T

T

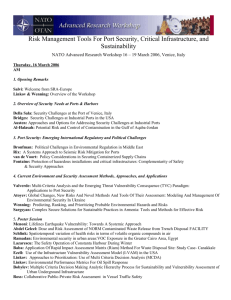

he Ports of Massachusetts Strategic Plan

Technical Memorandum Number 3

Macro Maritime Transportation Trends that Impact the

Compact Ports

Ports of Massachusetts Strategic Plan

TABLE OF CONTENTS

Technical Memorandum Number 3

3.1.2 Expansion of the Panama Canal and Use of the Suez Canal ............................... 3

3.3.4 Market Trends Affecting Demand for Local Water Transportation Services ....... 20

LIST OF TABLES

LIST OF FIGURES

September 12, 2013 Draft i

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3

M

acro Maritime Transportation Trends that

Impact the Compact Ports

3.0 Introduction

Massachusetts’ ports are part of a global logistics network. Framing an effective maritime strategy for the state thus requires an understanding of evolving global and national trends that define the context in which Massachusetts’ port facilities and port-related industries operate currently and will compete in the future. The purpose of this technical memorandum is to describe those macro trends that have the greatest relevance for the state’s maritime outlook, in order to assist in framing the Ports of

Massachusetts Strategic Plan’s capital and policy recommendations. The traditional maritime transportation system is structured around three main activities: cargo handling, passenger travel, and commercial fishing - and Massachusetts facilities are engaged in all three. The macro trends surrounding these maritime sectors are considered in Sections 3.1 through 3.3. The global maritime system supports a variety of ancillary activities that are valuable activities and sources of innovation as the industry evolves to meet emerging challenges. As they relate to Massachusetts’ ports, these ancillary activities and emerging issues include shipbuilding, vessel repair, maintenance and services, construction and salvage, offshore energy such as wind or oil and gas exploration, marine research, and recreational fishing and boating. Macro trends related to two of these less traditional maritime activities are considered in Sections 3.4 and 3.5. A summary is provided in Section 3.6.

3.1 Cargo Freight

Cargo freight is goods or produce transported generally for commercial gain. There are four main types of cargo freight: Bulk (dry or liquid); Breakbulk (traditional breakbulk, or project cargo), Roll On/Roll Off, and Container. Different types of cargo require different types of vessels and handing methods.

Examples of each include:

•

Dry Bulk: dry material that is loose and not packaged; sometimes transferred by a hopper.

Includes grain, sand, and gravel.

•

Liquid Bulk : liquid material that is not stored in a drum or can; usually transferred by a pipeline.

Includes petroleum products.

•

Breakbulk: cargo that is packaged and transferred piece by piece; sometimes stored on a pallet.

Includes lumber, steel and cement.

•

Project Cargo : cargo that is transferred piece by piece and not aggregated onto pallets or some other platform. Includes wind turbine components, or other heavy or large cargoes.

•

Roll On/Roll Off (RO/RO): cargo that is able to be rolled on and off a ship, such as automobiles and trucks.

•

Containers: cargo that can be packaged into a box; typically referenced as a twenty-foot equivalent unit (TEU). Includes consumer goods, and occasionally bulk goods.

September 12, 2013 Draft 1

Ports of Massachusetts Strategic Plan

3.1.1 Global Trends in Cargo Freight

Technical Memorandum Number 3

Globally, demand for maritime trade will strengthen in growing regions of the world, changing the pattern of maritime trade and routings. Typically, maritime trade follows growth in Gross Domestic Product

(GPD). According to the Conference Board

, the global economy has not yet recovered from the Great

Recession of 2008-2009, and is not expected to do so until after 2013. Emerging markets such as China,

India, and Africa are growing faster than the mature economies such as the U.S. and Japan. With the emergence of India and other West Asian countries as greater maritime users, trade flows to Eastern U.S. ports are expected to rise, but uncertainties still remain. These growth patterns and uncertainties about the pace of economic recovery across major world regions have influence the pattern of trade and the timing of investments

.

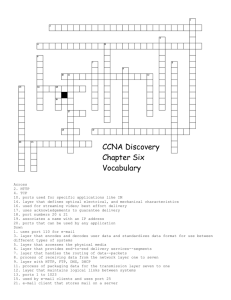

The 2013 forecast predicts an uptick in growth for advanced economies in 2013 to 1.2 percent overall, up from 1.1 percent in 2012. Growth in the United States is expected to fall slightly from 2.2 percent in 2012 to 1.6 percent in 2013, but improvements in European trade to 0.2 percent growth in 2013 will help improve the overall global growth rate. Emerging economies are expected to have slower growth over the foreseeable future, dropping from 5.5 percent in 2012 to 5.0 percent in 2013. Both China and India are projected to experience lower growth rates in 2013 than 2012. Figure 1 below shows the global outlook for growth of domestic product from 2013-2025 for various world economics.

Over the long term, the Conference Board projections indicate that while China remains the fastest growing economy over the 2014 to 2018 period, growth in India, Other Developing Asia and Africa will overtake it in terms of the pace of growth by the 2019 to 2025 period. Although China will remain the largest economy for the foreseeable future, accounting for roughly 23 percent of world GDP in 2025.

India, Other Developing Asia and Africa combined will account for about 17 percent of world GDP in

2025, offering important new markets for East Coast ports.

Figure 1: Global Outlook for Growth of Domestic Product, 2013-2025

Source: The Conference Board Global Economic Outlook May 2013

1

A global independent business membership and research association working in the public interest www.conference-board.com

2

The Conference Board Global Economic Outlook, May 2013 update.

September 12, 2013 Draft 2

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3

3.1.2 Expansion of the Panama Canal and Use of the Suez Canal

The ongoing expansion of the Panama Canal, which is scheduled for completion in early 2015, will result in larger locks, greater capacity and the potential to enhance the all-water route between Asia and the

U.S. East Coast. Recent forecasts, however, indicate that much of the anticipated shift of Asian traffic from the West Coast to the East Coast already occurred when ocean carriers sought to diversify their

North American ports of call following Southern California work stoppages in 2002. Moreover, today’s trade patterns will shift to match changes in global production and demand. Anticipated economic growth in India and Brazil, for example, would deemphasize the importance of the Panama Canal in reaching

U.S. markets.

The current dimensions of the Panama Canal limit ships to 39 feet in depth, 106 feet or 13 containers across (beam), and 965 feet in length—known as “Panamax” dimensions. Once the Canal expansion is complete, the larger Canal locks will allow the transit of “Neo-Panamax” vessels that have a deeper draft

(49 feet), wider beam (160.7 feet or 20 containers across), and greater length (1,200 feet).

The largest ships, however, will not call on every port. Rather, the industry is expected to dedicate its

10,000 to 12,000 TEU ships to one or two “mega ports” on the East Coast while 8,000 TEU containerships would be deployed to secondary ports using either a dual rotation or a hub-and-spoke operation. Understanding where Massachusetts’ ports fit within this distribution pattern is essential to making the correct investments to capture its niche and best support port-using industries in the state.

The industry’s focus on the Panama Canal is due to the dominance of Asian origins in the U.S. container trade. With a potential trade shift to India and other parts of Asia, the Suez Canal may become a more significant consideration in the size of vessels that serve the United States East Coast. The Suez Canal has no locks, and therefore no vessel length restrictions. Ships with a maximum draft of 68.9 feet and beam of nearly 200 feet can navigate the Suez Canal. Massachusetts may benefit because of closer proximity to the Suez Canal as a North Atlantic port, as opposed to Southeast U.S. ports.

Operational costs also have an impact on the destinations of container ships. Neo-Panamax ships that are only partially full have greater operating costs than existing Panamax ships that are mostly full

(considering crew costs and canal tolls). Until ports have demand to accept the full cargo load of larger ships, it is likely that smaller ships will remain in service and continue to serve secondary ports.

An additional consideration is the changing pattern of trade relations over the long term. While China is currently the dominant trade destination, anticipated economic growth in India and Brazil, for example, suggests that the U.S. will see growth and greater diversity among its major trading partners.

Additionally, the increased growth of near-sourcing activities such as automobile, auto parts and electronics manufacturing in countries such as Mexico could suggest a role for secondary ports in the

U.S

.

3

Near sourcing is the practice of returning production to a location closer to the U.S. headquarters. It is a reversal of U.S. companies’ decision to outsource work to Asian countries, which led to a steady outflow of jobs during the 1990s. Many companies are returning production to areas close to their customer bases -- called near-sourcing -- to gain a competitive edge .This may mean bringing jobs to South America or Mexico where labor costs are lower than the U.S., rather than bringing them to the U.S. Sourcing from locations closer to the U.S. allows companies to save on shipping costs.

September 12, 2013 Draft 3

Ports of Massachusetts Strategic Plan

3.1.3 Carrier Calls and Port Selection

Technical Memorandum Number 3

Carriers distinguish between captive and discretionary cargo when making routing decisions. Captive cargo must go to a specific port because of specialized handling equipment needs or business restrictions among the shipper or consignee. By contrast, discretionary cargo can utilize multiple gateways and ports will compete for the business.

Carriers’ selection of one port over another is driven by a variety of factors that encompass a broader range of considerations than just water depth. Factors driving the port selection decision include: water depth; available storage; available labor; surface transportation connections; use of technology; and cost structure. All these factors affect the cost to deliver goods, and carriers will continually look to call on ports that reduce costs. A port with shallow water, limited storage, congested landside transportation connections, community and environmental conflicts, and high labor, land or operating costs will have difficulty attracting carriers.

Massachusetts’ ports are unlikely to be the “first” port of call for Neo-Panamax ships. The decision of

Neo-Panamax carriers will concentrate on those ports that offer the most attractive portfolio of infrastructure and services, particularly uncongested landside access, including rail. Large ships typically carry discretionary cargoes that need to be distributed over a wide geographic range once inland. Rail access is essential to cost effectively and quickly offloading ships and accessing inland consumer markets. Moreover, from the carriers’ perspective, the best use of Neo-Panamax vessels is to keep them moving between U.S. and foreign ports, not between U.S. ports along the coast. Collectively, this argues for fewer “first” calls, but greater use of hub and spoke/transshipment strategies for container services, where large vessels serve major origin-destination points and small vessels serve smaller markets. The widening of the Canal and utilization of Neo-Panamax ships primarily affects the container market; whereas, bulk, breakbulk and RO/RO markets utilize smaller ships and are not likely to be impacted. This allows secondary container ports the opportunity to develop specializations in other cargo markets.

In addition to the potential for hub-and-spoke services, is the opportunity for short sea shipping. In the context of Neo-Panamax shipping, the “hub” would be the first port of call. The goods are transshipped

(moved from one marine vessel to another) at the hub and distributed to other regional ports. While the hub-and-spoke shipping and short sea shipping concepts are similar, the key difference is that under a hub and spoke arrangement; feeder service is tied to the mainline ship call, while the short sea shipping operates on a fixed schedule independent of mainline calls. With Neo-Panamax ships calling with greater frequency and regularity in the future, the distinction between the two services models will diminish.

The potential to use short sea shipping to distribute goods and thus relieve pressure on the landside rail and highway network is an impetus behind Marine Administration’s (MARAD) Marine Highway Program.

Established by the Energy Independence and Security Act of 2007, the Department of Transportation-led initiative seeks to expand the use of waterborne transportation while relieving landside congestion and reducing carbon emissions. USDOT has now identified 18 marine corridors, eight projects and six initiatives for further development as part of America’s Marine Highway Program (AMH).

Short sea shipping opportunities typically can be cost-competitive with trucking when the beginning and ending points are 400 miles or more apart. Thus, for example, a route between Massachusetts and

Maine is unlikely to prove cost-competitive. However, Massachusetts is located along one of the more

4

AASHTO. “Waterborne Freight Transportation: Bottom Line Report” June 2013.

5

Summarized from AASHTO. “Waterborne Freight Transportation: Bottom Line Report” June 2013.

September 12, 2013 Draft 4

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3 promising AMH routes proposed to date, the M-95 Corridor that runs between Maine and Florida. The

Port of New Bedford, Maryland Ports Authority, New Jersey DOT, and Port Canaveral, FL have all been proponents of this corridor. Additional AMH corridors extend across the Gulf of Mexico, and to Puerto

Rico. However, short sea shipping remains significantly underused as a cost-effective alternative for goods movement, as thus far services have focused on serving a small number of shippers; therefore volumes and the viability of the service suffer when the firm changes its logistics model or suffers a slowdown in the market. A greater diversity of shippers or ties to regular deliveries from a Neo-Panamax ship would improve the commercial viability of this type of service. There is precedent for hub-and-spoke and short sea service models to be offered by the same service; in eastern Canada, Oceanex provides regional short sea services (as well as feeder services) for the movement of containers between Montréal and St. John’s and between Halifax and St. John’s.

Additionally, these new international ocean services may promote trade expansion for Massachusetts. An example of this is the promotion of trade relations with Mexico through a carrier offering ocean service between the Port of New Bedford and the Port of Tuxpan, Mexico. If implemented, this service would facilitate the movement of fresh produce from Mexico to the New England and Canadian marketplaces through the Port of New Bedford. New England and Canadian exports may also be moved as backhaul cargo to the Port of Tuxpan for consumption in the Mexico City metropolitan region, thus supporting the

National Export Initiative (NEI) under the US Department of Commerce. The NEI is the Administration’s effort to double U.S. exports by the end of 2014, through support for private industry and trade agreements.

3.1.4 National Trends in Cargo Freight

In 2010, the U.S. maritime system carried over 2.3 billion tons of international cargo, according to USACE

Waterborne Commerce Statistics. Nationwide, the U.S. has a maritime trade imbalance, importing more by tonnage and value by water than it exports. The imbalance is primarily due to import of petroleum, manufactured products, and metals. The chief next export commodity in the U.S is agricultural products.

Projections for future maritime freight flows anticipate that in the near future, the maritime system will handle twice the volume that it carries today. The U.S. DOT Freight Analysis Framework-3 (FAF3) provides waterborne trade tonnage forecasts to the year 2040. The FAF3 projects that import tonnages will grow at a compound annual growth rate of 2.2 percent and that export tonnages will grow at a 3.5 percent compound annual growth rate. As a result, by 2040, export volume will equal import volume.

According to projections by IHS Global Insight, container cargo is anticipated to post particularly strong growth; rising to more than three and one half times current volumes over the next 25 years. Loaded import TEUs are forecast to grow to 60 million (around 5 percent per year growth), and loaded export

TEUs are forecast to grow to 52 million (around 5.5 percent per year growth).

6

James Frost and Marc-André Roy. “Study on Potential Hub-and-Spoke Container Transshipment Operations in

Canada for Marine Movements of Freight (Short Sea Shipping)” December 2008.

7

8

Summarized from “Waterborne Freight Transportation: Bottom Line Report” June 2013.

U.S. Port and Inland Waterways Modernization: Preparing for Post-Panamax Vessels. Institute for Water Resources, U.S. Army

Corps of Engineers, June 20, 2012, as reported in AASHTO Bottom Line Report.

September 12, 2013 Draft 5

Ports

South Louisiana, LA, Port of

Houston, TX

New York, NY and NJ

Beaumont, TX

Long Beach, CA

Corpus Christi, TX

New Orleans, LA

Los Angeles, CA

Huntington - Tristate

Texas City, TX

Plaquemines, LA, Port of

Mobile, AL

Baton Rouge, LA

Lake Charles, LA

Norfolk Harbor, VA

Baltimore, MD

Pascagoula, MS

Duluth - Superior, MN and WI

Savannah, GA

Tampa, FL

Philadelphia, PA

Pittsburgh, PA

Valdez, AK

St. Louis, MO and IL

Port Arthur, TX

Seattle, WA

Freeport, TX

Portland, OR

Richmond, CA

Tacoma, WA

Marcus Hook, PA

Newport News, VA

Port Everglades, FL

Jacksonville, FL

Boston, MA

Oakland, CA

Chicago, IL

Portland, ME

Charleston, SC

Paulsboro, NJ

Total top 50 b

All ports

Ports of Massachusetts Strategic Plan

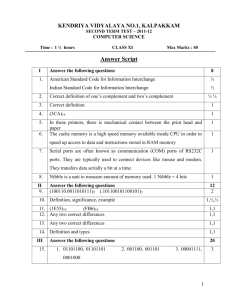

Table 1: Listing of the Top 40 U.S. Ports by Volume

Technical Memorandum Number 3

25.9

24.2

22.4

21.9

30.8

30.2

27.2

26.7

34.2

34.0

33.8

31.9

39.6

37.3

36.6

34.7

2010

Total tons

(Millions) Rank

236.3

1

227.1

139.2

77.0

75.4

73.7

72.4

7

4

2

3

5

6

55.7

55.5

54.6

41.6

62.4

61.5

56.6

55.8

12

13

11

15

10

14

9

8

20.8

20.2

19.1

19.1

18.6

18.5

18.2

18.0

17.5

39

36

2,127.8

NA

2,334.4

NA

33

40

24

37

35

38

34

31

28

32

30

23

19

29

27

17

22

20

18

26

16

25

21

28

29

30

31

24

25

26

27

20

21

22

23

16

17

18

19

36

37

38

39

40

NA

NA

32

33

34

35

12

13

14

15

10

11

8

9

4

5

6

7

Rank

1

2

3

13.8

22.5

19.7

20.8

34.3

19.4

22.3

21.2

12.2

23.9

28.8

21.1

25.0

2,182.7

2,424.6

33.3

20.5

24.2

29.0

46.5

40.8

53.9

48.1

40.8

28.6

41.7

19.5

53.7

65.2

53.0

42.3

2000 Percent

Total tons

(Millions) change

2009-2010

215.9

186.6

137.2

11.1%

7.5%

-3.8%

48.1

76.9

58.1

59.7

76.9

69.9

81.3

90.0

13.6%

4.0%

7.9%

6.3%

6.8%

4.0%

7.5%

9.8%

-2.0%

7.2%

2.9%

-7.5%

-1.8%

-10.6%

10.5%

-2.5%

6.7%

7.0%

4.5%

3.1%

31.5%

1.8%

21.1%

7.2%

11.3%

-4.7%

-3.3%

-10.7%

15.5%

0.9%

8.1%

-6.7%

6.9%

-3.6%

-13.5%

13.6%

-42.2%

5.0%

5.6%

23.3

25.4

23.2

24.6

31.3

33.8

24.6

27.4

34.9

31.8

32.9

34.5

30.1

36.6

30.2

32.3

2009

Total tons

(Millions) Rank

212.6

1

211.3

144.7

67.7

72.5

68.2

68.1

6

8

2

3

5

4

52.2

51.9

52.3

40.3

58.4

59.2

52.6

50.9

13

9

14

18

15

7

11

10

18.0

20.1

17.7

20.5

17.4

19.2

21.0

15.8

30.3

52

29

2,025.6

NA

2,210.8

NA

25

33

27

48

30

36

34

22

38

31

32

23

35

28

24

17

21

12

16

20

26

19

37

-26.4%

-16.6%

-37.2%

-33.6%

-7.7%

47.3%

12.6%

-7.9%

3.8%

-14.8%

3.0%

-1.8%

-2.9%

30.5%

-12.2%

77.7%

Percent change

2000-2010

9.4%

21.7%

1.5%

0.1%

8.0%

-9.4%

-19.5%

29.6%

-20.0%

-2.6%

-6.4%

-24.4%

24.7%

0.5%

3.6%

51.0%

-10.1%

-3.0%

-8.0%

53.0%

-22.5%

-36.9%

-14.7%

-30.0%

-2.5%

-3.7%

Source: U.S. Army Corps of Engineers, Waterborne Commerce of the United States, Part 5, National Summaries (New Orleans, LA:

Annual Issues), tables 1-1, and 5-2, available at http://www.ndc.iwr.usace.army.mil/wcsc/wcsc.htm as of July 5, 2012.

Nationally, the container traffic volume is returning to the peak volumes seen in 2007 (45,008,000 TEUs) after a low volume seen in 2009 (37,528,000 TEUs). In 2012, the total US container traffic volume reached 43,664,000 TEUs, or 97 percent of the peak volume. However, in Boston, the volume has been slower to return and in 2012, the volume of 187,000 TEUs was still only at 85 percent of the peak volume seen in 2009 of 220,139 TEUs.

September 12, 2013 Draft 6

Ports of Massachusetts Strategic Plan

3.1.5 Local Trends in Freight Cargo

Technical Memorandum Number 3

Freight cargo volumes throughout the Commonwealth have decreased over the last six years. Container volume at Massport reached a peak in 2007 at 220,000 TEUs and in 2012 the volume was down to

187,000 TEUs. Petroleum products movement at all five Compact ports is down from the 2007 peak of

17.5 million tons to 14.2 million tons (a 19 percent drop) and coal shipments are down from 4.4 million tons in 2007 to 2.0 million tons in 2011. These trends are tied to the economic recession as evidenced through reduced fuel consumption and a drop in manufactured goods. As the economy recovers nationwide, it is anticipated that cargo trends in the region will increase as well.

The tables below show the decrease in volumes by port and commodity since 2007. However, in Fall

River there is an increase in petroleum volume due to a changing fuel mix at the Brayton Point power plant. Power plant issues also affected Salem, as the decrease in coal imports can be linked to a lower power plant output.

Table 2: Top Commodities through Boston, 2007-2011

Source: U.S. Army Corps of Engineers Navigation Data Center

Table 3: Top Commodities through Fall River, 2007-2011

Source U.S. Army Corps of Engineers Navigation Data Center

September 12, 2013 Draft 7

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3

Table 4: Top Commodities through Gloucester, 2007-2011

Source: U.S. Army Corps of Engineers Navigation Data Center

Table 5: Top Commodities through New Bedford, 2007-2011

Source: U.S. Army Corps of Engineers Navigation Data Center

Table 6: Top Commodities through Salem, 2007-2011

Source: U.S. Army Corps of Engineers Navigation Data Center

3.2

Commercial Fishing

Many sectors of the fishing industry have declined over recent years. However, New England ports have shown flexibility and creativity in reacting and adjusting to regulatory and supply challenges. Each New

England port is unique from a historical and current fishing market perspective. Industry sectors associated with the commercial fishing arena generally include harvesters fish processers and fish dealers.

3.2.1 Global Trends in Commercial Fishing

Over the past decade, global wild-caught fishery landings continue to remain stable at approximately 198 billion pounds. Despite the overall stability of landings, significant stock fluctuation trends are present based on fishing area, country, and species, including a steady and comparatively large increase in

September 12, 2013 Draft 8

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3 inland fisheries landings and dramatic decreases in the anchoveta fishery. Global seafood aquaculture production has expanded significantly in the past several decades and continues to grow. In 2010, global aquaculture production was approximately 132 billion pounds, with an estimated value of $119 billion.

Overall annual per capita seafood consumption has increased steadily across the globe, but slightly decreased recently in the U.S. Despite this decrease, data indicate that the U.S. has surpassed Japan and is now second only to China in per capita seafood consumption.

To meet this increasing demand for seafood, countries continue to expand production from both wild- fisheries and aquaculture as much as possible. Due to recent significant expansion of its fish production, especially aquaculture, China was the leading nation in both fishery landings and aquaculture production

(35 percent of the total harvest) in 2011. India ranks second (6 percent), followed by Indonesia (just over

5 percent), while Vietnam, the United States, and Japan each contribute 3 percent of the global harvest.

A significant percentage of fish consumed in developed countries is imported. With a steady demand and declining domestic fishery production, developed countries are projected to increase their dependence on these imports. With the global population growing, seafood will continue to play an increasingly important role as a vital source of animal protein in the human diet.

Global fish stocks are undeniably finite, as exhibited by various stock collapses over the last half century, including the Pacific sardine fishery in the 1950s, Alaskan king crab stocks in the early 1980s, and the

Canadian northern cod fishery in the early 1990s. In 2009, approximately 30 percent of global marine fish stocks were overexploited. At the same time approximately 57 percent of global marine fish stocks are fully exploited, and are operating at or close to their maximum sustainability. These values indicate that overall, global marine fisheries are becoming less sustainable.

Fisheries scientists predict many global fish stocks could recover to sustainable levels under strict management regimes and improved enforcement of catch quotas. For example, of the stocks monitored in the U.S., 81 percent are not overfished. Although there is potential for many stocks to be rebuilt, one of the greatest threats to sustainable global fisheries is the occurrence of illegal, unreported, and unregulated (IUU) fishing. IUU fishing occurs across the globe and undermines sustainable management efforts to conserve and rebuild fish stocks. Some estimates indicate IUU fishing constitutes up to 20 percent of global wild-caught fish, with an annual financial loss of $23.5 billion worldwide.

The coming decades are likely to be marked by major changes in economies, markets, resources and social conduct. Impacts of climate change (see Section 3.5), such as ocean acidification and increasing global ocean temperatures, will cause increasing uncertainty in many food sectors, including capture fisheries. Climate adaptation approaches will need to be well integrated with the processes of improving fishery governance in order to produce a greater balance of sustainable fisheries across the globe.

9

Food and Agricultural Organization of the United Nations, 2012

10

Fisheries of the United States, 2011.

11

Ibid

12

Food and Agricultural Organization of the United Nations, 2012 .

13

Ibid

14

Pew Environment, n.d.

15

Food and Agricultural Organization of the United Nations, 2012 .

September 12, 2013 Draft 9

Ports of Massachusetts Strategic Plan

3.2.2 National Trends in Commercial Fishing

Technical Memorandum Number 3

In 2011, U.S. commercial fishermen harvested 9.9 billion pounds of finfish and shellfish, with an earned value of $5.3 billion. The species that generated the most revenue include Pacific salmon ($618 million), sea scallop ($585 million), shrimp ($536 million) and American lobster ($423 million). Based on pounds landed, four species comprised over half the total pounds landed in 2011: walleye pollock (2.8 billion pounds), menhaden (1.9 billion pounds), and Pacific salmon (780 million pounds).

Other key commercial species include: blue crab, pacific halibut, sablefish and tuna.

In 2011, approximately 91 percent of seafood consumed in the U.S. was imported, primarily from countries in Asia. This value represents a five percent increase from 2010. The top three imported seafood products are shrimp, canned tuna, and tilapia fillet. Of the seafood that is imported, nearly half of it comes from foreign aquaculture production. America’s aquaculture industry currently meets less than five percent of U.S. seafood demand, and produces primarily oysters, clams, mussels and some finfish, including salmon.

Due to minimal regulations and enforcement, foreign capture fisheries and aquaculture production are often unsustainable and environmentally destructive. In contrast, the U.S. manages wild-caught and farm-raised seafood under strict regulations with regular scientific monitoring for many species to meet established legal and scientific standards and ensure sustainable fish stocks, a healthy environment, and employment for the seafood industry.

Employment of fishermen and related shore-based infrastructure workers is expected to decline by 6 percent from 2010 to 2020. Most job openings in the fishing industry will be replacement-hires for those workers who leave the profession, as opposed to additional new-hires in an expanding occupation.

Opportunities with small independent fishing establishments are expected to be limited and better prospects are expected with large fishing operations.

The outlook for U.S. fishermen varies greatly depending on geography and species. Some fisheries, such as sea scallops and wild Alaska salmon, maintain strong population stocks and high market prices.

As a result, participants in this fishery enjoy greater job and income security. In contrast, NOAA recently declared a disaster in the groundfishery in New England, where low stock levels forced significant quota reductions. Fishermen dependent on groundfish face significant hardship in the coming years and may be forced to stop fishing altogether if their allotted quota no longer provides a livable income.

Advancements in fishing technology that have allowed fishermen to become much more efficient at finding and catching fish, combined with the detrimental impacts of pollution and environmental changes on fish reproduction, necessitate the continued implementation of adequate catch limits to restore and maintain the health of fish stocks.

With these ongoing challenges in some fisheries, fishermen will continue to innovate and to pursue nontraditional opportunities. For example, the fishing industry has begun to promote underutilized or alternative species for regular seafood consumption. Consumers have traditional preferences for seafood based on experience and availability. Underutilized species and those not traditionally preferred or even

16

Fisheries Economics of the United States, 2011.

17 Ibid

18

Ibid

19

National Marine Fisheries Service, n.d.

20

Bureau of Labor Statistics, 2012 .

September 12, 2013 Draft 10

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3 known about by the average consumer offer the opportunity to modify consumer seafood preferences and fishing habits of the industry. By promoting the sustainable consumption of an underutilized species, fishing pressure may decrease on a traditionally preferred species while it rebuilds to sustainable levels, and consumers can enjoy a new culinary experience. Unfortunately, these underutilized species often do not command a high enough market price to make it economically worthwhile for fishermen to harvest them. While educating the public and increasing consumer demand is important, an increased demand by seafood processors for these species is crucial to generating a higher market price, and therefore an economic incentive for fishermen to fish for these underutilized species.

In addition, the fishing industry is likely to continue to utilize a relatively new marketing mechanism called

Community Supported Fisheries (CSF), which are based on the model of Community Supported

Agriculture (CSA), and provide fresh, locally-caught seafood directly to consumers. The CSF system creates economic, health, and social benefits including fresh, local seafood for the consumer; guaranteed pre-season income often at a higher market price for the fishermen; development of the local economy through community relationships; and promotion of environmental stewardship. Although CSF have gained popularity in small pockets around the country, due to logistical limitations and the relatively low volume of seafood sold, CSF likely will not dominate as a national marketing strategy. However, CSF has the opportunity to be an important tool in the local areas where they are utilized.

With possible catch limit modifications, changing environmental conditions, and, for some species, decreasing stock population and catch, the potential for detrimental economic impact on the fishing industry persists. As some fishermen face greater economic hardship in the coming years, the need for and ability to afford shore-based resources, including waterfront dockage, supplies, and processing services, decreases accordingly. This loss of industry can have a devastating effect on the economy of fishing ports.

3.2.3 Local Trends in Commercial Fishing

3.2.3.1 Groundfish

The Northeast Multispecies Fishery, referred to as the groundfish fishery, is managed by the New

England Fishery Management Council under the Magnuson-Stevens Fishery Conservation and

Management Act. For many years the fishery was managed using effort controls, such as limiting vessels to a defined number of Days at Sea (DAS). In 2004, the National Marine Fisheries Service (NMFS) began implementing measures (Amendment 13) of the Northeast Multispecies Fishery Management Plan

(FMP). NMFS revised the DAS provisions and introduced the Sector Allocation program, which allowed fishermen to voluntarily form sectors that would be constrained by catch quotas rather than DAS. The purpose of this was to end overfishing and rebuild Northeast groundfish stocks to three times 2003 levels by 2014. In 2010, Amendment 16 to the FMP implemented a new catch share management program which established annual catch limits (ACL) for all groundfish stocks and expanded the use of sectors

,which are allotted a share of the total groundfish ACL. Each vessel with a groundfish permit has a portion of the sector’s quota based on its fishing history.

The success of the program has direct economic impacts on coastal communities as allowable landings or available fish stocks decline, vessels in the groundfish fleet either become more dependent on nongroundfish, or as these vessels leave fishing. This results in a decline in the associated businesses providing sales and services to the groundfishing industry.

September 12, 2013 Draft 11

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3

Groundfish landings improved from 2010 to 2011 (to 61.7 million pounds), though were not as high as in

2009. Groundfish revenues were higher in 2011 than in either of the two preceding years because although the number of vessels in the groundfish fishery continued to decline, the economic performance of the groundfish fleet generally improved for those vessels remaining active in the fishery. In 2011, the number of active vessels possessing a limited access groundfish permit declined to 1,279; 103 fewer vessels than in 2010 and 152 fewer than in 2009. Total crew positions declined 3 percent in both 2010 and 2011.

The Commerce Department declared the Northeastern commercial groundfish fishery a disaster industry in the fall of 2012 because the 2011 stock assessment revealed cod stocks had not rebuilt at the projected rate. In January 2013, the New England Fishery Management Council approved major cuts to the region’s cod catch and other groundfish because of the poor condition of the stocks and concern that the situation could worsen without additional protection. For fishing years 2013 through 2015, the Council agreed to decrease the overall catch quota for Gulf of Maine cod by 77 percent. This will translate to fishermen’s allocation being reduced from 6,700 metric tons in 2012 to 1,550 metric tons, beginning on

May 1, 2013. Cod quotas from the Georges Bank are shared with Canadian fishermen, and are set annually under an agreement between the two countries. In 2013, the U.S. share will be set at 2,002 metric tons, a 61 percent drop from the 2012 quota of 5,013 metric tons.

3.2.3.2 American Lobsters

American lobsters are one of the most valuable commercial fisheries on the Atlantic Coast, with harvesters receiving nearly $400 million for their catch in 2010. The Maine lobster fishery comprises nearly 80 percent of the value of this fishery. Massachusetts is the second largest contributor with nearly

13 percent. Along the Atlantic Coast, lobster landings have increased substantially in the past two decades, from 57 million pounds in 1993 to a high of 116 million pounds in 2010, with 90 percent caught in state waters. American lobsters are jointly managed by the states and the NMFS under the framework established by the Atlantic States Marine Fisheries Commission, with seven Lobster Conservation

Management Areas from Maine to North Carolina. A 2009 peer-reviewed stock assessment shows a range of stock conditions, including record high levels in the Gulf of Mexico and Georges Bank, but low levels in Southern New England.

In 2011, approved regulations reduced exploitation by 10 percent in the Southern New England management area, with proposed regulations to scale the fishery to the size of the resource. In the past few years in northern New England, environmental conditions, including warmer water temperatures, have caused an earlier lobster season. An earlier season, combined with large catches before peak demand, has led to a surplus of lobsters and prices have plummeted to the lowest level in decades, creating significant economic hardship for lobstermen. Commercial lobstermen work out of many ports in

Massachusetts, including Boston, Gloucester, New Bedford, and Salem, with the largest number of registered licenses located in Gloucester. As ocean temperatures continue to rise, lobsters will continue to migrate north to colder waters. Massachusetts fishermen will be forced to travel further to catch lobsters and may face reduced catch and income as a result.

21 NMFS, 2012

22 Atlantic States Marine Fisheries Commission, 2012

September 12, 2013 Draft 12

Ports of Massachusetts Strategic Plan

3.2.3.3 Atlantic Sea Scallops

Technical Memorandum Number 3

Atlantic sea scallops are managed as a single population across its range in U.S. waters, with five designated stock areas: eastern Georges Bank, the Great South Channel, the Gulf of Maine, the New

York Bight, and the waters off of Delaware, Maryland, and Virginia. During the early 1990s, sea scallop stocks were at record lows and the fishery was not sustainable. As a result, new management measures were implemented, including a crop rotation system of closed areas for growth and reproduction and open areas for harvest, increased dredge ring size to allow smaller scallops to escape and grow larger before being harvested and limits on fishing effort.

These management measures have been hugely successful. Total fleet revenue more than quadrupled from $123 million (adjusted) in 1994 to $582 million in 2011 and larger scallop stocks, combined with higher prices have greatly increased the profitability of scallop fishermen. While this stock likely will not continue on a constant upward trajectory, due to its sustainable management, it is anticipated to maintain its high stock levels and continue to command high market prices. The success of the scallop industry has benefited a range of ports in Massachusetts, in particular New Bedford, the largest sea scallop port in the country, and the top port in the nation based on the value of landings for the past 10 years.

3.2.3.4 New England Overview and Trends

The value of the seafood industry in Massachusetts is significant, as well as in other New England states.

Massachusetts either leads or comes in a close second in the majority of key categories.

In 2011, commercial fishermen in New England landed 622 million pounds of finfish and shellfish, with a value of $1.1 billion. Key New England commercial species include: Atlantic lobster, Atlantic herring,

Atlantic mackerel, Bluefin tuna, cod and haddock, flounders, goosefish, quahog clam, sea scallop, and squid. The species that generated the most revenue by far include American lobster ($419 million) and sea scallop ($353 million), for a combined 70percent of total landings revenue, but only 26 percent of total pounds landed in New England.

In 2011, Massachusetts had the highest overall landings revenue in the region ($565 million), followed by

Maine ($425 million) and Rhode Island ($76 million). Based on pounds landed, Maine had the highest landings volume (270 million pounds), followed closely by Massachusetts (256 million pounds), and

Rhode Island (77 million pounds).

Based on finfish landings, Massachusetts had the highest finfish landings revenue ($132 million), followed by Maine ($44 million), and Rhode Island ($25 million). Massachusetts also led the region in shellfish landings revenue ($433 million), followed by Maine ($381 million), and Rhode Island ($51.4 million).

3.2.3.5 Boston Overview, Forecasts, and Trends

Commercial Fishing

There are 18 groundfish vessels berthing at the Boston Fish Pier and, given the restrictions imposed in

May 2013, this number can be expected to decrease. The lobster cooperative on the Reserve Channel is

23 Fisheries Economics of the United States, 2011

24 Ibid

25 Ibid

September 12, 2013 Draft 13

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3 the only other fleet of commercial fishing vessels working from Boston Harbor. Figure 2 shows that both landings and revenues generally increased between 2001 and 2011.

Figure 2: Boston Fish Landings, Pounds and Dollars, 2001-2011

Source: NOAA, NMFS, Office of Science and Technology.

Processors

Massport is looking to expand fish processing activity. Eleven processors lease space from Massport on the Boston Fish Pier and other properties, and Massport has reserved approximately ten acres of land on the North Jetty as a seafood district. Together with the Boston Seafood Center, a modern 65,000 square foot, multi-tenant seafood processing facility opened in 2001 on city-owned land in the Boston Marine

Industrial Park, this will aim to be the center of seafood industry in Boston. Legal Sea Foods’ 75,000 square foot processing facility and headquarters opened in 2003 in this area.

The reported Average Monthly Employment at Seafood Product and Preparation establishments in

Boston peaked at 494 employees in 2003, and steadily declined to 272 in 2011.

Dealers

Boston is home to 118 permitted seafood and bait dealers. Their futures are closely tied to fisheries regulations and the health of the fisheries. Should regulations limit what can be landed, the number of dealers operating in Boston may also decrease.

3.2.3.6 Fall River Overview, Forecasts, and Trends

Commercial Fishing

There is limited commercial fishing activity in Fall River. The emphasis of the harbor and waterfront is on recreational activity. There is no indication that commercial fishing activity will increase in the coming years.

Processors

The number of seafood product and preparation establishments in Fall River (3) has been consistent since 2005, while the reported average monthly employment more than doubled from 2005 (136) to 2011

(313). This may be the result of Blount Fine Foods moving some of their fish processing to Fall River in

September 12, 2013 Draft 14

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3

2004. As with the dealers, processors are vulnerable to changes in fisheries regulations, and while some businesses already process non-local catches, those that process fresh seafood may need to look outside the region for seafood if fresh fish catches decrease.

Dealers

Fall River is home to 39 permitted seafood and bait dealers. Though the dealers might be physically located in Fall River, they may travel to other ports for their fish. Regardless of the location listed on their permits, dealers are closely tied to fisheries regulations and the health of the fisheries. Should regulations limit what can be landed, the number of dealers operating in Fall River may also decrease.

3.2.3.7 Gloucester Overview, Forecasts, and Trends

Commercial Fishing

Gloucester has traditionally been a groundfish port, a fishery that has been constrained by management measures imposed in response to scientific surveys that have documented declining stocks of groundfish.

Gloucester-based vessels continue to adapt and harvest other species, or even leave fishing entirely as the stock levels fluctuate. Those remain have had their value of landings increase even as the catch level fluctuated - see Figure 3. The reductions in the quota for cod (77 percent) and other groundfish imposed in May 2013 has the very real potential to deal a devastating effect on the groundfish fleet and related businesses for at least the near term. The lobster fishery, also important to Gloucester, is stable and expected to remain so.

Figure 3: Gloucester Fish Landings, Pounds and Dollars, 2001-2011

Source: NOAA, NMFS, Office of Science and Technology.

Dealers

Gloucester is home to 53 permitted dealers, though not all of these dealers necessarily land fish in

Gloucester, nor does this number suggest that other dealers are excluded from operating in Gloucester.

Their futures are closely tied to the fisheries regulations – especially groundfish regulations for those dealing in local catches– and the health of the fishery. While Gloucester is optimistic that the fishery will

September 12, 2013 Draft 15

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3 come back, should regulations further limit what can be landed, the number of dealers operating in

Gloucester may also decrease.

Processors

Gloucester has seen a decline in the processing of local fresh fish over time and this is likely to continue given the current volumes of fish landings.

In 2002, for example, eight establishments were reported as

Seafood Product Preparation and Packaging Companies. The number of establishments dropped to six in 2006, and is now four. Since 2006, however, the average number of reported employees grew from

501 to a high of 561 in 2010. Despite that increase, preliminary numbers from the Massachusetts Office of Labor and Workforce Development for 2012 suggest that the average number of reported employees is going to be slightly lower.

Even with the general decline in local fish processed in Gloucester, Neptune’s Harvest, a Division of

Ocean Crest Seafoods, Inc. on Harbor Cove, offers a product developed to use what had been waste from the fresh fish that they process. They recover the parts of the fish (head, skeletons, scales, and fins) previously discarded and convert this into organic liquid fertilizer that has gained an international reputation for quality and value as a plant supplement. In addition to providing an environmentally friendly consumer product, Neptune’s Harvest benefits the environment by effectively eliminating the need to dispose of gurry, the waste commonly generated in processing fish. The company reports strong and growing market demand for its fertilizers and insect repellents and will expand as it is able to obtain more gurry.

Gorton’s of Gloucester employs approximately 500 people in their frozen fish processing facility, but it is important to note that the company had been processing and packaging only imported fish since the mid-

1990s. Given this fact, the size and scope of the company’s operations are not contingent on groundfish regulation changes.

The City of Gloucester is pursuing an economic development strategy for the harbor that combines continuing support for commercial fishing, improved access to the waterfront, and diversifying waterfront industry by promoting research and development related to marine science, technology, innovation and commercialization. There are a number of examples of traditional ocean resource businesses innovating into sustainable processes, new fishery product development and gear development.

3.2.3.8 New Bedford Overview, Forecasts, and Trends

Commercial Fishing

While all indications are that the scallop industry will remain strong and sustain the New Bedford fishing industry overall, the community is concerned about the likely impact of the recent severe cuts in groundfish quotas on the groundfishing fleet. New Bedford is in a good position to continue to expand their fishing industry based on the strength of the scallop industry, the processing sector, and the condition of the port infrastructure, and further solidify its position as the top fishing port on the East Coast for value of commercial fishery landings. However, there has been a decline in the associated businesses providing sales and services to the groundfishing industry and a negative impact on the economy of the port. Figure 4 shows that while overall pounds of fish landing in New Bedford has fluctuated between

2001 and 2009, revenue has generally risen.

26 Mt. Auburn, 2009

September 12, 2013 Draft 16

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3

Figure 4: New Bedford Fish Landings, Pounds and Dollars, 2001-2011

Source: NOAA, NMFS, Office of Science and Technology.

Dealers

The population of permitted dealers in New Bedford is quite large (89) and includes the Whaling City

Seafood Auction, which deals in both scallops and groundfish. Not all of the 89 dealers operate in New

Bedford, and the number of dealers doing business in New Bedford may actually be greater than 89. As with other fishing ports, to the extent that dealers rely on local catches, the dealer activity in New Bedford could be significantly affected by stock health and fisheries regulations in New England. Therefore, any dramatic increase in the number of dealers is unlikely in the near future; and in fact, if major cuts are made, the number of dealers operating in the City may decrease.

Processors

The number of Seafood Product Preparation and Packaging companies in New Bedford has hovered around twenty for more than a decade, though 2012 saw the lowest number of reported processors (17) since 2001. These processors work with both locally caught species as well as frozen fish shipped in from other locations. The reported number of average monthly employees has also declined from a high of 1,219 employees in 2009 (the number of establishments was 21) to 763 in 2011 (when the number of establishments was 18). Final numbers are not yet available for 2012, but preliminary data suggest that the average number of reported employees will be slightly lower.

As with the dealers, processors are vulnerable to changes in fisheries regulations, and if catches decrease dramatically, the number of seafood processors may also decrease – unless those who process mostly locally caught species can transition into processing catches from other regions.

27 Massachusetts Office of Labor and Workforce Development, 2013

September 12, 2013 Draft 17

Ports of Massachusetts Strategic Plan

3.2.3.9 Salem Overview, Forecasts, and Trends

Technical Memorandum Number 3

Commercial Fishing

There is limited commercial fishing activity in Salem, with the lobster fishery being the largest component.

While the harbor draws significant seasonal business, the city seeks to attract more multi-season or yearround business. Salem is in the process of expanding the Salem Wharf and has plans to develop the adjacent embayment, Hawthorne Cove, to attract year-round commercial fishermen. The development will include approximately 30 slips for commercial use, as well as shore power and pump out access on

Salem Wharf. Further data collection is in progress on the composition of the fishing industry.

Processors

Salem currently has no seafood processors. The City hopes once construction on the Salem Wharf is complete and Hawthorne Cove is developed that these facilities will serve as a catalyst to attract other shoreside commercial marine support businesses, such as seafood processors or an ice company.

Dealers

Salem is home to six permitted seafood and bait dealers. Their futures are closely tied to fisheries regulations and the health of the fisheries. Should regulations limit what can be landed, the number of dealers operating in Salem may also decrease.

3.3 Waterborne Passenger Travel

Waterborne passenger transportation includes uses such as ocean cruises, intercity and local ferries, recreational excursions (i.e., whale watches, tours) and recreational boating. This section discusses the recent trends in waterborne transportation at the national, state and local level.

3.3.1 Global Trends in Cruise Travel

On a global scale, the cruise industry has sustained growth despite the economic recession. In 2011,

19.4 million passengers from around the world boarded cruises, with more than 60 percent from North

America. According to the Cruise Lines International Association (CLIA), forecasts for calendar year

2013 estimate that 20.9 million passengers will cruise worldwide.

As the cruise lines continue to expand and develop new markets, port-of-call decisions must consider passenger safety. Locations with high levels of unemployment, poverty, crime, and political turmoil will be avoided and/or removed from itineraries. A recent example of this is the decrease in passengers leaving from California on Mexican itineraries due to a reported decrease in overall safety.

There is an ongoing shift toward a more globally sourced market. The North American cruise market is more mature than in other countries, and as a result, growth in the number of North American cruise travelers is slower than in other source markets. Rising incomes and developing middle classes in Asia and Latin America are fueling international demand for cruise travel. As a result, the share of North

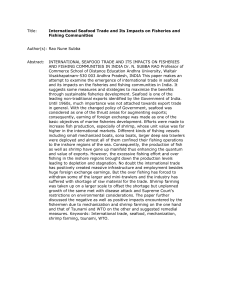

American travelers as a percentage of the overall cruise market is falling even as the overall market is growing, as shown in Figure 5.

September 12, 2013 Draft 18

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3

Although the globalization of the cruise market means that the share of world cruise passengers originating in North America is falling, there is still substantial growth potential in the North American market. Fewer than 10 percent of all residents have taken a cruise and once they do, many repeat.

Figure 5: Rising International Demand for Cruise Travel is Fueling the Industry

20 100

18

16

90

14

80

12

70

10

Passengers (Millions) 60

8

Percent North America

6 50

2000 2002 2004 2006 2008 2010 2011 2012 est.

Year

2013 f or.

Source: CLIA 2013

Due to the change in demands and the globalization of the industry, destination market shares have shifted in the past few years. According to information provided by members of the CLIA, the number of bed days has decreased over 2006–2011 and there have been shifts in market share for some destinations. Although the Caribbean remains the largest market share, its share has dropped as the cruise lines have expanded the range of destinations served. Most notably, the Mediterranean region has had significant growth, diverting a significant share of the market away from Caribbean cruises.

3.3.2 National Trends in Cruise Travel

The New England Region is growing as a U.S. source market for the cruise industry, according to data provided by CLIA. Although it represents a small share of the overall market, the New England Region has gained share even as several larger regions contracted. When broken out by individual states,

Massachusetts is the fourth largest source market, behind Florida, Texas and California, while ranking only as the 14 th

largest state in terms of population.

September 12, 2013 Draft 19

Ports of Massachusetts Strategic Plan

Table 7: Cruise Source Market Share by Region

Technical Memorandum Number 3

Regional Shares: 1990 to 2010

New England

(CT, ME, MA, NH, VT, RI)

1990

5.78%

2010

7.94%

Mid-Atlantic

(NJ, NY, PA)

East North Central

(IL, IN, MI, OH, WI)

West North Central

(IA, KS, MN, MO, NE, SD)

South Atlantic

(DE, DC, FL, GA, MD, NC,

SC, VA, WV)

East South Central

(AL, KY, MS, TN)

West South Central

(AR, LA, OK, TX)

Mountain

(AZ, CO, ID, MT, NV, NM,

UT, WY)

Pacific

(AK, CA, HI, OR, WA)

16.21%

14.03%

4.50%

24.16%

2.86%

5.42%

3.86%

23.18%

8.48%

6.08%

2.60%

36.88%

2.62%

13.06%

9.03%

13.31%

Change

2.16%

-7.73%

-7.95%

-1.90%

12.72%

-0.24%

7.64%

5.17%

-9.87%

TOTAL 100.0% 100.0% 0.00

Source: CLIA

3.3.3 Local Trends in Cruise Travel

Massachusetts ranked ninth nationally for economic impact from the cruise industry, according to CLIA.

The Port of Boston is a point of embarkation yielding economic benefits generated by spending among arriving passengers and the cruise operators for a wide range of services including fuel, food and professional services.

3.3.4 Market Trends Affecting Demand for Local Water Transportation Services

At the local level, maritime passenger travel extends beyond cruises. Demand for local water transportation services – including whale watching, sightseeing and other excursions, water shuttles, water taxis, and ferries (but not including cruise ships whose passengers are not typically local residents)

– is broadly determined by the number of people, households and jobs within the respective regions as well as visitors to those regions.

In the Commonwealth, the key regions are: Essex County for the ports of Gloucester and Salem; Suffolk County for the Port of Boston, and Bristol County for the Ports of New

28

Sources include MassDOT and the respective Regional Planning Agencies for population, households, and overall employment projections; the Massachusetts Department of Labor & Workforce Training, the North Shore and Boston Area Workforce Investment

Boards, and the US Department of Commerce, Bureau of Economic Analysis, Regional Economic Information System for historical and projected trends in specific relevant NAICS employment categories; and the Massachusetts Office of Travel & Tourism (MOTT) for historical trends in room tax collections, travelers and spending.

September 12, 2013 Draft 20

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3

Bedford and Fall River. Trends in employment in the Accommodations & Food Services industry, as well as room tax collections, are considered reasonable proxies for travel market demand and are the indicators used by the Massachusetts Office of Travel and Tourism (MOTT). Travelers are defined by

MOTT to include all persons who visit a region from more than 50 miles of their residence, including

Massachusetts residents (33 percent of all travelers) as well as persons living in other states and those arriving from international origins.

The overall picture that emerges from projections is that both resident and travel markets are expected to grow in each local region, sufficient to support both existing water transportation operators and potential service expansions. Growth rates for the resident markets range from 0.4 to 0.8 percent on an average annual basis over the next decade based on projected growth in population, households and jobs, and

0.1 to 1.2 percent annually for the markets that depend on tourist visitors based on projected growth in employment in travel-serving industries. These growth rates are consistent with historical and projected trends in employment, wages, and sales for water transportation services providers. Recent trends in

Massachusetts tourism have been positive according to MOTT. Massachusetts increases in travel expenditures have outpaced national gains: 8.2 percent versus 6.8 percent in 2010, and 8.9 percent versus 8.8 percent in 2011.

At the county level, these increases resulted in a 2010-2011 increase of 9.6 percent in Bristol County, 8.9 percent in Essex County and 8.9 percent in Suffolk County. In 2012, estimates show approximately 0.6 million persons traveled to Bristol County (New Bedford and Fall

River); about 1.0 million persons traveled to Essex County (Gloucester and Salem); and 9.5 million persons traveled to Suffolk County (Boston).

3.4 Offshore Wind Energy

Offshore wind power operations offer a new economic opportunity for Massachusetts’ ports. The state’s wind power capacity has risen steadily over the past decade from less than a megawatt to 100 megawatts as of December 2012. The state currently ranks 36 th

in terms of installed capacity, according to data from the American Wind Industry Association.

The industry’s development is supported by a federal tax credit for production. Renewed by Congress in

January 2013, the tax credit now requires projects be under construction by the end of the year to qualify, rather than fully operational, as had formerly been the case. The credit offers 2.2 cents a kilowatt-hour for electricity produced over a facility’s first 10 years of operation, a subsidy that narrows the gap between the price of wind power and that of conventional fuels. The industry is also supported by the

Massachusetts’ Renewable Portfolio Standard, which requires all retail electricity providers to provide a minimum percentage of kilowatt-hours (kWh) from eligible renewable energy resources. The minimum threshold increases over time with a 15 percent benchmark by 2020 and a one percentage point increase each year thereafter. While many renewable sources qualify, the wind industry is poised to benefit from these credits and regulations.

Wind power offers market opportunity to ports in multiple ways. First, if the port serves as the staging area for construction of an offshore wind farm, the port community and surroundings are likely to capture much of the construction work. In addition, the port will be the site for importing and transshipping the project cargo—supporting freight volumes. Second, once an offshore wind farm is constructed, it must be maintained. If the port serves as the supply location for operations and maintenance the local port community gains the jobs and earnings of these maintenance workers and their purchases of local supplies, much as Gulf Coast communities benefit from serving the offshore oil industry. Finally, if the

29

Economic Impact of Travel on Massachusetts Counties, 2011, MOTT.

September 12, 2013 Draft 21

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3 windfarm attracts a domestic manufacturer to locate in the state, the port would serve as the port of export for its product. While the construction job creation would be large and immediate, it is also temporary, lasting only for the duration of the construction cycle. The operations and industry research role are long term opportunities that can expand the local and regional economy, introducing new industry specializations to diversify the economy.

The Cape Wind project in Nantucket Sound offers the Port of New Bedford the opportunity to support construction and operations. As such, the new terminal has been designed with a heavy lift berth that will be unique among New England ports. Moreover, while the state’s high business costs and a discrete demand for equipment argue against attracting a manufacturing plant to the state, the state’s large research industry could partner with the industry to make New Bedford and the broader region a center for wind energy research and development in the U.S.

3.5 Climate Change

As the climate changes over the next several decades, air and ocean temperature are expected to increase, inciting several environmental changes. With melting land-based ice and thermal expansion of the ocean, the sea level is anticipated to rise. Globally, an expected sea level rise of two to three feet is expected by 2050 and three to six feet by 2100. For the New England coastal areas, the warming of the

Gulf Stream could add an additional six to nine inches of sea level rise by 2100 above the global average.

In addition to the rising sea level, increased ocean temperatures are correlated with increased storm intensity. A “100-year storm surge,” which has a one percent annual likelihood of occurring, will occur more frequently with a 20 percent likelihood of occurring by 2050.

Landside facilities in ports and marine transportation will grow increasingly vulnerable to flooding and storm surges and infrastructure will be affected by the rising ocean levels. This will likely require retrofitting as the lands subside and ocean levels gradually increase over time. However, warmer winter temperatures in the Northeast could also contribute to some favorable conditions for the maritime industry. With fewer days below freezing, less ice will accumulate on vessels, decks, riggings and docks, there will be fewer occurrences of dangerous fog, and a lower likelihood of ice jams within the ports. With less arctic sea ice, the accessibility of the Massachusetts ports would increase and shipping seasons would be longer. Potentially, these changes could reduce costs by reducing shipping times and distances. However, in the near decades, the high variability in conditions will increase uncertainty and unpredictability in shipping conditions, which could increase costs to shippers and ports through delays and unexpected damage to capital or goods and higher insurance costs.

The continued viability of the fishing industry depends upon the sustainability of fish stocks. Climate change, including increasing ocean temperatures and ocean acidification, has the potential to change the distribution and abundance of the species that the northeast fishing industry depends upon. Recent and current research is revealing the effects of ocean warming on fisheries worldwide and the distribution and abundance of fish are changing in response to rising ocean temperatures.

According to an Ecosystem

Advisory issued in early 2013 by NOAA’s Northeast Fisheries Science Center (NEFSC), sea surface temperatures (SSTs) in the Northeast Shelf Large Marine Ecosystem during 2012 were the highest recorded in 150 years. These high sea surface temperatures are the latest in a trend of above average

30

Douglas, Ellen, Paul Kirshen, Vivien Li, Chris Watson and Julie Wormser. “Preparing for the Rising Tide,” The Boston Harbor

Association. February 2013. http://www.tbha.org/sites/tbha.org/files/documents/preparing_for_the_rising_tide_final.pdf

31

National Research Council of the National Academies. “Potential Impacts of Climate Change on U.S. Transportation”

Transportation Research Board Special Report 290. 2008. http://onlinepubs.trb.org/onlinepubs/sr/sr290.pdf

32 Cheung 2013

September 12, 2013 Draft 22

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3 temperature seen during the spring and summer seasons, and part of a pattern of elevated temperatures occurring in the Northwest Atlantic. The NEFC also determined that some species have already begun to shift, potentially due to changing temperatures: lobster has moved upshelf, while Atlantic cod and haddock have moved downshelf.

3.6 Summary

This technical memorandum describes those macro-level trends that have the greatest relevance for the state’s maritime outlook. Massachusetts’ seaports are gateways through which its own local economy connects with the global economy. Using these strategic assets to obtain the highest return for the state and local economies requires an understanding of evolving global competitive landscape in which the ports operate and how local trends and industrial capabilities align with or operate independently of these global competitive forces.

The traditional maritime transportation system is structured around three main activities: cargo handling, commercial fishing and passenger travel. Among the oldest industries in the state economy, each is evolving to remain relevant and competitive in the 21 st

Century economy. The opportunities available to tenants and users of these port gateways are shaped by both top-down global and national trends and bottom-up local strengths and capabilities. This technical memorandum examines the forces influencing each of these three sectors from the global, national, and local perspective.

3.6.1 Cargo Handling

Port facilities are long-term investments. While near-term cyclical fluctuations in the economy may affect the timing of investment, the decision whether and how to invest in port facilities is based on long-term expectations for future volume, which sets the overall size of the maritime cargo market, expectations for the mix of trading partners which helps determine a port’s potential market share, and the mix of commodities that determines the type of equipment and facilities investment needed to capture the market opportunity. Key long-term expectations for maritime trade volume mix and trading partners are that:

•

The U.S. maritime system will have to handle twice the volume in 2040 that it carries today.

•

Container cargo, an important segment of U.S. maritime cargo trade, will post particularly strong growth; rising to more than three and one half times current volumes.

•

Export volume will match import volume by 2040.

•

China will remain a major U.S. trading partner for the foreseeable future—but rising demand in

India and West Asia by the early part of the 2020 decade indicates growing trade flows in a new part of the world whose physical location favors east coast ports of entry to the U.S. market such as Boston to a much greater extent than East Asian trade flows.

The bottom line is that global economic trends offer east coast ports reason for optimism. The maritime cargo market is anticipated to grow steadily and expand to parts of the world whose physical location favors routings that use East Coast ports within the next several years.

Beyond global economic developments, the ongoing expansion of the Panama Canal, which is scheduled for completion in early 2015, will enhance the all-water route between China and East Asia and the U.S.

September 12, 2013 Draft 23

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3 east coast. The Panama Canal expansion is expected to benefit those East Coast ports with the water depth and landside capacity to handle these large container volumes efficiently.

In addition, with a potential trade shift to India and other parts of Asia, the Suez Canal may become a more significant consideration in the size of vessels that serve the United States East Coast. The significance to Massachusetts is the benefit of closer proximity to the Suez Canal as a North Atlantic port, as opposed to the Southeast U.S. ports.

Although global patterns of economic growth and anticipated utilization of the expanded Panama Canal and Suez Canal favor U.S. East Coast ports and North Atlantic ports in the case of the Suez Canal, local conditions at Massachusetts’ ports will temper their ability to capitalize on these trends directly.

Massachusetts’ ports are unlikely to be the “first” port of call for Neo-Panamax ships. The decision of

Neo-Panamax carriers will concentrate on those ports that offer the most attractive portfolio of access, cost and value added services, particularly uncongested landside access—especially rail. Because of their size, their cargo is largely discretionary and will be destined in part for inland locations; no local market could absorb regular deliveries of goods in such quantities. Massachusetts’ ports, even were they to dredge and maintain a water depth to accommodate the largest Neo-Panamax carriers, are at a disadvantage relative to other East Coast competitors because the limited landside access and inland distribution options at these ports.

3.6.2 Commercial Fishing

Over the past decade, global wild-caught fisheries landings have continued to remain stable. Despite the overall stability of landings, significant stock fluctuation trends are present based on fishing area, country, and species. Global seafood aquaculture production has expanded significantly in the past several decades and continues to grow, although at a less dramatic rate. Overall annual per capital seafood consumption has increased steadily across the globe, and the U.S. is now second only to China in per capita seafood consumption. To meet this increasing demand for seafood, countries continue to expand production from both wild-fisheries and aquaculture as much as possible. The U.S. manages wild-caught and farm-raised seafood under strict regulations with regular scientific monitoring for many species to meet established legal and scientific standards and ensure sustainable fish stocks, a healthy environment, and employment for the seafood industry.

The outlook for U.S. fishermen varies greatly depending on geography and species. Some fisheries maintain strong population stocks and high market prices. As a result, participants in this fishery enjoy greater job and income security. In contrast, the groundfishery in New England faces low stock levels and significant quota reductions. Fishermen dependent on groundfish face significant hardship in the coming years and may be forced to stop fishing altogether if their allotted quota no longer provides a livable income. Advancements in fishing technology that have allowed fishermen to become much more efficient at finding and catching fish, combined with the detrimental impacts of pollution and environmental changes on fish reproduction, necessitate the continued implementation of adequate catch limits to restore and maintain the health of fish stocks. The success and growth potential of the seafood industry for each Compact port will depend on the specific fisheries makeup and market for each and U.S. regulatory and fish stock characteristics and demand.

3.6.3 Waterborne Passenger Travel

Passenger transportation of all kinds (i.e., cruise, excursion, ferry) has generally posted gains in recent years, despite the recession. For the cruise industry, the share of passengers traveling on U.S. vessels

September 12, 2013 Draft 24

Ports of Massachusetts Strategic Plan Technical Memorandum Number 3 has generally declined as more international providers have emerged, however Boston remains a strong port of call. Factors such as the range of destinations becoming less dominated by Caribbean routings

(i.e., elevated trips to Canadian ports of call) may have helped contribute to this factor.