ITU Patent Roundtable Introduction to the issues Rudi Bekkers

advertisement

ITU Patent Roundtable

Introduction to the issues

Rudi Bekkers

Presentation at the ITU Patent Roundtable

Oct. 10, 2012, Geneva

Outline

1. Introduction to SEPs and current situation

2. Trends and observations

3. Avenues that we might consider to explore

Note: personal views; this presentation does not necessarily represent views of the Committee on

IP Management in Standard-setting Processes at the US National Academies of Science (NAS)

PAGE 2

Introduction

‘That as a general proposition patented design or methods not be incorporated

in standards. However, each case should be considered on its own merits and if

a patentee be willing to grant such rights as will avoid monopolistic tendencies,

favorable consideration to the inclusion of such patented designs or methods in

a standard might be given.’

(Recommendation of ANSI’s Committee on Procedure from 1932)

Inclusion of patented technology in standards may be desirable

- … and sometimes is inevitable

But also potential negative consequences:

- Ambush (blocking properties)

- Holdup

- Cumulative licensing fees (‘royalty stacking’)

Most SSO’s have F/RAND policies to address these risks

PAGE 3

Introduction

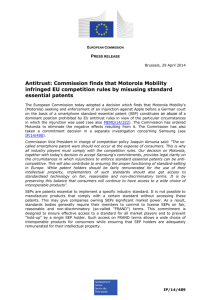

• Increasing litigation / interventions in ‘standards sectors’

• Is litigation / intervention a bad thing?

− Not necessarily (is a fundamental element of the design of FRAND!)

− But may signal problems (e.g. when they fail to clear fuzzy boundaries)

• Is our FRAND system broken?

PAGE 4

Trends and observations

Important trends and observations – often interrelated:

1. Standards are becoming more relevant and successful

2. Convergence of standardized and non-standardized technology

3. SEPs are extremely valuable business asset

4. Increasing number of SEPs

5. SEPs are more litigated than other patents

6. Market dynamics

7. SEPs often interrelated with non-SEPs

8. Increasing ownership transfer of SEPs

Also general developments: IP strategies have become more important over

time, a more patent friendly legal environment (e.g. CAFC in the US), growth of

applications and litigation, more aggressive IP business models (patent

aggregators, patent assertion entities, ‘trolls’)

PAGE 5

Trends and observations

1. Standards are becoming more relevant and successful

Success story of standards….

Standards becoming increasing prolific, especially in ICT and areas where ICT is

an enabler

− banking, public transport, logistics and intelligent transports systems,

smart grids, e-health, biometrics and agricultural systems

More and more, standards are central to a business model or a company

PAGE 6

Trends and observations

2. Convergence of standardized and non-standardized technology

As a result of generic computing power, vertical reliance of technologies and

related convergence of applications we see:

-Devices incorporate multiple standards

- A Blu Ray player will typically incorporate BR, DVD and CD plus its media

coding formats (e.g. H.264) in its various formats, but often also DiVX,

MP3, WiFi, ethernet, an internet browser

- A smart phone will typically include….. (well, you know)

-But also non-standardized technology

- A smart phone often has a software platform that is not an open standards

developed by an SSO, and often has lots of other not standardized feature

-And with the persuasive nature of ICT, we increasingly find standards used in cars

(EU: eCall), fridges, and all types of daily apparatus

Different worlds, different cultures, different fields of force, different expectations…

-> more tension

PAGE 7

Trends and observations

3. SEPs are an extremely valuable business asset

For implementing companies, during standardization:

− Can align standard with own R&D investments, technological advantages,

strengths, head start etc.

For implementing companies, after standardization:

− Provide bargaining power when securing access to the required

complementary SEPs and non-SEPS (cross-licensing)

−

-

for market entry scenarios

for for sustainable participation

- Keep doors open for move to a licensing-based business model, or

(partial) sale of assets

For non-implementing companies:

- Significant licensing, opportunities for litigation-based business models

Value reflected by prices in recent transactions

PAGE 8

Trends and observations

4. Increasing number of SEPs

Count of Declarations to 15 Standard Setting Organizations*

*Disclosure = {Firm, Date, SSO}, Some disclosures list hundred of individual patents

Source: Bekkers, Catalini, Martinelli and Simcoe (2012)

PAGE 9

Trends and observations

5. SEPs are more litigated than other patents

Lifetime Litigation Probabilities (20-Year Cumulative Litigation Hazard)

Declared Essential Patent:

Vintage / class baseline:

Source: Bekkers, Catalini, Martinelli and Simcoe (2012)

15.9%

2.9%

PAGE 10

Trends and observations

6. Market dynamics

Increasing dynamics in the market

- Entry, exit, bankruptcy, dramatic changes in market share

- Just compare the mobile phone market of today with that of 20 years ago

Changes in value chains:

- Vertical disintegration

-

Upstream technology developers,

Network operators moving out of R&D

- Increase of elaborate business models on the basis of patented

knowledge:

-

Non-practicing Entities (NPEs)

Patent aggregators –defensive or not

Patent Assertion Entities (PAEs)

Patent sharks / trolls, etc.

PAGE 11

Trends and observations

7. SEPs often interrelated with non-SEPs

In real life… its not easy to see SEPs in a context totally disconnected to nonSEPs.

From the implementation perspective

- Some technologies are considered as key or even ‘necessary’ from a

commercial point of view, but strictly speaking not in definition of essential

patents

- Interrelated with consumer expectations

Form the licensing perspective

- Very often, companies engage in broad (cross) licensing agreements in

order to achieve (mutual) freedom to operate

From the litigation perspective

- Many litigation cases included both SEPs and non-SEPs, or SEP cases

are countered with non-SEP, or otherwise

- SEPs: Good citizens but bad soldiers? (free after Florian Mueller)

PAGE 12

Trends and observations

8. Increasing ownership transfer of SEPs

Our information on actual SEPs is imperfect (self-declarations, blanket

declarations). Neither SSOs or patent registers provide a comprehensive insights

into patent transfer.

Yet anecdotal evidence demonstrates that many transactions take place involving

SEPs

New owner may have rather different objectives with SEPs, even if it did commit

itself to FRAND. Quite a few transferred patents end up being litigated.

For large transfers, authorities (e.g. DoJ) now keep a special eye on SEPs and the

consequences of transfer. But many below the radar.

PAGE 13

Trends and observations

Some examples of transactions involving SEPs:

8. Increasing ownership transfer of SEPs

− Auction of Nortel patent portfolio

Our information on

SEPs

is imperfect

(self-declarations,

blanket sold to

− actual

Motorola

Mobility

(including

a large patent portfolio)

declarations). Neither

SSOs or patent registers provide a comprehensive insights

Google

into patent transfer.

− Eastman Kodak is seeking parties interested in acquiring its

patents

Yet anecdotal evidence demonstrates that many transactions take place involving

− Ericsson sold SEPs to Research in Motion

SEPs:

− Nokia sold SEPs to MOSAID, Sisvel and Vringo

New owner may have

ratheracquired

differentRobert

objectives

with

SEPs, even if it did commit

− IPcom

Bosch

SEPs

itself to FRAND. Quite

a few transferred

patents

end up being

litigated.

− Highpoint

acquired SEPs

originating

from AT&T

− HTC acquired SEPs from both Google and Hewlett Packard

For large transfers, authorities (e.g. DoJ) now keep a special eye on SEPs and the

AcaciaBut

acquired

SEPs from

Adaptix

consequences of −transfer.

many below

the radar.

− Intel acquired SEPs(?) from InterDigital

− Apple acquired SEPs from Novell

− Intellectual Ventures teamed with NVIDIA to acquire SEPs from

IPWireless

PAGE 14

Trends and observations

8. Increasing ownership transfer of SEPs

Our information on actual SEPs is imperfect (self-declarations, blanket

declarations). Neither SSOs or patent registers provide a comprehensive insights

into patent transfer.

Yet anecdotal evidence demonstrates that many transactions take place involving

SEPs

New owner may have rather different objectives with SEPs, even if it did commit

itself to FRAND. Quite a few transferred patents end up being litigated.

For large transfers, authorities (e.g. DoJ) now keep a special eye on SEPs and the

consequences of transfer. But many below the radar.

PAGE 15

Avenues that we might want to explore

If we are concerned about current situation (or some aspects, or future situation)

some areas may deserve our attention.

1.Transfer of encumbered patents

2.The meaning of F/RAND

3.Transparency in SEPs identity

4.Technology inclusions processes

PAGE 16

Avenue 1: Transfer of encumbered patents

In principle, we would like the (FRAND) commitment to travel along to the new

owner….

SSO rules are divergent and struggle to address the issue of transfer…

Some aspects are specifically troublesome:

− Cascading transfers

− Bankruptcy situations (best practice: OASIS policy)

− When the original patent owners made blanket disclosures

No general recordation of change in patent

-

Desirable at SSO level? (problem: blanket claims)

-

Desirable at Patent Office level, e.g. proposed USPTO regulation (problem:

blanket claims - which patents are SEP?)

Private actors to foster coordination to arrive at a harmonized approach in SSOs?

PAGE 17

Avenue 1: Transfer of encumbered patents

Several legal theories to address FRAND and transfer issues:

-Patent law

- Latches and equitable estoppel, implied licenses,

“License of Rights” (UK/ES/DE, perhaps EU Community Patent)

- Country particularities (US: District Courts and ITC; Germany)

-Antitrust / competition rules

- Most countries have several routes (US: DoJ, FTC, private litigation)

-Formal contract (private law)

-(Detrimental reliance - US)

-(Property law and the Law of Servitudes - US)

Limitations:

− Theories have conditions that are not necessarily met

− Theories differ by jurisdiction

-

Different outcomes; forum shopping

− Theories depend on exact IPR policies in SSOs

PAGE 18

Avenue 2: The meaning of F/RAND

F/RAND is the most important (or minimum) commitment SSOs seek to prevent

holdup

Yet universal absence of a definitions of F/RAND, and holdup even unmentioned

- Effects at conflict resolution phase

- Parties in court make widely different interpretations of this amorphous

concept

- Judges are faced with challenges with not knowing what the policies

mean (or were supposed to mean by those who drafted them)

- Limited precedents for judges

- Effects at negotiation phase (misuse of bargaining power and threat)

- Many implements might be paying way above F/RAND but do not have

the resources or guts to challenge it -> distorts markets

Also: Transfer policies have little value of FRAND is weak

PAGE 19

Avenue 2: The meaning of F/RAND - dimensions

1. License fees

− Both EC and FTC have argued that fees should bear a reasonable

relationship to the economic value of the IPR

2. License base

− Wide variety between industry sectors (upfront payment, per-unit or

percentage)

− Different implications when markets change (product prices, convergence)

− Suggestions to link base to smallest identifiable unit

3. Licensing conditions allowed or mandated

- Reciprocity, defensive suspension, subject to standard compliance, etc.

- See http://sites.nationalacademies.org/PGA/step/IPManagement

4. (Preliminary) injunctive reliefs / exclusion orders

− Some argue that these are the cornerstone of patent rights / litigation

− Others suggest these are inappropriate remedies in contact of FRAND

− Some advocate conditional access to injunctions

5. Process

-

F/RAND relates to initial offer or to outcome? Good faith obligation?

PAGE 20

Avenue 3: Transparency in SEPs identity

While some SSOs have significantly improved transparency via their IPR database,

there are still limits to transparency:

- Information quality problem (best practice: ETSI)

-

See also The Open Essential IPR Disclosure Database (OEIDD)

www.nber.org/~confer/2012/IPKE/program1.htm

- No requirement to update statements when patents are no longer essential

-

Final standard often differs from earlier proposals

Granted patent often differs from initial application

- No requirement to update patent ownership information

- Many SSOs allow blanket disclosures

-

On average 75% for all bodies that allow this

Shift search costs to all other stakeholders and creates information assymetries

Problematic in context of patent transfers

- Some SSOs do not make essential claim disclosures and/or licensing

statements public at all

PAGE 21

Avenue 4: Technology inclusions processes

Strong incentive to drive patents into standards

− Scholarly studies show strategic behavior and ‘just-in-time’ patenting

High concentrations of patents already visible in IPR databases

“increasing number of marginal patents”,

“no mechanism exists to determine whether a patent claim brings a standard

forward (real innovation) or just tries to get a patent into the standard in

order to make money”.

(Public statements of ETSI representative)

The lack of guidance may lead to levels of technology inclusion that far exceeds

optimal results from a public perspective

- ‘direct’ licensing costs passed on to the purchaser, as well as the costs

associated with oligopolistic competition in the upstream market for

necessary technologies, plus adoption risks

Need for awareness and more conscious technology inclusion process

PAGE 22

Avenues that we might want to explore

If we are concerned about current litigation (or some current litigation), and

possible future litigation, some areas may deserve our attention.

1.Transfer of encumbered patents

2.Transparency in SEPs identity

3.The meaning of F/RAND

4.Technology inclusions processes

PAGE 23

I hope this introduction provided some guidance into

what we can talk about today….

Thank you!

PAGE 24