Committee Name: Benefits Committee Minutes Date: 4/17/2015 Time: 10:00 am – 11:00am

advertisement

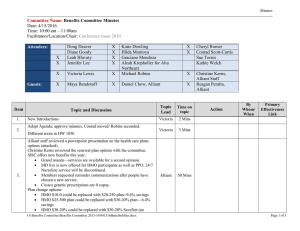

Minutes Committee Name: Benefits Committee Minutes Date: 4/17/2015 Time: 10:00 am – 11:00am Facilitators/Location/Chair: Conference room 2030 Attendees: X X X X X Doug Deaver Diane Goody Leah Hlavaty Jennifer Lee Victoria Lewis X X X X Anne Lucero Loree McCawley Graciano Mendoza Alta Northcutt Michael Robins X X X X Cheryl Romer Conrad Scott-Curtis Sue Torres Kathie Welch Alliant Staff Guests: Item Topic and Discussion Topic Lead Time on topic 1. New Introductions Victoria 2 Mins 2. Adopt Agenda Victoria 3 Mins 3. Approve Meeting Minutes: 3/19/15 Benefits Committee Mtg. Victoria 3 Mins Alliant 30 Mins Victoria 5 Mins 4. Alliant staff reviewed the renewal info in the booklet: Overall 2015-16 medical rate increase is 1.9% 2015-16 Plan designs and cost changes Contribution analysis (10thly and 12thly) Blue Shield 65+ HMO Medicare Advantage Plan Anthem Companion Care Kaiser Dental Plan – 3% renewal anticipated in June Action By Whom/ When Primary Effectiveness Link Approved: Robins/Torres SISC will review ACA at the 5/14/15 Benefits Committee meeting Actual Dental rates anticipated by 5/28/15 5. Summary/Agenda Building 6. Next meeting dates: May 14, 2015: Alliant will present on ACA implementation O:\Administrative Services\Benefits Committee\Benefits Committee 2014-15\041715BenefitsMins.docx Page 1 of 2 Minutes Item Topic Lead Topic and Discussion Time on topic Action By Whom/ When Primary Effectiveness Link Information Requested 1. Rates for Bronze plan? To be emailed out before 5/14/15. 2. Meeting Summary/Take Aways: 1. To be added during the meeting 2. Effectiveness Links 1. 5. Facilities Plan 6. Technology Plan 3. Mission Statement and Core 4 Competencies (Communication, Critical Thinking, Global Awareness, Personal and Professional Responsibility) Strategic Plan 1. Professional Development and Transformational Learning 2. Sustainable Programs and Services 3. Community Partnerships and Economic Vitality 4. Institutional Stewardship 5. Institutional Responsibilities Board Goals 7. Program Plans 4. Education Master Plan 8. Student Equity Plan 2. O:\Administrative Services\Benefits Committee\Benefits Committee 2014-15\041715BenefitsMins.docx Page 2 of 2 Cabrillo College 2015/16 Renewal Meeting April 17, 2015 Christine Kerns, Senior Vice President Eryn Elola, Account Executive Sommer Griffin, Account Manager AGENDA 2015/16 Financial Overview SISC Updates 2015/16 Renewal Current Rates and Benefits (Handout) Contribution & Plan Analysis (Handout) Next Steps © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 2 FINANCIAL OVERVIEW Cabrillo College FINANCIAL SUMMARY Line of Coverage BLUE SHIELD ACTIVE & EARLY RETIREE HMO $10-0 HMO $25-500 HMO $30-20% PPO 80-E PPO 80-J PPO HDHP B BLUE SHIELD RETIREE +65 HMO $10-0 HMO $25-500 HMO $30-20% PPO 80-E PPO 80-J PPO HDHP B COMPANIONCARE (Individual Ret Plan) CompanionCare KAISER PERMANENTE (Individual Ret Plan) Kaiser Permanente DELTA DENTAL (ACSIG) Active Retirees Enrollees 10/1/2014 10/1/2015 $∆ %∆ 61 252 68 91 41 34 $1,264,152 $4,288,284 $1,069,116 $1,561,740 $737,856 $344,880 $1,270,416 $4,403,448 $1,095,252 $1,584,156 $749,712 $355,092 $6,264 $115,164 $26,136 $22,416 $11,856 $10,212 0.5% 2.7% 2.4% 1.4% 1.6% 3.0% 5 7 0 41 4 0 $40,260 $38,556 $0 $268,320 $22,752 $0 $40,440 $38,808 $0 $273,996 $23,280 $0 $180 $252 $0 $5,676 $528 $0 0.4% 0.7% 0.0% 2.1% 2.3% 0.0% 8 $35,520 $36,960 $1,440 4.1% 2 $11,844 $11,880 $36 0.3% 465 162 $713,577 $181,579 $734,984 $187,026 $21,407 $5,447 3.0% 3.0% $10,578,435 $10,805,450 $227,015 2.1% Estimated Total Annual Premium © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 3 SISC OVERVIEW RENEWAL RATE HISTORY SISC STATE-WIDE RATE HISTORY YEAR PPO HMO 2005 - 2006 2006 - 2007 2007 - 2008 2008 - 2009 2009 - 2010 2010 - 2011 2011 - 2012 2012 - 2013 2013 - 2014 2014 - 2015 2015 - 2016 AVERAGE 7.4% 6.8% 7.5% 4.8% 0.0% 12.1% 6.4% 8.3% 8.2% 6.0% 2.8% 6.4% 7.1% 17.8% 5.3% 5.7% 14.7% 12.4% 6.4% 8.3% 8.2% 6.0% 2.8% 8.6% Santa Cruz County: 2011-12 – 3.7% 2012-13 – 3.7% 2013-14 – 6-10% 2014-15 – 6-10% 2015-16- 0-4% * HMO/PPO combined Note: PPO/HMO renewal increases represent average Anthem Blue Cross and Blue Shield rate increases. © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 4 SISC PLAN UPDATES/PROGRAMS EFFECTIVE 10/1/2015 SISC 2015-2016 Plan Year Medical Changes/Updates – PPO Plans Out-of-Pocket (OOP) Maximum Changes As SISC continues to comply with the ACA, there will be some changes to medical outof-pocket maximums on some PPO plans. The OOP maximum changes for the Cabrillo College plans are identified in the benefit summary handouts. Rx Plans – The OOP Max has been added per ACA compliance. X-Ray & Lab, Durable Medical Equipment, and Physical Medicine – Out-of-Network Benefit Change X-Ray, Lab, Durable Medical Equipment and Physical Medicine provided by nonparticipating providers will no longer be covered. Physical Medicine includes chiropractic, physical and occupational therapy. This change does not apply to emergencies. © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 5 SISC PLAN UPDATES/PROGRAMS EFFECTIVE 10/1/2015 Diabetic Test Strips • As of October 1, 2015, SISC will have preferred test strips from Abbott (Freestyle) and Lifescan (One Touch) available at the generic co-pay. All other test strips will be covered at the brand co- pay. Members affected by this change will be notified by Navitus 90-days and again 30-days prior to October 1. If a physician prescribes a preferred test strip, a new meter will be provided at no cost. • The SISC Health Benefits Manual indicates that all diabetic supplies are available only in brand form but SISC charges a generic co-pay. So right now everyone is paying a generic copay for test strips but as of October 1, 2015, only the preferred test strips will have a generic copay and all others will have a brand copay. © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 6 SISC PLAN UPDATES/PROGRAMS EFFECTIVE 10/1/2015 MDLive 24/7 Physician Access • MDLive provides SISC PPO members with on-demand access to board-certified physicians by online video, phone, or secure e-mail. • These “doctor visits” are available to PPO Members for a $5 co-pay regardless of the plan’s regular office visit co-pay. • Great alternative if members are considering the ER or urgent care for a nonemergency medical issue or when a Primary Care Physician is not available. • Also when traveling and in need of medical care • Available weekends and even holidays • The service is secure, confidential and compliant with all medical privacy regulations © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 7 SISC PLAN UPDATES/PROGRAMS EFFECTIVE 10/1/2015 Employee Assistance Program (EAP) Districts continue to find value in the Employee Assistance Program • Voluntary program offered to employees & their families • No cost to use EAP, Available 24 hrs/7 days per week • Confidential service by Licensed Professionals • 6 brief counseling sessions per incident • Comprehensive website • Resources for Managers and Supervisors 800-999-7222 www.anthemeap.com Program name: SISC © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 8 SISC PLAN UPDATES/PROGRAMS ADDITIONAL PLAN - CONSIDERATION FOR CABRILLO COLLEGE Two-Tiered Anchor Bronze PPO Plan Same plan design as the Minimum Value PPO Plan Will be added to current plan options – will NOT count towards max number of plans allowed Two-tier rate structure: Employee OR Employee + Child(ren) No dental, vision or life option No participation or contribution rules apply Only plan option available to variable hour, temporary and seasonal employees © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 9 2015/16 FINAL RATES, BENEFITS & CONTRIBUTIONS See Handouts © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 10 2015/2016 FINAL RATES & BENEFITS BLUE SHIELD HMO (SISC) Benefits Calendar Year Deductible (Individual / Family) Out-of-Pocket Maximum Individual / Family MAJOR MEDICAL HMO $10-0 w/Chiro HMO $25-500 w/Chiro HMO $30-20% Zero Facility w/Chiro None $1,000 / $2,000 Calendar Year Copayment Maximum None $2,000 / $4,000 Calendar Year Copayment Maximum None $1,500 / $3,000 Calendar Year Copayment Maximum Physician Office Visit Specialist Visit $10 $25 $30 $10 referral / $30 Access+ self-referral $25 referral / $30 Access+ self-referral $30 referral / $45 Access+ self-referral Preventive Care No charge $0 $0 $10 $25 $30 Inpatient Hospital No charge $500 / Admit 20% up to $1,500 p/member Lab & X-Ray No charge No charge No charge $10 / 30 visits (combined) $10 / 30 visits (combined) Urgent Care Chiropractic / Acupuncture Outpatient Surgery No charge Emergency Room $100 $10 / 30 visits (combined) $150 at an Ambulatory Surgery Center; $300 at a Hospital $100 Mental Health Care/Substance Abuse No charge $500 / Admit 20% up to $1,500 p/member Inpatient Hospital Facility No charge $500 / Admit 20% up to $1,500 p/member $10 $25 per visit Outpatient Physician Visit Outpatient Prescription Drugs Showing In-Network Benefits Only Navitus (Retail) Costco Costco $1,500 / $2,500 $2,500 / $3,500 (At participating Pharmacies only) Generic/Brand Generic/Brand $5/$10 Mail order - 90 day supply $9/$35 Navitus (Retail) Costco $2,500 / $3,500 Generic/Brand $0/$35 $9/$35 Generic/Brand $0/$35 $0/$20 (Costco Mail Order) $0/$90 (Costco Mail Order) $0/$90 (Costco Mail Order) N/A N/A N/A Annual Deductible Actives $0/$10 $150 $30 per visit Navitus (Retail) Rx Out of Pocket Maximum (Ind / Fam) Retail - 30 day supply No charge 2014 - 2015 2015 - 2016 2014 - 2015 2015 - 2016 Employee Only 14 $975 $980 98 $771 $792 33 $724 $742 Employee + 1 15 $1,890 $1,900 48 $1,512 $1,554 7 $1,417 $1,453 Family 15 $2,641 $2,653 90 $2,130 $2,186 27 Total Monthly Premium 44 $81,615 $82,015 236 $339,834 $348,948 67 $1,995 $87,676 $89,818 $979,380 $984,180 $4,078,008 $4,187,376 $1,052,112 $1,077,816 Total Annual Premium 2014 - 2015 2015 - 2016 $2,043 $ ∆ to Current $4,800 $109,368 $25,704 % ∆ to Current 0.5% 2.7% 2.4% Early Retiree Employee Only Employee + 1 Family Total Monthly Premium Total Annual Premium $ ∆ to Current % ∆ to Current Retirees Over Age 65 Retiree Retiree plus 1 dependent Total Monthly Premium Total Annual Premium $ ∆ to Current % ∆ to Current 10 6 1 17 5 0 5 2014 - 2015 $975 $1,890 $2,641 $23,731 $284,772 2015 - 2016 $980 $1,900 $2,653 $23,853 $286,236 $1,464 0.5% 2014 - 2015 $671 $1,342 $3,355 $40,260 2015 - 2016 $674 $1,348 $3,370 $40,440 $180 0.4% 9 7 0 16 7 0 7 2014 - 2015 $771 $1,512 $2,130 $17,523 $210,276 2015 - 2016 $792 $1,554 $2,186 $18,006 $216,072 $5,796 2.8% 2014 - 2015 $459 $918 $3,213 $38,556 2015 - 2016 $462 $924 $3,234 $38,808 $252 0.7% 0 1 0 1 0 0 0 $0/$60 (Costco Mail Orde 2014 - 2015 $724 $1,417 $1,995 $1,417 $17,004 2015 - 2016 $742 $1,453 $2,043 $1,453 $17,436 $432 2.5% 2014 - 2015 $457 $914 $0 $0 2015 - 2016 $460 $920 $0 $0 $0 0.0% © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 11 2015/16 FINAL RATES & BENEFITS BLUE SHIELD PPO (SISC) PPO 80-E Benefits PPO 80-J $300 / $600 $1,000 / $3,000 Calendar Year Out-of-Pocket Max In Network Out of Network Calendar Year Deductible (Individual / Family) Out-of-Pocket Maximum Individual / Family MAJOR MEDICAL PPO HDHP -B w/HSA Compatibility $750 / $1,500 $3,000 p/ind; $6,000 per fam Calendar Year Out-of-Pocket Max In Network Out of Network $3,000 / $5,000 $5,000 p/ind or $10,000 per fam Calendar Year Out-of-Pocket Max In Network Out of Network Physician Office Visit Ded waived; $20 50% Ded waived; $30 50% 90% Specialist Visit Ded waived; $20 50% Ded waived; $30 50% 90% 50% Preventive Care Ded waived; 100% Not Covered Ded waived; 100% Not Covered Ded waived; 100% Not Covered Ded waived; $20 50% Ded waived; $30 50% 90% 50% 80% $600 p/day 80% $600 p/day 90% $600 p/day 80% Not Covered 80% Not Covered 90% Not Covered 80% 1 Not Covered 80% 1 Not Covered 90% 1 80% $350 p/day Urgent Care Inpatient Hospital Lab & X-Ray Chiropractic / Acupuncture Outpatient Surgery 80% $350 p/day 2 $100 per visit + 20% (waived if admitted) Emergency Room Mental Health Care/Substance Abuse Inpatient Hospital Facility Outpatient Physician Visit Outpatient Prescription Drugs Showing In-Network Benefits Only Rx Out of Pocket Maximum (Ind / Fam) Ded waived; $20 50% Annual Deductible Actives $100 per visit + 20% (waived if admitted) Not Covered $350 p/day Ded waived; $30 50% 90% 50% $600 p/day 80% $600 p/day 90% $600 p/day 50% Ded waived; $30 50% 90% 50% Navitus (Retail) Costco Navitus (Retail) Costco $1,500 / $2,500 (In-network Only) $2,500 / $3,500 (In-network Only) Generic/Brand Generic/Brand $0/$25 $9/$35 Rx w/ Blue Shield Contracted Provider Combined with Medical OOP Maximum Generic/Brand $7/$25 after the deductible $0/$35 $0/$60 (Costco Mail Order) $0/$90 (Costco Mail Order) $300 p/ind; $600 p/fam $750 p/ind; $1,500 p/fam $14/$60 (Blue Shield Mail Order)after the deductible $3,000 medical deductible must be met before co-pays apply 2014 - 2015 2015 - 2016 2014 - 2015 2015 - 2016 Employee Only 29 $956 $968 15 $848 $861 27 $681 $701 Employee + 1 17 $1,778 $1,807 13 $1,578 $1,607 3 $1,281 $1,323 Family Total Monthly Premium 9 55 Total Annual Premium $2,679 11 $81,755 $82,902 39 $981,060 $2,645 $994,824 $2,348 2014 - 2015 $2,382 3 $59,062 $60,008 33 $708,744 $720,096 $1,943 2015 - 2016 $1,998 $28,059 $28,890 $336,708 $346,680 $ ∆ to Current $13,764 $11,352 $9,972 % ∆ to Current 1.4% 1.6% 3.0% Early Retiree Employee Only Employee + 1 Family Total Monthly Premium Total Annual Premium $ ∆ to Current % ∆ to Current Retirees Over Age 65 Retiree Retiree plus 1 dependent Total Monthly Premium Total Annual Premium $ ∆ to Current % ∆ to Current 1 2 19 17 0 36 39 2 41 2 $100 per visit + 10% (waived if admitted) 80% $7/$25 Mail order - 90 day supply 90% Ded waived; $20 (At participating Pharmacies only) Retail - 30 day supply 2 50% 2014 - 2015 $956 $1,778 $2,645 $48,390 $580,680 2015 - 2016 $968 $1,807 $2,679 $49,111 $589,332 $8,652 1.5% 2014 - 2015 $520 $1,040 $22,360 $268,320 2015 - 2016 $531 $1,062 $22,833 $273,996 $5,676 2.1% 1 1 0 2 4 0 4 2014 - 2015 $848 $1,578 $2,348 $2,426 $29,112 2015 - 2016 $861 $1,607 $2,382 $2,468 $29,616 $504 1.7% 2014 - 2015 $474 $948 $1,896 $22,752 2015 - 2016 $485 $970 $1,940 $23,280 $528 2.3% 1 0 0 1 0 0 0 2014 - 2015 $681 $1,281 $1,943 $681 $8,172 2015 - 2016 $701 $1,323 $1,998 $701 $8,412 $240 2.9% 2014 - 2015 $483 $966 $0 $0 2015 - 2016 $485 $970.00 $0 $0 $0 0.0% Chiropractic limited to 20 visits per calendar year, Acupuncture limited to 12 visits per calendar year Performed at an ambulatory surgery center © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 12 2015/16 FINAL RATES & BENEFITS BLUE SHIELD MEDICARE ADVANTAGE 65+ BLUE SHIELD 65+ HMO MEDICARE ADVANTAGE PLAN Effective October 1, 2015 SERVICES Current Renewal $0 co-pay per trip $0 co-pay per trip Annual Physical Examination • Office visit co-pay may apply $0 co-pay* $0 co-pay* Durable Medical Equipment (DME) Medicare covered services $0 co-pay $0 co-pay $0 co-pay per admission $0 co-pay per admission Ambulance Hospitalization • Inpatient • Outpatient hospital services • Emergency Room Immunizations • Includes flu injections and all Medicare approved immunizations Laboratory Services $20 co-pay $20 co-pay $50 co-pay/waived if admitted within 24 hrs for the same condition $50 co-pay/waived if admitted within 24 hrs for the same condition $0 co-pay* $0 co-pay* No charge No charge $10 co-pay per visit (subject to medical necessity) $20 co-pay per visit (subject to medical necessity) No charge for day 1-150 Member pays 100% from day 151 and over No charge for day 1-150 Member pays 100% from day 151 and over $20 co-pay $20 co-pay • Office visits $20 co-pay $20 co-pay • Consultation, diagnosis & treatment by a specialist $20 co-pay $20 co-pay Prescription Drugs 30 day supply at Retail and 90 day supply through Mail Order 10/30/50 Three Tiered Plan 10/30/50 Three Tiered Plan Generic $10 Retail, $20 Mail order $10 Retail, $20 Mail order Preferred Brand $30 Retail, $60 Mail order $30 Retail, $60 Mail order Non-Preferred Brand $50 Retail, $100 Mail order $50 Retail, $100 Mail order Injectables 20% up to $100 per prescription Retail, $300 Mail order 20% up to $100 per prescription Retail, $300 Mail order Specialty 20% up to $100 per prescription Retail, $300 Mail order 20% up to $100 per prescription Retail, $300 Mail order Covered in full for 100 days per benefit period Covered in full for 100 days per benefit period $0 co-pay* $0 co-pay* 2014 - 2015 $406 2015 - 2016 $428 $0 $0 $0 $0 Manual Manipulation of the Spine Mental Health - Inpatient Mental Health - Outpatient unlimited visits Physician Services/Basic Health Services Skilled Nursing Facility X-Ray Services • Includes routine annual mammography Rates Retiree Total Monthly Premium Total Annual Premium 0 © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 13 2015/16 FINAL RATES & BENEFITS COMPANIONCARE – RETIREE PLAN Anthem CompanionCare - RETIREE PLAN Effective October 1, 2015 CompanionCare Current / Renewal Pays $1260 (1-60 days) Pays $315 a day (61-90 days) Pays $630 a day (91-150 days) Pays 100% after Medicare and Lifetime reserve are exhausted up to 365 days per lifetime Pays nothing Pays $157.50 a day for 21st to 100th day Pays nothing after 100th day Pays $147 Pays 20% MA charges including 100% of Medicare Part B deductible Pays 20% MA charges SERVICES Inpatient Hospital (Part A) Skilled Nursing Facilites (Must be approved by Medicare) Deductible (Part B) Basis of Payment (Part B) Medical Services (Part B) Doctor, x-ray, appliances, & ambulance Lab Pays nothing Pays 20% MA charges up to the Medicare annual benefit amount. (Physical & Speech Therapy Combined) Pays 1st 3 pints unreplaced blood and 20% MA charges Physical/Speech Therapy (Part B) Blood (Part B) Travel Coverage (when outside the US for less than 6 consecutive months) Pays 80% inpatient hospital, surgery, anesthetist and in hospital visits for medically necessary services for 90 days of treatment per lifetime * Generic: $9 co-pay for a 30-day supply at a retail pharmacy or $18 copay for a 90-day supply through home delivery service * Brand: $35 co-pay for a 30-day supply at a retail pharmacy or $90 copay for a 90-day supply through home delivery service Outpatient Prescription Drugs (Navitus) CompanionCare EMPLOYEES Retiree Total Monthly Premium Total Annual Premium EE 2014 - 2015 2015 - 2016 8 $370 $2,960 $35,520 $385 $3,080 $36,960 8 $ ∆ to Current $1,440 % ∆ to Current 4.1% © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 14 2015/16 FINAL RATES & BENEFITS KAISER PERMANENTE INDIVIDUAL RETIREE PLAN KAISER PERMANENTE INDIVIDUAL RETIREE PLAN Effective October 1, 2015 SERVICES Hospitalization * Inpatient * Emergency Room Skilled Nursing Facility Physician Services/Basic Health Services * Office visits * Consultation, diagnosis, and treatment by a specialist X-Ray Services * Includes routine annual mammography Laboratory Services Annual Physical Examination * Includes pap smears Current Renewal $200/Admit $50 co-pay/waived if admitted $0/Admit $50 co-pay/waived if admitted Covered in full for 100 days per benefit period Covered in full for 100 days per benefit period $10 co-pay per visit $10 co-pay per visit No charge No charge No charge No charge $10 co-pay per visit $10 co-pay per visit Chiropractic/Acupuncture * ASH Network $10 co-pay per visit/ 30 visits combined Outpatient Mental Health / Unlimited Visits Vision Care * Examination for eyeglasses * Glaucoma testing * Standard frame/lenses every 24 months Dental Care (DeltaCare) Hearing Examination Immunizations * Includes flu injections and all Medicare approved immunizations Ambulance $10 co-pay per visit; $5 co-pay per group visit $10 co-pay per visit; $5 co-pay per group visit $10 per visit $10 co-pay per visit $150 frame and lens allowance every 24 months Not covered $10 co-pay per visit $10 per visit $10 co-pay per visit $150 frame and lens allowance every 24 months Not covered $10 co-pay per visit No charge Manual Manipulation of the Spine Prescription Drugs Retiree Over Age 65 Subscriber w/Medicare Subscriber w/Medicare + Spouse w/Medicare 1 Total Monthly Premium Total Annual Premium $ ∆ to Current % ∆ to Current 2 1 1 No charge 1 $50/Trip $50/Trip $10 co-pay per visit $10 co-pay per visit (subject to medical necessity) (subject to medical necessity) $10 co-pay per generic/$20 co-pay $10 co-pay per generic/$20 co-pay per per brand name up to 100-day supply brand name up to $100 day supply at at Kaiser pharmacies Kaiser pharmacies 2014 - 2015 2015 - 2016 $329 $330 $658 $660 $987 $990 $11,844 $11,880 $36 0.30% © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 15 2014/15 FINAL RATES & BENEFITS DELTA DENTAL PPO + PREMIER (ACSIG) - 3% ESTIMATED DELTA DENTAL PPO PLAN OVERVIEW ACSIG Effective October 1, 2015 2015 / 2016 Illustrative Rates with a 3% Increase ACTIVES Delta Dental PPO Dental Benefits Calendar Year Maximum Calendar Year Deductible Individual / Family Diagnostic and Preventive Oral Exam & X-Rays Teeth Cleaning Fluoride Treatment Space Maintainers Bitewings Basic Services & Crowns Amalgam/Composite Fillings Periodontics (Gum disease) Endodontics (Root Canal) Extractions & Oral Surgrey Sealants Crown Repair Restorative - Inlays and Crowns Prosthodontics Orthodontics Eligible for Benefit Lifetime Maximum Dental Accident Lifetime Maximum PPO Premier PPO Premier Out-of-Network PPO Premier PPO Premier Out-of-Network $2,000/Member $2,000/Member $2,000/Member $2,000/Member None None None None 70-100% 70-100% 70-100% 70-100% 70-100% 70-100% 70-100% 70-100% 50% 60% 50% 60% 50% Child(ren) Only $1,000 100% $1,000/Member 100% $1,000/Member 1 Year 1 Year Rate Guarantee Active Employee Only Employee + 1 Dependent Employee + 2 or More Dependents Total Monthly Premium Total Annual Premium $ ∆ to Current % ∆ to Current EE 188 120 157 465 RETIREES 2014 - 2015 $67.29 $132.73 $196.73 2015 - 2016 $69.31 $136.71 $202.63 $59,465 $713,577 $61,249 $734,984 $21,407 3% Not Covered EE 80 77 5 162 2014 - 2015 $65.09 $117.88 $169.52 2015 - 2016 $67.04 $121.42 $174.61 $15,132 $181,579 $15,586 $187,026 $5,447 3% © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 16 NEXT STEPS Future Committee Meeting Date May 14 SISC District must submit any desired benefit changes to SISC by August 1 ACSIG – Delta Dental Renewal ACSIG Board meeting on May 22 Expect to have Cabrillo College’s specific Dental renewal no later than May 28 Open Enrollment Dates? © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 17 NOTES © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 18 Public Entity Benefits Group 100 Pine Street, 11th Floor San Francisco, CA 94111