CELEBRATING MILESTONES ANNUAL REVIEW TWO THOUSAND FIFTEEN

advertisement

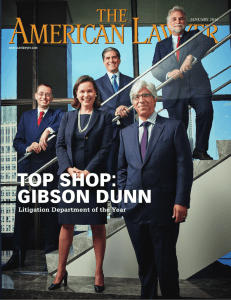

CELEBRATING MILESTONES ANNUAL REVIEW TWO THOUSAND FIFTEEN 2 Gibson, Dunn & Crutcher TABLE OF CONTENTS 3 2015 ANNUAL REVIEW MESSAGE FROM OUR CHAIRMAN AND MANAGING PARTNER.............................................................1 LITIGATION Appellate and Constitutional Law........................................................................................................5 Antitrust and Competition...................................................................................................................7 Class Actions.....................................................................................................................................9 Intellectual Property.........................................................................................................................11 Securities Litigation..........................................................................................................................13 White Collar/Regulatory ...................................................................................................................15 TRANSACTIONAL Mergers and Acquisitions.................................................................................................................19 Capital Markets................................................................................................................................20 Global Finance.................................................................................................................................21 Real Estate.......................................................................................................................................23 Private Equity...................................................................................................................................25 Investment Funds............................................................................................................................27 INDUSTRIES Energy.............................................................................................................................................31 Life Sciences....................................................................................................................................33 Sports Law.......................................................................................................................................35 NEW PARTNERS Promoted Partners...........................................................................................................................39 Lateral Partners................................................................................................................................43 DIVERSITY, PRO BONO AND COMMUNITY ACHIEVEMENTS Diversity...........................................................................................................................................53 Pro Bono ........................................................................................................................................55 Frank Wheat Memorial Awards.........................................................................................................57 1 Gibson, Dunn & Crutcher MESSAGE FROM OUR CHAIRMAN AND MANAGING PARTNER Our firm rose from modest beginnings in a Los Angeles office of just five attorneys. In the early years, we worked on important water rights cases and boundary disputes, and represented the railroads and other major clients who laid the foundation for California becoming the powerful economic and cultural engine that it is today. We now have more than 1,250 lawyers spread across 18 offices around the globe, and routinely handle Clients, Colleagues and Friends, T high-stakes disputes often involving enterprise risk, complex and sophisticated he year 2015 marked our 125th transactions and precedent-setting legal anniversary as a firm. Needless to matters. say, the world and the practice of law have changed a great deal over the years but We are incredibly honored to have been our unique culture – born 125 years ago – selected as Litigation Department remains intact, and is the bedrock of our of the Year by The American Lawyer success. At Gibson Dunn, all strategic again. Our Litigation Group has now decisions are made against a backdrop of been heralded as the best of the best in their impact on our culture, the quality of three out of the four most recent biennial our lawyers and the value proposition that competitions – an accomplishment that is we deliver to our clients. unprecedented as no other firm has won this prestigious competition even twice. The American Lawyer also ranked Gibson 2 2015 ANNUAL REVIEW Dunn second on its A-List for 2015, With thanks for your continuing support where we were recognized for our strong and in anticipation of another rewarding financial performance, coupled with our year of collaborative service, commitment to pro bono, to diversity and to associate satisfaction. Law360 named Gibson Dunn a Law Firm of the Year for the third consecutive year, having been Kenneth M. Doran designated Practice Group of the Year in Chairman and Managing Partner 10 distinct substantive areas, the most of any firm. Our commitment to diversity, pro bono and community service is an integral part of our cherished and distinctive culture. This past year, we were, once again, privileged to work on certain pro bono matters that defended the rule of law and had a profound effect on our society and the civil rights of its citizens. In the pages that follow, we want to share with you some of our accomplishments and highlights of 2015. 3 LITIGATION Gibson, Dunn & Crutcher Acclaimed as a litigation powerhouse, Gibson Dunn has a long record of outstanding successes. The American Lawyer named the firm its 2016 Litigation Department of the Year, our unprecedented third win out of the last four competitions and an unparalleled achievement given that no other firm has even won twice. Gibson Dunn achieved back-to-back wins as 2010 and 2012 Litigation Department of the Year, and 2014 Finalist honors. “Time and again,” noted the publication in 2016, “Gibson Dunn litigators set out to win big rather than just escape defeat, and they succeeded. Drawing on its deepening bench, harnessing a collective expertise through a collaborative approach, and viewing the legal landscape through a wide-angle lens, the firm repeatedly delivered when it mattered most.” 4 2015 ANNUAL REVIEW 5 Gibson, Dunn & Crutcher APPELLATE AND CONSTITUTIONAL LAW Gibson Dunn excels at challenging unconstitutional government action and punitive and excessive damage awards. When clients face such daunting situations, our widely renowned Appellate and Constitutional Law group delivers wins such as these. We obtained a major First Circuit victory for We won reversal of a $32.5 million punitive BlueMountain Capital Management, LLC, damages award against BorgWarner Morse in its challenge to the debt restructuring of TEC LLC, in the California Court of Appeal. Puerto Rico’s largest electric utility, PREPA. The wrongful death suit was brought against In 2014 the Commonwealth’s legislature numerous companies after a former security enacted the Puerto Rico Public Corporation guard at a General Motors manufacturing plant Debt Enforcement and Recovery Act, a died from asbestos-related mesothelioma. statute that purported to create a binding BorgWarner Morse TEC LLC, the sole defendant bankruptcy-like debt-restructuring regime for at the time of trial, stood as successor-in- Puerto Rico’s highly indebted public entities interest to Borg-Warner Corporation, which including PREPA. We filed suit on behalf of had made clutches containing asbestos friction PREPA bondholder BlueMountain shortly materials several decades earlier. The $32.5 after the law was enacted, and the District of million punitive damages award included in Puerto Rico agreed that the U.S. Bankruptcy the jury’s $35 million verdict was named one of Code preempts the Recovery Act. The First the largest plaintiff verdicts in California for that Circuit unanimously affirmed, rejecting each year. BorgWarner Morse TEC LLC hired Gibson of the defendants’ contrary arguments and Dunn to handle the post-trial and appellate frequently relying on responses developed in process. In a lengthy published opinion, the BlueMountain’s brief. Court of Appeal agreed with Gibson Dunn’s arguments and struck the punitive damages award in its entirety as a matter of law, without remanding for retrial. We also successfully defended against two cross-appeals that raised significant legal issues of first impression. 6 2015 ANNUAL REVIEW For Covenant Transportation, Inc. we secured complete Ninth Circuit affirmance of an order Law360 named Gibson Dunn a 2015 granting a remittitur of damages from $13.2 Law Firm of the Year, a recognition given million to $1.6 million, and an order granting to the three firms that received the most summary judgment on punitive damages. Practice Group of the Year awards. Gibson Dunn took over the wrongful death case Our firm was named among Law360’s after the jury rendered its verdict, arguing in 2015 Practice Groups of the Year in post-trial motions that the damages award was 10 categories, the most that any firm shockingly large and inconsistent with verdicts received. This was Gibson Dunn’s third in similar Arizona cases. The district court consecutive year as a Law Firm of the agreed, finding the evidence did not support the Year. award, and the Ninth Circuit affirmed. The National Law Journal named Gibson Dunn to its 2015 Appellate Hot List, which recognized 20 firms that “represent appellate advocacy at its strongest – winning the big cases and changing the law.” 7 Gibson, Dunn & Crutcher ANTITRUST AND COMPETITION From U.S. antitrust litigation to merger clearance and the EU’s credit default swaps investigation, our Antitrust and Competition lawyers achieved phenomenal outcomes, resounding victory, and results that no other firm has duplicated. For Allergan, Inc. we achieved an unusual AT&T Inc. turned to Gibson Dunn when the victory: outright dismissal of a direct purchaser company needed to be sure that its proposed antitrust class action brought by pharmacy $49 billion acquisition of DirecTV Inc. – one of chain Hartig Drug Company. The basis for the the year’s most significant megamergers – dismissal related to the fact that Hartig, a retail would secure approval from the U.S. pharmacy, was not itself a direct purchaser; Department of Justice. Working as an integral it was suing by virtue of an assignment from part of the company’s broader legal team on a drug wholesaler that purchased directly the matter, we helped develop the critical and then resold to Hartig. We persuaded the strategy that succeeded in obtaining regulatory District of Delaware that the assignment was not approval from the DOJ Antitrust Division with valid because it contradicted terms in Allergan’s no conditions. This was a phenomenal result, distribution agreement with the drug wholesaler. particularly considering the size and complexity Various other pharmaceutical defendants in of the transaction and the significant length of similar circumstances have made the same the agency’s investigation. argument without success. Gibson Dunn won on this issue in part by persuading the court to follow the reasoning of a prior federal court Global Competition Review ranked decision in which we won on the same issue Gibson Dunn No. 4 in its 2016 GCR 100 for another client. Although the majority of – Global Elite, a list of the world’s top 25 courts dealing with this question in the context antitrust practices, and No. 1 among the of high-stakes pharmaceutical antitrust actions top 10 cartel practices. have gone the other way, Gibson Dunn has now won dismissal on these grounds in not one but two major class action matters, a result that no other law firm has been able to replicate. 8 2015 ANNUAL REVIEW Our Brussels team successfully represented We successfully defended The Estee Lauder UBS AG in the European Union’s four-year Companies, Inc. against an antitrust lawsuit credit default swaps (CDS) investigation brought by Duty Free Americas Inc. (DFA), an involving allegations that 13 of the world’s airport duty-free retailer, based on an alleged largest investment banks infringed Article refusal to deal. After we had twice convinced 101 of the Treaty on the Functioning of the the district court to dismiss DFA’s complaint European Union by conspiring to prevent CDS we secured Eleventh Circuit affirmance. The exchange trading. The investigation began in Circuit rejected all allegations that the Lauder 2011, formal charges were issued in 2013, Companies’ actions constituted violations of the and we presented UBS’s defense during a six- antitrust laws, and subsequently denied DFA’s day oral hearing. In a rare development, the motion for a limited rehearing. European Commission’s Directorate-General for Competition subsequently dropped the case against UBS and the other banks. Law360 named Gibson Dunn both a 2015 Competition Practice Group of the Year and a 2015 Competition All-Star for having been designated Competition Practice Group of the Year multiple times in the past five years. 9 Gibson, Dunn & Crutcher CLASS ACTIONS In 2015 our Class Actions litigators demonstrated once again why Gibson Dunn is sought out to defend when potentially massive liability is at stake. In a sweeping opinion that relied extensively As part of our continuing work as national on the arguments and authorities that Gibson counsel for PepsiCo in a range of U.S. Dunn, counsel for American International food and beverage lawsuits, we obtained a Group, Inc. (AIG) presented, the D.C. Circuit significant victory for the company by defeating affirmed the dismissal of a $2 billion purported a class action alleging that the presence of nationwide class action involving claims 4-methylimidazole (“4-MEI”) in certain Pepsi asserted under RICO, the Longshore and products causes an increased risk of certain Harbor Workers’ Compensation Act, and a host forms of lung cancer. The Northern District of state law torts against AIG, four other insurers of California agreed with us that the plaintiffs’ and 23 defense contractor employers. The claimed levels of consumption did not state a plaintiffs alleged that they were employees of plausible claim for relief. The court dismissed the contractors and were improperly denied all personal injury and medical monitoring workers’ compensation benefits for injuries claims with prejudice – a rare achievement in a sustained while working in overseas combat putative class action in the food and beverage zones. Representing AIG as the lead insurer industry. defendant, we took primary responsibility for preparing the consolidated brief and presenting oral argument in the Circuit on behalf of all defendants. Along with addressing the flawed basis for the allegations, we also argued that the claims were preempted by a comprehensive statutory remedial framework and that essential elements of the claims could not be pled as a matter of law. The court denied plaintiffs’ subsequent request for reconsideration and the U.S. Supreme Court declined to review. Law360 named Gibson Dunn a 2015 Class Action Practice Group of the Year, our sixth consecutive win. We were the only firm to have received this recognition for all six years. 10 2015 ANNUAL REVIEW Gibson Dunn is lead counsel for Cal-Maine that the plaintiffs’ proposed classes were not Foods, Inc., the largest shell egg producer in ascertainable, that plaintiffs could not satisfy the the United States. Along with multiple other predominance requirement, and that they had defendants, Cal-Maine was named in a series failed to prove an overcharge, that any such of putative class actions by direct and indirect overcharge was passed through to consumers, purchaser plaintiffs alleging a decade-long, that damages could be established on a nationwide conspiracy by egg producers to classwide basis, and that a single class trial raise the prices of eggs and egg products. would be manageable. We led the entire defense group’s successful effort to obtain a statute of limitations ruling on a motion to dismiss that reduced the scope of the plaintiffs’ damages claims by billions of dollars. The Eastern District of Pennsylvania then denied the indirect purchasers’ request to certify enormous classes of all consumers from 21 states seeking damages back to Oct. 1, 2006. The court based its decision on six different arguments, many of which our team advocated. Specifically, the court held Gibson Dunn was named one of the top four Food & Beverage Practice Groups of the Year for 2015 by Law360. 11 Gibson, Dunn & Crutcher INTELLECTUAL PROPERTY Two blockbuster trial wins, and summary judgment that shut down multipatent infringement litigation, were at the top of our Intellectual Property group’s successes. For T-Mobile USA, Inc. we won a complete On behalf of Sharp Corp. and Sharp defense jury verdict after a three-week trial Electronics Corp. we achieved a complete in the District of Nebraska in a $100 million defense win after a one-week trial before patent infringement case. The lawsuit had the International Trade Commission in an been brought by Prism Technologies, LLC, an investigation brought by Cresta Technology Omaha-based patent licensing entity. But the Corp., a California-based former virtual jury found that none of T-Mobile’s five accused fabrication company, on two patents directed networks infringed any claim of the two asserted toward television tuners. Cresta sought an patents. This victory was especially significant exclusion order keeping Sharp from importing considering that Prism had already gone to trial any televisions into the United States – nearly in the same court against other U.S. wireless $1 billion in annual sales. The Administrative service providers and secured a trial victory Law Judge found that none of Sharp’s products against one and a significant settlement against infringed any valid claim of either asserted another. Gibson Dunn’s trial team kept the jury patent, and further that Cresta had failed to focused on the accused T-Mobile networks, and establish the requisite domestic industry. The showed that they were noninfringing. Commission reviewed and affirmed the ALJ’s determination in favor of Sharp. Managing IP Handbook, 2015 edition, recognized Gibson Dunn among the top International Trade Commission Litigation and Patent Contentious firms in the United States. 12 2015 ANNUAL REVIEW We successfully secured summary judgment of non-infringement for Medtronic, Inc. in the Western District of New York in multi-patent litigation brought by Medgraph, Inc. against Medtronic’s market-leading blood glucose monitors and associated software related to remote patient monitoring. We convinced the court that because multiple independent actors were required to perform the steps of the asserted method claims, there could be no direct infringement, and also that Medtronic’s accused system lacked key elements of the asserted system claim as it would be understood by a person of ordinary skill in the art. The National Law Journal ranked Gibson Dunn one of the top intellectual property practices in the United States in its 2015 Intellectual Property Hot List. 13 Gibson, Dunn & Crutcher SECURITIES LITIGATION From multi-level marketing and anti-pyramid scheme laws to rare earth mining and alleged liability for staggering losses, our Securities Litigation practice dealt defeat to plaintiffs across the board. We obtained a complete dismissal of all On behalf of Molycorp, Inc. and five of its securities fraud claims against Herbalife Ltd. current and former senior executives we Tossing the third amended complaint without secured complete dismissal of all claims leave to amend, the Central District of California under the Securities Exchange Act of 1934 in found that plaintiffs failed to plead material the Southern District of New York. Plaintiffs misstatements or scienter in support of the claimed that the defendants were liable to allegations that the company lied about its Molycorp’s shareholders for making false and compliance with the anti-pyramid scheme laws. misleading statements regarding: The court ruled that any misstatements were (1) the progress of “Project Phoenix,” an not material, because Herbalife made extensive effort to modernize Molycorp’s rare earth warnings to investors that its multi-level mine in Mountain Pass, California and expand marketing business model could potentially be its production capacity, (2) the amount of challenged as a pyramid scheme. The court inventory, cost of sales, and income tax benefit also firmly rejected plaintiffs’ arguments that the reported in Molycorp’s first quarter 2013 complaint sufficiently alleged that defendants financial results, which were subsequently did anything with an intent to defraud Herbalife restated, and (3) the marketability of Molycorp’s shareholders. cerium-based water filtration product known as “SorbX.” Based on the strength of Gibson Dunn’s motion papers, the court held that plaintiffs failed to raise a strong inference of scienter with respect to their allegations regarding Project Phoenix and the financial restatement, and that defendants’ statements regarding SorbX were forward-looking and protected under the Private Securities Litigation Reform Act’s “safe harbor.” 14 2015 ANNUAL REVIEW For UBS AG and four of its senior executives we secured Second Circuit affirmance of the Law360 named Gibson Dunn a 2015 dismissal of a putative class action filed in the Securities Practice Group of the Year wake of reports that a UBS London employee as well as a 2015 Securities All-Star and rogue trader, Kweku Adoboli, engaged in for having been designated Securities unauthorized trades resulting in more than $2 Practice Group of the Year multiple times billion in losses to UBS’s proprietary account. in the past five years. The plaintiffs, alleging that statements by UBS and the individual defendants concerning the quality of the company’s risk management and controls were false or misleading, asserted claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934. The Second Circuit affirmed the dismissal, also obtained by Gibson Dunn, agreeing that plaintiffs had provided “no plausible explanation as to why Defendants would turn a blind eye to the possibility that unauthorized trading was exposing UBS to billions of losses.” 15 Gibson, Dunn & Crutcher WHITE COLLAR/REGULATORY In its 2016 Litigation Department of the Year competition, The American Lawyer named our firm the winner in the White Collar/Regulatory category, noting that “[c]lients routinely describe lawyers at Gibson, Dunn & Crutcher in superlatives,” such as “‘[s]trategic thinkers,’ ‘creative,’ ‘tenacious’ and ‘responsive.’” The publication called our appellate work in these areas “exceptional” and “involving areas where there was little law on the books.” In 2015 Gibson Dunn continued to be a leader require the company to retain an independent in defending companies against government compliance monitor or otherwise self-report to investigations and enforcement of the U.S. the SEC on an ongoing basis. Likewise, Bristol- Foreign Corrupt Practices Act (FCPA). We Myers Squibb, which also neither admitted nor successfully guided Mead Johnson Nutrition denied the SEC’s findings, agreed to pay $14 and Bristol-Myers Squibb toward resolving million to the agency in disgorgement, penalties years-long investigations by the U.S. Securities and prejudgment interest. In an investigation and Exchange Commission and the U.S. that initially encompassed the company’s Department of Justice regarding alleged FCPA operations in multiple countries, the settlement violations. Mead Johnson, which neither eventually narrowed the matter to alleged admitted nor denied the SEC’s findings improper interactions with doctors in China. regarding alleged improper payments in China, The SEC credited Bristol-Myers’s recent efforts agreed to pay $12 million to the agency in to improve its compliance program and internal penalties, disgorgement, and prejudgment controls and did not impose a compliance interest. The SEC credited Mead Johnson’s monitor. In both cases, the DOJ declined extensive and thorough cooperation, and its criminal prosecution. compliance remediation efforts, and did not The National Law Journal named Gibson Dunn the winner of the White Collar category in its 2015 Washington Litigation Department of the Year competition. 16 2015 ANNUAL REVIEW 17 Gibson, Dunn & Crutcher TRANSACTIONAL 18 2015 ANNUAL REVIEW 19 Gibson, Dunn & Crutcher MERGERS AND ACQUISITIONS Our Mergers and Acquisitions lawyers partnered with clients on multiple billion-dollar transactions, bringing to each successful representation our tailored approach, sophisticated judgment, technical excellence and creative solutions. We represented professional services group Our Beijing office represented an investment Towers Watson in its $18 billion merger of consortium consisting of Hua Capital equals with Willis Group Holdings, a global Management Co., Ltd., CITIC Capital Holdings risk advisory, reinsurance broking and human Limited and Goldstone Investment Co., Ltd., capital and benefits firm. Willis Towers Watson, in the $1.9 billion purchase of California-based the combined company, is based in Ireland with OmniVision Technologies, a leading developer approximately 39,000 employees in more than of advanced digital imaging solutions. 120 countries. We were counsel to The Ryland Group, Inc. in its transformational $5.4 billion merger of equals with Standard Pacific Corporation. This combination of two of the premier U.S. homebuilders created the fourth largest homebuilding company in the United States that, upon closing of the deal, had an enterprise value of approximately $8.4 billion. 20 2015 ANNUAL REVIEW CAPITAL MARKETS Our Capital Markets group saw clients scouting the globe in 2015 for the most advantageous transaction terms. Practice members guided a number of investment grade issuers in the technology, consumer product, financial services and delivery and freight industries through the complexities of accessing markets around the world, advising on offerings of over $13 billion in debt securities denominated in Australian dollars, Canadian dollars, euros, pounds sterling and Swiss francs, as well as U.S. dollardenominated offerings listed on the Taipei Exchange. And the group rang in the New Year with one of the first IPOs. In one of 2015’s first IPOs, we represented the Our group also represented Wells Fargo underwriters, led by UBS Investment Bank, Securities, LLC and other underwriters in BMO Capital Markets and SunTrust Robinson over $17 billion of offerings by Wells Fargo & Humphrey, in the $116.4 million initial public Company, a diversified U.S. financial services offering of Patriot National, Inc., a U.S. provider company with $1.8 trillion in assets and offices of comprehensive outsourcing solutions within in 36 countries. the workers’ compensation marketplace. In addition to representing a leading semiconductor company in certain of the international offerings of debt securities referred to above, we represented the company in its $7 billion offering of senior notes in the United States to fund a portion of the purchase price for an acquisition. 21 Gibson, Dunn & Crutcher GLOBAL FINANCE The billions in financings that our Global Finance practice advised on facilitated high-profile corporate undertakings including acquisitions and spin-offs in information technology and health care. We represented T-Mobile in connection with We served as counsel to St. Jude Medical, $4 billion in financings, which were composed Inc., the global medical device company, in of a $2 billion senior secured term loan credit its $4.1 billion financing to acquire California- agreement and a $2 billion offering of 6.500% based Thoratec Corporation, a world leader senior notes due 2026. T-Mobile is one of the in mechanical circulatory support for patients largest providers of wireless voice and data suffering from advanced heart failure. This communications services in the United States. acquisition financing was composed of a $2.6 billion senior unsecured term loan facility and For Hewlett-Packard Company, the global the company’s successful issuance of $1.5 information technology company, we worked billion of senior unsecured notes. In addition to closely together with our Capital Markets these facilities, we represented St. Jude in an practice to advise on multiple financings, amendment and restatement of its $1.5 billion including a $5 billion delayed draw term loan multi-year senior unsecured revolving credit facility used, among other purposes, to finance agreement. its multibillion-dollar acquisition of Aruba Networks, Inc., and to cover certain costs associated with the separation of HewlettPackard into two separate publicly traded companies: HP Inc. and Hewlett Packard Enterprise. The spin-off of Hewlett Packard Enterprise was also financed by Hewlett Packard Enterprise’s issuance of $14.6 billion senior notes and tender offers for up to $8.8 billion of outstanding Hewlett-Packard Company debt. We subsequently advised both companies on separate, $4 billion revolving credit facilities entered into in connection with the separation. 22 2015 ANNUAL REVIEW 23 Gibson, Dunn & Crutcher REAL ESTATE Across the United States and the globe, our vibrant Real Estate group handled even the most complex transactions with mastery, seamless teamwork and flawless execution. We represented a joint venture of The Related We advised Hudson Pacific Properties, Inc., Companies and Oxford Properties in closing on a Los Angeles-based real estate investment a multibillion-dollar equity and debt financing trust, in its $3.5 billion acquisition of a Northern for the new flagship office building they are California portfolio of 26 high-quality office developing at Hudson Yards, a 28-acre project assets and two development parcels from on Manhattan’s West Side. To be built on a Blackstone Real Estate Partners V and VI. The platform over a working commuter rail yard, transaction made Hudson Pacific the largest Hudson Yards is set to include office buildings, publicly traded office owner in Silicon Valley, a one-million-square-foot retail mall, hotel and with a combined portfolio totalling 53 properties cultural facilities and residential buildings. or 17.3 million square feet across Northern and In December 2015, Time Warner, KKR and Southern California and the Pacific Northwest. Wells Fargo closed on deals to relocate to the new two-million-square-foot office tower, and Related and Oxford simultaneously closed on the construction financing for the tower. Gibson Dunn also handled the closing on construction loans for 15 Hudson Yards, an approximately 740,000-square-foot luxury residential condominium project with an affordable housing component, and is handling the construction loan for 35 Hudson Yards, a onemillion-square-foot mixed use project that will include luxury residential condominium units, an Equinox lifestyle hotel, an Equinox fitness club, office space, and retail space. Chambers and Partners named Gibson Dunn Real Estate Team of the Year at its 2015 Chambers USA Awards dinner, awards that recognize law firms’ “preeminence” and “reflect notable achievements over the past 12 months.” 24 2015 ANNUAL REVIEW In a transaction valued at over $3 billion, we represented Lion Gables Apartment Fund L.P. in connection with its sale of Lion Gables Residential Trust, a privately held real estate investment trust that owns, manages and develops multi-family residential properties. UK work included advising funds managed by Oaktree Capital Management, L.P. in the sale of six million square feet of UK logistics assets owned by a joint venture between Oaktree and Anglesea Capital. The portfolio, which consisted of 16 warehouse properties across the UK and leased to a diverse range of tenants, was acquired by Blackstone Real Estate Partners for its European logistics business, Logicor. Gibson Dunn was named on the 2015 Global Private Equity Real Estate “PERE: A Decade, 100 Most Influential” List. 25 Gibson, Dunn & Crutcher PRIVATE EQUITY Our full-service Private Equity group works globally across industries, engaging our extensive resources on a wide range of sophisticated transactions. These particularly notable 2015 deals included a rare example of Western private equity capital being injected into the Middle East region. We were counsel to CVC Capital Partners and We advised Sleepy’s Inc. and the members Canada Pension Plan Investment Board on of its holding company, including fourth- their acquisition of Petco Animal Supplies, generation family members and private Inc., a leading specialty retailer of premium equity firm Calera Capital, in a $780 million pet food, supplies and services, from a group sale to Mattress Firm Holding Corporation. of investors led by TPG and Leonard Green & The transformational transaction united the Partners for approximately $4.6 billion. Petco two largest U.S. mattress specialty retailers. operates more than 1,400 locations across the Sleepy’s, with more than 1,050 retail locations United States, Mexico and Puerto Rico, along in 17 states in the Northeast, New England, with one of the leading e-commerce platforms the Mid-Atlantic and Illinois, will be combined in the pet industry. CVC Capital Partners is with Mattress Firm’s more than 2,400 owned one of the world’s leading private equity and and franchised stores in 41 states, to create the investment advisory firms, with a network of largest border-to-border, coast-to-coast mattress offices throughout the United States, Europe specialty retailer. The combined nationwide and Asia. Canada Pension Plan Investment company is expected to operate nearly 3,500 Board is a professional investment management retail stores and 80 distribution centers across organization, governed and managed 48 states. independently of the Canada Pension Plan, that is headquartered in Toronto and has offices in We represented Aurora Capital Group, the Hong Kong, London, Luxembourg, Mumbai, Los Angeles-based private investment firm New York City and São Paulo. with more than $2 billion of assets under management, in its acquisition of Restaurant Technologies, Inc., the only national provider of an integrated cooking oil management solution to the food service industry across the United States. RTI serves over 22,000 restaurant chains, universities, hospitals and other food service outlets. 26 2015 ANNUAL REVIEW In one of the very few secondary private equity deals in the Middle East region, we represented Emirates NBD in connection with the acquisition of a 49% stake in Network International by global investment firms General Atlantic and Warburg Pincus from Abraaj Capital Holdings Limited, the UAE-based private equity firm. Emirates NBD will continue to own a 51% stake in the company, a leading payment solutions provider in the Middle East and Africa with a presence in more than 40 countries. The sale was a rare example of Western private equity capital being injected into the Middle East, with both investors attracted by the gradual transition from cash to electronic transactions in the Middle East and Africa. Law360 named Gibson Dunn a Private Equity Practice Group of the Year for 2015. 27 Gibson, Dunn & Crutcher INVESTMENT FUNDS Our premier Investment Funds practice brings deep experience and broad market knowledge to clients around the world as they seek to further their strategic goals. Working across sectors including private equity, hedge funds, infrastructure and real estate, we advised on the formation of funds that raised billions of dollars – including the largest first-time infrastructure private equity fund ever raised. We were very active for AnaCap Financial We successfully represented the Junius Partners, a client that invests in the European Partners real estate platform of J.P. Morgan financial services sector. We represented Private Investments in the formation of three AnaCap in the organization of Anacap Credit real estate funds: a blind pool fund (Junius Opportunities III, L.P., its credit fund which Hospitality Partners) and two funds focused on will target investments in performing, semi- single real estate assets (Junius Bel Air Partners performing and non-performing European credit and Junius LVH Partners). Junius is one of the assets, and also in AnaCap Financial Partners primary real estate investment groups within the III, L.P., its private equity fund which will target bank. investments in mid-market European financial services businesses. We represented Hamilton Lane in the organization of Hamilton Lane Co- We advised I Squared Capital in the Investment Fund III. This fund program was organization of its inaugural global oversubscribed relative to its target fundraising infrastructure fund, which raised $3 billion from amount, closing at its hard cap of $1.5 billion. approximately 50 institutional investors from With the addition of this fund, Hamilton Lane is around the world. This was the largest “first- now ranked among the largest managers of co- time” infrastructure private equity fund ever investment capital in the world. raised. The fund targets the energy, utilities (including water and waste management) and transportation sectors, with a geographic focus spanning North America, Europe, China and India. 28 2015 ANNUAL REVIEW 29 Gibson, Dunn & Crutcher INDUSTRIES 30 2015 ANNUAL REVIEW 31 Gibson, Dunn & Crutcher ENERGY Our work for energy clients across the transactional, regulatory, litigation and enforcement spheres included multiple first-of-their-kind matters. We served as regulatory counsel to Halifax, Achieving a highly unusual success for Tucson Nova Scotia-based Emera, Inc. in its successful Electric Power Company, an indirect subsidiary bid for the Federal Energy Regulatory of Fortis, Inc., we secured denial of a complaint Commission’s approval of its proposed filed against the company with FERC. The $10.4 billion acquisition of TECO Energy, Inc. agency denied the complaint in its entirety, an The deal, one of the year’s biggest in energy, action of particular significance given that the is expected to close in mid-2016. overwhelming practice has been to set such matters for hearing before FERC administrative We successfully represented the Western law judges. The case alleged breaches Electricity Coordinating Council (WECC) in of contract, violation of Tucson Electric’s its defense and settlement of a joint Federal open access transmission tariff and undue Energy Regulatory Commission (FERC) and discrimination in providing transmission service. North American Electric Reliability Corporation (NERC) enforcement action stemming from We advised Houston-based Dresser-Rand the 2011 blackout that extended from Arizona Group Inc., a leading supplier for the oil & gas, to Southern California. The first-of-their-kind process, power and other industries worldwide, FERC/NERC allegations essentially charged in its $7.6 billion takeover by Germany-based that WECC, which was at that time the reliability Siemens AG, a global technology company coordinator for the Western Interconnection, active in more than 200 countries with a focus was partially responsible for the blackout. on electrification, automation and digitalization. FERC accepted a highly favorable settlement with WECC, which included reinvestment of more than 80% of the settlement amounts back into WECC’s systems and operations. 32 2015 ANNUAL REVIEW We served as counsel to top energy private other acquirers, investors and financing sources equity firm First Reserve Corporation in alike – and we played a leading role in many of connection with its $500 million majority equity the most important of such transactions during investment in FR Warehouse LLC, a company the year. jointly owned by First Reserve and publicly traded SunEdison, Inc. In a first-of-its-kind We are representing Luminant Holding transaction, establishing a vehicle with a Company, the power generation subsidiary of revolving financing capability of up to Dallas-based Energy Future Holdings Corp., $1.5 billion, FR Warehouse was formed to in its proposed $1.3 billion acquisition of acquire and construct development-stage solar two natural gas-fueled power plants from La and wind power projects from SunEdison, with Frontera Ventures, LLC, a subsidiary of NextEra a view to reselling the projects to SunEdison’s Energy, Inc. Of particular significance for the YieldCo subsidiary, TerraForm Power, or to transaction is the fact that Luminant was the third-party acquirers upon completion of winning bidder in a competitive auction process construction. The development of innovative notwithstanding that Energy Future Holdings, financing and investment strategies such as the largest power company in Texas, is in the FR Warehouse in 2015 reflected a year of process of reorganizing in U.S. Bankruptcy unprecedented change in the renewable power Court. The acquisition received both court and space – for sponsors, developers, YieldCos and creditor groups’ approvals. 33 Gibson, Dunn & Crutcher LIFE SCIENCES From a hostile takeover bid to hotly contested patent and False Claims Act lawsuits involving best-selling pharmaceutical products, our Life Sciences teams represented clients’ interests with these exceptional results. In the most significant hostile takeover action to a premature special meeting to replace involving a California corporation in years, we Depomed’s directors. At the same time, our scored a resounding win for Depomed, Inc., litigation team filed a lawsuit against Horizon a specialty pharmaceutical company focused alleging that its bid was unlawful and should on pain and other central nervous system be enjoined because it was premised on conditions, defeating a hostile takeover bid by misuse of highly confidential information about Horizon Pharma plc initially valued at Depomed’s principal asset. Following expedited $2.2 billion. Following Horizon’s launch of a discovery, briefing and argument, the Superior public, unsolicited all-stock offer, our corporate Court of California, Santa Clara County, issued team reinforced Depomed’s structural defenses a rare preliminary injunction stopping the through the adoption of a “poison pill” and takeover. Less than one hour after the ruling, amended organizational documents to ensure Horizon dropped the attempt altogether. This a fair and orderly process for considering was an exceedingly rare case in which a hostile and responding to Horizon’s bid. With these takeover was enjoined on the basis of a breach measures in place, Horizon was unable to of a confidentiality agreement. close on a hostile exchange offer or rush 34 2015 ANNUAL REVIEW We successfully represented Sanofi in a Also for Sanofi we secured dismissal of a complicated and hotly contested case involving novel False Claims Act lawsuit by qui tam patents on both pharmaceutical formulations relator Amphastar Pharmaceuticals, Inc. The and delivery devices. At issue was Sanofi’s suit, which related to U.S. federal and state Lantus/SoloSTAR® product, which is the third reimbursements for Sanofi’s blockbuster best-selling prescription drug in the United anticoagulant drug Lovenox®, sought damages States and provides long-acting insulin for and fines exceeding $5 billion. After a four- the treatment of diabetes. This drug product day evidentiary hearing, the Central District of is protected by patents covering the insulin California found that rather than independently glargine formulation as well as pen injector developing a generic version of Lovenox®, devices. Eli Lilly and Company had filed New Amphastar had copied the teachings of Sanofi’s Drug Applications with the U.S. Food and Drug patent. As a result, the court determined that Administration seeking approval to market Amphastar had failed to prove that it qualified competitive insulin pen injector products. In as an “original source” of the information response, on behalf of Sanofi we brought an underlying its allegations, a jurisdictional infringement suit under the Hatch-Waxman Act, requirement under the False Claims Act for asserting that Lilly’s proposed product would suits based on publicly disclosed information. infringe multiple patents owned by Sanofi. On that basis, the suit was dismissed. On the morning of trial, just before opening statements, Lilly consented to, and the District of Delaware entered, an order enjoining Eli Lilly from selling its proposed product for more than a year. As part of the negotiated resolution of this dispute, Lilly further agreed to a royaltybearing license to certain Sanofi patents. Law360 named Gibson Dunn a Life Sciences Practice Group of the Year for 2015. 35 Gibson, Dunn & Crutcher SPORTS LAW Whether it’s bringing an NFL team back to its former home city, defending a quarterback against suspension, or playing key roles in executive moves, NBA home court and hospitality deals, our Sports Law practice draws on the deep, multidisciplinary resources and experience of its firmwide members to win the game for our clients. Gibson Dunn serves as lead counsel for Hollywood Park Land Company, a joint venture between Stockbridge Capital Group LLC and the Kroenke Group, in its plan to develop 298 acres in Inglewood, California, including the addition of a much-anticipated multibillion-dollar NFL stadium and 6,000 seat performance venue. Our coordinated team of more than a dozen New England Patriots quarterback Tom Brady turned to Gibson Dunn when he wanted personal counsel to assist the NFL Players Association in his appeal of a fourgame suspension by the National Football League. The closely watched “Deflategate” matter arose from allegations that the Patriots used underinflated footballs in the AFC Championship game against the Indianapolis Colts. Following release of a report on the investigation that it had commissioned, the lawyers accomplished the formation of the venture and entitlement of the property in record time. Slightly less than two months after the high-profile proposal was announced, we secured its approval by the City Council through a groundbreaking and innovative votersponsored initiative. And then the Kroenke Group, owner of the St. Louis Rams football franchise, secured NFL approval for the Rams to move to Inglewood, returning the team to the Los Angeles region after 20 years. NFL announced various sanctions against the Patriots and that it intended to suspend Brady without pay for four games of the upcoming 2015 season. Working side-by-side with counsel for the Players Association, we won a victory for Brady when the Southern District of New York tossed his suspension, allowing him to play in the Patriots’ season opener. Law360 named Gibson Dunn a 2015 Sports Practice Group of the Year. 36 2015 ANNUAL REVIEW We represented Arn Tellem in his move to In a landmark “hospitality” transaction we become Vice-Chairman of Palace Sports & represented Legends Hospitality – the Entertainment, the owner of the Detroit Pistons. concession and sports-marketing venture co- Tellem, the well-known and former “super owned by affiliates of the New York Yankees agent,” will help run the Pistons. and the Dallas Cowboys – in the buyout of Checketts Partners Investment Fund (CPIF). Gibson Dunn is representing NBA champion CPIF is run by David Checketts, the former basketball team the Golden State Warriors President of Madison Square Garden and owner in connection with the development of a new of the St. Louis Blues hockey team. Legends mixed-use office, retail and event center project Hospitality partners with, among others, in the Mission Bay area of San Francisco; LiveNation, Manchester City Football Club, the event center will serve as the new home Notre Dame Athletics, and the Los Angeles basketball court for the Warriors. Advising the Angels. team on California Environmental Quality Act analysis and entitlements, we secured approvals from the City of San Francisco and the Office of Community Investment and Infrastructure for the project, which the Governor of California has certified as an Environmental Leadership Project. 37 Gibson, Dunn & Crutcher 38 2015 ANNUAL REVIEW PROMOTED AND LATERAL PARTNERS 39 Gibson, Dunn & Crutcher PROMOTED PARTNERS We have the utmost respect for our new partners and their dedication to our firm. They exemplify our culture of collegiality and collaboration across offices and practice areas that enables us to provide the highest quality of service to our clients. DANIEL ANGEL New York DOUGLAS M. CHAMPION Los Angeles Daniel Angel focuses his practice on Douglas M. Champion represents real structuring and negotiating intellectual estate developers, energy companies, property transactions and information institutional lenders, private equity funds, technology arrangements. These include sports and entertainment operators, patent, trademark and software licensing; and nonprofit institutions in a broad the settlement of IP litigation; outsourcing range of real estate matters, including arrangements; complex transition services the negotiation and processing of land agreements; commercial technology use approvals; the purchase, sale and transactions; and IP and IT issues in leasing of commercial, mixed-use and connection with mergers, acquisitions and multi-family assets; the development of financing transactions. He represents renewable energy projects; the origination a broad variety of clients, from market and restructuring of mortgage debt; and leaders to start-ups, across a wide range the negotiation of title insurance. Matters of industries. Mr. Angel graduated cum handled include those relating to sports laude from Tulane University School of and concert facilities; office, residential, Law, where he was the editor-in-chief of transportation and municipal properties; the International and Comparative Law wind and solar farms; and oil fields. Mr. Journal. Champion received his degree from the University of California, Berkeley, School of Law. 40 2015 ANNUAL REVIEW DANIEL P. CHUNG Washington, D.C. GABRIELLE LEVIN New York Daniel P. Chung is a former Assistant U.S. Gabrielle Levin’s practice focuses Attorney in the Southern District of New on representing corporate clients in York and a recipient of the Federal Law securities class actions, shareholder Enforcement Foundation’s Prosecutor of derivative litigation, SOX and Dodd-Frank the Year award. His practice covers a whistleblower litigation, and employment wide range of civil and criminal matters, litigation. She also has experience including white collar criminal defense, representing media, technology and securities enforcement defense, internal entertainment companies in a wide investigations, corporate governance and array of matters. At the University of compliance counseling, and complex Pennsylvania Law School Ms. Levin was commercial litigation. He served as a law an Editor of the Law Review. clerk for Judge Norman Stahl of the First Circuit and for Judge Michael Mukasey of the Southern District of New York. Mr. Chung graduated cum laude from Harvard Law School. 41 Gibson, Dunn & Crutcher PROMOTED PARTNERS JOHN D. W. PARTRIDGE Denver HEATHER L. RICHARDSON Los Angeles John D. W. Partridge represents clients Heather L. Richardson concentrates in complex commercial litigation, on health care, insurance, and class government and regulatory enforcement action matters. She has represented defense, internal investigations, and health plans and insurers in a variety of compliance counseling. He has particular lawsuits, arbitrations and government experience in False Claims Act, health inquiries on a wide range of issues, care fraud and abuse, anti-corruption, including reimbursement policy, coverage and securities enforcement matters. Mr. determinations, quality of care, behavioral Partridge served as a law clerk for Judge health, and provider contracting. Ms. David Ebel of the Tenth Circuit, and Richardson has also represented a variety received his degree with distinction from of health care clients in data privacy Stanford Law School, where he served as lawsuits and HIPAA compliance. She an Executive Editor of the Stanford Law graduated from UCLA School of Law Review. and also holds a Master of Public Health degree from UCLA. 42 2015 ANNUAL REVIEW BENYAMIN S. ROSS Los Angeles ROBERT VINCENT Dallas Benyamin S. Ross handles mergers Robert Vincent’s practice focus is and acquisitions, equity investments, intellectual property litigation. He has joint ventures and restructurings. His handled all phases of complex patent experience covers a broad range of litigation, including trial, in cases industries, with a particular focus on involving a variety of technologies and in media, entertainment and technology. jurisdictions across the United States. He He served as a law clerk for Chancellor also has experience in Lanham Act, trade William Chandler of the Delaware Court of secret and False Claims Act litigation, Chancery. At New York University School regulatory enforcement proceedings, and of Law Mr. Ross received the Vanderbilt punitive damages liability. While in law Medal and the President’s Service Award school Mr. Vincent was an extern for then- for achievements and public service. Judge Sonia Sotomayor in the Second Circuit. At Columbia University School of Law he was named a Kent Scholar and received the Whitney North Seymour Medal, awarded annually to the student who shows the greatest promise of becoming a distinguished trial advocate. 43 Gibson, Dunn & Crutcher LATERAL PARTNERS We strategically strengthened and expanded our global capabilities with the addition of these lateral partners across the United States, in London, the Middle East and Asia. JEREMY BRANDON Dallas PHILIP CRUMP London Jeremy Brandon has significant Philip Crump’s practice covers a wide commercial litigation experience in a range of complex financing transactions. wide range of practice areas, including He has extensive experience in acquisition antitrust, class actions, intellectual financings for multijurisdictional LBOs property, shareholder/creditor derivative in Europe, acting primarily for private litigation, and securities litigation. In equity sponsors and debt and equity addition to trying cases in U.S. state and sponsors in par, stressed and distressed federal courts, Mr. Brandon, who clerked transactions. He has also advised clients for Judge Jeffrey Howard of the First on super senior revolving credit facilities Circuit, has also briefed and argued issues provided alongside high-yield bond in appellate courts. He was most recently packages, and private equity investment a partner with Susman Godfrey, leaving for firms on leveraging and bridging private a two-year hiatus in 2010 to serve as legal equity funds and co-investment plans. counsel for then-U.S. Senator John Kerry. His client roster includes a broad range of In that role he advised the Senator on U.S. private equity sponsors, alternative asset legal matters. managers and hedge funds. Mr. Crump was previously a partner with Kirkland & Ellis International in London. 44 2015 ANNUAL REVIEW SÉBASTIEN EVRARD Hong Kong Y. SHUKIE GROSSMAN New York Sébastien Evrard handles the full Y. Shukie Grossman joins Gibson Dunn as spectrum of inbound and outbound co-chair of the Investment Funds Practice competition work in Asia and the Group. He concentrates on the formation European Union, including merger of private investment funds of all sizes control and abuse of dominance and and investment strategies, including U.S. cartels, antitrust-related investigations and offshore funds focused on buyout, and litigation matters, and counseling growth equity, infrastructure, real estate and compliance work. He has substantial and credit. He has significant experience experience in the antitrust aspects of advising on the acquisition and sale of intellectual property rights. He has minority and majority stakes in fund represented companies in the aviation, sponsors, as well as spin-outs of fund automotive, telecommunications, media businesses and management teams, and and entertainment, technology, and oil on secondary transactions involving fund and gas industries. Joining from Jones interests. He advises investment firms Day, where he practiced in the Brussels, on their operation, regulation and internal Beijing and Hong Kong offices, Mr. Evrard governance arrangements. Mr. Grossman is co-author of Anti-Monopoly Law and previously served as co-head of the U.S. Practice, the leading English-language private funds group at Weil, Gotshal & treatise on China’s competition law, Manges and is a Columbia Law School and Competition Law in China: Laws, adjunct faculty member. Regulations, and Cases. 45 Gibson, Dunn & Crutcher LATERAL PARTNERS CHRIS HAYNES London BRIAN KNIESLY New York Chris Haynes is a corporate partner Brian Kniesly concentrates his tax focusing on equity capital markets practice in the areas of real estate, real transactions and M&A. He has extensive estate investment funds, investment experience advising companies and trusts, and M&A. He has extensive investment banks on initial public experience advising on New York state offerings, rights issues and other equity and local taxes, including transfer offerings, as well as on corporate and taxes, commercial rent and occupancy securities law and regulation. He also taxes and others. His investment fund advises on public and private M&A and experience is focused on fund formations, joint ventures. Mr. Haynes joins from including fund structuring for hedge Herbert Smith Freehills, where he was a funds, real estate funds, private equity partner. debt funds and investor negotiations. Mr. Kniesly was most recently a partner with Fried, Frank, Harris, Shriver & Jacobson. 46 2015 ANNUAL REVIEW JANE M. LOVE New York GRAHAM LOVETT Dubai Jane M. Love practices intellectual Graham Lovett’s practice covers a broad property and patent litigation, with range of disputes, including regulatory an emphasis on life sciences and investigations, regulatory and enforcement pharmaceutical-related cases. Holding actions, arbitration, compliance and a Ph.D. in molecular biology as well as a commercial litigation. His significant law degree, she has extensive experience experience relates to a wide variety in biotechnology and chemistry patent of matters, sectors, industries and issues, and advises on biosimilars and regulators. He sits as an arbitrator in post-grant proceedings under the America domestic and international arbitrations Invents Act. She also advises on patent and has as well significant experience prosecution, patent interferences and as an advocate in Dubai International reexaminations, and further provides Financial Centre (DIFC) Court litigation. strategic patent portfolio advice and He is Chairman of the DIFC Authority diligence. Ms. Love is experienced in a Legislative Committee. Formerly with wide variety of medical technology. She Clifford Chance in London and later in was previously the co-vice chair of Wilmer Dubai, where he was head of the Litigation Hale’s IP practice. and Dispute Resolution Practice for the Middle East region, Mr. Lovett also served as that firm’s Managing Partner of the Middle East region for nine years. 47 Gibson, Dunn & Crutcher LATERAL PARTNERS DEEPAK NANDA Orange County ROBERT PÉ Hong Kong Deepak Nanda focuses on transactional Robert Pé’s areas of practice are and securities matters, including cross- international arbitration and commercial border M&A, dispositions, privatization dispute resolution, with significant transactions, leveraged recapitalizations experience as well in commercial litigation and buyouts. He also handles venture and corporate investigations. He has capital and private equity fund formation handled a broad range of disputes, and portfolio company investment, including high-value international private and public offerings of equity and arbitrations in Hong Kong, London and debt securities, and compliance issues. Singapore under various rules, including He advises companies in an array of those of the Hong Kong International industries and has represented clients Arbitration Centre (HKIAC), Singapore with projects in the United States, Europe, International Arbitration Centre (SIAC), the Middle East, India, Singapore, China, ICC and UNCITRAL. Mr. Pé, a member South Korea, Latin America and Australia. of the HKIAC Council, is an accredited Mr. Nanda joins from Foley & Lardner, mediator and member of multiple most recently serving as Managing organizations’ panels of arbitrators. He Partner of that firm’s Los Angeles office. was most recently a partner with Orrick, Herrington & Sutcliffe in Hong Kong. 48 2015 ANNUAL REVIEW VICTORIA SHUSTERMAN New York ERIC SLOAN New York Victoria Shusterman concentrates on Eric Sloan has 25 years of broad commercial real estate finance. She transactional and structuring experience, represents commercial banks, REITs, focusing his tax practice on the use insurance companies and private of partnerships and limited liability equity investors in commercial real companies in U.S. and cross-border M&A, estate financing transactions and financing transactions and restructurings. investments, including balance sheet He also has substantial expertise in financings; permanent and bridge loan initial public offerings, including advising originations; mezzanine financing and on many “UP-C” IPOs in a range of other subordinate financings; construction industries. He is experienced as well in loans; loan participation, syndications the formation of U.S. and cross-border and other co-lender arrangements; and joint ventures and acquisitions and work-outs and restructurings. She has dispositions of businesses and interests also handled real estate investments in joint ventures. Previously a principal across the United States, Mexico and the with Deloitte, where he established and Caribbean, including multistate portfolio then led its National Office Partnership transactions involving financing of the Taxation group, Mr. Sloan is a Georgetown acquisition of hotel portfolios and multi- University Law Center adjunct professor. family apartment complexes. She joins from Katten Muchin Rosenman. 49 Gibson, Dunn & Crutcher LATERAL PARTNERS STEVE THIERBACH London ROBERT TRENCHARD New York Steve Thierbach has a broad cross- Robert Trenchard has 20 years of border equity and debt capital experience in life sciences and patent markets transactions practice. A U.S. litigation and large, complex litigation qualified lawyer, he advises issuers and in a broad range of areas, including underwriters on complex, innovative securities, antitrust, bankruptcy, and multijurisdictional offerings. He has commodities regulation, insurance, represented companies and investment torts, telecommunications and contract banks in major financial centers and disputes. He has represented corporate developing markets. Mr. Thierbach joins and individual clients in high-profile from Herbert Smith Freehills, where he government investigations, in complex was Global Head of the Capital Markets civil and regulatory matters in U.S. federal Practice. and state courts, and before regulatory agencies and in international arbitrations. Mr. Trenchard, formerly a partner with Wilmer Hale, clerked for Judge Lewis A. Kaplan in the Southern District of New York. 50 2015 ANNUAL REVIEW 51 Gibson, Dunn & Crutcher DIVERSITY, PRO BONO AND COMMUNITY ACHIEVEMENTS 52 2015 ANNUAL REVIEW 53 Gibson, Dunn & Crutcher DIVERSITY drafting and implementing a strategic action plan. Led by management, we BARBARA BECKER Chair, Firmwide Diversity Committee built a solid infrastructure comprised of an expanded department, strong diversity committees and affinity groups, and we undertook measures to communicate the importance of diversity. These early steps resulted in a culture shift at the firm, helped us create a strong inclusive environment, and led to an increased T he year 2015 marked a decade of continued focus on our firm’s diversity efforts. level of fluidity when discussing diversityrelated issues. In the second part of the decade, we witnessed an upward shift in our Over the first half of the decade, we demographics that continues today. embarked on a journey of self-reflection, The firm has launched innovative and goal-setting and action-planning to collaborative initiatives aimed at furthering expand diversity and inclusion. To assist diversity internally and externally. We us in doing so, Gibson Dunn hired a proudly support organizations that move professional dedicated to advancing diversity forward in the profession and diversity internally, and an external society, and we have achieved great consultant to help us move our efforts success in both our community service forward. Together they led the firm and legal matters to advance diverse through a multi-year process that involved communities. Whether we are fighting for undertaking a cultural assessment, developing a diversity task force, and 54 2015 ANNUAL REVIEW LGBT equality or public education reform, retaining and advancing this targeted we are proud that our endeavors have demographic. We believe that these made a considerable difference in these measures will help us achieve our goal of communities in which we reside. retaining top female talent into the firm’s We could write endlessly about our efforts partnership and leadership roles. over the past decade. We do, however, We are sharpening our focus and working want to highlight a few successful events harder than ever to ensure that we truly in 2015 as part of the Women of Gibson have an inclusive environment. At Gibson Dunn Initiative. The firm hosted an All Dunn, we know that is the winning Women’s Retreat for over 500 lawyers combination and look forward to seeing that featured a number of experts, where the next decade takes us. including Professor Amy Cuddy, Harvard Business School; Sara Holtz, President, Client Focus; and Verna Myers, Founder, Verna Myers Consulting. This was in addition to the Retreat’s substantive programming featuring our own women partners and associates. Throughout the year we hosted a dozen other substantive programs led by our partners and senior associates. In addition, the firm developed a Women of Color Initiative and strengthened our LGBT Women’s Initiative, both of which are focused on increasing our resources for recruiting, 55 Gibson, Dunn & Crutcher PRO BONO service, invaluable pro bono work and meaningful financial contributions. SCOTT EDELMAN Pro Bono Chair We let community service and pro bono projects originate with interested associates and partners. In this way our program remains continually dynamic, reflects the diversity of our lawyers, and achieves the widest scope and impact. The firm further supports participation by giving one-to-one billable credit for all pro W bono work performed. our firm’s long tradition of service to the Challenge, we have pledged to use our communities that are such a big part of best efforts to perform at least 60 pro our success, we were again privileged bono hours annually per lawyer. And and honored to serve those in need. We every year since 2005, when we signed believe that by working to strengthen the the Challenge, we have exceeded that rule of law, help the disadvantaged and target. In 2015, our United States-based bring top-quality legal thinking to those attorneys devoted a total of 130,005 hours who might otherwise be overlooked by to pro bono, averaging over 120 hours per the justice system, we deliver tangible person – double the 60-hour minimum. benefits to both our firm and our clients. Our international offices also contributed Our community involvement adds impressively to local and global important dimensions to the growth and communities, including working to set development of our lawyers, both as up a clinic to assist low-income domestic professionals and as citizens of those violence victims in an underserved part communities. of London, and assisting a vast array e are pleased to report on another stellar year. Continuing We are involved in the community in every region around the globe in which the firm As a firm committed to the Pro Bono of charities in the Brussels and Paris communities. has locations. With the efforts of vibrant We are well-known for representing clients Community Affairs Committees and with passion, commitment, innovative dedicated partners and associates in each thinking and limitless tenacity. We office, Gibson Dunn supports hundreds approach community and pro bono of nonprofit organizations through board service no differently than we approach paid work. We are proud of the results 56 2015 ANNUAL REVIEW and the impact we have had, providing area, the Capital Area Immigrants’ Rights access to justice for those who could (CAIR) Coalition presented Gibson Dunn not otherwise afford it. In 2015, lawyers with its Law Firm of the Year 2015 award across the firm worked on a wide variety in recognition of the number of matters of matters, including asylum, immigration our firm successfully handled for CAIR cases for unaccompanied minors, and clients over the last year. And our Orange the representation of domestic violence County office received the California State victims, special needs children seeking Bar President’s 2015 Pro Bono Service public benefits, trafficking victims, Award. Finally, Asian Legal Business low-income families facing improper named Gibson Dunn to its 2016 CSR List, evictions, and veterans. which recognizes the corporate social In 2015, we also partnered with a number of our clients on a variety of projects. In doing this, we were proud to assist in growing the network of attorneys providing responsibility initiatives of 25 law firms in Asia “that clearly have their hearts in the right place when it comes to giving back to their communities.” pro bono service to the communities in The results that we achieved were only which we live and work. It is our hope possible through the commitment and that by continuing these partnerships, we hard work of all staff, lawyers and clients will collectively serve our communities who devoted their time, energy and skills. even more forcefully. We acknowledge and deeply thank them We are continually gratified by the recognitions that we receive. Law360 named Gibson Dunn as one of its 20 Pro Bono Firms of 2015, our fourth consecutive year on the list. Law360 for their willingness and desire to give back to the community, to step out of their comfort zones, and to make a difference in others’ lives. Their efforts allowed us as a firm to make such an impact. also named our firm to its 2015 list of Pro To specifically honor exemplary pro bono Bono All Stars, featuring 17 law firms that work by our lawyers and staff, each had “demonstrated exceptionally stalwart year as a firm we give our own Frank commitment to pro bono work year after Wheat Memorial Award. We invite you year.” to read descriptions of the 2015 team Gibson Dunn was additionally honored with The Legal Aid Society’s 2015 Pro Bono Publico Award for providing exceptional legal services to low-income New Yorkers. In the Washington, D.C. and individual winners on the pages that follow. 57 Gibson, Dunn & Crutcher FRANK WHEAT MEMORIAL AWARDS Each year, Gibson Dunn honors exemplary pro bono work of our lawyers and staff by giving our own Frank Wheat Memorial Award, named for our late partner Frank Wheat, a superb transactional lawyer and giant in the nonprofit community. These annual awards are given to lawyers who obtained significant results for their pro bono clients, demonstrating leadership and initiative that serves as inspiration to others. The award recipients receive $2,500 to be donated to a pro bono organization of their choice. INDIVIDUAL AWARDS TOM PACK SAN FRANCISCO JIN YOO WASHINGTON, D.C. Associate Tom Pack is honored for Associate Jin Yoo is honored for his work winning U.S. asylum for two women representing three Honduran children and their daughter who fled their small who had suffered severe domestic abuse Mexican city in the middle of the night at the hands of their fathers while living after witnessing a neighbor’s murder at in that country. The children came to the hands of a drug cartel and receiving the United States undocumented to subsequent death threats. Within weeks join their mothers, and the government of arriving in California the women were promptly initiated removal proceedings. able to legally marry, thanks to equal A hearing was granted in a Maryland marriage rights secured by Gibson court to determine the children’s custody Dunn in the U.S. Supreme Court’s 2013 status and their eligibility for Special Hollingsworth v. Perry decision. Tom Immigrant Juvenile Status relief. The learned about the persecution the clients Maryland court granted complete custody had experienced in Mexico as LGBT over the children to the mothers and individuals and as a family, and was found all three children eligible for SIJS able to build a strong case for asylum. relief. One month later, the Immigration He successfully represented them in Court in Baltimore took notice of the pretrial negotiations with the Department Maryland court’s findings and dismissed of Homeland Security and at the merits the government’s removal proceedings hearing in immigration court. After against the children. asylum was granted, DHS waived its right to appeal. 58 2015 ANNUAL REVIEW TEAM WINNER FIGHTING AND WINNING FOR MINORITY VOTING RIGHTS Our 2015 winning team secured a Voting the Act by unlawfully diluting the voting Rights Act victory on behalf of a group of strength of black voters; enjoined the minority citizens of Albany County, New County from holding further elections York following three years of litigation and under the plan; and ordered it to create a 13-day trial in the Northern District of a remedial redistricting plan adding a New York. Gibson Dunn filed suit against fifth majority-minority district before the the County of Albany and the Albany next election. Defendants elected not to County Board of Elections after the Albany appeal. This was the third consecutive County Legislature enacted a redistricting suit against the defendants over the plan that maintained the number of redistricting of the Albany County majority-minority districts (those in which Legislature, with both prior suits (in 1991 minority residents are a majority) at four, and 2003) leading to the addition of over the objections of minority legislators majority-minority districts. and Albany County citizens. The team was led by partners Mitch The Northern District found that, following Karlan, Aric Wu and Anne Champion and the 2010 census, the Legislature used included associates Kyle Kolb, Brittany an unduly restrictive definition of minority Garmyn, Gabriel Gillett, Jonathan Fortney, in designing the redistricting plan, which Kristin Carlson, Amy Mayer, Alyssa Kuhn, it enacted without adequate opportunity Masha Bresner, Jeana Maute, Lindsey for community review or input. The court Schmidt and Peter Wade held that the plan violated Section 2 of (pictured top to bottom, left to right). 59 Gibson, Dunn & Crutcher 60 2015 ANNUAL REVIEW 61 Gibson, Dunn & Crutcher www.gibsondunn.com Beijing Brussels Century City Dallas Denver Dubai Hong Kong London Los Angeles Munich New York Orange County Palo Alto Paris San Francisco São Paulo Singapore Washington, D.C.