Broadband costing and pricing – The case

advertisement

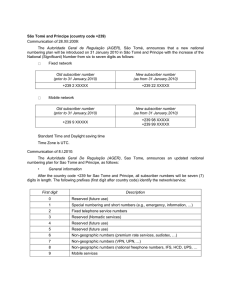

Broadband costing and pricing – The case of Sao Tome and Principe ITU-D Regional Economic and Financial Forum of Telecommunications / ICTs for Africa Emery d’Alva Marketing and Business Development Director at CST Hotel Praia, Sao Tome and Principe, 03 Feb 2015 Summary Understanding the santomean context Small country, small market, big problems The challenge of satisfying customers with high tech in a low income market From B B.C C to A A.C C period on broadband services Bridging the digital divide and state of the art technology A new era on broadband costing and pricing 2 Understanding the santomean market 3 Understanding the santomean context Small country, y, small market,, big g problems p Country overview 2 small islands 1,001 Km2 187,000 inhabitants 50% less than 20 years old 1,134 € GDP per capita Agriculture and Tourism as main economic activities GDP grows 5% annually Telecom represents 7% of GDP 4 Understanding the santomean context Small country, y, small market,, big g problems p Telecom market overview 2 operators - CST and Unitel CST is 51% owned by Portugal Telecom and 49% owned by Santomean Government 15,000,000 € market CST’s estimated market share: 10% 146,201 mobile phone users FY 2014 (CST) 6 700 fixed lines FY 2014 (CST) 6,700 25,000 internet users jan 2015 (CST) 13% penetration on internet 3G network covering 90% of the population and 80% of the territory 5 Understanding the santomean context Small country, y, small market,, big g problems p Smalls islands specific costs São Tome and Príncipe geography Rain Power network Mountains and trees Import – export costs Higher supply costs Higher power costs 6 Understanding the santomean context Satisfying y g customers with high g tech in a low income market People desire the same things they see in developed economies 2 operators - CST and Unitel Mobile broadband Fiber to the home and IPTV VoIP Fast downloads Flat tariffs Last Apple and Samsung smartphones Corporate offer 7 Understanding the santomean context Satisfying y g customers with high g tech in a low income market PIB/Capita EUR 8,201 , 7,342 6,219 4,513 3 960 3,960 2,859 3.043 +168% 389 Togo 567 Benin 818 Cote d’Ivoire 1,134 1,147 STP Nigéria 1,177 1,230 Ghana Cameroun Congo Angola Namíbia South Africa Botswana Gabon 8 Understanding the santomean context Satisfying y g customers with high g tech in a low income market Voice price On-Net EUR cent./min SMS price EUR cent 24.0 Cabo Verde 23.2 South Africa 17.6 Angola 14.2 Gabão Minimum top up EUR 8.9 Cabo Verde 7.3 Angola Angola 6.5 Cameroun South Africa 6.4 Nigéria 13.6 Cote d’Ivoire Botswana 13.4 Togo Cote d’Ivoire 13.0 Sao Tome and Principe Congo 12.8 Benin 6.2 4.9 4.3 3.8 Namíbia 0.6 Congo 0.6 Gabon 0.6 T Togo 05 0.5 N íbi Namíbia Namíbia 11.2 Gabon 3.3 Soth Africa Congo 3.2 Cote d’Ivoire Nigéria 8.9 Botswana Benin 8.6 Nigéria Ghana 4.1 Ghana 13,3 2.8 2.5 1.6 0.5 0.3 Ghana 0.2 Sao Tome and Principe 0.2 Benin 4,7 0.9 0.7 11 4 11.4 10.2 1.1 Cabo Verde C Cameroun Sao Tome and Principe 36 3.6 2.0 Botswana Cameroun Togo 5,3 0.2 1,0 9 From B.C. B C to A.C. A C period on broadband services 10 From B.C to A.C period on broadband services Bridging g g the digital g divide and state of the art technology gy 11 From B.C to A.C period on broadband services Bridging g g the digital g divide and state of the art technology gy - 96% on internet on the phone MB price, 22.8 22 8 x less than 2 years ago without any “regulatory push” Very fast adoption of smartphones Fiber to the home is beeing replacing DSL for the same price Selected clients are experiencing IPTV pilot New business are appearing thanks to better customers t experience i 12 From B.C to A.C period on broadband services A new era on broadband costing g and p pricing g Internet price / month 42€ Broadband equipment becomes free Customers get back the money they spend buying CST’s broadband mobile equipments by receiving additional MB to use on internet 5x cheaper 8.16€ Before Submarine Cable After Submarine Cable 13 From B.C to A.C period on broadband services A new era on broadband costing g and p pricing g GB included in minimum speed Max internet speed (fiber to the home) 100 Mbps 12 GB 12 100 80 8 3x 50 x faster 60 4 4 GB 40 20 2 Mbps 0 0 ADSL 128 Kbps Æ ADSL 1 Mbps Before Cable After cable 8 x faster 14 From B.C to A.C period on broadband services A new era on broadband costing g and p pricing g # internet users Used international bandwidth 30000 775 Mbps 800 +67% 600 13% +239% 239% 5.7 x more 15000 15.5 15 5x higher 400 8 57% 8,57% 200 50 Mbps 2 57% 2,57% 0 0 2012 1 2013 2014 Before Cable After cable Percentage in the bars refers to penetration rate: # internet users per 100 inhabitants 15 Thank you Merci Obrigado emerydalva@cst.st