I C D :

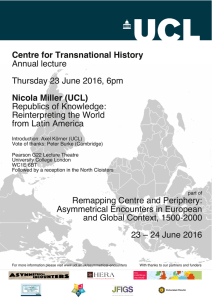

advertisement

I NCOME AND C ONSUMPTION D YNAMICS :

PARTIAL I NSURANCE AND I NEQUALITY

L ECTURE I, BU

Richard Blundell

UCL & IFS

April 2016

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

1 / 53

I NTRODUCTION

There are many dimensions to income and consumption inequality:

I

Wages! earnings! joint earnings! income! consumption

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

2 / 53

I NTRODUCTION

There are many dimensions to income and consumption inequality:

I

Wages! earnings! joint earnings! income! consumption

This link between the various measures is mediated by multiple

‘insurance’ mechanisms

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

2 / 53

I NTRODUCTION

There are many dimensions to income and consumption inequality:

I

Wages! earnings! joint earnings! income! consumption

This link between the various measures is mediated by multiple

‘insurance’ mechanisms, including:

I

I

I

I

I

Labor supply, etc. (wages! earnings)

Family labour supply (earnings! joint earnings)

Taxes and welfare (earnings! income)

Saving and borrowing (income! consumption)

Informal contracts, gifts, etc.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

2 / 53

I NTRODUCTION

There are many dimensions to income and consumption inequality:

I

Wages! earnings! joint earnings! income! consumption

This link between the various measures is mediated by multiple

‘insurance’ mechanisms, including:

I

I

I

I

I

Labor supply, etc. (wages! earnings)

Family labour supply (earnings! joint earnings)

Taxes and welfare (earnings! income)

Saving and borrowing (income! consumption)

Informal contracts, gifts, etc.

But how important are each of these mechanisms? Can we explain

the linkages?

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

2 / 53

I NTRODUCTION

There are many dimensions to income and consumption inequality:

I

Wages! earnings! joint earnings! income! consumption

This link between the various measures is mediated by multiple

‘insurance’ mechanisms, including:

I

I

I

I

I

Labor supply, etc. (wages! earnings)

Family labour supply (earnings! joint earnings)

Taxes and welfare (earnings! income)

Saving and borrowing (income! consumption)

Informal contracts, gifts, etc.

But how important are each of these mechanisms? Can we explain

the linkages?

In this lecture the aim is to begin to add more structure to the

distributional dynamics of wages, incomes and consumption.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

2 / 53

A N O VERVIEW

The main aim of the work presented here is to develop a framework

for uncovering the insurance mechanisms, primarily during the

working life.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

3 / 53

A N O VERVIEW

The main aim of the work presented here is to develop a framework

for uncovering the insurance mechanisms, primarily during the

working life.

Why the focus on income dynamics?

I

It is a key way of thinking about the transmission of inequality over

the life-cycle and the mechanisms used by families to ‘insure’ against

shocks.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

3 / 53

A N O VERVIEW

The main aim of the work presented here is to develop a framework

for uncovering the insurance mechanisms, primarily during the

working life.

Why the focus on income dynamics?

I

It is a key way of thinking about the transmission of inequality over

the life-cycle and the mechanisms used by families to ‘insure’ against

shocks.

Selected references:

I

I

I

I

I

I

Blundell, Pistaferri and Preston [BPP] (AER, 2008)

Blundell, Low and Preston [BLP] (QE, 2013)

Blundell, Graber and Mogstad [BGM] (JPubE, 2015).

Blundell, Pistaferri and Saporta-Eksten [BPS] (AER, 2016)

Arellano, Blundell and Bonehomme [ABB] (cemmap WP, 2015)

all on my website: http://www.ucl.ac.uk/~uctp39a/

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

3 / 53

A N O VERVIEW

The main aim of the work presented here is to develop a framework

for uncovering the insurance mechanisms, primarily during the

working life.

Why the focus on income dynamics?

I

It is a key way of thinking about the transmission of inequality over

the life-cycle and the mechanisms used by families to ‘insure’ against

shocks.

Selected references:

I

I

I

I

I

I

Blundell, Pistaferri and Preston [BPP] (AER, 2008)

Blundell, Low and Preston [BLP] (QE, 2013)

Blundell, Graber and Mogstad [BGM] (JPubE, 2015).

Blundell, Pistaferri and Saporta-Eksten [BPS] (AER, 2016)

Arellano, Blundell and Bonehomme [ABB] (cemmap WP, 2015)

all on my website: http://www.ucl.ac.uk/~uctp39a/

First, and briefly, some broad evidence:

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

3 / 53

C ONSUMPTION I NEQUALITY IN THE UK

.1

.15

Variance

.2

.25

.3

.35

.4

By age and birth cohort

20

40

60

80

Age

1930

1950

1970

R ICHARD B LUNDELL ()

1940

1960

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

4 / 53

I NCOME I NEQUALITY IN THE UK

.1

.15

.2

Variance

.25 .3 .35

.4

.45

.5

By age and birth cohort

20

40

60

80

Age

1930

1950

1970

R ICHARD B LUNDELL ()

1940

1960

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

5 / 53

C ONSUMPTION I NEQUALITY IN THE US

By age and birth cohort

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

6 / 53

Here I want to go behind these Figures

To investigate the linkages, the mechanisms which underlie the

evolution of these inequality measures.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

7 / 53

Here I want to go behind these Figures

To investigate the linkages, the mechanisms which underlie the

evolution of these inequality measures.

Drawing on new consumption and assets data from the US and also

detailed population panel data from Norway.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

7 / 53

Here I want to go behind these Figures

To investigate the linkages, the mechanisms which underlie the

evolution of these inequality measures.

Drawing on new consumption and assets data from the US and also

detailed population panel data from Norway.

Start with the way this has been done to date and raise some issues,

some puzzles, some controversies... and even some solutions!

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

7 / 53

Here I want to go behind these Figures

To investigate the linkages, the mechanisms which underlie the

evolution of these inequality measures.

Drawing on new consumption and assets data from the US and also

detailed population panel data from Norway.

Start with the way this has been done to date and raise some issues,

some puzzles, some controversies... and even some solutions!

The existing literature (references in paper) usually relates

movements in consumption to predictable and unpredictable

income changes as well as persistent and non-persistent shocks to

economic resources.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

7 / 53

Here I want to go behind these Figures

To investigate the linkages, the mechanisms which underlie the

evolution of these inequality measures.

Drawing on new consumption and assets data from the US and also

detailed population panel data from Norway.

Start with the way this has been done to date and raise some issues,

some puzzles, some controversies... and even some solutions!

The existing literature (references in paper) usually relates

movements in consumption to predictable and unpredictable

income changes as well as persistent and non-persistent shocks to

economic resources.

One consistent, and somewaht puzzling, finding in most of this

recent work is that household consumption appears significantly

smoothed, even with respect to quite persistent shocks.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

7 / 53

I NCOME D YNAMICS

To set the scene, consider consumer i (of age a) in time period t, has log

income yit ( ln Yi,a,t ) written

yit = Zit0 ϕ + f0i + pt f1i + yPit + yTit

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

8 / 53

I NCOME D YNAMICS

To set the scene, consider consumer i (of age a) in time period t, has log

income yit ( ln Yi,a,t ) written

yit = Zit0 ϕ + f0i + pt f1i + yPit + yTit

where yPit is a persistent process of income shocks, say

yPit = ρyPit

R ICHARD B LUNDELL ()

1

+ vit

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

8 / 53

I NCOME D YNAMICS

To set the scene, consider consumer i (of age a) in time period t, has log

income yit ( ln Yi,a,t ) written

yit = Zit0 ϕ + f0i + pt f1i + yPit + yTit

where yPit is a persistent process of income shocks, say

yPit = ρyPit

1

+ vit

which adds to the individual-specific trend pt fi and where yTit is a

transitory shock represented by some low order MA process, say

yTit = εit + θ 1 εi,t

R ICHARD B LUNDELL ()

1

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

8 / 53

I NCOME D YNAMICS

To set the scene, consider consumer i (of age a) in time period t, has log

income yit ( ln Yi,a,t ) written

yit = Zit0 ϕ + f0i + pt f1i + yPit + yTit

where yPit is a persistent process of income shocks, say

yPit = ρyPit

1

+ vit

which adds to the individual-specific trend pt fi and where yTit is a

transitory shock represented by some low order MA process, say

yTit = εit + θ 1 εi,t

1

A key consideration is to allow variances (or factor loadings) of yP

and yT to vary with age/time for each birth cohort.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

8 / 53

I NCOME D YNAMICS

To set the scene, consider consumer i (of age a) in time period t, has log

income yit ( ln Yi,a,t ) written

yit = Zit0 ϕ + f0i + pt f1i + yPit + yTit

where yPit is a persistent process of income shocks, say

yPit = ρyPit

1

+ vit

which adds to the individual-specific trend pt fi and where yTit is a

transitory shock represented by some low order MA process, say

yTit = εit + θ 1 εi,t

1

A key consideration is to allow variances (or factor loadings) of yP

and yT to vary with age/time for each birth cohort.

Allowing for non-stationarity we find pt f1i to be less important and ρ

closer to unity, especially in the 30-59 age selection.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

8 / 53

I NCOME D YNAMICS

To set the scene, consider consumer i (of age a) in time period t, has log

income yit ( ln Yi,a,t ) written

yit = Zit0 ϕ + f0i + pt f1i + yPit + yTit

where yPit is a persistent process of income shocks, say

yPit = ρyPit

1

+ vit

which adds to the individual-specific trend pt fi and where yTit is a

transitory shock represented by some low order MA process, say

yTit = εit + θ 1 εi,t

1

A key consideration is to allow variances (or factor loadings) of yP

and yT to vary with age/time for each birth cohort.

Allowing for non-stationarity we find pt f1i to be less important and ρ

closer to unity, especially in the 30-59 age selection.

Detailed work on Norwegian population register panel data....

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

8 / 53

L IFE - CYCLE I NCOME D YNAMICS

Norwegian pop panel: Var of perm shocks over the life-cycle

Variance of Permanent Shocks : Average Cohort Effects all

e

du

Individual Market Income

Individual Disposable Income

0.1

0.05

0

30

35

40

45

50

55

Source: Blundell, Graber and Mogstad (JPubE, 2015).

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

9 / 53

L IFE - CYCLE I NCOME D YNAMICS

Norwegian population panel (low skilled)

Variance of Permanent Shocks : Average Cohort Effects LowSkilled

Individual Market Income

Individual Disposable Income

0.1

0.05

0

30

35

40

45

50

55

Source: Blundell, Graber and Mogstad (JPubE, 2015).

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

10 / 53

C ONSUMPTION G ROWTH AND I NCOME "S HOCKS "

To account for the impact of income shocks on consumption we

introduce transmission parameters: κ cvt and κ cεt , writing consumption

growth as:

∆ ln Cit = Γit + ∆Zit0 ϕc + κ cvt vit + κ cεt εit + ξ it

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

11 / 53

C ONSUMPTION G ROWTH AND I NCOME "S HOCKS "

To account for the impact of income shocks on consumption we

introduce transmission parameters: κ cvt and κ cεt , writing consumption

growth as:

∆ ln Cit = Γit + ∆Zit0 ϕc + κ cvt vit + κ cεt εit + ξ it

which provides the link between the consumption and income

distributions and has a simple structural economic interpretation...

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

11 / 53

C ONSUMPTION G ROWTH AND I NCOME "S HOCKS "

To account for the impact of income shocks on consumption we

introduce transmission parameters: κ cvt and κ cεt , writing consumption

growth as:

∆ ln Cit = Γit + ∆Zit0 ϕc + κ cvt vit + κ cεt εit + ξ it

which provides the link between the consumption and income

distributions and has a simple structural economic interpretation...

For example, in Blundell, Low and Preston (QE, 2013) show, for any

birth-cohort,

∆ ln Cit = Γit + ∆Zit0 ϕc + (1

where

π it

π it )vit + (1

π it )γLt εit + ξ it

Assetsit

Assetsit + Human Wealthit

and γLt is the annuity value of a transitory shock for an individual

aged t retiring at age L.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

11 / 53

C ONSUMPTION G ROWTH AND I NCOME "S HOCKS "

The transmission parameters provide the link between the

evolution of consumption inequality and income inequality

I

BLP also show how to use this relationship to identify the growth in

the variances of the shocks even with cross-section data.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

12 / 53

C ONSUMPTION G ROWTH AND I NCOME "S HOCKS "

The transmission parameters provide the link between the

evolution of consumption inequality and income inequality

I

BLP also show how to use this relationship to identify the growth in

the variances of the shocks even with cross-section data.

Typically (1 π it ) averages at around .82. But this is only the

transmission parameter in the case of self-insurance alone.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

12 / 53

C ONSUMPTION G ROWTH AND I NCOME "S HOCKS "

The transmission parameters provide the link between the

evolution of consumption inequality and income inequality

I

BLP also show how to use this relationship to identify the growth in

the variances of the shocks even with cross-section data.

Typically (1 π it ) averages at around .82. But this is only the

transmission parameter in the case of self-insurance alone.

Additional insurance over and above self-insurance we label partial

insurance.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

12 / 53

C ONSUMPTION G ROWTH AND I NCOME "S HOCKS "

The transmission parameters provide the link between the

evolution of consumption inequality and income inequality

I

BLP also show how to use this relationship to identify the growth in

the variances of the shocks even with cross-section data.

Typically (1 π it ) averages at around .82. But this is only the

transmission parameter in the case of self-insurance alone.

Additional insurance over and above self-insurance we label partial

insurance.

Estimates of transmission of permanent shocks κ cvt from Blundell,

Pistaferri and Preston [BPP] (AER, 2008) range from .98 to .56;

averaging around .64, given this age selection.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

12 / 53

C ONSUMPTION G ROWTH AND I NCOME "S HOCKS "

The transmission parameters provide the link between the

evolution of consumption inequality and income inequality

I

BLP also show how to use this relationship to identify the growth in

the variances of the shocks even with cross-section data.

Typically (1 π it ) averages at around .82. But this is only the

transmission parameter in the case of self-insurance alone.

Additional insurance over and above self-insurance we label partial

insurance.

Estimates of transmission of permanent shocks κ cvt from Blundell,

Pistaferri and Preston [BPP] (AER, 2008) range from .98 to .56;

averaging around .64, given this age selection.

Estimates of transmission of transitory shocks κ cεt from BPP remain

quite significant for low wealth household, especially once we

include durable/semi-durable goods expenditures.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

12 / 53

C ONSUMPTION G ROWTH AND I NCOME "S HOCKS "

The transmission parameters provide the link between the

evolution of consumption inequality and income inequality

I

BLP also show how to use this relationship to identify the growth in

the variances of the shocks even with cross-section data.

Typically (1 π it ) averages at around .82. But this is only the

transmission parameter in the case of self-insurance alone.

Additional insurance over and above self-insurance we label partial

insurance.

Estimates of transmission of permanent shocks κ cvt from Blundell,

Pistaferri and Preston [BPP] (AER, 2008) range from .98 to .56;

averaging around .64, given this age selection.

Estimates of transmission of transitory shocks κ cεt from BPP remain

quite significant for low wealth household, especially once we

include durable/semi-durable goods expenditures.

Note that these values for κ cvt and κ cεt pose potential puzzles! Is

there excess insurance?

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

12 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

Self-insurance (i.e., savings) through a direct measure of π it

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

2

Self-insurance (i.e., savings) through a direct measure of π it

Joint labor supply of each earner

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

2

3

Self-insurance (i.e., savings) through a direct measure of π it

Joint labor supply of each earner

Non-linear taxes and welfare

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

2

3

4

Self-insurance (i.e., savings) through a direct measure of π it

Joint labor supply of each earner

Non-linear taxes and welfare

Other (un-modeled) mechanisms

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

2

3

4

Self-insurance (i.e., savings) through a direct measure of π it

Joint labor supply of each earner

Non-linear taxes and welfare

Other (un-modeled) mechanisms

and tests for "superior information",

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

2

3

4

Self-insurance (i.e., savings) through a direct measure of π it

Joint labor supply of each earner

Non-linear taxes and welfare

Other (un-modeled) mechanisms

and tests for "superior information", perhaps durable replacement?

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

2

3

4

Self-insurance (i.e., savings) through a direct measure of π it

Joint labor supply of each earner

Non-linear taxes and welfare

Other (un-modeled) mechanisms

and tests for "superior information", perhaps durable replacement?

Examining the importance of each step in the wage to consumption

chain.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

2

3

4

Self-insurance (i.e., savings) through a direct measure of π it

Joint labor supply of each earner

Non-linear taxes and welfare

Other (un-modeled) mechanisms

and tests for "superior information", perhaps durable replacement?

Examining the importance of each step in the wage to consumption

chain.

I Distinctive features of this research:

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

2

3

4

Self-insurance (i.e., savings) through a direct measure of π it

Joint labor supply of each earner

Non-linear taxes and welfare

Other (un-modeled) mechanisms

and tests for "superior information", perhaps durable replacement?

Examining the importance of each step in the wage to consumption

chain.

I Distinctive features of this research:

Allow for non-separability, heterogeneous assets, correlated shocks to

individual wages, see BPS (AER, 2016).

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

2

3

4

Self-insurance (i.e., savings) through a direct measure of π it

Joint labor supply of each earner

Non-linear taxes and welfare

Other (un-modeled) mechanisms

and tests for "superior information", perhaps durable replacement?

Examining the importance of each step in the wage to consumption

chain.

I Distinctive features of this research:

Allow for non-separability, heterogeneous assets, correlated shocks to

individual wages, see BPS (AER, 2016).

Use new data from the PSID 1999-2009

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

2

3

4

Self-insurance (i.e., savings) through a direct measure of π it

Joint labor supply of each earner

Non-linear taxes and welfare

Other (un-modeled) mechanisms

and tests for "superior information", perhaps durable replacement?

Examining the importance of each step in the wage to consumption

chain.

I Distinctive features of this research:

Allow for non-separability, heterogeneous assets, correlated shocks to

individual wages, see BPS (AER, 2016).

Use new data from the PSID 1999-2009

I

I

More comprehensive consumption measure.

Asset data collected in every wave.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

T O INVESTIGATE THE PUZZLES FURTHER I FIRST LOOK

IN MORE DETAIL AT FOUR MECHANISMS :

1

2

3

4

Self-insurance (i.e., savings) through a direct measure of π it

Joint labor supply of each earner

Non-linear taxes and welfare

Other (un-modeled) mechanisms

and tests for "superior information", perhaps durable replacement?

Examining the importance of each step in the wage to consumption

chain.

I Distinctive features of this research:

Allow for non-separability, heterogeneous assets, correlated shocks to

individual wages, see BPS (AER, 2016).

Use new data from the PSID 1999-2009

I

I

More comprehensive consumption measure.

Asset data collected in every wave.

Then finish by considering the role of non-linear dynamics, see

ABB (cemmap 2015).

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

13 / 53

NIPA-PSID C OMPARISON

1998

2000

2002

2004

2006

2008

PSID Total

NIPA Total

ratio

3,276

5,139

0.64

3,769

5,915

0.64

4,285

6,447

0.66

5,058

7,224

0.7

5,926

8,190

0.72

5,736

9,021

0.64

PSID Nondurables

NIPA Nondurables

ratio

746

1,330

0.56

855

1,543

0.55

887

1,618

0.55

1,015

1,831

0.55

1,188

2,089

0.57

1,146

2,296

0.5

PSID Services

NIPA Services

ratio

2,530

3,809

0.66

2,914

4,371

0.67

3,398

4,829

0.7

4,043

5,393

0.75

4,738

6,101

0.78

4,590

6,725

0.68

Note: PSID weights are applied for the non-sampled PSID data (47,206 observations for these

years). Total consumption is defined as Nondurables + Services. PSID consumption categories

include food, gasoline, utilities, health, rent (or rent equivalent), transportation, child care,

education and other insurance. NIPA numbers are from NIPA table 2.3.5. All numbers are

nonminal

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

14 / 53

D ESCRIPTIVE S TATISTICS FOR A SSETS AND E ARNINGS

Total assets

Housing and RE assets

Financial assets

Total debt

Mortgage

Other debt

PSID Assets, Hours and Earnings

1998

2000

2002

332,625 352,247 382,600

159,856 187,969 227,224

173,026 164,567 155,605

72,718

82,806

98,580

65,876

74,288

89,583

7,021

8,687

9,217

2004

476,626

283,913

192,995

115,873

106,423

9,744

2006

555,951

327,719

228,805

131,316

120,333

11,584

2008

506,823

292,910

214,441

137,348

123,324

14,561

First earner (head)

Earnings

Hours worked

54,220

2,357

61,251

2,317

63,674

2,309

68,500

2,309

72,794

2,284

75,588

2,140

Second earner (wife)

Participation rate

Earnings (conditional on participation)

Hours worked (conditional on participation)

0.81

26,035

1,666

0.8

28,611

1,691

0.81

31,693

1,697

0.81

33,987

1,707

0.81

36,185

1,659

0.8

39,973

1,648

Observarions

1,872

1,951

1,984

2,011

2,115

2,221

Notes: PSID data from 1999-2009 PSID waves. PSID means are given for the main sample of estimation: married couples

with working males aged 30 to 65. SEO sample excluded. PSID rent is imputed as 6% of reported house value for

homeowners. Missing values in consumption and assets sub-categories were treated as zeros.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

15 / 53

H OUSEHOLD O PTIMIZATION IN A U NITARY

F RAMEWORK

To motivate the framework consider a household that chooses

T t

Ci,t+j , Hi,1,t+j , Hi,2,t+j j=0 to maximize

Et

T t

∑ (1 + δ )

τ

v (Ci,t+τ , Hi,1,t+τ , Hi,2,t+τ ; Zi,t+τ )

τ =0

subject to

Ci,t +

R ICHARD B LUNDELL ()

Ai,t+1

= Ai,t + Hi,1,t Wi,1,t + Hi,1,t Wi,2,t

1+r

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

16 / 53

H OUSEHOLD O PTIMIZATION IN A U NITARY

F RAMEWORK

To motivate the framework consider a household that chooses

T t

Ci,t+j , Hi,1,t+j , Hi,2,t+j j=0 to maximize

Et

T t

∑ (1 + δ )

τ

v (Ci,t+τ , Hi,1,t+τ , Hi,2,t+τ ; Zi,t+τ )

τ =0

subject to

Ci,t +

Ai,t+1

= Ai,t + Hi,1,t Wi,1,t + Hi,1,t Wi,2,t

1+r

Our approach

Extend previous work and express the distributional dynamics of

consumption and earnings growth as functions of Frisch elasticities,

‘insurance parameters’ and wage shocks

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

16 / 53

WAGE P ROCESS

For earner j = f1, 2g in household i, period t, wage growth is:

0

∆ log Wi,j,t = ∆Xi,j,t

βj + ∆ui,j,t + vi,j,t

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

17 / 53

WAGE P ROCESS

For earner j = f1, 2g in household i, period t, wage growth is:

0

∆ log Wi,j,t = ∆Xi,j,t

βj + ∆ui,j,t + vi,j,t

0

1

ui,1,t

B ui,2,t C

B

C

@ vi,1,t A

vi,2,t

R ICHARD B LUNDELL ()

00

1 0 2

σu,1

0

BB 0 C B σu1 ,u2

B C B

i.i.d. B

@@ 0 A , @ 0

0

0

σu1 ,u2

σ2u,2

0

0

I NCOME AND C ONSUMPTION D YNAMICS

0

0

σ2v,1

σv1 ,v2

0

0

σv1 ,v2

σ2v,2

11

CC

CC

AA

UCL & IFS A PRIL 2016

17 / 53

WAGE P ROCESS

For earner j = f1, 2g in household i, period t, wage growth is:

0

∆ log Wi,j,t = ∆Xi,j,t

βj + ∆ui,j,t + vi,j,t

0

1

ui,1,t

B ui,2,t C

B

C

@ vi,1,t A

vi,2,t

00

1 0 2

σu,1

0

BB 0 C B σu1 ,u2

B C B

i.i.d. B

@@ 0 A , @ 0

0

0

σu1 ,u2

σ2u,2

0

0

0

0

σ2v,1

σv1 ,v2

0

0

σv1 ,v2

σ2v,2

11

CC

CC

AA

Allow the variances to differ by gender and across the life-cycle.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

17 / 53

WAGE PARAMETERS E STIMATES

Sample

Males

Females

Correlation of shocks

σ2u1

Perm.

σ2v1

Trans.

σ2u2

Perm.

σ2v2

Trans.

ρu1 ,u2

0.244

Perm

ρv1 ,v2

0.113

Observations

R ICHARD B LUNDELL ()

All

0.033

Trans.

I NCOME AND C ONSUMPTION D YNAMICS

(0.007)

0.032

(0.005)

0.012

(0.006)

0.043

(0.005)

(0.22)

(0.07)

8,191

UCL & IFS A PRIL 2016

18 / 53

C ONSUMPTION AND E ARNINGS G ROWTH

T HE ’S IMPLE ’ S EPARABLE C ASE

0

1

0

∆ct

0

@ ∆y1,t A ' @ κ y1 ,u1

∆y2,t

0

R ICHARD B LUNDELL ()

0

0

κ y2 ,u2

κ c,v1

κ y1 ,v1

κ y2 ,v1

κ c,v2

κ y1 ,v2

κ y2 ,v2

1

0

1

∆u1,t

∆ec,t

B ∆u2,t C

C @ ∆ey ,t A

AB

1

@ v1,t A +

∆ey2 ,t

v2,t

1

I NCOME AND C ONSUMPTION D YNAMICS

0

UCL & IFS A PRIL 2016

19 / 53

C ONSUMPTION AND E ARNINGS G ROWTH

T HE ’S IMPLE ’ S EPARABLE C ASE

0

1

0

∆ct

0

@ ∆y1,t A ' @ κ y1 ,u1

∆y2,t

0

0

0

κ y2 ,u2

κ c,v1

κ y1 ,v1

κ y2 ,v1

κ c,v2

κ y1 ,v2

κ y2 ,v2

where the key transmission parameters:

κ c,vj = (1

R ICHARD B LUNDELL ()

β ) (1

π i,t ) si,j,t

1

0

1

∆u1,t

∆ec,t

B ∆u2,t C

C @ ∆ey ,t A

AB

1

@ v1,t A +

∆ey2 ,t

v2,t

1

0

η c,p 1 + η hj ,wj

η c,p + (1

β ) (1

I NCOME AND C ONSUMPTION D YNAMICS

π i,t ) η h,w

UCL & IFS A PRIL 2016

19 / 53

C ONSUMPTION AND E ARNINGS G ROWTH

T HE ’S IMPLE ’ S EPARABLE C ASE

0

1

0

∆ct

0

@ ∆y1,t A ' @ κ y1 ,u1

∆y2,t

0

0

0

κ y2 ,u2

κ c,v1

κ y1 ,v1

κ y2 ,v1

κ c,v2

κ y1 ,v2

κ y2 ,v2

where the key transmission parameters:

κ c,vj = (1

β ) (1

π i,t ) si,j,t

κ yj ,uj = 1 + η hj ,wj ![Frisch]

R ICHARD B LUNDELL ()

1

0

1

∆u1,t

∆ec,t

B ∆u2,t C

C @ ∆ey ,t A

AB

1

@ v1,t A +

∆ey2 ,t

v2,t

1

0

η c,p 1 + η hj ,wj

η c,p + (1

β ) (1

π i,t ) η h,w

κ yj ,vj ![Marshall]

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

19 / 53

C ONSUMPTION AND E ARNINGS G ROWTH

T HE ’S IMPLE ’ S EPARABLE C ASE

0

1

0

∆ct

0

@ ∆y1,t A ' @ κ y1 ,u1

∆y2,t

0

0

0

κ y2 ,u2

κ c,v1

κ y1 ,v1

κ y2 ,v1

κ c,v2

κ y1 ,v2

κ y2 ,v2

where the key transmission parameters:

κ c,vj = (1

β ) (1

π i,t ) si,j,t

κ yj ,uj = 1 + η hj ,wj ![Frisch]

π i,t

Assetsi,t

Assetsi,t +Human Wealthi,t

R ICHARD B LUNDELL ()

1

0

1

∆u1,t

∆ec,t

B ∆u2,t C

C @ ∆ey ,t A

AB

1

@ v1,t A +

∆ey2 ,t

v2,t

1

0

η c,p 1 + η hj ,wj

η c,p + (1

β ) (1

π i,t ) η h,w

κ yj ,vj ![Marshall]

and si,j,t

Human Wealthi,j,t

Human Wealthi,t

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

19 / 53

C ONSUMPTION AND E ARNINGS G ROWTH

T HE ’S IMPLE ’ S EPARABLE C ASE

0

1

0

∆ct

0

@ ∆y1,t A ' @ κ y1 ,u1

∆y2,t

0

0

0

κ y2 ,u2

κ c,v1

κ y1 ,v1

κ y2 ,v1

κ c,v2

κ y1 ,v2

κ y2 ,v2

where the key transmission parameters:

κ c,vj = (1

β ) (1

π i,t ) si,j,t

κ yj ,uj = 1 + η hj ,wj ![Frisch]

π i,t

Assetsi,t

Assetsi,t +Human Wealthi,t

1

0

1

∆u1,t

∆ec,t

B ∆u2,t C

C @ ∆ey ,t A

AB

1

@ v1,t A +

∆ey2 ,t

v2,t

1

0

η c,p 1 + η hj ,wj

η c,p + (1

β ) (1

π i,t ) η h,w

κ yj ,vj ![Marshall]

and si,j,t

Human Wealthi,j,t

Human Wealthi,t

β is ‘insurance’ over above savings, taxes and labour supply.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

19 / 53

T RANSMISSION PARAMETERS :

Consumption response to j’s permanent wage shock:

κ c,vj = (1

R ICHARD B LUNDELL ()

β ) (1

π i,t ) si,j,t

η c,p 1 + η hj ,wj

η c,p + (1

I NCOME AND C ONSUMPTION D YNAMICS

β ) (1

π i,t ) η h,w

UCL & IFS A PRIL 2016

20 / 53

T RANSMISSION PARAMETERS :

Consumption response to j’s permanent wage shock:

κ c,vj = (1

β ) (1

π i,t ) si,j,t

η c,p 1 + η hj ,wj

η c,p + (1

β ) (1

π i,t ) η h,w

declines with π i,t (accumulated assets allow better insurance of

shocks)

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

20 / 53

T RANSMISSION PARAMETERS :

Consumption response to j’s permanent wage shock:

κ c,vj = (1

β ) (1

π i,t ) si,j,t

η c,p 1 + η hj ,wj

η c,p + (1

β ) (1

π i,t ) η h,w

declines with π i,t (accumulated assets allow better insurance of

shocks)

declines with β (outside insurance allows more smoothing)

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

20 / 53

T RANSMISSION PARAMETERS :

Consumption response to j’s permanent wage shock:

κ c,vj = (1

β ) (1

π i,t ) si,j,t

η c,p 1 + η hj ,wj

η c,p + (1

β ) (1

π i,t ) η h,w

declines with π i,t (accumulated assets allow better insurance of

shocks)

declines with β (outside insurance allows more smoothing)

increases with si,j,t (j’s earnings play heavier weight)

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

20 / 53

T RANSMISSION PARAMETERS :

Consumption response to j’s permanent wage shock:

κ c,vj = (1

β ) (1

π i,t ) si,j,t

η c,p 1 + η hj ,wj

η c,p + (1

β ) (1

π i,t ) η h,w

declines with π i,t (accumulated assets allow better insurance of

shocks)

declines with β (outside insurance allows more smoothing)

increases with si,j,t (j’s earnings play heavier weight)

increases with η c,p (consumers more tolerant of intertemporal

fluctuations in consumption)

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

20 / 53

T RANSMISSION PARAMETERS :

Consumption response to j’s permanent wage shock:

κ c,vj = (1

β ) (1

π i,t ) si,j,t

η c,p 1 + η hj ,wj

η c,p + (1

β ) (1

π i,t ) η h,w

declines with π i,t (accumulated assets allow better insurance of

shocks)

declines with β (outside insurance allows more smoothing)

increases with si,j,t (j’s earnings play heavier weight)

increases with η c,p (consumers more tolerant of intertemporal

fluctuations in consumption)

declines with η h j ,w j ("added worker" effect)

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

20 / 53

T RANSMISSION PARAMETERS :

Consumption response to j’s permanent wage shock:

κ c,vj = (1

β ) (1

π i,t ) si,j,t

η c,p 1 + η hj ,wj

η c,p + (1

β ) (1

π i,t ) η h,w

declines with π i,t (accumulated assets allow better insurance of

shocks)

declines with β (outside insurance allows more smoothing)

increases with si,j,t (j’s earnings play heavier weight)

increases with η c,p (consumers more tolerant of intertemporal

fluctuations in consumption)

declines with η h j ,w j ("added worker" effect)

declines with η hj ,wj only if j’s labor supply responds negatively to

own permanent shock. In one-earner case, true if

(1

R ICHARD B LUNDELL ()

β ) (1

π i,t )

η c,p > 0

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

20 / 53

I DENTIFICATION WITH ASSET DATA

Note that β is not identified separately from π

Back out π from the data and estimate β

Observed in PSID

π i,t

z }| {

Assetsi,t

Human Wealthi,t + Assetsi,t

|

{z

}

Projected lifetime earnings

Human wealth is projected using observables that evolve

deterministically (e.g. age).

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

21 / 53

I DENTIFICATION WITH NON - SEPARABILITY

When preferences are non-separable, we have:

1 0

κ c,u1

∆ct

@ ∆y1,t A ' @ κ y1 ,u1

κ y2 ,u1

∆y2,t

0

κ c,u2

κ y1 ,u2

κ y2 ,u2

κ c,v1

κ y1 ,v1

κ y2 ,v1

0

1

∆u1,t

κ c,v2

B ∆u2,t

κ y1 ,v2 A B

@ v1,t

κ y2 ,v2

v2,t

1

C

C

A

κ c,uj ! non-separability between consumption and leisure j

κ yj ,uk ! non-separability between spouses’ leisures

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

22 / 53

D ATA AND S AMPLE S ELECTION

PSID biennial 1999-2009:

I

PSID consumption went through a major revision in 1999

F

F

F

I

I

~70% of consumption expenditures. Good match with NIPA

The sum of food at home, food away from home, gasoline, health,

transportation, utilities, etc.

Main items that are missing: clothing (now included), recreation,

alcohol and tobacco

Earnings and hours for each earner

Assets data available for each wave

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

23 / 53

D ATA AND S AMPLE S ELECTION

PSID biennial 1999-2009:

I

PSID consumption went through a major revision in 1999

F

F

F

I

I

~70% of consumption expenditures. Good match with NIPA

The sum of food at home, food away from home, gasoline, health,

transportation, utilities, etc.

Main items that are missing: clothing (now included), recreation,

alcohol and tobacco

Earnings and hours for each earner

Assets data available for each wave

To begin with focus on:

I

I

I

Married couples, male aged 30-60 (with robustness on 30-55 group)

Working males (93% in this age group)

Stable household composition

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

23 / 53

D ATA AND S AMPLE S ELECTION

PSID biennial 1999-2009:

I

PSID consumption went through a major revision in 1999

F

F

F

I

I

~70% of consumption expenditures. Good match with NIPA

The sum of food at home, food away from home, gasoline, health,

transportation, utilities, etc.

Main items that are missing: clothing (now included), recreation,

alcohol and tobacco

Earnings and hours for each earner

Assets data available for each wave

To begin with focus on:

I

I

I

Married couples, male aged 30-60 (with robustness on 30-55 group)

Working males (93% in this age group)

Stable household composition

Methodology: Use structural restrictions that ‘theory’ imposes on

the variance covariance structure of ∆ci,t , ∆yi,1,t and ∆yi,2,t

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

23 / 53

S OME E CONOMETRICS I SSUES

Measurement error

I

I

For consumption, use martingale assumption and mean-reversion

For wages, use external estimates from Bound et al. (1994)

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

24 / 53

S OME E CONOMETRICS I SSUES

Measurement error

I

I

For consumption, use martingale assumption and mean-reversion

For wages, use external estimates from Bound et al. (1994)

Non-Participation

I

I

~20% of women in our sample work 0 hours in a given year

Selection adjusted second moments

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

24 / 53

S OME E CONOMETRICS I SSUES

Measurement error

I

I

For consumption, use martingale assumption and mean-reversion

For wages, use external estimates from Bound et al. (1994)

Non-Participation

I

I

~20% of women in our sample work 0 hours in a given year

Selection adjusted second moments

Inference

I

I

Multi-step procedure

Block bootstrap standard errors

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

24 / 53

D ISTRIBUTION OF s BY A GE

.62

.64

s

.66

.68

.7

Human Wealthmale,i,t

Human Wealthi,t :

.6

si,t

30-34

R ICHARD B LUNDELL ()

35-39

40-44

45-49

Age of household head

50-54

I NCOME AND C ONSUMPTION D YNAMICS

55-59

60-65

UCL & IFS A PRIL 2016

25 / 53

D ISTRIBUTION OF s BY A GE

si,t

Human Wealthmale,i,t

Human Wealthi,t :

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

26 / 53

D ISTRIBUTION OF π BY A GE

.1

.2

Pi

.3

0

200

400

600

Total Assets (Thousands of Dollars)

.4

.5

800

Assetsi,t

Assetsi,t +Human Wealthi,t :

0

π i,t

30-34

35-39

40-44

45-49

50-54

Age of household head

Pi

R ICHARD B LUNDELL ()

55-59

60-65

Total Assets (Thousands of Dollars)

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

27 / 53

D ISTRIBUTION OF π BY A GE

π i,t

Assetsi,t

Assetsi,t +Human Wealthi,t :

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

28 / 53

R ESULTS : W ITH AND W ITHOUT S EPARABILITY

E (π )

β

η c,p

η h1 ,w1

η h2 ,w2

(1)

Additive separ.

0.181

(0.008)

0.741

(0.165)

0.201

(0.077)

0.431

(0.097)

0.831

(0.133)

η c,w1

-.-

η h1 ,p

-.-

η c,w2

-.-

η h2 ,p

-.-

η h1 ,w2

-.-

η h2 ,w1

-.-

R ICHARD B LUNDELL ()

(2)

Non-separab.

0.181

(0.008)

0.120

(3)

Non-separab.

0.181

(0.008)

0

(0.198)

0.437

(0.124)

0.514

(0.150)

1.032

(0.265)

0.141

(0.051)

0.082

(0.030)

0.138

(0.139)

0.162

(0.166)

0.128

(0.052)

0.258

(0.103)

I NCOME AND C ONSUMPTION D YNAMICS

0.448

(0.126)

0.497

(0.150)

1.041

(0.275)

0.141

(0.053)

0.082

(0.031)

0.158

(0.121)

0.185

(0.145)

0.120

(0.064)

0.242

(0.119)

UCL & IFS A PRIL 2016

29 / 53

M ARSHALLIAN E LASTICITIES : B Y A GE

-.1

0

.1

.2

.3

.4

Marshallian Elasticities

30-34

35-39

40-44

45-49

50-54

Age of household head

55-59

60-65

Wife's Marshallian Elasticity

Head's Marshallian Elasticity

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

30 / 53

M ARSHALLIAN E LASTICITIES : B Y A GE

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

31 / 53

M ARSHALLIAN E LASTICITIES : B Y A GE

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

32 / 53

I NSURANCE VIA L ABOR S UPPLY (S HOCK TO M ALE

WAGES ): B Y A GE

-7

-6

-5

-4

-3

-2

Response of Consumption to a 10% Permanent

Decrease in the Male’s Wage Rate

30-34

35-39

40-44

45-49

50-54

Age of household head

55-59

60-65

fixed labor supply and no insurance

with family labor supply adjustment

with family labor supply adjustment and other insurance

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

33 / 53

I NSURANCE VIA L ABOR S UPPLY (S HOCK TO M ALE

WAGES ): B Y A GE

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

34 / 53

S OME M ISSPECIFICATION T ESTS

C ONCAVITY AND A DVANCE I NFORMATION

Concavity of preferences. Use the fact that:

0

B

@

η cp pc

η h1 p hp1

η h2 p hp2

η cw1 wc1

η h1 w1 wh11

η h2 w1 wh21

η cw2 wc2

1

0

B

η h1 w2 wh12 C

A = λB

@

η h2 w2 wh22

d2 u

dc2

d2 u

dl1 dc

d2 u

dl2 dc

d2 u

dcdl1

d2 u

dl21

d2 u

dl2 dl1

d2 u

dcdl2

d2 u

dl1 dl2

d2 u

dl22

1

1

C

C

A

Concavity is satisfied at average values of wages, hours,

consumption.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

35 / 53

S OME M ISSPECIFICATION T ESTS

C ONCAVITY AND A DVANCE I NFORMATION

Concavity of preferences. Use the fact that:

0

η cp pc

B

@

η h1 p hp1

η h2 p hp2

η cw1 wc1

η cw2 wc2

1

0

B

η h1 w2 wh12 C

A = λB

@

η h2 w2 wh22

η h1 w1 wh11

η h2 w1 wh21

d2 u

dc2

d2 u

dl1 dc

d2 u

dl2 dc

d2 u

dcdl1

d2 u

dl21

d2 u

dl2 dl1

d2 u

dcdl2

d2 u

dl1 dl2

d2 u

dl22

1

1

C

C

A

Concavity is satisfied at average values of wages, hours,

consumption.

Advance Information. Consumption growth should be correlated

with future wage growth (Cunha et al., 2008, and BPP 2008).

I

Test has p-value 13%

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

35 / 53

R ESULTS : E XTENSIVE M ARGIN

Estimate a "conditional" Euler equation, controlling for changes in

hours (intensive margin) and changes in participation (extensive

margin)

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

36 / 53

R ESULTS : E XTENSIVE M ARGIN

Estimate a "conditional" Euler equation, controlling for changes in

hours (intensive margin) and changes in participation (extensive

margin)

∆EMPt (Male)

∆ht (Male)

∆EMPt (Female)

∆ht (Female)

Sample

Instruments

Regression results

(1)

(2)

0.144

(0.369)

0.073

(0.175)

R ICHARD B LUNDELL ()

26.3

135.5

98.4

91.2

86.5

77.7

(0.021)

0.356

0.362

(0.169)

(0.186)

0.220

(0.100)

0.171

(0.094)

All

lags

2nd ,4th

Note: ∆xt is defined as (xt

0.013

First stage F-stats

(1)

(2)

23.4

xt

EMPt (Male)=1

2nd ,4th lags

1 ) / [0.5 (xt

+ xt 1 )]

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

36 / 53

P UTTING THE PIECES TOGETHER SO FAR ...

Focus on understanding the transmission of inequality over the

working life.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

37 / 53

P UTTING THE PIECES TOGETHER SO FAR ...

Focus on understanding the transmission of inequality over the

working life.

From wages! earnings! joint earnings! income! consumption.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

37 / 53

P UTTING THE PIECES TOGETHER SO FAR ...

Focus on understanding the transmission of inequality over the

working life.

From wages! earnings! joint earnings! income! consumption.

Addressing some of the key ‘puzzles’ in the literature.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

37 / 53

P UTTING THE PIECES TOGETHER SO FAR ...

Focus on understanding the transmission of inequality over the

working life.

From wages! earnings! joint earnings! income! consumption.

Addressing some of the key ‘puzzles’ in the literature.

Documenting the importance of four different ‘insurance’

mechanisms

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

37 / 53

P UTTING THE PIECES TOGETHER SO FAR ...

Focus on understanding the transmission of inequality over the

working life.

From wages! earnings! joint earnings! income! consumption.

Addressing some of the key ‘puzzles’ in the literature.

Documenting the importance of four different ‘insurance’

mechanisms:

I

Saving and credit markets

I

Taxes and welfare

I

Family labour supply

I

Informal contracts, gifts, etc.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

37 / 53

P UTTING THE PIECES TOGETHER SO FAR ...

Focus on understanding the transmission of inequality over the

working life.

From wages! earnings! joint earnings! income! consumption.

Addressing some of the key ‘puzzles’ in the literature.

Documenting the importance of four different ‘insurance’

mechanisms:

I

Saving and credit markets

I

Taxes and welfare

I

Family labour supply

I

Informal contracts, gifts, etc.

Showing the value, and possibilities for collecting, good panel data

on consumption and assets.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

37 / 53

A ND GATHERING UP THE RESULTS ...

Need to allow for non-stationarity over the life-cycle and over time

I

I

variances (of persistent shocks) display an U-shape over the

(working) life-cycle,

note the spike in the variance of permanent shocks during the 80s

and 90s recessions, Blundell & Preston (QJE, 1998).

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

38 / 53

A ND GATHERING UP THE RESULTS ...

Need to allow for non-stationarity over the life-cycle and over time

I

I

variances (of persistent shocks) display an U-shape over the

(working) life-cycle,

note the spike in the variance of permanent shocks during the 80s

and 90s recessions, Blundell & Preston (QJE, 1998).

Found that family labor supply is a key mechanism for smoothing

consumption

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

38 / 53

A ND GATHERING UP THE RESULTS ...

Need to allow for non-stationarity over the life-cycle and over time

I

I

variances (of persistent shocks) display an U-shape over the

(working) life-cycle,

note the spike in the variance of permanent shocks during the 80s

and 90s recessions, Blundell & Preston (QJE, 1998).

Found that family labor supply is a key mechanism for smoothing

consumption

I

I

especially for those with limited access to assets,

and non-separability between consumption and labour supply is

essential.

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

38 / 53

A ND GATHERING UP THE RESULTS ...

Need to allow for non-stationarity over the life-cycle and over time

I

I

variances (of persistent shocks) display an U-shape over the

(working) life-cycle,

note the spike in the variance of permanent shocks during the 80s

and 90s recessions, Blundell & Preston (QJE, 1998).

Found that family labor supply is a key mechanism for smoothing

consumption

I

I

especially for those with limited access to assets,

and non-separability between consumption and labour supply is

essential.

Once family labor supply, assets and taxes/benefits are accounted

for, there is little evidence for additional insurance

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

38 / 53

A ND GATHERING UP THE RESULTS ...

Need to allow for non-stationarity over the life-cycle and over time

I

I

variances (of persistent shocks) display an U-shape over the

(working) life-cycle,

note the spike in the variance of permanent shocks during the 80s

and 90s recessions, Blundell & Preston (QJE, 1998).

Found that family labor supply is a key mechanism for smoothing

consumption

I

I

especially for those with limited access to assets,

and non-separability between consumption and labour supply is

essential.

Once family labor supply, assets and taxes/benefits are accounted

for, there is little evidence for additional insurance

I

lots to be done to dig deeper into these, and other, mechanisms.

I

I want to close this lecture by considering the whole distribution of

consumption and income - nonlinearities turn out to be key...

R ICHARD B LUNDELL ()

I NCOME AND C ONSUMPTION D YNAMICS

UCL & IFS A PRIL 2016

38 / 53

Part II: Extensions to a Nonlinear The Panel Data Framework

• Linearity of the income process simplifies identification and estimation. However, by construction it rules out nonlinear transmission of shocks.

• The aim in ABB (2015) is to take a different tack and to develop a new approach to modeling persistence in which the impact of past shocks on current

earnings can be altered by the size and sign of new shocks.

⇒ this new framework allows for “unusual” shocks to wipe out the memory

of past shocks.

⇒ the future persistence of a current shock depends on the future shocks.

• We show the presence of “unusual” shocks matches the data and has a key

impact consumption and saving over the life cycle.

Methodology and data

• Nonlinear dynamic model with latent variables (the unobserved earnings

components).

– Nonparametric identification builds on Hu and Schennach (08) and Wilhelm

(12).

– Flexible parametric estimation that combines quantile modeling and linear

expansions in bases of functions.

• Panel data on household earned income, consumption (≈ 70% of expenditures of nondurables and services) and assets holdings from the new waves of

PSID (1999-2009). Recently (2004) further improved.

– Avoids need to use food consumption or imputed consumption data.

– Compare with population panel (register) data from Norway, see Blundell,

Graber and Mogstad (2014) - not quite finished constructing consumption

data.

Nonlinear Persistence

• Consider a cohort of households, i = 1, ..., N , and denote age as t. Let yit

denote log-labor income, net of age dummies.

yit = η it + εit,

i = 1, ..., N,

t = 1, ..., T.

⊲ η it follows a general first-order Markov process (can be generalised).

• Denoting the τ th conditional quantile of η it given η i,t−1 as Qt(η i,t−1, τ ), we

specify

η it = Qt(η i,t−1, uit),

where (uit|η i,t−1, η i,t−2, ...) ∼ Uniform (0, 1).

⊲ εit has zero mean, independent over time (at a 2-year frequency in the

PSID).

⊲ The conditional quantile functions Qt(η i,t−1, uit) and the marginal distributions Fεt are age (t) specific.

A measure of persistence

• The model allows for nonlinear dynamics of income.

• To see this, consider the following measure of persistence

ρt(η i,t−1, τ ) =

∂Qt(η i,t−1, τ )

∂η

.

⇒ ρt(η i,t−1, τ ) measures the persistence of η i,t−1 when it is hit by a shock uit

that has rank τ .

– Allows a general form of conditional heteroscedasticity, skewness and kurtosis.

• In the “canonical model” η it = η i,t−1 + vit, with vit independent over time

and independent of past η ′s,

η it = η i,t−1 + Fv−1

(uit)

t

⇒

ρt(η i,t−1, τ ) = 1 for all (η i,t−1, τ ).

– But what’s the evidence for such nonlinearities in persistence?

Some motivating evidence: Quantile autoregressions of log-earnings

∂Qy |y

(y

,τ )

t t−1 i,t−1

∂y

PSID data

Norwegian administrative data

1.2

1.2

1

0.8

persistence

persistence

1

0.8

0.6

0.4

0.6

0.4

0.2

0.2

0

1

1

0.8

0.5

0.6

init

0

1

0.8

0.6

0.4

0.2

0

0.8

0.6

0.4

percentile τ

0

1

percentile τ

shock

0.4

0.2

percentile τinit

0.2

0

0

percentile τshock

Note: Residuals of log pre-tax household labor earnings, Age 35-65 1999-2009 (US), Age

25-60 2005-2006 (Norway). Estimates of the average derivative of the conditional quantile

function of yit given yi,t−1 with respect to yi,t−1 , using a grid of 11-quantiles and a 3rd degree

Hermite polynomial.

Nonlinear earnings persistence, Norwegian administrative data

Individual income

1.2

1.2

1

1

0.8

0.8

persistence

persistence

Family income

0.6

0.4

0.6

0.4

0.2

0.2

0

1

0

1

0.8

1

0.6

0.8

0.6

0.4

1

0.6

0.8

0

percentile τshock

0.4

0.2

0.2

0

0.6

0.4

0.4

0.2

percentile τinit

0.8

percentile τinit

0.2

0

0

percentile τshock

Note: Estimates of the average derivative of the conditional quantile function of yit given yi,t−1

with respect to yi,t−1 , evaluated at percentile τ shock and at a value of yi,t−1 that corresponds to

the τ init percentile of the distribution of yi,t−1 , using a grid of 11-quantiles and a 3rd degree

Hermite polynomial. Age 25-60, years 2005-2006.

Conditional skewness, Norwegian administrative data

Individual income

−.2

−.1

−.1

0

skewness

.1

skewness

0

.1

.2

.2

.3

.3

Family income

0

.2

.4

.6

quantiles of distribution of yt−1

.8

1

0

.2

.4

.6

quantiles of distribution of yt−1

.8

Note: Skewness measured as a nonparametric estimate of

Qyt |yt−1 (yi,t−1 , .9) + Qyt |yt−1 (yi,t−1 , .1) − 2Qyt |yt−1 (yi,t−1 , .5)

Qyt |yt−1 (yi,t−1 , .9) − Qyt |yt−1 (yi,t−1 , .1)

Age 25-60, years 2005-2006.

.

1

Outline of the ABB paper

• Consumption simulations and model specification

• Identification

• Data and estimation strategy

• Empirical results

An Empirical Consumption Rule

• Let cit and ait denote log-consumption and log-assets (beginning of period)

net of age dummies.

• Our empirical specification is based on

cit = gt (ait , η it, εit, ν it)

t = 1, ..., T,

where ν it are independent across periods, and gt is a nonlinear, age-dependent

function, monotone in ν it.

– ν it may be interpreted a taste shifter that increases marginal utility. We

normalize its distribution to be standard uniform in each period.

• This consumption rule is consistent, in particular, with the standard life-cycle

model of the previous slides. Can allow for individual unobserved heterogeneity

and for advance information and habits.

Insurance coefficients

• With consumption specification given by

cit = gt (ait, η it, εit, ν it) ,

t = 1, ..., T,

consumption responses to η and ε are

"

#

∂gt (a, η, ε, ν )

φt(a, η, ε) = E

,

∂η

"

#

∂gt (a, η, ε, ν )

ψ t(a, η, ε) = E

.

∂ε

– φt(a, η, ε) and ψ t(a, η, ε) reflect the transmission of shocks to the persistent

and transitory earnings components, respectively. That is the lack of insurance

to shocks.

• The marginal effect of an earnings shock u on consumption is

∂ gt a, Qt(η, u), ε, ν

E

∂u u=τ

∂Qt(η, τ )

= φt a, Qt(η, τ ), ε

.

∂u

Earnings: identification

• For T = 3, Wilhelm (2012) gives conditions under which the distribution of

εi2 is identified.

– In particular completeness of the pdf s of (yi2|yi1) and (η i2|yi1). This requires

η i1 and η i2 to be dependent.

• We build on this result to establish identification of the earnings model.

• Apply the result to each of the three-year subpanels t ∈ {1, 2, 3} to t ∈

{T − 2, T − 1, T }

⇒ The marginal distribution of εit are identified for t ∈ {2, 3, ..., T − 1}.

⇒ By independence the joint distribution of (εi2, εi3, ..., εi,T −1) is identified.

⇒ By deconvolution the distribution of (η i2, η i3, ..., η i,T −1) is identified.

• The distribution of εi1, η i1, and εiT , η iT are not identified in general.

Consumption: assumptions

• uit and εit are independent of ai1 for t ≥ 1, where η it = Qt(η i,t−1, uit).

• We let η i1 and ai1 be arbitrarily dependent.

– This is important, because asset accumulation upon entry in the sample

may be correlated with past persistent shocks.

• Denoting η ti = (η it, η i,t−1, ..., η i1), we assume (in this talk) that:

t−2 t−2

ait is independent of (η t−1

,

a

, εi ) given (ai,t−1, ci,t−1, yi,t−1).

i

i

– Consistent with the accumulation rule in the standard life-cycle model with

one single risk-less asset.

Extensions

• Consumption rule with unobserved heterogeneity :

cit = gt (ait, η it, εit, ξ i, ν it) .

• We assume that uit and εit, for t ≥ 1, are independent of (ai1, ξ i).

• The distribution of (ai1, ξ i, η i1) is unrestricted.

• A combination of the above identification arguments and the main result of

Hu and Schennach (08) identifies

– The period-t consumption distribution f (ct |at, η t, yt, ξ).

– The distribution of initial conditions f (η 1, ξ, a1).

Empirical results

Nonlinear persistence of η it

∂Qη |η

(η

,τ )

t t−1 i,t−1

, nonlinear model

ρt(η i,t−1, τ ) =

∂η

1.2

persistence

1

0.8

0.6

0.4

0.2

0

1

1

0.8

0.5

0.6

0.4

percentile τ

init

0

0.2

0

percentile τ

shock

Note: Estimates of the average derivative of the conditional quantile function of η it on η i,t−1

with respect to η i,t−1 , evaluated at percentile τ shock and at a value of η i,t−1 that corresponds

to the τ init percentile of the distribution of η i,t−1 . Evaluated at mean age in the sample (47.5

years).

Nonlinear persistence of yit

∂Qy |y

(y

,τ )

t t−1 i,t−1

∂y

Nonlinear model

1.2

1.2

1

1

0.8

0.8

persistence

persistence

PSID data

0.6

0.4

0.6

0.4

0.2

0.2

0

1

0

1

1

0.8

0.5

0.6

1

0.8

0.5

0.6

0.4

percentile τ

init

0

0.4

0.2

0

percentile τ

shock

percentile τ

init

0

0.2

0

percentile τ

shock

Note: Estimates of the average derivative of the conditional quantile function of yit given yi,t−1

with respect to yi,t−1 , evaluated at percentile τ shock and at a value of yi,t−1 that corresponds

to the τ init percentile of the distribution of yi,t−1 .

Nonlinear persistence of yit (cont.)

∂Qy |y

(y

,τ )

t t−1 i,t−1

∂y

Canonical model

1.2

1.2

1

1

0.8

0.8

persistence

persistence

PSID data

0.6

0.4

0.6

0.4

0.2

0.2

0

1

0

1

1

0.8

0.5

0.6

1

0.8

0.5

0.6

0.4

percentile τ

init

0

0.4

0.2

0

percentile τ

shock

percentile τ

init

0

0.2

0

percentile τ

shock

Note: Estimates of the average derivative of the conditional quantile function of yit given yi,t−1

with respect to yi,t−1 , evaluated at percentile τ shock and at a value of yi,t−1 that corresponds

to the τ init percentile of the distribution of yi,t−1 .

Densities of persistent and transitory earnings components

η it

εit

1.4

7

1.2

6

1

5

0.8

4

0.6

3

0.4

2

0.2

1

0

−2

−1.5

−1

−0.5

0

0.5

1

1.5

2

0

−1

−0.5

0

0.5

1

Note: Nonparametric kernel estimates of densities based on simulated data according to the

nonlinear model.

Consumption response to η it, by assets and age

∂gt(a,η it,εit,ν it)

φt(a) = E

, nonlinear model

∂η

consumption response

0.8

0.6

0.4

0.2

0

0

0.5

1

percentile τ

age

0

0.2

0.4

0.8

0.6

1

percentile τ

assets

Note: Estimates of the average consumption response φt(a) to variations in η it, evaluated at

τ assets and τ age .

Consumption responses to yit, by assets and age

∂

E ∂y yit

E (cit|ait = a, yit = y, ageit = age)

PSID data

Nonlinear model

0.5

consumption response

consumption response

0.5

0.4

0.3

0.2

0.1

0

0

0.4

0.3

0.2

0.1

0

0

0.2

1

0.4

0.8

0.6

0.6

percentile τage

0.8

0.4

0.6

0.6

0.4

0.8

1

0.2

0.8

0.2

1

0

0.4

percentile τ

assets

percentile τ

0.2

1

0

percentile τ

assets

age

Note: Estimates of the average derivative of the conditional mean of cit given yit , ait and ageit

with respect to yit , evaluated at values of ait and ageit that corresponds to their τ assets and

τ age percentiles, and averaged over the values of yit .

Consumption response to εit, by assets and age

consumption response

∂gt(a,ηit,εit,ν it)

ψ t(a) = E

, nonlinear model

∂ε

0.5

0

1

−0.5

0

0.8

0.2

0.6

0.4

0.4

0.6

0.2

0.8

percentile τ

1

0

percentile τ

assets

age

Note: Estimates of the average consumption response ψ t(a) to variations in εit, evaluated at

τ assets and τ age .

Consumption response to η it, by assets and age, household heterogeneity

φt(a) = E

∂gt(a,η it,εit,ξ i ,ν it)

, nonlinear model

∂η

consumption response

0.6

0.5

0.4

0.3

0.2

0.1

0

0

1

0.8

0.6

0.5

0.4

0.2

1

percentile τ

0

percentile τ

assets

age

Note: Estimates of the average consumption response φt(a) to variations in η it, evaluated at

τ assets and τ age .

Model’s simulation

• Simulate life-cycle earnings and consumption after a shock to the persistent

earnings component (at age 37).

• We report the difference between:

– Households that are hit by a “bad” shock (τ shock = .10) or by a “good”

shock (τ shock = .90).

– Households that are hit by a median shock τ = .5.

• Age-specific averages across 100,000 simulations. At age 35 all households

have the same persistent component (percentile τ init).

Impulse responses, earnings

Bad shock: τ shock = .1

τ init = .1

τ init = .5

τ init = .9

0

0

0

−0.05

−0.05

−0.05

−0.1

−0.1

−0.1

−0.15

−0.15

−0.15

−0.2

−0.2

−0.2

−0.25

−0.25

−0.25

35

40

45

50

55

60

65

35

40

45

50

55

60

65

35

40

45

50

55

60

65

60

65

Good shock: τ shock = .9

τ init = .1

τ init = .5

τ init = .9

0.25

0.25

0.25

0.2

0.2

0.2

0.15

0.15

0.15

0.1

0.1

0.1

0.05

0.05

0.05

0

35

40

45

50

55

60

65

0

35

40

45

50

55

60

65

0

35

40

45

50

55

Impulse responses, consumption

Bad shock: τ shock = .1

τ init = .1

τ init = .5

τ init = .9

0

0

0

−0.02

−0.02

−0.02

−0.04

−0.04

−0.04

−0.06

−0.06

−0.06

−0.08

−0.08

−0.08

−0.1

−0.1

−0.1

−0.12

−0.12

−0.12

−0.14

35

−0.14

40

45

50

55

60

65

35

−0.14

40

45

50

55

60

65

35

40

45

50

55

60

65

60

65

Good shock: τ shock = .9

τ init = .1

τ init = .5

τ init = .9

0.1

0.1

0.1

0.05

0.05

0.05

0

35

40

45

50

55

60

65

0

35

40

45

50

55

60

65

0

35

40

45

50

55

Impulse responses, consumption, household heterogeneity

Bad shock: τ shock = .1

τ init = .1

τ init = .5

τ init = .9

0

0

0

−0.02

−0.02

−0.02

−0.04

−0.04

−0.04

−0.06

−0.06

−0.06