Session 5: Financial Management I Post-award – Policies Grants and Contracts Accounting

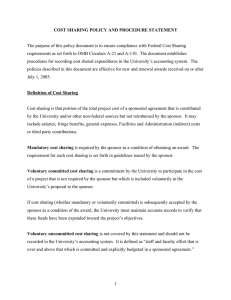

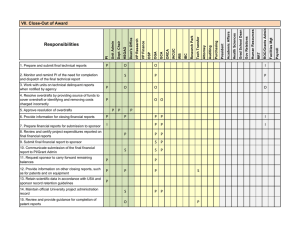

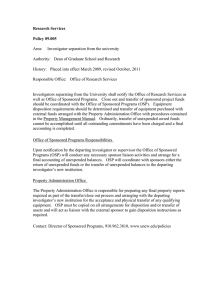

advertisement

Session 5: Financial Management I Post-award – Policies Grants and Contracts Accounting February 13, 2014 I. Introduction II. Roles & Responsibilities III. Time & Effort Certification IV. Cost Transfer Policy V. Cost Sharing VI. Audits VI. Quick Notes VII. OMB Circular A-110 VIII. OMB Circular A-21 Introduction No matter what your training or background is, as long as you work in a public management capacity you will have at least three (3) jobs to fulfill: • Personnel • Procurement • Budget In other words • People • Things • Money As the research partnership between the federal government and universities evolved, federal agencies developed principles for reimbursing both the direct costs of research and some of the costs of facilities and administration. The reimbursement of these costs has long been the subject of congressional interest. RAND “Paying for University Research Facilities and Administration” 2001. Who We Are Code of Business Ethics “ The American University Code of Business Ethics is intended to guide faculty and staff in identifying and resolving issues of ethical conduct that arise in the course of their various transactions and relationships with each other and the wider community. It is the underlying principle of the University that all of its transactions are conducted with the highest degree of integrity and honesty.” – Scott Bass, Provost Don Myers, CFO, Vice President and Treasurer The Code of Business Ethics can be found at: http://www.american.edu/policies/index.cfm Post Award Management EVALUATION • Reconcile • Report • Close Out Fiscal Cycle IMPLEMENTATION • Authorize Transactions • Analyze Your Data • Document Your Actions PLANNING • System Access • Budget • Fiscal Time Controller’s – Grants and Contracts Accounting Organizational Chart Mr. Frank Wilson Director of Accounting Ext. 2844 fwilson@american.edu General Accounting Grants & Contracts Accounting (GCA) Mr. Jesús A. Adame Asst. Director, Grants & Contracts Accounting Ext. 8873 adame@american.edu Mrs. Koki Hurley Manager, Grants & Contracts Accounting Ext. 2896 khurley@american.edu Mrs. Leslie Enriquez Senior Accountant Ext. 2843 enriquez@american.edu Mrs. Shailee Upadhyay Senior Accountant Ext. 3807 upadhyay@american.edu Mr. Samuel Sipkin Grants Accountant Ext. 2851 sipkin@american.edu Training Goals • To enhance skills sets of Faculty and Staff involved with sponsored grants • To promote operational efficiencies • To better understand shared responsibilities Sponsored Contracts Roles and Responsibilities Principal Investigator (PI) Overall management of project, including budgetary management Initiation of Payment Requests Notification of OSP in case of any potential contractual issues Completion of time and effort certifications Preparation of technical or progress reports Dean’s Office Expense Approval Processing of personnel paperwork Office of Sponsored Programs (OSP) Grants and Contracts Accounting (GCA) Negotiations with sponsors and coordination of award signatures Establishment of new project accounts based on project briefs from OSP Issuance of project briefs to establish grant accounts and codify important changes Preparation of consultant agreements and other subcontracts documents Interpretation of grant agreement terms and conditions Liaison with sponsor on potential modifications to grants and contracts Preparation and submission of all financial reports on grants and contracts Review of cost transfer entries Coordination of financial audits and site visits, as well as liaison with PIs on the annual A-133 audit Coordination of grant closeouts Financial Research Administration Roles and Responsibilities RESPONSIBILITIES PI DEAN/ DEPT. ADMIN. CHAIR1 OSP GCA VPGS&R AVPF PRE-AWARD ACCOUNTS Request pre-award account, if necessary Approve commitment of department funds if project not funded Approve pre-award account Vice Provost to notify GCA of pre-award account approval GCA will establish pre-award "risk" account If award is not received within a reasonable time frame (1 -2 months), all associated expenses will be transferred to the department's operating account RAC Handout RESPONSIBILITIES PI DEAN/ DEPT. ADMIN. CHAIR1 OSP GCA VPGS&R NEGOTIATION Review and approve proposed award Negotiate award terms and conditions Ascertain that all contracts adhere to AU procurement policies Develop subcontracts Negotiate subcontracts Notify all applicable offices of changes in project scope and budget ACCEPTANCE AND SET-UP Receive grant award Notify PI and school that award has been received, forward copy if necessary Evaluate whether award is a gift or grant Accept the agreement on behalf of the institution Prepare budget with object codes for unit review Prepare project brief and distribute to PI, department, school, GCA, others as necessary Establish grant account in general ledger Attend Project Startup meetings to review specific project requirements Provide training in administrative procedures to project staff Provide training in Financial Procedures and use of system reports for project tracking and performance AVPF RESPONSIBILITIES PI DEAN/ DEPT. ADMIN. CHAIR1 OSP GCA VPGS&R AVPF BUDGET AND CASH MANAGEMENT Establish account access Initiate non-salary purchases Prepare single-source justification for purchases, as necessary Set up payroll on grants Verify that expenditures meet Accounts Payable procedures at the time they are requested Verify that expenditures are appropriate and adhere to federal, state, and local regulations Perform periodic review of grant transactions for appropriateness and adherence to federal, state, and local regulations (see tab for Periodic Review) Establish policy and procedures that ensure the accuracy and timeliness of all financial transactions posting to the general ledger Initiate request for re-budgeting and prepare documentation Assist with and submit requests for re-budgeting Receive subcontractor invoice Approve work done by subcontractor; sign invoice Process payment of subcontract invoice Ensure that A-133 reports are received from subcontractors if required Ensure that A-133 reports are received and reviewed from subcontractors at inception and annually In cases of for-profit sub recipients, obtain a copy of an audit or review performed by an independent certified public accountant Review For-Profit audit documents for any weaknesses RESPONSIBILITIES PI DEAN/ DEPT. ADMIN. CHAIR1 OSP GCA COST SHARING (pending revision to policy) Establish and publish policy. Review annually with the Deans. Codify cost-sharing requirements in the project brief Gather cost sharing data Cost sharing must be recorded through the use of a Journal Entry. Report cost sharing to sponsors (SF-425) COST TRANSFERS (pending revision to policy) For all Awards, the Department Admin must submit a written request to Grants Accounting. The request will be reviewed on a case by case basis Prepare documentation/justification for cost transfers (journal entries) Review, approve and document cost transfer requests Review, approve and document cost transfer requests exceeding 90 days Process cost transfer requests Provide institutional oversight on cost transfers AVPF Approve cost sharing prior to submission of grant VPGS&R RESPONSIBILITIES PI DEAN/ DEPT. ADMIN. CHAIR1 OSP GCA VPGS&R BUDGET AND CASH MANAGEMENT Monitor "under-spending" of grant accounts; notify departments Maintain local oversight for the project Prepare and submit invoices to sponsors Prepare and process letter of credit draws (SF-425) Receive payments from sponsors and deposit them in institution accounts Grants Accounting will report all aged accounts Billed, Received and Outstanding to Department Admin/PI Resolve payment problems with late or non-payment by funding agencies FINANCIAL AND MANAGEMENT REPORTING Provide timely and accurate financial information/reports to PI/Dean Utilize monthly reports for financial monitoring and identify and resolve errors on the account in a timely manner. Utilize Business Intelligence tools (Microstrategy) Prepare, certify and submit interim financial reports. PI and departmental administrators will be copied on the submission of the report. Define, Identify, Monitor, and report program income Deposit program income. Department Admin will forward all checks to GCA for handling Provide institutional oversight to record and report program income AVPF RESPONSIBILITIES SUBRECIPIENT DETERMINATION AND REPORTING PI's proposal to the awarding agency identifies the need for a sub recipient (subcontractor, co investigator). OSP will review the proposed role of an anticipated project partner and determine if it is a sub recipient or a vendor. Annually, GCA will contact and request a copy of the sub recipient's A133 In the case of for-profit sub recipients, GCA will request a copy of their audited statements PROGRAM MANAGEMENT Conduct the sponsored project Complete and submit interim technical reports (OSP will route and submit technical reports requiring institutional signature) Complete the progress report for non-competitive renewals PI DEAN/ DEPT. ADMIN. CHAIR1 OSP Provide local oversight over appointment of individuals to the project Initiate programmatic changes to the project Provide oversight for all research activity Review programmatic changes to the project Conduct official communications with sponsor for program, contractual and budget modifications; no cost extensions, time extensions Conduct official communications with sponsor for financial matters. Provide institutional endorsement to the sponsor for requests for administrative or programmatic changes initiated by the principal investigator GCA VPGS&R AVPF RESPONSIBILITIES HUMAN RESOURCE MANAGEMENT Hire or assign research personnel for project and prepare documents for appointment of individuals to project Approve appointments of personnel to project As necessary, approve appointments to project subject to special terms and conditions (e.g., Patriot Act) Assist with matters that involve faculty, such as special appointments and resignations Assist with matters that involve terminations of faculty/research personnel Terminate research personnel PI DEAN/ DEPT. ADMIN. CHAIR1 OSP GCA VPGS&R EFFORT REPORTING Establish and publish policy. Review annually with the Deans Distribute effort reports Complete effort reports PI to sign off on effort reports Track current and pending effort Provide information to facilitate compliance with effort reporting policy Provide local oversight for effort certification Maintain official records of effort reporting Ensure compliance with effort reporting Receive and review effort reports to ensure all federal projects are represented AVPF RESPONSIBILITIES AWARD CLOSE-OUT Notify the PI and OSP of the impending end of the grant award (90 day notices) Prepare and submit final technical report (in coordination with GCA when technical and financial reports must be submitted together) File copy of Technical Report with OSP for retention Work with units on delinquent reports when notified by agency Provide information for closing financial reports Prepare and approve the final financial report and notify the PI Provide information on other closing reports, such as on patents and equipment Retain the scientific data Maintain the official institutional record Resolve issues related to late payment and problems with collection of awarded funds Review and provide guidance for completion of patent reports Communicate to ensure all work has been performed and expenses incurred; inactivate the account PI DEAN/ DEPT. ADMIN. CHAIR1 OSP GCA VPGS&R AVPF RESPONSIBILITIES PI DEAN/ DEPT. ADMIN. CHAIR1 OSP GCA VPGS&R AVPF EXTERNAL AUDIT/SITE VISIT LIAISON * Notify OSP and GCA of any requests for audit/review received by the unit Upon receipt from OSP/PI of the audit notice, GCA will contact the auditor and determine the scope of the audit. GCA will issue to all parties a procedure memo to be followed during the audit/site visit. Since this is a joint responsibility of all parties involved in the management of the university's grants, this memo will specify roles, responsibilities and due dates. Logistical issues of the auditors, if any, will be addressed. For a university-wide center, the VPGSR serves in this capacity. Time and Effort Certification Employees of American University (faculty, staff, students, or temporary employees) who receive payment from a federally-funded grant are required to certify their percentage of effort expended-on that grant on a biannual basis. The University provides documentation for this certification by requiring periodic effort reports from each individual who receives salary charged to one or more sponsored projects and/or a cost sharing account during the effort reporting period. These effort reports document the percentages of the individual’s total effort that were dedicated to each sponsored project and other University activities, and require a certification from the person receiving payment that the reported effort percentages were accurate. Time and Effort Certification Faculty members are required to be aware of their proportions of committed effort to all sponsored projects in which they have roles, their ability to meet those commitments in light of any other University obligations they may have and to communicate any significant changes in level of committed effort on sponsored projects to his/her respective business office. Significant financial penalties, expenditure disallowances, and reputational harm will result from failure to provide accurate time and effort certifications or other failures to comply with the University’s time and effort reporting requirements. All individuals involved in the effort certification process are expected to abide strictly by the provisions of this policy or face the suspension of payments from sponsored research accounts. Cost Sharing In many instances, the grantee is required to “match” the federal award or “cost-share” to help pay for the project. Recipients can provide their cost-sharing/matching contributions in any of the following ways: • Cash Contributions • In-kind contributions • Program income • Combination of nonfederal sources It is imperative that all cost share documentation be provided in a timely manner to your assigned GCA accountant in order to be in compliance with the financial reporting requirements of the grant award or agreement. Cost Transfer A cost transfer is the reassignment of an expense to a sponsored project after the expense was initially charged to another sponsored project or non-sponsored project. Cost transfers include reassignments of salary, wages, and other direct costs. While every effort must be made to charge costs to the correct account(s) when they are incurred, cost transfers are appropriate when their purpose is to correct posting or bookkeeping errors in the original charges, to appropriately reallocate expenditures between accounts, or to transfer pre-award costs from an institutional account to a sponsored project account. Under no circumstances may costs that benefit one sponsored project be charged temporarily to another sponsored project. Sponsored project costs that may not be charged to the appropriate project for any reason may be charged to a non-sponsored Cost center and transferred to the appropriate sponsored project at the earliest opportunity. Failure to adhere to this policy will result in improper financial reporting and inappropriate reimbursement from the sponsor. Cost Transfer Cost transfers may be made, provided all of the following conditions are met: • The cost reflects a good or service that directly benefits the project • The cost is a proper and allowable charge to the project • The transfer is supported by adequate documentation fully explaining the circumstances under which the error occurred and justifying the charge to the project to which the transfer is made • The transfer is approved by the Principal Investigator (PI) Cost transfers must be made within 90 days of the original charge. Any transfer made after this period raises serious questions regarding the propriety of the transfer. If a project director desires to request a transfer after this time, an explanation of why the transfer is late must accompany the full explanation for the transfer, and its justification, as well as a certification by the principal investigator/project director. Any transfer of costs on a sponsored program is ultimately the responsibility of the project director, who should retain appropriate documents to support the requested changes. All cost transfers are subject to the review and approval of the Grants and Contracts Accounting office. Auditors and sponsors will audit and request additional justification on suspicious cost transfers with the following characteristics: • Costs transferred 90 days after the original charges were recorded • Transfers supported by inadequate documentation or justification • Transfers made at the end of a project that relieve cost overruns or spend out a project AUDITS A-133 Audit The most common audit in federal grants is the organization wide or single audit under OMB Circular A-133. Entities that expend $500,000 or more each year in federal financial assistance are required to have an A-133 audit. The A133 audit entails both a financial audit and an audit to determine if the grantee is meeting applicable programmatic requirements. SOX at American University • Under the guidance of the Audit Committee, the University undertook an extensive Sarbanes-Oxley review of its internal control environment. • While not required for non-public companies, the University Audit Committee adopted a SOX program to show the public the University’s management was dedicated to quality and accuracy around financial reporting. • This review is conducted each year by the internal audit team Protiviti, using best practices developed during similar reviews at their corporate and other not-for-profit clients. Sarbanes-Oxley Act of 2002 • In 2002, the Sarbanes-Oxley Act (or “SOX”) was made a United States federal law which set new or enhanced standards to monitor the internal control structure of an organization. • The bill was enacted as a reaction to a number of major corporate and accounting scandals including those affecting Enron and WorldCom. How SOX Will Impact You • AU and Protiviti worked together to prepare a flowchart for each of the processes within the University. • On an annual basis, Protiviti tests the controls within each of the processes to ensure they are designed appropriately and working effectively. • As an employee of the University, you may be asked to provide evidence of a controls operations throughout the fiscal year. How SOX Will Impact You • AU and Protiviti worked together to prepare a flowchart for each of the processes within the University. • On an annual basis, Protiviti tests the controls within each of the processes to ensure they are designed appropriately and working effectively. • As an employee of the University, you may be asked to provide evidence of a controls operations throughout the fiscal year. Quick note: Gift vs. Grant The University has a fiduciary to sponsors and donors. The appropriate classification of external funding sources facilitates the assignment of responsibility, the proper recognition of achievements, and the appropriate reporting results. Gift - A gift is any item of value given to the University by a donor who expects nothing in return other than recognition and disposition of the gift in accordance with his or her wishes. To be considered a gift, item(s) being given or contributed: must be devoid of contractual requirements and with no deliverables (gift may be for a stated purpose, with the use of the funds designated for that purpose); must be irrevocable with no specified period of performance; does not require formal fiscal accountability beyond general stewardship and communication as a courtesy to the donor; e.g., progress reports, reports of expended funds and balances; and qualify for tax purposes as a charitable contribution by the donor. Gift vs. Grant Grant - To be considered a grant or contract, the following requirements must be met: submission of a formal proposal by the University is required; contractual agreement binding the University to a specified line of scholarly study or educational training within a specified period of performance; documents must contain provisions regarding intellectual property rights, and/or the disposition of tangible, or intangible results from the project; documents require formal accountability (budgets and financial reports) for all funds received and expended; and documents may be cancelled by either party for failure to perform. Quick Note: Budget RevisionPrior Approval Requirements During the performance of project it may be appropriate for funds to be reallocated to support advancement of a project. While grantees have some discretion to re-budget, there are some actions that require specific prior written approval from the agency. Most common instances of need for prior sponsor approval are: • Changes in project scope or objectives • Changes in key personnel • Approval for the absence of the principal investigator/project director for more than three months or a 25% reduction in time for the same individual • The need for additional funding There are other approvals prescribed by the circulars and individual agency guidelines. Talk with your assigned OSP staff member who will provide guidance about whether the requested budget change for your project will fall within the prior approval requirements. Budget Revision Should significant funds need to be transferred from one object code to another, the project brief will need to be revised. The principal investigator must request such action from OSP in writing. If sponsor approval is required, OSP will obtain the approval before revising the project brief. For general guidance on re-budgeting for federal projects refer to OMB Circular A-110, Section 25 - Revision of Budget and Program Plans as listed below. <http://www.whitehouse.gov/omb/circulars/a110/a110.html> Project Expenditure Control Authority The principal investigator approves charges to an account. The signatures of other project personnel will not be honored without prior written approval. By signing off on a project cost, the principal investigator certifies that the expenditures were appropriate, project-related, and actually incurred. To assist Principal Investigators with their account responsibilities, the Controller’s Office and the Office of the School/College Dean jointly perform expenditure control functions designed to ensure that: Expenditures are allowable and allocable Allotments are available Proper approvals have been obtained Expenditures appear consistent with the approved budget Expenditures are consistent with sponsor and university policies Expenditures Principal Investigators are responsible for accessing and reviewing their accounts on a timely basis to ensure that expenditures are proceeding according to plan and that all costs are charged to the correct accounts and object codes. Principal Investigators must request access to their restricted account through the office of their School/College Dean. Two reports have been developed for Principal Investigators and their departments to track expenditures on restricted accounts. These screens are: XEX2 – provides totals by object code for one project XEX3 – provides reports on all projects, one project per page BI Tool In addition, Principal Investigators are encouraged to use the Business Intelligence Reporting tool found at my.american.edu portal under the Technology Link. Financial Reports/Invoices Financial reports and invoices are prepared by the GCA office when required or mandated by the grant award. The grant accountant uses the guidelines supplied by the sponsor to complete such reports. Once prepared and signed by the accountant, it is reviewed by the immediate supervisor before submission to the sponsor. What is a Grant Closeout? A Grant closeout includes all of the final steps in completing a grant agreement. A Grant closeout occurs when the awarding agency determines that all applicable administrative actions and work under the grant have been completed. The recipients must submit all required financial, performance and other reports, and refund any balances of unobligated cash that the awarding agency approved. Within how many days should a cost transfer take place? 100 90 120 180 Within how many days should a cost transfer take place? 100 90 120 180 Recipients can provide their cost-sharing/matching contributions in any of the following ways: Cash Contributions In-kind contributions Program income Combination of nonfederal sources Recipients can provide their cost-sharing/matching contributions in any of the following ways: Cash Contributions In-kind contributions Program income Combination of nonfederal sources We will resume in 5 minutes There are five sets of cost principles applicable to federal awards: 1. OMB Circular A-21 Cost Principles for Educational Institutions. 2. OMB Circular A-87, Cost Principles for State, Local, and Indian Tribal Governments. 3. OMB Circular A-110, Cost Principles for Educational Institutions 4. Federal Acquisition Regulations System (FARS), Contracts with Commercial Organizations, codified at 48 CFR. 5. 45 CFR 74 Principles for Determining Costs Applicable to R&D with Hospitals. Circular No. A-110 Uniform Administrative Requirements. This Circular sets forth standards for obtaining consistency and uniformity among Federal agencies in the administration of grants to and agreements with institutions of higher education, hospitals, and other non-profit organizations. A-110: • C21: Standards of Financial Management • C23: Cost Sharing or matching • C24:Program Income • C27: Allowable Cost • C28: Period of availability of funds • C30-37: Property Standards • D70-73: After the Award Requirements Allowable Expenditures on Sponsor Awards Circular No. A-21 Cost principles for Educational Institutions Provides principles for determining the costs applicable to research and development, training, and other sponsored work performed by colleges and universities under grants, contracts, and other agreements with the Federal Government. These agreements are referred to as sponsored agreements. A-21: • Introduction to Sections B &C • Introduction to Section J • Definition of "F&A" costs • J3: Alcoholic beverages • J5: Audit cost and related services • J18: Equipment and other capital expenditures • J36: Pre-agreement costs Technical Support for you A one point contact: GCA is now on i-Support through OIT Please direct your questions and comments through askaccounting@american.edu. or you can reach us at our main office phone number ext. 3875