Introduction 4 Section 1: Calculation of VAT Section 2: Examples Invoice Credit note Statement of account Cheques and receipts 13 20 22 24 Section 3: Exercises 28 Section 4: Answers to exercises 41 © Learning and Teaching Scotland 7 3 Accounting Intermediate 1; Intermediate 2 Business Documents Higher ------------------------------------------------------------------------------------------------------------ INTRODUCTION A business document provides information and is an official record of a transaction for both the buyer and the seller. In a cash transaction goods/services are paid for by cash, cheque or debit card immediately they are received. A credit transaction is one in which the goods/services change hands but payment is made at a later date. A cash transaction is straightforward and needs little documentation: cash sales may be recorded from the till roll cash purchases may be recorded from receipts, cheque counterfoils or debit card receipts. A credit transaction requires more documentation: credit sales are recorded from copies of invoices sent to buyers; payments received are written up from cheques received from customers or from direct debit and credit transfer documents credit purchases are recorded from invoices sent by suppliers; payments made are written up from the counterfoils of cheques sent or from direct debit and credit transfer receipts. All business documents are used as records but only a few are used by the accounts department. Documents A firm interested in finding a source of goods or services would investigate the possibilities. When possible sources are found, an Inquiry may be sent to each one asking for details of quality, prices and delivery times. In response to this inquiry a Catalogue, Price list or Quotation might be sent, showing the information required. These are studied and compared and a supplier is selected. This selection may be on the basis of the lowest price but quality of goods/ services, reliability in delivery and follow-up service are extremely important. The buyer can now place an order with the selected supplier. © Learning and Teaching Scotland 4 Accounting Intermediate 1; Intermediate 2 Business Documents Higher ------------------------------------------------------------------------------------------------------------ INTRODUCTION Customer’s documentation Inquiry sent Quotation/price list received Order placed Goods received along with dispatch/advice note Invoice received If payment made now If payment not made Statement received Cheque written Cheque written © Learning and Teaching Scotland 5 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------INTRODUCTION Order An order is sent by the buyer to the supplier and shows the following information: name and address of both the buyer and supplier date order number details of goods required – catalogue number, description, quantity and unit price signature of the person authorised to make the purchase any special delivery instructions. One order form is sent to the supplier; the buyer may need several copies of the order for various departments. Example GLENTRESS GARDENS Lakeside Road GLENTRESS GS4 6YB Tel: 01643 845128 ORDER To: Terracotta Supplies Braehead Road GLASGOW G78 3ND Order no: 4176 Date: 07.02.04 Please supply the following: Cat No T246 T247 T248 T1398 Signature the following: Quantity 50 80 50 100 Description Unit price Oak leaf, large Oak leaf, medium Oak leaf, small Special offer: set of 4 pots £ 10.00 7.50 4.80 15.00 K L Dawson BUYER © Learning and Teaching Scotland 6 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------CALCULATION OF VAT SECTION 1 Calculation of VAT VAT is a tax (currently at the rate of 17.5%) that must be added to the value of most goods and services. In many instances VAT will be 17.5% of cost price of the goods, the amount being added at the point of sale. Note that when VAT is calculated to more than 2 decimal places the amount is rounded down, e.g. £6.948 is shown as £6.94. Examples • • • Cost price VAT (17.5%) Total cost £100 £500 £1,000 £17.50 £87.50 £175.00 £117.50 £587.50 £1,175.00 Task 1 Copy and complete the following table to show the VAT and total cost payable. Cost price VAT (17.5%) Total cost 1. £800 2. £960 3. £2,400 4. £3,800 5. £4,260 6. £5,320 © Learning and Teaching Scotland 7 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------CALCULATION OF VAT VAT when cost includes trade discount Customers who buy in bulk are often allowed to buy at a lower price – they are allowed trade discount. Trade discount is deducted from the original cost of the goods and gives a lower net cost. VAT is calculated on this lower figure. Examples • • • Cost Trade discount % Net cost VAT 17.5% Total cost £400 £840 £1,400 20% 25% 20% £320 £630 £1,120 £56 £110.25 £196 £376 £740.25 £1,316 £80 £210 £280 Task 2 Copy and complete the following table to show the VAT and total cost. 1. £600 Trade discount % 20% £120 2. £1,500 15% 3. £3,200 10% 4. £5,480 20% 5. £8,264 25% 6. £10,000 20% Cost Net cost VAT 17.5% Total cost £480 £225 © Learning and Teaching Scotland 8 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------CALCULATION OF VAT VAT when cash discount is allowable Terms of payment may include cash discount. This is a deduction allowed to customers who pay promptly (usually within a stated time e.g. 10 days). VAT is calculated on the lowest possible price. If cash discount terms are shown on the invoice, VAT is calculated on cost less cash discount. However, the final invoice figure is net cost + VAT. Total cost = Cost price – trade discount + VAT (The customer only receives cash discount if the invoice is paid on time.) Examples Cost Trade discount Cash discount VAT 17.5% • £10,000 % 0 Lowest price 2.5% £250 £9,750 £1,706.25 • £10,000 10% 2.5% £2251 £8,775 £1,535.62 • £24,000 0 5% £1,200 £22,800 £3,990 • £24,000 20% 5% £9602 £18,240 £3,192 • £32,000 0 4% £1,280 £30,720 £5,376 • £32,000 15% 4% £1,0883 £26,112 £4,569.60 £1,000 £4,800 £4,800 2.5% × (£10,000 – £1,000) 2 2.5% × (£24,000 – £4,800) 3 4% × (£32,000 – £4,800) 1 © Learning and Teaching Scotland 9 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------CALCULATION OF VAT Task 3 Complete the following table to show the amount of VAT chargeable and invoice total. Cost £ 600 2,000 4,000 1,600 240 545 8,420 12,400 25,000 54,800 84,000 77,000 Trade discount % 0.0 0.0 0.0 0.0 0.0 0.0 25.0 15.0 20.0 10.0 12.5 12.0 Cash discount £ 0.00 0.00 2,105.00 1,860.00 © Learning and Teaching Scotland % 2.5 5.0 4.0 4.0 2.0 2.5 2.0 4.0 2.5 5.0 2.5 5.0 Lowest price £ 15.00 100.00 £ 585.00 126.30 421.60 6,188.70 VAT VAT % 17.5 17.5 17.5 17.5 17.5 17.5 17.5 17.5 17.5 17.5 17.5 17.5 Invoice total £ 102.38 £ 702.38 1,083.02 7,398.02 (i.e. £600+£102.37) (i.e. £8,420 - £2,105 + £1,083.02) 10 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------CALCULATION OF VAT Answer to Task 1 Cost price VAT (17.5%) Total cost 1. £800 £140 £940 2. £960 £168 £1,128 3. £2,400 £420 £2,820 4. £3,800 £665 £4,465 5. £4,260 £745.50 £5,005.50 6. £5,320 £931 £6,251 Answer to Task 2 Cost Trade discount % Net cost VAT 17.5% Total cost 1. £600 20% £120 £480 £84 £564 2. £1,500 15% £225 £1,275 £223.12 £1,498.12 3. £3,200 10% £320 £2,880 £504 £3,384 4. £5,480 20% £1,096 £4,384 £767.20 £5,151.20 5. £8,264 25% £2,066 £6,198 £1,084.65 £7,282.65 6. £10,000 20% £2,000 £8,000 £1,400 £9,400 © Learning and Teaching Scotland 11 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------CALCULATION OF VAT Answer to Task 3 Complete the following table to show the amount of VAT chargeable and invoice total. Cost £ 600 2,000 4,000 1,600 240 545 8,420 12,400 25,000 54,800 84,000 77,000 Trade discount % £ 0.0 0.00 0.0 0.00 0.0 0.00 0.0 0.00 0.0 0.00 0.0 0.00 25.0 2,105.00 15.0 1,860.00 20.0 5,000.00 10.0 5,480.00 12.5 10,500.00 12.0 9,240.00 © Learning and Teaching Scotland Cash discount % £ 2.5 15.00 5.0 100.00 4.0 160.00 4.0 64.00 2.0 4.80 2.5 13.63 2.0 126.30 4.0 421.60 2.5 500.00 5.0 2,466.00 2.5 1,837.50 5.0 3,388.00 Lowest price 585.00 1,900.00 3,840.00 1,536.00 235.20 531.38 6,188.70 10,118.40 19,500.00 46,854.00 71,662.50 64,372.00 VAT VAT % 17.5 17.5 17.5 17.5 17.5 17.5 17.5 17.5 17.5 17.5 17.5 17.5 £ 102.38 332.50 672.00 268.80 41.16 92.99 1,083.02 1,770.72 3,412.50 8,199.45 12,540.93 11,265.10 Invoice total £ 702.38 2,332.50 4.672.00 1,868.80 281.16 637.99 7,398.02 12,310.72 23,412.50 57,519.45 86,040.93 79,025.10 (i.e. £600+£102.37) (i.e. £8,420 - £2,105 + £1,083.02) 12 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES SECTION 2 Invoice When the order is received the goods, if available, are packed for delivery to the customer. Full details are recorded on an Invoice. Part of the invoice may be copied and forwarded as an Advice note or included with the parcel(s) as a Delivery note. The invoice is sent to the customer when the goods are despatched and shows the following details: names and addresses of supplier and buyer order number and invoice number date details of goods – quantity, catalogue number and description unit price and total price for the quantity total price before any deductions/additions trade discount deducted, if any VAT added, if any total amount due from customer terms applicable e.g. cash discount for payment within a stated time. The advice and delivery notes show the first four items but all prices are excluded. The invoice is sent to the customer and several copies are retained by the supplier e.g. one copy each to sales, despatch, stock and accounts departments. The customer is usually required to pay the amount due on receipt of the invoice or within the time stated on the invoice e.g. one month. Late payment may result in the loss of cash discounts. Two discounts may appear on an invoice – trade discount and cash discount. Trade discount is usually allowed between traders in the same line or for buying in bulk. It is expressed as a percentage and the amount shown after deduction is the net purchase price. For example, goods sold for £800 less 20% trade discount would cost the buyer only £640 (£800–£160). © Learning and Teaching Scotland 13 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES Cash discount is offered to encourage customers to pay promptly. For example, terms may show a discount of 5% for payment within 10 days. A customer settling an account within that time can deduct 5% from the amount due. The customer owing £640 need only pay £608 (£640–£32) if the account is paid within 10 days. VAT (Value added tax) is a government tax on most goods and services and the current rate is 17.5%. It is calculated on the lowest possible price. The calculation may be based on cost price cost price less trade discount cost price less cash discount cost price less trade and cash discounts. © Learning and Teaching Scotland 14 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES Example (Invoice with no discounts) INVOICE TERRACOTTA SUPPLIES Braehead Road GLASGOW G74 3ND Glentress Gardens Lakeside Road GLENTRESS GS4 6YB Order no: 4176 Invoice no: 5930 Date: 10.02.04 Quantity Cat No Description Unit price £ 50 80 50 100 T246 T247 T248 T1398 Oak leaf, large Oak leaf, medium Oak leaf, small Special offer: set of 4 pots 10.00 7.50 4.80 15.00 Total price £ 500.00 600.00 240.00 1,500.00 2,840.00 Add VAT @ 17.5% AMOUNT DUE 497.00 3,337.00 Terms: Delivery: Rail NOTE: VAT is calculated on cost. £2,840 × 17.5% = £497 © Learning and Teaching Scotland 15 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------Examples Example (Invoice with trade discount only) INVOICE TERRACOTTA SUPPLIES Braehead Road GLASGOW G74 3ND Glentress Gardens Lakeside Road GLENTRESS GS4 6YB Order no: 4176 Invoice no: 5930 Date: 10.02.04 Quantity Cat No Description Unit price £ Total price £ 50 T246 Oak leaf, large 10.00 500.00 80 50 100 T247 T248 T1398 Oak leaf, medium Oak leaf, small Special offer: set of 4 pots 7.50 4.80 15.00 600.00 240.00 1,500.00 2,840.00 Less 20% trade discount 568.00 2,272.00 Add VAT @ 17.5% AMOUNT DUE 397.60 2,669.60 Terms: Delivery: Rail NOTE: VAT is calculated on cost less trade discount Cost price Less 20% trade discount £2,840.00 568.00 £2,272.00 £2,272 × 17.5% = £397.60 . © Learning and Teaching Scotland 16 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES Example (Invoice with cash discount only) INVOICE TERRACOTTA SUPPLIES Braehead Road GLASGOW G74 3ND Glentress Gardens Lakeside Road GLENTRESS GS4 6YB Quantity Cat No Order no: 4176 Invoice no: 5930 Date: 10.02.04 Description Unit price Total price £ £ 50 T246 Oak leaf, large 10.00 500.00 80 50 100 T247 T248 T1398 Oak leaf, medium Oak leaf, small Special offer: set of 4 pots 7.50 4.80 15.00 600.00 240.00 1,500.00 2,840.00 Add VAT @ 17.5% AMOUNT DUE 472.15 3,312.15 Terms: 5% within 10 days Delivery: Rail NOTE: VAT is calculated on cost less cash discount, but added to net cost of goods. Cost £2,840 5% cash discount 142 Cost less discount £2,698 VAT @ 17.5% £2,698 × 17.5% = £472.15 © Learning and Teaching Scotland 17 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES Example (Invoice with trade and cash discounts) INVOICE TERRACOTTA SUPPLIES Braehead Road GLASGOW G74 3ND Glentress Gardens Lakeside Road GLENTRESS GS4 6YB Order no: 4176 Invoice no: 5930 Date: 10.02.04 Quantity Cat No Description Unit price £ Total price £ 50 T246 Oak leaf, large 10.00 500.00 80 50 100 T247 T248 T1398 Oak leaf, medium Oak leaf, small Special offer: set of 4 pots 7.50 4.80 15.00 600.00 240.00 1,500.00 2,840.00 Less 20% trade discount 568.00 2,272.00 Add VAT @ 17.5% AMOUNT DUE 377.72 2,649.72 Terms: 5% within 1 week Delivery: Rail © Learning and Teaching Scotland 18 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES NOTE: VAT is calculated on the lowest possible cost i.e. cost less trade discount less cash discount. Cost price £2,840.00 Less 20% trade discount Net cost Less 5% cash discount Lowest cost VAT 568.00 £2,272.00 113.60 £2,158.40 £2,158.40 × 17.5% = £377.72 © Learning and Teaching Scotland 19 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES Credit Note Sometimes goods bought have to be returned, for example if they are faulty, damaged in transit or not exactly as ordered. The amount due from the customer will have to be reduced by the value of the returned goods. The document used to show this is a Credit note. A credit note is also used to correct an overcharge. The credit note is made out by the seller and sent to the buyer. A copy is kept for the accounts department. The information given in a credit note is the same as in the invoice but it shows the reason for the credit. It is called a credit note because it results in a credit entry in the customer’s account. Note: If goods sold at a trade discount are returned, the same amount of trade discount must be deducted on the credit note and the net value entered in the accounts. When trade and cash discounts are shown on the invoice, the same method of calculation of VAT is used on the credit note. © Learning and Teaching Scotland 20 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES Example CREDIT NOTE TERRACOTTA SUPPLIES Braehead Road GLASGOW G74 3ND Glentress Gardens Lakeside Road GLENTRESS GS4 6YB Credit Note no: 48 Invoice no: 5930 Date: 16.02.04 Quantity Cat No Description 20 T1398 Special offer: set of 4 pots Faulty Unit price £ 15.00 Total price £ 300.00 Add VAT @ 17.5% 52.50 CREDIT AMOUNT 352.50 A Debit note is sent by the seller to the buyer to correct an undercharge. It is similar to a credit note in layout but shows details of the undercharge. This is used to correct the entries in the customer’s account. © Learning and Teaching Scotland 21 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES Statement of account A statement of account is used when customers do not settle their debts on receipt of invoice. The statement summarises all transactions that have taken place since the previous statement. It is a copy of the customer’s account in the ledger and notifies the customer that payment is due. The seller sends the statement to the customer and passes one copy to its own accounts department. Example STATEMENT OF ACCOUNT TERRACOTTA SUPPLIES Braehead Road GLASGOW G74 3ND Glentress Gardens Lakeside Road GLENTRESS S4 6YB Date: 28.02.04 Date Details Debit £ 2004 Feb 10 Feb 16 Invoice 5930 Credit 48 3,237.00 Credit £ Balance £ 352.50 3,237.00 2,884.50 The last amount shown in the balance column is the amount owing. Terms: net cash within one month. TERRACOTTA Braehead OF ACCOUNT SUPPLIES Road GLASGOW G74 3ND © Learning and Teaching Scotland 22 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES Example (showing opening balance) STATEMENT OF ACCOUNT ULLAPOOL TWEEDS North Road ULLAPOOL Date: 30 January 2004 Classic Clothing plc Perth Road CRIEFF PH42 6YH Date Details Debit £ Credit Balance £ £ 2004 Jan 1 Jan 5 Jan 8 Brought forward Invoice 3468 Invoice 3752 Jan 15 Jan 23 Credit note 426 Cheque 002451 Discount allowed Invoice 4010 Jan 28 820.00 2,060.00 3,043.50 1,240.00 983.50 220.00 780.00 40.00 2,823.50 2,043.50 2,003.50 4,463.50 2,460.00 The last amount shown in the balance column is the amount due on 28 February. Explanation Date Transaction Effect on balance Jan 1 Jan 5,8 Jan 15 Jan 23 Amount owing from previous transactions Credit sales to Classic Clothing plc Goods returned by Classic Clothing plc Cheque sent by Classic Clothing plc Discount allowed to Classic Clothing plc (for settling the opening balance within the stated time) Credit sales to Classic Clothing plc Debit balance Increase Decrease Decrease Decrease Jan 28 © Learning and Teaching Scotland Increase 23 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES Cheques A cheque is an order to a bank to pay out the sum of money shown on the cheque to the person named on the cheque. This is a safe form of payment. Crossed cheques must be paid into a bank account and cannot be cashed across the counter. Cheque books are issued by the bank (the drawee) and contain the following: name of bank, the branch address and the sort code account name and number cheque number – cheques are numbered consecutively through the book. The person writing the cheque (the drawer) must fill in the following details: date name of person to whom the money is to be paid (the payee) the amount in words and in figures authorised signature. Cheque counterfoils may be completed or pages at the back of the book may be used to keep a record of payments made. These provide the information for accounting records. Example © Learning and Teaching Scotland 24 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------Example © Learning and Teaching Scotland 25 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES Receipts for cash payments A receipt is a document confirming that cash has been received. A receipt is not necessary when payment is made by cheque because the bank statement issued by the bank lists all cheques paid out from the account. There are different types of receipt and a few are listed below: a statement stamped and signed by the recipient and returned to the customer; a receipt form showing date, amount received, name of payer and signature of the recipient of the cash; the appropriate part of the till roll torn off and handed to the customer. Credit/debit card receipt Credit and debit cards are often used in place of cash or cheques and are regarded as safe methods of payment. Payment by debit card means that the amount is immediately electronically transferred (switched) from the customer’s bank account to the account of the supplier. Payment by credit card defers payment until a later date. The bill is sent to the credit card company e.g. Visa, Barclaycard and payment need not be made until the credit card statement is received. The receipt shows how payment has been made. If a credit or debit card has been used the card number (or part of it) is shown. Pay-in slip When money is deposited in the bank it must be accompanied by a pay-in slip. The pay-in slip shows the date, name and number of the account and the amount paid in. These details are entered in the counterfoil which can then be used when writing up the accounts. © Learning and Teaching Scotland 26 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXAMPLES Till Roll Receipt (cash) Till Roll Receipt (debit card) PERTHSHIRE FOODS Crieff PERTHSHIRE FOODS Crieff VAT No: 426 3108 04 Date: 2 March 2004 Time: 1230 hrs VAT No: 426 3108 04 Date: 2 March 2004 Time: 1230 hrs 425679 Cream of Tomato 20 @ £2.50 419834 Cream of Chicken 20 @ £2.60 365412 Tartare Sauce 30 @ £1.20 365420 Hollandaise Sauce 20 @ £1.15 425679 Cream of Tomato 20 @ £2.50 419834 Cream of Chicken 20 @ £2.60 365412 Tartare Sauce 30 @ £1.20 365420 Hollandaise Sauce 20 @ £1.15 Items: 4 Total 50.00 52.00 36.00 23.00 161.00 Items: 4 Total 50.00 52.00 36.00 23.00 161.00 Paid by cash Paid by Switch************6807 Authorisation Code 2164 You were served by: Pauline CARDHOLDER PLEASE RETAIN FOR YOUR RECORD You were served by: Pauline Pay-in counterfoil Date: 14 March 2004 Account: J Robinson Co 135682 Amount: £540.00 Paid in by: M Robinson © Learning and Teaching Scotland 27 Accounting Intermediate 1; Intermediate 2 Business Documents Higher ------------------------------------------------------------------------------------------------------------ SECTION 3 EXERCISES Exercise 1a INVOICE Yorkshire Leather plc 12 Ripon Road WETHERBY HE8 9US To: M&R Russell 64 Fife Street ST ANDREWS KY32 7MO Quantity Cat No 18 prs C345 18 prs C498 12 prs S530 10 Date: 7 March 2004 Order no: 3471 Invoice no: 10455 Description Unit price Total price £ £ 50.30 905.40 52.00 936.00 58.20 698.40 C345 Leather shoes, navy, sizes 4–8 Leather shoes, cream, sizes 4–8 Leather shoes, mink, sizes 4–8 Bag, navy 36.00 360.00 5 BC498 Bag, cream 37.45 187.25 3 BS530B Bag, mink 25.10 75.30 Total 3,162.35 Add VAT @ 17.5% AMOUNT DUE Terms: Delivery: Own transport You are required to calculate the following figures and insert them in the invoice above. VAT @ 17.5% amount due. © Learning and Teaching Scotland 28 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXERCISES Exercise 1b INVOICE Yorkshire Leather plc 12 Ripon Road WETHERBY HE8 9US To: M&R Russell 64 Fife Street ST ANDREWS KY32 7MO Quantity Cat No 18 prs C345 18 prs C498 12 prs S530 10 Date: 7 March 2004 Order no: 3471 Invoice no: 10455 Description Unit price Total price £ £ 50.30 905.40 52.00 936.00 58.20 698.40 C345 Leather shoes, navy, sizes 4–8 Leather shoes, cream, sizes 4–8 Leather shoes, mink, sizes 4–8 Bag, navy 36.00 360.00 5 BC498 Bag, cream 37.45 187.25 3 BS530B Bag, mink 25.10 75.30 Total 3,162.35 Less 25% trade discount Net cost Add VAT @ 17.5% AMOUNT DUE Terms: Delivery: Own transport You are required to calculate the following figures and insert them in the invoice above. trade discount net cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 29 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXERCISES Exercise 1c INVOICE Yorkshire Leather plc 12 Ripon Road WETHERBY HE8 9US To: M&R Russell 64 Fife Street ST ANDREWS KY32 7MO Quantity Cat No 18 prs C345 18 prs C498 12 prs S530 10 Date: 7 March 2004 Order no: 3471 Invoice no: 10455 Description Unit price Total price £ £ 50.30 905.40 52.00 936.00 58.20 698.40 C345 Leather shoes, navy, sizes 4–8 Leather shoes, cream, sizes 4–8 Leather shoes, mink, sizes 4–8 Bag, navy 36.00 360.00 5 BC498 Bag, cream 37.45 187.25 3 BS530B Bag, mink 25.10 75.30 Total 3,162.35 Add VAT @ 17.5% AMOUNT DUE Terms: 5% within 10 days Delivery: Own transport You are required to calculate the following figures and insert them in the invoice above. (Remember to check the terms shown at the end of invoice). VAT @ 17.5% amount due. © Learning and Teaching Scotland 30 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXERCISES Exercise 1d INVOICE Yorkshire Leather plc 12 Ripon Road WETHERBY HE8 9US To: M&R Russell 64 Fife Street ST ANDREWS KY32 7MO Quantity Cat No 18 prs C345 18 prs C498 12 prs S530 10 Date: 7 March 2004 Order no: 3471 Invoice no: 10455 Description Unit price Total price £ £ 50.30 905.40 52.00 936.00 58.20 698.40 C345 Leather shoes, navy, sizes 4–8 Leather shoes, cream, sizes 4–8 Leather shoes, mink, sizes 4–8 Bag, navy 36.00 360.00 5 BC498 Bag, cream 37.45 187.25 3 BS530B Bag, mink 25.10 75.30 Total 3,162.35 Less 25% trade discount Net cost Add VAT @ 17.5% AMOUNT DUE Terms: 5% within 10 days Delivery: Own transport You are required to calculate the following figures and insert them in the invoice above. trade discount net cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 31 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXERCISES Exercise 2a INVOICE Moorhouse Lighting Broughton Road Peebles Solway Homes Stranraer Road DUMFRIES DS2 3RT Date: 10 March 2004 Ref no JK178 JK462 JM329 JM862 HL21 RL15 Quantity 10 15 20 40 6 10 Order no: 14 Invoice no: 842 Details Table lamp and matching shade Table lamp Floor standing lamp Table lamp with glass shade Hobby lamp Desk lamp Unit price Total price £ £ 38.00 24.00 62.30 32.60 18.20 25.40 380.00 360.00 1,246.00 1,304.00 109.20 254.00 Total VAT @ 17.5% AMOUNT DUE Terms: Delivery: Borders Transport You are required to complete the invoice by calculating and inserting the following figures. total cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 32 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXERCISES Exercise 2b INVOICE Moorhouse Lighting Broughton Road Peebles Solway Homes Stranraer Road DUMFRIES DS2 3RT Date: 10 March 2004 Ref no JK178 JK462 JM329 JM862 HL21 RL15 Quantity 10 15 20 40 6 10 Order no: 14 Invoice no: 842 Details Table lamp and matching shade Table lamp Floor standing lamp Table lamp with glass shade Hobby lamp Desk lamp Unit price Total price £ £ 38.00 24.00 62.30 32.60 18.20 25.40 380.00 360.00 1,246.00 1,304.00 109.20 254.00 Total Less 10% trade discount Net cost VAT @ 17.5% AMOUNT DUE Terms: Delivery: Borders Transport You are required to complete the invoice by calculating and inserting the following figures. total cost trade discount net cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 33 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXERCISES Exercise 2c INVOICE Moorhouse Lighting Broughton Road Peebles Solway Homes Stranraer Road DUMFRIES DS2 3RT Date: 10 March 2004 Ref no JK178 JK462 JM329 JM862 HL21 RL15 Quantity 10 15 20 40 6 10 Order no: 14 Invoice no: 842 Details Table lamp and matching shade Table lamp Floor standing lamp Table lamp with glass shade Hobby lamp Desk lamp Unit price Total price £ £ 38.00 24.00 62.30 32.60 18.20 25.40 380.00 360.00 1,246.00 1,304.00 109.20 254.00 Total VAT @ 17.5% AMOUNT DUE Terms: 2.5% within 1 month Delivery: Borders Transport You are required to complete the invoice by calculating and inserting the following figures. total cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 34 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXERCISES Exercise 2d INVOICE Moorhouse Lighting Broughton Road Peebles Solway Homes Stranraer Road DUMFRIES DS2 3RT Date: 10 March 2004 Ref no JK178 JK462 JM329 JM862 HL21 RL15 Quantity 10 15 20 40 6 10 Order no: 14 Invoice no: 842 Details Table lamp and matching shade Table lamp Floor standing lamp Table lamp with glass shade Hobby lamp Desk lamp Unit price Total price £ £ 38.00 24.00 62.30 32.60 18.20 25.40 380.00 360.00 1,246.00 1,304.00 109.20 254.00 Total Less 10% trade discount Net cost VAT @ 17.5% AMOUNT DUE Terms: 2.5% within 1 month Delivery: Borders Transport You are required to complete the invoice by calculating and inserting the following figures. total cost trade discount net cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 35 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXERCISES Exercise 3 STATEMENT OF ACCOUNT MARCHMONT COMPONENTS PLC 24 Crail Road KIRKCALDY KY3 7UL Fife Engineering Ltd Harbour Street ANSTRUTHER Date: 30 March 2004 Date 2004 March 1 5 12 16 21 Details Brought forward Invoice 236 Invoice 468 Credit note 132 Cheque 3480 Discount allowed Debit Credit 560.00 285.60 65.10 225.00 10.50 Balance 235.50 795.50 1,081.10 1,016.00 The last figure in the balance column is the amount due on 30 April. You are required to complete the statement by calculating and inserting the balances on 21 March. © Learning and Teaching Scotland 36 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXERCISES Exercise 4 STATEMENT OF ACCOUNT MARCHMONT COMPONENTS PLC 24 Crail Road KIRKCALDY KY3 7UL Macduff Boatyard Harbour Street MACDUFF Date 2004 March 1 6 9 18 20 28 Details Brought forward Invoice 242 Cheque 14682 Discount allowed Invoice 683 Credit note 138 Date: 30 March 2004 Debit Credit Balance 1,450.85 2,600.00 1,325.00 125.85 3,420.00 328.00 The last figure in the balance column is the amount due on 30 April. You are required to complete the statement by calculating and inserting the necessary figures in the balance column. © Learning and Teaching Scotland 37 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXERCISES Exercise 5 STATEMENT OF ACCOUNT MARCHMONT COMPONENTS PLC 24 Crail Road KIRKCALDY KY3 7UL Inverythan Marina Inverythan ABERDEEN AB25 7SH Date Details 2004 March 1 6 10 15 20 20 Brought forward Invoice 3864 Invoice 4026 Credit note 145 Cheque 24632 Discount allowed Date: 30 March 2004 Debit Credit Balance 760.00 The last figure in the balance column is the amount due on 30 April. You are required to enter the following amounts in the appropriate columns in the statement above; update the balance after each entry. March 6 March 10 March 15 March 20 March 24 Invoice 3864 Invoice 4026 Credit note 145 Cheque 24632 Discount allowed Invoice 4152 © Learning and Teaching Scotland £1,250.00 £2,525.60 £324.80 £725.00 £35.00 £468.10 38 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------EXERCISES Exercise 6 You are employed by D R Mutch and have been asked to prepare and sign three cheques to settle the debts listed below. Use today’s date. £125.60 to S J Kendall £1,240.80 to The Lochleven Catering Co £45 to Desktop Supplies © Learning and Teaching Scotland 39 Accounting Intermediate 1; Intermediate 2 Business Documents Higher ------------------------------------------------------------------------------------------------------------ © Learning and Teaching Scotland 40 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES SECTION 4 Exercise 1a INVOICE Yorkshire Leather plc 12 Ripon Road WETHERBY HE8 9US To: M&R Russell 64 Fife Street ST ANDREWS KY32 7MO Quantity Cat No 18 prs C345 18 prs C498 12 prs S530 10 Date: 7 March 2004 Order no: 3471 Invoice no: 10455 Description Unit price Total price £ £ 50.30 905.40 52.00 936.00 58.20 698.40 C345 Leather shoes, navy, sizes 4–8 Leather shoes, cream, sizes 4–8 Leather shoes, mink, sizes 4–8 Bag, navy 36.00 360.00 5 BC498 Bag, cream 37.45 187.25 3 BS530B Bag, mink 25.10 75.30 Total Add VAT @ 17.5% AMOUNT DUE 3,162.35 553.41 3,715.76 Terms: Delivery: Own transport You are required to calculate the following figures and insert them in the invoice above. VAT @ 17.5% amount due. © Learning and Teaching Scotland 41 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES Exercise 1b INVOICE Yorkshire Leather plc 12 Ripon Road WETHERBY HE8 9US To: M&R Russell 64 Fife Street ST ANDREWS KY32 7MO Quantity Cat No 18 prs C345 18 prs C498 12 prs S530 10 Date: 7 March 2004 Order no: 3471 Invoice no: 10455 Description Unit price Total price £ £ 50.30 905.40 52.00 936.00 58.20 698.40 C345 Leather shoes, navy, sizes 4–8 Leather shoes, cream, sizes 4–8 Leather shoes, mink, sizes 4–8 Bag, navy 36.00 360.00 5 BC498 Bag, cream 37.45 187.25 3 BS530B Bag, mink 25.10 75.30 Total Less 25% trade discount Net cost Add VAT @ 17.5% AMOUNT DUE 3,162.35 790.59 2,371.76 415.05 2,786.81 Terms: Delivery: Own transport You are required to calculate the following figures and insert them in the invoice above. trade discount net cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 42 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES Exercise 1c INVOICE Yorkshire Leather plc 12 Ripon Road WETHERBY HE8 9US To: M&R Russell 64 Fife Street ST ANDREWS KY32 7MO Quantity Cat No 18 prs C345 18 prs C498 12 prs S530 10 Date: 7 March 2004 Order no: 3471 Invoice no: 10455 Description Unit price Total price £ £ 50.30 905.40 52.00 936.00 58.20 698.40 C345 Leather shoes, navy, sizes 4–8 Leather shoes, cream, sizes 4–8 Leather shoes, mink, sizes 4–8 Bag, navy 36.00 360.00 5 BC498 Bag, cream 37.45 187.25 3 BS530B Bag, mink 25.10 75.30 Total Add VAT @ 17.5% AMOUNT DUE 3,162.35 525.74 3,688.09 Terms: 5% within 10 days Delivery: Own transport You are required to calculate the following figures and insert them in the invoice above. VAT @ 17.5% amount due. © Learning and Teaching Scotland 43 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES Exercise 1d INVOICE Yorkshire Leather plc 12 Ripon Road WETHERBY HE8 9US To: M&R Russell 64 Fife Street ST ANDREWS KY32 7MO Quantity Cat No 18 prs C345 18 prs C498 12 prs S530 10 Date: 7 March 2004 Order no: 3471 Invoice no: 10455 Description Unit price Total price £ £ 50.30 905.40 52.00 936.00 58.20 698.40 C345 Leather shoes, navy, sizes 4–8 Leather shoes, cream, sizes 4–8 Leather shoes, mink, sizes 4–8 Bag, navy 36.00 360.00 5 BC498 Bag, cream 37.45 3 BS530B Bag, mink 25.10 Total Less 25% trade discount Net cost Add VAT @ 17.5% AMOUNT DUE 187.25 75.30 3,162.35 790.59 2,371.76 394.30 2,766.06 Terms: 5% within 10 days Delivery: Own transport You are required to calculate the following figures and insert them in the invoice above. trade discount net cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 44 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES Exercise 2a INVOICE Moorhouse Lighting Broughton Road Peebles Solway Homes Stranraer Road DUMFRIES DS2 3RT Ref no JK178 JK462 JM329 JM862 HL21 RL15 Quantity 10 15 20 40 6 10 Date: 10 March 2004 Order no: 14 Invoice no: 842 Details Table lamp and matching shade Table lamp Floor standing lamp Table lamp with glass shade Hobby lamp Desk lamp Total VAT @ 17.5% AMOUNT DUE Unit price Total price £ £ 38.00 24.00 62.30 32.60 18.20 25.40 380.00 360.00 1,246.00 1,304.00 109.20 254.00 3,653.20 639.31 4,392.51 Terms: Delivery: Borders Transport You are required to complete the invoice by calculating and inserting the following figures. total cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 45 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES Exercise 2b INVOICE Moorhouse Lighting Broughton Road Peebles Solway Homes Stranraer Road DUMFRIES DS2 3RT Ref no JK178 JK462 JM329 JM862 HL21 RL15 Quantity 10 15 20 40 6 10 Date: 10 March 2004 Order no: 14 Invoice no: 842 Details Table lamp and matching shade Table lamp Floor standing lamp Table lamp with glass shade Hobby lamp Desk lamp Total Less 10% trade discount Net cost VAT @ 17.5% AMOUNT DUE Unit price Total price £ £ 38.00 24.00 62.30 32.60 18.20 25.40 380.00 360.00 1,246.00 1,304.00 109.20 254.00 3,653.20 365.32 3,287.88 575.37 3,863.25 Terms: Delivery: Borders Transport You are required to complete the invoice by calculating and inserting the following figures. total cost trade discount net cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 46 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES Exercise 2c INVOICE Moorhouse Lighting Broughton Road Peebles Solway Homes Stranraer Road DUMFRIES DS2 3RT Ref no JK178 JK462 JM329 JM862 HL21 RL15 Quantity 10 15 20 40 6 10 Date: 10 March 2004 Order no: 14 Invoice no: 842 Details Table lamp and matching shade Table lamp Floor standing lamp Table lamp with glass shade Hobby lamp Desk lamp Total VAT @ 17.5% AMOUNT DUE Unit price Total price £ £ 38.00 24.00 62.30 32.60 18.20 25.40 380.00 360.00 1,246.00 1,304.00 109.20 254.00 3,653.20 623.32 4,276.52 Terms: 2.5% within 1 month Delivery: Borders Transport You are required to complete the invoice by calculating and inserting the following figures. total cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 47 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES Exercise 2d INVOICE Moorhouse Lighting Broughton Road Peebles Solway Homes Stranraer Road DUMFRIES DS2 3RT Ref no JK178 JK462 JM329 JM862 HL21 RL15 Quantity 10 15 20 40 6 10 Date: 10 March 2004 Order no: 14 Invoice no: 842 Details Table lamp and matching shade Table lamp Floor standing lamp Table lamp with glass shade Hobby lamp Desk lamp Total Less 10% trade discount Net cost VAT @ 17.5% AMOUNT DUE Unit price Total price £ £ 38.00 24.00 62.30 32.60 18.20 25.40 380.00 360.00 1,246.00 1,304.00 109.20 254.00 3,653.20 365.32 3,287.88 560.99 3,848.87 Terms: 2.5% within 1 month Delivery: Borders Transport You are required to complete the invoice by calculating and inserting the following figures. total cost trade discount net cost VAT @ 17.5% amount due. © Learning and Teaching Scotland 48 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES Exercise 3 STATEMENT OF ACCOUNT MARCHMONT COMPONENTS 24 Crail Road KIRKCALDY KY3 7UL Fife Engineering Ltd Harbour Street ANSTRUTHER PLC Date: 30 March 2004 Date Details 2004 March 1 5 12 16 21 Brought forward Invoice 236 Invoice 468 Credit note 132 Cheque 3480 Discount allowed Debit Credit 560.00 285.60 65.10 225.00 10.50 Balance 235.50 795.50 1,081.10 1,016.00 791.00 780.50 The last figure in the balance column is the amount due on 30 April. You are required to complete the statement by calculating and inserting the balances on 21 March. © Learning and Teaching Scotland 49 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES Exercise 4 STATEMENT OF ACCOUNT MARCHMONT COMPONENTS PLC 24 Crail Road KIRKCALDY KY3 7UL Macduff Boatyard Harbour Street MACDUFF Date Details 2004 March 1 6 9 18 20 28 Brought forward Invoice 242 Cheque 14682 Discount allowed Invoice 683 Credit note 138 Date: 30 March 2004 Debit Credit Balance 1,325.00 125.85 1,450.85 4,050.85 2,725.85 2,600.00 6,020.00 5,692.00 2,600.00 3,420.00 328.00 The last figure in the balance column is the amount due on 30 April. You are required to complete the statement by calculating and inserting the necessary figures in the balance column. © Learning and Teaching Scotland 50 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES Exercise 5 STATEMENT OF ACCOUNT MARCHMONT COMPONENTS PLC 24 Crail Road KIRKCALDY KY3 7UL Inverythan Marina Inverythan ABERDEEN AB25 7SH Date Details 2004 March 1 6 10 15 20 20 24 Brought forward Invoice 3864 Invoice 4026 Credit note 145 Cheque 24632 Discount allowed Invoice 4152 Date: 30 March 2004 Debit Credit 1,250.00 2,525.60 324.80 725.00 35.00 468.10 Balance 760.00 2,010.00 4,535.60 4,210.80 3,485.80 3,450.80 3,918.90 The last figure in the balance column is the amount due on 30 April. You are required to enter the following amounts in the appropriate columns in the statement above; update the balance after each entry. March 6 Invoice 3864 £1,250.00 March 10 March 15 March 20 Invoice 4026 Credit note 145 Cheque 24632 Discount allowed Invoice 4152 £2,525.60 £324.80 £725.00 £35.00 £468.10 March 24 © Learning and Teaching Scotland 51 Accounting Intermediate 1; Intermediate 2 Business Documents Higher -----------------------------------------------------------------------------------------------------------ANSWERS TO EXERCISES Exercise 6 © Learning and Teaching Scotland 52 Accounting Intermediate 1; Intermediate 2 Business Documents Higher ------------------------------------------------------------------------------------------------------------ © Learning and Teaching Scotland 53 Accounting Intermediate 1; Intermediate 2 Business Documents Higher ------------------------------------------------------------------------------------------------------------ © Learning and Teaching Scotland 54