COMPREHENSIVE FARMLAND PRESERVATION PLAN County of Warren April 2008

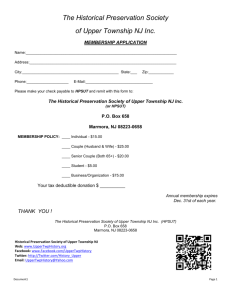

advertisement