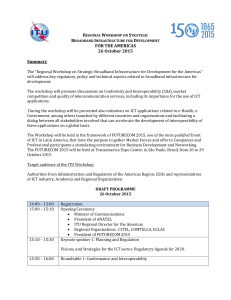

2015 reform READY DIGITAL

advertisement