BOARD OF DIRECTORS MEETING IN PUBLIC 31 July 2014

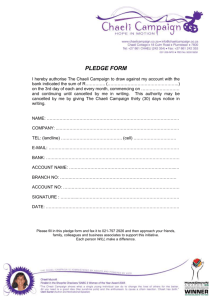

advertisement