Digital Financial Inclusion: CGAP Initiatives on Demand, Supply, and Enabling Environment

advertisement

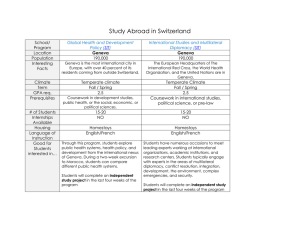

ITU Workshop on “Digital Financial Services and Financial Inclusion” (Geneva, Switzerland, 4 December 2014) Digital Financial Inclusion: CGAP Initiatives on Demand, Supply, and Enabling Environment Kathryn Imboden Advisory Consultant, CGAP kathryn.imboden@gmail.com Geneva, Switzerland, 4 December 2014 What is CGAP? We Build Knowledge on issues such as customer needs and business models We Strengthen Markets so that promising services can thrive We Promote Policies and Regulations that allow services to expand and reach unbanked populations Geneva, Switzerland, 4 December 2014 2 Four examples of CGAP initiatives addressing digital financial inclusion 1. Robust provider ecosystems 2. Digital finance frontiers 3. Digital finance plus 4. Global policy architecture Geneva, Switzerland, 4 December 2014 3 Example 1. Robust Provider Ecosystems 1. Support for ensuring that basic regulatory enablers are in place, including rules governing: E-money Agents Tiered KYC Allowing multiple types of institutions to deploy digital financial services Consumer protection Geneva, Switzerland, 4 December 2014 4 Example 1. Robust Provider Ecosystems 2. Support for government policies and practices that open up pathways to support use of digital payments services 3. Support for building provider ecosystems able to scale low-cost digital payments services Geneva, Switzerland, 4 December 2014 5 Robust Provider Ecosystems: country-level work Countries identified: Ghana, Kenya, Rwanda, Tanzania, Uganda Bangladesh, India, Myanmar, Pakistan Examples of work in progress: Ghana Myanmar Interoperability work Geneva, Switzerland, 4 December 2014 6 Example 2. Digital Finance Frontiers Driving innovation in products beyond payments, leveraging digital channels to reduce barriers to usage; expand the range of solutions delivered to the poor Digital payments platforms are expanding around the world = a low-cost channel for range of services delivered through them = bringing other opportunities to innovate in kinds of services offered Geneva, Switzerland, 4 December 2014 7 Latent innovation potential can expand range of financial solutions offered to poor and low income Review of 119 startups and ongoing deployments globally, leveraging digital channels 3% Transactional device 8% Digital channel attributes driving inclusive offerings Transactional device Enable frequent spontaneous transactions and track financial relationships across family and social networks Digital data trail Facilitate customer acquisition and onboarding, design better products, improve assessment of risk Digital data trail 14% 49% Graphic User Interface Location intelligence 26% Real time interactions Graphic User Interface Instant location intelligence Real time interactions Help customers relate more intuitively to financial services, improve their understanding of services and their choices Contextualize delivery of transactions, use information to validate KYC profile, reduce risks Interact with customer at key times, inform adequately, create confidence and proximity Example 3. “Digital Finance Plus” Use of digital finance to increase accessibility to basic, essential services and utilities more accessible Finance as a means to help solve significant development challenges Identification of services that leverage established infrastructure of mobile payments Public goods research Research partnerships Geneva, Switzerland, 4 December 2014 9 Digital Finance Plus: Example Pay-as-you-go utilities in East Africa Leveraging digital finance to deliver modern energy to the poor, sold on a pay-as-you-go basis Designed to be flexible and to fit well with the existing economic realities of the energy poor consumer Research partnerships with three pay-as-you-go solar providers operating in East Africa (See www.cgap.org for video Geneva, Switzerland, 4 December 2014 10 Example 4. Global Policy Architecture: Digital Financial Inclusion Digital transactional platforms and additional services they enable introduce new non-bank actors and shift risks among the new entrants and legacy players Key financial regulatory issues: agents, anti-money laundering and countering financing of terrorism (or “AML/CFT”), e-money regulation, consumer protection, payment system regulation, competition (but non-financial issues as well, e.g., USSD channel access) Combining financial & non-financial services calls for collaboration with non-financial regulators and standard setters (e.g., telco ministries & ITU) Geneva, Switzerland, 4 December 2014 11 Global Policy Architecture: Digital Financial Inclusion 2nd G20 Global Partnership for Financial Inclusion (GPFI) Conference, Oct. 30 & 31: “Standard Setting in the Changing Landscape of Digital Financial Inclusion,” hosted by Bank for International Settlements (BIS) in Basel: “In the financial inclusion context, the standard-setting bodies . . . need to work together. But when it comes to digital financial inclusion, those represented in this room alone are not likely to cover all of the relevant landscape. In December, for example, the International Telecommunications Union will launch a new Focus Group on Digital Financial Services, and other collaborative forums are likely to emerge.” Geneva, Switzerland, 4 December 2014 - Jaime Caruana, BIS Gen. Manager 12 2014 CGAP Publications on DFS CGAP blog: “The Seismic Implications of Digital Financial Inclusion [for Standard Setters]” CGAP Brief: “bKash Bangladesh: A Fast Start for Mobile Financial Services” CGAP blog: “5 Sources of Untapped Innovation in Digital Finance” CGAP Focus Note: “Electronic G2P Payments: Evidence from Four Lower-Income Countries” CGAP paper: “Access to Energy via Digital Finance: Models for Innovation” CGAP Focus Note: “Serving Smallholder Farmers: Recent Developments in Digital Finance Geneva, Switzerland, 4 December 2014 See www.cgap.org 13