The 2012-13 state budget was signed in early July. ... updated budget simulations. The League scenario A assumes the... 2012-13 Final Budget Planning Parameters

99

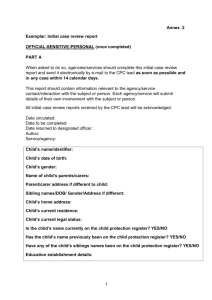

AGENDA ITEM BACKGROUND

TO: GOVERNING BOARD

FROM:

PRESIDENT

DATE

August 6, 2012

SUBJECT:

2012-13 Final Budget Planning Parameters

REASON FOR BOARD CONSIDERATION ITEM NUMBER

C.8

ACTION

ENCLOSURE(S)

Page 1 of 11

BACKGROUND:

The 2012-13 state budget was signed in early July. The California Community College League has updated budget simulations. The League scenario A assumes the November tax proposals pass and scenario B assumes a 7.3% workload reduction if the tax increases do not pass, resulting in a reduction of $3.5 million for Cabrillo. The workload reduction would be permanent. The state enacted budget includes full hold harmless protection from any shortages in RDA- related revenues. If the tax initiative passes, $50 million in restoration/growth funding will be allocated to districts that are able to show an increase in FTES beyond their cap. The best case scenario also includes a reduction of $159.9 million in apportionment deferrals.

Considerable risk remains for funding shortfalls in 2012-13 even if the Governor’s Tax Initiative passes.

Revenue estimates for taxes that would be generated by the passage of the initiative are overly optimistic. The college will plan for mid-year reductions of funding as part of the 2012-13 Final Budget development.

The following attachments were reviewed by the College Planning Council and are included for the

Governing Board’s action:

Budget Update: 2012-13 Enacted Budget

Budget Simulation: Cabrillo CCD

Updated 2012-13 Base Budget Planning Assumptions including best, mid-range and worst-case scenario

Updated Multi-year Base Budget Planning Parameters for 2012-13 through 2015-16

Projected Operating Reserves for 2011-12 and 2012-13

FISCAL IMPACT:

Estimated $4.6 million 2012-13 unrestricted general fund shortfall. The college plans to use $2.6 million of one-time reserves for 2012-13. The base budget reduction target for 2012-13 Final Budget is

$2.0 million. The Final Budget will be submitted to the Governing Board for approval in September.

The college will continue with additional reductions to offset the remaining deficit for 2012-13.

RECOMMENDATION:

It is recommended that the Governing Board approve the 2012-13 through budget planning parameters.

Administrator Initiating Item:

Victoria Lewis

Academic and Professional Matter

If yes, Faculty Senate Agreement

Senate President Signature

Yes

No

Yes No

Final Disposition

100

A best, mid and worst case scenario has been developed based on state enacted budget (see page 101).

The college will develop the 2012-13 Final Budget based on the mid-case scenario. The mid-case assumption includes one half of the 7.3% cut based on the tax increases not passing. This scenario assumes the state will identify other revenue solutions that mitigate the impact of the tax increases not passing.

The updated ongoing structural deficit for 2012-13 is currently projected at approximately $4.6 million after the implementation of Phase I through III. One of the major components of the structural deficit is the built in increases in expenses that the college must budget each year. The college is currently in negotiations with all employee groups for concessions for 2012-13. It should be noted that Cabrillo reduced the number of full-time faculty positions in the budget by ten and one half. The reduction of faculty positions has yielded significant savings in the budget to date. The college is planning to utilize $2.6 million in operating funds to bridge the 2012-13 deficit leaving a balance of approximately

$2.0 for 2012-13.

The college has set a budget reduction target of $2.0 million for the 2012-13 Final Budget. The college has begun work on Phase IV reduction plans. Phase IV reduction plans identified to date total just over $1 million. Phase IV reduction plans are included in a separate board item for the Governing

Board’s information.

The updated planning assumptions are presented for Governing Board approval. If the tax initiatives fail, the college will face mid-year cuts.

101

102

103

1 of 1 http://www.ccleague.net/districtimpact2.php?id=5&printer=y

104

Statewide printable version

The reduction simulations assume a dollar reduction in each of credit, noncredit and

CDCP FTES in a proportional manner across the district's offerings. Because noncredit and CDCP are funded at a lower rate, the percentage of FTES reduced is greater. Similar to 2011-12, each district would likely be able to decide the exact blend of its reductions.

The base FTES assumptions are assuming proportional reductions of the 2011-12 workload reduction, as identified in the Chancellor's Office Budget Workshop information. All non-excess local property tax districts are included, as the 2011-12 small district exemption was a one-time policy decision.

2012-13 Base revenue (before reductions)

Number and percent credit FTES

Number and percent noncredit FTES

Number and percent CDCP FTES

$54,088,568

10,518 (98.16%)

197 (1.84%)

0 (0.00%)

Net Apportionment

Change:

Workload reduction percent:

TOTAL FTES

Reduced

Scenario A: Governor's

Budget and Tax Package

$0

Scenario B: Governor's Budget, with Failure of Tax Package

$-3,531,887

0%

0

-7.3%

-778.81

Reduced credit FTES

Reduced noncredit FTES

Reduced noncredit CDCP FTES

-764.63

-14.18

0.00

6/20/2012 1:37 PM

08/06/12 Board

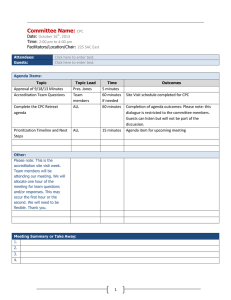

2012-13 Base Budget Planning (Best, Mid, Worst Case)

2011-12 Structural Deficit

Worst

Range

MidBest

Case Range Case

(4,233,200) (4,233,200) (4,233,200)

2012-13 Revenue Adjustment

2012-13 Reductions in revenue

A. November Tax Proposal (passes/ fails (assumes state identifies some other solutions)

B. Restoration/Growth (if tax initiative passes and is earned)

C. Property tax shortfall

D. Student Fee Revenue Shortfall

Non-Resident Tuition

(3,531,887) (1,765,944)

0 0

0

500,000

(400,000) (300,000) (200,000)

(250,000) (250,000) (250,000)

(75,000) (50,000) 0

30,000 40,000 50,000

(8,460,087) (6,559,144) (4,133,200)

Other

TOTAL Revenue Adjustment

2012-13 Expenditure Adjustments

Full-time Faculty Obligation - reduction) - actual faculty FTE = 212

Step, Column, Longevity, etc

Medical Benefit increase- 5% increase of Fed. One-time Funds

Retiree Medical Benefit Increase

PERS rate increase to 11.417%

Increase in Worker's Comp., Gen. Liability,

TRAN Interest Expense

Utilities

Operating Cost Increases

Reduction in Indirect Reimbursements from Grant programs

Recalculation of 5% Reserve

Total Expenditure Adjustments

Projected 2012-13 Structural Balance (Deficit)

Reductions (Phases I through III)

397,000 397,000 397,000

(10.5) (10.5) (10.5)

(320,000) (320,000) (320,000)

(200,000) (200,000) (200,000)

(20,000)

(60,000)

(75,000)

(70,000)

70,000

(20,000)

(60,000)

(50,000)

(60,000)

(20,000)

(60,000)

(25,000)

(50,000)

90,000 110,000

(175,000) (150,000) (100,000)

(50,000)

209,000

(38,000)

209,000

0

209,000

(294,000) (202,000) (59,000)

(8,754,087) (6,761,144) (4,192,200)

2,124,990 2,124,990 2,124,990

66 2/3 of One-time Reserves used to bridge deficit

Net Deficit for 2012-13

2,635,000 2,635,000 2,635,000

(3,994,097) (2,001,154) 567,790

Labor Agreements- Salary/Benefit concessions and/or position reductions

Cost of 1% for all groups $446,000 (including adjuncts)-base budget ?

* Does not include categorical program reductions for 2012-13 for restricted funds

?

?

105

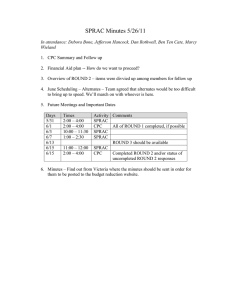

State Enacted Budget

08-06-12 Governing Board

Difference between ongoing Revenues & Expenses (Structural Deficit)

Increase in State Revenue Anticipated

November Tax Proposals fail, 1/2 of the 6% reduction

Property Tax Shortfall

2012-13 Student Fee Revenue Shortfall

Possible Increase in CCC Prop 98 allocation- if tax proposals pass (2%)

Reduction in Non-Resident Tuition

Other changes in revenue

* 1/2 of RDA Risk budgeted as one-time deficit (See Operating Reserves)

Net change in revenue

2012-13 through 2015-16

Base Budget

Planning Parameters

2012-13

Mid-Range Projected

(4,233,200)

(1,765,944)

(300,000)

(250,000)

(50,000)

40,000

(6,559,144)

2013-14

Projected

(4,636,154)

1,100,000

(3,536,154)

Net Increases in Ongoing Expenses

Full-time Faculty Position changes (-10.5, -6, +6, +6) (net of adjunct backfill)

Step, Column, Longevity Increases, etc.

Medical Plan Rate Increase-- 5%, 8%, 8%,8%

Retiree Benefit Increase

PERS Rate Increase

STRS Rate Increase

Worker's Comp, Unemployment Insurance

TRAN Interest Expense

Utilities

Net Operating Increases

Reduction in Indirect Reimbursements from grants

Labor agreements

Recalculation of 5% reserve

Total Expenditure Increases

Budget Reductions Phase I

Budget Reductions Phase II

Budget Reductions Phase III

Ongoing Shortfall*

Allocation of 66 2/3% of operating reserves

*Deficit net of One-time funds

397,000

(320,000)

(200,000)

(20,000)

(60,000)

?

(50,000)

(60,000)

90,000

(150,000)

(38,000)

?

209,000

(202,000)

938,864

744,921

441,205

(4,636,154)

2,635,000

(2,001,154)

*If the Governor's tax proposal is not approved by voters, the deficit will increase by another $3.5 million (7.3%).

One half of the increase is reflected above based on mid case planning assumptions.

The RDA risk has been removed--it is assumed that the state will backfill all risk associated with RDA

200,000

(300,000)

(360,000)

(85,000)

(120,000)

?

(100,000)

(100,000)

(100,000)

?

(965,000)

?

(4,501,154)

106

2014-15

Projected

(4,501,154)

2015-16

Projected

(4,891,154)

1,100,000 1,100,000

(3,401,154) (3,791,154)

(240,000)

(345,000)

(360,000)

(145,000)

(150,000)

?

(50,000)

(50,000)

(150,000)

?

(1,490,000)

?

(240,000)

(345,000)

(360,000)

(145,000)

(175,000)

?

(50,000)

(50,000)

(175,000)

?

(1,540,000)

?

(4,891,154) (5,331,154)

CABRILLO COLLEGE

GENERAL FUND BALANCE

08-06-12 Board Meeting

OPERATING RESERVES

Projected Operating Reserves

Beginning Balance (Mid Year-Bridge Fund Reserves, Final Budget)

ADD:

Carryover and One-time Fund Give Backs

One-time transfer from Bookstore Fund

Projected Ending balance (increased by $175,500 in mid-year reductions)

2012-13 Estimated One-Time Subfund Allocations

LESS:

2011-12 Increase in Student Fee Revenue Shortfall (February 2012)

66.67% Allocated to 2012-13 Deficit

Projected Ending Operating Reserves

= (2,450550+1,500,000) *66.67%

Projected

Projected

@ 66.67%

FY 2011-12 FY 2012-13

1,309,000 2,450,550

666,050

200,000

1,675,500

(200,000)

1,500,000

(1,200,000)

(2,635,000)

2,450,550 1,315,550

3,950,550 2,633,832

107

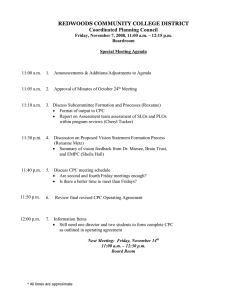

CABRILLO COLLEGE

FY 2012-13 Base Budget/Categorical Budget Development Timeline Draft

August 6, 2012 Board

September 7, 2011

September 21 & 22

SANTA CRUZ COUNTY COMMITMENT KICK OFF

BUDGET TOWN HALL MEETINGS

CPC MEETING

- Budget Planning Kick Off For 2012-13

September - December, 2011

October 3, 2011

October 4/5, 2011

October 25/19, 2011

October 4-December 1, 2011

October/November

November 7, 2011

November 8/2, 2011

November 22/16, 2011

December 5, 2011

December 6/7, 2011

December 20/21, 2011

January 9, 2012

January 10, 2012

January 10/11, 2012

January 13, 2011

January 24/18, 2012

February 6, 2012

February 7/1, 2012

February 21/15, 2012

March- April 2012

April - June 2012

FACULTY SENATE- Program Review Task Force meets to develop recommendations

BOARD MEETING

Information Items:

- Budget Presentation 2012-13

- Review of 6/30/11 Ending Fund Balance

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/CPC MEETING

Information Items:

- Budget Planning Parameters for 2012-2014

- Budget Development Timeline

ADMINISTRATIVE COUNCIL/CPC MEETING

Carryover and One-Time Fund review by Components, Cabinet, Admin. Council and CPC

Faculty Prioritization Process/ Determine FON requirements for Fall 2012

BOARD MEETING

Information Items:

- Budget Planning Parameters for 2012-2014

- Budget Development Timeline

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/

CPC MEETING

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/

CPC MEETING

BOARD MEETING

Action Items:

- Budget Planning Parameters for 2012-2014

- Budget Development Timeline

- Review Faculty Obligation number for 2012

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/

CPC MEETING

ADMINISTRATIVE COUNCIL/CPC

BOARD MEETING

Information Items:

- Budget Update

2012-13 GOVERNOR'S STATE BUDGET

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/

CPC MEETING

STATE BUDGET WORKSHOP

ADMINISTRATIVE COUNCIL/CPC

BOARD MEETING

Information Items:

- Update Budget Parameters FY2011-12 and FY 2014-15

- Update Budget Development Timeline- FY 2013-14

- Review Budget Reduction Target for 2012-13- ALL Funds, $2.5 million for Base Budget

- Carryover and One-Time Fund review/Critical Needs

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/

CPC MEETING

ADMINISTRATIVE COUNCIL/CPC

SPRAC Review of Program Reduction Plans for 2012-13

2012-13 Negotiations- All groups

108

CABRILLO COLLEGE

FY 2012-13 Base Budget/Categorical Budget Development Timeline Draft

August 6, 2012 Board

March 5, 2012

March, 2012

March 6/7, 2012

March 20/21, 2012

April, 2012

April 2, 2012

April 3/4, 2012

April 24/18, 2012

May 7, 2012

May 8/2, 2012

May 29/16, 2012

May 25, 2012

June 2012

June 11, 2012

June 12/6, 2012

June 26/20, 2012

July 18/25, 2012

August 6, 2012

August 7/1, 2012

August 28/15, 2012

September 11/5, 2012

September 17, 2012

September 25/19, 2012

BOARD MEETING

Information Items:

- FY 2011-12 Mid Year Cuts from the state

- 2012-13 Budget Reduction Plans Phase I (Base, Categorical Budgets & Other Funds)

- Projected General Fund Ending balance as of June 30,2012

Action Items:

- 2011-12 through 2014-15 Budget Planning Parameters

- March 15 Notices to Faculty- Reduction or Discontinuance of Services

- Resolution-Reduction or Discontinuance of Classified/Confidential/Management Service

First Principal Apportionment 2011-12 Received

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/

CPC MEETING

ADMINISTRATIVE COUNCIL/CPC MEETING

Continue to evaluate/revise Planning Parameters

BOARD MEETING

Action Items:

- Update Budget Development Timeline- FY 2013-14

- FY 2011-12 Mid Year Cuts from the state

- Budget Reduction Plans Phase I (Base, Categorical Budgets & Other Funds)

- Resolution-Reduction or Discontinuance of Classified/Confidential/Management Service

Information Items:

- 2012-13 Budget Reduction Plans Phase II

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/

CPC MEETING

ADMINISTRATIVE COUNCIL/CPC

BOARD MEETING

Action Items:

- Final Notices to Faculty- Reduction or Discontinuance of Services

- Resolution-Reduction or Discontinuance of Classified/Confidential/Management Service

- Budget Reduction Plans Phase II (Base Categorical Budgets & Other Funds)

Information Items:

- 2012-13 Budget Reduction Plans Phase III

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/

CPC MEETING

ADMINISTRATIVE COUNCIL/CPC MEETING

Governor's May Revise for 2012-13 released

Second Principal Apportionment 2011-12 Received

BOARD MEETING

Action Items:

- 2012-13 Budget Reduction Plans Phase II and Phase III

- 2012-13 Preliminary Budget

Information Items:

- 2012-13 Updated Budget Planning Parameters

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/

CPC MEETING

ADMINISTRATIVE COUNCIL/CPC MEETING

CPC MEETINGS

BOARD MEETING

Action Items:

- 2012-13 through 2015-16 Budget Planning Parameters

Information Items:

- 2012-13 Budget Reduction Plans, Phase IV

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/

CPC MEETING

ADMINISTRATIVE COUNCIL/CPC MEETING

ADMINISTRATIVE COUNCIL/MANAGER'S MEETING/

CPC MEETING

BOARD MEETING

Action Items:

- 2012-13 Budget Reduction Plans, Phase IV

- 2012-13 Final Budget

ADMINISTRATIVE COUNCIL/CPC MEETING

109